Fire & Ice: The Real-Estate Market Is on Ice Because Bond Yields Are on Fire

Interest on US Treasury bonds blows up to 2007 levels while mortgage interest blows even higher!

The 10YR US Treasury bond today, exploded upward to its highest yield since the close of 2007 (at 4.315% this morning).

CNBC carried a story about the S&P 500 attempting to rise this morning, as if that is even news, while it said nothing in its headlines when I was putting this editorial together about the 10-Yr bond, which is certainly the news. This is where trouble is coming for everything in the US economy – the sudden rise in Treasury yields that I warned would be hitting as the US Treasury massively increases its number of new issuances — not from stocks (though they will have troubles of their own to be sure).

Related news this morning said that US mortgages are, as a result, forecast to soon hit 8%, which will also be the highest since the start of the Great Recession. Because that headline links to a story behind a paywall, I’ll quote the important parts here while also providing the MarketWatch link for those who are able to follow it: (I was able to find the story for you on other free sources earlier that are no longer available, so I have captured parts of it here for you.)

The 30-year rate is “at a critical stage,” Lawrence Yun, chief economist at the National Association of Realtors, told MarketWatch….

“High rates have already taken a toll on the U.S. housing market. Even home builders, who have in recent months experienced strong demand from homebuyers, are reporting a drop in buyer traffic as those rising rates rattle their customers….

“"If the 30-year-fixed mortgage rate can hold at a high mark of 7.2% -- and the 10-year yield holds at 4.2% -- then this would be the high for mortgage rates before retreating," Yun said. "If it breaks this line and easily goes above 7.2%, then the mortgage rate reaches 8%."

Well, the 10-year yield abruptly broke that line this morning, so the 30-year mortgage could be soon to follow. In fact, I did find one site that reports a US mortgage rate of 8% this morning.

This is the point at which economic damage starts to move outside of the Fed’s control. Fed hikes have pushed interest on US debt upward, but the slew of Treasury issuances that came out after the moratorium on US debt expansion was lifted in June is now driving government interest higher, and with Biden’s deficits now ripping the face off US debt records, that climb in issuances is set to continue for another full year. That, in turn, is driving many other rates higher, regardless of what the Fed does at this point. The market is taking over.

As Wolf Richter writes on Wolf Street,

The US Treasury Department today released data to what extent it will boost the issuance of Treasury notes (maturities of 2 years to 10 years) and Treasury bonds (20 years and 30 years), and it starts in August. This oncoming flood of supply at these coupon auctions is a doozie.

So far, Treasury has funded the huge gigantic deficits and the refilling of its checking account, the Treasury General Account, by selling at auction a torrent of Treasury bills (1 year or less) and Cash Management Bills (short-term bills with maturities ranging from a few days to months). But now comes the supply of longer-term notes and bonds.

Next month, we’ll see a 14% increase in the amount of Treasury notes and bonds auctioned. As if that is not bad enough, over the course of the next year, the Treasury plans to increase the issuance of it main notes and bonds by 60%! This is going to happen without the Fed around as buyer, as it was for years.

What is it going to take to increase demand enough to soak up all of those additional Treasuries? Of course, if the surge in additional Treasuries drives up interest to attract enough new buyers — and it is hard to see how it wouldn’t — the US Treasury may have to increase its increases down the road just to fund its soaring interest payments. This is likely to snowball.

If you think the Fed will step in, bear in mind that stepping in means raising inflation by going back to stimulus-type actions. Bond investors hate inflation, so they price all of it into bonds, demanding a rise in yields commensurate with the anticipated rise in inflation.

That means stepping in may be self-defeating. Since the Fed is still fighting inflation and certainly cannot save bonds by creating more inflation, the Fed cannot step in as the “buyer of last resort” (really the buyer of first resort because it always telegraphed its intention of hosing up all US treasuries to its primary bond-dealer banks so they would buy up all bonds). That means the US government is on its own for raising money and must pay market rates.

The one thing sparing the US government so far has been the old “best horse in the glue factory” scenario where flight of capital from worse economies is soaking up a lot of what the US Treasury has to offer. Old Glue is going to have to stretch to quite a gallop, however, in order for capital flight to keep demand up with the growing supply of Treasuries. While a flood of foreign money has enabled US bond auctions to perform well so far, it is now going to take a lot more.

