2023 Economic Predictions: The Road Dead Ahead

Since this is a long article packed with my predictions (and some near-predictions, so let's say "high likelihoods"), you will probably want to read it in sections, which you'll find cover my ongoing predictions about the following topics:

and wars and rumors of war, including their impact on globalism

To make it easier to get back to where you left off, I've made these targeted links within the article that you can click on to drop down to the section you want.

Inflation continues to be the driving story in 2023

Inflation will not resolve to the level the Fed needs to see to back its key interest rate down to a neutral level, but the Fed has told us clearly its goal is now to taper its interest increases to a pause where it will wait and see what the increases it has done achieve.

Inflation may rise again in the first few months of the year, pressing the Fed, once again, to tighten to a higher level than either the market or Fed expects. We saw that at many of the Fed's meetings last year. The Fed cannot control shortages, which are a major factor in our present inflation around the world, and the Fed will need to create a lot of economic damage to get inflation down by sucking money out right when scarcity is driving up prices. As a result, the Fed may even exacerbate shortages by clamping down on an economy that is already underproducing due to crippled labor. In that case, inflation may rise even more late in the year as economic wreckage worsens shortages.

That will depend on which force is greater -- the destruction of demand through the gradual impoverishment of citizens (job losses, stock crashes, bond crashes, housing crashes, pension fund crashes ... all the usual stuff) or further destruction of supply (death of zombie companies that maintained production only via debt finance along with widespread reduction in the scale of operations of healthy companies -- due to numerous financial impacts of shortages and raised financing costs and inflation on top of demand destruction, etc. -- or even the death of some currently healthy companies).

I think the most likely course is that the Fed holds interest levels at about 5.5% for as long as inflation looks like it is moderating until something major breaks. At that point, it won't pivot directly to stimulus-level rates and not to QE either, but it may bail out the thing that breaks and will lower interest to what it considers a likely neutral level. (If breakage spreads wider, all bets are off.)

Since I covered the explanations for my inflation predictions in a recent prediction article available to the general public, I won't go into the details this recap. (See: "2023 Prediction: The Fed’s Inflation Fight is FAR from over!")

Moving into digital dollars rapidly now

First, the US dollar will not collapse. That might seem like a no-brainer to some, but many who have either an anti-US bent or others with gold fantasies or just Fed distrust (matching my own Fed distrust) are constantly predicting the dollar will fail due to hyperinflation within the nation or will fail as a global currency because it has been so weaponized it will be rejected by many nations. The prevalent belief in the alternative press right now is that Russia and China will rush in to seize the day. I do not share the belief of the many who are predicting the dollar's collapse. I have never been one of them and have been right not to get on that bandwagon all along, and I still am not going there. Maybe someday because nothing lasts forever, but not this year.

This proclamation has been made for decades, but the sanctions over the Ukraine war are pumping new life into the rumors. Even though predictions of the dollar's collapse and replacement have been completely wrong for decades, people just don’t understand how far all other currencies are from being able to carry the load the US dollar carries as the global currency because they don’t understand what it takes to be the global reserve currency. Here Peter Zeihan does a great and quick job of summarizing what it takes, so I needn't lay all that out in this article: "Global Currency: The Dollar Ain't Going Nowhere."

That said, I fully expect the dollar will decline some in value (against other currencies, not just due to inflation) for the simple reason that the Fed's tightening is the force that has been pushing the dollar up in value on the Dollar Index. As the Fed now moves into a holding pattern on tightening, that lift will subside, especially as other nations continue to tighten. There is bound to be some settling relative to other currencies, which are all combatting their own internal inflation as well. What I also predict is that all the dollar-collapse prognosticators will find it hard to resist that bait and will use it to say the dollar is now being destroyed by something like the bogus new petro-ruble they all talked about this year. They will be wrong, but that won't stop them from continuing to say it. The ruble may take some of the heat out of the dollar's rise in value within the Dollar Index, and the Chinese renminbi may as well, but neither are positioned anywhere near what it takes to take the dollar down. Both nations have severe financial and economic problems of their own, making their currencies less desirable as a global reserve currency than they were before.

Rather, what we will see happening is the normal softening of the dollar as Fed tightening stabilizes after a year of pushing harder and harder on the brakes. We'll also see some forced need for some nations to trade oil in something other than dollars due sanctions. So, of course, they will do ruble trades and renminbi trades, etc. But all of the West will stay in the dollar to the level they aren now, and many Eastern nations will stay in, too, because they continue to trade with numerous nations in the West using dollars (and euros) as their trade currency.

That said there is a new relacement for the dollar as we know it coming: a Federal Reserve Central Bank Digital Currency. Joe Biden, as noted in some of my earlier articles, has ordered all branches of government to get ready for integrating with its deployment. I'm sure they still have plenty of working out to do, but he has ordered that a proposal go to congress by the end of last year. I haven't seen any proposal that would make a change to a digital currency and a cashless system a reality this year, but we will see visible moves in that direction of the kind we have not seen before.

