2019 Economic Headwinds Look Like Storm of the Century

2018 was the year Wall Street was wrong about everything. You can trust your stock broker if you want, but 2018 doesn't give much confidence in her ability to stop talking her book and start talking straight. However, this overview of global economic headwinds -- greater in number and more severe than I can ever recall -- should give you a good feel for what the global economy has in store. This is not so much an article of 2019 economic predictions as an article that lays out the many forces that are already in play and that show every likelihood of continuing to grow in severity.

As a subscriber to The Great Recession Blog, you are among the only ones who will get this broad overview. I probably won't be writing many subscriber-only articles because my goal is to help as many as people as possible and to build resistance against the establishment; but I will try to make subscriber-only articles premium articles that are worth your extra support so you'll feel you got a big cut of meat while the rest are dining on the daily cereal.

The Fed's Great Recovery Rewind tightens to breaking point: The ultimate downdraft for the entire global economy is the Fed's balance-sheet unwind. If you get that, you're ahead of the Fed because they clearly don't, and neither do market analysts or most economists. The Great Rewind is far more significant than the Fed's targeted interest rates, which really have just been playing catch up to what the zapping out of existence of fiat money is doing.

We saw last January that the market plummeted when the Fed doubled down on the rate at which it is rewinding its recovery accomplishments, and then we saw the market immediately fall to pieces in the fall when the Fed finally amped up to full rewind velocity. This retraction of money from the monetary system affects some industries quite severely and not just stock prices or bond prices.

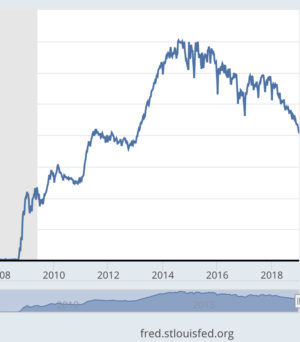

As money disappears from the monetary system, we see those pumped-up bank reserves insidiously collapsing, as shown in the chart below. These reserves were supposed to be our insurance against another banking blowout like the last one. They are down now by a trillion dollars since their high in the fall of 2014.

That decline makes sense to me because the Fed originally pumped up those reserves when it was buying bonds from banks in what it called quantitative easing. This how the money supply was inflated. The Fed is not allowed to buy its bonds directly from the US government, so it asked banks to buy them and then bought them from the banks by creating new money in their reserve accounts. Because banks can create loans out of thin air at a 70:1 ratio (or whatever ratio the Fed sets), the new money is hugely multiplied as new loans are issued. So, I would think now that they are rolling the bonds they bought off their balance sheet, they would have to suck money out of the bank reserves that they pumped up in order to meaningfully take money out of the system and to properly balance their books.

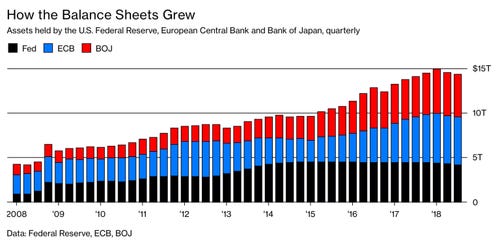

When did stocks take their first plunge? End of January 2018. When did the combined balance sheets of central banks peak and start to decline? End of January. When did stocks go totally crazy? When the Fed's balance-sheet unwind hit full speed in the fall.

Morgan Stanley's chief US equity strategist Michael Wilson argued that the inexorable rise in interest rates from September into the beginning of October put US equities in overvalued territory for the first time since January.

Note the connection: stocks drop in January because of rise in bond interest rates that happened as soon as the Fed started casting off bonds; stocks next big drop comes in October after another big rise in bond interest rates. This is called "equity-risk premium." The more low-risk bonds offer in yield, the more stocks have to offer as a premium above bonds in order to attract buyers. It is not just this competition for investors that causes money to move from stocks to bonds but concern that rising interest rates will diminish future corporate profit margins by raising the cost of doing business. Lower margins equal lower earnings per share.

