The Everything Bubble Bust Pt. 3: The Big Bond Blowup

The stock bubble, the bond bubble (along with its sub-bubble, the zombie corporation bubble), and the housing bubble are all major parts of the economy that central banks directly inflated with their profligate monetary whoring that will all deflate catastrophically when the hot air blown into their love dolls is taken away. These bubbles constitute the "Everything Bubble."

In this article, I want to focus on what a bursting bond bubble would look like and the evidence that we are in one that is already blowing up. (Supernovas, you know, don't blow up in a day. They go through phases of rapid self-destruction and then their big bang.) Because the zombie apocalypse I wrote about in my last Patron Post is one aspect of the bond bubble, you need to factor in all that was said there as well in order to fully comprehend the stellar scale of the bursting of the global bond bubble.

This article will focus on some of the other aspects of the big bond bubble beyond the Zombie Apocalypse. As you read, keep within your peripheral view the broader scope, which is that the bond bubble collapse described here is just the core implosion in the Everything Bubble supernova that will be blowing up around the same time because the other bubbles have strong, interacting "bonds" with the core.

The supernova overview

No one has ever seen a universal bond bubble collapse at the center of the entire financial solar system of little and large orbiting nations; so, this is not something we have a clear concept about in terms of its danger, but it is really bonds that are the epicenter (core) of the exploding Everything Bubble. While we are used to stock market crashes being the biggest financial events we've seen, they are mere solar flares compared to the core implosion of a global bond bubble. (In a supernova, the core collapses, then the whole, suddenly compressed star explodes away the solar system around it.)

The collapse of the Everything Bubble will be an economic supernova. Think Lehman Bros. and Bear Stearns and all the rest of what happened to cause the great recession, then raise it an order of magnitude because most of that developed just out of mortgage-backed securities.

MBS are just a part of the bond bubble, but the interactive "bonds" I mentioned mean the implosion of MBS, like we saw in the Great Financial Crisis, will have a big impact on housing credit. Housing credit (and hence the whole housing market) would blow up, regardless of the likely repeated problems in MBS, due to the withdrawal of Fed funding. That great sucking away of money supply, if we ever even get that far, will cause mortgage rates to rise due to the collapse of easy money. However, we already see mortgage rates rising because they are also pegged to interest on certain government bonds.

The interaction of other markets with bond rates is why we have already seen stocks starting down into a bear market of their own, too. Stocks, like housing, would crash on their own due to the withdrawal of central-bank money seeking a place to park. Nevertheless, we've already seen that, every time bond yields rise quickly, stocks tremble and fall; and the Fed hasn't even begun to withdraw money from bank reserves and ultimately the nation's money supply.

The bond bubble also involves perilous corporate credit all over the world blowing up in one long cascade because inflation is forcing central banks all over the world to tighten at the same time. That forces bond interest rates up on thousands of zombie companies around the world that have become utterly dependent on cheap credit for their survival.

And then there is personal credit. What happens when all those credit cards everyone is using have their variable interest skyrocket?

That is the sum of the everything bubble that is tied in all its parts to the repricing of bonds that will act like a detonator.

One other insidious aspect of the bond bubble blowing up is that the yield curve for bonds is now rapidly flattening as bond vigilantes seize the reins on the bond market that the Fed is releasing. That flattening presages a recession. I don't think a flat and then inverted yield curve, in itself, causes recessions, but simply that it is a sign that is regarded by the Fed as its most reliable indicator of recessions; so, when the yield curve inverts, it creates recessionary sentiment throughout all financial markets. In that sense, it is an amplifier that makes it somewhat of a self-fulfilling prophecy. It's almost like a guarantee or a seal on the recession to follow. This time it is a delayed indicator because of how tightly the Fed held the reins on bond pricing, restricting its own best indicator like a broken gauge to where the Fed doesn't even see recession is already at the door.

The bond bust is global

While the housing bubble of the early 2000s in the US caused US banking damage that eventually spread to become a global banking pandemic, the bond bubble will blow up all over global financial systems. This is going to happen because numerous central banks are simultaneously tightening the loose credit that has fed these bond bubbles.

First, the Federal Reserve, which started its taper in November, picked up its pace in December and then doubled down on it again in January. As I already discussed this in detail in an earlier Patron Post (see "Fed Tightening Impacts Markets: How Fast and How Furious?"), I won't go into detail here; but the gist of it was the Fed came out in January with a triple threat of ending all QE by March, shifting immediately at that point into interest hikes, and then moving into actual QT shortly thereafter.

Next, the Bank of England surprised investors with how rapidly it intends to tighten the economy by backing out of bond purchases and raising interest rates simultaneously. Having voted 8-1 to make its first interest hike to 0.25% on December 16, it just announced, less than a month later, that it will start to take back down its balance sheet of QE bond purchases in March and make its second interest hike simultaneously. So, like the Federal Reserve, the BOE has rapidly doubled down on all aspects of tightening because its governing body is feeling driven more intensely than they originally expected by inflation.

The BOE's announcement is not one of just tapering how many bonds it is adding to its balance sheet, as is the Fed's sole action to date, but of starting to unwind its balance sheet by running off all bonds as they mature, instead of rolling over the payoff it receives upon maturity as it has been doing. At 895-billion pounds in bonds ($1.2 trillion), the BOE has amassed a pretty good wad over the past decade of easing. It plans to roll off 200-billion pounds by 2025 and hopes to expedite the roll-off of corporate bonds by selling them to fully close out those holdings by next year, not just letting them mature without reinvesting the proceeds.

In fact, the BOE's governors are feeling the need to move so much more quickly than usual that they barely avoided making a double hike, voting only 5-4 against a fifty-basis-point raise over the standard CB twenty-five-point hike. A fifty-point rise in in the BOE's base interest target would have been the largest hike by England's central bank since 1997. That is how concerned about the present inflation it has become (and/or how far behind the curve for tightening its governors feel they are).

