Bank Emergency ... or Not?

Two red lights flashed on Friday in the world of central banks—one at the US Federal Reserve and one at the Reserve Bank of India.

You’ve heard me refer back to the repo crisis of 2019, which forced the Fed to leap back into doing massive quantitative easing (money “printing”) to replenish cash reserves in banks after they took their balance-sheet reserves down further than the banks could handle.

Repo loans are overnight loans banks take out from other banks to reconcile their accounts at the end of the day if they are short on cash to cover all the checks and debits that came through due to getting too many withdrawals and/or not enough deposits. Normally banks use Treasuries from their own reserves as collateral to trade with other banks for cash at very low interest rates due to be collateralized in US Treasuries.

Banks are normally reluctant to use the Fed’s “repo facility,” because doing those overnights loans with the Fed has long carried the stigma of bank troubles in that it looks like no other bank wants to touch you. When a bank turns to the Fed for one of these overnight loans it is typically because the borrower is looking like trouble to other banks or because all other banks are also tight on cash reserves or stuffed with Treasuries so they don’t want to lend to anyone. Either situation looks bad.

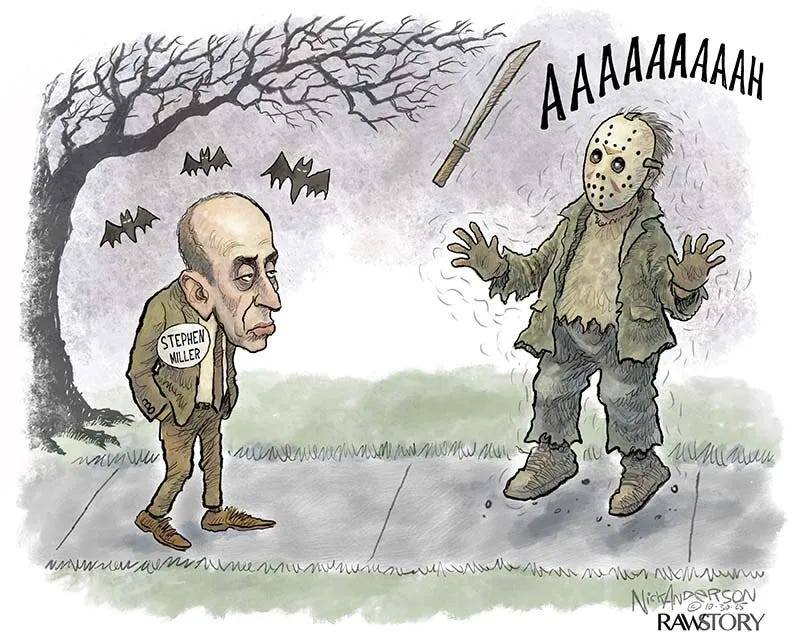

Well, on Friday the repo alarm light started spinning again … like this:

You can see that the extent to which banks have been tapping into emergency overnight loans (repo loans) from the Federal Reserve began to increase and became more frequent as the Fed’s quantitative tightening—which the Fed has just announced will end on Dec. 1—has approached the present day. Of late, repo loans with the Fed have become much more frequent; and, on Friday, they shot up much higher in billions of dollars transacted.

The overview

Here are a few comments from the headlines below:

The Banks needed $29.4 Billion in Cash last night; they pledged Securities they hold to the Federal Reserve, to get instant cash against those Securities.

I do not yet know WHICH or HOW MANY banks suddenly found themselves needing cash, but I do know that this is a larger Overnight REPO injection than occurred even during the Dot Com Bubble collapse.

Someone, or several someones, needed a ton of cash last night - and no one is saying who or why. This doesn’t seem good to me.

What is the Fed not telling us? The numbers clearly indicate that big trouble is brewing in the banking system. I wish that I could specifically tell you which banks are in the most trouble, but at this stage we simply aren’t being told anything. They probably figure that the best approach is to try to keep everyone as calm as possible. But they won’t be able to keep a lid on what is going on indefinitely, and when word finally gets out people could start to panic….

