The Fed Actually Reveals the Way its Own Delusional Thinking Works, and Why That Assures a Worse Crash!

I just came across an internal Fed staff document that shows what a mess their minds are. When you see how seriously they are misunderstanding this economy and the causes of inflation and how they are going to fight that inflation like Don Quixote jousting at windmills, you'll realize there is no way they find a path of out of this that they are not going to make worse for us all.

Have a look at the following graph and see which of the two lines you think is going to move to catch up or down to the other: (The bonds line on the graph is inverted because bond prices run opposite of yields. So, by graphing yields inverted, you track what's happening in bond prices. As yields rise, the price/value of bonds falls.)

The price-to earnings ratio of the S&P has tracked very closely with 10-yr-bond action for years. Every time the P/E ratio (a measure of value by comparing the price of a stock to its earnings) rose, the value of bonds rose. In almost all cases, the P/E ratio followed right after the move in bonds. You'll see, in 2021, where bonds fell behind the move of the S&P, but that was because the Fed had seized total control on the bond market and was choosing to push bond yields down (prices up) as hard as it could with massive QE, while the value of stocks was falling in the face of rapidly rising inflation, which was being pressured higher by all the Fed's QE. Now that the Fed is tightening faster and bond prices are plummeting in response faster than stocks are falling, guess which is going to catch up?

Let me make that easy: Bonds are almost always the smart money compared to stocks. Anyone familiar with both markets knows that. It's practically a mantra among market gurus. The time it wasn't true was back when the Fed totally owned the bond market as the biggest whale in the pool, sucking up half of all new treasury issuances. Everyone in the market also knows that anyone who buys half the market on a daily basis for months on end owns the market (as you've heard me say if you are a regular reader here, but as I briefly am explaining for those who are new). They ARE the price-setter.

That means the Fed, by intention, set bond yields/prices WHEREVER IT WANTED THEM. That was the whole intention -- to stimulate the economy by bringing credit costs (yields) down. So, the Fed drove yields to the lowest levels ever (highest point for prices). And, of course, anyone doing that is going to spread those purchases in whatever manner across the full spectrum of bond maturity dates that they need to in order to maintain the kind of orderly yield curve they want (total YIELD-CURVE CONTROL).

One last review on how that works: The Fed likes a nice curve, meaning yields on short-term Treasuries are lowest; and yields over longer terms, curve upward on a graph in order to compensate for the risks of longer, therefore, more unknown, timeframes. The curve, however, inverts as it has now to the opposite shape when the present timeframe looks TERRIBLE, so safer bets look further down the road when hopefully things settle down.

If a nice curve is what the Fed wants, why would it not control how that curve looks in order to present a stable-looking economy? We all KNOW it would if it is buying enough bonds to do so. You would buy bonds in sufficient number at each maturity point along the graph to set the yield where you want it relative to shorter and longer term yields. So, we all KNOW the Fed practiced total yield curve control during its QE period, whether it declared it was doing so or not.

That brings us to today. The bond market has been freed of that Fed nonsense to go back to true price discovery in the market place because the Fed has exited the buyer's pool, except the Fed dumping bonds is also affecting prices in the opposite manner. They seem less concerned about controlling the curve now though, perhaps because that's a harder battle since things tend to become more disorderly on the way down and inflation is is persistent, I think the Fed has given up on managing the curve to look nice and is just doing whatever is most effective to combat inflation now, which means higher interest right now on the short end of the curve to tighten the economy as much up front as possible.

The bond vigilantes are also back, and they are going to set prices wherever they feel they need to be, not as a scheme but as simply how the MARKET works to the extent true price discovery is allowed. Right now, with the Fed forced to raise its own minimum interest rates between banks (the Fed Funds Rate) to drive short-term credit costs higher in order to tighten up the inflation battle until it gets searing inflation back down to something near its target, the bond market is also going to naturally price that in, staying ahead of Fed rates. So, of course, bonds are pricing down to compensate for inflation that they will be losing out to over time.

