Expect the Bureau of Lying Statistics to Tell a Whopper with Thursday's CPI

They already promised they will. That's the kicker, and everyone in the financial press accepted their promise with no complaints because everyone in finance wants to see lower inflation that won't disturb broker's bullish selling and investor sentiment and bond funds and hedge funds, etc. It pays to not question.

Here is the statement the BLS put out in December to describe the deeply embedded changes they will make in how they calculate the consumer price index. Notice how devoid of detail and vague it is:

Starting in January 2022, weights for the Consumer Price Index will be calculated based on consumer expenditure data from 2019-2020. The BLS considered interventions, but decided to maintain normal procedures.

I think the BLS needs an intervention.

How would expenditure data from two years ago be more relevant? Why not five years ago if going back in time is better for its own sake? Why not last year? Why not this year? Why not to the first year when CPI was ever calculated?

I'll come back to that.

Today's inflation is not your father's inflation

It's more than a little suspicious that we have never seen the BS department create a revision in its methodology that resulted in a shift toward higher CPI. All changes create lower inflation rates -- the kinds of numbers governments would prefer to report to the restless masses who really don't like inflation eating their wallets.

Thus, you cannot compare today to the 70's and say, "At least, we're not that bad" because the BLS helped fight those high numbers back then by changing the calculus back in the 80s. Since then, the inflation that you feel in your pocket has been different than the official number, and I'm not talking about the move by the Fed to look at just "core inflation" for determining its own policies.

The biggest change in the 80s was the substitution of "Owner Equivalent Rent" for actual changes in US housing prices. As a reminder, OER works by surveying owners to guess the rental value of their homes. It naturally understates even the rental value of that home because who knows less about rental values than the people who have been out of the rental market, sometimes for decades, who, therefore may likely have old valuations in their heads?

If mere surveys provided sufficient information for CPI, why doesn't the BLS just survey homeowners for what they think a car is worth today and what they think meat costs, etc. Why, on the most heavily weighted item of all, do they trust a consumer survey that GUESSES at current values rather than do as they do with all other items and actually go out and price everything? It's meaningless and lazy. Maybe BLS stands for the "Bureau of Lazy Statistics."

Rental values may be a lot different than what homeowners are experiencing, even on average. Renters may live in much different neighborhoods. Renters may live predominantly in apartments, and homeowners in houses. Vacancy rates affect renters one way, while availability of homes on the market affects new homeowners another. And so on.

Remember, also, the other thing I said last summer was that there is long lag in how housing prices factor into rental rates. Rents don't go up the same month housing prices rise because most rentals out there have been around awhile so they are not impacted by today's housing prices and because rents often have one-year leases so rents have to wait to go up, and they may even have caps within the lease on how much they can go up. So, I said you could expect, at minimum a half year lag for the big spike in housing prices last summer to start factoring into CPI via these rent guesses. Minimum. So, I said to expect housing prices to finally start to drive up CPI in January of 2022, just about the time when other supply factors might be maxing out, and that would make sure inflation kept rising for, at least, the first half of 2022. (And that would be if housing stopped rising at the end of 2021.)

I'll be coming back to this shortly because it's key.

Lumber prices. Guess what is not included in CPI as an item with a tracked price? Lumber, because it is not thought of as a consumer item, but mostly a producer item. Remember what happened to lumber prices last year? Through the roof. Where is lumber used? Most of it is used in housing construction? What is also not included in CPI? The cost of new homes. Get it? Now, steel prices are not included in CPI for the same reason, but unlike lumber, most of the items made from steel, such as new and used cars, are included in CPI. In fact, cars and truck are long-life assets, like houses, but they're a big part of CPI.

The dastardly BLS has already thrown out any shred of credibility

When you think about the BLS' statement that it will be revising the way it reports CPI for January, remember the job adjustments the BLS did in January, as I wrote about here: "Federal Job Fakery Hits Peak Balderdash." From what just happened there, you can imagine how much adjustment there will be to their new calculus for CPI to get rid of the hideous uglies:

In summary, that article showed how unemployment is only low because MILLIONS of unemployed people dropped out of the labor force. Since the quoted unemployment numbers only measure the part of the LABOR FORCE that is unemployed, this naturally had the effect of making official unemployment statistics fall over Yosemite Falls within just a single report. If you cut the size of the labor force by 11,000,000 people who to the best of your knowledge largely remained unemployed, then clearly the unemployment rate in the remaining force is going to drop! People have not returned to the labor force as was expected, and they show no signs that they will. What the real unemployment numbers show is permanent economic damage.

