2023 Prediction: The Fed's Inflation Fight is FAR from over!

The dominant theme for last year, I said way back in 2021, would be that inflation would become such a raging inferno it would force the Fed to tighten harder than anyone expected by rapidly raising interest and erasing money supply, causing stock and bond markets to both crash together (a coinciding set of events so rare almost no one would dare predict it), taking us into a recession.

Today, one writer at Seeking Alpha summarized the year as follows:

Surging Interest Rates And Inflation Result In The Worst Year For Stocks And Bonds In Decades

Multi-decade highs in inflation combined with historically aggressive Fed rate hikes and growing concerns about corporate earnings and a possible recession, pressured both stocks and bond market returns.

The S&P 500 Index fell 18%, its worst calendar year decline since 2008 and the 4th worst since 1945. Bond markets recorded some of the worst declines in history. Major benchmarks for both stocks and bonds declined together for the first time since the 1960s.

While the bond market's fall was its worst in, at least, forty years, it was the first decline ever that spread over two years.

With last year having done everything that was expected of it in record-breaking ways, you might be wanting to know what I'm predicting for this year, so I'm going to tell you the most significant part of my predictions for 2023 now, but the rest will be solely for my active patrons as my appreciation to them for staying with me. The part I'd like to share with everyone now is where we are going from here with inflation, which is what drove the other themes through all of the year last year. Inflation was, in other words, the biggest story of the year in economics by far.

We start this year with the Fed appearing to be getting inflation under control, and most of the stock market smells victory in the air. However, the Fed isn't taking victory in its battle with inflation for granted, and neither should you. I think there is a strong chance we'll see inflation rise again very soon and a reasonable chance we'll see it rise worse in the latter part of the year than what we've already seen, and what follows are the indicators and reasons why that is likely.

The road to getting here

This is more of a warning than an absolute prediction, but I think it has fairly high odds, and a mere warning to keep your eye on inflation was where I began with my Patrons, at least, as far back as mid 2020 when almost no one was talking about inflation because consumer inflation had not even started yet. Noting that I had not warned of inflation during years of writing my blog, I started warning for the first time that inflation was becoming a strong likelihood because of the Fed's actions, so be wary of it:

Magic Monetary Theory Comes at a Price (Aug. 2020)

MMT is Here! Start Stacking Money Like Firewood (April 2020)

When the first trickles of inflation began to show up as producer inflation in early 2021, I explained through the year how that would eventually become severe consumer inflation because of how it was stacking up on the producer side and how it would flow through. At that point, the Fed was not even talking about inflation, and one blow-hard, who is a somewhat popular writer at Seeking Alpha, flaunted his credentials and lectured me on how I was nuts -- no inflation was happening at all. Anyone who knew a thing about economics certainly knew that, and he had the Fed's opinion plus the yield curve to back him, not to mention again and again his economic credentials! (I tried explaining why the yield curve would be late to the party to show inflation as well as to show trouble for bonds, but he thought all of that was the talk of an idiot, too.)

Regardless of the ridicule, I persisted in showing my own readers where those signs were emerging. The Fed didn't even start talking about inflation until about the middle of 2021, and then it promised us for months on end it would be "transitory." I argued, "No way" to the Fed's transitory fantasy:

The Great Inflationary Train Wreck is Here (July 2021)

I’ve bet my blog on my prediction that inflation will crash both the economy and the stock market, saying I believe with enough conviction that I’ll stop writing on economics if it fails to happen. Why? Because I wouldn’t want to be one of those doom-porn writers who keeps going even after major misses, and because I have a track record to keep.

Stocks could be the first car in this great train wreck

While the Fed is the locomotive in this inflationary disaster, stocks may be the first car behind the Fed to jump the rails....

Then on November 14, 2021, the NASDAQ began its decline into what eventually got deep enough to be declared a bear-market crash. Prior to that bet, I had laid out the following plots for the path ahead for my Patrons:

Why “Persistent Inflation†Will Become an Intense Fire Tornado, Greater Than the Fed Even Imagines (June 2021)

The Best Arguments Against “Persistent Inflation†Have it Wrong (June 2021)

Inflation Tsunami Sirens Are Screaming! (May 2021)

Inflationary Rocket Train Accelerating Rapidly (April 2021)

The Coming Inflation Conflagration (Feb. 2021)

I lay out those tracks that were given in advance of the actual events because it gives credibility to the warnings I'm about to give here regarding the path of inflation that has a good chance of re-emerging this year.