Clear back in April of 2020 I wrote,

National currencies will lose the trust of their citizens because those currencies have already been manipulated to death, and are already in the throes of currency wars. Alternate electronic currencies will battle for significance as a solution. These are actually far less secure than the government-bankster-controlled currencies. So, I would expect, at least, one of those big-name electronic currencies to fail spectacularly, bringing losses to millions, or expect that one of them will prove to be hugely corrupted. This will demand a government currency solution.

Banks and governments want a currency they can directly control anyway. Their turf is enormously threatened by alternative currencies because controlling the currency has been the major money-maker for all of the major banks that own the Federal Reserve. It is ultimately those banks that decide to create new currency and give it to themselves. Banks already want a cashless solution because cash is awkward and costs more money to process. Governments also want a cashless financial system because cash cannot be controlled, other than for its overall value; it can’t be easily tracked; so, it cannot be easily policed or easily taxed."The Epocalypse is Different This Time, Yet Much as Predicted"

That was not a prediction specifically for 2020 (the kind I put in red type to make clear what I am actually predicting) but was a stated expectation of something I believed we'd see coming down the road without saying when it would arrive. We certainly saw the massive collapse of many of those alternative digital currencies hit hard in 2022. They were epoch in scale and came with plenty of corruption attached to the cryptocrash as well. That all increases the opportunity, as I've said in many Patron Posts, for central banks to rush in with a CBDC of their own.

This may be the year for some sort of street-level introduction or testing of a CBDC in the US. It's important to note that a CBDC issued by the Federal Reserve will not be the end of the dollar. It will still be "the dollar," both in name but more importantly in the sense that it will be fully controlled for value by the Fed. It will not have a value determined by blockchain mining or anything else outside of the Fed. It will be a Fed buck in a new digital form. Some writers have claimed Fed bank accounts for a digital dollar won't happen because commercial and retail banks, which own the Fed, would never allow the Fed to cut them out of that action.

Well, of course not, I covered that problem in Patron Posts more than two years ago and since then, too:

Unlike the US central bank where our own Federal Reserve president indicated commercial banks could be cut out of the loop (I doubt it), the BoJ makes it clear that any CBDC it issues will be done through its member banks: (Of course it will. So will the Fed’s.)

"...Even if the Bank were to issue general purpose CBDC, it would still be appropriate to maintain a two-tiered payment and settlement system of a central bank and the private sector. This means that CBDC would be issued indirectly through intermediaries.""Central Banks All-in on Cashless Cash" (October 24, 2020)

That always seemed like a no-brainer to me for the Fed as well. There is no reason the Fed cannot issue a CBDC that goes directly into your commercial/retail bank account but still requires you to that regular bank account for all processing of your digital currency through a Fed member bank. This is the kind of "distributed ledger" they started beta-testing in 2022, as I described in an article last year. (See: "The Money of the Apocalypse is Rising in US Banks from the Ashes of the Cryptocrisis THIS WEEK!")

So, we see what has been a relentless march through my Patron Posts and out in the real world for a few years now toward digital currencies, which will eventually replace cash completely, as CBDCs have started to emerge and governments, like the US, government, begin seriously working out their implementation.

I predict this year will will see much more publicly visible steps taken toward rolling out a fully digital dollar, and this may be the year we see it beta tested, just like last year was the year the Fed began closed testing within some of its member banks of its new distributed ledger that will eventually be used to allow the flow of digital dollar from you, through the member banks, and to the Fed instantly, to avoid all the cumbersome clearing processes currently used to move money through the Federal Reserve System ... or, at least, greatly streamline them.

Government debt debacles

Consider the Fed’s predicament: The Fed is forced by law to tighten the economy in order to battle inflation, which means raising the government’s interest rates, since the Fed does most of its financial manipulation in the Treasuries market. That makes the debt ceiling a much larger problem because it will be impossible to refinance the debt at these higher rates without major government cuts, and this happens at a time when a faction within the Republican Party is determined to cut spending, and that faction is empowered more than minority factions usually are by the fact that the Republican Party overall has such a slim majority in congress, and Democrats certainly aren’t going to vote to cut spending.

So, we are going to see major turmoil of the debt ceiling as we approach the middle of the year when it is estimated the government will run out of money if it cannot raise the debt ceiling. That will have its own financial repercussions in stocks and bonds and could cause the nation's second credit downgrade as I predicted would likely happen in 2011 and as did happen. I won't go quite that far just yet. Maybe later as we see how the squabble gets heated.

