Bond Baloney Everywhere! Let me help you digest it.

The bond market is crazy weird right now. Inflation is soaring, and bond yields, which are supposed to price in inflation, are falling through the floor, causing many experts to scratch their heads as they try to figure out what on earth to make of it all:

The US 10 year yield continues falling, currently at 1.26%. The trend line is broken, we are approaching the 200 day moving average and RSI has not been this oversold since March 2020.... The crowd remains confused. JPM writes today: "The continuous rally in USTs continues to surprise both ourselves and our clients…" As JPM notes, "Treasury yields are nearly 3 standard deviations below their model-implied fair value."

In other words, bonds are not just ignoring current inflation but are running as quickly as they can in the opposite direction of inflation.

We have seen bond volatility explode higher recently, back to FOMC "confusion" levels.

This is causing some -- even the Fed -- to believe inflation will be fleeting, even as many analysts see plenty of reason (as I'll lay out in another updating post soon) to believe inflation is here and hot for the long haul.

Are yields actually predicting no inflation or even deflation? ZH says yields, which had been rising, are now suddenly responding to the newly apparent fact that "the recovery is going [to] hell." I believe that is right, but it won't stop inflation, even though recessions are typically deflationary. You can have a recovery die and have inflation explode. (Think Weimar Republic to visualize the extreme in how an economy can crash while inflation soars.) That is called "stagflation," and that is the kind of inflation I have been expecting, though I am not saying to the hyperinflationary Weimar degree where another kind of baloney -- Weimar wieners -- would cost you a basketful of money. Add some buns for your wieners, and you had to take your money shopping in a wheelbarrow.

What bonds are suddenly pricing in is full belief that the Fed will HAVE to keep its foot on the financial accelerator. That means it will have to keep buying vast amounts of bonds, which also means it will keep artificially suppressing bond yields. That is the easiest way to comprehend what appears to be craziness. Bond yields are now controlled by the Fed, and they will go where the Fed with its infinite monetary resources says they will go.

Ironically, this means the Fed is also completely self-deceived about inflation. Have no fear. I am here to guide you through the bond-induced confusion about inflation. This article will clear things up for you, as I hope my more extensive Patron Post did for my patrons. To start with, I'll show you why you cannot even begin to trust what the Fed is saying about short-term inflation, using its own words.

Fed follows its own fantasies as facts

When the Fed gauges future inflation, here is what it is primarily looking at, as revealed in one of its own statements:

The median 2021 core personal consumption expenditures (PCE) inflation forecast from the Open Market Desk's Survey of Primary Dealers jumped nearly 1 percentage point from the previous survey. However, median forecasts for 2022 and 2023 each rose less than 0.1 percent, suggesting expectations for inflationary pressures to subside. Inflation compensation as measured by five-year breakeven rates on Treasury Inflation-Protected Securities peaked in mid-May at the highest level in more than a decade, but the increase was driven almost entirely by higher inflation compensation at short horizons. Indeed, one-year-forward inflation compensation at horizons beyond a year was relatively stable.

Stop and actually think about that. To put it in simpler terms, the Fed is gauging what will happen to inflation based on what investors in the bond market appear to be predicting -- yes, the same bond market in which the Fed entirely rigs interest rates from top to bottom by controlling the major share of US bonds and bills that are purchased. In other words, the Fed believes that its own entirely rigged bond market still holds meaningful price information! The Fed writes its own fantasies and then is guided by them when it sets policy as if they are evidence of the inflation that is to come. And that is why inflation will go out of control.

What the Fed is really saying is completely circular logic: "We are buying bond yields down across the board; therefore, because bond yields are low and still falling, we can see the bond market is not pricing in inflation, and that's how we know the inflation we actually do see in the consumer market right now will be transitory."

How dumb!

It is so simple to see that bonds cannot show anything about inflation when the Fed is determining where bonds price! Yet, the old-world belief that bonds are inflation gauges still persists in some of my dimmest critics who claim -- even in the brutal face of some of the fastest inflation in history -- we are not going to face the serious inflation I have been predicting for a year because bond rates are going down, not up. These are people who were schooled in economics decades ago and know their theory but have no ability to actually think on their feet for themselves in the present.