The remit is clear the inflation target applies at all times, reflecting the primacy of price stability in the U.K. monetary policy framework.

Casting a stagflationary outlook, as I've been predicting, the BOE said UK inflation will peak at 7.25% in April and hang around awhile while GDP growth is expected to become "subdued." That is already a two-point rise in their inflation forecast above their last predicted peak. So much for their ability to accurately guess where the peak will be! They expect unemployment to rise to nearly 5% by the end of 2024, but that number also keeps getting revised up with each new guess. They clearly underestimate.

All voting members agreed that more tightening will be forthcoming.

Numerous less influential central banks are tightening at the same time as these global behemoths:

The Bank of Canada is set for liftoff next month.... Just last week, Brazil delivered a third consecutive 150-point hike, while the Czech Republic lifted its benchmark to the highest in the European Union. Russia, Poland, Mexico and Peru may extend tightening campaigns this week.... Economists at JPMorgan Chase & Co. estimate that, by April, rates will have gone up in countries that together produce about half of the world’s gross domestic product, versus 5% now.

And the shift isn’t confined to rates. Central banks are also dialing back the bond-buying programs they’ve used to restrain long-term borrowing costs. Bloomberg Economics calculates the combined balance sheet of the Group of Seven nations will peak by mid-year....

“The tables have turned,†Bank of America Corp. economist Aditya Bhave wrote in a report on Friday. “The surge in global inflation has pulled forward central bank hiking cycles and balance sheet shrinkage across the board...."

Bonds have plunged all over the world, sending yields higher.... What has forced the central-bank rethink is a wave of inflation.... This week, the U.S. is expected to report a 7.3% inflation rate for January, the highest since the early 1980s. Euro-area inflation just hit a record.Bloomberg via Yahoo!

So much for the lame "transitory" argument that I always said, against a few strenuous objections, was wrong. And if CBs all over the world can be that wrong about inflation, they can be that wrong about everything else they're doing right now, and for the first time in history, almost all of them are doing it at exactly the same time! So, this will be a simultaneously timed global economic collapse of every bubble out there.

Then, this past week, even Christine Lagarde, the uber-dove head of the European Central Bank, announced a more rapid shift out of easing, too, also pointing to inflation as the driver. She, too, set a critical March date if inflation does not ease by then. Her words launched some European interest rates to escape velocity so that they achieved positive yields for the first time in seven years:

While Legarde's mere words flipped interest rates from years of extreme negativity to positive, she did not state any specific action from the ECB, but just said as softly as a central banker can speak that the ECB will use its March meeting to evaluate inflation and possibly change policy then. The Governing Council did say they might end bond buying by the third quarter and hike rates in the fourth quarter.

While the ECB is a little slower than the other two major central banks, Bloomberg summarized that ECB policy setters "see policy change at March meeting if inflation doesn't ease," adding that a sizable minority wanted to change policy immediately and that they had said they would taper bond purchases at the "first port of call to fight high inflation" if necessary. So, the March meeting could move the hinted dates up closer if Euro inflation picks up, which it most likely will, since it is already red hot. I guess they need it to become white-hot like the sun.

Like the Fed, Lagarde noted that inflation had proven more persistent than the 19-nation bloc had first expected. (Apparently, they don't read The Great Recession Blog, or they would have known it never had a chance of being "transitory.")

In spite of Legarde's soft language and all her "maybes," Deutsche Bank, nevertheless, announced the ECBs pivot had arrived:

President Lagarde in today's press conference has clearly signaled a pivot from slow-moving calendar-based guidance to something far more active. This suspension of guidance is a critical development for the FX market. Effectively, it is validating the liberation of the European interest rate curve this year and turning the ECB in to a live central bank.

That last line, of course, embeds the key that I've laid out in past Patron Posts for understanding the significance of the changes that are now arriving. By backing away from bond purchases (as is now seen happening in various places around the world simultaneously), central banks are liberating interest-rate curves all over the world. That means markets will start pricing in the inflation that they were locked out of pricing by massive CB interference; so, expect the repricing of bonds to happen quickly (in a realm of normally glacial moves in interest) and yield curves to flatten quickly and all of that to roil a lot of markets.

Don't think Legarde's soft pivot last week didn't cause a major reaction, though. On the contrary, the reaction has proven that, just as I said, what I am writing here about US markets is equally true for Europe and other markets moving to a tightening regime. All Legarde did was give a whiff of oxygen to the burning concerns about tightening, and the Euro bond vigilantes took over like a storm.

As Zero Hedge described on Monday,

While most headlines are focused on stock market losses recently, a much more dangerous tidal wave of risk-awareness is spreading to peripheral European sovereign spreads (which are always far more susceptible to panic, and then pain).... This is an ongoing reaction to expectations for an earlier removal of the ECB’s bid -- and one that seems to have legs... Something very ominous is back on the radar - EUR redenomination risk (the possibility of an exit from the Euro) is on the rise once again in CDS markets.

So, the Credit Default Swaps that proved so treacherous for Lehman Brothers and Bear Stearns back in 2008 are back in play as potential trouble makers in Europe, and Grexit and Italeave may soon be back on the table, too.

As Bloomberg's Ven Ram writes, Lagarde has uncorked the genie from Europe's bottle of unintended consequences.... Last week two-year German yields rose at a pace not seen in years, corporate spreads widened and rates volatility received a kickstart. In effect financial conditions tightened, contrary to the European Central Bank’s avowed intentions.... This means risk-models (VaR) will be blowing out in every bank and fund.

The bond vigilantes came out in force over French Legarde's squeak of "en guarde."

Former JPM trader, Nick Givanovic, who is old enough to know what all of this means, summarized the bond action in Europe in stark terms:

This is a very big swing already in action. So, time to hedge up with some options, warns Givanovic, because the battle is engaged.

