Economists Just Don't Get The Great Recession

The Business Editor of The Daily Telegraph must be dining on the food of the gods to be so high about recovery from the Great Recession, but he's also eating with his feet and making quite a mess in his analysis, which speaks against any evolutionary development in his thirty years.

According to The Telegraph, “Ambrose Evans-Pritchard has covered world politics and economics for 30 years.â€Â In that case, he should know better than to present the following graph and make the claims he does:

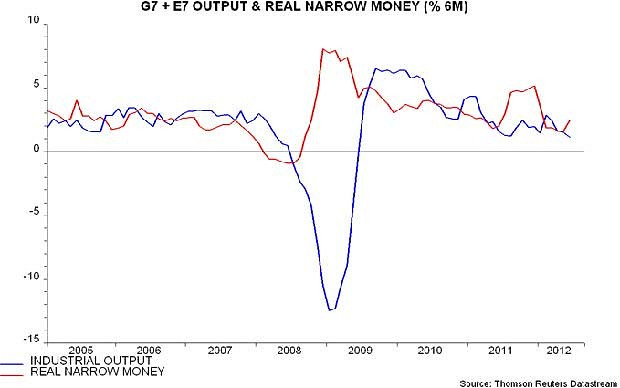

This Chart by Thompson-Reuters Datastream shows the supply of money expanding and contracting during the Great Recession

... and then proclaims...

The first green shoots have begun to emerge in money supply data from across the world, raising hopes of a tentative global recovery by later this year. (The Telegraph)

Recovery? Really? Rather than raising tentative hopes, I think the graph above hangs my hopes out to dry on tenterhooks.

A graphic Great Recession

Let's parse the graph Ambrose is talking about with a little more reality and less ebullient optimism.

First, the deep plunge in the blue line reveals how much global industrial output fell during the first year of the Great Recession.

Shortly after the plunge begins, money supply (red line) is expanded through the bailout programs started by George Bush and continued by Barrack Obama. (The big rise.)

The inrush of new money resulted in an enormous increase in industrial output -- though who could see it in reality as jobs continued to decline rapidly during that period. Nevertheless, the graph shows industrial output going up.

Ambrose's point from the graph is that six months after every great increase in money supply, industrial output goes up. What I see in the graph, however, is that those results proved unsustainable every time. From that point on, the Great Recession kept hammering away. As the influx of  new money dried up, industrial output dried up. Notice the long decline is made up of many upward bumps in both lines, followed by equal dips in both lines. After the first so-called "recovery" in the middle of 2009 (where the blue line crosses back above the zero mark), every low is lower than the low before. In other words, at the end of each subsequent burst of new money, we were worse off than before.

In 2011, I wrote in my "Letters to Stan" that the end of Q.E.II, which was artificially propping up the Great Recession so that it appeared it had ended in 2009, would result in the economy falling off a cliff again in August. You can see in the graph that the economy (best represented by the blue line) dropped again in August after rising from a large influx of new money. Money supply remained in decline until the last couple of months, and Industrial output is still in decline.

The graph looks like nothing but a long bumpy, downhill recession to me where each attempt to boost industrial growth with new cash quickly founders and sinks to a lower bottom.

Where is our recovery from the Great Recession?

Ambrose Evans-Pritchard heralds the little upturn at the end of the money supply line in his graph as a sign that the green shoots of recovery from the recession are finally here!

Again, really?

Look at how many other upturns of the same size happened in money supply along the long downfall of the red line that marks the Great Recession in his graph. Each one was followed by another drop off, and the average trend of both lines has been downward from the beginning of the Great Recession to the present. So, who cares if industrial output rises a few months after the present quantitative easing that is happening in other parts of the world? It isn't going to last. The graph proves that.

Abrose also bizarrely claims,

The combined growth rate for the G7 economies and E7 emerging powers levelled out at 1.6pc in May and rebounded at 2.5pc in June, though China and India are still contracting.

You couldn't prove that from the chart he presents. Global industrial output is still falling on the chart ... and in the news.

They give some comfort that the latest growth scare will stop short of outright slump.

Looks to me like its still slumping, and the upward tick in global money supply has done nothing at all to arrest the slump in global industrial output. It is as if Ambrose is trying to whip up some ambrosia out of swamp mud.

