A Tale of Two Cities: Centrally Planned, Communist, Fascist Economics v. Capitalism and Conservative Reform

Today's tale is one of Washington, the home of US socialism, with today's fascist central planning, versus the rebuilt ruins of Athens, the former city state and home of democracy, under capitalism.

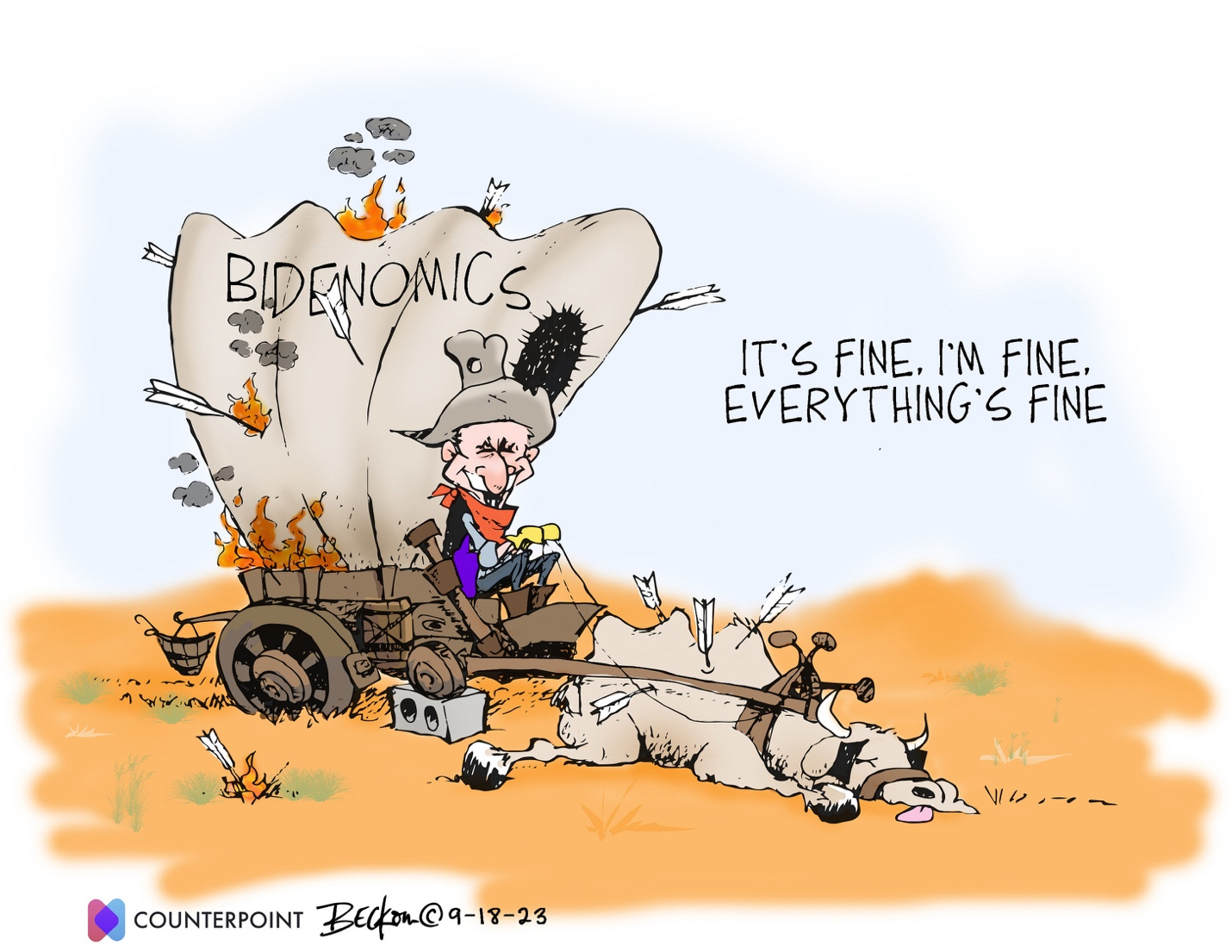

Bidenomics is fascist economics. Biden, as the central planner, has decided for the nation and its businesses what kinds of businesses the nation should be building. Then he is saying, “We must pay for these things together as a communty” like a true centrally planned socialist economy would do. Like the Chinese did when they decided to fuel their economy by building new highrise ghost cities. Only in communism it’s often all the government’s money that gets created and spent on the big projects.

