Cryptocurrencies, stocks and the dollar crash as gold and silver soar

As “The Deeper Dive” this past weekend looked at the signs building for a stock market crash and economic collapse into an especially deep recession, more headlines came in on Friday and over the weekend to lay out further signs of recession, now that the government warning lights have been shut down.

It all timed out with the biggest one-day dump on the stock market since the start of tariff troubles last spring and an equally huge dump in the crypto world (pound for pound) that showed just how much fragility there really is in each of those markets.

Bitcoin has suddenly fallen sharply, with a “flash crash” wiping $12,000 from the bitcoin price in a matter of minutes after a “cascade” warning.

The bitcoin price dropped to under $107,000, down from a high of $123,000 yesterday and a bitcoin price all-time high of $126,000 earlier this week….

“A flash crash of liquidations saw almost $7 billion wiped across all markets within one hour, with $5.5 billion coming from longs,” Sean Dawson, head of research at leading onchain options platform Derive.xyz, wrote in emailed comments….

“The extreme volatility in the price of bitcoin overnight highlights why institutional investors increasingly view access to 24/7 liquidity as essential to prudent risk management,” Tommy Doyle, global head of relationship management at Xapo Bank, said in emailed comments.

After Trump’s latest China tariff $100 sneeze, which he partially (and almost predictably) wound back a day later in what seemed like another TACO trade opportunity, crypto melted like a butterscotch chip in a frying pan. That situation seems to have stabilized some since, but where you can see signs of the more chronic troubles in stocks and also bonds is in the metals market, which is the replacement trade for faltering markets.

One major silver miner is saying they have never seen anything like the present.

There is something happening today that is totally different…. What you’re starting to see, whether it’s in the Middle East or Eastern Europe or even further East, you’re starting to see central banks get into silver. So you’ve got gold leading the move, and you’ve got central bank buying.

The demand is so great the market is drying up due to supply shortages. A few headlines today discuss different places where the desertification of the metals market is happening. Hal Turner points out that Australia’s Perth Mint has halted all silver purchase. There is also “not even a sliver of silver available to buy in India.” In fact, thanks to Amazon’s continuing sales beyond availability, India silver sellers are accused of having “defaulted” on silver sales. Silver is also running out of stock in the UK. It’s reminiscent of the rush for silver and gold that took place during the Covid lockdowns.

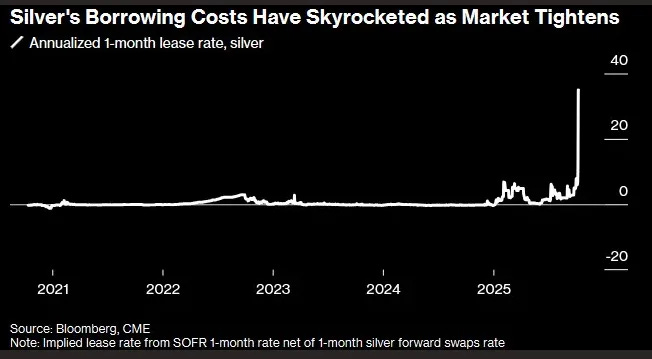

[Silver] Lease rates in London have exploded to 39%, a full-blown panic signal…. If banks can’t find the metal, they’ll be forced to buy back futures or deliver actual silver - both actions that could ignite a violent price surge.

London’s crisis is said to be mostly on paper. India’s shortage is physical; but there is not really much daylight between the two. Says, Zero Hedge,

The London silver market is in rare disarray. A powerful short squeeze has driven benchmark prices above $50 an ounce, marking only the second time in history the metal has reached that level. For veterans, the surge recalls the infamous Hunt brothers’ attempt to corner silver in 1980….

According to Bloomberg, liquidity in London has nearly vanished. Traders short the physical market are struggling to find metal, paying steep borrowing costs to maintain positions. “There is no liquidity available currently,” said Anant Jatia, Chief Investment Officer at Greenland Investment Management. “What we are seeing in silver is entirely unprecedented.”

What’s the underlying cause?

The immediate catalyst is a surge in investment demand for gold and silver as Western debt concerns and currency fears intensify. The tension has been amplified by a U.S. budget impasse and fears of devaluation. Yet silver’s shortage is also structural. Indian demand spiked abruptly during Golden Week, coinciding with dwindling inventories in London and concern over potential U.S. tariffs on the metal.

