Fed Does as Expected, Market Does as Expected

... and then the market wanders for direction.

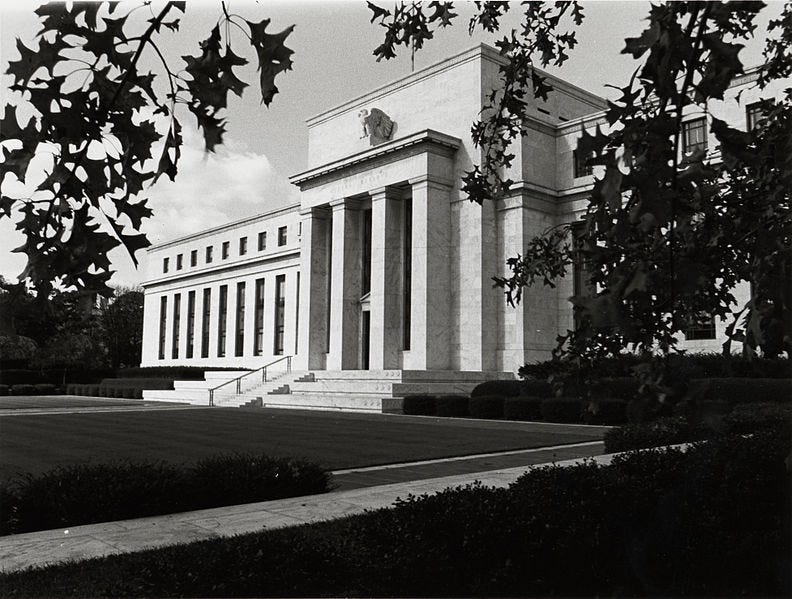

So, the Federal Reserve did what everyone believed it would do and raised its benchmark interest rate another quarter point, and the stock market reacted by going up again this morning. Most of the market news I read came from analysts who seemed pretty convinced Fed Chair Powell was saying this was likely the Fed’s last rate hike. That top-of-the-morning view seemed, at first, to be guiding the ever-euphoric stock market on up toward new dizzying heights.

However, after opening up about 150 points on the Dow, the old-time index fell to unch … likely because, if you dig a little deeper into what Powell actually said, he said nothing of the kind. Wolf Richter does a good job of laying out in one of the stories below why what Powell really said sounds more likely to project along a path to another two rate hikes to come. As I finish writing this, the market has gone about a third of the way back up. It looks like it is struggling for direction, and that makes sense. It should be.

With Fed hikes out of the way until September, the market has only economic data now to look at during the time of year when stocks become more volatile because traders leave for vacation, so lower volume in trades means things don’t quite average out as smoothly. Smaller trades can have more impact on the major stock indices.

As traders are pressed pressed to rely more on economic data than on Fed decisions, that data does not look so great even though GDP reported in today’s news looked great — as in better than expected and well above recession. One reading on today’s market action would say the market started falling once the GDP report came in because higher GDP means Powell is not taking the economy even close enough to a landing to ever get inflation back down. We’re still almost at cruising altitude and slightly rising. Another view would say that is reason for the market to be optimistic that Powell can easily avoid a recession altogether even because inflation is slowly coming down, and shows no economic impact.

There is, however, a major contradiction with GDP that I’ll be digging into in this week’s “Deeper Dive” where I can lay out why all is not as it seems on the surface. There is solid reason to believe GDP may be lying, and even BlackRock, the Fed’s corporate partner in crime, is waking up to the fact that labor market tightness is also not what it seems.

The stock market has a lot to worry about but has been burying its head in the sand. For now it appears to believe the GDP reading is a clear sign of Powell’s soft landing. However, with Powell clearly stating that more rate hikes are, at least, as likely as not, while economic troubles are building everywhere from the past rate hikes that are sucking the ground out from under the foundation of the Fed’s ginned-up recovery, the whole economic/banking edifice is at risk of collapsing as the next “Deeper Dive” will lay out with the data and logic to support that claim for paid subscribers.

I’ll say this much in advance: the grave concern that BlackRock now points out is exactly the error that I said more than a year ago would cause the Fed to over-tighten, even as we are already sinking into an unseen recession.