However, the definition of a fascist economy, which many do not realize, is an economy where large investments of public money are combined with private or corporate money to build large-scale projects, ostensibly for the public good. These government-private partnerships ultimately result in huge gains for the capitalist partners who benefit by not having to contribute too large of a large share of the investment for their projects.

You can get a lot done with that kind of muscle, and can always justify it based on job creation. However, our nation hardly needs more jobs, and its always questionable whether what the central planners want done will be the thing that is really best for the economy — central planners usually not being all that smart about where they place everyone else’s capital.

Fascist economics works like this, as CNBC describes in today’s news:

The Biden administration has been betting big on industrial policies to bring manufacturers back to the United States.

“If you look at the three pieces of legislation that were passed in about the last two years, you’re looking at, give or take, more than $1 trillion in new government spending on industrial policy,” said Scott Lincicome, the vice president of general economics at the Cato Institute. “And it could be even more depending on a bunch of open-ended tax credits.”

If successful, industrial policies can potentially lead to big payoffs.

Especially big payoffs for the corporations that get the benefit of that trillion dollars of government money on projects that the corporations will own. Trumpenomics was not necessarily any better:

“An example would be the development of mRNA vaccines for Covid,” said Ed Gresser, vice president and director for trade and global markets at the Progressive Policy Institute. “They [the gov’t] put out a goal for business to do and they financed it and the business delivered on it. That cost a lot of money but I think most people would say it was well worth it.”

It sure wasn’t worth it to some of us who did just fine without the vaccines but got fired for refusing them; but, hey, that is your dictatorial government working for you as it surely knows best. So, the Trump government did all the investing in development and production, took all the risk, indemnified the corporations the government partnered with, and then agreed to buy vast quantities of the final product at an extremely high price, and Pfizer et. al. reaped the huge rewards! That’s fascist economics! And Biden followed through on the program.

Now Bidenomics is taking a similar path with getting corporations to build large high-tech development facilities and factories at substantial government cost.

Yes, it works well with big payoffs for some and maybe even for the economy in general … until it doesn’t because, oops, the planners were wrong:

Linicicome argues the government should not be playing favorites with industries. “Politicians and bureaucrats are ill-suited to pick winners in the market,” Lincicome said. “We are headfirst into electric vehicles today and we’re running the risk of pushing a technology that isn’t quite ready for prime time and in the process sidelining a technology that maybe turns out to be a better approach.”

We’re forcing a conversion to entirely electric cars in the US without electrical infrastructure that is even remotely capable of powering it. Such are the follies of central planners. We’ll pay with brownouts for years, unclean forms of electrical generation to turn the “clean” cars, and austere conservation. The central planners tend to think they know it all, know what is best for us, and have the dictatorial powers to press their wishes through. Often, as happened a lot in Russia, they mostly grease the palms of the oligarchs. The US, of course, has its oligarchs, and they are getting greased really well right now.

Even if there were no cronyism involved in who gets the money (almost never the case in highly lobbied Washington), you still have this problem to worry about:

Others are concerned about the issue of mismanagement.

Like China.

Athens’ rebirth from its ruins

Now here’s a success story from Europe’s ghetto, known as Greece. Only it’s not a ghetto anymore. It is a testimony to stringent debt reduction and conservative financial reforms that were forced on socialist Greece back in its ghetto days when its wanton ways threatened to bring down the entire European empire.

Paris Skouros pointed toward the sky outside his office in Athens on a recent weekday. In the past six months, four high-rises had sprung up, built by Greek and international builders to be sold for use as tourist rentals, foreign real estate investments and company offices. Farther afield, a fresh crop of new buildings dotted the horizon.

