Are US Businesses Hiring or Boarding up?

Today's dwindling jobs report runs smack in the face of yesterday's shimmering jobs report.

Yesterday, payroll company ADP reported new jobs that came in at double the amount most economists had expected, sending the stock market down on fears that the robust economy meant the Fed would not be pivoting back to easing anytime soon (as if that was ever going to happen). Today, the US Labor Department came in well below economists’ expectations with the lowest gain in jobs since December of 2020, which was when payrolls actually fell during Covid collapse.

Which report is true?

First off, the one thing that is true from each report is that neither report gives the Fed any breathing room to back off from its tightening regime. Out of the 209,000-job increase reported today, 60,000 of those jobs were new government jobs and more than 60,000 were new healthcare jobs, neither of which reflect a strong economy, which was how many investor’s mistakenly read yesterday’s ADP report. Remember that I said that report was an anomaly as an economic indicator in that many more-significant economic indicators I would be reporting on in this week’s “Deeper Dive” looked sour.

Even this latest report offers no breathing room for the Fed as the Fed uses jobs to gauge when it can quit tightening the financial side of the economy. Unemployment actually dropped a notch lower, in spite of the low number of new jobs in the government report. Yesterday’s ADP number is now said to have been distorted by “seasonal adjustments,” indicating it was the anomaly I suggested it was. Who could imagine that “seasonal adjustments” might be the fly in the ointment? Wages, according to today’s report, are still rising faster than the Fed would like to see, too. So, Fed tightening will continue right on schedule with more interest hikes just like the Fed clearly projected, much to the market’s stubborn refusal to hear.

The Fed’s draining of money from the economy via what it calls “quantitative tightening” is also now back on schedule. The Fed’s balance sheet has just dipped beneath the level that caused this spring’s major banking crisis, leaving Treasuries held in reserves lower in value that they were then (in good part because of the impact on Treasury interest rates from so much QT) and bank reserves lower in cash than they were then. So, we might reasonably expect an instant replay of the banking crisis as the next braindead zombies in line that were too greedy to learn their lesson from recent bank failures begin to fall as we now enter an even worse environment for bank reserves (with a lot more worsening to come as my “Deeper Dive” will lay out).

For over a year, the Fed has been sucking money out of bank reserves by no longer refinancing the government bonds it holds, which means the private sector has to carry all the government’s refinancing on its own, which drives up interest on those bonds, making money everywhere more expensive to borrow. Fed QT also sucks money out of bank reserves as people and businesses buy the bonds and the banks transfer money from their Fed accounts to the government’s Fed account to pay for the bonds, which is how the government fills up its bank account after drawing it down to nothing in recent months.

