While the Fed is Crushing Jobs, I'm Crunching Job Numbers, and They Are a Smashup Mashup!

What a mess of convoluted reporting and contradictory data we have to sort through as a result of the once-in-a-lifetime economic crisis the Fed's profligate recovery plans and our crazed Covid lockdowns and other sundry problems have heaped upon us. Very few people understand the gravity of the situation because of the twists involved in making sense of baffling facts in an environment that is almost other-worldly to them.

As a example, Bloomberg reported,

The eagerly anticipated December jobs report failed to offer a clear picture of the state of the American labor market, especially since it came a day after two jobs readings signaled continued tightness. Hiring exceeded estimates for the month and unemployment fell to the lowest in decades. Traders continued to mull how that strength contrasts with the weaker gains in hourly wages and what that means for Fed policy ahead.

With all those signs that the Fed is failing to reach its stated objective of raising unemployment to fight inflation, the stock market boomed upward on Friday in hopes the Fed will be quitting the fight sooner. It fastened on a single wage data point and ignored the rest of the data because, I guess, it confused investors with conflicting messages.

Before we pull away the layers of misunderstanding to grasp what the actual numbers show about the real employment/jobs situation in the US or talk anymore, as I just did, about the stock market's strange reaction to this past week's job stats, let me summarize the basic facts we were given this week, as well as what we know from earlier:

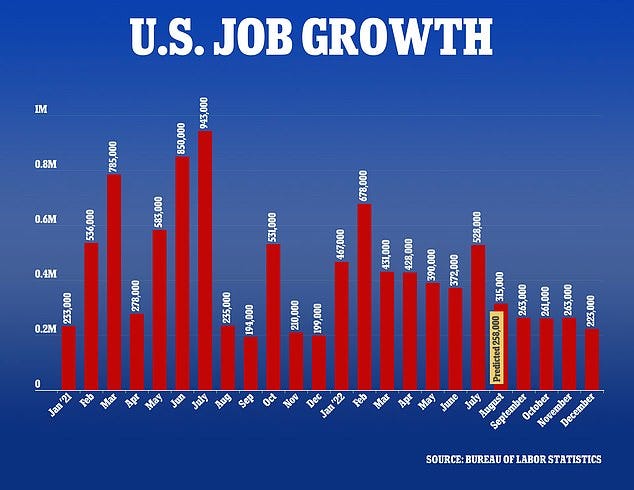

223,000 new jobs (net change) were added to the US economy in December, according to the Establishment Survey, which was more than the expected 200,000, but less than November's 256,000.

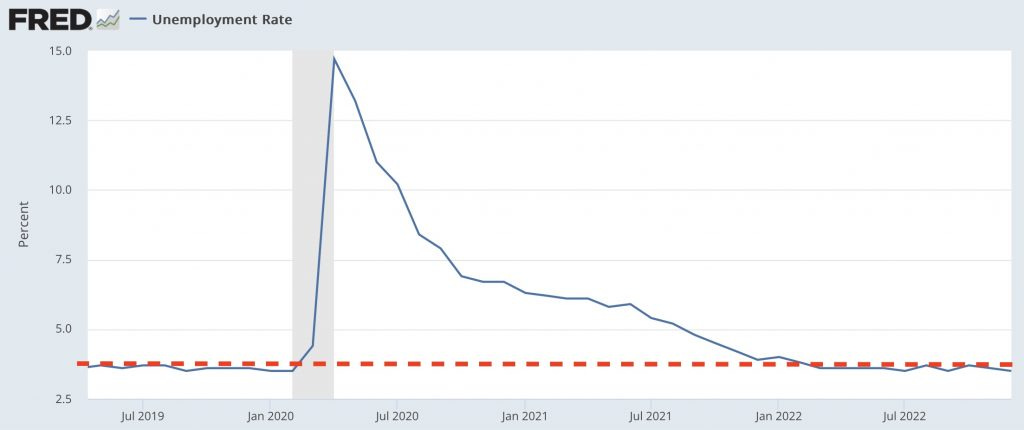

The official unemployment rate dropped from 3.7% in November to 3.5% in December, the lowest rate in 53 years! (according to the BLS' Household Survey)

A more-encompassing unemployment rate, which claims to account for discouraged workers who quit seeking jobs and to adjust for part-time work by people who want full-time work, also fell to its lowest level in many years (since 1994) to 6.5%.

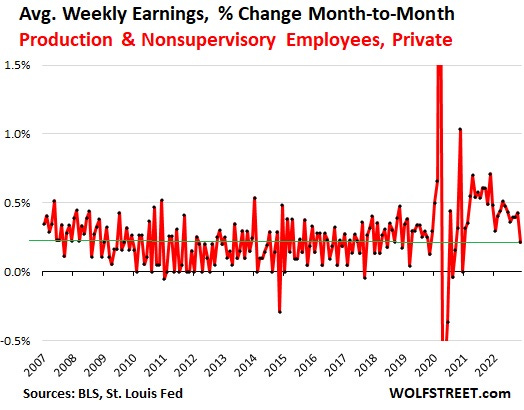

Wages grew by 0.3% MoM from November to December, which was slightly less than expectations and lower than November's 0.4% growth over October.

Wages grew 4.6% YoY, which was less than the expected 5% or November's 5.1% YoY growth.

According to the BLS, the total number of workers (people who are working) took a huge leap in December (up 717,000).