Greece’s financial crisis almost ruined his firm, Skouros & Sons, an elevator company. Years of harsh austerity measures imposed by international bailouts had been wrenching, Mr. Skouros said, as new construction ground to a standstill. But now an economic recovery has barreled in….

Laden with debt it couldn’t pay back, Greece nearly broke the eurozone a decade ago. Today, it is one of Europe’s fastest-growing economies. In a significant acknowledgment of the country’s turnaround, credit ratings agencies have been upgrading their appraisal of Greece’s debt, and opening the door for large foreign investors.

The economy is growing at twice the eurozone average, and unemployment, while still high at 11 percent, is the lowest in over a decade. Tourists have returned in droves, fueling a construction frenzy and new jobs. Multinational companies, like Microsoft and Pfizer, are investing. And banks that almost collapsed have cleaned up and are lending again, benefiting the broader economy.

And here is the coup de grâce:

The country’s prime minister, Kyriakos Mitsotakis, a business-friendly conservative politician, was re-elected by a landslide in June after being credited with spurring a recovery by reducing taxes and debt. The government cut red tape for businesses and raised the minimum wage. The country is even paying back international bailout money ahead of schedule.

Yes, highly socialist Greece elected and then re-elected a conservative, capitalist leader because decades of socialism had left it utterly bankrupt to such extent it had to sell off its national landmarks to raise money. This rare kind of conservative even managed to raise the minimum wage while simultaneously cutting debt.

Mr. Mitsotakis hailed Greece’s return to investors’ graces. “I will never allow us to relive the trauma of a national bankruptcy…..”

Greece became the center of Europe’s debt crisis after Wall Street imploded in 2008. Ireland, Portugal and Cyprus were also forced to take international bailouts.

These are, of course, the kinds of reforms I said the US should have made back in 2008, too, correcting its problems at whatever cost right away, rather spiraling up mountains of new debt to bailout the big banks that caused the problem and putting off real economic reform by trying to quick-fix the economy with lost of cheap debt and printed fiat money. The US solution was “throw more money at it, and someone will pay for it later.” Later has become now.

Greece’s solution, imposed on it largely by the austere Germans, was to buckle up for a rough ride. While they started from a far worse position than the US, they got the dirty work out of the way with some considerable suffering, and life is now better because of it:

Greece had it the worst, requiring three rescue packages from 2010 to 2015, totaling 320 billion euros, or $343 billion, with bitter austerity terms. Household incomes and pensions were slashed. The economy shrank by a quarter, and hundreds of thousands of businesses collapsed as banks shuttered. By 2013, nearly a third of Greeks were unemployed.

They let the dead wood burn away.

“We would have liked the austerity to be milder, but the measures were the Greek contribution to saving itself,” said Yannis Stournaras, a former finance minister who is the governor of Greece’s central bank and a member of the European Central Bank board. “Greece had to take these tough steps to survive.”

Greece exited the bailout programs’ strict fiscal controls in 2018, and the government’s actions since then have earned confidence from the European Union.

Greece did the tough work, paid the pain required to square up the wreck that it had turned itself into, and is better off today because of it.

This month, DBRS Morningstar, a global credit rating agency recognized by the European Central Bank, raised Greece’s debt rating to investment grade…. And that will lower borrowing costs for households, businesses and the government after the E.C.B. has been raising interest rates to fight inflation.

But in the US, we have a government intent upon saving us from low unemployment by heaping up mountains of additional debt for future generations. It is plan that is — AGAIN — giving all the money to the people with the most money on the basis that they are the job creators for the rest of us. This tired argument is even being used when we have a lot more job than interested or available workers! Now that’s dumb!

Oh, and the best part from Athens — Surprise, surprise: corporations will actually invest their own money when they see you have your capitalist act together:

Investors are jumping in. Microsoft is building a €1 billion data center east of Athens. Farther north, Pfizer is anchoring a €650 million research hub. American, Chinese and European companies are pitching renewable-energy deals. And investments by Cisco, JPMorgan, Meta and other multinationals are projected to have an economic impact worth billions of euros over the next few years.