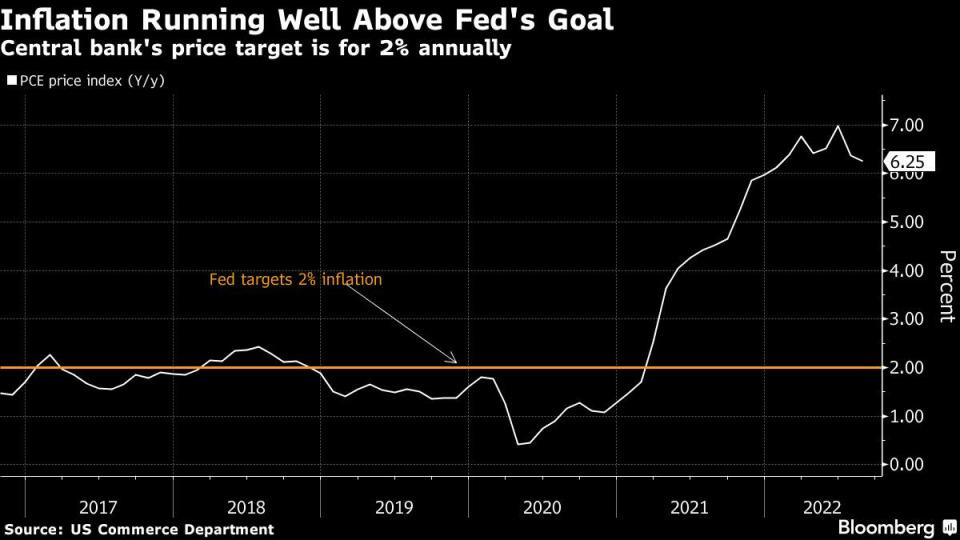

Inflation is still way above the Fed's goal and, at very best, topping out but not really falling:

So, that's half your answer to my initial question: There is NO way that bonds are going to move toward stocks. There are too many factors pressing them down. We saw that become very disorderly in a hurry in the UK where the Bank of England had to rush in to the rescue, or the whole market was about to collapse and yields soared so that prices plummeted. That same kind of pressure is building here.

ON THE OTHER HAND, there is absolutely nothing to save stocks right now from falling further and catching down to the "greater wisdom" of the "smart money" in falling bonds. I mean, realistically, what would it be? The Fed can't come to the rescue as it's done so many times without throwing gasoline on the fires of inflation by going back to QE. It's at war. The federal government cannot come to the rescue if the Fed doesn't go back to money printing, as it did in joining the Fed to save the market during the lockdowns in 2020 because the cost of its debt will soar even worse and because its at war ... sort of.

Not only is the US government helping the Ukrainians fight a war to retain their independence at great cost that will require even more US debt, especially as we go to replace all that equipment getting blown up, but the US government's existing mountains of debt are soaring in interest costs because of the Fed's moves, so how will the government take on more debt to stimulate the economy as it did in massive ways under Trump in 2020, which continued under Biden in 2021?

Labor isn't coming back. It died or is sick, as fully covered here and here and here; so I won't explain that again. Productivity hasn't gone anywhere in years, and may be now starting to rise, but it has a long way to go to make up for the greatly decreased supply of labor. So, lack of labor means continued low production for months to come.

That means GDP isn't going to boost stocks -- if it is reported honestly. How can you produce more with fewer workers and shortage of materials and higher prices. Not likely.

The Feds' GDP predictions disagree with me but also make no sense

While almost everyone in finance has disagreed with me on GDP and a recession throughout the first half of the year, I did, at least, have the Atlanta Fed starting high each quarter but tracking down in my direction as the end of the quarter came near so that they had more data to work with.

However, this quarter, the Atlanta Fed's GDPNow strongly disagrees with me, compared to the previous quarters where it wound up down near zero, even though not as low as I predicted, but then GDP growth actually turned out to be below zero, just as I predicted. This time, they are moving away from me as the time of the report draws near. Here is their prediction for the third quarter (green line):

They are actually predicting GDP growth will look very healthy! I've still been predicting it will come out sub-zero as it did in the last two quarters, leaving us in nine months of full-on, albeit undeclared, recession. I have no idea how they think it will come out to be near 3%, and all the mainstream economists they survey (blue line) are trending closer to me than to the Fed (which really scares me about the likely success of my prediction when economists are closer to agreeing with my position). Until this quarter, the mainstream economists have been higher than the Atlanta Fed's estimate -- opposite of me -- in fact, right about where the Atlanta Fed is now. I can only hope (in terms of my prediction) that, since they have run consistently the most over-optimistic all year, they are still too high.

That makes me wonder if the Fed's estimate is just an engineered prognostication this time, designed to get Team Biden through the election cycle with the congressional support he wants. That is my cynical side speaking because I know that wouldn't actually play well for Biden or the Fed since the official GDP report comes out on Oct. 27, just in time for Halloween. It could be quite a scare for markets if the Fed has been forecasting 3%, and GDP growth actually barrels in below zero ... again.