The sovereign funds of other nations are experiencing serious decline because the collapse this time is much different than in the past. I don't know if we've ever seen another time stocks and bonds and housing all crashed together, but that has even left some major sovereign-wealth funds experiencing serious losses because they don't have the usual shelter in one market or the other that they have had in the past for their conservative methods to work. Thus, we are starting to see headlines like the following from today's Daily Doom:

Norway’s gigantic sovereign wealth fund loses a record $164 billion, citing ‘very unusual’ year

Norway’s Government Pension Fund Global, among the world’s largest investors, returned -14.1% last year.

“The market was impacted by war in Europe, high inflation, and rising interest rates. This negatively impacted both the equity market and bond market at the same time, which is very unusual,†said Norges Bank Investment Management CEO Nicolai Tangen. "“All the sectors in the equity market had negative returns, with the exception of energy."

Those managing their nation's funds reserved for paying of pensions, etc., have nowhere to turn for traditional safe havens this time around. It's very unusual, but something I laid out in last year's predictions as part of what we have to expect from the collapse of the Everything Bubble:

Putin's War has certainly increased the number of sovereign debt defaults we are going to see....

Sovereign-debt defaults are now more likely, not less, in nations that will be impacted the worst by these sanctions because they have less capacity to add more debt to carry the burden of the sanctions, especially as some see their credit ratings downgraded due to the collateral economic damage caused by the sanctions....

Sovereign defaults have not become cataclysmic so far, but they have worsened appreciably, and these new sanctions now pile more pressure onto those sovereign debts....

[It is] impossible to say how this mess will actually play out; but one thing that is easy to say is that the sovereign debt problem that was building has become a lot messier due to the sanctions of war....

Other nations will face sovereign debt problems due to the sanctions, and it's happening when we were already sliding into a global recession that few in the US seem to recognize and as central banks all over the world began tightening into that recession, etc. etc. It's way too complex for anyone to see how it will play out, but it's certainly one more massive boulder added to the mountains of debt troubles I wrote about in the Everything Bubble Bust series.

That prior Patron Post in the Everything Bubble Bust series went like this:

A sovereign debt crisis is coming

While zombie corporations may appear to be the biggest threat in a bond-bubble burst, there are others that may become bigger over time. We have zombie governments! Those are nations that can manage to pay only the interest on their debt, and that is only because central banks have helped their national governments by keeping interest extremely low. The only way CBs will be able to help their nations at that level now is to create Weimar-style hyperinflation by giving up the inflation battle they have just set out on unless the supply issues all over the world resolve themselves and cut CBs some slack. (I'll point out in another article for all readers how that is not happening and why it is very unlikely that it even CAN happen in time to save central banks from the traps they have set for themselves.)

We can look at what Greece went through a few years ago as some indication of the strains that result when sovereign debt gets downgraded due to default risk. You may say the risk of that for the US or other large nations is not likely (and to some extent the US may be spared by being the best horse left in the glue factory to where global money coagulates over here for safety); but what I am saying is national salvation by CBs is not a likely result from whatever happens because central banks have guaranteed their mother nation's extraordinarily cheap credit for years. If that doesn't end right now by central banks refusing to cooperate with their sovereign's needs, then currency debasement and soaring inflation take over. So, either way…."The Everything Bubble Bust Pt. 3: The Big Bond Blowup" (February 8, 2022)

As you can see, I didn't say major sovereign debt defaults were a prediction for last year, but only that the pressures toward them would grow increasingly severe through the year. And so we see that situation continuing to get worse. Norway is a nation making bank off of its fossil fuels, and its sovereign wealth is highly invested in that energy, which is doing extremely well; yet, they still saw overall losses of 14%. While other nations can invest their stored funds in energy stocks, too, depending on their legal restrictions, I suspect many are less invested than Norway, being the major energy producer that it is for its size. After all ...

The $1.3 trillion fund was established in the 1990s to invest the surplus revenues of Norway’s oil and gas sector. To date, the fund has invested in more than 9,300 companies in 70 countries around the world.

So, imagine how much worse many other nations are struggling that have not been so heavily invested in energy and with money derived from national energy royalties/leases if Norway's fund went down 14%.

This deterioration in stored sovereign wealth due to market declines is going to make it hugely problematic for central banks to continue the battle they largely created for themselves against inflation. Sovereign funds are seeing collapse from all sides because, as I said at the start of last year's predictions, 2022 was the beginning of the bursting of the Everything Bubble that central banks overinflated and are now tying hard to deflate.

With inflation also rising and pressing CBs to keep raising interest rates, governments have to face higher payments on all of their debt as the debt rolls over, PLUS they are seeing a good part of their stored sovereign wealth collapse as all markets go down at once, forcing them to raise even more through increasingly expensive debt or else taxes, and who will be able to bear higher taxes in a global recession? Raising taxes, all by itself, would drive us deeper into recession tax increases are a huge force for tightening the economy and one of the ways economists traditionally have recommended tightening be done.