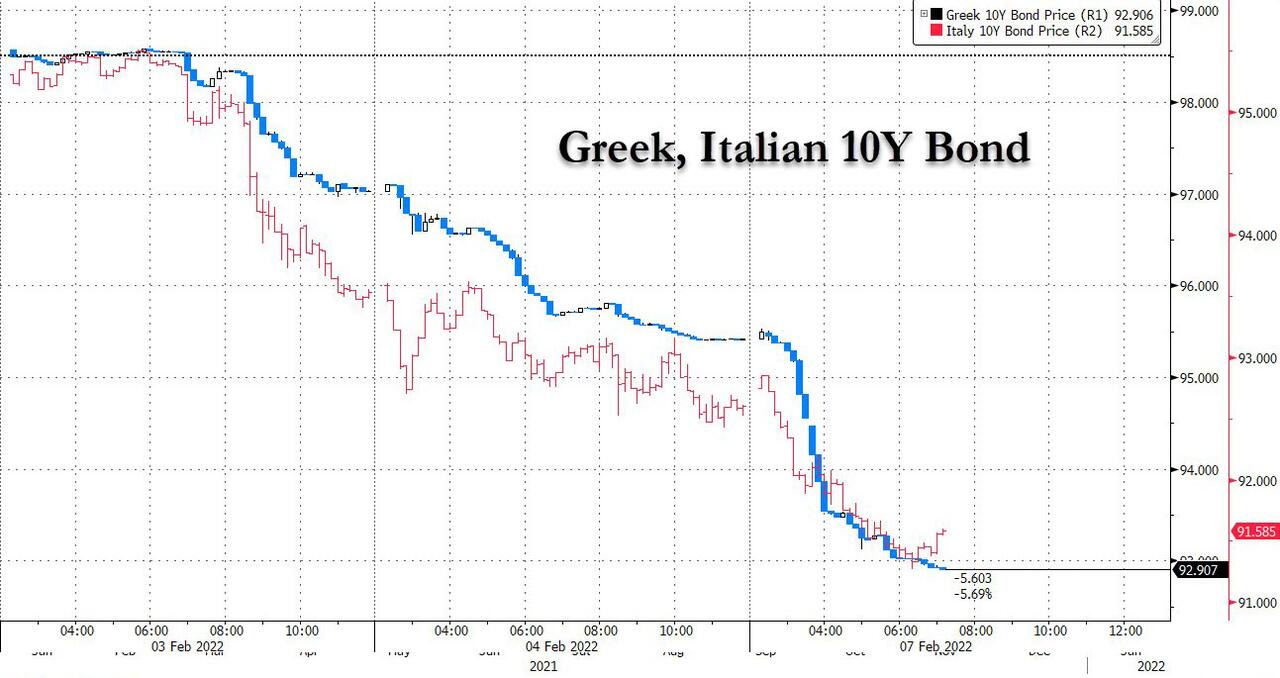

We can already see for ourselves that the old Greek and Italian Eurocrisis could soon be coming back into play as financing costs blow out around Europe's periphery:

Not a bad plunge in bond value (i.e., rise in financing costs) for three days of trading! 'Twill soon be time to start talking sovereign debt defaults all over again around the bocci ball alleys for nostalgia sake. But, if you think it's starting to get messy now, wait until central banks are entirely out of the QE games, freeing bond investors to catch up on pricing in the inflation they were squeezed out of by extraordinary CB interference for the past two years.

The only thing that might keep bond yields from going up extremely high is that the Everything Bubble is likely to completely blow up due to bond action before most rates can rise more than two percentage points, which is barely back to the normal level of historic lows. However, all that means is the full damage is in sooner. In the peripheral Eurozone states, the rate blowout will be worse than that, as those rates are prone to rise in knee-jerk fashion.

The old adage goes “Believe whatever you want about equities, but in bonds there is truth.â€

There is now! The truthsayers are being ungagged.

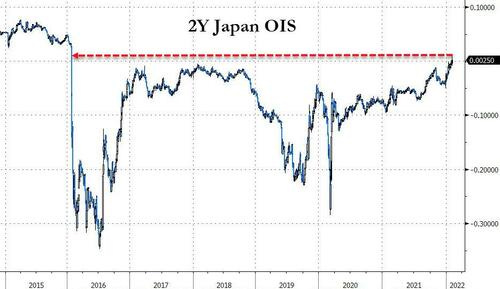

Finally, even the most dovish bank in the world, the Bank of Japan, allowed interest rates to flip back to positive last week:

Or close enough for government work:

They didn't say anything. No formal tightening decisions were announced, but they appear to be relaxing their tight patrol over interest rates where yield-curve control has been overtly practiced compared to the Fed's more covert control.

The end of easy money is upon us. Two years after the pandemic sent the global economy into a deep but short recession, central bankers are withdrawing their emergency support -- and they’re moving faster than they or most investors had foreseen....

Rates are rising because policy makers judge that the global inflation shock now poses a bigger threat than further damage to growth from Covid-19. Some say it took them far too long to reach that conclusion. Others worry that the hawkish turn could slow recoveries without offering much relief from high prices, given that some of the surge is related to supply problems beyond the reach of monetary policy.

Bloomberg via Yahoo!