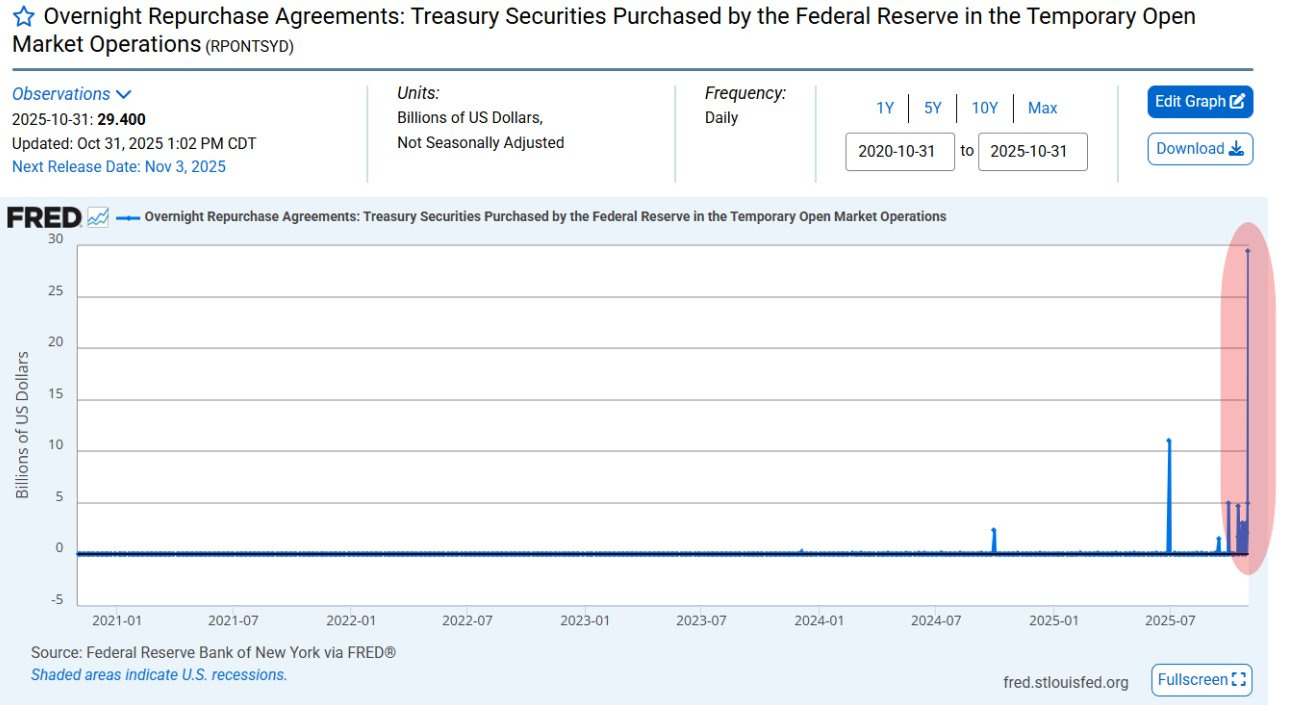

“US bank reserves have crashed to a four-year low, plunging to about $2.8 trillion, according to the latest Federal Reserve data, sending fresh warning signals across Wall Street and Washington. The steep decline marks the second straight week reserves have stayed below $3 trillion, a critical threshold analysts say could test the banking system’s liquidity strength.”

Did something big just break?

Was it one big bank in bad trouble or many banks dipping into the Fed for emergency cash … or something else altogether and less alarming. There are no clear details available anywhere that I could find so far.

There is an oddity in the numbers, though, because, as banks ran to the Fed to get more cash, they deposited an equal mount of cash with the Fed:

Federal Reserve liquidity facilities caught fire on Friday as month-end pressures pushed a key lending tool to a record level of usage.

The Fed’s Standing Repo Facility lent a total of $50.35 billion on Friday to eligible financial firms in two separate availabilities, the highest-ever usage since the tool was put in place in 2021 to provide fast loans collateralized with Treasury or mortgage bonds. At the same time, financial firms also parked a considerable amount of cash on Fed books, with the reverse repo facility seeing inflows of $51.8 billion.

Measured another way, as bank liabilities v. capital, the spike looks like this:

Bigger than anything seen since the Covidcrisis.