If the Fed's monetary policy is not the central cause of the stock market's demise, why did everyone from Crazy Cramer to Donald J. Trump start crying for the Fed to take its foot off the brake? Their focus, however, has been on the Fed's stated interest targets, but the market soared through a whole year of interest-rate target increases. So, it's not the Fed's interest target that is the problem. The stock market didn't fall until the combined balance sheets of the Fed, ECB and BoJ began to decline in January and then again when the Fed reached full Rewind pitch in the fall. I've always said, this is where the big action will be; and because everyone is more focused on the Fed's interest rate policy, the Rewind is likely to go too far.

Taking Stock in the Year of the Bear: The stock markets of this world are only bits and pieces of that vast economic landscape over which these dry, cold winds are starting to howl, but what happens in the markets has a big impact on the overall economy, so the two often are conflated. 2018 closed as the worst year in stocks since the Great Recession with the worst December since the Great Depression. That left 2019 starting with the S&P sitting on the bear barrier and with the Nasdaq and Russel 2000 decidedly in bear country. This has transformed the market's decadal dynamics from "buy the dip" to "sell the rip."

While this article is about headwinds that face the economy as a whole, the stock market, itself, is already positioned to be a source of major turmoil to the general economy. Twelve-trillion dollars in global stock value has evaporated, leaving the world to feel twelve-trillion dollars less wealthy. That effects the whole economy. We are at a tipping point where any further erosion in stocks will start to damage banks, which have been hit the hardest so far, and other companies to where dominoes start to fall.

Up-and-down chop is making the market feel woozy, and the chop is being made worse by mysterious algorithms with their occulted self-taught formulae running the trade. (Even the original programmers say they do not know how their own algorithms now look because of the algo's self-programming ability.) Algos, which include high-frequency traders, run a higher risk of volatility exploding at any unknown minute into flash crashes. Set against rapidly changing reality in the economic landscape, these algo's become even more unpredictable as to how they will rewrite themselves.

This bear cub, born out of the worst December since 1931, is already a storm rocking the economy. As market analysts struggle to figure out why the stock market is falling when economic statistics, as they view them, have been solid, you know they're looking in the wrong direction. The answer is bond interest. Bonds have become a great vacuum, sucking money out of stocks. So, let's move on to bonds:

In stocks and bondage: Right now, capital flight from stocks is saving the bond market by helping to pull yields back down. This creates a seesawing effect between stocks and bonds that I have said will be the new dynamic for 2019. Nevertheless, a shuddering mysterious tremor hit the bond market during the New Year's Eve festivities. Overnight bond repo yields skyrocketed from 2.5% to 6.125%, the sharpest increase since 2001. Some have suggested this was a foreshock of deep bank liquidity problems that are starting to surface. One securities trader noted that year-end funding pressure should have created a 50-basis-points rise, but this was a 350-basis-points rise. The spike left mouths hanging open. It suggested banks suddenly had to raise cold cash.

On the same day, the yield curve on one-year bonds over two-year bonds suddenly plunged dramatically and inverted, hitting its lowest level since 2008. The yield curve on ones over sevens also inverted. In fact, every yield curve up to 8-year bonds has inverted now. Inversion of the yield curve -- especially if it hits the 10-year level -- is considered the strongest evidence that a recession lurks on the near to medium event horizon.

The unprecedented bond interest spike is a hint that bond yields could have more surprising upward moves in store. They are, of course, being tamped down right now due to money fleeing stocks. So the big bond bust probably won't happen until the stock market is depleted of capital. (If you buy and hold bonds until maturity, rising interest rates are a good thing; but if you buy bonds to hold them and then resell them when their price goes up; rising yields means falling prices, which can leave bond funds in trouble as the value of their holdings drop. You don't own bonds in your 401K. You own membership in a bond fund; so there goes your retirement fund if bond funds go down and they were your safe-haven strategy.)

