CPI: An Outright Lie!

But everyone believed it so much they raised a toast to dying inflation and threw celebrations everywhere.

While I’m going to wait until the weekend in my “Deeper Dive” to lay out what really happened in beneath the surface of CPI and what an outright lie that report is so that I can let my head cool before writing, I’ll note that one normally soft-spoken economist in the headlines below calls what just happened “chickenshit” that he says should cause heads to roll at the BLS. What they did was just that bad. I thought I might have to dig hard to find it, but it is practically hiding in plain sight.

The Bureau of Lying Statistics has now fully and blatantly earned the moniker I’ve given it for years. What happened is that eventually the liars get away with it for so long they brazenly do it right out in the open. They’ve been called on it today by one economist who doesn’t usually write with language like that, but I’m glad he did. I’ll just say in this general editorial for now that this was probably the most blatant lie the government has ever told on CPI. Keep an eye out for my next “Deeper Dive” to get an eyeful of their “chickenshit.”

For my editorial, I’m going to concentrate on the absurdities surrounding the stock market’s reaction to this CPI report as well as the comedy of the equally chicken congress that not only failed to pass a real funding plan and once again kicked the funding can down the road two months by dodging all the issues. Then the people we have in congress who are too afraid to resolve some of the nation’s funding problems showed how brave they are by leaping chairs like kindergarteners to smash-mouth people as well as a former speaker of the house allegedly elbowing his adversary in the lunch line, so to speak.

The inflation headlines in the news were eyeball deep in the manure pile, or let’s say they were all like flowers growing on top of the manure pile. I picked out a small sampling of seven headlines just to limit myself, but the florid news was all over the place. Here is the gist of them all put together in one paragraph of baloney:

Inflation has now cooled so much it likely means the end of Fed rate hikes. The pause will now become a full stop. [Never mind the market just stopped “doing the Fed’s work for it,” assuring the Fed will have to back into action again in a few months.] Stocks soar because cooling inflation has ended the rate hikes because inflation is cooling faster than expected, significantly, in fact, giving relief to consumers.

Did you feel the relief? You don’t feel it when it is all in the numbers and not in reality, but I’ll get to that aspect of this manure pile in the next “Deeper Dive.”

The mainstream financial media literally could not stop itself from scrambling to cover the smell of manure with roses, so let’s look at what the CPI report actually said (regardless of how false what it says is). What the report showed was that inflation dropped all of 0.1% more than economists already thought it would! Wow! A tenth of a percent beyond what had supposedly been priced into the market because economists had already said it was going to drop. (But that is not the half it in terms of how ludicrous the response has been, as you’ll see.)

Here’s the thing you have to ask yourself. What does it mean when the entire mainstream press stumbles all over itself because of a small beat on inflation and the market takes off for the moon over this when they all completely ignored three months of rising inflation as if it were utterly meaningless? It means to me they were literally dying for a breath of hope and were afraid everything would go upside down if we got one more month of rising inflation. What we saw was a huge relief rally, and the relief was that, “Ah, maybe the rise in inflation we have all been avoiding talking about as the elephant in the room is finally over, and we can pretend it never happened and pretend the Fed will pivot in ’24.

Here is all that really happened when you dig down into the manure beneath the shimmering flowers:

Consumer prices overall were flat last month and rose 3.2% from a year earlier.

All this falderal because inflation was just “flat!” In fact, all that happened was economist expected core inflation to stall, and core inflation dropped by 0.1%!

October CPI inflation came in flat on the month, as the core measure came in a bit softer than expected as well. Whereas the market consensus had expected the gradual decline in core inflation to stall at 4.1% y/y, a slightly softer 4.0% print means that the downtrend that started in March continued through October.