Money supply has ticked upward at the end of his graph, but the only thing that proves is that the economy is in bad shape. Money supply in each case shown on the graph rises because the central banks of industrial nations have been "expanding their balance sheets," a phrase the generally means "creating money out of thin air." They only do that when they see the economy is falling into a deep pit. The latest short burst in money supply, however, has done nothing to change industrial output. And that is what the graph tells us we should expect: Each burst in money supply has resulted in a smaller increase in industrial growth than the burst before. That says to me that the ability of quantitative easing and other government measures to help lift us out of The Great Recession may be nearly dead at this point. It is a case of diminishing returns -- a case of the drug addict needing a bigger hit each time to get a smaller high.

Of course the rise in industrial output at other points on the graph shows a lag of about six months behind the expansion of money supply. So, it could be that growth in industrial output is about to come, but the expansion of money supply 1) never guarantees that industrial output will respond just because it has in the past, and 2) that monetary expansion is only happening because the economy is going down and is being pumped up along its inevitable decline by central banks. Clearly the graph shows the last upward burst in money supply led to only a small blip on the patient's heart monitor compared to the first enormous burst. Everyone knows QE3 will have even less effect. As the patient's tired heart gets worse and worse, a shot of adrenalin accomplishes less and less. Moreover, the recent inflation in the amount of money at the end of the graph is a much smaller dose than either of the previous increases, so it should garner a smaller response still in industrial output. The graph says to expect very little.

The fact that the graph for money supply and industrial output averages out to an obvious downward slope from the start of the Great Recession says everything you need to know about the ability of quantitative easing or any other kind of increase in money supply to create a sustained recovery with the present patient. In fact, it illustrates what I've been saying throughout The Great Recession Blog: The Great Recession did not end in the summer of 2009 as economists have been saying all along. It has merely been pumped up by mainlining money in huge doses. The patient is dead.

To put the graph in perspective as to what it says about the economy, imagine posting that exact graph on the end of a patient's bed. Do you think his family is going to see any good news in those vital signs where it takes endless hits of drugs to keep him less and less alive?

I think Ambrose has been hitting the happy juice.

The reality behind talk of "recovery" in the Great Recession

What Ambrose's graph really shows is that GDP was propped up with an enormous flood of new money at the beginning of the recession, but retreated back toward recession. It has been pumped up again and again, but stubbornly falls right back off afterward. It proves that Q.E. is only temporary in its benefits. That's because hits of adrenaline do not right any of the fundamental problems that are killing the patient. If I were this man's family, I would be fighting with the doctor right now who keeps prescribing hits of adrenaline as the sole solution to the patient's problems.

Nothing has been done to surgically rebuild the economy's misconstructed foundation. Governments around the world are still trying to entice consumers into more deficit spending in an attempt to restore the moribund debt-based economy. The governments, themselves, are more stuck in deficit spending than ever before. All of the new money  was injected into the worst of banks, not the best of banks, in order to bail them out. That fiat money could have been created in new accounts designated for the depositors in the old broken banks so that the depositors could be saved inside of healthy banks while those broken banks were allowed to fail. Since the new money didn't create inflation when it was deposited out of nowhere into the Federal Reserve bank accounts of the big banks, why would it have created inflation if, instead, it was deposited in personal bank accounts of insured depositors at good banks while the bad banks were left to fail?

Moreover, the governments of both George Bush and Barrack Obama have chosen to solve the problem of banks that were too big to fail by forcing them to merge with other massive banks that were failing in order to get emergency bailout money. Thus, the government created larger monsters that to this day look like they could topple on all of us and crush us all. Just last week, one of the greatest advocates of bank mergers, Sanford Weill, switched sides to join the small chorus that says these big banks must be broken up. Conglomeration has gone as far as it can. The game is over.

Moreover, governments have taken out enormous additional debt to bail out banks, which gives the future generation that must pay that debt nothing for their money. How can anyone think this mountain of unrepayable debt will end as a sustainable recovery?

A different graphic look at the Great Recession, which I prefer for understanding where we're heading

The following graph compares the spring and summer of 2011 (red line) to the same period in 2012 (blue line). The lines begin in May when the positive economic signs of "recovery" in the spring began to fade away, leading to a summer of growing consumer anxiety and discontent. In 2011, that ended with a plunge in the stock market that was triggered, in large part, to the brinksmanship played out over the U.S. debt ceiling and the resulting firt-time credit rating downgrade for the U.S. government. It was due in greater part, of course, to the bad economic fundamentals that still underly the U.S. economy and to the crumbling situation in Europe at that time. Has any part of that equation changed in 2012?