So, the job market is HORRIBLE, yet analysts, investors, brokers, economists, banks, and especially central banks, wave the BS Department's headline numbers and say, "We have a really strong job market!" Au contraire.

Think about what I said about how jobs were reported for January, too, if you want a clear picture of how the BLS is doing its best to doctor January. Actual payroll statistics were beyond horrible, and the BS jobs numbers were grossly concocted! I mean SHAMEFULLY! Actual jobs in January also plunged over waterfall by 1.2 MILLION -- a massive drop in actual jobs falling off of payrolls -- but the BS Department "adjusted" the number up to what they felt it should be, based on "seasonal factors" and COVID, which turned the deplorable real payroll plunge to more than 460,000 reported to the positive. Everyone celebrated. Great news. But the truth, regardless of any rationale for seasonality as a cause being "adjusted" out, was still that actual payrolls plunged 1.2 MILLION due to sick people and assumed season layoffs! So, yay, celebrate!

Seriously? People can believe that fantasy adjustment to almost half a million in job improvement if they want, but I certainly don't. Why would I? The Bureau also adjusted the preceding five months up by an average of about 166,000 more jobs PER MONTH, and they adjusted three months in summer down by almost a MILLION (about 330,000 jobs per month) to make room for all of that. If their initial numbers are THAT FAR OFF each month, why would I trust any immediate monthly print they give? They have zero credibility when their self-confessed margin of error is running +/- more than 100% of their typically reported jobs numbers during half of the months of last year!

Yet, no one in the mainstream financial press that I saw questioned it. Just a free hall pass! Report whatever you want, and we print it as gospel.

So, if CPI still does NOT come out lower than expectations on Thursday, after these adjustments or actually somehow manages to rise even under the new formulation, just imagine how bad it would have been without the new "adjustments."

Now, when I say a "whopper of a lie," I don't think for a moment they will show inflation falling by 1% annually or something big like that. I assume they are smarter than that, though it's hard to say by looking at them. They must realize any immediate plunge would raise questions. All they need is to reverse the upward trend to a small fractional decline, and bond yields will relax a little, the stock market will chill. Then next month they can put in the same additional amount of decline.

I can only hope some miracle prevents them -- some whistleblower blows the doors of their deceit. Why am I so sure it is deceitful? I come back to the fact that ALL BLS revisions of its inflation formulae have benefited the government the BLS belongs to by keeping COLA increases for government workers and Social Security beneficiaries down. A lower CPI saves the government hundreds of billions while keeping you from getting what you deserve. I simply have no reason to believe that is not the goal here when all revisions of their formulae move inflation down.

I suspect they will justify the change by saying it is necessary to remove undue impact from COVID as they do with undue impact from seasonal changes when one season is hotter or colder than usual. Why would you remove ANY impact from COVID? Our responses to COVID are a major reason we have shortages and have inflation due to the all the money printing we did in response to COVID. But you KNOW that is what they are doing, because their vague statement says, weights for their data will be "calculated based on consumer expenditure data from 2019-2020."

Really? Why 2019-2020? Could it possibly be because all of 2019 and the first two months of 2020 are the last months that preceded the entire ruckus created by COVID and all lockdowns, mandates, etc. and the Bureau of Lying Statistics now wants to "weight" everything that happened since COVID a little less, so it doesn't look like the government and its banker wiped out our economy? "Let us just factor out everything after the start of COVID when we calculate which data in the economy should be given the most weight. Let's pretend much of that didn't exist by factoring part of it out like we do seasons to pretend extra-cold seasons don't exist or that their economic impacts are meaningless."

Now, getting back to what I said at the start about my predicting last summer that housing prices would suddenly start showing up more significantly as part of CPI in January of 2022 because of the lag time for rents to catch up with housing prices, etc., how much do you want to bet the change in the calculus for how data is weighted has a great deal to do with wanting to reduce the weight of housing prices in the CPI once again! It worked splendidly back in the 80s. Maybe it's time for another tweak before the explosion in housing prices that happened last summer and prior start seriously passing through to CPI!