Overall bank liquidity crisis or one-time convergence of a few harsh realities

There might be some plausible explanation, other than bank troubles or banks running out of cash in their reserves. The convergence in timing with the end of government paychecks for all air-traffic controllers (and likely other government workers who remain employed) and the end of SNAP cards (which replaced food stamps) for those in need, may have sent many people running to their bank for some of the limited cash they still have while many usual paycheck deposits failed to hit banks, causing a surge around the government shutdown that banks needed to bridge with short-term loans from the Fed. I don’t know if those shakeups in the usual routine of some banks’ cash flow would have caused such a spike or not; but they hit at the same time.

We’ve also reached the time (end of September) when 150,000 DOGE buyouts for Federal workers that were agreed to last spring finally time out. That means the government money quits going into the bank accounts of workers who are no longer working. Severance is severed. The last government checks came at the end of September. That makes the end of October the first time when no checks showed up.

So, there could be a combination of forces leaving banks short of deposits that they have been seeing and/or high on emergency withdrawals. In that case, this may just be a bump in the road—a hard spot where a few things came together like a rogue wave that will quickly go away. However, over the same weekend, the Reserve Bank of India also called an emergency meeting to discuss what to do about short liquidity in Indian banks.

This meeting in India comes just days after the US Federal Reserve had to pump $29.4 Billion cash into the U.S. Banking System on Friday last week, via the Standing Repo funding mechanism.

The Bank of Indias emergency meeting is probably an unrelated coincidence, rather than the emergence of global banking troubles. Still, we’ve seen that before where the Fed had to make emergency loans to other international banks in troubled times.

We’ll have to see over the days ahead if the Fed’s repo facility continues to receive these sizable hits, or if the overnighters get paid off and use of the facility dies back down. The increasing number of spikes and the progression in their height since summer started, however, raises concern that this is an actual bank liquidity crisis, which means the Fed may not have quite stopped its quantitative tightening in time … again.

An alternate explanation

I’m not sure I should call it “alternate” since it doesn’t explain solidly there easons this occurred; but Wolf Richter gives a detailed explanation of the situation. Maybe I’m just opaque, but it didn’t help me understand why the spikes just started happening. He points out that increased usage of their new repo facility that is supposed to carry less stigma is what the Fed has been advocating.

That’s true; however, given that the Fed’s “new and improved” repo facility was created over four years ago to encourage greater bank use, why did it take all the way to the present for it be engaged, and why with such a large spike? While explaining the Fed’s creation of this relatively new repo facility over what it had in the past, the article leaves the big and important questions unanswered for me.

Even Fed encouragement to use the facility on the same day as the transactions by Dallas Fed president Lorie Logan doesn’t ring like an answer to me because I’ve heard the Fed encouraging banks to use the facility off and on for months. Logan’s speech, with its mention of “crises” sounds more like a cover story for an emergent crisis. In the very least, it just raises the question I’m asking.

“I anticipate that primary dealers will use the facility [the SRF] to obtain repo funding when it is economical to do so. Drawing on the SRF when the rate is economical is a sound way for a primary dealer to serve the [repo] market….”

Why did it suddenly become so economical to do so?

She exhorted “dealers” – the banks that are the approved counterparties at the SRF—to borrow at the SRF and lend to the repo market when the rate spread makes this profitable for the banks because that would keep repo rates near the Fed’s policy rates.

The Fed has been exerting banks to no avail for months? What changed.

“Dealers may now need to step up their readiness to access the SRF in response to rate moves,” she said.

And today, dealers did. She should be pleased. Today, they borrowed $20 billion at the morning auction and $30 billion at the afternoon auction at the SRF, $50 billion in total….

Why? Logan seems to prefer a potential answer, but it is not hear-warming:

“Streamlined SRF borrowing could be particularly helpful in the event of financial stress. Times of stress are the times when it’s most crucial for the Fed to be able to deliver the liquidity the system needs. Yet times of stress are also exactly when market participants try to de-risk their balance sheets by pulling back from intermediation.”

Which makes me wonder if this was a sudden time of stress that finally encouraged banks to engage the facility they have almost entirely ignored for four years.