I wouldn't want to be standing here. Would you? Yet, that is exactly where we stand ... again.

That is the graph I'd be paying attention to. The blue line for 2012 stops where we are in time today. What will happen at the end of August as a result of this year's brinkmanship over the "fiscal cliff" that has been in the news every week and that has seen no positive action taken by either Democrats or Republicans? Â What about the fact that we face the same situation with Greece that we faced in August of 2011, but now have Spain and Italy sitting more on the brink of a fall than they did back then? What about the fact that European leaders continue to act at a speed that indicates they believe the markets will buy zolpidem tartrate 5mg accord them whatever time they need? Thus, Europe's leaders have all left for their summer holidays!

Is the August plunge a cliff we want to go over again? Not only does this graph show an almost exact reflection of the stock market in 2011, but the exact same triggers are in play in the major economic headlines  this summer. Is not "insanity" expecting the same actions to lead to different results?

How deficit spending could have brought recovery from the Great Recession

If government had focused on putting all of its new debt to work building and repairing infrastructure, it would 1) be creating the structures necessary for an efficient and vibrant economy in the future, 2) be buying and creating assets today that the future generation will have to build anyway, but would be doing so at today's prices. That means the government would have been able to pass the debt along in manageable form because those purchases today would decrease the expenditures the next generation has to make.

The next generation would have to pay for those roads and repairs in their own time, but would be doing so in today's dollars, which would offset the interest they have to pay. Instead, they will inherit roads that are even more crumbled, so they'll get the mountain of debt from us along with worse roads and bridges than we have now, which they will still have to repair on their own. What a sad situation for them! Oh, and they will get a pile of hideously giant banks, riddled with corruption (as we are finally learning) that we saved for them! Won't they love us!

Economists like Paul Krugman talk about ending the Great Recession by spending our way out with more government debt, and they are right, but they are ignored. Sometimes, when you come to a deep mud hole, you have to decide whether to drive through slowly and cautiously -- lest you get in too deep and sink beyond salvation -- or to power through with the pedal to the metal and just hope you can create enough momentum to make it to the other side. We are in a situation where we need to power through and just hope that will be enough to get us to the other side.

HOWEVER, Krugman and others who hold this view need to be more focused if they're going to get their message across. Talk of greater deficit spending is far too vague, so it meets understandably with a lot of rejection, since we're sinking in debt already. We are in deep quagmire, but power spending must be sharply focused so that ALL of the new debt we are taking out goes to repairing and creating things for the future. That is the only way this enormous debt will be manageable. We have an honor-bound duty to give those who must pay for this recovery something tangible and necessary for their money and for their own economic well being  ... not just a bunch of bloated dinosaur banks run by fat banksters.

We have already missed that opportunity!

What an unforgivable and foolish legacy of self-saving self-interest we are passing along.

The only redeeming factor in our present debt scenario is that this debt is not going to push along very far. To use another analogy, we have plowed the deep snow (the cost of recovery efforts from a frozen economy) straight down the road, instead of off to the side, so it is rapidly becoming a larger pile than our economic snow plows can push. Most of us alive today will be that "future generation" that gets stuck with a mountain of debt it cannot begin to repay along with nothing but monstrous banks to show for it. We will suffer a long winter of discontent that we have merely pushed a few years into our future. Those who thought we could let someone else pay for all our problems will prove to be wrong ... unless they are already very old or die prematurely.

We began pushing the mountain of debt ahead a few years ago, so those few years of time we bought with enormous deficit spending are about to end. If you think the long push of 2010, 2011, and 2012 were difficult, wait to you see the disaster of 2013 when we can no longer push the mountain of snow forward. To jump back to the patient analogy, the next round of Q.E. from the Fed will be the hit of adrenaline that barely raises a blip on the patient's monitor. After that, it will be obvious to all that the patient has died.

How cronyism worsened the Great Recession

This Great Recession is what cronyism buys you. It is the end result of following a mantra that has been used to justify that cronyism -- the obviously false proclamation that the rich are "the job creators." (I say "obviously" false because the rich have been given their best tax breaks ever for twelve years now, and jobs have rarely ever been worse. On top of that, the rich have been given huge bailouts in the greatest transfer of wealth from public sector to private sector ever witnessed, and still they have created no jobs.)

On the basis that wealthy investors are the "job creators," we were sold the idea that we must put all money toward bailing out investment bankers so they can save us with investments that create jobs. Wasn't it obvious all along that we could create those jobs directly (i.e. with no investment from Rich people made richer) by laying new pavement and replacing worn-out sewer lines so that the fired bankers can find a job behind a shovel somewhere!

