Two Down, One to Go, and the Fed is Stuck: My most important economic predictions have come in rock solid

Two of my biggest and longest-term predictions for 2018 and 2019 proved resoundingly true this week, and my sole prediction for this year -- a prediction of recession bolder than anyone else's -- moved a big step closer to coming true.

Prediction #1: The Fed will prove to have no exit plan from its recovery program

The oldest prediction on my blog, repeated like a refrain throughout the writing of this blog, has been that the Fed would discover as soon as it tried unwinding from its recovery program that it cannot do it. I've claimed over and over we'll all discover the Fed has no exit plan that will work for the simple reason its recovery plan was never sustainable. It is important to prove now that that claim was clearly laid out and is, once and for all, established fact because if people don't get their head fully around that fact they have been denying for years as I have been writing this blog, then we are destined to repeat this delirium forever.

For years the Fed promised that it someday would unwind its balance sheet and that this process would be "as boring as watching paint dry" or that it would happen "on autopilot," but I pointed out the end-game problem for quantitative easing clear back in 2012 when the Fed first began its QE program:

Regardless of its objective, the debt IS what The Fed has been buying with the money [from QE]. With the Fed now as its ready buyer for long-term bonds, the U.S. government is assured of auctioning all its bonds at very low interest rates. Apparently the Federal Reserve as a whole has decided this is only a bad game if you keep playing it, but what is the end game so that you can stop playing it?

I stated again in 2012 that there was no actual exit strategy from quantitative easing:

The political leaders of this world — U.S. and European both — will continue to run the presses at full velocity because the cost of admitting they are money-printing and that they are on a bad course is too high politically. They will stay with their present plan, hoping they are buying enough time for an exit to emerge.

In 2013, I predicted in a similar vein that the QE-based recovery would only hold so long as some form of QE held (which would mean you can certainly never unwind it):

While luminaries like Marc Faber predicted a great economic collapse in 2013, I decided the government has a lot of energy to keep powering through a bad plan.... My economic predictions at the start of 2013 [were] the leaders of the world would continue to believe they could resurrect the dinosaur economy by trying to pump it up with debt. It is what worked before and what worked before that, so it is all they know, and all they’ll try. They will do all they can to save the economy through low interest rates, designed to entice people to to buy homes and take on debt again.... Since quantitative easing has never righted the situation for good, it should be evident that is nothing more than a prop … a crutch…. I have said from the time the first quantitative easing was promised by the Fed, that it would fail to have any lasting result, and each round has failed as soon as it stopped…. So, I predict the dinosaur economy I have written about will continue to breathe awhile longer, but ... what we have seen in recent years is not a recovery at all. It [is] merely the intoxicating effect of trillions of dollars mainlined into banks for free. It lasts as long as the drug lasts and is not, in the least, sustainable.

In December of 2015, I noted again that it continued to be evident the Fed had no end game after it equivocated all year on starting its rise in interest rates:

Does the Fed not believe in its own recovery? Will we suffer the uncertainty of “will they/won’t they†like a repeating, nauseating dream forever? Does the Fed have no end game? Have they really painted themselves into a corner?... The Fed will lose all credibility, and in the fiat money game, credibility is the core value of money....

Two years ago (in 2017), I wrote in a comment to one of my articles ...

Of course markets respond to free money! How could they not respond to trillions of dollars of free money? But there is no end game to that. It only creates wealth for those who have extra income that they can afford to put at risk and who also think they understand markets well enough to gamble in that casino; but there is no end game because it ends as soon as the free money ends.

"Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?"

And in another article that year, I wrote ...

I have always stated that the recovery program is completely unsustainable and that all signs of life end as soon as the artificial life support is removed.... There is no end game.... These people are flying by the seats of their pants to go where no man (or one Yellen) has ever gone before. They are trying to figure their way out as they go, just like Japan, which finds itself endlessly pitched back into new and greater rounds of QE every time it tries to taper.... The Fed’s recovery is a failure because it was never sustainable from its onset..... The end game was supposed to be that a thriving economy would be able to absorb the Fed’s very gradual unwinding, but that vital economy never emerged.... The central banks have painted themselves into a corner.

"Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery"

As if that wasn't strong enough, I came even more strongly to the point in July of 2017:

I believe the Fed WILL start to unwind, as they’ve said they will, and havoc will begin in stocks and bonds and housing and all kinds of markets as quickly as the Fed starts to do what it has long said it will do and people begin to see that it cannot do it. I have always suspected they have no end game, but they thought they would eventually unwind into a strong economy with a lot of resilience toward their unwinding. They probably even thought their recovery would build to where some gradual cooling might be necessary to avoid inflation. Their unwinding would cause that necessary cooling. Instead, they find they have, at best, a nearly stagnant economy where borderline stagnation promises to be the best they can hope for throughout years to come, and they have almost no inflation (by their measure). So, they must now figure out how to unwind in a situation of borderline stagnation … or never unwind.

Here's how I said that would play out for the stock market:

Rising interest on bonds will tend to draw money out of stocks, so stocks will fall unless they receive even more extraordinary propping.

And so it happened last year.

I even wrote ...

Since the Fed used quantitative easing in order to lower interest rates (especially long-term interest rates, such as on mortgages) and to increase liquidity, I don’t see how they unwind their QE without causing interest rates to rise. In a robust economy, they might want interest to rise; but in the present flagging economy, a rise in mortgage rates will cause the latest housing bubble to collapse because the housing market already looks like it is turning.

And so that happened, too.

Many have seen this conglomeration of collateral problems coming (or, at least, something like it), but the Fed continues to tell everyone it can manage its way through all of that. I think investors in most markets have just been covering their eyes, saying, “Well … OKaaaay….†but have no idea how the Fed will actually be able to do what it says it will do. Investors are extending blind trust in order to avoid thinking about the party ending. They are saying, “Well, the omniscient Fed gave us a recovery and made us rich on stocks and bonds all at the same time, so they will be able to do this, too.†That’s dogma, not science or even math. It's also denial.

After all of this played out at the end of 2018, I reiterated ...

I have always said there is no end game. That is, there is no way out of years of quantitative easing that will not undo what quantitative easing did.

"It’s Up, It’s Down, It’s Done — a Day in a Year of the Dow"

Then in February of this year, I wrote...

Here is a single chart that proves how completely the Fed’s end-game for its recovery failed, which means the fake recovery, itself, is failing.... 2018 became a year filled with market explosions.... 2018 gave us the worst stock market crackup by far since the bottom of the Great Recession. (So much so that it stands out like a fire on a hilltop in the graph above of that entire period. You don’t have to look for it to find it.) We can now clearly see the market’s breakup coincided perfectly with the Fed’s balance-sheet unwind. In only three months the market lost almost a quarter of everything it had gained over the entire past decade of massive quantitative easing! There is not the slightest chance the Fed would have made such a hard reversal of its stated plan, causing Powell to look (as many commentators are now saying) like “Trump’s bitch,†if the Fed did not believe the market was crashing hard. That it caved in on its master plan so quickly says to me that it feared the market’s blow-off top risked becoming an all-out crash if it did not capitulate to Trump’s demands.

"The Fed’s Failure is a Fait Accompli, Exactly as This Blog Said it Would be!"

My repeated claim about the Fed's inability to unwind, of course, was a prediction that took years to prove out (as I said it would) because there were years of recovery effort before the Fed even tried to stop economic stimulus -- as I said would be the case (see the final section below) -- and then more time beyond that before the Fed started to try to unwind its balance sheet. Yet, the time of the Fed's last stage of its exit plan finally came in 2018, and my prediction has now proved resoundingly true.