The total labor force (those who are working plus those who are active looking for work), however, jumped up a less impressive 439,000. (The difference between #5 and #6 could presumably be accounted for by the drop in unemployment.)

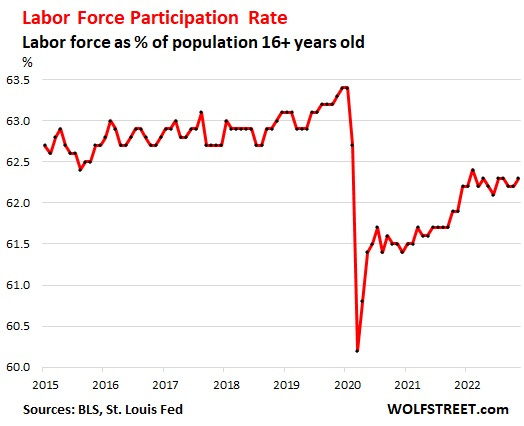

The labor force participation rate edged higher to 62.3%, but that remains a full percentage point below where it was in February 2020.

The JOLTS report (Job Openings and Labor Turnover Survey) on Wednesday showed a total of 10.46 million jobs that are unfilled in the economy for November, down a mere fraction from October. (Job openings are positions employers are actively seeking to fill for which work is available within thirty days, whether full or part-time, permanent or short-term.)

There remain about 1.7 job openings for every available (officially unemployed) worker in the labor force.

Digging beneath the surface of the numbers

Overall, the addition of new jobs to the economy is slowing, but we're still adding jobs, not taking them off the table, while the number of jobs that remain unfilled due to lack of laborers is a cavernous gap.

The growth in the total number of people employed is slowing along with the slowing in new jobs being added, as could be expected, but what is notable is how far short that number still lies below the trend that existed before the Covidcrisis:

That is some serious damage!

The growth in the total number of working people slowed way down throughout 2022 compared to 2021 and even compared to the years before Covid. The green trend line has roughly matched population growth each year; but it is now increasing along a trend that is not only a big step lower but also increasing at a less steep rate. The gain shown in the final blip is the 717,000 mentioned in the summary above.

Those are the working people. The labor force, which includes those who are not working but are actively seeking work, looks similar:

It saw the gain mentioned above of 439,000, which more than offset two prior months of decline.

However, the labor force participation rate mentioned above looks weaker since the start of the year:

The labor force participation rate is the percentage of the total non-institutionalized population (people not in prison, military, mental hospital, nursing home, etc.)above the age of sixteen who are either working or actively looking for work. That percentage of the population that is participating in the labor force could decline if people keep getting sick and dropping out of the labor force because they wouldn't fit the definition of being "actively looking for work." As I've revealed before, that could (and likely does) explain in good part why labor force participation has only recovered a little more than halfway from the level we fell to during the Covid lockdowns. (And the Fed isn't going to be able to boost labor force participation that is down due to poor health in order to reduce wage pressure as it wants to. It's hope there has been creating tighter times throughout the economy will force people back to work, but that doesn't work if people have quit due to poor health.)

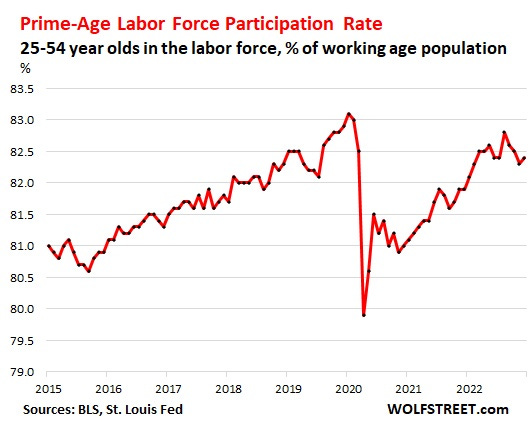

The prime-age labor force participation rate, which effectively eliminates retirees from the participation rate, is actually going downhill:

That indicates the problem is not due to early retirement unless we have a lot of people retiring under the age of 55.

All of these graphs (from Wolf Richter's detailed article, "My Thoughts about Wages: What Changed?") reveal a huge shortfall in laborers from where we stood before Covid or from the previous trend line. Unless the number of jobs openings (unfilled) is equally below trend, the Fed has a lot of work yet to do if it is going to crush the economy down to close that gap to where the number of jobs open roughly matches up to the number of workers, taking pressure off wages.

But here is where open jobs are based on the JOLTS report:

The number of jobs that are open (unfilled) -- based on the JOLTS report -- rose well above trend due to the lack of people in the participating labor force. Open jobs are the measure of the unmet demand for labor (labor shortages). What we have is labor well under trend and open jobs well above trend. So, while the Fed has achieved significant narrowing of this gap, it still has a ways to go to meet its own plan goals of reducing wage inflation. We still have 1.7 total jobs remaining open for each unemployed person seeking work.

Note also that the recent mountain of job openings merely offsets the valley in normal job openings prior to and during the Covidcrisis. The area above the trend line for openings explains why people think the economy is booming. However, since these jobs are going unfilled, they are completely unproductive. This is not a measure of new jobs but of jobs (new and old) that are hanging open. They can be created jobs (new jobs), or they can be jobs that people quit that have been re-listed. They don't represent a boom in economic growth (production) because how can they? They are essentially just empty place holders.

The report brought job creation for the year to 4.5 million, pending revisions, as the economy continued to recover from its plunge in 2020. Still, total employment is still millions short of where it was headed before the pandemic, with job losses predicted in the year ahead.