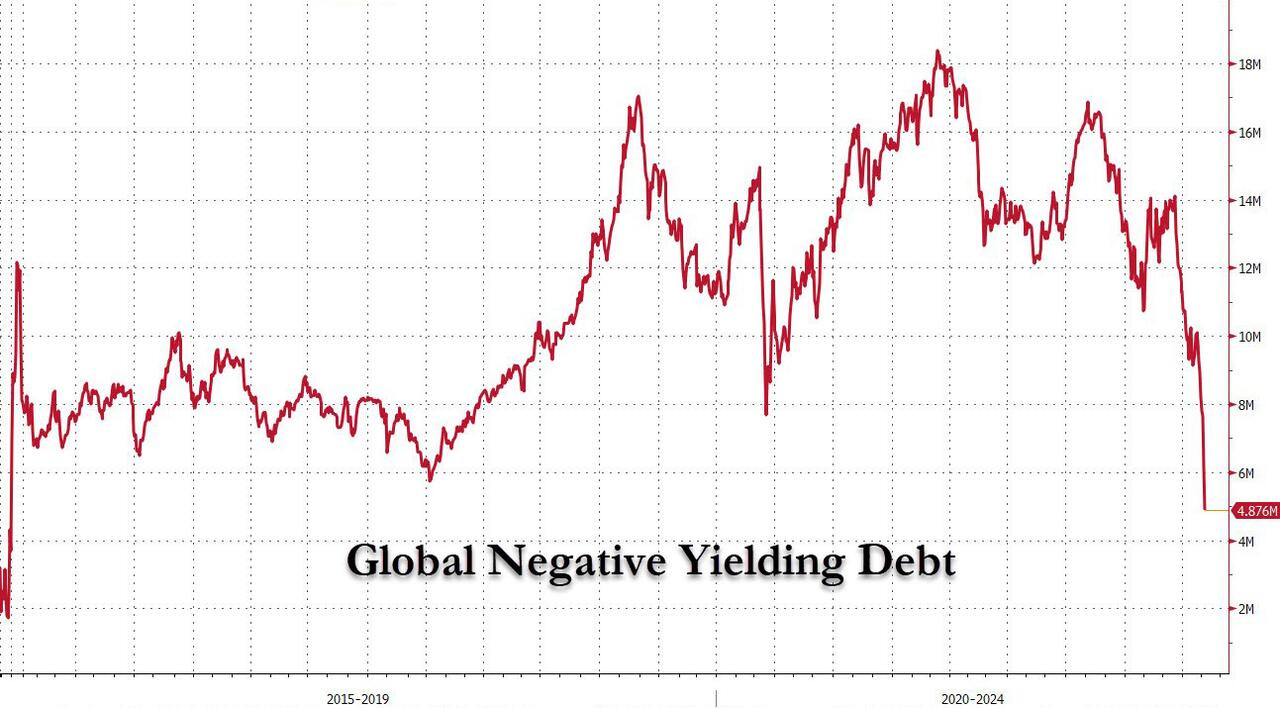

So, hopefully no one, at this point, doubts my original bet that "inflation will kill the stock market" because it is now killing everything all over the world by forcing nearly all central banks to tighten quickly. One sign of that can be seen in the value of debt with negative yields, which has declined substantially across the globe, factoring in the term of those debts:

In just the space of one-and-a-half months, negative-yielding credit is now at its lowest total amount of debt globally in five years. This would be all good if the debt were being paid off, but that is not what I mean at all. I mean all of that debt is no longer carrying negative interest as it rolls over, making it more expensive to carry.

In fact, $1.5 Trillion of negative yielding bonds went “non-negative†last Thursday, which was the largest one-day event on record.

The cost of debt is rapidly rising. That, of course, means big trouble for the zombie corporations I wrote about that have been carried along by the negative-yield environment surrounding them, which makes their own credit cheaper as well. It's also a problem for highly indebted sovereign nations that were getting a free or nearly free ride for all their massive overspending due to their central banks being essentially the buyer of first resort for all their bonds by telegraphing how much they would soak up from banks (and it means TINA, There is Nothing Else, is dead for stocks).

A sovereign debt crisis is coming

While zombie corporations may appear to be the biggest threat in a bond-bubble burst, there are others that may become bigger over time. We have zombie governments! Those are nations that can manage to pay only the interest on their debt, and that is only because central banks have helped their national governments by keeping interest extremely low. The only way CBs will be able to help their nations at that level now is to create Weimar-style hyperinflation by giving up the inflation battle they have just set out on unless the supply issues all over the world resolve themselves and cut CBs some slack. (I'll point out in another article for all readers how that is not happening and why it is very unlikely that it even CAN happen in time to save central banks from the traps they have set for themselves.)

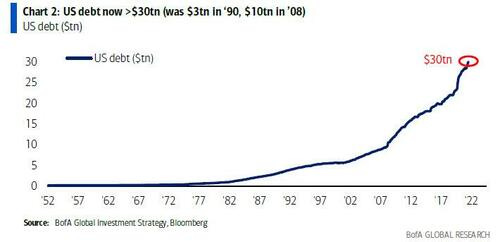

Let's not forget locally that, in the US, sovereign debt has piled up like this: (Notice that for the first time there were a couple of straight-up legs there during the COVIDcrisis. That's as parabolic as you get.)

(Most nations have similar lines on their own scale; so, all that I am saying in these Everything Bubble Patron Posts applies equally to all developed economies in our world.)

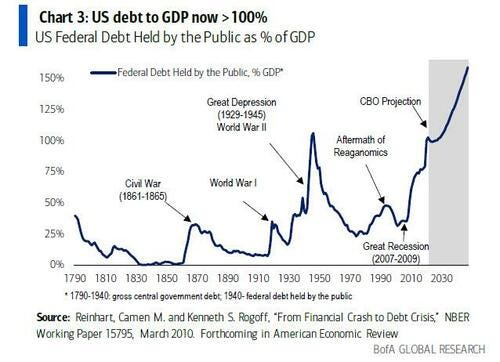

The US debt-to-GDP ratio now almost matches its worst peak after the Great Depression and WWII and is projected to rise significantly higher, making the financial side of the battle against the Great Recession and COVID already equal in scale financially with the overall economy to the battle against the Great Depression and WWII:

(Note those are percentage changes, not dollar values, so they are not affected over time by inflation.)

That assumes the economy does not go into recession this year, actually bringing GDP down and likely raising debt more, which I think is a faulty assumption. (If it does, the scale gets worse.)

Bank of America notes,

The historic solutions to excess debt: war, currency debasement, repudiation, inflation.

In other words, the question to ask is to what extremes will nations go if their central banks cannot save them from the inevitable debt defaults a rise in interest on government bonds will cause? Moreover, how will the nations pile on more debt to save their economies as they have in the past? Most likely they will demand their CBs capitulate by financing their recovery attempts, which really means they will demand currency debasement and hyperinflation over sovereign defaults.