So, maybe I'm just wrong this time.

There are, however, some real peculiarities in how the Fed is reasoning about this. Based on its projection and its understanding of the labor market, the Federal Reserve now believes the economy is and WAS even hotter than it thought, and that means harder tightening for longer, which cannot be good for stocks. In part, it believes this an an explanation for why it missed so badly on inflation:

The Federal Reserve’s influential staff judges that under the surface the US economy is running even hotter than they thought, helping to explain why inflation remains at a 40-year high and providing reason to expect even more interest-rate hikes.

I have been claiming the Fed's way of interpreting things means they are going to seriously over-tighten during the middle of a recession because the economy, as measured by GDP is running colder than they think. Now their understanding has moved even further from mine, meaning their over-tightening will be even worse if I am right about the state of the economy. However, their reasoning seems REALLY WEIRD:

Tucked within 12 dense pages describing the Fed’s September policy meeting last week was a statement concerning a seemingly innocuous yet vital estimate that the staff use as a building block for internal economic forecasts.

Their gauge of US potential output was “revised down significantly,†the minutes showed, due to disappointing productivity growth and slow gains in labor force participation.

Huh, and that's not even the weird part yet. They think the "economy is running even hotter than they thought" due to worse productivity growth an poor labor participation. That's a brain knot.

The view stated there by staff about what's happening with productivity and labor agrees with mine: potential output (GDP) is going down, which means the Atlanta Fed's GDPNow should be "revised down significantly" to match what I've been saying, and that would not be surprising because they have always started high and gone down as we near the date of the actual report. The surprising part is this quarter they went higher, even contrary to what their internal staff say should be happening. They also agree with me that there is a serious labor-force participation problem holding the potential for production down, though they have no understanding of that because, at the same time, the Fed ludicrously believes that the shrunken labor force has nothing to do with the tight labor market being tight but believe, instead, the labor market is tight because of high demand for labor.

On from the messed-up thinking to the downright weird parts:

Potential gross domestic product is essentially an estimate of how fast the economy can run without breaking a sweat in the form of tightening resources and higher inflation. The new estimate was not disclosed -- nor was the prior one.

Why? Is it top-secret?

There's your definition: they're saying the economy because strong enough that it actually outran its true potential for production, meaning it is exceeding the available resources, causing shortages and higher inflation in order for producers to move more resources in their direction. Balderdash! The shortages were not caused by too much demand but from lockdowns and breakage of everything. Demand did not exceed normal levels of available resources. Rather available resources shrunk considerably. The Fed want to validate its long claim that "the economy is fundamentally strong." It boggles my mind that people cannot see how bad the BREAKAGE was. So, they GUESS it had to be due to the economy running above its actual potential and, therefore, outstripping resource supplies and labor supply, driving inflation up. That's totally backward to what happened.

Even so, “the policy implication is significant,†said Anna Wong, chief US economist at Bloomberg Economics. “Lower potential growth means the economy has been more overheated last year and this year than realized, and it will take more rate hikes or a longer period of below-trend growth to close the output gap,†said Wong, a former Fed economist.

Oh my gosh! How does lower potential (meaning, in this usage, the economy's ability to rise without outpacing available resources and supply) mean the economy "has been more overheated in the last year," as in having actual POSITIVE GDP over the last year (which the Fed believes or it would know we are in a recession), rather than negative GDP as has been reported all year? You certainly CANNOT call an economy running negative GDP overheated. That's beyond absurd, but to say it has been even more overheated than the Fed thought is absolutely asinine!

Obviously, the picture that adds up right with what GDP has been telling us all year is that the shortages came first, LIMITING the potential for the economy (including labor shortages), so those shortages inevitably pressed economic production DOWN. You cannot make what you don't have resources to make. But herein you get to see how the Fed's thinking is causing it to miss the truth about labor and the strength of the economy. They think only an economy strong enough to overrun available supplies would drive prices up (demand), and cannot even imagine that a serious reduction of supplies would grind an economy DOWN. So, they think GDP numbers must be misrepresenting the true state of the economy ... all year.