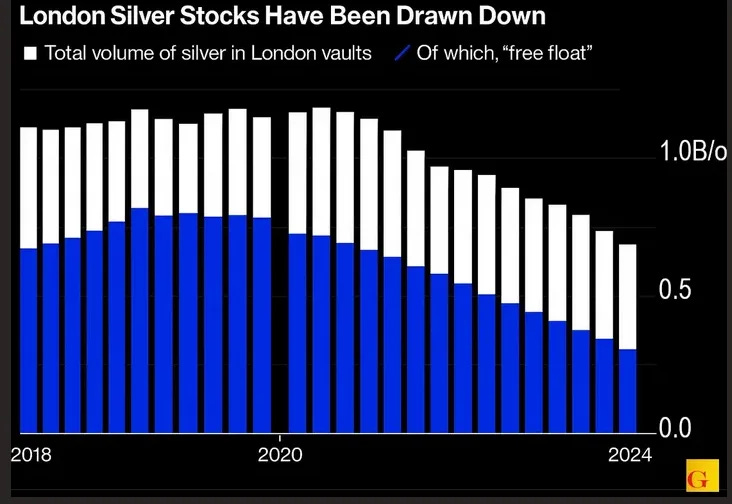

In London, the situational crisis has been slowly evolving:

The market tightened, then demand hit, and this is what happened to the price of silver borrowed to temporarily meet order demand:

India has emerged as an unexpected force in this episode. Shifting from Hong Kong to London sourcing, Indian buyers have drawn heavily on the already-tight market. TD Securities’ Daniel Ghali noted that even Indian exchange-traded funds have suspended new inflows due to a lack of available metal….

Prices in London’s daily silver auction have now broken records. Spot premiums have widened to as much as $3 over New York futures, while overnight borrowing costs have climbed beyond 100% annualized—levels possibly exceeding those of 1980.

Much of that is paper trade, but here is where there is not much daylight between paper trade and physical

Relief must come from increased physical supply: either from ETF liquidations or shipments from abroad. Some traders are already moving silver by air, a costly but necessary step to rebalance a market where paper prices have once again collided with the limits of physical reality.

Bill Bonner explains the more hideous mechanism behind this, which I said would become hugely problematic this year due to tariffs—death of the dollar:

It looks like the administration is doing everything it can — including whimsical tariff threats — to make the value of the US dollar and US bonds go down….

Fortune elaborates:

“Trump to hike China tariffs to 130% and impose software export controls next month, as trade war reignites to nearly ‘Liberation Day’ levels”

The announcement on Friday led to $2 trillion in losses for investors. But not to worry. Dow futures are up this morning. Why? POTUS says “everything will be fine with China.”

“Don’t worry about China, it will all be fine!” quoth the president. “Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!”

There’s the “D” word, not just the “R” word.

Any resemblance between this and serious economic management is purely coincidental. China and the US are the two largest ‘traders’ in the world. The former exports. The latter imports. Any interference will be bad news for just about everyone.

But the markets (at least this morning) seem to think the latest Trump move is just theater or a passing tantrum. Many mention the ‘TACO’ trade (Trump Always Chickens Out) as a way to understand and profit from the latest outburst….

Meanwhile …

“The US dollar has fallen more in 2025 than any time in the last 50 years,” he said. “The amount of US debt has soared...and is now at $37.5 trillion. And while the debt was going up, so was the interest rate that the feds had to pay on it. At an average of 3.75%, it’s twice what it was just five years ago.”

“This is the real problem for the US,” he says.

It’s a one-two punch of tariffs and escalating debt piled on top of recently escalating interest rates.

But the major reason the dollar is going down, says Jeff, is that the Trump team wants it to go down. They believe a lower dollar would make US manufacturing more competitive and lower the real value of US debt.

There is that. Their key dollar guy—now installed at the Fed—has made that argument in his Mar-a-Lago Accords; but I think they also want the dollar to go down in hopes that the Trump family foray into cryptoworld will pay off more bigly if $Trump and Melaniacoin, or whatever they call it, come in as replacements now that Trump is also creating a debit card that’ll work with the new Trump coin of the realm.

As tariffs and debt profligacy nibble away at the dollar, it didn’t help crypto this time around. Instead, it turned perilous, just as the times are perilously perched for a Great-Depression-sized crash in other headlines that are provided as supplemental to all of those covered in “THE DEEPER DIVE: 1929 Stock Market Crash on the Horizon Again.”

A lot is adding up, and it is all adding up in the same direction. More than a trillion dollars in paper wealth was wiped out on Friday in market value. Some of that came back today, but the fragility in stocks and bonds is made evident, though it is even more evident by the strength of their investment replacements—gold and silver as safe havens.

Was this just an isolated incident, or is this the beginning of the Big Crash? The carnage that we witnessed on Friday was absolutely breathtaking. The largest single day wipeout in the history of the cryptocurrency industry was accompanied by a tech bloodbath of epic proportions. Many investors that were very highly leveraged got absolutely monkey-hammered. In particular, wave after wave of forced liquidations caused a cascading cryptocurrency crash that was unlike anything that we have ever seen before. Approximately 19.2 billion dollars in leveraged positions were suddenly liquidated, and as a result the collective value of all cryptocurrencies fell by almost 800 billion dollars in just 24 hours….

Don’t trust any one thing to be safe when it looks like we’re entering the breakup of the Everything Bubble. John Rubino, for examples, points out in the headlines that follow the mechanism by which the AI stock bubble may even have been fake during the last few months. Interesting. Meanwhile there is more than enough evidence outside of the government bean counters, which are now closed, to say the US is skidding into a recession. One article below that points out some sizable evidence of recession, yet says there is no recession in sight. That is unfortunately typical of the knucklehead financial writers in the mainstream press who have spent their lives parroting government statistics and talking up markets.