We can look at what Greece went through a few years ago as some indication of the strains that result when sovereign debt gets downgraded due to default risk. You may say the risk of that for the US or other large nations is not likely (and to some extent the US may be spared by being the best horse left in the glue factory to where global money coagulates over here for safety); but what I am saying is national salvation by CBs is not a likely result from whatever happens because central banks have guaranteed their mother nation's extraordinarily cheap credit for years. If that doesn't end right now by central banks refusing to cooperate with their sovereign's needs, then currency debasement and soaring inflation take over. So, either way....

(Bank of America also notes, as an aside, that nearly half of the NASDAQ has now crashed by more than 50%. That is already a big bear market even though five tech stocks are keeping the headline number in the big-three indices above crash levels; however, one of the five generals just packed it in with a Faceplant last week, too. So, my predicted market crash has gotten deeper underneath and the surface crust is finally starting to crack and cave. We place too much emphasis on indices as proving bear markets when every stock that goes into a bear market represents huge losses for all people and institutions heavily invested in that company. Do that with 50% of corporations out there, as we now have, and you have a lot of damage beneath the surface view of the indices that are finally buckling at the top, too. For now, that wealth has mostly just moved into high tech; but with some tech starting to crumble, too, paper wealth will be destroyed as total market value crashes.)

What the supernova financial collapse and explosion of its core bond bubble will look like

If rates rise rapidly, inflation pressures intensify, and fears trigger a selloff in the bond market, investors will experience significant market-value losses. Just a moderate interest rate increase could result in [bond] market losses dwarfing credit losses [defaults]—even if defaults reach highs consistent with a historic stress scenario, which would be much more severe than the credit issues experienced in the pandemic.

Bond crashes play out as a cascade of events just like the Everything Bubble supernova they are a part of. That cascade is seen in a very clear way in bond funds, where it happens like this (which scenario does not even take into account the losses to creditors from defaults):

An interest-rate shock [Hello? Developing now.] would cause mark-to market ... losses in corporate-bond mutual funds, and those losses would pose contagion risks to other asset prices. Investors would react to falling prices—and to forward-looking projections of further declines—by redeeming their holdings. And because [bond] funds tend to hold relatively low levels of cash and near-cash instruments, they would be forced to sell into declining markets to meet these redemption requests.... Material selling could trigger further negative price migration, thus fueling further redemption requests and even lower liquidity among the remaining assets.

We see that already in the early stages of happening as funds that buy US high-yield bonds have suffered large outflows for four weeks straight, drawing down almost $11-billion.

But it gets worse because the above description is just phase one in the supernova cascade of events. The second phase is a broader reaction. The corporate bond market essentially has two buckets of bonds -- investment grade and high-yield (junk) bonds. Many kinds of institutions and investment products are only allowed to buy investment grade. When bond yields rise, numerous companies whose bonds were in the investment-grade bucket because they could easily pay off or roll over their bonds at low interest get rerated into the junk bucket when interest rises above their means to cover.

When the credit rerating happens, all the institutions or investment products that are required to buy only investment-grade are forced to sell all those bonds. You can see that, if the entire bond market suddenly has a repricing that has nothing to do with the quality of companies and what the economy is doing to them (where repricing is individual), but with central-bank unified actions that reprice the full market, many companies that could easily pay off their bonds in the present ultra-low interest environment will get rerated into the high-yield bucket, forcing the institutional sale of those bonds. That huge supply being forced onto the market will lower the price of those bonds to attract buyers from a much smaller buyer pool now that they are in the junk bucket from which far fewer buyers are allowed to participate, forcing yields higher still. Sudden credit downgrades become their own cascade in the nuclear fusion of this supernova event.

If you think the Fed will, as it has done throughout the lives of many investors, simply rush right in to buy corporate bonds to suck up all the slop or buy government bonds to stop the rise in rates that reprice other rates, remember why the Fed is taking all this risk in the first place: the Fed has a constitutional mandate in its charter to fight unstable inflation, so racing back in may require an act of congress to override its mandate (or the majority in congress to tacitly turn a blind eye to the outright illegality). CBs also have their own innate fears about inflation devaluing their sole proprietary product, which is their currency. So, think again:

It is worth noting that the Fed’s incentives to act as a “circuit breaker†could be quite different in a rising-rate scenario that is prompted by inflation. The Fed might view anchoring inflation expectations as more important to financial and monetary stability than supporting corporate bond prices. If so, the Fed might take a very different tack this time, compared with the interventionism that markets got used to in the wake of the Great Financial Crisis.

In fact, central banks typically hate high inflation and worry a great deal about it because they fear how quickly it can get out of control and how devastating to an entire economy it can be to get it back under control and how devastating to their own currency and to trust in them as an institution, which is the only thing that backs their money.

Over recent years, however, CBs became complacent about inflation because they couldn't seem to get it up to save their rich, lardish butts. However, that situation has flipped on them because their complacency led them to wait too long in overconfidence last year. Now we see them rushing head-over-heals to position for tightening, but trying (in the Fed's case anyway) to ease the transition a little via expedited tapering in order to avoid creating a credit shock to the entire system. (This is still the fastest transition to major tightening from exceptionally loose financial conditions the Fed has ever tried to pull off. Even their slight delay until March risks allowing inflation to go even more out of control.)

An alternative circuit breaker to this total bond collapse that then explodes to engulf the whole financial solar system would be that the SEC allows the "phase one" bond funds to stop redemptions at a certain point in the plunge, effectively locking your money in the bond fund. That, however, can result in greater rushes when the fund reopens for redemptions, causing another immediate shutdown, making it hard to get out and causing things to lurch downward in major purges that don't prevent the collapse, but just slow it down in an erratic way. Leveraged hedge funds will, of course, fall the fastest. Insurance companies, large in the corporate bond market, could also become imperiled.