It all turned into such a massive blowout that it caused the Fed to back away from an end-game that it had just told us would be so easy it would run on autopilot -- the very statement that triggered the market's collapse. It did that at the end of December. Now the Fed has gone a step further in showing just how done it is with raising interest and unwinding its balance sheet. Says one economic advisor,

The Fed's abrupt policy reversal says it all. No more rate hikes (yes, one is "scheduled" for 2020, but that's fake news), and the balance sheet run-off is being "tapered," but will stop in September. Do not be surprised if it ends sooner. Listening to Powell explain the decision or reading the statement released is a waste of time. The truth is reflected in the deed. The motive [for the statement] is an attempt to prevent the onset [of] economic and financial chaos.... As the market began to sell off in March, the Fed's FOMC foot soldiers began to discuss further easing of monetary policy and hinted at the possibility, if necessary, of introducing "radical" monetary policies.

(You can read the Fed's full sanguine summary of its latest March meeting here.)

The short of it all is that the Fed no sooner got up to full unwind speed in the fall of 2018, than the stock market crashed. The Fed now knows it can go no further down that road and, therefore, it just added the assurance in last week's meeting that it will retain indefinitely a much larger balance sheet.

Today, Four time best-selling author Jim Rickards sees the Fed's situation as having turned out just the way I said it was going to all along:

Rickards says, “Bernanke painted them into a corner, and they can’t get out. There is no escape from the room.... They got into it, but they can’t get out of it because every time they try, they sink the stock market. They sink the housing market. They raise the specter of recession. They slow economic growth. They don’t want that. So, they sort of pause and maybe tiptoe back into it, but they really can’t get out of it.â€

The Fed got only as far as reversing its quantitative easing a mere 10%, and it had to do a hard stop! Even so, the Fed's attempt to stop economic chaos by doubling down on how fast it is ending its reversal, which is called "quantitative tightening," only led to the fulfillment of my other big prediction regarding the Fed's end of its recovery program.

Prediction #2: The Fed will find itself stuck between a rock and a hard place

The market vomited on Friday, the day after the Fed's March meeting where it talked of stopping its unwind and retain a huge balance sheet for good. So, it's not going any further forward with tightening. However, it can't go back either to easing either.

One of my other refrains has been that, after tightening, the Fed would find it cannot move back toward more quantitative easing without crashing the economy because doing so will jar markets into the reality that the Fed doesn't know what it is doing. We saw that prove out this past week when the Fed could not even make a statement about staying on hold, much less easing, without a huge negative effect on interest rates and stocks.

Here is the Fed's rock and here is the Fed's hard place:

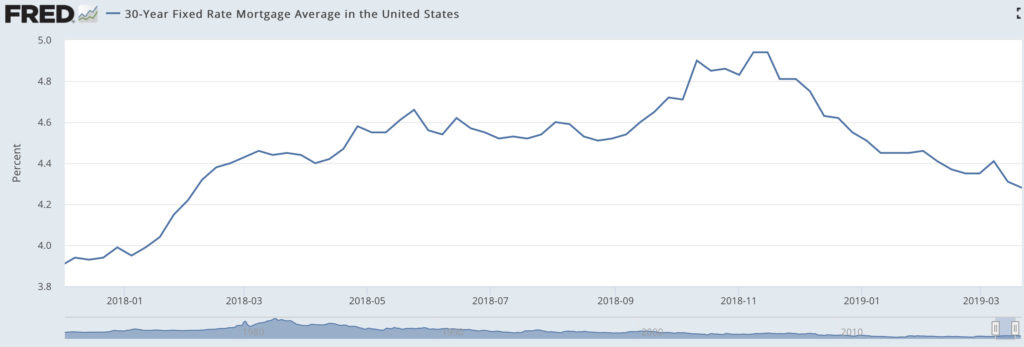

Rock: The Fed's increase in interest rates and its balance-sheet rolloff caused a housing slump and crashed the stock market in 2018. The stock market's dive into a bear market (3 out of 4 major indices), pushed money rapidly into bonds, lowering bond yields, and that lowered mortgage interest rates, even though the Fed was still raising its target lending rate and dumping bonds from its balance sheet. You can see below how mortgage interest started rising in late 2017 with the Fed's first little nips off its balance sheet and how, when its balance sheet unwind doubled in speed at the start of 2018, mortgage rates shot up and then shot up again as the balance-sheet unwind hit full velocity in the fall of 2018 but then fell rapidly away when rising yields began drawing a massive flow of money into bonds, driving interest back down and sucking money out of stocks:

In the recent past, such a long slump in housing as the past six-month decline caused the Great Recession. You may recall the team action of the Fed and Fannie May and Freddie Mac that led to that housing crash. The Fed lowered interest, and Fannie and Freddie eased mortgage qualifying terms, such as down-payment requirements, to keep goosing the market up until none of those things could go any further. When the market looked too hot, the Fed started to raise interest, and the low-interest-dependent housing market crumbled.

What have they done this time?

In January 2015 ... Fannie Mae and Freddie Mac began reducing the qualification requirements for government-backed "conforming" mortgages, starting with reducing the down payment requirement from 5% to 3%. For the next three years, the government continued to lower this bar to expand the pool of potential homebuyers and reduce the monthly payment burden. This was on top of the Fed artificially taking interest rates down to all-time lows. In other words, the powers that be connected to the housing market and the policymakers at the Fed and the government knew that the housing market was growing weak and have gone to great lengths in an attempt to defer a housing market disaster. Short of making 0% down payments a standard feature of government-guaranteed mortgage programs, I'm not sure what else can be done help put homebuyers into homes they can't afford.

In other words, this threesome of fetid finance did exactly what they did to create the last housing bubble, and then the Fed did what it did to pop that bubble. the Fed began raising interest, as it did in 2007. Look at where we are now. The housing market's decline through the last half of 2018 and the stock market's hard fall in the fall, caused the Fed to back off immediately (by Fed glacial speed comparisons).

The housing market in February of this year responded with some notable improvement, and the Fed backed off one final step more. However, it's too late. I doubt that February's bounce in housing sales is going to turn into anything more than a temporary reprieve after months of continuous decline in sales. Here's why:

Hard place: Backing off a tiny bit more this week on interest-rate increases and its balance-sheet rolloff, as the Fed did, instantly caused a yield-curve inversion, the biggest and most reliable recession indicator (or cause) there is. That's because an inversion of the yield curve pushes banks away from making mortgages and other kinds of loans. That leads into recession because available credit starts to dry up, causing its own tightening of the economy, for credit is the slack we run with.

This inversion looks even worse than previous inversions:

What's unusual about this yield curve inversion ... is that typically the spread between the 10-year and 2-year Treasury yield inverts first - rather than the spread between the 10-year and 3-month yield. "The difference between the 10-year and the 3-month is the bigger deal,... so make no mistake: this is a sign that the market needs to take very seriously."

The yield-curve inversion means Fed is stuck. It has no room to move back into more easing in order to help the housing market with lower interest rates again because its back is up against the inverted yield curve that resulted from prior years of easing.

The stock market felt the lurch the Fed is stuck in so it fell off a little cliff of its own on Friday, reinforcing the wall that the Fed has backed into. At first, the stock market responded by soaring upward on Thursday. Before I could even put together this article to say that was a meaningless euphoric bounce, the bond market put in a response of its own, inverting the yield curve, and stocks fled in terror. The VIX (volatility index) leaped up 24%.

For stocks, Friday was the worst day since the start of the year with the Dow down 460 points and the Nasdaq down almost 200 points (2.5%), primarily due to the yield-curve's first full inversion since 2007 but also due to a few staggering blows in economic data. (That being said, I would not be surprised if the stock market gets a bump at the start of this week due to the weekend release of the long-awaited Mueller report, which largely exonerated President Trump. If so much relief from concerns about how impeachment will throw twists and turns into the economy doesn't give the market some temporary lift, then it is falling like a rock.)