Total employment down by millions when efficiency is also down inescapably means reduced production. With all of that said about how the number of working people is staying low, 2022 was reported as

The second-best year for the labor market in records that go back to 1939.

While I disagree with that broad interpretation, it doesn't sound to me like the Fed is winning if its goal is to curb inflation by depressing the labor market, even if things are cooling down a little; but I suppose it depends on whose "new jobs" numbers you go by, as we'll look into below. CNN called it ...

A year of extraordinary job growth.... The economy added about 4.5 million jobs in 2022. That’s the second-highest-ever total, after the 6.7 million jobs added in 2021 — a boomerang from 2020’s 9.3 million job losses.

Not what the Fed has repeatedly stated it needs to see before it backs off from its tightening regime.

Those latest gains come following months of jumbo interest rate increases from the Federal Reserve in its attempt to cool off the economy after inflation last year hit its highest level since the 1980s. Those efforts have, so far, remained mostly elusive.

If you look at the number of laborers, it's clear why those jobs are just hanging open. The continuing tight labor market appears to be far more due to lack of laborers, than to a strong job market (abundance of jobs). As you can see, total employment never recovered anywhere near back to trend either:

So, there are a lot more jobs than workers. That means, if the Fed is going to stuff down inflation by stuffing down jobs to reduce wage inflation, it's going to have to suppress the economy below the already diminished level of employed people shown above.

The danger in the lowest unemployment rate in history is that the Fed has indicated it will tighten until it sees this rate rise to about 4.5%. The new number means things are actually going the wrong direction from where the Fed wants things to head. It likely won't tighten harder, but it will have to tighten longer based on its stated objectives:

“A new 53-year low in the unemployment rate is a real problem, suggesting the Fed made zero progress toward relieving labor market strain in 2022,†wrote Chris Low, chief economist at FHN Financial....

Lisa Erickson, senior vice president and head of public markets group at US Bank Wealth Management:

“The Fed is indicating a keen interest in seeing the labor market normalize. So, as long as we continue to see strong and robust labor growth, that again provides more opportunity for the Fed to overtighten as it goes over time because it’s really trying to bring that part of the economy to more of a slowdown.â€

Here you can see a picture of how much the Fed has accomplished in getting unemployment to start rising:

Since that is their stated goal, its a dismal failure!

That's because we're dealing with a structural labor shortage, not with economic growth.

I quit!

Don't worry; I don't mean me. I said above that job openings can be due to created jobs (new jobs), or they can be jobs that people quit that have been re-listed. Quits are seen as a sign of a vibrant, therefore confident, labor market. Normally, people quit because they retire or because they move on to something that pays better or offers better working conditions, but that is not necessarily the case; so, we shouldn't jump to conclusions about what the high quits rate means:

People can also quit for neutral reasons, such as to follow a spouse whose job has taken them elsewhere. They can quit for negative reasons, such as they become disabled, as I already wrote about at length here and here. Normally, sickness, death or a change of scenery are not major factors in the ups and downs of open jobs or quits because they tend to follow a constant path; but we live in anomalous times.

The "Consumer Confidence Labor Differential" in the graph above is essentially a measure of sentiment, asking people how they feel about the job market. We can see quits have risen in an environment where people feel good about the jobs market. However, it's quite possible that people feel much better about the jobs market (as the above graph indicates) but still have to quit for reasons having nothing to do with getting a better job. Such could be the case now where jobs are paying better and its easy to get one, but that doesn't mean people are not quitting because sickness is forcing them to. Those who are quitting (and those who remain employed) just don't see health situations as a measure of the job market where they still see it is easy to find good-paying work if you want it (which can mean if you able).

So, the question is, how can we suss out whether these people are quitting to move to better jobs or because they became disabled, died or had some other reason than a move to better jobs?

All the wage rage

Regardless of the reason for the high level of people quitting their jobs, the high quits rate is going to keep pressure upward on wages and keep the Fed leaning into tightening. The more people quit, for whatever, reason, the more employers have to replace. In a labor market that is tight because of a structural labor shortage (lack of participating bodies) that is going to force wage competition for the limited supply of workers available.

While we can see the Fed has achieved some reduction in confidence and quits, we can see they are still at historic highs. (As in nose-bleed section highs.) So, if the Fed is going to cut inflation by trimming wage growth, it clearly has a long way to go to get that wage competition down from a quits perspective, too.

Raising wages can bring people back into the participating labor pool who have stepped out, but not if they stepped out because they died or got sick. All the wages in the world won't overcome those obstacles. So, IF those are the reasons many have quit, wage growth could remain a persistent problem for employers and inflation pressures as the total labor pool will remain about the same size no matter how much wages rise.

Also, wages have risen only about half as much as inflation averaged over the year, so inflation is keeping its own pressure on wages to keep rising in a self-feeding loop.