And, even if we are talking about the potential (as in the maximum limit) the economy can grow without outstripping its available resources (including human), how does that mean the Fed needs to tighten harder in future months to solve the problem? Tightening will not raise resources in short supply if the problem is lower quantities of resources, not increased demand for resources, but that is where they are going with this:

"Tighten her down harder boys. It turns out our negative GDP is running way hotter than we thought, and we already thought it was really hot, in spite of being negative, so we're going to have to wrestle this scorching GDP down to the ground with a tighter grip in order to get rid of the inflation overheated economy is causing."

Wow! What an error. Here is what would be more truthful:

"Because we were way off in thinking inflation was transitory, we kept goosing the economy hotter and hotter, and it turns out goosing the economy to demand more and to try to produce more when resources are short so that it can't create more only creates inflation without boosting the economy because resources are the limiting factor, not money; so now we're going to try to cool the economy off a lot in the future with higher interest to squeeze demand down to match limited resources in order to make up for our past two years of error when stimulus only made inflation much higher because the economy didn't need stimulus; it needed resources, including labor."

What a mess they made! What a hideous mess.

And, thus, they might continue:

"So, just ignore those negative GDP numbers you've been seeing because they're just noise left over from the lockdowns. Nothing to see there folks. Oh, and that's why we just revised our GDPNow forecast way up in order to reflect how much hotter this economy is than we thought it was."

Because of this thinking disaster, we are now at the point where,

Wong estimates the US central bank will deliver a fourth consecutive 75 basis-point rate increase next month and keep going until they get rates in the 5% range next year.

Raise your hand if you don't think that'll be catastrophic. It will be for sure, especially for stocks whenever stock investors take their heads out of their behinds long enough to see what is coming. Of course, some fools will keep betting the Fed is going to pivot any day now as if the Fed won't do what it believes it needs to do and keeps saying it IS going to do. They will believe it won't do it because it can't do it. However, when did that ever stop the Fed from crashing the party right as everyone was headed out the door anyway just to kick them out harder?

That is normal operating procedure for the Fed to think it can tighten more than it can. They are in the business of creating recessions. They're just going to commit policy error much more extravagantly this time. They've already taken away the punch bowl, but this time they're going to throw it all over the guests to make sure the revelers leave in a hurry to get a clean change. And while they're at it, they're going to clear the dinner table and throw that, too! So, run before the food flies! This is going to get ugly!

(That 5% rate, by the way, if Wong is wight, is up from the Fed's last projection of a top rate at 4.6%.)

To linger just a moment longer on this, let's decipher the idea behind their all-out folly:

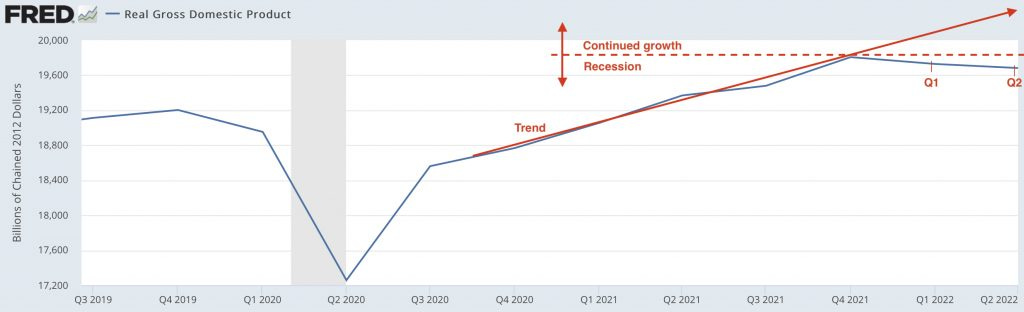

Like a rocket whose trajectory is overshooting its target, if the economy’s level is still above its longer-run trend, that explains why inflation continues to be broad and stubborn.

First, it's not above it's longer-term trend even if it outstripped its very limited resources, which are now even more limited. It is under its longer-term trend. WAY under. They need to look at their own graphs:

There appears to be some circular logic here: We know the economy was running hotter than where we thought it was because inflation went way higher than we thought it would; therefore, that explains why inflation continues to be broad and stubborn: The economy was so strong it was outstripping supply.

They are trapped in their own circular reasoning because they CANNOT see the simple truth -- that the tight jobs market has nothing to do with a strong economy, but is due to truly sick and dead labor, AND they do not realize that inflation is also up and staying up due to massive supply problems that they can do NOTHING about, and that the labor shortage only makes worse.