The inflation invasion

As with the start of those predictions back in 2021, I'm not ready to state with certainty quite yet whether another advance of inflation is coming, but there are good reasons forming again to be concerned about it, and one reason that could make inflation absolutely formidable.

What I can say with certainty is that inflation will not back down to where the Fed believes it has won the inflationary war as easily as stock investors keep believing. This war will outlive expectations just like the Ukraine war that was supposed to be over in a month and still has no end in sight. In that war, Russia made initial gains as the Fed is doing against inflation right now. But Ukraine held on longer than most believed and even staged a surprising comeback. I think that war makes a good example of how the war with inflation is likely to go. Inflation has that kind of fight in it that many in the stock and bond markets are not expecting, and it has empowerment behind it, too.

In the short term, we see again the kinds of background (producer) inflation that I said in those months now far behind us would push through to new inflation. Those background pressures are starting to show in some areas again now, indicating that, inflation could edge back upward even if the Fed keeps its foot on the brakes.

All gassed up but where to go?

One major driver I reported in The Daily Doom today is that fuel prices are back on the rise.

U.S. Gasoline Prices Continue To Climb

Gasoline prices continue to climb for the fourth straight week, rising 32.7 cents over the last month as crude oil prices rise, data from AAA showed on Monday.

Gasoline prices are rising along with the rise in WTI crude oil prices, which are up $3 per barrel from a week ago, and up $2 per barrel from a month ago.

That doesn't mean much if crude prices do not continue to rise; however, there are reasons to think they will, and gasoline and diesel, of course, drive the price of just about everything because they are involved in the transport of all resources and all finished products. So, they are a major leading indicator of future price rises in all goods and services IF the rise in crude prices continues. There is more, though, than just the cost of crude pushing those prices up:

In addition to rising crude oil prices, gasoline prices are rising as “continued refinery challenges kept supply of gasoline from rising more substantially,†Patrick DeHaan, head of petroleum analysis at GasBuddy said in a Monday note.

Aside from those refinery issues that are pressuring prices right now, the crude price pressure looks likely to build for the following reasons:

“Macroeconomic factors have continued to weigh on oil and refined products, as strong demand in China hasn’t been slowed much by a surge in new Covid cases. In addition, releases of crude oil from the Strategic Petroleum Reserve have wrapped up. Concerns are increasing that without additional oil, supply will tighten in the weeks ahead, especially as the nation starts to move away from softer demand in the height of winter. Moving forward, it doesn’t look good for motorists, with prices likely to continue accelerating,†DeHaan added.

On top of that, the recent European price caps put on Russian crude are already showing strong effect. Another article in The Daily Doom today reported the following:

Russian Oil Exports Plunged By 820,000 Bpd Last Week

Russian crude oil shipments from its key export terminals slumped by 22%, or by 820,000 barrels per day (bpd), last week, compared to the previous week, according to tanker tracking data monitored by Bloomberg.

A 22% decline in crude shipments out of Russian ports puts upward price pressure on all other crude prices as other sources have to make up the shortfall.

On top of that, the EU bans—effective February 5—seaborne imports of Russian refined oil products and around 1 million bpd of Russian diesel, naphtha, and other fuels need to find a home elsewhere if Moscow wants to continue getting money for those products.

What that likely translates into is additional pricing pressure on all petroleum products in areas where those bans will cut off Russian supply as they become effective since those price caps in refined products don't go into play until February. They may have the same effect as the price caps on crude, cutting back supply of refined Russian products throughout the West where the sanctions apply, pushing more demand to the US and giving those supply sources more room to raise their prices due to the dwindling price competition.

OilPrice.com also warns in another article in today's Daily Doom that upcoming European caps in GAS prices could cause disorder in other markets (meaning ultimately surprise inflation in other markets):

The upcoming price cap on the benchmark European gas contract could abruptly change the gas market and impact the functioning of other markets as well as financial stability, according to the European Securities and Markets Authority (ESMA)....