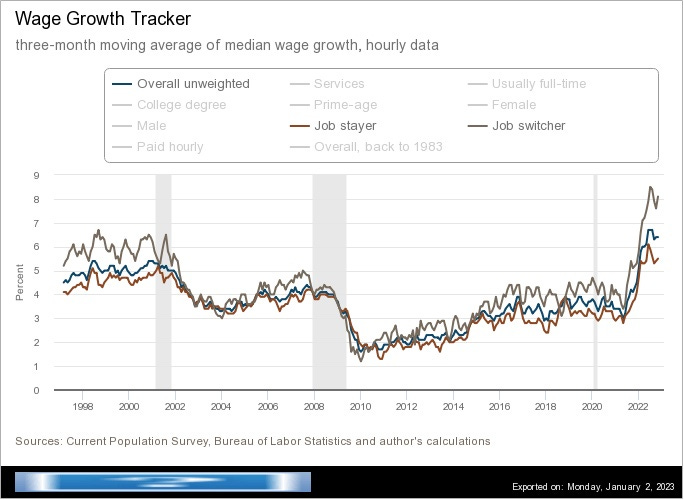

Now, as for that dip in the rate of wage growth that got the market all excited in the past week ...

... it was a good-sized drop. No doubt about it, but you can see this number tends to spike up and down a lot, too. So, it may ping back up as it tends to alternately do, though there is a clear down-trend in play since the start of last year.

I quit again!

Coming back to quits after that segue to wages, in order to bring the two together, wage growth has almost always been better for those quitting their jobs than for those staying with them. The gap between the two has never been this extreme, at least, in the last quarter century:

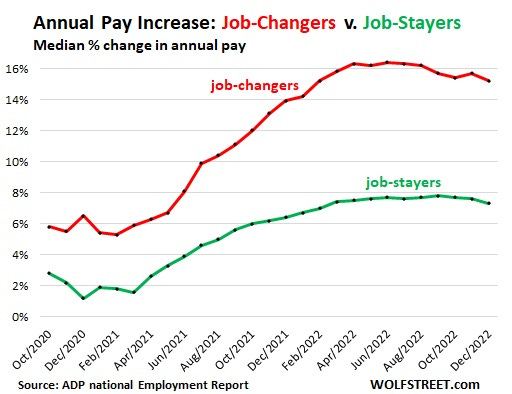

I don't trust the BLS, which provided the above data, after their major discrepancies and noted faults in their new jobs numbers between their own reports. Looking at the numbers reported by payroll processor, ADP (Automatic Data Processing), we see much higher actual wage gains reported in payrolls and a much bigger gap between quits and those who stay in their jobs:

With the differential in actual pay increases for those who quit and take a new job versus those who stay being anywhere from 3% (government numbers) to about 8% (ADP), there will be continued upward draw on the wages of those who have not quit in order to keep them from being enticed to quit. That remains true whether illness is a primary cause of quitting or not. Those who remain working will reach toward the higher pay.

That makes it reasonable, if all other factors are ignored, for the stock market to have taken a big sigh of relief when it saw actual wage growth drop, but the problem is there are some serious factors that are being ignored, including most of all that illness/death contribution to the picture that nothing can change.

“From the market’s perspective, the main thing they’re responding to is the softer average hourly earnings number,†said Drew Matus, chief market strategist at MetLife Investment Management. “People are turning this into a one-trick pony, and that one trick is whether this is inflationary or not inflationary. The unemployment rate doesn’t matter much if average hourly earnings continue to soften.â€

However, the labor market is not a one-trick pony in terms of what it will lead the Fed to do and what impact the Fed's reaction will have on the economy and stocks further down the road. So, a more nuanced view might be instructive. The Fed is looking at all those other factors above -- continued new job growth (even if it slower), continued moves lower unemployment, continued major gaps between available jobs and available workers, and believes it needs to see movement in all of those before it can feel confident wage inflation will settle down. And, it has many other things it is considering that have nothing to do with wages (the inflationary effect of too much money being the biggest of them).

And it is judging all of this with some very faulty gauges.