Collateral collision course: The value of stocks and bonds deteriorated enough in December that we are going to start seeing collateral feedback loops in markets where those assets were pledged as collateral. The drop in collateral value forces all kinds of snowballing cycles, such as margin calls in the stock market. Rushed selling to match leveraged positions with declining collateral pushes prices down more, which creates more margin calls, etc. Bank collateral requirements on their derivatives (those nasty things that were central to our last collapse) are reduced to the extent they buy government bonds. The lowering of government bond prices as yields rise reduces the value of those bank reserve assets, requiring the banks to add to their collateral or to sell their derivatives into a falling market. The need to raise collateral can force banks to cut dividends or sell stock into what is now a falling financial market, pushing the value of stocks down further.

Credit crisis: There are so many ways in which a credit crisis is developing of such magnitude that I will be dedicating a full article soon to that topic. This developing headwind is felt particularly in the bond and collateral problems mentioned above. This change in how robust bank reserves are as their holdings in bonds devalue creates fear between banks, reducing their willingness to lend to each other, which tightens up the credit market for the whole economy because money stops moving as freely. At the same time, leveraged loans (meaning loans extended to companies or individuals who already have taken out a lot of credit or who have a poor credit history) are showing signs of crumbling in mass, creating a high default risk.

This is more in the realm of prediction than current headwind, but this gentle wind looks likely to whip up later in the year. The vital note here is that credit of every kind is tightening as central bank money supply shrinks. We've seen sudden spasms in bond rates. Recently, major loan sales have failed that banks usually wouldn't have had a problem with. When banks cannot sell large loans, they are less inclined to make them, and they have to drop the price at which they are offering those loans. The issuance of new high-yield bonds also ground to a near halt in December. That hasn't happened since November of 2008. Because the world is built on debt-based monetary systems, a credit seizure is everything; and we can now see dust falling out of the cracks in these columns that support our economy.

US Banks gone bonkers: Twice in two weeks, the government yelled out, "The banks are fine; don't worry," which caused everyone to worry about why the government felt the need to make such proclamations. The first unintentional alarm was rung loudly by Secretary of the Treasury Steven Mnuchin, who created a Christmas Eve Market Masacre; and the second alarm was accidentally rung at the start of the new year by the Office of the Comptroller of the Currency, which announced in an unanticipated report that the U.S. banking system has "strong capital and liquidity" and is "well-positioned" to navigate more adverse market conditions." He added that "OCC expects supervised institutions to understand exposures within their portfolios and take appropriate action to mitigate any risks.... Hubbard also explained that possible risks could include adverse effects on liquidity, pricing, or terms for corporate loans and bonds." (Zero Hedge) Again, no one was anticipating a report from him, so people wondered why this came pouring out of the blue.

Maybe the severity of the crash in bank stocks during the fourth quarter of 2018 into such a deep pit caused our financial engineers to fear we might all be fearing. Bank stocks fell about 30-40%. It seems the Treasurer and OCC were yelling, "Nothing to see here, folks. Move along!" That always makes me want to stop and look down into the sinkhole to see how deep it is.

Apparently, all of that still wasn't enough alarm, so the next trading day, the FDIC joined the chorus and spooked stocks even further down by announcing, again unexpectedly, that they had "no concerns" because banks are "superbly capitalized." (Never mind that steep decline in the Fed's graph above of member bank reserves.) "Nothing that happened in December gave us concern," the FDIC continued. It seems we are prepared for whatever is happening, so I wouldn't worry about it. The same people that had it all under control in 2007 and 2008 have it all under control.

Eurozoning out: This past year of the Fed's Great Recovery Rewind has been made a little easier by the fact that the European Central Bank was still printing money (still engaged in quantitative easing). That, we have been assured, just ended at the close of 2018. While ECB President Draghi is not reducing his balance sheet like the Fed, the end of new free money takes more lift out of the global economy, stock markets and bond markets in particular. Some of the ECBs new free money was making its way into US markets as a safer refuge than the Eurozone (best horse in the glue factory). Unless Draghi goes back on his word, fewer European bonds being soaked up by the ECB will mean European bond yields tend to rise to find other buyers, which will put additional upward pressure on the bond yields of other nations in order to complete in the global bond market.