After all, the central bank has worked really hard to try to push up housing prices as an asset and to stimulate the economy because nothing boosts the economy like home construction, so why should the central bank now be penalized for its huge success? Housing is an asset, right? So, let's factor that out so that we also don't treat it as a cost of living during the tens of years before you sell your asset and realize its value even though it is, in fact, the largest cost of living every month in almost every homeowner's household. So large, we have to do it on a thirty-year loan to handle it. What the BLS should be doing is averaging out all housing payments as the cost of living for homeowners and property tax and insurance. (Maintenance costs would presumably be included under durable goods and services.)

Now, what does the BLS mean when it said it considered "interventions" but decided not to do that. Did it mean it was going to just intervene by dummying down housing prices, or was it going to intervene by boosting housing prices because it was aware of how the lag time for factoring them in as rent made that method especially inadequate now due to how rapidly housing prices are rising? Rental equivalence, already a laggard, is really falling behind now! The BLS doesn't say, but this would be the first time we ever saw them boost prices for housing as is actually merited; but past experience leads one to naturally suspect their intervention would have been to just manually, so to speak, lower some housing prices when January hit and those ultra-high costs started passing through to a greater degree in OER.

One can well imagine the BLS would like to lower what I said would be hitting CPI in January from early 2021's spike in housing prices, and nowhere is there more room to massage CPI when it is getting out of control than in the guesswork of surveys that provide OER, so maybe some of the secret sauce is in the new weighting formula is in that vast area of wiggle room.

I'll be more than shocked if the arrival of the new formula on Thursday takes out the lag in housing costs and puts real numbers back in place of the old owners survey of rent guesses ... like we had in the seventies. I might fall over dead if that happens or have restored faith in government. I will be more than delighted to find out that I am wrong on all of this. I'll go have a mai tai if I don't go unconscious.

Here is where the BS hits the fan

Why is this critically important just as rental rates were going to start showing up in OER? Morgan Stanley reported this week that

A Miss In January CPI Is All That Can Save Government Bonds

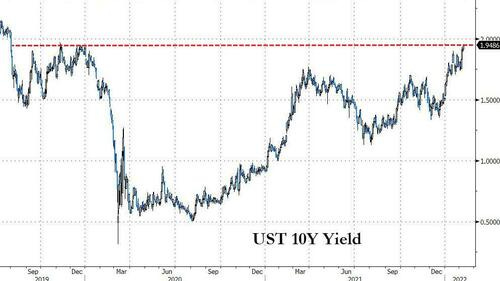

...US 10Y Yields are fast approaching the critical 2.00% level, which will likely be taken out as soon as we see a sustained push above 1.95%....

By "a miss" they mean coming in below expectations. Here is the level the 10YR just hit (1.96%):

I just laid out in a huge Patron Post, how massive and broad in impact a bust of the bond bubble will be (WAY beyond what you might imagine, dwarfing anything that happens in stocks) and how very close we are to it; but for all readers, let's see what Morgan Stanley has to say about how critical the present moment is:

While there are multiple views what happens to bond yields next, most ... agree that Thursday's CPI report will be critical in setting at least the near-term trajectory of yields, and as Morgan Stanley's strategist Matthew Hornbach writes most eloquently, "we think a downside surprise on January US CPI inflation is all that can save government bonds near term."

The escalation in government bond yields due to inflation is happening so quickly and sits at such a critical juncture that Morgan Stanley believes the tipping point will be Thursday's CPI print. If it comes in low, bonds can take a breather. If it comes in hot, look out below!

Hornback warns that, if CPI comes in hot, the bond market will be saying,

"Toto, I have a feeling we're not in Kansas anymore...."

The upcoming US CPI report might be the last hope to save global government bonds from their worst start to the year since 2009 (see Exhibit 7). An upside surprise next Thursday would mean further talk of the Fed raising rates 50bp in March. At a minimum, calls for the Fed to hike at every meeting this year will look much less off-base ... and investors aren't adequately protected against that, given current market prices....

The Fed changed its guidance on the policy path (rates and balance sheet) much faster than in the past two cycles. And economic data - first on inflation, and now on the labor market - has been much more volatile relative to expectations. Real term premiums (the bedfellow of inflation risk premiums) should be higher than before, as a result.

In other words, the BLS can't risk an upside surprise.

So much depends on Thursday's CPI.

There are three kinds of lies: lies, damned lies, and statistics.