Discrepancies in net job gains or losses

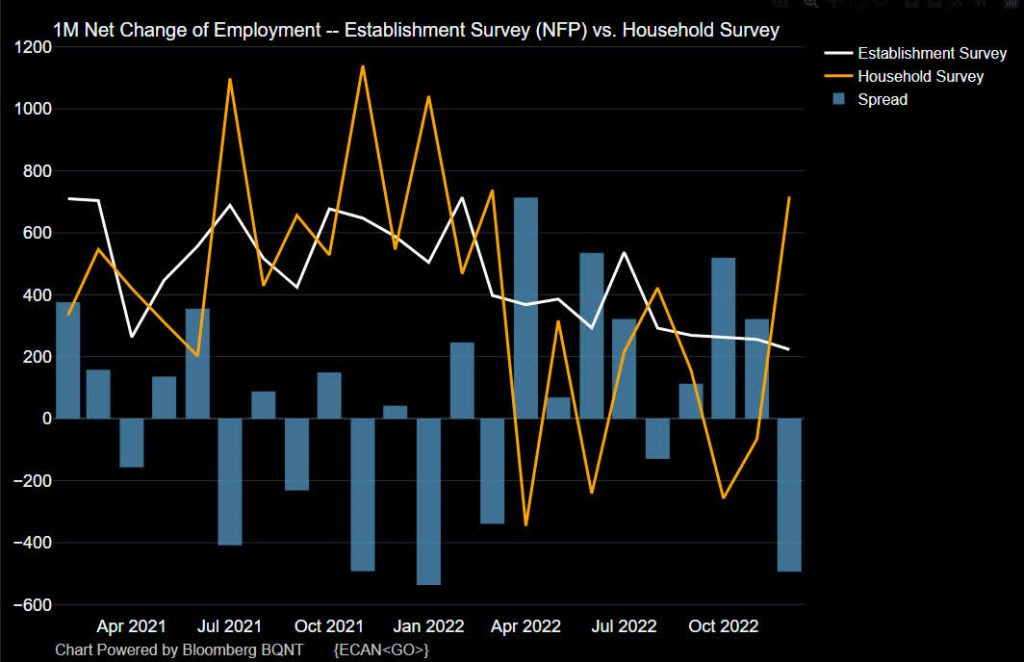

Recently I reported on how the Bureau of Lying Statics (BLS) had a blatant discrepancy of well over a million jobs between the two employment surveys it conducts to show the net gains or losses in total jobs each month. The Establishment Survey is less reliable because it counts each job each person holds as a separate employed individual because it has no way of knowing who holds the job. Thus, three part-time jobs held by one individual counts as three employed people. The Establishment Survey has been running much hotter than the Household Survey, which avoids counting people with multiple jobs more than once by talking to each household directly. In fact, the Household Survey has reported almost zero growth in jobs for half a year.

This month, however, the Household survey bolted upward. Keep in mind, though, the Establishment Survey was reported by the Fed to be the one that it believes has been way off most of the past year -- by, at least, 1.1-million jobs. The Fed's report enraged, at least, one member of congress into howling about the false information and demanding an answer. It even turned into a public scrap between the government's Bureau of Lying Statistics and the Fed.

Nearly two weeks ago the Philadelphia Federal Reserve wrote that the Biden administration had overstated US job growth by at least 1.1 million - directly implying that the Bureau of Labor Statistics (BLS) had fabricated US payroll data to provide political talking points....

The Philly Fed's revision, however, indicated that the actual number of jobs added was more like 10,500.

Clearly a massive cloud of confusion hangs over what conflicting job statistics should be, but here is how the low-lying Household Survey (orange line), which the Fed deems to be the accurate report, suddenly shot up after the discrepancy was pointed out by the Fed:

The BLS argued that the Fed doesn't know what it is talking about:

the BLS is on the war-path suggesting that the Philly Fed is using 'lower quality' data.

In other words, the BLS believes more in their highly massaged report than the one that is closer to raw numbers from the general public. I'm sure that is because they love adjusting those numbers, and the Establishment Survey is the one they manipulate with all their "seasonal adjustments." It gives their abacus workers something to do and makes them feel smart and valuable and keeps the department flush with a bigger team. Now it appears they may have taken to adjusting the Household Survey to bring it into compliance with their always-massaged Establishment Survey. (I'm innately concerned about any entity that raises "the establishment" over "households.")

The BLS argued with the following rebuttal to the Fed:

In the past, other Regional Federal Reserve Banks have conducted similar research using various methodologies. However, BLS has determined, following years of research and engagement with the Federal Reserve Banks and data users that this general approach resulted in lower quality data....

BLS employment data from the Current Employment Statistics (CES) survey are widely recognized as a key indicator of labor market performance, in large part because of the consistent, transparent methods used to produce timely and accurate statistics.... Once a year, BLS revises the official monthly estimates by benchmarking to BLS quarterly administrative data (the Quarterly Census of Employment and Wages, or QCEW) that is available on a 5-month lag....

"Historically, CES estimates of national employment are extremely reliable; last year, which included the effects of the pandemic on labor markets, the revision was only -7,000

Hmm. I think they cherry-picked a good year. As I reported here a couple of years ago, their revision for 2019 took the benchmark for the year's total job creation down by over half a million! 2020 got revised down by a quarter million jobs. Of course, they further massaged that with additional "season adjustments" to reduce the error to a downward revision of 120,000 over their previous new-job reports.

They did better during the Fed's Great Recovery plan where employment stayed on a steady path of constant improvement. However, their results were even more abysmal during the Great Financial Crisis, itself:

They later revised their job growth benchmark for 2010 down by 378,000 jobs.

2009 by ALMOST A MILLION! (-902,000)

2007 down by 293,000.

One might reasonably ask, if their monthly massaged reports are so accurate during times of economic crisis like the present, why have they had to revise them DOWN by hundreds of thousands of jobs to establish a revised benchmark because their own annual March audit revealed the total number of jobs they listed for the US economy had become grossly inflated over the course of the previous year's reported monthly "new jobs" additions.

As ZH humorously (but wisely) summarizes the situation,

In short, the BLS will drastically revise all of its data some time in 2023 ... at which point nobody will care what happened in ... 2022.

Both surveys are done by the BLS, but now the one that consistently reported a an almost non-existent number of new jobs is suddenly shooting up. What's going on here? Did the BLS just realize the two reports were grossly out of synch so it "corrected" the much the lower survey to boost it to better numbers for Biden to boast about, in spite of the Fed weighing in that the lower survey is the more accurate one based on its accounting of job numbers from data that it considers superior?

One thing is for sure, such huge discrepancies between the two reports tell you one of them is so grossly off as to be worse than useless. (As in downright misleading.)

I'm going to put my money on the low-figure Household Survey as being the right report, even though it just burst upward, and suspect the upward burst may have been an attempt by the Bureau of Lying Statistics to get the two survey's to reconcile better. I don't trust numbers the government massages. however, if this sudden leap in net jobs is not manipulation, it means things are really not going the direction the Fed wants!