It has nothing to do with the economy running hot, so outstripping supply; but everything to do with supply being crippled, which makes it VERY EASY TO OUTSTRIP available supply. Thus, the economy cannot grow because it has NO POTENTIAL FOR GROWTH under the present severely damaged supply situation in both resources and labor. (The causes of which I explain in an interview linked below.)

My gosh, how dense they are! And we are going to suffer the consequences of their poor thinking.

Can you STOCK up with low supply?

So, from that, let's continue along with this question of what can send stocks up to save them from catching down to bonds

1. Earnings are way down, but are being reported as tremendous simply because they did better than horridly reduced expectations, but that is just how the mainstream financial media feed these things to us with endless stock-boosting euphoria.

For example, Goldman Sachs earnings per share came in at $8.25 compared to the average estimate of $7.69, so its stocks shot up 4%. That's nice because PROFIT (earnings) fell 43%! So a massive drop in earnings was told as if it were exuberant news. It was actually terrible news, but it was better than the news about the horrific plunge in profits people had expected, which was already priced into stocks. However, let's not lose site of the fact that it was truly deeply terrible, which only shows how much the economy is going down because this has been typical of many reports this season. And this is why you saw Goldman restructuring, surely not a sign of a good experience in a "strong economy."

Goldman’s revenue decline was expected after last year’s IPO boom cooled down this year.

Yeah, along with nearly everything else, which is why those GDP numbers have been the true representation of the state of the US economy all year long. (But do you suppose the government will ever even get to the point of admitting that ... even after the election?)

Oh but look at this lying spin:

Goldman CEO David Solomon said the results show the company’s “strength, breadth and diversification†and officially announced a corporate reorganization that had been reported on earlier this week.

“Today, we enter the next phase of our growth, introducing a realignment of our businesses that will enable us to further capitalize on the predominant operating model of One Goldman Sachs,†Solomon said.

You don't restructure because of your "strength, breadth and diversification." And your profits don't plunge 43% because you have been in a "phase of growth" and are now moving into your "next" phase of growth. And recovering from a 43% plunge in profits is not something from which you "further capitalize," but is something from which you "recover."

What a load of hog slop! And, yet, the market just sucked this swill up because it wanted to believe it, and the Fed, of course, fosters these delusions with its own and then wonders why it can't get stocks to believe in it enough when it says it won't pivot so they go down and end the wealth effect, even as it keeps maintaining its "fundamentally strong" economic narrative. Everyone is just believing whatever they want to.

As for future earnings, economic reality keeps clubbing the market over the head anyway, so earnings are likely to stay low, in spite of the Fed's GDPNow predicting this quarter will show we've moved back to an upward spurt in growth. With the Fed now pressing for even lower future GDP growth because the economy that was supposedly more overheated than the Fed realized is (in their view) still outstripping its potential for growth, the Fed is going to club it some more to punish it for exceeding its potential.

That ought to work out great! That will suck down production even more to match up with the lack of supply that is already limiting economic potential, but there is no way that leads to a better world for stocks or lets GDP rise. It will cripple the weak economy and markets to bring them down to supply levels but do nothing to fix the real problem of short supplies. I don't know about your car, but mine won't run on gasoline that isn't available, even if I put more gas money in it my wallet. It's potential, being limited by gasoline supply, really does limit its actual production of movement. Economic engines are the same way. You cannot produce without supply.

You might power through by upping what you pay to channel limited supply your way, but that means earnings will also go further down because of higher costs while labor will remain tight, holding down production, and will continue up in cost, too, if you're going to attract more to do you part in raising GDP. So, production (GDP) falls as costs rise, finding a new equilibrium with resource supply. If all of that does not get priced into stocks now because of the delusional thinking that abounds everywhere, then the market will crash even harder when earnings are finally reported as actual earnings and not estimated. Earnings beating expectations at the moment is but a head-fake that may not even continue through this quarter.

2. Buybacks, which were the main drivers of massive stock gains over the past decade, are much less likely to start back up after the current earnings season in any significant way, I would think, with company cash flows down due to lowered revenue (showing all the way through to lowered actual earnings/profits) and higher costs, tightening margins, and, hence, the ability to share earnings/profits either as buybacks or dividends.