My prediction for this year is the same as last, which is that we will continue to see pressure on sovereign wealth funds intensify throughout the year. Last time, holding the prediction to that level, rather than predicting actual national collapse like the kind that developed during the Grexit crisis, proved to be the right level. I believe it is the right level of caution this year, too. Expect to see continued pressure in the direction of sovereign wealth funds collapsing and the buildup toward corresponding sovereign debt defaults; but I won't go as far as to say I am certain we'll those defaults actually happen this year ... yet.

The bear market in stocks keeps roaring downhill

Stocks will fall 15-20% from where they are now during 2023. They could fall a lot further than that, but falling further will depend on what breakage happens in the economy. The 15-20% is where Fed tightening will take stocks before they find their bottom if we merely go into an officially recognized soft recession.

There will be big rallies of new but vapid hope along the way, just as there were throughout last year. The present rally is the only one since this bear market began where all the major indices finally broke out of their bear channels. Not only did they breach their longterm declining trend line for those bear-market rallies, but they have risen slightly above their 200-day moving average.

As I noted in an earlier article, the Dow broke solidly out its bearish channel in December:

While breaking above its top trend was the first hint that the Dow's bear market could be ending, I found it interesting that it only went high enough to level off with the peak of its big summer rally and has subsequently bumped along, unable to push through that level. So that height is proving to be very hard resistance to bust even with all the current enthusiasm, but it only needs to rise a little from where it closed on Tuesday to try to punch through that ceiling again.

It also broke above its 200 DMA (tan line) with its August peak, but that didn't hold even briefly. However, the 200 DMA did hold as support when it fell from its last rally peak in December. However, breaking through its 200 DMA did not carry it a bit further back in August as it fell to a knew low. That line did, however, seem to give support when the market fell off the peak of its December rally. So, the charts lean toward support for the bulls breaking out, but a clean breakout hasn't happened yet. Any hint of wavering hawkishness by the Fed on Wednesday could give the market the nudge it needs to break through the ceiling for awhile.

Essentially the same thing can be said for the S&P, except that it only touched its 200DMA in August, and its bear rally into December did not break its upper trend line but fell right back down along that line. In the last several day, however, it it did break through that trend and is resting on it and slightly its above its 200 DMA but still under the ceiling of its last peak like the Dow. So, it's breakout is a little more troubled than the Dow's.

The NASDAQ is even more undecided, having arrived right at its upper trend line, its 200DMA, its and the ceiling hit in its last bear rally all at essentially the same time in the last few days:

All of that is seen as very bullish. In my view, however, the bulls managed this only by overdosing on delirium on the continued addicted basis that they think the Fed will soften its stance, maybe even pivot this year, and we won't fall into a recession, or it will be very soft, and that stocks will stay at their current earnings level. I don't believe any of that, and I don't make my predictions based on charts, though they do clearly show the sentiment to go higher has been strong and could break in that direction. It will if the Fed comes in light tomorrow (Wednesday), and might defy the Fed regardless, but investors fight the Fed to their own peril.

As famed short seller Jim Chanos said in this morning's Daily Doom headlines, this is the most overpriced bear market he has seen in his career. In fact, Chanos says the bulls have the market priced to perfection. He notes the market is anticipating corporate profits rising 12% this year, 2% inflation and a Fed rate cut within the next six to seven months. He calls that “bull nirvana†and sees a long way for the market to fall, given the reality that is more likely to play out on Main Street.

I think, as does Chanos, the market is smoking some pretty hot delirium because the economy and Fed are highly unlikely to come close to any of that. As the Fed stays on track with its tightening, the market will become more dependent on earnings to justify upward speculation, and we are headed into an environment where earnings are rapidly falling.

Michael Wilson, the most on-track prognosticator in the mainstream all of last year, says the same thing, hoping the same chart formations for sentiment. He comes to the conclusion from the multiple metrics that his crew watches in addition to those major trend lines:

Wilson thinks we will soon have the final leg of this bear market. "...Bottom line, we double down on our thesis, which is now out of consensus again, based on sentiment and positioning. With month end this week taking some pressure off active managers to keep chasing this rally that is based on a narrative that started in October from much lower valuations, it's time to fade it...A pause is very different this time given the fact the Fed is still doing QT and remains unlikely to cut rates in the absence of a recession. In short, we think the Fed meeting this week will be a reminder of that fact." (Wilson, Morgan Stanley)

I do, too. I expect Powell to sound tough in Fed terms, but whether it is tough enough to brake the crack pipe the market is using to smoke its delirium, I don't know. If not now, soon enough. Legendary investor Jeremy Grantham, who admittedly tends to be usually bearish, makes the following statement:

My calculations of trendline value of the S&P 500, adjusted upwards for trendline growth and for expected inflation, is about 3200 by the end of 2023. I believe it is likely (3 to 1) to reach that trend and spend at least some time below it this year or next. Not the end of the world but compared to the Goldilocks pattern of the last 20 years, pretty brutal. And several other strategists now have similar numbers. To spell it out, 3200 would be a decline of just 16.7% for 2023 and with 4% inflation assumed for the year would total a 20% real decline for 2023 – or 40% real from the beginning of 2022. A modest overrun past 3200 would take this entire decline to, say, 45% to 50%, a little less bad than the usual decline of 50% or more from previous similarly extreme levels.