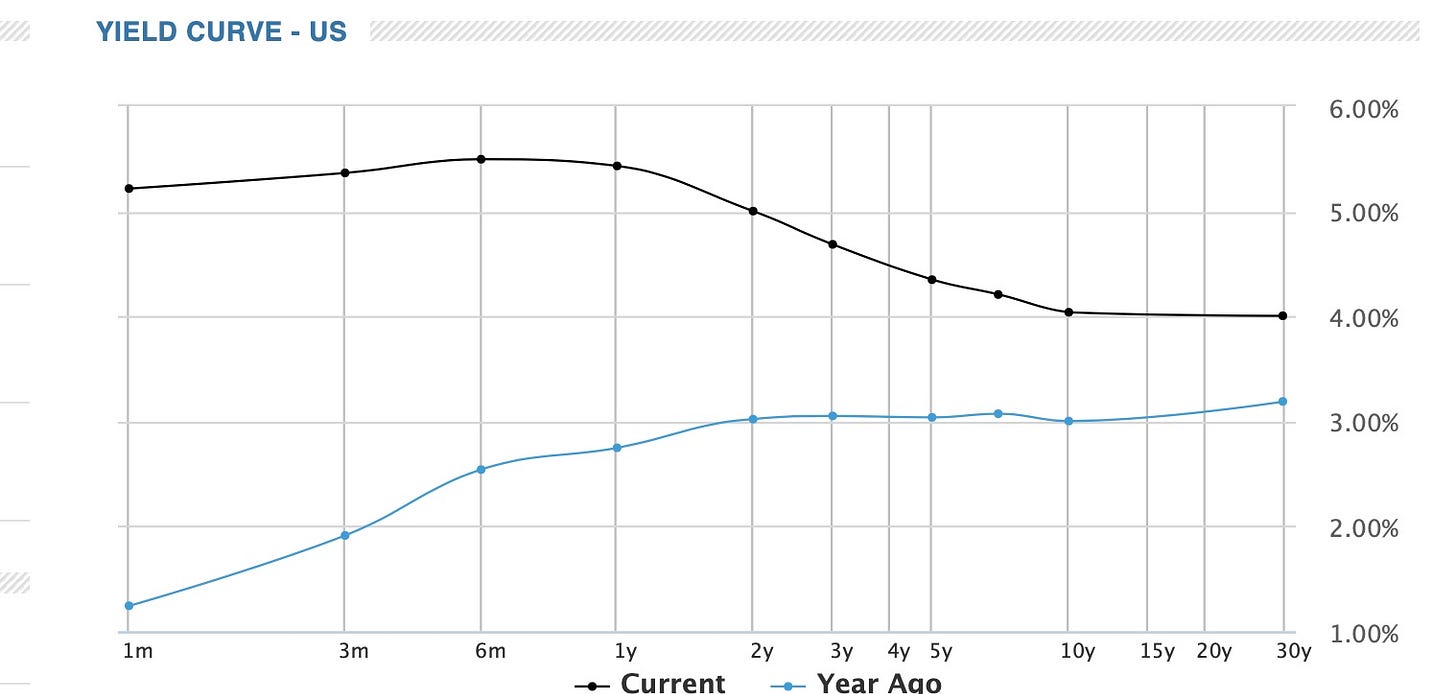

Interest rates on bonds had remained frozen until ADP’s job reported finally brought some realistic fear back to the bond market. Short-term rates went on a tear yesterday as investors realized there have to be more Fed rates hikes to come. They are now catching up to price in what they should have seen coming. Of course, bond yields are rising (prices dropping) due to the pressure I predicted would be hitting bonds once the debt ceiling was raised and the government began flooding the bond market with new issuances. As a result of all of this, two-year Treasuries hit a 16-year high, rising above 5% yesterday, while shorter-term Treasuries continued even higher today, rising to 5.5%, to where the yield curve has distended to become the most inverted it has been since 1981!

(I will be plunging into this complex set of economic indicators in the “Deeper Dive” that will be published for paid subscribers later today or tomorrow.)

In the meantime, let’s take a glance at news from China. I have been almost a lone voice in saying China would become the next Japan, where I pointed out that Japan was feared to be buying up US land and businesses back in the late seventies and early 80s and eating up US manufacturing to where it would soon dominate the US. Those fears never materialized into such domination because Japan’s stimulus hit the falling side of the diminishing-returns curve and it is now kept on the life support of pure stimulus ever since it became dependent on that drug. At the same time, the US economy, particularly automakers, navigated some tough changes to keep up with their competition and wound up doing fine. There are always countervailing forces that rise up.

Now China, which many feared in the same way, is going the way I said it would. Xi is being pressured to increase stimulus because stimulus is no longer doing the job for the addicted economy. The yuan is requiring almost daily rescues, even as extreme as limiting trading of US dollars or banking in US dollars while saving the yuan with government selling of US dollars. State media today sharply criticized Goldman Sachs for reporting the truth about Chinese bank instability because Goldman’s reports added to banking instability, as such reports inevitably do. (China has never been big on economic or financial truth.) The government also managed to get Tesla to agree to be less capitalistic and swear “to honor socialist values” by stopping its heavy-handed price competition with Chinese EV makers. The government, meanwhile, is taking its own heavy-handed approach of delisting more Chinese companies than ever from its stock exchange. It’s looking like a rolling implosion.

Finally, as a little taste of sloppy mainstream financial/economic reporting, CNN reports that 2,500 Americans now say they need to make an average of $233,000 a year just to feel financially secure. They report that as if it is meaningful number! 2,500 out of how many? They don’t say! Was it a scientifically balanced poll of 2,500 Americans and 100% of those polled said they have to make $233,000 a year just to feel secure? Or was it a poll of 250,000 Americans and only 1% say they need to make that much to feel secure. In which case, who cares what it takes for “the 1%” to feel secure?

With no context, it is a meaningless number, but they quote it and base a headline off of it as if it means something. I included it in the headlines below just to make reference to it here as yet another example of weak financial reporting by the mainstream media — that, and there was some help in the article on how to trim your budget (I guess in order to stay within the confines of what a quarter-million a year restrains you to in order to feel financially secure).

I suspect CNN meant to say that 2,500 was the total number of people polled (but they didn’t make that clear), and the average of what all of them stated for financial security came to $233,000. I find that a little hard to believe as a meaningful statistical average for what Americans need to feel financially secure.