It wasn't just the yield curve, though that sent stocks plummeting, it was the very fact that the Fed has so sharply backed off. Many commentators have been talking about how the Fed spun on a dime and about how embarrassing that must be after all the assurances about how easy unwinding was going to be, calling to question the Fed's credibility. The market took also the Fed's further step back from tightening as a warning that the Fed sees something dangerous immediately ahead:

“The Fed has set the tone for the markets, and if you trust their ability to ‘see around corners,’ then you will continue to maintain a risk-off position,†said [Kevin Giddis, head of fixed income capital markets at Raymond James] in a note to clients.

There’s something brewing in the financial sector that could be worrisome to stock-market investors, especially those who shiver recalling events that led to the 2008-09 financial crisis.... The SPDR Financial Select Sector exchange-traded fund, XLF, tumbled 2.8% Friday, with 64 of its 68 equity components losing ground.... The financial sector is viewed by many on Wall Street as a leading indicator for the broader market.... The XLF has been in a downtrend for the past 14 months.... This week, it broke below the December trough to hit the lowest levels seen since October 2016.

Perhaps Friday's big plunge in the overall stock market indicates the market is now paying attention to where financials have been leading.

The Fed couldn't go any further forward with its Great Recovery Rewind without causing a housing recession and a stock market crash, but when it backed one tiny step further back this week, bond buyers pushed for recession anyway, and the stock market returned to crash-mode anyway.

So, the Fed is now jammed in place, which is where I've said all along it would find itself very early in its attempts to return to normalcy. The instant inversion of the yield curve is a screaming warning that the Fed has tightened us into a recession:

S&P 500 could fall 40% as yield curve inverts, says analyst of one of 2018’s best hedge-fund returns.... Stock investors should heed the warning emanating from the bond market, says at least one hedge-fund manager, as the yield curve staged a stunning inversion Friday. “I think people are going to be surprised where the S&P 500 is trading at the end of the year. We’re going at least for a 40% decline from the S&P’s top,†Otavio Costa, a macro analyst at Crescat Capital, a hedge fund that oversees $52 million, told MarketWatch in an interview.... An inversion of this spread — the most closely watched by economists — has preceded every recession since 1960, though the timing between the two events can vary.

“Yield curves are responding to what they see, to what I believe is a global economic slowdown,†said Peter Boockvar, chief investment officer at Bleakley Advisory Group. “You don’t see this kind of move in curves, not just here but everywhere, unless you get one.†Short-term yields moving ahead of their longer-duration counterparts is seen as a sign that growth will be higher now than it will be in the future....

In short, the bond market didn't believe Jerome Powell when he said at the close of last week's FOMC meeting that the US economy was stable because, if the economy is as good as the face Powell tried to put on it, why has the Fed gone full dove?

“All anyone needs to do is read the first paragraph of the Fed press statement to see that the central bank has marked down its assessment of the economic landscape – the choice of words suggests far more than the tweaking that was done to the numerical projections,†David Rosenberg, chief economist and strategist at Gluskin Sheff, said in his daily note Thursday.

Rosenburg notes that the real yield on the ten-year note never got this low even at any point in the Great Recession. That overall yield shifted so far in twenty-four hours was nothing short of stunning. On the other hand, Ed Yardeni, who is always too optimistic in my opinion stated with his usual rosy glow in this same CNBC article,

“Could it be that the yield curve is signaling weak global economic growth and low inflation without necessarily implying a recession in the US? We think so, and the US stock market apparently supports our thesis,†Ed Yardeni of Yardeni Research said in his morning note Friday. “So why are global stock markets also doing so well? Perhaps there is too much pessimism about the global economic outlook.â€

Too bad he published that only moments before the stock market strongly disagreed with his thesis and capitulated in a major roll-over response to what was happening in bonds. Perhaps there was too much optimism about the global economic outlook in Yardeni's permabearish smile.

“It will come down to the U.S. consumer. That’s the last thing that’s holding us up,†Boockvar said. “We’ll need a decline in the stock market to tip over the consumer. So if the stock market can hang in, I think the U.S. can continue to see some growth. If we start to go back to the December lows again, that could be enough to tip us over.â€

Oops.