“It could trigger significant and abrupt changes of the broader market environment, which could impact the orderly functioning of markets, and ultimately financial stability,†ESMA was expected to say, according to the opinion seen by Bloombergahead of its publication....

EU energy ministers reached a political agreement on a regulation that sets a so-called “market correction mechanism,†which would come into force on February 15, 2023....

However, if risks to the security of supply occur, the European Commission will suspend the price cap rule, the EU agreed last month.

“The Commission stands ready to suspend ex ante the activation of the mechanism...†EU Energy Commissioner Kadri Simson said.

Some effects could be seen only after the activation of the gas price cap, and it’s difficult to predict, ESMA says in today’s opinion, according to the draft Bloomberg has seen....

Market liquidity could be reduced, says the EU authority, although significant effects could not be identified so far....

“ESMA however notes that setting position limits in the uncertain geopolitical environment created by the Russian invasion of Ukraine and Russia’s decision to significantly reduce delivery of natural gas to the EU may prove challenging, especially in relation to the calculation of deliverable supply,†the authority said.

Price caps have always been problematic and often backfire in ways that are not expected, so the short take on all of the above is that there is plenty of room for volatility because NO ONE, obviously after reading this, really understands how the price caps will play out. That makes it impossible to have any certainty on what will happen with fossil fuel prices in all the various products, but creates plenty of possibility of supply shocks that can send prices the opposite of the way intended:

The gas price cap is “a difficult creature. It’s unprecedented, it’s untested,†ACER’s director Christian Zinglersen told the Financial Times in December. Zinglersen also noted that he would be “reluctant to rely on this gas price cap†to protect EU consumers from price spikes.

Here is the important takeaway: One of the biggest factors that took down consumer price inflation in recent months was falling energy prices, but there is plenty of reason to think those won't hold, so they could easily become one of the biggest factors driving inflation back up. And it is not just the "energy" component that will go back up in that case, but all components that use energy in their production and transport, which means everything.

On a monthly basis, CPI ticked down -0.1%. The consensus was for monthly CPI to be unchanged.

If you take the headline numbers in isolation, it appears that price inflation has cooled off, but digging deeper into the data reveals that falling energy prices papered over the fact that most other prices continued their relentless climb....

Falling gasoline and energy prices were the biggest contributor to the overall decline in prices and skewed the overall numbers lower. Most other categories continued to chart price increases last month.

The energy price index plunged by -4.5% on a monthly basis with gasoline prices down -9.4% and fuel oil cratering by -16.6%.

But food prices continue to climb relentlessly. Overall, food prices rose by another 0.3% on a monthly basis. Year on year, food prices have risen by 10.4% according to the BLS data.

Inflation was far from beaten in the last report, since it all hinged on volatile energy taking the overall numbers down, and the stock market was foolish to take that report as a sign that the Fed is winning its war. The Fed has absolutely no control over what happens in energy prices. It is hoping its high interest will cause enough economic destruction to bring down demand for fuel, but the question is will the demand drop as much as available supply may drop? If not, then prices will rise until demand and supply find their equilibrium. While the Fed can hope to have some impact on energy demand, it has zero control on the supply side, which is where all the problems are forming.

So, there is still lots of room here for CPI to rise if energy makes a sustained rise, and there are plenty of reasons to think that is likely.

Prices have not peaked

I'm not the only one pointing out the concern that the last peak in prices was a false summit.

Prices have not peaked yet, says CEO of one of the world’s largest consumer goods firms

The CEO of consumer goods giant Unilever said Tuesday that prices would likely continue to rise in the near term...

“For the last 18 months we’ve seen extraordinary input cost pressure … it runs across petrochemical derived products, agricultural derived products, energy, transport, logistics,†he said.

Remember, that those producer inputs from 2021 are where the first massive round of consumer inflation in 2022 came from. It shows up first on the producer side, which was my basis, as I pointed out with the articles above, for predicting we would see massive consumer price inflation before we actually saw any consumer price inflation because producer inflation ultimately flows through to the consumer. So, while my self-avaunted expert critic saw no sign of consumer price inflation, he wasn't paying attention to what was happening behind the scenes, even when I pointed it all out for him.