Oh, so the downtrend that turned into an uptrend in the summer, finally dropped 0.1%. Based on that, scores of headlines tell us today we’re to believe the Fed is going to stop tightening even though inflation remains well above its target. Though overall inflation did not drop at all, core inflation did; but that was NOT core inflation less gas and food. It included those, and almost all of the improvement was in highly volatile fuel prices that started dropping again, but here is what the energy news says about that today:

IEA Raises Oil Demand Outlook For 2023 And 2024

Despite concerns about the economy, global oil demand continues to exceed expectations, according to the International Energy Agency (IEA)…. Global oil demand is set to rise to a record annual high of 102.9 million bpd in 2024, the agency noted.

If accurate, that is a thin thread to hang your gang-busting prediction on that says the Fed has won its war and will now stop fighting, much less to hang your bets on that now say the Fed will lower interest rates four times next year.

They concluded,

For now, with demand still exceeding available supplies heading into the Northern Hemisphere winter, market balances will remain vulnerable to heightened economic and geopolitical risks – and further volatility ahead.

So, doesn’t it seem a little excessive to bet the farm on a nearly universal media declaration that the Fed’s fight is over when the primary driver of the drop in core CPI was the most volatile component in core CPI and the very component that the Fed ignores? Especially when overall CPI didn’t drop at all?

Even …

OPEC dismissed on Monday the most recent negative [oil] market sentiment as overblown and said that the oil market fundamentals remain strong, with Chinese crude imports set to increase to a new annual record in 2023.

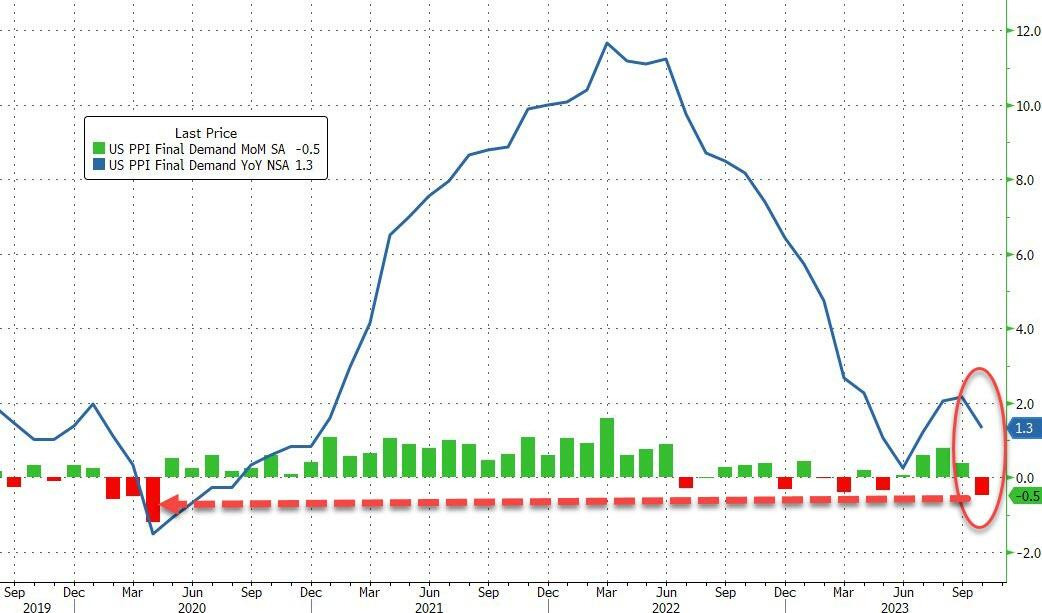

The stock market’s rise got more support from PPI (Producer Price Index) inflation today; but, again, the improvement was all due to oil and gas, and if you look at PPI you see that, during time when I kept telling everyone CPI had been rising the last three months, PPI had also been rising the last three months, too, which remains to get priced through to CPI:

The sharp slowdown [in PPI] was largely reflective of a decline in gasoline prices, as excluding food and energy, the so-called core PPI was unchanged (and the smallest annual increase since the start of 2021)…. Over 80% of the decrease in goods prices was due to a 15.3% slump in the cost of gasoline, the government report.