Like Chanos, Wilson and Grantham, I believe the market will see all of that. The Fed is still ready to rumble with this market, and the Fed wins. Even if it loses a few battles, it wins the war. If the Fed's stance at this meeting is not harsh enough to beat the full-throated roaring sentiment out of the bulls, I believe we have months of falling earnings in store, continued inflation, a long period of interest remaining just as high as it is or higher, the vicissitudes of war and global shortages continuing plus over a year of QT unless a new Repo Crisis breaks out and forces the Fed to stop. It's not even entirely certain Covid is done with mangling us, in good part due to our own response to it. So, the market is beyond delusional!

The return of the Repocalypse?

I believe another repo crisis like we saw in 2019 due to the Fed going further with its QT than banks could handle is less likely this time around, but could show up near the end of the year.

We all remember how the Fed's last attempt at QT ended in the Repocalypse, forcing the Fed to end QT way before it intended to and to swing right back into QE. Another headline in today's Daily Doom reported that Lorie Logan, one of the architects of the Fed's present policy and president of the Dallas Fed, sees lots of room left for Fed QT to continue. While the Fed is not good at seeing the damage its tightening will create, I do believe she is right from the standpoint of a ways to go before causing another Repo crisis, though not right in terms of how the economy will survive it. The Fed may stop everything before the end of this year if the economy breaks badly enough.

Federal Reserve officials believe their efforts to reduce the Federal Reserve’s bond holdings are far from over.... Fed officials believe there is plenty of liquidity, properly measured, that they can remove as part of their push to tighten financial conditions and lower inflation.

These officials also noted that the Fed could eventually even cut short-term interest rates as it continues to draw on its roughly $8.5 trillion balance sheet, and that such a move would not be at odds with broader monetary policy.

“I’m confident that we still have quite a while to run down our assets further,†Dallas Fed President Lorie Logan said in a speech earlier this month. “Exactly how long that will be depends on a careful assessment of the financial environment....â€

[The Fed] now aims to unwind just under $100 billion a month, and so far this approach has taken nearly $420 billion worth of bonds off the Fed’s balance sheet....

Withdrawing too much liquidity could jeopardize control over short-term interest rates and trigger a repeat of the September 2019 market turmoil that marked the end of the initial balance sheet shrinking effort, also known as quantitative tightening. Then the Fed was forced to intervene in the markets and reverse course to rebuild bank reserves through renewed net bond purchases.

Fed officials and outside observers do not expect this to happen again. For one thing, Fed Chair Jerome Powell has already said he doesn’t want to test how far the Fed can shrink reserves. Meanwhile, the Fed has a new and untested facility called the Standing Repo Facility that can provide quick liquidity when financial firms need it.

Logan, for example, said that some turbulence in the drawdown alone would not be enough to stop the process. And as it stands now, Fed officials see plenty of liquidity to eliminate....

New York Fed President John Williams said this month that the roughly $2 trillion parked overnight by money market funds and others daily in the Fed’s reverse repo facility is the “key†to the outlook. As markets adjust to rising interest rates, cash from this facility will flow into the private sector, effectively replenishing reserves, giving the Fed the extra runway it needs to continue reducing its holdings, he said.

You may recall, I laid out the likelihood in last year's predictions that the Fed was preparing exactly such a cushion to bring into play sometime later on during its QT if another repo crisis emerged:

The Fed appears to have pumped a lot of slack into the system, but no one has ever seen how this kind of slack plays out either. The Fed stacked in a tremendous amount of the exact opposite of repo loans — reverse repo loans, whereby it took excess cash out of bank reserves and replaced it with bonds as collateral. I noted last year that the Fed was taking money out the back door almost as quickly as its continuous QE was creating it. It had to do this because there was too much cash sloshing around from all the Fed’s excess liquidity, leaving me to wonder why they were even creating so much liquidity that they had to remove it in this clandestine fashion. I suggested maybe they were banking it as slack for when they started to tighten, should the need it. That money taken out of bank reserves on loan ... can go immediately back....

