Economy Plunges into Stagflation with Both Feet

Talk about a one-two-three punch to the ground!

Stagflation came in perfectly on target for The Daily Doom’s predictions today. Real GDP is now falling much harder than was expected yesterday by two-faced Jamie Dimon when he spoke out of his second face, saying the economy is “booming,” backed by “healthy consumer finances.” He called it an “unbelievable” economy. I’ll agree with that part. I certainly didn’t believe it when he said it yesterday.

You see, only the day before, his first face said the economy looked like we could be heading into the stagflation of the 70s, which means a stagnant economy with high inflation. Those are diametrically opposite claims to my way of thinking. After he appeared to walk stagflation back yesterday when he said the economy was booming, today we all learned we are already in the stagflation of the 70s. (We’ve actually been in it all year, but it finally got reported.)

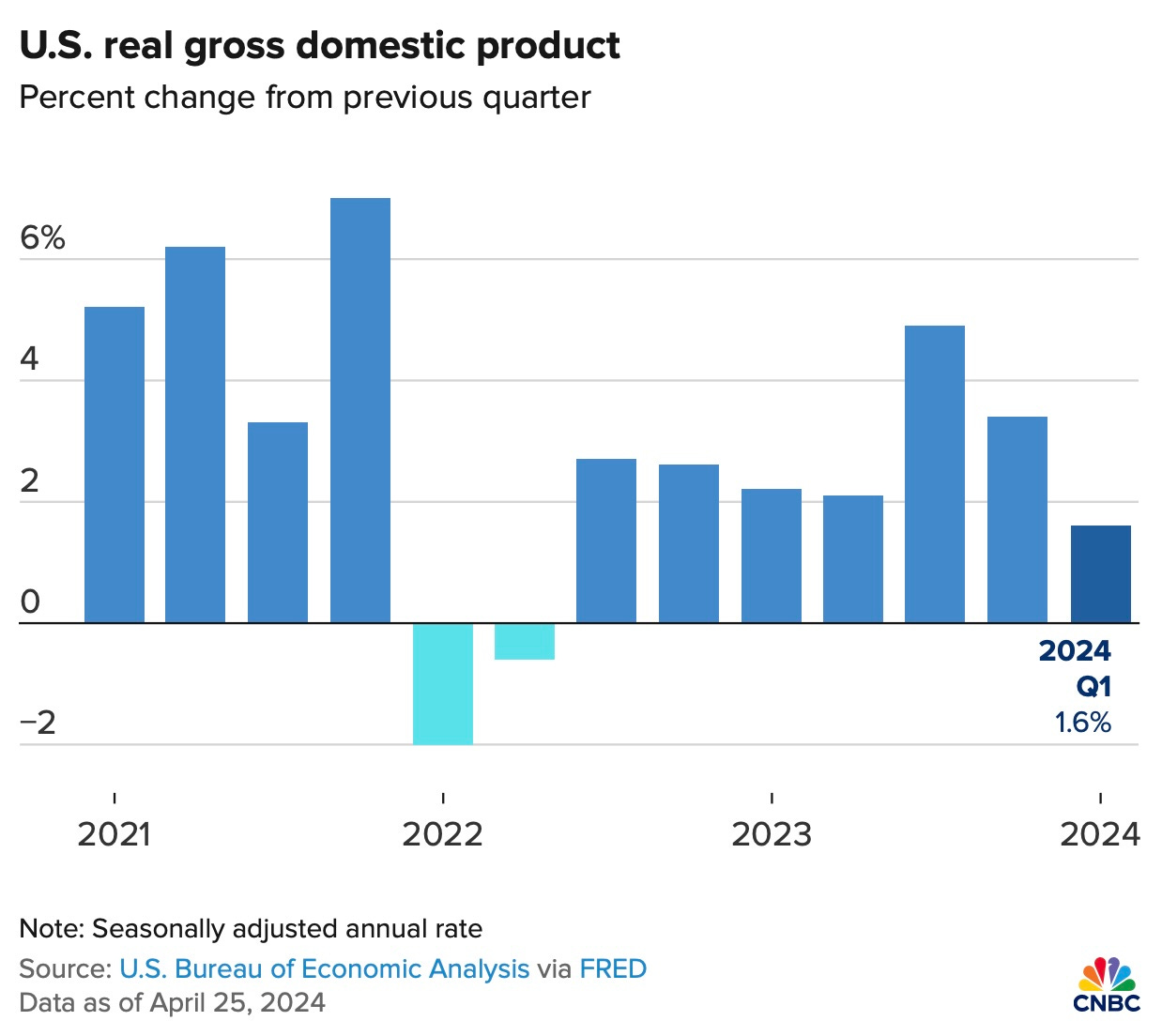

The official report on Q1 real GDP for 2024 showed the economy is stagnant, while the Personal Consumption Expenditures (PCE) price index scored its largest inflation gain all year (at 3.4% annualized). To be specific, GDP fell off to a 1.6% annualized pace (adjusted for seasonality and inflation), according to the Bureau of Economic Analysis. That is a plunge to less than half of the 3.4% growth the BEA claimed for the final quarter of 2023 and the 4.9% in the quarter before that, and it even came in well below the 2.4% that was forecast recently by economists in a Dow Jones survey.

So, the two-faced Dimon should have stayed with what his first face said two days ago because GDP readings under 2% are usually considered borderline recession—far from “BOOMING,” which means the US economy is, in fact, stagnant with rising inflation, which means the 1970s are back … because …

… this was the worst quarter for GDP growth since the rapid plunge during the Covidcrash into the nation’s shortest bear market and shortest but deepest recession by one measure in that we experienced our worst real GDP growth ever (if you don’t manipulate it with seasonal adjustments or express it as an annualized rate).

Consumer spending came in at a 2.5% increase, which was well below the 3.3% increase seen in the final quarter of 2023 and well below the Wall St. estimate of 3%. That shows the drop in GDP is related to a decline in consumer strength, hardly the kind of booming strength backed by a strong consumer that Dimon’s second face talked about yesterday. With inflation coming in hotter, the drop in spending growth means consumers are no longer holding up so well under the rising strains of inflation.