We just saw France trying to exceed the budget deficit ceiling required by Europe in order to placate flaming Parisians. Allowing that would mean Italy, Spain, and Greece get the same treatment. Not allowing it could create a rift between the Eurozone superpowers -- the French and the always austere Germans. Brexit, Grexit, Spexit and Italeave are always swirling around like autumn winds caught in eddies that can't make up their mind which way to blow the leaves. No one knows if or how any of those pieces will fall, but the potential negative energy from Europe never stops building as the number of swirling leaves grows, making it a near certainty that the European Community weighs negatively on the global economy this year.

I have always believed the EU is destined to failure because there is far less commonality holding it together than holds the states of the United States together, while there are infinitely more differences wedging those European states apart. Even in the US, that glue is cracking and the wedging is intensifying. Slowing growth in Europe (and China) can also cause significant US dollar appreciation, which further suppresses US exports.

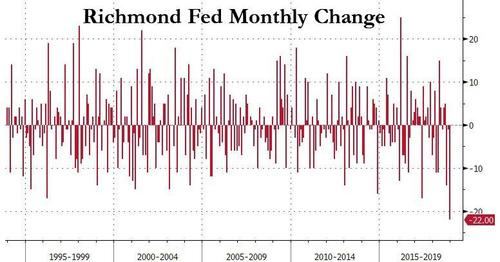

Declining global economies: Synchronized growth skidded to a halt near the start of 2018, and 2019 looks much worse. China's PMI just dropped below the 50-point neutral level. Europe's remains below, and the US got one blip of great GDP growth in the 2nd quarter of 2018 with the third quarter down about a point, and fourth quarter looking like it will come in at least a point below that. US manufacturing PMI slipped to a fifteen-month low in December. “Everybody is terrified that this is a sign of a global slowdown,†Art Cashin, director of floor operations at UBS, told CNBC on the first trading day of the new year. Both the Richmond Fed and Dallas Fed business surveys plunged last month. The Richmond Fed's manufacturing index saw shipments plummet to their lowest since 2009, local business conditions hit their lowest point on record, while new order volume and backorder backlogs both fell and inventory started stacking up, which means pressure into the year. The composite of this survey took its biggest drop in history:

Carmageddon and the Retail Apocalypse: GM and Ford have already announced factory layoffs due to the decline in auto sales that was long forecasted here. It seems like every quarter Sears announces more store closures. Problems in these two economic sectors, which along with housing, led the way into the present crash, are not abating. In fact, tariffs are making pressure in both auto sales and retail worse. While the jobs report in December was a burst of good news that might seem to belie the idea of looming layoffs, the unreported part of that news was that most of December's apparent increase came due to downward revision that happened in previous monthly statistics! The rest was likely due to "seasonal adjustments," which I've dug into in the past to show how jobs are adjusted way up for December "due to extreme cold" and then go way up again the next December "due to unseasonable warmth." Apparently there is only one perfect temperature for December, which is never the temperature of December Present!

Trump Trade: The Trump Tariffs can swing either way in terms of what they will do to markets and the economy in 2019, depending on how they are resolved. For now they are a lid on the stock market and on the expansion of global sales markets. Because they have struck a lot of fear into the stock market and into corporate business strategies, their resolution would likely cause the stock market to briefly boil over ... until all the other problems discussed in this article regained control over the market's mind. It looks like resolution could take awhile, though, and will most likely end, as did Trump's European trade war, with paltry promises of minor concessions that have yet to materialize (and may never materialize as the major players find ways to stall through Trump's next two years). U.S. Trade Representative Robert Lighthizer says he wants to prevent President Donald Trump from accepting “empty promises†from China, and he has warned Trump that more tariffs may be needed to get to meaningful negotiations. In the end, this tariff turmoil will probably have yielded us little balm for our bruises; but I would anticipate resolution of this strong headwind sometime this year to cause some temporary lift.