It was all about the fall in gas prices that could blast off in a second with two wars in major gas-and-oil-producing areas and that have NO impact on the Fed’s Foo-Fighter inflation decisions anyway. Everyone who bet the Fed’s fight is over KNOWS the Fed ignores energy prices because of their volatility, yet…

“Hey, gas is down, so the Fed’s fight must be over!” This is purely self-delusional, and it pervaded every mainstream article in the news this morning.

“The hard part of the inflation fight now looks over,” said David Mericle, chief U.S. economist at Goldman Sachs.

Stocks and government bonds soared as investors concluded the Fed was done raising rates and shifted attention to when officials might begin cutting rates.

Uh huh.

We’re all done now, Folks, because there is almost no chance gasoline and other energy prices will rise now; and pay no attention to the fact that the Fed pays NO attention to those particular prices anyway.

Here’s another factor: Once again, it was year-on-year inflation that went down, not month-on-month, which was what remained flat:

The consumer price index (CPI) inflation gauge increased by 3.2 percent in the 12 months to October, down from 3.7 percent a month earlier, the Labor Department said.

Inflation was unchanged month-over-month from September, with a sharp monthly decline noted in energy prices.

In other words, without the month-on-month decline in energy prices, MoM inflation would have risen significantly! As for the YoY inflation, didn’t inflation fall a lot in those months that were back about, oh, ten to twelve months ago? Could there be a base effect for the year-on year numbers because on how quickly inflation was falling in the early months of that year-long-period they’re measuring, given that INFLATION DIDN’T CHANGE AT ALL IN THE LAST MONTH?

In other words, all the noise is about how much inflation was falling each month nearly a year ago while it is not falling at all right now and would have even risen if energy hadn’t experienced a sudden drop!

Even the Fed via Powell’s talks has ignored the month-on-month rises in inflation to focus on the YoY figures, which it does to its own demise much like its belief that inflation was transitory was to its own demise. You can only ignore monthly events for so long before they bite you in the butt, and we all got bitten because of that massive Fed fail each month back in the “transitory” days, and we may get bitten again as they pretend MoM inflation doesn’t matter as much as YoY, even though it is exactly what eventually makes up tomorrow’s YoY inflation.

Good grief. Does anyone who wrote all of these stellar inflation articles that flooded the media today even THINK at all?

Joe Biden, of course, saw good news in all of this, but we don’t expect walking dead men to think:

"Today we saw more progress bringing down inflation while maintaining one of the strongest job markets in history," President Joe Biden said in a statement.

Biden should stay with shaking hands on stage with dead people.

We got zero progress against inflation over the last month, but we got some assistance in the YoY figures from 10-12 months ago, and that is presented as “more progress.” If the LAST month didn’t change, there can be no PROGRESS. Even harder to choke down is that we got to hear from Baloney Biden again how this is the “strongest job market in history.” That’s like boasting your labor market is tight because all the workers have died so no one showed up to work. “We just can’t get enough workers now that they all died, so the resulting tightness clearly shows our dead labor is “strong and resilient” as is the whole economy.”

Nobody gets it. Nobody thinks! (Not in the media anyway.)

But, hey, stocks are up because why think when you can fly?

Speaking of flying, tempers are flying in congress as the members work hard to find ways to pass funding bills that do their best to avoid solving any of the nation’s funding problems. Congress did as I said they might yesterday (as anyone could say) and, again, kicked the can down the road in a meaningless move to avoid solving anything. Some have decided to solve things with their fists because other people are calling them names and saying they don’t know what they are doing. Of course, picking a fight with the Teamster boss might mean you just disappear in a few weeks, but for congressman thinking with their testosterone, what does that matter.

The former house speaker, meanwhile gave an elbow kidney punch to one of the people who ousted him from his vainglorious speaker position. This he did as a sucker punch while walking past the other member of congress who was speaking to a reporter.