Isn’t that interesting? The very same companies that Biden hopes to get to invest in those kinds of high tech industries here in the US by offering them a trillion dollars if they will stay here in their corporate homeland. There is more glory to this story, which you can get by reading it, but this gives you the gist of it.

Think of where the US would be today if it had done that with its existing debt failed banks back in the Great Recession, instead of, as I (and some others) wrote back then “trying to fix a debt problem with more debt.”

The risk for Greece now is that it could become a victim of its own great success:

The comeback is moving so quickly that Mr. Skouros is worried about a real estate bubble forming. So he is steering clear of new high-rise construction that he fears could go bust, and targeting smaller residential buildings with sound finances.

Sounds like the leadership there recognizes the risk so won’t be trying to steer the Greek central bank toward creating a lot more cheap debt of fund the high-rises of new ghost cities, as happened in China and the US, where cheap credit is leaving us stacked up high in offices that, according to another story today, have no chance of ever renting out, as we have, it appears, reached full office recovery at a level of 50% recovery that refuses to go higher.

For Konstantinos Kanderakis, 62, a supervisor at Greece’s digital services agency, the gains are meaningful. He earns €1,300 a month after a 35-year career in government, and he will get a €100 monthly increase after a decade in which his income had fallen.

“It’s a big psychological boost,” he said. “Greece is stable again, and what I am happy about is that things will be better for my children.”

Yes, because, unlike the situation in the US, his children will not be saddled with infinite debt they can never repay.

For entertaining humor-laden lessons on the over-and-over plan we have been on in the US, check out my little rundown of the Great Recession and why we are destined to repeat it because we never solved it: DOWNTIME: Why We Fail to Recover from Rinse and Repeat Recession.

(Today’s headlines are free for all, and the stories above are in boldface below.)

Economania (national & global economic collapse + stocks & bonds)

The Biden administration bet big on industrial policies. Experts warn it may not pay off

Greece, Battered a Decade Ago, Is Booming!

Bonds Resume Selloff as Hawkish Fed Talk Sinks In

10-year Treasury yield rises to start the week, trades at 4.5%, at levels not seen since 2007

Ford says 'significant gaps' remain in UAW labor contract talks

‘Private equity is now king’ for the ultra-rich, says Tiger 21, an exclusive club of investors

China property stocks tumble as Evergrande drops 25% on debt restructuring roadblock

Short Sellers Scramble As Energy Stocks Surge

Real-Estate Rubble (housing, commercial & global real-estate bubble trouble)

Money Matters (monetary policy, metals, cryptos, currency wars & cashless)

Yen falls to fresh 11-month low against dollar, focus on intervention risks

Overinflated & Underfed (too much money chasing too few goods due to weather, sanctions or other supply issues)

What we see now are [oil] inventories falling at the fastest pace in history.

Russia’s Oil Export Revenues To Rise This Year As It Evades The G7 Price Cap

Wars & Rumors of War, Revolts, Hacks & Cyberattacks (+ AI threats)

Ukraine Advances on Russian Defenses as US Battle Tanks Arrive

Commander of Moscow Black Sea Fleet killed in missile strike

Spotify will use AI to replicate podcasters’ voices and translate them to other languages

Political Pandemonium & Social Senescence (major socio-political issues & events but not campaigns)

As Trump Prosecutions Move Forward, Threats and Concerns Increase

Post-ABC poll: Biden faces criticism on economy, immigration and age

Dana Perino of Fox News Is About to Face Her Biggest Test as a Journalist

Congress remains divided on budget negotiations: ‘Our financial ship is sinking’

Doomsday cult leader who thinks he's Jesus 'keeps 1,500 sex slaves on island'

Russell Brand and why the allegations took so long to surface

A Pox Upon Us (the plagues, pandemics & health police of the 2020s)

Anti-vaxxers are now a modern, well-funded, political force

Calamity and Catastrophe

Doomer Humor

Excellent. Except for the part tacitly extolling the virtues of government owning your body (telling you that you must work for a certain minimum, or you can't work), it's almost like reading von Mises.

And except for the part about Obama having been our ruler in that time-frame, which means the collapse in living standards would never have been properly explained. Which would likely have lead to massive civil disturbances.