So, let me demonstrate how to actually think about what bonds reveal about inflation right now, which is nothing, versus just parroting what one was schooled in back in the old days when price discovery in bonds actually worked because the Fed wasn't controlling bond prices, as I did a couple of weeks ago for my patrons in the following section of one of my Patron Posts:

Putting bond baloney to bed

You have probably heard Chairman Powells’ infamous quote when he was on the FOMC back in 2012, near the beginning of the end of economics as we once knew it:

Why stop [monetary expansion] at $4 trillion? The market in most cases will cheer us for doing more. It will never be enough for the market. Our models will always tell us that we are helping the economy, and I will probably always feel that those benefits are overestimated. And we will be able to tell ourselves that market function is not impaired and that inflation expectations are under control. What is to stop us?

[That is exactly what is happening right now.]

One of the arguments some have thrown up against my inflation articles as they have appeared on other sites is that bond interest does not support my claim that inflation will rise much hotter. I’ll counter that with the help of an article by Nicholas Colas of Datatrek, who questions the proverbial wisdom that says the long-term bond market is great at predicting where inflation is going and pricing interest accordingly. Colas asks, “What If Everyone Is Wrong About US Inflation’s Impact On Interest Rates?â€

While high inflation was not a widely shared concern among stock investors a little more than a year ago in April when I started writing in these Patron Posts that inflation was likely, at last, to come in hot and hard (see “MMT is Here! Start Stacking Money Like Firewood,†Colas now writes, and many would, I think, agree,

I (Nick) have never seen a stronger consensus around a macroeconomic topic in my +30-year career in finance. Fed money printing plus fiscal stimulus/debt issuance plus economic reopening is supposed to equal high and likely lasting inflation.

Colas goes on to say, however, of people like me who think inflation will rip the market to shreds,

When the [bond] market doesn’t go in the direction you expect while all the headlines are in your favor (and, boy are they ever…), you have to stop and reassess your point of view. There is nothing wrong with being wrong. Continuing to stay wrong when the market says you’re wrong is, however, not a great idea.

My problem, however, is not that the stock and bond markets aren’t going my way even though nearly everyone agrees inflation is here. The problem is that nearly everyone is trusting that the Fed knows what it is talking about when it says this rapid inflation that is filling the headlines will be merely temporary. That is inspite of the fact that the Fed just coughed up a hairball and admitted it may not have been right about that after all. The biggest problem, however, is one that Colas will demonstrate: Inflation at a consumer level has only just arrived, and longterm bond yields are actually more reflexive than accurately predictive. They respond to the inflation that was and that is. As to what lies ahead, bond investors are not omniscient.

Inflation has months to go in which to finish its work on both bonds and stocks, and there is much evidence in my opinion that it will. You cannot expect inflation to arrive and instantly kill market sentiment because, by definition, inflation does its corrosive work over time, and bond investors have no better crystal ball than stock investors. A look at the history of bonds and inflation will prove that point.

I said clear back in that April, 2020, post that inflation would take its time in building before it does any damage to markets:

If you’ve read here long, you know I have not been one to write arguments fearing hyperinflation ever on this blog. (And we have not had any in all that time, except in assets where I said we’d see inflation….) We’re in a generally very disinflationary environment. So, that buys the Fed room for now and time for you to keep an eye on inflationary pressures.

Well, now you see those pressures in plain sight. Prior to now, I’ve been pointing out how they were building behind the scenes on the producer side. So, don’t expect the market to crash in a day now that inflation has broken through the surface on the consumer side. This is going to be a battle between the bulls and the bears. What I’ve said is that inflation will win for the bears.

So, let’s deal with the permabulls’ main argument against any market consequences from inflation, which is that bonds are not showing much belief in inflation so far; so, there won’t be much inflation.