“It’s been feeding through for quite some time now and we’ve been accelerating the rate of price increases that we’ve had to put into the market,†he added.

“So far, the consumer response in terms of volume softness has been very muted, the consumer has been very resilient,†Jope said.

That resiliency is going to cost you more as they will take advantage of it. Companies like Unilever that own many large consumer brands are pressured by producer price increases to send you more of it so long as consumers remain resilient, though that will be the limiting factor when the resiliency ends:

“We do see the prospect of higher volume elasticity as winter energy costs hit, as households’ savings levels come down and that buffer goes away and as prices continue to rise,†he said.

The Fed is hoping to end consumer resiliency by sucking money out of the economy with QT and higher interest rates and by crushing jobs so consumers are crippled into not buying as much. You ultimately get to pay for the Fed's mistakes in printing all that money you thought they were giving you for free. Well, now it is payback time as they try to crush inflation.

However, Unilever is saying they expect the end of that resiliency is not here yet, and so they are increasing prices at a faster clip until they find that end because they have those background producer pressures to deal with in the prices Unilever pays. Speaking of those rising input costs/prices that drive inflation, the CEO gave a warning:

Jope was asked if he foresaw any moderation when it came to inflationary pressures. “It’s very hard to predict the future of commodity markets,†he replied.

“Even if you press the oil major CEOs, they’ll be a little cagey on giving an outlook on energy prices.â€

Unilever’s view, he said, was that “we know for sure there’s more inflationary pressure coming through in our input costs.â€

So, energy is the big variable, and its starting to rise again with reasons to continue to rise, but no one will say for sure. Not being at peak prices is, however, not the same thing as not being at the peak inflation rate. Prices can go up but at a slower rate of inflation. However, Unilever said they have been accelerating the rate of price increases; but the CEO does give this caveat even there:

“We might be, at the moment, around peak inflation, but probably not peak prices,†he went on to state. “There’s further pricing to come through, but the rate of price increases is probably peaking around now.â€

So, they have been accelerating the rate of price increase, but MAY now be seeing the rate of increases slow, though prices will still rise, meaning the inflation rate may drop, but inflation will still continue strong into the foreseeable future. As he notes, though, that can change with energy prices if they go up. The Fed's fight is far from over in his view as head of one of the nation's largest consumer-oriented conglomerates.

He's ambivalent because ...

“Nobody running a business at the moment has really lived through global inflation, it’s a long time since we’ve had global inflation,†he said....

“But now those markets are having to deal with the combination of commodity pressure and currency weakness. So our instinct is to act quickly when costs start coming through.â€

In other words, things can change quickly ... and in the wrong direction for the consumer. The war on inflation is far from certain and certainly not over anytime soon.

The greatest tragedy would be to end the battle early

The Fed's big fear is that, if it ends the battle early, it will have it to do ALL OVER AGAIN. That will result in inflation expectations becoming cast in concrete in the consumer's mind and in trust in the Fed's ability to fight inflation becoming greaty diminished. Trust is all the Fed really has to sell because that is the only thing its money is based on.

That's why former US treasurer Larry Summers said at Davos last week,

The ‘greatest tragedy’ would be if central banks don’t finish the job on inflation....

Speaking on a CNBC-moderated panel at the conclusion of the World Economic Forum in Davos, Switzerland, on Friday, Summers said economists and business leaders at the summit were experiencing an “exhilaration of relief†but cautioned policymakers against resting on their laurels....

“Inflation is down, but just as transitory factors elevated inflation earlier, transitory factors have contributed to the declines that we’ve seen in inflation and as in many journeys, the last part of a journey is often the hardest.â€

If transitory factors are the primary cause in the lowering of inflation, then the lowering of inflation is, itself, transitory in nature. The biggest of those transitory factors is, as I noted, energy prices, and those are, for now anyway, back on the rise.

“The greatest tragedy in this moment would be if central banks were to lurch away from a focus on assuring price stability prematurely and we were to have to fight this battle twice,†Summers said.

He added that he had been encouraged by recent comments from Federal Reserve Chairman Jerome Powell and European Central Bank President Christine Lagarde.