“There’s a host of worries out there and those worries continue to mount,†said Peter Cardillo, chief market economist at Spartan Capital Securities. “The fear of recession is increasing. As a result, we have a market that is rethinking some of the optimism that was priced in....†Friday’s moves come after Fed surprised investors by adopting a sharp dovish stance on Wednesday, projecting no further interest rate hikes this year and ending its balance sheet roll-off.

Two steps back from tightening turned out to be one step too many. There is no end-game that works for the dilemma the Fed has created.

Jeff Gundlach, the new anointed bond king now that PIMCO's former CEO, Bill Gross, has abdicated the throne, seems to agree:

Three months ago the Fed predicted totally different policy than where they are now. How can they predict 2020 policy with a straight face?

— Jeffrey Gundlach (@TruthGundlach) March 21, 2019

In an interview with Reuters, Gundlach said,

“This U-Turn - on nothing fundamentally changing - is unprecedented.... Three months ago, we were on 'autopilot’ with the balance sheet - and now the bond market is priced for a rate cut this year. The reversal in their stance is stunning.â€

Gundlach says the Fed's hard stop and double-dovish statements could hurt the central banks credibility. As I've noted many times credibility is all the Fed has to sell.

Just because things seem invincible doesn’t mean they are invincible. There is kryptonite everywhere. Yesterday’s move created more uncertainty.

As with my own prediction of a stock market crash in 2018, Gundlach correctly predicted 2018's negative returns for the S&P 500, and he sees the S&P as set for another negative year this year, just as I said last year would be the start of a long market crash that would be interrupted by a number of major rallies, taking a couple of years to find its bottom -- maybe more. “It feels eerily like '07,†Gundlach noted.

Even the Fed admits it went too far with its tightening and is scrambling to avoid the problem it has created:

The Powell Fed is moving fast because it “recognizes that it was behind the curve on ending the balance sheet runoff,†said former Fed governor Larry Meyer, in a note to clients.

When the Fed flinches, better everybody flinch. The stock market, the housing market, and the general economy couldn't handle it ... just as I said would be the case.

Prediction #3: We'll be in recession by sometime this summer

On February 17th of this year, I wrote ...

My first prediction for 2019: I believe the US will go back into recession as soon as the Fed actually reverses course on interest rates. I believe things will be generally bad enough by late spring or summer (for all the reasons I laid out in my Premium Post titled “2019 Economic Headwinds Look Like Storm of the Century“) that we’ll see the Fed actually stop QT and reverse interest rates. However, we will already be in a recession when they do, though it will not be officially declared that the US entered recession until the end of the year or start of 2020 because recessions are only declared a month after GDP has receded for two straight quarters.

"The Bears Have it Right: Economy went Polar Opposite of Bullish Predictions"

The first part of that already proved exactly on with the Fed stating it will cut QT in half before summer starts and will stop it altogether at the end of summer. (They will phase the stop throughout the summer, ending it in September, the last month of summer.) Whether the Fed will reverse interest rates by then remains to be seen, but the main part of this prediction was that we will be in a recession by or before summer.

I was leaning toward making that prediction in January when I wrote ...

I think the Fed actually sees the recession coming but can never say so because its mere change of a pronoun reverberates throughout markets. What would happen if it ever said it sees a recession developing? Why else would the Fed start easing if it didn’t see trouble coming? By the time the Fed returns to easing, a recession is already foaming at the mouth. So, either they see it coming but lie and say they don’t — as Ben Burn-the-banky famously said in the summer of 2008 — or they are blind in the area of their supposed expertise.

"The Great Recovery Rewind: How the Federal Reserve’s Balance-Sheet Unwind is Unwinding Recovery"

By the end of January, I added ...

... the Fed had said that runoff would continue unless there was a substantial risk of a recession.... If such a face-losing change of course is due only to economic data, the Fed has surely put us all on economic watch.

The Fed, of course, also stated in February that the US economy was solid, a statement it removed in its March meeting summary.