Delayed tariff impact via GDP: Irrespective of what happens in the future with tariffs, I noted last summer that the main reason US GDP rose in the second quarter was that industries all over the US saw sales jump in order to close before tariffs hit. Everyone did as much buying and warehousing as they could to stock up ahead of tariffs. That brought future economic activity forward. I projected GDP would decline in the third quarter but still remain fairly high due to one pre-tariff month coming in that quarter. And that's what it did, dropping from the 4s to the 3s. With all pre-tariff sales completed before the 4th quarter, I project that quarter will come in down in the 2s. From there, we will now pay in the first quarter of 2019 when it is reported later in the year with even more shrinkage in GDP growth down into the 1s, due to a temporary decline in purchases as we burn through the overstock created last year as well as due to all the headwinds above taking their toll. GDP is a number a lot of people watch more than they should because is highly rigged, but there is limit to how much they can rig it and be believable, and because it is the most lagging of all economic indicators, telling us only where we were months ago. Nevertheless, it is watched by many, so the number all by itself can create its own feedback loop into stock markets and the general economy. People change how they plan if it looks like we're going into recession (where GDP growth turns negative; i.e. GDP recedes).

Housing over the hump: We all know the American economy has long been designed for housing growth to be its major driver. Nearly two years ago, I said the Fed's balance-sheet unwind, which primarily impacts long-term interest rates, would drive down the housing market. I'll have a full article on housing soon, but suffice it to say in this headwinds overview that we saw a housing decline begin in 2018, and it will grow worse in 2019 as mortgage rates rise even further. New housing feeds real-estate agents, mortgage brokers, bankers, developers, road crews, carpenters, landscapers, drywall installers, painters, plumbers, electricians, furniture salesman, cabinetmakers, glazers, appliance manufacturers, furnace manufacturers, lumber mills and loggers, the grocery stores, restaurants and gas stations that supply them all. You get the point, and that is why we build our economy around it. It's why so many people want immigrants (partly for cheap labor and partly because they will need more housing). That is a minuscule part of the total list of people who make money off of new housing and off of remodeling old housing. So, with housing now clearly going down, the economic impact comes down to simple math: higher interest equals higher payments in a land of flat wages, which means fewer buyers and/or lower prices to get the payments back down. Housing sales and prices are falling now in Australia and Canada, too.

China Syndrome: (Bear in mind that the following is just about current headwinds that are building from China and not risks on the event horizon, such as military conflict in the South China Sea or over Taiwan.) The People's Bank of China has warned the Chinese people not to buy housing because there is no longer any money to be made due to extravagant prices and high vacancy rates. (There are only 50,000,000 (yes, million) vacant Chinese apartments right now. That's 22% of China's urban housing that is unoccupied, double the US, which is second-highest in the world. However, 75% of Chinese wealth is held in housing, as opposed to 28% in the US. So, when you have millions of Chinese underwater on their condos and fifty-million vacant homes, it does dent the world's second-largest economy. Remember, the Chinese economy helped save the rest of the declining world through the Great Recession. That doesn't look likely this time.

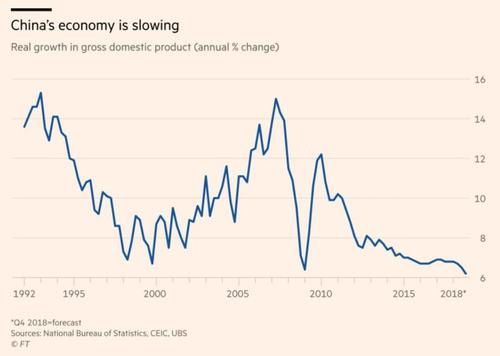

For the first time since 2011, other Chinese economic data, such as manufacturing surveys, retail sales indicators, factory output, investment, hiring, and consumption are way down -- both year on year and quarter on quarter. China's individual, corporate and government debt are also all much higher than they've ever been, and China no longer runs a surplus budget, leaving China less room for new stimulus. Moreover, the Law of Diminishing returns has insidiously crept up on China to where it now takes twice as much capital investment to create a given amount of GDP increase than it did 2007.