“We have to carry through, because if inflation were to be allowed to surge back, that would put not just price stability, not just standards of living for some of the lowest income people at risk, but also pose very substantial risks to cyclical stability,†he said.

Those substantial risks to stability would be the serious loss in confidence/trust in the Fed's ability to manage this problem and rising expectations, therefore, that inflation will continue as well as the sense of defeat you get when you fight something for a year and then lose the battle. It could be devastating because that change in confidence leads to hoarding and higher wage demands; but the risk gets worse than that, as I'll show in the next section. (Again risk, not certainty.)

So, if you are (as would be unlikely for my readers) still in the camp that thinks the Fed will pivot, GET OUT OF IT! It's a fool's paradise. The Fed knows better. It knows it cannot, and it has stated it cannot. The inflation war will continue deep into this year ... even if the Fed sees improvement, but especially if it sees things flip.

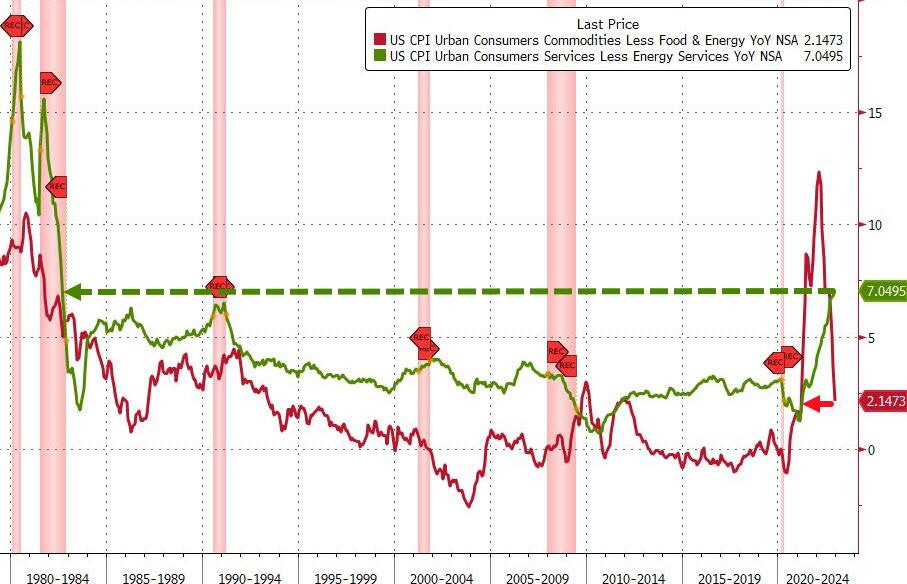

In fact, while the rate of consumer inflation on the prices of goods has been falling, the rate of inflation on the prices of consumer services has been rising, and services are not only the larger component of overall CPI (by far) but also the most sticky and most wage related:

The services inflation rate, in fact, climbed to hit the fastest clip in forty years!

So, what do you think the Fed does if services inflation continues on that trajectory in the next CPI report (being about 80% of CPI) and if energy starts putting some upward pressure back on the goods portion (20%) of CPI? That will put a little panic in Powell's bones, and don't think he isn't concerned it could happen. It looks almost poised to happen. (And, if energy rises, it pushes up the services side, too.)

If that happens, then the Fed over-tightens hard, and what follows is why that will be over-tightening:

Formidable inflation

The biggest risk is that the Fed's crushing of the economy makes shortages worse, because that can actually backfire and drive prices up. Yes, over-tightening could, incongruently and counter-intuitively, drive prices higher.

The pandemic brought a warning shot, a reminder that the saying “too much money chasing too few goods†still applies. Global inflation surged to 9% last year as bottlenecks emerged in all supply chains.

The Fed cannot control shortages, which are a major factor in present price increases, and it will need to create a lot of economic damage to get inflation down by sucking money supply out in the manner Summers says must continue at a time when scarcity of goods and services is driving up prices. If you've read here long, you know I don't like Larry Summers, but this time, even he is on the side of necessary continued tightening if the battle with inflation is to be won.