A month after I made my bold February prediction (having seen no one else make it), others are starting to line up with my recession timing, which many would have though premature when I made that leap (and most still do):

“The indicators are stacking up to suggest that this [a recession] is not a 2021 phenomenon, that we could actually see the possibility of a recession starting maybe later this year,†Liz Ann Sonders, chief investment strategist at Charles Schwab, told CNBC’s "Closing Bell."

One of the reasons I gave for my prediction in the article where I made it was that the yield curve was close to inverting:

The yield curve has already twisted and contorted into portions that are flat or inverted. Nomura’s Charlie McElligot notes that steepening of the curve after inversion is the actual point at which we have almost always gone into recessions historically. My way of putting it is that “flattening of the yield curve cocks the gun; reducing interest rates again fires the gun.â€

I had just noted in another article that yield-curve inversion is the most reliable predictor of recessions there is, using the following chart:

An inverted yield curve has happened shortly before every US recession because the Fed has always tightened up financial conditions at the end of its recovery programs by raising interest rates until the yield curve inverts.... If you click on the link in the caption to the graph, you’ll see that even the Federal Reserve is aware of the fact that it tightens interest until it creates recessions. Apparently it doesn’t care because it continues to do this every time.

"BOND PRIMER: Does Inverted Yield Curve Indicate Recession?"

And, so, here we are. They've done it again, tightening until things go bonkers and the yield curve inverts. The fact that the yield curve stepped into full agreement last week with my February prediction is the strongest support that prediction can ask for, short of the final proof of a recession measuring out in GDP.

The reason the yield curve has been an absolutely reliable indicator of imminent recessions is that inversion of the yield curve makes it almost impossible for banks to borrow money cheaply now in order to loan it out longterm for a profit. Banks do poorly in that kind of abnormal interest environment. Caught in that odd position, credit starts to dry up.

That's why bank stocks have been leading the downhill the charge in stocks. Lack of easy credit creates a liquidity squeeze on the entire economy, and that is why the rest of the stock market rapidly followed banks over the cliff like a bunch of lemmings on Friday. With easy credit rapidly drying up and cash hoards from foreign profit repatriation last year now diminishing, stock buybacks will also dry up soon, leaving no money left to pump stocks up since companies have already entered an earnings recession.

Bam! The whole economy hits a wall.

The following recession indicator by Bloomberg and Financial Sense Wealth Management shows we are now right at the point where most recessions begin.

Just as the following chart shows we are as high and long in the business cycle as we have ever been:

Usually the business cycle has turned down just ahead of a recession, but in four instances it turned down exactly at the start of a recession or even slightly inside of a recession. So, any time now is fine.

Other US signs of recession: The Empire State Manufacturing Index took a huge plunge last week from 8.8 in its February report to 3.7 in March. (Wall Street's rosy-eyed economists were looking for a robust reading of 10!) IHS Markit’s purchasing manager’s index hit a 21-month low, dropping from 53 to 52.5 when America's brilliant economists expected it to rise to 53. E-commerce sales (not brick-and-mortar) dropped from 2.6% growth in the third quarter of 2018 to a just-reported 2.0% growth in the fourth quarter. (And the third-quarter growth rate was revised downward from a previously reported 3.1%.)

The world is awash in chaos

At the same time, we just learned this week that the Donald's trade war with China (with all of its attending tariffs) has likely been extended into the summer, according to the South China Morning Post. Brexit got pushed against a hard-Brexit wall by the EU, and the European economy is sliding so far backward that German bunds fell back Friday to yielding negative interest rates as the European Central Bank slashed its already low economic growth projections and rapidly switched from its promise to follow the Fed in tightening immediately back into easing (seeing how the Plan Fed failed) and as Europe's German industrial giant flash crashed.

The ECB cut its GDP growth projections from from a sad 1.7% to a pathetic 1.1%. German manufacturing PMI fell from an already low 47.6 (under 50 leans into recession) to 44.7, its lowest reading since 2012! France followed a similar path -- dismal news, given that our dim-bulb economists had generally expected a nudge of improvement but got a face-plant instead.