As for heavenly-minded Ambrose, who thinks that spring has sprung, just remember that it was these graph-toting, number-crunching economists that completely failed to see the Great Recession yawning wide open in front of them. They didn't see it coming because they spend so much time doodling over numeric bumps that they pay no creed any more to economic fundamentals.

More on the road to to recovery from the Great Recession

There will be no recovery from the Great Recession until economic fundamentals are restored. That means...

Money supply becomes rational, rather than reactionary, so that businesses and investors start investing on the wise basis of which businesses look sound again, rather than the silly basis of guessing when central banks will throw more free money into the air for investment banks to speculate with;

Computer-generated stock market speculation is ended;

Banks that were conglomerated like Frankenstein's monster from the parts of other dying monsters are broken down and parted out, themselves;

Sound regulations to prevent human greed from running amok are firmly back in place, while avoiding excessive red tape;

The crooks who created this mess are no longer awarded with bailouts, but find they need to raise bail money on their own because they're going to jail;

Corporations smarten up and start distributing pay checks more proportionately between workers and executives so there is a more balanced distribution of wealth and rewards in society, making for a healthier society (If CEOs were really worth so much, they wouldn't have bankrupted the entire world, and a dwindling middle class cannot buy the goods the rich would like to produce);

The government stops trying to base the economy on a foundation of housing, which was unsustainable in the first place because it assumes our towns and cities must sprawl forever to keep the economy healthy;

The government stops trying to encourage people to take out more debt and consume more in order to stimulate the economy by purchasing things they never really own (false wealth) and don't really need;

The government of the U.S. refinances as much of its current debt as it can on long-term bonds while the interest rate on those bonds is at a record low due to Europe's troubles because much higher interest is coming when Europe starts to recover  (which won't be anytime soon);

The U.S. government stops spending more money on the military than its populous can afford because it is spending itself broke on wars all over the world as surely as the former Soviet Union did (so we need to stop acting like we can still afford to be the world cop, stop acting as if we can right all wrongs at our expense or can reshape the world in our image); and

The government makes sure that every bit of new debt it takes out is for job-creating projects that give the next generation something tangible and enduring for their money so they can reduce their own costs because we've repaired everything and turned it over to them in good shape. They may be given a giant debt, but they will also be standing on the shoulders of giants.

The key to understanding why no recovery effort is working lies in realizing that the Great Recession was not just a boom that went bust like the dot-com boom. It was NOT an economic correction. It is the result of a deeply flawed economic model (a debt-driven economy) employed for the last thirty years that finally ran wild until it burst. It is a core failure! No efforts to pump up the broken model are going to get it going again. Adrenaline will not fix a broken heart. Encouraging consumers toward more debt again is not going to solve a debt-based problem. That should be a self-evident truth to all, but apparently it is not.

Only with full employment can we power the economy out of this mud hole, but only with a thorough restrategizing of our economy from top to bottom can we create jobs without creating nonrepayable debt. . That certainly means deficit spending because the employment isn't going to happen otherwise, but it has to be prudently targeted as described above, or it creates unrepayable debt. If it is used for repairs, new roads, etc., we can reduce the deficits in our projected budgets by the amount we have spent on those things now because we've done the work now so that we will not have to spend that money then. We have to be far more responsible and wise than we've been. That kind of accounting should not be hard to understand.

That's the kind of clear vision we need from our president and our congressional leaders if we're going to hit escape velocity and free ourselves from the Great Recession, but you have scarcely heard anything so reasonable from any of our world's leaders. Instead, they spend their time arguing over the revival of their tried-and-failed ideas, hoping to take them one more round. If we stay in a power struggle between Republicans and Democrats, our society is certainly doomed. We need to start looking at creating a new economy with new ideas (or old ones that we wrongly abandoned years ago), not by patching an old economy just to keep it working for the "job creators" who spend it all by speculating up the price of commodities for the rest of us.

Until cronyism is ripped apart, you'll never see that happen due to all the heavily vested interests in the dinosaur economy that will fight against it. And that is why this continues to be a great recession ... for a few.

(If you liked this article and want to be notified of others when they're posted each week, please use this RSS feed link and subscribe. You will not get added to any email list. Also, please use the email button that accompanies each article to pass a link along to friends who might be interested in this article with a recommendation they do the same. They will not get added to any email list either.)