The discrepancy between a number of different reports caused the Dow to open 300 points lower on Thursday due to ADP's count showing an addition of 235,000 new jobs and then to soar 800 points in a sigh or relief over the government's (BLS/BS) report of 223,000 new jobs (along with those declining wage gains). Even though both of those were more than the expected 200,000 jobs, the wage relief was a also relief for the stock market compared to the day before (for those who are counting on a softening labor market causing the Fed to back away from tightening).

Here is another reason the Establishment Survey with its much higher job count makes no sense to me:

[Average growth of 300,000 jobs per month this year] has come even with an economy that saw negative [GDP] growth in the first two quarters — a widely accepted definition of a recession — and aggressive tightening from the Fed. At their December meeting, central banker policymakers said they plan to continue raising rates and don’t anticipate any reductions at least through 2023, according to minutes released Wednesday.

An annual average of 300,000 jobs added per month is not consistent with half a year of negative GDP, so many people thought that meant GDP was wrong and we weren't in recession. Knowing, as we do now, that one of the two jobs reports is definitely dead wrong, I'm going to put my money on the accurate jobs report being the one that squares with GDP reports. That, of course, comes back to my claim that these jobs are a serious blind spot because people don't believe (including the Fed) that the economy is in recession because the jobs numbers don't square with a recession. Yet, we KNOW one of those sets of numbers to be way off, and now even the Fed reports that it knows it. How long it has realized that I don't know.

This means the Fed risks over-tightening if this month's upward spike in the more reliable Household Survey is an anomaly or government contrivance and if the Fed pays any attention to that rise because it happened in the report the Fed trusts the most. The spike in the preferred Household Survey (about 700,000 new jobs) was more than triple the new jobs number everyone focused on from the Establishment Survey (223,000 new jobs). If it's not an anomaly, we have a worse problem of figuring out why new jobs started soaring in the more accurate survey this late in the Fed's tightening regime. It's either a fluke or government contrivance in the Fed's preferred numbers, which we better hope the Fed ignores, or it means the Fed's plan is failing.

ADP also showed on Thursday that wages increased more than expected (up 7.3% YoY), versus the lower number the government reported (4.6%, which is to the government's favor if it is trying to show inflation will be slowing) on Friday. ADP uses actual payrolls.

Layoffs in a time of labor shortages? What gives?

It seems ironic that companies claiming they cannot get enough workers in a climate that shows 1.7 more jobs open than there are unemployed people to fill them would now have layoffs. Why not just cut the open jobs or move people laterally into them from the jobs you do want to cut?

In fact, that is what is happening, rather than layoffs, and its referred to by some as "quite hiring," which is the present trend in human resource management:

A new year is here, and with it, a new workplace phenomenon that bosses and employees should prepare for: quiet hiring.

Quiet hiring is when an organization acquires new skills without actually hiring new full-time employees.... Sometimes, it means hiring short-term contractors. Other times, it means encouraging current employees to temporarily move into new roles within the organization....

“In a lot of cases, organizations are not necessarily doing a hiring freeze, or layoffs, but maybe slowing down a little bit on their hiring.... The talent shortage that we talked about throughout 2022 hasn’t gone away.... So, you’re in a situation where it’s harder to get head count, and you have a desperate need for talent...."

The idea is to prioritize the most crucial business functions at a given time, which could mean temporarily mixing up the roles of current employees.

This is another area of lazy financial-media reporting that one has to dig down into in order to understand what is really happening. Many of the big-sounding layoffs are being reported in the industry leaders of the last decade -- tech companies.

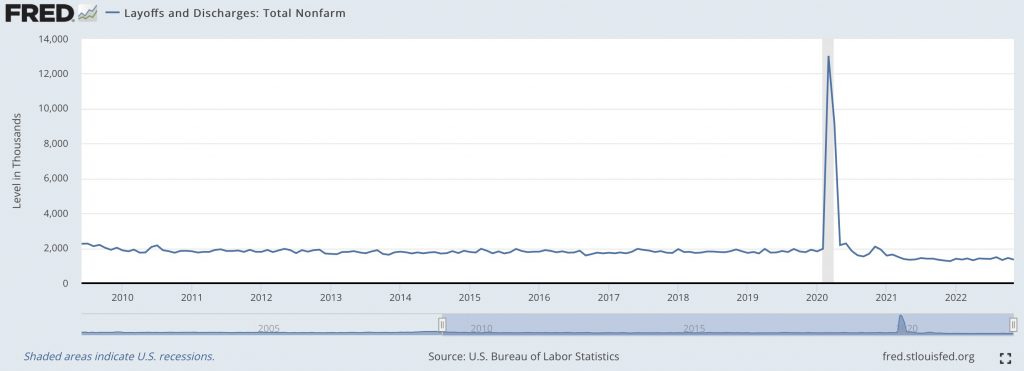

The technology industry led job cuts in 2022, totaling more than 97,000 announced across the sector, according to a report released Thursday from outplacement services firm Challenger, Gray & Christmas. That’s up 649% from the nearly 13,000 tech jobs that were cut in 2021, the report said. Overall last year, employers across industries announced plans to cut nearly 364,000 jobs, according to the report.

649% sounds huge until you realize 2021 was a massive hiring year, not a layoff year and that, in every year -- even ones resplendent with aggressive hiring -- there are some layoffs. Because media reporting is misleading in that it fails to sift out what is really happening here, we have to dig deeper below the surface numbers being reported. In this case, CNBC does a little better than most because, though the numbers sound bad, they go on to say,

Still, the figure represents a relatively low number of job cuts in a year. Challenger said it’s the second-lowest recorded total job cut announcements since it began tracking them in 1993, with the lowest occurring in 2021.