Trade War followup

After a presentation of trade facts related to the Trump-Xi deal for my paying subscribers in my last Deeper Dive, I came to the following conclusion about where we have landed six years after Trump started his endless trade wars:

Why has it worked out that China has captured this huge gain in global market share [of all trade]? Likely because of the biggest mistake I said Trump was making from the start of his trade wars—engaging all nations in trade wars with the United States at the same time, rather than taking on the biggest offender—China—and trying to get as many nations as possible to collaborate against China. If you fight the whole world at once, you make yourself the common enemy of all. As a result, China is doing great! It has captured market share away from the US as other nations retaliated against the US in their own Trump-imposed trade wars….

As a result, America permanently lost global market share to other nations, like Brazil, because it engaged in trade wars with all nations at the same time, driving them into each other’s arms, which is exactly how I said this would turn out back in 2019! While I’ve found that telling such truths before they happen doesn’t pay because those who leave because they don’t want to hear them never come back when it proves true, I’m going to keep up with it anyway. No one ever promised the world was fair or that it would love truth. (“THE DEEPER DIVE: In Trump v Xi, Who Was the Biggest Loser?”)

The hard truth is that it was neither so much Trump or Xi who came out the biggest loser. America was the biggest loser as the graphs and other data presented revealed. America has permanently lost a large share of global trade, while China has gained a large share of global trade. The article also gave some of the explanation of the permanence.

Meanwhile, the search for truth among headlines filled with fakery and politicians on both sides of the aisle who are even worse … continues here at The Daily Doom. Hard truth for hard times.

Economania (national & global economic collapse plus market news)

The U.S. Economy Is in Serious Trouble — And Nobody Wants to Admit Who’s to Blame

Money Matters (monetary policy, metals, cryptos, currency wars & going cashless)

WHOA! Federal Reserve Had to Pump $29.4 BILLION into Banking System Last night

Banks tap Fed Standing Repo Facility in record numbers amid month-end pressures

Reserve Bank of India Calls Emergency Meeting over Liquidity in Banking System

Wars & Rumors of War (including cyberwar, civil unrest and revolts)

U.S. poised to strike military targets in Venezuela in escalation against Maduro regime

—

Digital Dominance (AI threats, transhumanism, hacks & cyberattacks, etc.)

Chore-Performing AI Robot to Hit Homes in Coming Months for $20,000

Urgent alert issued to anyone who uses Gmail after 183 million passwords leaked

Political Pandemonium & Social Senescence (socio-political issues & events)

President Trump shows off White House’s Lincoln Bathroom renovated entirely in marble

The luxury gap: Trump builds his palace as Americans face going hungry

The Charlie Kirk Shooting: Too Many Questions, Not Enough Answers

Days before Palisades inferno, firefighters were ordered to leave smoldering burn site

Norwegian Peace Council Rejects Peace Prize Winner

Trump Claims He Has ‘No Idea’ Who Billionaire He Pardoned Is

Reverend shot by ICE shares chilling warning after being left with ‘dent’ in his head

U.S. citizen shot from behind as he warned ICE agents about children gathering at bus stop, lawyers say (but there’s more to the story)

MAGA Lawmaker Calls Tucker Carlson ‘The Most Dangerous Antisemite In America’

Deep Domination (globalism, unelected government, unconstitutional government & censorship)

State employees fired over Charlie Kirk posts inundate courts

A Pox Upon Us (the plagues, pandemics & health police of the 2020s)

First Independent Report Finds Routine Childhood Vaccines a Risk Factor for Autism

Calamity, Catastrophe & Climate Craziness

Antarctic Amundsen-Scott Station Sees Coldest October in 44 Years…Mainstream Media Silent!

BBC Lie About Hurricane Melissa

A Bite Of Dark Chocolate Could Sharpen Your Memory For The Next Hour

Off-the-Beat News & Just Plain Offbeat News

Long-term use of melatonin supplements linked to higher risk of heart failure and death

Doomer Humor

VIDEO – In Defense Of Sun Dimming: A New York Times Editorial By Count Dracula

Sure glad I’ve been buying silver for ten years!

DJT the real Manchurian candidate