Theoretically, banks could stop rolling those over and get cash back from the Fed as a buffer for the Fed’s tightening.... The risk I see here is that, to the extent banks reverse the reverse repos to rebuild their reserves, QT will be slow to tighten down on inflation. The pile means there are still Fed money sources squirreled away that can rapidly backflow into reserves."Economic Predictions for H2 2022, Part 4: Zombies in Bondage and Their Broken Banksters" (August 19, 2022)

They would do it that way in order to not lose face on their forecast QT program as they did last time. That quote followed an article, almost a year ago, where I laid out how that might work:

Repos, which are the interbank lending that lubricates the financial world, are starting to show some bizarre activity again, perhaps due to the $1.2 Trillion in reverse repos the Fed engineered last year to take money out of bank reserves even as it was adding money in, which I saw as possibly being a plan to set aside some ballast it could release back into reserves as it tightens reserves to soften the fall. This it could do by not rolling over those reverse repos. (Reverse repos when done by the Fed take cash out of bank reserves and replace the cash temporarily with bonds the Fed has been holding.)

I can’t say I was certain of that, but it was a peculiar thing for the Fed to be doing over a trillion in cash removal from bank reserves at the same time it was doing trillions in QE to add to bank reserves. Made one wonder why they were hosing up so many bonds in order to add money in the front door of the Federal Reserve System just to be smuggling so much out the back door. Kind of looked like a money-laundering operation."The Big Bond Blowup: Worst Bust Since Marshall Plan" (March 27, 2022)

Many months ahead of that conclusion, I had noted the oddity more than once of the Fed piling in Reverse Repos; but it was at the start of 2022 that I started to figure out why they were doing that, which the Fed now finally states as part of the contingency plan to avoid another Repocalypse. Will it work?

The Fed still has plenty of reverse repos ($2T) piled in to use as a buffer:

I think the slew of reverse repos buys the Fed some time as a buffer against another repo crisis from their tightening if needed; but I doubt they'll make it to the end of this year before they have to pull that buffer into more serious play. It may keep them from going back to QE because it is a form of QE in itself, and so it may avoid another Repocalypse, too, but likely will not give them the latitude they hope they have for continuing QT while they unwind those reverse repos. So, I think they end QT sometime late in 2023!

Housing Collapse 2.0

Housing sales and housing prices will decline throughout the year. I don't think saying housing prices will decline through the end of the year is anything more than a statement of the obvious at this point, but I say it just to be clear it is also where I stand. There may be little leveling off spots, but then the decline will resume.

The real question for prediction here will be how much damage does the housing plunge cause. Does it become a bank-wrecking crash like the last one?

Jeremy Grantham has this to say about that:

The bursting of the global housing bubble, which is only just beginning, is likely to have a more painful economic knock-on effect than the decline in equities is having….

Housing busts seem to take two or three times longer than for equities – from 2006 for example it took 6 years in the U.S. to reach a low – and housing is more directly plugged into the economy than equities through construction starts and associated expenditures.... Housing is ... much more important for the middle class, whose wealth is often mainly in housing, who use far greater leverage through established, traditional mortgages than they ever do in stocks, and who are these days sitting on large gains resulting from 40 years of falling mortgage rates pushing up housing prices. Many of them see their houses as a major store of value and the bedrock of their retirement plans, and to see that value start to melt away will make them very nervous....

So don’t mess with housing! But we have.

The housing-bubble collapse will be worse for markets like Australia and Canada that either have a high level of adjustable-rate mortgages (ARMs) or require refinancing every five years, amortized over 30 years. (Essentially five year loans with large bubble payments at the end strung like sausages for 30 years.) The US has not done nearly as many of those this time around as it did ahead of the last housing-market collapse. So, there is far less chance of a big-bank failure in the US than there is in some other nations, but it's not out of the question, of course.

Remember that housing prices fell for over a year last time before we started to see US banks collapsing because of it. Prices have only been falling for a few months this time around; however, they are falling at a steeper rate.

So, banking problems are likely to develop in some nations because of the housing collapse this year, but are less likely to do so in the US due to its lower level of ARMs this time around. That said, we still sit on a huge heap of Mortgage Backed Securities in the US, those nasty derivatives that were such a blind spot last time for buried problems to hide in and were key to the last housing collapse. So, don't rule out a housing collapse in the US that breaks the bank.

We take another dip in recession

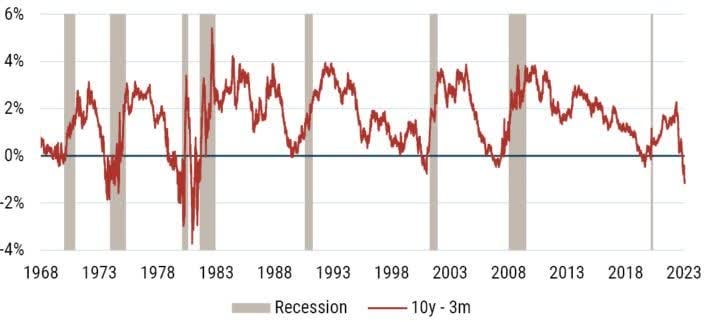

One more thing Grantham had to show us was the most accurate predictor of recessions there is (100% accuracy):

Grantham says,

The most ancient and effective predictor of future recession, the 10-year minus 3-month yield spread (see Exhibit 2 below), is now clearly signaling recession within the next year. This spread has gone negative only 8 times in the past 50 years and all 8 times have been followed by recessions. To rub it in, there have been no other recessions. That is, every one of them was preceded by a negative reading. Not bad.