Bond funds are not at all the safe haven many presume them to be. Buying bonds directly to park your money in them while collecting interest is completely different than being invested in bond funds. In the former situation, rising yields provide the individual bond buyer (and holder) better return on his or her stored money, enticing more people or institutions to buy and hold bonds and just clip coupons along the way. In the latter situation, bond funds have already loaded up with low-interest bonds for years because that is all that was available, and rising yields in the new-issuances market makes their old bonds worth less. Then the cascade described ensues, causing a bond-fund collapse.

The next step in the supernova sequence, without even regarding defaults, happens when the implosion of bond prices (values) explodes across the bond system as a rise in all debt interest. In other words, the initial implosion of the bond bubble at the core, then blows outward by seizing-up credit throughout the global financial system, which clubs corporate zombies all over the world on the head, stalls and falls the housing market, cuts off consumer credit-card spending as credit-card rates are mostly all adjustable so they can rise the quickest, and curbs business growth and investment and particularly the cheap credit that has been exploited for stock buybacks. Everything in the system, in other words, gets blown away.

(Keep in mind that use of consumer credit has already risen sharply in the last few months as stimulus money wears off while interest on consumer credit is more sensitive to rate increases than just about any credit, having easily adjustable rates that are indirectly pinned to sovereign-bond interest rates.)

As Bill Blain opined on Monday,

Corporate debt is likely to crack on rising rates, price distortion, forgotten risk metrics, and rising defaults. It will signal the perilous financial health of some sectors – bursting the current bubble violently. Anyone for the last few choc-ices?...

When the bond market is working properly then bond prices tell us important things about the economy, but also truths about how well a company is doing in terms of its balance sheet and ability to pay....

At least, that was how it was supposed to work. In the past capital was properly priced and acted as proper check on good vs stupid ideas. As a result the world was generally a happier place, and stockbroking was what we gave the idiot children of the upper middle classes....

The reason we are in for trouble is that large parts of the markets now implicitly believe companies don’t go bust – because for the last 12 years of monetary experimentation, distortion and insanely low interest rates have kept all those companies that should have failed and tumbled into default… sort of solvent....

As companies haven’t been going bust at normal rates since 2008 (when QE, monetary experimentation and Zero rates begain), then it’s been easy to believe that a company that has been building out its business for the last 10-years but still hasn’t made a penny of profit will ultimately be worth billions because of the position its built and the clients it’s acquired.

Not if the cheap capital that has sustained them this far suddenly were to dry up.. because… say interest rates rise or bond markets widen?

This is where the divergence will happen. Equities continue to believe growing companies will tick upside. Bond markets are waking up to the reality a tidal wave of defaults is likely coming as rates normalise and QE programmes wind down. Even the rating agencies – who remarkably failed to spot the looming sub-prime crisis in 2007, happily giving AAA ratings to any poke of worthless mortgage – agree defaults will rise this year....

When a bond crash comes the market will set like concrete....

Corporate defaults are going to rise. That’s simple logic – for the past 12 years a growing number of profitless, cash strapped companies have skirted the bankruptcy courts only through insanely low interest rates and the ready availability of cheap money – even the deepest, darkest depths of the junk bond market have been able to find bond market funds.... 12 years of QE and monetary experimentation leaves a vast numbers of zombie firms to be decapitated

This, of course, is what I wrote about expansively in yesterday's Patron Post, "The Everything Bubble Bust Pt. 2: Zombie Apocalypse." I'm just folding all of that back into the bond-bubble picture that it is a part of here because it also leads us to the other big chain event that happens as bond interest rates rise -- credit/bond defaults. (See how incredibly complex and integrated this monster bubble is?) This means bankruptcies, and bankruptcies sometimes result in companies going out of business. And the stock value of companies that go out of business smashes in a hurry to zero. So... more impact on the stock market is inevitable, which is why I've said this crash will take a good amount of time to find its bottom.

However, this is more than just about the zombies that go out of business with the impact they have on the stock market, the jobs market and other aspects of the economy. It's about more than the loss of wealth for the average investor or some crashed bond funds. It is also about what so many defaults do to banks.

If there are enough of these bankruptcies, it can easily mean Lehman-Bros/Bear-Stearns events that crush entire vertebrae in the spine of our banking/financial system ... again. Instead of being largely contained to mortgage-backed securities (sort of a hybrid type of bond), wiping out major financial corporations, as happened in 2008, a more general bond bubble bust creates defaults throughout the bond market, breaking the most exposed banks, including those that are too big to fail. That creates the entire global Great Recession all over again, only far worse because the stock market is already going down; housing joins the parade; more banks are pulled in; but this happens this time when central banks and their governments are in far worse positions for throwing more aid into the situation. That is the Everything Bubble bust.

Here is a picture of how easy our financial conditions are now in the US and how rapidly they have begun to tighten already: (I'm sure the situation is not much different in a lot of other nations.)

Look how far up they still have to go just to get to the bottom level of "neutral" financial conditions, which were actually far looser than the neutral level that existed for decades prior to the Great Recession. Then consider how much the stock market and bond markets are already trembling and ask yourself how much more they are likely to be crumbling when we simply get back up to the peach-colored zone that had been the ultra-loose level of already loose financial conditions that pervaded the decade prior to the pandemic. (We are, in other words, not even halfway back to the former bottom of ultra-slack financial conditions, but we are rising quickly to reach the bottom of loosely normal conditions.)

In this scenario of uber-ultra-easy financial conditions, Bank of America referred to our past week as an...

...historic week as rates shock goes global, tech wreck threatens systemic damage, recession scare goes mainstream.

And we haven't even started yet on actual tightening! This has just been from backing off the accelerator, not hitting the brakes.