However, it is quite possible that production (the way we typically measure our economy)will tighten enough to where the Fed may actually exacerbate the shortages we already have. The economy is already underproducing due to crippled labor, as I've written several times. Here is where that gets serious dangers. One big reason production is down is that labor is down. The Fed's blind spot, as well as everyone like Larry, is that crushing the economy down more to squeeze out inflation by definition means taking production down more, and that unavoidably makes means even lower supply and likely worse shortages (shortages being the gap between supply and demand). That is when we enter no-man's land. There is no solution to the problem the Fed has set for itself if continuing the battle against inflation erodes production (supply) faster than it kills that consumer resiliency (demand).

If the Fed were to flip to stimulus in such an environment of even worse shortages, it would trip us straight into hyperinflation because impoverished people with new jobs would start using their new money to hoard all the things they have become short on in fear of future inflation and worse shortages.

“If you want two cups of coffee, save money and order both at the same time,†a student at the University of Freiburg famously quipped during Germany’s hyperinflation. That’s the inflation we worry about.

If hoarding begins because people are out of money at a time when supplies are also low, that is the situation that becomes formidable inflation if the Fed should revert to easing because it realizes its policy has gone desperately wrong. That is a situation, if it develops, that the Fed can only make worse by changing policy to an easier stance. It would be the Fed's most formidable fail. We can only hope that the Fed does not over-tighten or that its tightening crushes demand a lot faster than it crushes already short supply.

Market expectations call for a cratering of inflation this year, to 2.33%. It’s also expected to stay there for a very long time, 2.19% in 2024 and an average of 2.29% in the next ten years.

Don't you believe it. What is more likely to happen than that rosy scenario is that the Fed fails to understand the labor shortage and continues to believe it needs to crush down jobs to get this inflation battle under control (especially if it sees inflation raise its head again for the reasons noted above); and, in that case, the supply shortages drive inflation up on the reduced number of good available. People buy less because they have less money, but there are so many fewer goods and services that they pay more for what they do buy.

That's inflationary hell if it happens, but whether it does depends on whether the Fed overcorrects because it continues to believe a tight job market is a sign of a still resilient economy, rather than is a sign that laborers are scarce and that labor shortages only make supply problems worse, as will Fed tightening.

This is a perilous path the Fed has never walked. We have not had a time in history where inflation has been fueled by the greatest money creation ever while labor was tight -- not tight due to high labor demand but due to shortages of available workers who died or became chronically ill in the MILLIONS while others retired in the MILLIONS because we have just entered the demographic stage long warned about where baby boomers retire at a faster rate than new labor enters the market -- all compounded by trade wars, lockdowns, real wars and sanctions ALL making supply problems worse.

That is one heck of a horrible stew that has been brewing and that continues to brew. And the Fed can do nothing about any of that, except make it worse by crushing down harder on production. It would probably do about as good as it can by stopping where it is and holding; but its misbelief about labor, as I said in earlier posts is the major blind spot that will likely cause it to fail ... and fail badly. (See: "Powell’s Peril Lies in Lanquishing Labor Market" based on a much earlier Patron Post I wrote: "A Recessional for the Recession: Everyone Sings the "Strong Labor Market" Tune in Unison, and They're All Wrong!")

In conclusion

So, inflation will decrease generally to a lower rate of price inflation (disinflation, not deflation) in first part of year, but will bump up again during the early months of the year if energy keeps rising (which is impossible to be confident of one way or the other right now because of all the untested variables).

By the end of the year or in early 2024 inflation could take a seriously bad turn if the Fed’s crushing of production makes product shortages and even service shortages greater. What that will mean is that America’s standard of living starts to slide in 2023 where, by the end of the year we’ll start to feel we are living with a lot less but paying more to do it.

That is something to take as a warning and be watchful for, and I will be tracking that because the picture there will become clearer as we see what happens in that short-term perspective on inflation in the first paragraph of this section and as we see how intensely the Fed clamps down if it sees inflation bob upward again. That is where the risk of considerable over tightening that cripples already short supplies comes in. Consider this like a hurricane watch, versus a hurricane warning.

In-depth coverage like this is now mostly for my patrons, but I wanted to make sure everyone has a grasp on how serious the inflation problem that I said would be the driving theme all of last year remains for the coming, year, too. My next Patron Post will cover all the rest of my predictions for the coming year (at least, those that I can make at this point) with the rationale behind them.