Everyone in the clearly disabled financial media got excited last quarter when PCE came in at a surprisingly low 1.8%. Readers here knew that was likely to prove to be an anomaly, and now we can see it clearly was because PCE is right back to its rising trend. The Core PCE picture, which excludes food and energy as the Fed likes to do, looked even worse, rising at 3.7% rate, getting close to double the Fed’s target.

Jobless claims, meanwhile, came in much lower than expected at 207,000 new claims. That was even lower than last week’s drop to 215,000, which jostled markets down last week because of what it said about Fed rate cuts. It means jobs are still coming in on target for The Daily Doom, as in refusing to give the Fed latitude under its jobs mandate to start stimulating the economy with interest cuts as the Fed swings, instead, to tightening longer to force inflation back into retreat. My claim remains that the Fed will likely have to raise interest another notch to make that happen. As expected here, the broken jobs gauges are giving the Fed no leeway or CAUSE to do otherwise.

If all of that doesn’t scream “stagflation is here,” I don’t know what does. So, with that terror now squaring off with Wall St., it is hardly surprising that bond yields jumped higher, putting the 10YR UST solidly above 4.7% today, while the Dow fell more than 700 points intraday, closing down 375.

“This was a worst of both worlds report – slower than expected growth, higher than expected inflation,” said David Donabedian, chief investment officer of CIBC Private Wealth US. “We are not far from all rate cuts being backed out of investor expectations. It forces [Fed Chair Jerome] Powell into a hawkish tone for next week’s [Federal Open Market Committee] meeting….”

“The economy will likely decelerate further in the following quarters as consumers are likely near the end of their spending splurge,” said Jeffrey Roach, chief economist at LPL Financial. “Savings rates are falling as sticky inflation puts greater pressure on the consumer. We should expect inflation will ease throughout this year as aggregate demand slows, although the path to the Fed’s 2% target still looks a long ways off.”

We’ll see about the “inflation will ease” part, but he’s right on the rest. Probably a bit optimistic on inflation, though he does say it means the Fed’s tightening path runs a lot further off than was previously believed. I would agree that it is likely that the recession that is coming will eventually wear down inflation, especially with the Fed tightening into recession; but great damage will be done by then due to how much the Fed has to tighten us into recession before that happens.

The market still has a lot of error to adjust out of itself because the “booming” economy is going to continue to pound its fantasies right out of the market’s wishful, wistful head.