I've said enough about the recession starting in 2022 for half a year where we saw what almost everyone called a "technical recession" that was not declared officially by the NBER that makes such calls, and I've said I expect us to go down into another dip this year. So, I needn't say anything more on my recession predictions than I have, other than to point out the most accurate recession indicator in history has entered full agreement with my prognostication. Whether or not the NBER ever recognizes that its faith in the "strong labor market" as proof against recession was seriously misguided, I don't know. They may not have a lot of capacity for learning, even when the labor market proves out badly busted it already is -- another prediction I've said enough about in the past to where I won't go into it here.

But we are taking a second and deeper dive into recession this year.

Wars and rumors of war

I won't pretend for a second to know how wars will go this year, as even those directly planning them -- the leaders who know exactly what they intend to do and who have spies to try to figure out what the other side intends -- still find their battle plans are obsolete the second a war begins.

I think it is likely, as I suspect many do, that the Ukraine war will grind on through the whole year or, at least, the better part of it. I don't think it will end until either Russia is spent into the dust or the last Ukrainian dies … or Putin dies. I doubt very much that Putin drops a nuke and rakes the extraordinary risk of seeing some NATO nation send a nuke of retribution back his way. Mutually Assured Destruction is still a NATO doctrine. Putin knows that, but he gets all he can out of his nukes by leveraging them to try to paralyze the West into not helping Ukraine stand against his invasion. He's obviously had considerable success at that, as it has dominated NATO discussions and considerably slowed down the rate at which nations approve more serious weapons. I think that is the best Putinuke can hope for.

Those are guesses, not predictions. I believed Putin would not use his nukes from the start of the war all the way through 2022, and that much was correct. I still believe the same, but Putin wants to keep us guessing, and that is working for him to some degree.

Likewise what happens with war in China is a pure guess that even the smartest minds in national defense departments have very little clarity on because of the complexity, secrecy and deception around wars.

Will Chinese economic collapse bring revolution in China, or will social unrest bring a coup against Xi? Probably not, but we saw the basis last year for knowing it realistically could. We saw such intensity build during Xi's draconian Covid lockdowns, which actually caused him to capitulate and drop his Zero-Covid policy.

Today's Daily Doom carried headlines about Generals speculating China will either start a war with Taiwan this year or in the South China Sea; but the generals also say it is always there job to believe war may be imminent and to figure out which ones are most imminent or probable and prepare for them. (See "Is China preparing for a Taiwan blitz to ‘cut island off from US’?" and "US military poised to secure new access to key Philippine bases.")

China has too many of its own problems under the sanctions and due to Covid and so it is becoming less of an economic powerhouse. Many will disagree with me on this, but I believe in the years ahead we will see its threat of economic dominance fade just as we saw in the eighties when everyone was afraid Japan was going to rapidly dominate the US economically, and look where Japan is now.

As a result, I will say we will not see Globalization end in 2023, in spite of these global conflicts, and will claim we did not see it end as many claimed in 2022. What we will see in 2023 is that it will actually strengthen but with bifurcated boundaries. The WEF and all who participate in it aren’t going to fold and leave the game, as many who hate globalization (as do I) fantasize; but the West will cleave into a more solid Western cooperation. That closer cooperation will be forced in order to maintain and survive the sanctions and to maintain unification against the war in Europe into an actually tighter pact forged of necessity. (And the WEF will keep doing its best to exert its own plans as the matrix that holds that together.) That will pair off with greater global cooperation among some nations in the East -- a much smaller contingency of nations, any of whom will do their best not to upset trade with the West, which is extremely valuable to them. No one wants to throw away mountains of money for years to come.

You see, I don't predict the world will go as I would like it to go, but predict what I think will actually be.

War with Iran has become very likely for 2023. The US has clearly exhausted its negotiations with Iran. It appears nothing more is happening with respect to the JCPOA.

The US and Israel on Thursday announced the conclusion of their largest-ever joint military exercises, known as Juniper Oak 23.

The drills were launched Monday and involved over 140 aircraft and nearly 8,000 troops from both militaries. The massive show of force was clearly a provocation toward Iran despite claims from US officials that it wasn’t aimed at any one country.