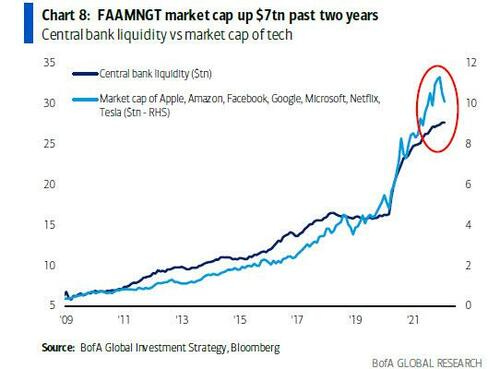

Sometimes people miss how the stock market aligns almost perfectly with central bank balance sheets because they look at only the actions of one balance sheet -- usually the Fed's -- while forgetting that markets are global. Yet, look at how stocks in this global market have paralleled the global changes in liquidity by CBs, and look at the catching down US stocks have to do now that CBs have begun slowing the expansion of their balance sheet. Then remember these CBs promise to soon begin to shrink their balance sheets further away from stocks, sucking money supply out of the world everywhere at once, and giving stocks even further to fall to catch down:

Tell me that won't be a race to the bottom! You can see the high-tech portion of the stock market, which has been the only thing floating the major indices above bear-market level, has some substantial catching down to do, even though it has already made a big move in its first leg down, even for those high-flying tech stocks, thanks in particular to last week's Faceplant. However, they are going to be chasing a falling balance of CB money when the central banks begin actual tightening. Even the Bank of England's latest tightening decision still has to be carried out in financial markets.

The only thing holding those leading stocks up now is desperation because there is nowhere else to go. Even then, you can see they are falling quickly with a long way to go.

On top of all of that, all these CBs right now are tightening into a slowdown -- into a recession -- and that is some seriously bad chemistry. We're tightening into a weak patch here, folks:

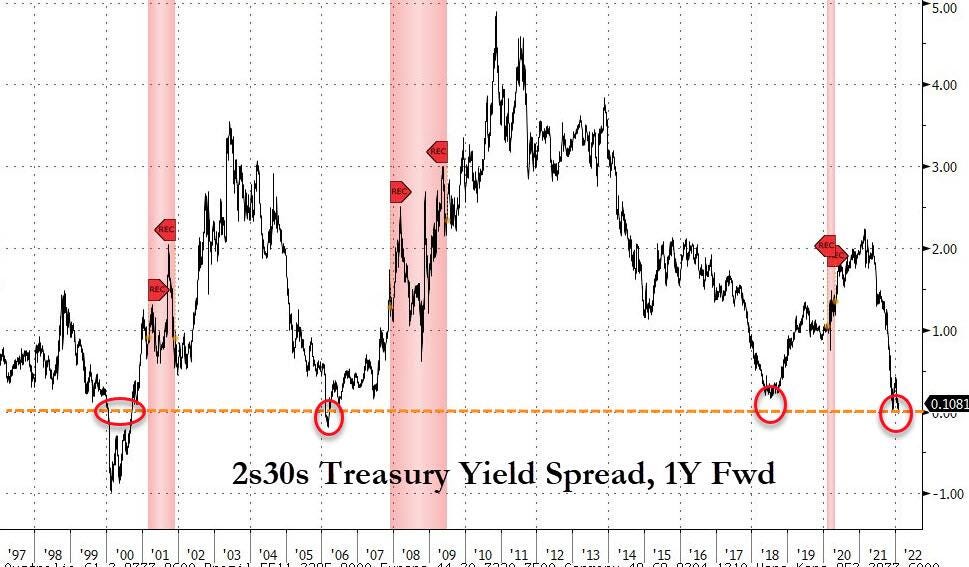

I've already noted in my recession article, which I referenced above, that the Fed's most reliable indicator for recession (the yield curve) has already moved to sit on its recession level a year forward:

And I explained that the yield-curve indicator is behind the curve because the Fed exercised its tightest control ever over the yield curve during the last two years, which is why the curve is rapidly changing now, AND why it is can be expected to be a late arriver in predicting the recession because it would have priced this in months ago (the amount of time before a recession when it usually turns negative), if the Fed had not been exerting total control, which brings us to my penultimate section here:

How close are we to imploding the bond bubble at the supernova's core?

Here is where we already stand:

Interest rates on the government 10yr bond have already risen to the highest they've been since the Federal Reserve rapidly lowered rates as COVID crashed onto US shores:

The 10YR government bond is back to where it was pre-COVID. The short-end 2YR treasuries have a little more catching up to do, having lain languid for the better part of two years, but the bond vigilantes have awakened, and they are now rapidly making up for lost time even though the Fed hasn't started intentionally raising rates on the low end:

That rapid rise in the 2YR is now causing the yield curve to quickly assume the pre-recession flat-on-its-back, screw-me-over position that the Fed did not allow it to assume when the Fed was buying up vast quantities of government bonds across the spectrum of the curve in whatever amounts at each inflection point it needed to do in order to get the curves to undulate in the manner it wanted to see (without ever saying it was forcing yields to yield to its control just like it didn't say it had returned to QE in the fall of 2019 when it was doing all it could to get us out of the "Repocalypse" that it created).

So, here we are with the past months' action in markets as follows:

While everyone knows the mauling stocks took in January, few may be aware that January also saw the biggest monthly loss in BB-rated high yield bonds (down 3.3%) outside of WorldCom, 9/11, GFC, COVID shocks.

In other words, the phase-two part of the core collapse -- rerating corporate bonds -- has already begun! Markets are taking over bond pricing even ahead of the Fed's actual tightening just because the Fed is, as my main thesis has been, relinquishing control. This is why I've said the Fed's own stated interest cuts will be nothing more than a desperate attempt to chase market action so that it appears the Fed remains in control. The market has already taken control, and the Fed isn't even fully out yet.