Colas asks,

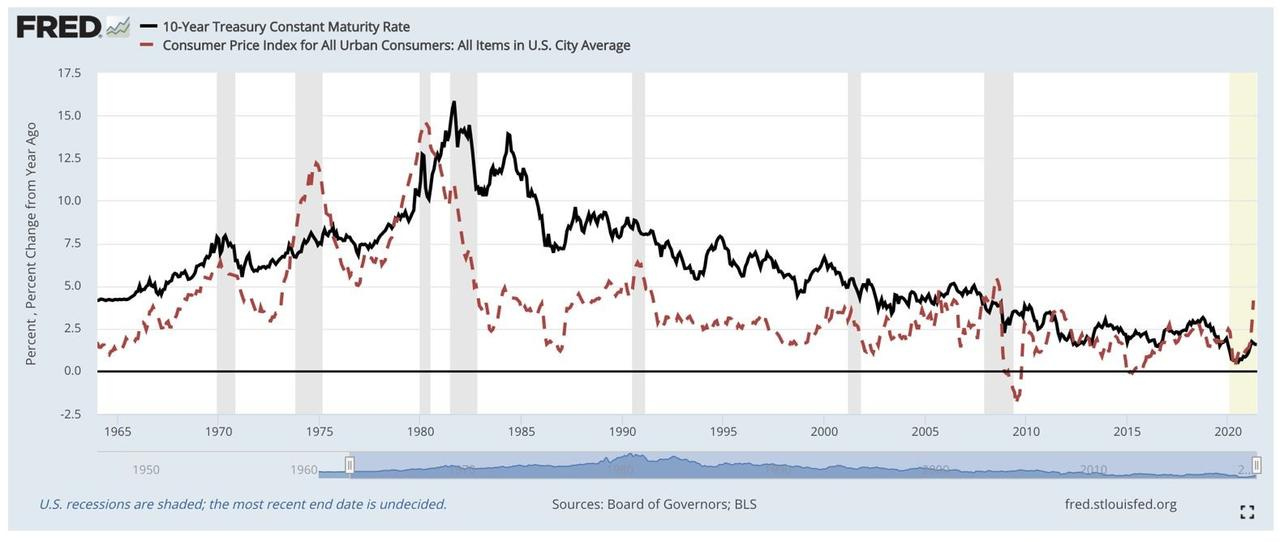

So, what is really going on with Treasuries? Our answer is that this is a much more of a “show me†market than many investors may realize. It takes its lead from long-run historical precedent, not present-day data. Consider this graph of 10-year Treasury yields (black solid line) and CPI headline inflation (red dotted line) from 1962 to the present:

This graph shows me quite plainly (beyond argument really) that bonds are not particularly forward looking! What I see is that inflation has sometimes peaked and bonds didn’t respond much at all. (See the mid seventies). Then I see the ten-year rate has sometimes even peaked a year or two after inflation peaked. (See the early 1980s that everyone compares to the present.) Bond interest has sometimes been reluctant to follow inflation down, not really trusting how low inflation was going. (See the two decades in the middle of graph.) Then there are times when it did ever so slightly anticipate inflation and also fall a little before inflation. (See just before 2000.) Right now (at the end of the graph), we can see inflation, as measured by CPI has just begun to rise steeply, and bond yields have started to rise synchronously with it. There is nothing on the graph that would make me surprised that 10-year bond yields are not fully trusting and joining inflation’s current moves.

So, I am not inclined to make as much about the predictive ability of the bond market using the ten-year for a gauge as many do. I’d say the belief that long-term bonds are predictive is a fable. Look back at 1970 when bonds and inflation peaked simultaneously, but the move up in bonds started after the move up in inflation.

In point of fact, the 10-year yield reveals itself historically to have had almost no predictive ability at all. It looks largely responsive and even a bit hesitant to track with inflation. There is, therefore, no sound basis for claiming now that, because long-term bond interest seems hesitant to rise, inflation won’t be much of a problem. It’s fabulous nonsense. Today may prove to be much like the mid-seventies where the rise in bond interest was slow and steady while inflation blasted off like a rocket, and where bond interest didn’t peak until, at least, a year after inflation peaked.

This graph, in my opinion, puts that argument to bed for good. People are just believing what they’ve heard in their economics classes without thinking about it or checking the argument out against historic facts. They have the theories they’ve learned, and they are sticking to them in spite of no evidentiary support to the theory. Says Colas,

The lesson here, which seems to be playing out right now, is that 10-year Treasuries anchor their inflation expectations around long-run trends rather than any year or two of CPI reports.

I would argue even further: At best they match up to inflation, but often with a lag.

Moron bond baloney

Bond investors are no smarter than stock investors or anyone else. They have no special crystal ball for inflation. But, what is more important, is that bond investors barely even exist right now. More than half of all US bonds are purchased by the Fed (not an investor, calculating where the market is going, but a controller, trying to set where the market is going). If bond yields were more reflective or responsive than predictive over past years, how much less predictive (or even reflexive) of inflation are they now that the Fed is sucking up more than half of all US treasuries! What they reflect now is whatever the Fed is doing!