Oh, so actually a 649% rise compared to 2019 is nearly a record low! CNBC got that much in there, but many did not. Usually, you only hear about all the layoffs. However, even in this article, CNBC immediately goes on to talk about all the layoffs as if they are a big deal, having just said they are about the lowest in history!

You see, instead of laying people off, companies are doing, as I said a few months ago they would, and moving employees laterally. Tech jobs, however, are highly specific skills that don't move well laterally. These companies went on hiring binges during the early Covid years as everyone started using more tech to work from home and to entertain themselves when they couldn't go out due to lockdowns. In short, mismatches in skills to jobs or in expectations of tech workers, regarding the kinds of compensation and working conditions they expect, may mean people are not so willing to transition to other positions and so wind up laid off.

There’s some inherent tension here: If you’re temporarily reassigned to a different part of your company, you might interpret that as being told that your regular job isn’t particularly important....

No one wants to get thrown into an entirely new role if they already like their job. Nobody wants to work for a crumbling business, either....

Also, many of the announced layoffs will take a few months to play out. As layoffs are a fairly recent phenomenon in this tight labor market, many of them have not even started to show up in actual jobs numbers yet. Many are also by global companies, so many of the jobs are in other nations. As Wolf Richter points out, there are huge discrepancies between what the media reports companies are doing versus what the companies have said they are going to do because the media, as usual, is too lazy to parse the numbers to see when the layoffs are scheduled to actually happen and where the layoffs will be happening v. where the company is headquartered.

Wolf reports one company that tracks these stats as announcing that all of Salesforce's 8,000 layoffs will be in San Francisco where the company is headquartered, even though Salesforce's news release stated clearly most of them will be happening globally and won't be done until the end of 2024. I am constantly trying to wade through this kind of sloppiness in financial media, which is why I am having to do this article.

The financial media keep citing these figures as if they were actual US layoffs, including the Wall Street Journal today, when it said, in the past tense, as if it were an accomplished fact: “Collectively, tech employers cut more than 150,000 jobs in 2022, based on estimates from Layoffs.fyi…†No, no, no, they “announced†x number of layoffs of their global workforce, not their US workforce. And no one knows what their actual layoffs in the US were.

So, when the big news hit Thursday that Amazon.com Inc. is laying off more than 18,000 employees, you have to adjust perspective and recognize that they've hired 800,000 over the last two years. That's hired in the last two years, not employed. So, that number is a minor adjustment by comparison, and it is a global number, not all in the US, and Amazon has about 1.5-million global employees all told. So, this is about a 1% shave after two years of massive hiring. Amazon simply over-hired a bit during the tumultuous Covid years and is fine-tuning as people's purchasing, perhaps, moves a little less online now that they are out and about more. And, again, that 18k is a global number. Yet, Amazon is being billed as "the biggest cut yet for tech companies." Put in perspective, it's miniscule.

Sure, there will be a deeper downturn that companies are starting to prepare for; but, given our severe labor shortage, even the biggest corporations are doing a delicate paring job. That means, if Powell is going to win his inflation fight by cutting jobs, as he says is his plan, he's got a lot of economic wreckage to create in order to reduce all those 1.5 million open jobs back to where companies actually start laying off people, rather than shifting them laterally.

So, we get confusing headlines like these:

We're actually adding jobs, not taking them off the table. It can be explained this way: Hiring has cooled because there is essentially no one to hire, so employees are being shifted laterally into new positions that open up.

Let's clear up the perspective on all those layoff articles even more. Even good times experience lots of layoffs. Companies, for example, laid off about 20% fewer people this November than they did in November 2019; yet 2019 was seen as a really solid year for employment. Want to see how layoffs in 2022 through November stack up to previous years?

Lower than ever! They are not rising at all because companies are keeping a grip on their employees because new ones remain scarce, which you may recall is the scenario I laid out awhile back as to how this was likely to play out, making the Fed's plan a obviously difficult one to accomplish since it requires layoffs.

That's what you would expect when companies can't get enough employees because employees are not to be had. Perhaps because they are sick or dead. It looks like the Fed may have a lot more work to do if it's going to crush inflation by crushing jobs and laying people off so they can't spend as much. It is a misguided plan because the Fed does not grasp the causes of the labor shortage.

Now, here's the rub

While there are signs of progress in the wage downturn, that depends on whose numbers you are looking at -- the government's probably cooked books or ADP. And, while the Fed has been on a wage rampage with its tightening, many of the employment numbers above, such the jobs reports, are still strong numbers (even in the lowest report). Likewise with unemployment, which just got even stronger (as in lower unemployment) or layoffs, where literally nothing has been happening compared to previous years.

So, it may have been just a little ridiculous for the market to get so excited about the one number this last week that looked like progress, given all the others. But we don't care what the market thinks in our little group. At least, I don't because I got out of it in time, and I hope my readers were able to do so, too. (You can tip me 10% of the money you saved if these reports were instrumental, and you'll still be a lot of money ahead. Heck, I'd be happy with 1% ; )

The big risk here is that the Fed is likely to keep tightening far too long based on the numbers it claims to respect the most. By that, I mean, by the time they get the job market to collapse into enough layoffs to bring wages down as a path to driving inflation down, they'll crush the economy because of what the Fed isn't seeing:

There are far too few laborers, probably in fair part due to longterm illness, which is why the numbers aren't moving as the Fed intended. The Fed particularly hoped tougher financial times would move people back to participating in the labor force in order to create more labor supply. This tightness isn't happening due to too many jobs and a hot economy, so crushing jobs down is the wrong medicine. The number of jobs remaining open is high because people aren't taking them, possibly because they are not able. In the same way, the likely reason unemployment isn't rising at all is because those who quit cannot work, so they don't qualify for unemployment.