The British were told by Europe, either accept the Brexit deal that the UK parliament has already overwhelming rejected twice, or crash out of the EU with no deal on April 12th. They got a wee bit of extension from the end of March to chew on that and then take the deal as it stands or get their butts out the door.

South Korean exports dropped 19.1% last month.

Parts and pieces of the global economy are falling like ice calving from a glacier in the summer heat. After ten years of red-hot stimulus recovery efforts, the Fed and its European counterpart thought they could tighten things up a little, and within the shortest time imaginable the global economy hasn't looked this bad since the Great Recession.

And that is why the Fed and the ECB put a panic stop on their tightening efforts.

Never been a permabear

For the sake of those who wrongly claim I'm a permabear who just keeps predicting recession and stock market collapses from year to year, I'll highlight that I said there would be no stock market crash or economic recession in 2013:

No spectacular end in site for the economy in 2013. Nouriel Roubini, and Jim Rogers also predicted an economic collapse in 2013. The ... parties mentioned ... believed it would be triggered by the “fiscal cliff†we would slide off of at the start of the year. I believe they are right that greater economic collapse is coming, but I did not believe their timing. Instead, I predicted, “we are more apt to see a long and worsening economic malaise than an imminent crash.â€

More to the point, I went on to say back in 2013 ...

The Fed will hit its end limit, and it’s repeat failures to accomplish anything that sustains itself are solid evidence that I am right.... We are out of recession only because quantitative easing continues at a huge level. As said above, that locks the Fed into continuing it.

In 2014, I also refrained from predicting a stock market crash or a recession:

I’m not going to go so far as to say there will be a 2014 stock market crash this fall, but there are some concerning forces building up.... I’m still not crying in this blog that the sky is falling this year — not putting the indicator at red just yet.

I did, however, predict a critically bad time for the stock market to come in the fall of 2014, and such a time hit like a truckload of bricks. The market broke, and after the break failed to rise again for two full years:

This is coming from someone who has not been crying the sky is falling for some time.... I won’t go as far as I did with the housing market [in 2007] by predicting a stock-market crash based on the evidence at the moment, but I will say it is looking like a significant risk this fall.... I avoid sensationalism or market pessimism, but unlike bullish market optimists I will predict doom when doom really is on the horizon, but not before. I would move the needle on my gauge that monitors the likelihood of an economic crash this year from yellow to solidly orange where I predicted in the spring that it would be come fall … while most others are saying it has moved from yellow toward green. The sad tale to be seen in the market today is that we have learned nothing from the economic crash of 2008 and less than nothing from the high-tech crash at the beginning of the millennium.... The likelihood of that market toppling in the fall has increased. I’m still not crying in this blog that the sky is falling this year — not putting the indicator at red just yet — but you need to keep your eye on these forces.

As soon as fall hit, the market broke. It didn't crash, just as I said it might not get that bad, tumbling only into a correction, but it truly broke in that it did nothing but churn violently sideways all the way up to the day Trump was elected two years later.

In an earlier article for 2013, I had stated,

With the U.S. and most of Europe financing their toppling debts with Ponzi schemes, I predict years of malaise that will not go away until our economies either blow apart from their own centrifugal forces or until leaders break denial and realize they have not laid groundwork for a new sustainable economy but have tried to keep alive a dying dinosaur. That dinosaur has to fail because its principles of building “wealth†out of debt were wrong in the first place.

That is essentially where we are now: the Fed realizes its recovery is not sustainable without maintaining an enormous balance sheet (though it has no idea why); nor is it sustainable under normalized interest rates. So, the Fed has stopped interest increases just below the level that it said last year it would consider "normal" and has promised to sustain a huge balance sheet indefinitely.

One tiny second step away from tightening just caused as much market mayhem in both stocks and bonds as a little too much tightening caused. Imagine what a move back, toward actual quantitative easing would do! The Fed is jammed in tight.

And why is it so important to make all of this crystal clear? Because the bailout banksters -- Fed and pocket politicians included -- will soon be telling you no one could possible have seen something like this coming. Yes, you could. It was baked into the phony recovery recipe from the beginning.