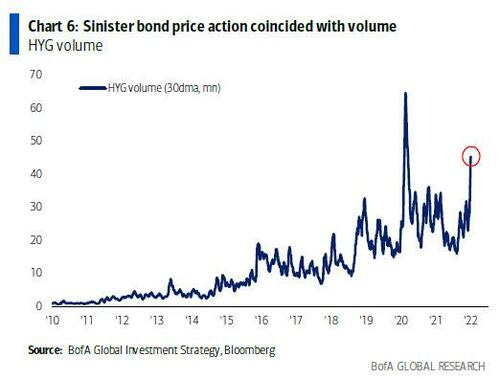

All of this, BofA warns,

...points to the "sinister price action in corporate bonds" which coincided with big outflows

Yes it does. As you can see, the outflow from high-yield debt is already approaching the worst we have seen, which happened at the peak of the COVIDcrisis when markets were in a free-fall:

However, the Fed didn't have inflation burning its backside then, so it was free to stimulate. This time, the outflow is not due to the arrival of a global pandemic but due precisely to the inflation-forced stripping away of a multitude of CB and government recovery schemes.

Where does it all end?

Given the massive ramifications and complexity of the bond bubble, you can see why I broke the sub-bubble of the Zombie Apocalypse out separately. Even the above doesn't cover it all, but is intended to provide a sweeping overview of the peril in the system that is starting to react and the dynamics.

How bad all of these systemic reactions become depends on how long central banks avoid rushing back in. Clearly, the last thing they want to have to do is expand their balance sheet more when they are hoping to shrink them because of their inflation concerns. Obviously, on the other hand, they will rush back in at some point along with their governments. This time, with inflation hot, the banks will be more reluctant toward turning back to solve problems by throwing more monetary gasoline on the inflation inferno just to save all the zombies once again. That risks creating hyperinflation like Zimbabwe or the Weimar Republic; and it certainly will result (though the Fed seems blithely unaware) in piling even more tinder of dead wood into the zombie forest because they would be, again, saving zombies that should have been slash burned in the past but weren't because we aren't brave enough to bear the pain.

Each time they do that, the economy functions more poorly on its own, requiring even higher levels of artificial stimulus to keep it where we like it, because zombie companies are mostly dead weight the economy has to drag along. We've been through two major rounds of that with single bubbles bursting. With the Everything Bubble blowing up, one can only imagine years of total stagnation as our future due to all the detritus the Fed and feds will try to save. In a word, "stagflation" if they pull out the save, leading to hyper-stagflation like the Weimar Republic where money was measured on scales at stores because it took too much of it to count even though times were destitute because Germany tried to print its way out of a crisis. Without money-printing as an attempted solution, you get the Great Depression with deflation. You can't print your way out of a crisis that is not just caused by money.

Even if CBs rapidly retreat to avoid the global supernova above, you'll know how bad it would have been by 1) the scale of the recovery effort they make to stop it from getting worse and 2) by how bad it ends up even after their massive recovery efforts.

Fed intervention failed to work during the COVIDcrash because the Fed had already hit the final downward slope of the Law of Diminishing Returns. As I said then, "The Fed is dead." It had to be joined by huge government muscle to power us through. The stock market completely ignored everything the Fed did until the US government joined its side.

I think this time the combined efforts of Fed and feds won't be enough to restore the economy; but we created this time by piling up debt to save zombie companies and bad banks all the other times, laying in the tinder of dead wood throughout the forest for a conflagration like none other before it. That is what happens when you keep putting off the pain. It's what I warned of in the very first articles I wrote on economics prior to this blog, collected in my ebook (DOWNTIME: Why We Fail to Recover from Rinse and Repeat Recession Cycles), saying someday, well down the road, we'd get to where we are now. Ta da!

I'm not saying the CBs and their governments will not be able to eventually arrest the fall, but that they will arrest it into a pile of rubble because of their reluctance to step back from fighting the fires of inflation will allow things to get too badly out of hand in market disruptions to readily stop those reactions. Because of the widespread carnage, they will not turn stocks around into a skyrocketing stock market like we saw when CBs and their governments combined their strength in 2020.

It will take us years to sort our way out of the rubble piles. They will, of course, continue to use the easy ways out to build on top of the rubble, rather than truly clear out the rubble and redesign our corrupted systems. They will do that because the corrupted systems serve the banksters and other members of the 1%. They will still be wholly vested in saving what's left of the wealth or the rich (saving the bankers first on the pretext it is necessary to save them in order to save the rest of us from having our banks fall on us). They will not wisely force banks that are too big to fail to become smaller as was once done to "Ma Bell." They are too greedy to offer a real solution to "to big to fail." In the midst of global fear, they will come up with a miracle global solution (stuff for a future article) that the majority in each civilization will readily snarf up like the majority did with vaccines because the majority will fear and dread the economic squalor they find themselves surrounded by and will want the easy path out.

Socially, it is not going to be an easy path, any more than vaccine mandates were. Protests will grow, but I imagine central banksters and their pocket politicians will successfully use the readily abundant fear to guide people via pier pressure and mandates into the channels they dream up, which will be as authoritarian as the vaccine mandates and as Orwellian as the social-media suppression/censorship we saw develop during the COVIDcrisis. Consider all of that a test run.

Whether by Davos-developed conspiracies plotted out in dark paneled, cigar-scented rooms, as some believe, or not, consider the COVIDcrisis a learning experience for governments and their CBs in which they learned a lot about social control of the narrative and coercion based on the exploitation of fear. (My point is, I don't need to know it is a conspiracy to see exactly where we are headed based on what we've just seen in the Orwellian seizure of our brave new world. We know how they think because we've seen how they act!)

That will be a social nightmare. However, at this point, I am straying into the apocalyptic views I said I would stay clear of in my introduction to "The Everything Bubble Bust" series. So, just ignore these last three paragraphs of imaginative views of the world we'll have left, but the rest of this article above lays out what I believe we are about to go through with the bursting of the bond bubble that is part of the Everything Bubble, regardless of whether or not society becomes more Orwellian.

How far short we end of the apocalyptic view or just the multitude of problems I laid out above will depend on how long it takes for the CBs and their governments to give up on the delusion that they can tighten and go back to full-on easing and then trundle merrily down the road to the perdition of hyperinflation. As I said above,

You'll know how bad it would have been by the scale of the recovery effort they make to stop it from getting worse and by how bad it ends up even after their massive recovery efforts.