Deeper in Debt

The US government just can't go deep enough these days; neither can US corporations.

My latest “Deeper Dive” laid out the serious moves into a US sovereign debt crisis that are developing as a result of the devastating Fed-caused worst-in-history crash in the Treasury bond market that is overseen by Yammering Yellen. (See: “Look Out! The Retard Speaks.”) That article came out yesterday, and today’s news says we just threw another half a trillion to the gaping maw of that debt monster in a mere twenty days. Not bad for less than a moth’s work. Keep it up, and pretty soon we’ll be talking real money.

While the Federal Reserve is taking major steps to drain the US money pool in order to tighten down on the economy to squash inflation, Bidenomics is pumping in the stimulus and issuing wads of new Treasuries to cover the cost … because that makes sense when jobs all over the nation have been going unfilled for over two years as it is. One would think the left hand doesn’t know what the right hand is doing. The cost of all of that to you is what I laid out in that “Deeper Dive” as well the roads twists and turns to certain failure.

To put the size of this ballooning debt in perspective, to pay it all off with all the money made by everyone and every business in the US in a year, we’d have to increase our gross production of goods and services (GDP) by a third.

At $33 trillion, the US national debt is more than the total economies of China, Japan, Germany, and the UK combined.

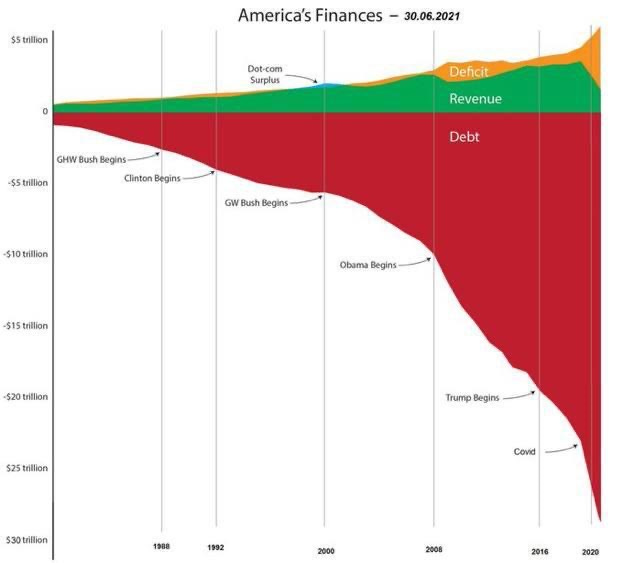

Here is a look at what is happening to the widening yearly deficit as government revenue declines and the overall debt dug out beneath us all increases:

That gives you a hint, but that chart doesn’t even cover the last three years, which have been horrendous in terms of debt spending.

One would think a strong economy would be generating more revenue for the government, not less, but Gross Domestic Income, contrary to GDP, indicates the economy is declining in terms of the amount of money it makes.

As I laid out in my “Deeper Dive,” the problem is not just restricted to government spendaholics; the same thing is being seen in corporations all over America where, even though their cost of corporate credit has just about tripled, they are still taking out massive amounts of debt to spend on buybacks just as they have for years.

CEOs will apparently willingly spend their companies broke with debt they cannot pay in order to bolster their stocks (which was for decades illegal until it was deregulated). The evidence of that can be seen in another story today about the onslaught of corporate bankruptcies.

459 US firms have filed for bankruptcy this year - the most since 2020 - and 16 had more than $1 billion in assets….

Economists warn the rise in large-scale collapses can have devastating consequences on the economy…. The rise in bankruptcies coupled with a weakening stock market and surge in credit card delinquencies has sparked fears the US is heading for a recession.