Immediately following that exercise, Iranian military targets got hit with surgical strikes that the US said were effective but didn't say effective at what. The exercise may have been to warn Iran not to retaliate on the basis forces were already in place to do far worse. The strikes are fully believed to have been carried out by Israel. Iran, rather than escalating to war, chose to talk the strikes down as it has in the past. These stories were also carried in The Daily Doom. (See: "Drone attack on Iranian ammunition plant: What do we know so far?," "rone attack on Iranian weapons factory was phenomenal success," and "US, Israel Conclude Largest-Ever Joint Military Exercise Aimed at Iran.")

Another article that ran that day in The Daily Doom claimed that "Iran can fuel ‘several’ atomic bombs." The claim was made by the UN's head nuke guy.

So a war with Iran is much more probable this year than last, but still Israel might manage the problem for another year as it has in the past and did last week with surgical strikes that keep setting Iran's nuclear-weapon ambitions backward, and Iran may fear all-out war with Israel enough while it still lacks nuclear warheads to do all it can to avoid a war. Avoiding war would be essential for Iran to keep refining nuclear material to its final stage and to develop delivery weapons in order to carry out its true ambition of nuclear destruction in Israel -- not Jerusalem of course, but some city less important to Muslims.

So, Iran is likely to back away from war until its nuclear weapons are fully deliverable, especially now that it is so close. If a full war happened, Israel and the US would destroy every nuclear weapon facility they know to exist to the level they can without spreading a radioactive cloud, and then they would seize control of what remained. However, having nukes would be a complete game-changer for Iran.

While there is no prediction here, there is no question the war drums keep pounding louder and louder from more directions and more nuclear or near-nuclear powers. That means the twists and turns from war during the year will continue to complicate everything.

Conclusion

Back when I started this blog, I would never have guessed it would take this many years for upside-down economic fundamentals to bring us to ruin. The resilience of the US economy is greater than I imagined. It took more to get it to break than I though it would, and even now the breakage is going so slowly that many people deny it is happening, even though the facts of real breakdowns of every kind all across the global landscape are now solidly materializing in front of all of us -- many of them economic or financial in origin, some of them things outside of economic origin that will have an impact on economies all the same.

For example, we are in our second recession since the start of 2020 after spending trillions to end the first one. (Of course, it was officially denied, but the two quarters of receding GDP speak for themselves, and the third quarter look rigged to me based on the totally absurd inflation factors that were used.) We are also now seeing all the major named bubbles breaking up -- stocks, bonds, and housing. We are suffering multiple man-made causes of shortages (from trade wars, real wars, sanctions over wars as well as some serious natural cause from droughts and Covid -- albeit a good part of Covid's contribution to our economic troubles was brought about by our extreme responses to Covid).

So, we are now seeing global collapse play out everywhere -- most of it brought upon ourselves over the course of years. But I originally thought this kind of all-encompassing breakdown would happen about seven years sooner than it is. I called it "the Epocalypse," but it took so long building that I stopped using the term because people were tired of a term that went nowhere -- that kept not happening on my schedule.

While the timing has been slower than I once thought, the list of things breaking down is going as I anticipated. It's just grinding apart more slowly. Like any of you, I am fatigued from it all, too, which is one reason I sometimes question how much longer I want to go on with writing on this topic because my greatest fatigue comes from the fact that the Fed and government endlessly repeat the same mistakes to prop up the same cycles that we now see converging and because it is still hard to convince people that the Fed and the greed built into the speculative nature of our financial markets are leasing causes. It would have gone down as quickly as I thought, except the Fed and Feds and other central banks and governments too extreme interntive measure ... as in far beyond anything we've ever seen at each breaking point, which only shows how bad it would have been.

While they have managed repeatedly to keep recycling into larger spirals, I never had any idea I would still be saying these things are going to happen this far down the road. They are like a recurring nightmare where you wake from one collapse only to go back into the same nightmare again; except that it is gradually worse each time -- 2000, 2006, 2020, 2022 and continuing. All the Fed's reconstructions have turned into massive bubbles that collapsed catastrophically, requiring the Fed to blow up even larger bubbles each time to buy more time by repeating the cycle.

Now I have switched from just saying these things are going to happen to pointing out how they ARE happening; yet, people still don't want to hear it and don't acknowledge it. That, I have found to be even more exasperating. While I was sometimes ahead of schedule in the past, during the last four years turning points have played out right on the schedule. (Stock crash in 2018, repo crisis in 2019, another stock crash and recession in 2020, inflation in 2021, and the crash of the Everything Bubble throughout 2022 and another, at least "technical" recession.)

Thanks to my patrons for hanging in there with me. Your interest is the only thing that has kept me going. It's not even the money but the fact that there are some who stand behind this effort. Without that kind of interest, I'd feel I was completely wasting my time.