By cornering the market to such an influential degree, the Fed sets bond prices (and, thereby, bond yields and all interest pegged off of those yields) WHEREVER IT WANTS TO! At its extreme, this is called yield-curve control, something I said last year in my Patron Posts the Fed would soon be doing. The Fed tries to pretend it is not doing that, but acknowledges it has deliberately done it in the past. That is because it likes to maintain the charade of an actually open market.

Those who have been around long enough and who can think for themselves, know that all price discovery in bonds is dead, just as all value in bonds is dead. Another long-time bond investor, Mark Grant, says bonds are baloney:

There is no value left in bonds, neither "absolute value" nor "relative value." Due to the ministrations of the Fed, you are receiving way less than inflation, no matter where you look or what index that you use for comparison, and you are receiving just about nothing for "credit risk." The biggest "sore losers" are individuals, or people that handle their accounts, who have headed into high yield bonds as the choice of last resort or put more and more money into equities in the hope that appreciation in the stock markets will offset the loss of yield.

You see, the Fed has to keep the interest on all treasuries low to keep the bloated government debt manageable. It has no choice. Its continued existence depends on keeping politicians convinced it is managing the economy for the good of the government, even though it shouldn't be managing the economy at all. It knows whose fingers are on the plug that can remove its charter if it fails in an abject way to keep the government financed, and right now government finance has never been more completely dependent on Fed bond purchases to maintain continued low rates and to provide a financier of last resort. So, the Fed is managing the yield curve, even though its management is killing US citizens who would love stable, safe income growth for their retirement funds; but the formerly stable things provide no growth at all now that the Fed is keeping yields pinned to the floor for the government.

Says the writer above, who understands the old way of thinking about bonds, and who knows it no longer applies,

I have been on Wall Street for a very long time. Longer than most. More than 47 years now. Having said that, I am still here. Still up and still going.... Consequently, when I say that there is no value left in bonds, I mean exactly that. No “absolute value.†No “relative value.†Due to the ministrations of the Fed, for right or for wrong, you are receiving way less than inflation.

So, when the Fed claims inflation will be "transitory" because bonds tell us so, the Fed is using its own created fantasy as evidence that inflation will go back down soon. That wouldn't give a thinking man or woman any confidence at all.

Let’s take a look at the hard data, the facts. The 2-year Treasury yields 0.21%, while the 5-year yields 0.76% and the 10-year benchmark Treasury yields 1.28%. Nowhere close to any inflation index, and no yield left for any investors of any kind or stripe....

More astonishing is the Bloomberg High Yield Index. It now yields 3.60%, with a duration of 3.64 years, and it is also at the tightest in history to the Bloomberg Treasury Index, which only provides 228 bps for “credit risk.†Nothing of value to be seen here - and I mean “nothing.â€

The reason high-yield/high-risk bonds are pricing at historic low yields right now is because you cannot find any yield in any government bond that beats inflation. Even TIPS adjust their yield based on the government's understated inflation metrics, so lose money over time. So, people are pressed to reach for more risk to find any reward at all. The real clue to how poorly bonds reflect inflation today is glaringly obvious in how low yields are on known high-risk instruments. Says this longtime bond investor,

The biggest “sore losers,†in my view, are individuals, or people that handle their accounts. They have headed into high yield bonds as the choice of last resort, or put more and more money into equities in the hope that appreciation in the stock markets will offset the loss of yield. It is certainly one strategy, but one that contains a high degree of risk, in my view , and not the one that I use with my clients.

Anyone who is looking at the Fed-controlled bond market as a gauge for measuring inflation expectations -- especially the Fed when it does it, knowing full well that it controls the bond market -- is a complete fool. That is the risk of people who rest on their credentials and are capable only of parroting what they learned in Bonds 101 back in their college days a quarter of a century ago when the US still had a real bond market. Wiser investors, who can think for themselves, recognize there is no truth whatsoever left in the bond market.

We all know the Fed intentionally sets interest rates via the bond market. All price discovery has been killed by central control. Bonds will do WHAT THE FED SAYS THEY WILL DO! Period! When you are literally buying half the treasury market, bills and bonds will price where you price them. It's as simple as that. If they don't, buy two-thirds of the bond market! Buy whatever it takes to get interest down to where you want it! Easy to do when you control the money making machines.

It is not, however, so easy to continue doing when it starts to create inflationary feedback loops. And that is where we are today.