If you're not sure how much China matters, just remember the times the US market and other world markets plunged because Chinese markets plunged. And then think of how Apple's stock tanked 10% ($100,000,000,000) when it announced iPhone sales in China would be down in 2019. The world is still connected, so China is a hard-blowing threat already to the rest of the global economy. Check the graph out below to see where we were the last two times China's GDP growth was this low (not proving cause, but certainly correlation with major downturns):

Oiled up or oiled down: I'm not going to venture a prediction on where oil prices are headed, but will just note that they currently have entered a troubling level and show little sign of rising. Low oil prices are customarily thought to be good for the economy because cheap oil greases the economic skids by making energy and transportation and product ingredients less expensive for business while increasing available consumer income because consumers are paying less for auto fuel and heating fuel and, in some areas, electricity. However, we saw in 2016 that prices below $50 a barrel cause companies in the oil industry to collapse and jobs to be lost in those regions and stocks in all those companies to plummet and their bankers to shudder. We've just entered that danger zone where low oil can cause the economic engine to seize up. One has to also consider the cause of falling oil prices. This time around it is not due to OPEC over-production in an attempt to shut out US shale drillers, as it was last time, but due to declining demand; so the prices are indicative of what is already happening to the general economy, which will begin to show up in GDP numbers.

A taxing problem: The repatriation of years of foreign corporate profits at lower tax rates was a one-year program that helped prop up the stock market after its January plunge in 2018 because some of the big tax advantages were front loaded into the Trump Tax Cuts with the express purpose of getting as much economic acceleration from the tax cuts into the first year as possible. That accelerant is over! Instead of being used to build stronger companies, the repatriated cash was largely used to fuel record stock buybacks after a long period of prior record stock buybacks and to inflate dividends.

Yet, those record buybacks, impactful as buybacks are to corporate earnings per share, were not able to lift the market last year. They were not even able to keep the market from falling. So, how much worse will stocks do this year as the fuel for buybacks (low interest and repatriated cash) all comes to an end? There is probably still enough repatriated cash in the coffers from last year for some buybacks, but you can certainly expect fewer than we saw in 2018.

Moreover, with stock prices falling badly, CEOs now have to return to their board rooms to explain why they used up vast sums of corporate cash just to make shareholders poorer because now they have nothing to show for it. Whereas, if they had spent the cash on R&D or capital improvements or market expansion, the investors would have something extra in value for all the money spent; but the money vaporized as quickly as stock values fell. Pretty sure that is going to make it hard to convince boards to do more of same.

We saw the same thing happen leading into and then during the last financial crisis. Corporations raised their stock values exponentially with buybacks right before the big crash only to watch it all evaporate and then wound up selling stocks into a plunging market. Maybe it turns out the CEOs are the dumb money unless they, at least, got all their own money out during the buyback period by using company cash to buy their own stocks (which I reported about a year ago many were doing). Pretty sure all of that is ending.

Government debt bomb: If you thought the government deficit exploded last year when taxes were cut and spending was increased, wait until you see how bad it looks this year. Foreign-profit repatriation dumped huge stockpiles of cash into corporate tax payments last year. While it got taxed at a lowered rate, it still got taxed. Some of that will remain to be paid in the first quarter of this year, but then that is over! Even in 2018, we saw GDP decline after the second quarter, so the idea that the stimulus effect of tax breaks will start to pay for those tax breaks is an idea that went bust after the second quarter. The fourth quarter is actually expected to come in no better than an average OBAMA quarter!