Worse still, the life-blood for buybacks was mostly cheap credit, allowing greedy investors to milk their companies dry, sometimes by using company credit to buy out their own stocks. That cheap credit is rapidly rinsing away, and is going to flush away faster if the Fed follows its staff's advice and keeps fighting inflation up to a Fed Funds Rate in the 5% RANGE (so maybe higher). Now that we know the Fed thinks labor is tight because the economy is strong AND thinks prices are rising because the economy is SO strong it is outstripping supply (not because supply was so badly damaged), then we really know the Fed is going to over-tighten.

And finally, corporate board members are not usually inclined to do buybacks when the whole stock market is sliding away because that is just a meat grinder that eats up corporate cash piles. You can evaporate corporate cash into nothing by dumping it into a market crash ... if one continues to play out. They're only likely to do that in sales of their own stocks outside of the exchanges at board-set prices, using company funds to buy themselves out if the ship is going to sink.

For more on WHY the Fed will Fail

For some actual conversation on how messed up our present situation is, I invite you to listen to this week's interview with Tom Pochari. It gets up to speed in the second half and digs into this argument here and the multifaceted causes of our inflation, showing why the Fed has no ability to cure the economic potential problem without massively crushing growth to get GDP growth down to actual potential based on available resources and explains why inflation may actually shoot up again this winter, really forcing the Fed into this tight corner it has created for itself.

Continuing with tightening at that point, if inflation is still rising higher, would really be a meat grinder for stocks and would dismantle the bond market. Given what we saw in England this month, though, I think the US bond market is already on borrowed time so that prices will fall more as yields rise to compensate for the rising risks of major defaults. We've seen that this week with the 10Yr bond yield soaring to almost four-and-a-quarter percent and the yield curve becoming more inverted (higher at the short end) than it was just at my last writing by quite a bit.

It risks becoming a cascade. (And don't think for a minute the BoE can successfully proceed with tightening even while essentially doing QE to stabilize bonds. That, too, is ludicrous -- as crazy as the Fed's belief back in 2019 that it could resolve tight bank reserves with overnight repos, which just endlessly grew larger and longer in duration, as could be expected, until the Fed went full QE. Even companies at no risk of default may feel some upward pressure on the interest they have to pay on bond refinancing as it comes due just from the uplift in the more precarious rates around them.

Tom Pochari and I debate the merits of my Apocollapse view v. his that everything is about to swing positive in the interview posted here.

Now, here is how you could potentially benefit

The fire-sale prices in stocks are not here yet, given all the problems in store, but when the cost of government interest gets to where the Biden Administration (like Trump), and especially congress, starts maximizing Powell pressure to lower rates, after the economy has flushed out to sea, there could be a rocket ride in stocks that are greatly relieved to see Powell has finally stopped raising rates. I don't think he will pivot straight to lower rates or, especially to QE. He may make that additional move without too much delay, but only after the economy is crushed, leaving him no choice.

As this situation I'm describing becomes more perilous and disorderly, Powell is likely to pause just due to public and political pressure, even if inflation is high but not rising. He may even announce a stop if inflation is settling. That, in itself could be a catalyst for a another strong rally in stocks, depending on how bad the damage is (and therein lies the major caveat).

I'm keeping cash on hand as the best place for me to be even with this high inflation, given the alternatives. It is too hard to say how the dust will settle. If the economy becomes as broken down as I think it will be, it may be nothing is going on a rocket ride. It may also easily be that inflation is still too hot for Powell to even pause much less risk QE. This is going to get really crazy.

Inflation could even start going higher this winter, as I describe in that interview. But, if stocks do crash hard this fall, and the dust settles without the Epocalypse (or maybe I should call it the "Apocollapse") becoming evident yet, as it will likely play out in a cascade of many events all over the world over time, I'll still be in a better position for heeding these strenuous warnings because I may have some resources left to invest in bargains; and, if the collapse does become undeniably evident (not sure what DEEP level is undeniable these days), as I believe it is going to do, I'll be better off to have seen it coming and not take the rest of the ride down in stocks. "Have patience, and don't shoot till you see the whites of their eyes."

I'm not giving investment advice, and I'm not licensed to do that, but I'm giving some warnings about what to look out for as well as a heads-up of what to watch for that could cause a big rally, even if it only lasts a couple of months. I'll leave the all up to you. I just map out the pitfalls and point out some possible campfire sights for you to explore. Feel free to share you own ideas with others in the comments below, as that adds value to the site.

(And I'd like to get your comments on whether I should stay with "epocalypse" as the new word I've been attempting to popularize for this terrible time ahead or "apocollapse." The latter I see, upon checking Google, has been used a few times.)