Sure those statistics have now been shut down (likely for good reason, as far as Trump is concerned, since he wouldn’t want to hear what they would have to say); but things are turning fast, AND those stats were never, as Trump claimed, too pessimistic just to make him look bad. I showed over and over before he even came into office how they were routinely too optimistic just to make the encumbent boss, whoever he was, look good. That’s called job security. It doesn’t matter who the president is. They’re leaning into hopes of good numbers.

Remember that it is nearly always the mainstream view that there is no recession in site or, at least, that the recession is a year or more away, even when it turns out we are already walking through one in hip-waders. So, just look at the signs they give and ask yourself how badly the general economy if falling for those early signs to have fallen that far.

I can see why Trump is glad to keep the government closed and to fire a lot of people. Dead offices tell no tales.

Economania (national & global economic collapse plus market news)

The first highlighted articles here were covered in the weekend Deeper Dive along with many supporting events foreshadowing a 1929-style bust in the making:

The Big Crash: Are we really heading for another 1929?

MarketWatch: This is the dumbest stock market in history

And here are the newer headlines on today’s matching theme:

John Rubino: Is the AI Stock Bubble Partially Fake?

Recession warning signs to watch: Goodbye lipstick, hello Hamburger Helper

Two industries were supposed to drive America’s future. One is booming, the other slumping.

Money Matters (monetary policy, metals, cryptos, currency wars & going cashless)

Markets braced for chaos after Trump triggers record-breaking crypto crash

Australia Mint HALTS all Silver Sales, While In India, “No Silver Available to Buy”

London Silver Squeezed: US Bars Sent to Cover Physical Shortfall

Bill Bonner: Why Gold is Going Up

Wars & Rumors of War (including cyberwar, civil unrest and revolts)

Trump Unveils “20-Point Gaza Plan” and Announces New ‘Board of Peace’ to Oversee Gaza Transition

Jared Kushner reenters as key player in Middle East peace push

‘Let me finish my thought!’ Trump’s envoy shouted down by Israelis after hailing Netanyahu

Trump Urges Pardon For Netanyahu At Knesset: “Cigars & Champagne, Who The Hell Cares?”

New Gaza Turmoil Begins as Muslim Militias Vie for Power

Jubilation in Israel as hostages returned to families who fought for deal

—

As Russian Aggression Turns West, Poland Says It’s Ready

Kremlin warns the West over ‘dramatic’ escalation moment in Ukraine war

Trump says he might send Tomahawk missiles to Ukraine

Donald Trump deliberates sending Tomahawk missiles to Ukraine as NATO braces for WW3

Ukraine hit Russian energy sites with US help

—

How China could use U.S. farmland to attack America

—

Bannon Slams Pentagon Pete’s ‘Screwed Up’ Military Plan

Pentagon Pete Fires ‘Fat’ Soldiers as War on Weight Rages

—

Laura Loomer Reaches Her Final Straw With Trump: ‘I Don’t Think I’ll Be Voting in 2026.’

—

US strikes another boat off coast of Venezuela

Digital Dominance (AI threats, transhumanism, hacks & cyberattacks, etc.)

AI’s Worst Case A “National Economic Crisis”

The More Scientists Work With AI, the Less They Trust It

Trump Trade Wars & Turf Wars

China’s rare earth gambit reveals the next phase of its economic warfare

‘China isn’t afraid’: Beijing citizens shrug off tariff threat

China says it will ‘fight to end’ in trade war

Does Beijing have upper hand in trade war?

TACO King Returns: Dollar cuts losses, after Trump tones down tough talk on trade

Political Pandemonium & Social Senescence (socio-political issues & events)

Firings of federal workers begin as White House seeks to pressure Democrats in government shutdown

You Heard It Here First: DOGE Didn’t Cut Much

Will U.S. Troops Fire on Civilians on Trump’s Orders?

Prosecutors push toward charging other Trump foes after Letitia James

Peace in Trump’s Time — Except Here

Originalist ‘Bombshell’ Complicates Case on Trump’s Power to Fire Officials

Marjorie Taylor Greene, Welcome to the Resistance

Trump Says ‘I Don’t Think There’s Anything That’s Gonna Get Me In Heaven.

Airports refuse to air Noem video blaming Dems for shutdown

Trump Melts Down at Unflattering Photo of His Hair in Late-Night Rant

A Pox Upon Us (the plagues, pandemics & health police of the 2020s)

He proved unvaccinated kids were healthier. They revoked his license.

Heart Disease Surging Among Covid-Vaccinated Children

What’s Poisoning Dolphin Brains Near Miami Could Be An Alzheimer’s Warning for Humans

Off-the-Beat News & Just Plain Offbeat News

Interstellar Object Is Spraying Something Weird, Scientists Find

What Happens After Near-Death Experiences: Study Reveals A Dark Aftermath From Seeing The Light

Swarm reveals growing weak spot in Earth’s magnetic field

Doomer Humor