The now-skyrocketing government deficit from tax cuts and spending increases forces more government bond issues at a time as the Fed's Great Recovery Rewind forces the government to refinance more of its old maturing bonds. That becomes double pressure on bond interest rates this year, which will snowball for the government as the rising interest costs also make each new round of bond issues larger and harder. The generally rising rates on government bonds (allowing for the seesaw effect mentioned earlier) mean financing costs for corporations will rise this year because their bonds have to compete against safer government bonds.

This time bomb is exploding in slow motion. We are now on a course of trillion-dollar annual deficits as far as the eye can see in an environment pressuring interest up. Europe's sovereign debt bombs and Japan's and China's are all worse. Some of this is just risk and not actual headwinds yet, but the breeze is already stirring your hair. At some point, whether this year or next, it becomes an all-out storm because there is almost certainly no way to diffuse the problem.

Social disruption and government stalemate: Why is there no way to diffuse the government debt-bomb problem ... at least, in the US? The animosity over the 1% versus all the rest of us has pressured the US into intensely polarized social discord between Left and Right. With congress now divided again, and half of congress hating Donald Trump viscerally, this discord makes government less able to do anything about anything. Gridlock is guaranteed.

The battle between fake news and false presidential statements is also likely to get worse -- and more polarizing to audiences -- as Trump comes under increasing fire now that Democrats have resumed a little control. Now that Trump has committed the unpardonable mistake of being at war with the military brass, expect more heat. Those guys fight back, and they've got the ammunition to do it. Again, this article isn't about predictions but actual headwinds; so suffice it to say this current headwind of constant disruptions shows only signs of intensifying. Markets don't like disruptions.

Getting Trumpled underfoot: It all goes without saying, but Trump's troubles will be a headwind for the economy, especially the stock market, which hates surprises; so I have to say it: Trump loves surprises. Trump loves headlines. Trump loves reality T.V., and Trump loves toying with the press. Trump loves attention, and he's going to get plenty of it because Trump is in trouble ... everywhere. His daughter, son and son-in-law may all be indicted on minor charges by Mueller, whether deserved or not. While I doubt Mueller has anything on Trump regarding Russian collaboration against the Democrats, he has been on a two-year fishing trip that has probably turned up some notable tax problems for the Old Man, too. Trump will fight back like the elder lion against his rival. So, lots of political turmoil is going to be swirling around this year.

The Democrats can finally impeach Trump, even if they cannot successfully bring him to trial, and they probably will if only to please their base, but also just to disable Trump as much as they can. Subpoenas will be flying like paper airplanes between the Capitol building and the White House. As James Howard Kunstler calls it, this will be the year of Investi-Gate.

So, get ready to get Trumped at every turn. In addition to Mueller finally unloading whatever he has on Trump, the 2020 presidential race locks and loads this year. The loose cannon in the White House is going to be unmuzzled and bouncing off the White House walls in a red-hot frenzy every day. I can't see how that makes for a risk-taking climate in stocks or in business.

I don't think the Trump Troubles are priced into the market yet because no one has any idea how they are all going to play out, except as some sort of generalized political mess. They will get priced in as each one crystalizes into view. The mayhem surrounding Trump as he fights back also means few in government will be paying attention to steering the ship until the tearing of icebergs against the hull gets everyone back to paying attention. We've long seen that party politics trumps patriotism on both sides.

In conclusion: Some of those headwinds that are already roaring could die down, as can happen in any year; but they do not appear likely to, and there are so many already blowing from all directions that this year promises turmoil at every turn. Brace yourself.

If you found this article helpful, please consider leaving a few positive references to it in comments elsewhere on the site when appropriate that will encourage others to sign up at this level. My premium articles will likely be the more comprehensive ones like this, while others on the site will be shorter takes on one specific topic. These take more time digest, so they give you some meat to chew on for awhile; but they also hopefully give you a much more comprehensive picture than the sound-byte size that is common today. Whether they come quarterly or monthly will depend on how often broader or deeper articles seem necessary.