That means production is down just as GDP revealed in the first half of the year. Forcing the economy down harder and harder in an attempt to square all those numbers when there is already such a major shortage of laborers, is going to take a lot of job destruction to close the gap. So, if the Fed does crush jobs enough to create lower employment, that will mean even lower production, which likely means more shortages.

And what is the formula for high inflation? Too much money chasing too few goods. So, the Fed COULD even see inflation eventually start to rise in a backlash effect due to the shortages it will be exacerbating down the road when the economy starts showing obvious breakage in the form of businesses closing down on Main Street for good.

That will depend on what the Fed succeeds best at -- reducing its bloated money supply or reducing productive jobs that were already greatly diminished by Covid and Covid lockdowns (as shown in the graphs above) back when the Fed was pumping money till the cows come home. And, with numbers as wonky as some of those above, who can be sure the Fed will even see the right place to take its foot off the brake? That crash might be extremely messy and hard to climb back out of, given the Fed doesn't seem to be doing a good job with the complex predicament it has already gotten itself into.

Yet, the stock market remains delirious over a single number. Even so, in 2022, the overall stock market already put in its fourth-worst annual performance since the end of WWII in 1945 because reality kept ignoring what the market wanted to believe and what the Fed wanted to achieve. It fell that hard, and we haven't even seen any real breakage on Main Street yet -- massive layoffs from major business shutdowns. We've seen financial breakage in crypto, stocks, and bonds, but no significant layoffs in the Main-Street economy. No rise in unemployment. Just the opposite in fact. So, what is the market going to do if these bizarre and conflicting numbers and this seemingly immovable labor shortage don't square up the way Fed wants and the Fed crushes production down to where the economy cracks wide open?

While hiring may be cooling ...

... remember it takes net job losses, not smaller net gains, to curb inflation via the job market. We are still FAR from net job losses.

Moreover, if you go by ADP's numbers, there actually was a surge upward in hiring:

And that is in spite of the fact that ADP reports have, until this month's peculiar government new-jobs report, been well below the Bureau of Lying Statistics all year:

But the total fail of the Fed's plan to reduce jobs and raise unemployment is not stopping the biggest of bosses from using the past week's jobs data to declare victory:

"Today’s report is great news for our economy and more evidence that my economic plan is working. The unemployment rate is the lowest in 50 years," Biden said

Umm ... I thought the "plan" was to get unemployment to rise in order to curb inflation. Did I miss the memo?

It seems even the president is confused as to whether the past week's job news was good or bad because he's been telling us his big goal is to battle inflation, not to lower unemployment to levels the Fed would consider all-out-stimulus achievements.

"We have just finished the two strongest years of job growth in history. And we are seeing a transition to steady and stable growth that I have been talking about for months. We still have work to do to bring down inflation, and help American families feeling the cost-of-living squeeze," [Biden] said. "But we are moving in the right direction."

I'd call that a brain squeeze.

The Daily Mail article goes on to note,

Interest-rate sensitive industries like housing and finance, and technology companies, including Twitter, Amazon and Meta, the parent of Facebook, have slashed jobs.

Well, not really. As I just laid out.

However, airlines, hotels, restaurants and bars are desperate for workers as the leisure and hospitality industry continues to recover from the COVID-19 pandemic.

Yes, really.

Plan Fed is a disaster in the making because it's going to crack up the entire economy by the time the Fed gets job numbers to move where it think its wants them. In the meantime, you're going to keep seeing a lot of tangled and confused reporting about the labor market because no one in financial media understands what is happening here. Even the Fed and feds cannot get their heads out of the knot that believes a tight labor market must be due to too many jobs to fill, which would mean the economy is strong. It does not occur to them that these times are different than anything they've ever seen: Usually the labor shortage is because a great number of jobs is exceeding available labor due to a hot economy. However, this labor shortage is due to unfortunate shrinkage in labor supply.

'These historic jobs and unemployment gains are giving workers more power and American families more breathing room,' Biden said. 'Real wages are up in recent months, gas prices are down, and we are seeing welcome signs that inflation is coming down as well. It’s a good time to be a worker in America.'

You can't have it both ways, NoMoJo. Inflation is coming down because the economy is slowly getting crushed as money supply is being withdrawn and credit costs raised, but unemployment is lower than ever because there are too few workers for the limited number of jobs in a struggling economy. That's due in large part to illness and death, while wages are rising because there are too few healthy workers to do the work. So, if the Fed continues using job numbers, and especially an actual upturn in unemployment, as the gauges for when to stop tightening, we're in for a world of hurt as we crush out production.

As I've argued for years, the Fed has painted itself into an impossible corner with no viable exit plan. And if the stock market wants to get giddy about that, as it did on Friday, well, giddy up!

Or giddy down:

How many years do you suppose the Fed and financial media will spend arguing about what went wrong when the Fed crushed jobs in a sub-par economy that was already underproducing, in good part, due to lack of workers, especially if the resulting increase in production shortages forces inflation back back up? Do you think they will ever understand what they have done to us?