Regardless, interest rates on US debt are rising quickly, and this is the thing that I said would break the US economy back down into recession, not the condition of the US consumer that most people are focused on, nor even the current state of the economy, though there are plenty of signs of weakness there.

It is the effect of rising government bond interest on all other interest as the government is now subject to market-set interest rates. Those basic interest rates set interest levels for many other things, including all other bonds, which have to price higher than US Treasuries because US Treasuries are seen as the zero-risk investment (for anyone buying and holding to maturity, though not for people buying into bond funds, which are a whole different story because they can experience runs due to holding a lot of older bonds just as banks did back in March where their existing holdings dropped in resale value because of the Fed’s rising interest regime we are now in).

Going back to MarketWatch:

Currently, the spread between the 30-year fixed-rate mortgage and a 10-year Treasury bond is around 300 basis points, which is "elevated and highly unusual," he said.

"Historically, the mortgage-rate spread has only been around this level only during periods of financial crisis such as the Great Recession or the early 1980s recession," deRitis added. "The historical average is closer to 175 basis points."

If the 30-year mortgage interest rate reached 8%, there would be serious consequences for the housing market, Yun said. "At 8%, the housing market will re-freeze, with fewer buyers and far fewer sellers," he added.”

Well, we’re already there. As I recently wrote, the housing market has already frozen. That is now perfectly in keeping with the 8% mortgage rate I found this morning and certainly with the rise in bond yields.

Here was how I explained the freeze: Prices are climbing because no one is selling because no one who currently has low-interest mortgage wants to sell their home in order to take on a new much-higher-interest loan. As a result, existing homes have become scarce on the market. While that is fueling some new home construction to fill in the supply gap, few people can afford the higher mortgage rates. If they must have a home, they still have no choice but to do all they can to hit the higher price homeowners are holding out for because supple still remains short of demand. New homes don’t get built overnight. This has bid prices up on the short supply that is available, but that is not enticing people to sell. So, the market is frozen. Frozen high.

Some people can buy at the higher prices because incomes are rising and jobs remain readily available for those who want them or because they are selling homes they fully own and buying a new home with all cash. There are enough of those to eat up the small supply. So …

… don't expect high rates to hurt home prices just yet, Yun added: "As long as the job market doesn't turn negative, then home prices will be stable -- though home sales will take another step downward. If there is a job-cutting recession, then home prices will fall as some will be forced to sell while there are few buyers."

That is the other thing I’ve long pointed out: Rising unemployment will come slowly because there is a severe labor shortage. We have to eat down new jobs enough to get to the point, which we are probably close to this summer, where available jobs finally match down to available workers. Only then is unemployment going to rise as layoffs continue.

The thing to understand is that housing prices are not high due to lots of people buying and lots of homes selling. They are high because existing owners have no desire to sell (for the most part), so the few buyers who are willing and able to buy at such high mortgage rates still have to compete on price for the limited inventory. Eventually, the ice will have to break — either because jobs fall and able buyers shrink even more or because supply grows — and prices will start to fall. However, there is little evidence of that happening anytime soon. Instead, the market has frozen up at high prices and very few sales.

So, the perilous rise that lifted the US 10-year (a benchmark for morgages) to its 2007 level this morning is terribly bad news for mortages and housing.

He noted that the monthly mortgage payment for a median-priced home at the prevailing 30-year mortgage rate has risen from close to $1,100 per month in January 2019 to over $2,100 today. "At 8%, the monthly payment would rise to over $2,300, excluding an even larger number of potential buyers with above-average incomes," deRitis added.

This is where the housing-based US economy starts getting into serious trouble, and these higher rates impact corporate bonds, too, although recent news said most corporations were smart enough to grab long-term financing through 2030 at lower rates when it could be found. It will be the less-smart or less-fortunate corporations that find themselves in zombie situations.

High rates also discourage homeowners from selling, since they may have to surrender an ultra-low mortgage with a low monthly payment for a high rate. They may end up with a smaller budget to purchase a home, or worse, not find any listings at all, given an ongoing inventory crunch.

With high rates, many home buyers may be priced out of the market. Yet some buyers -- particularly baby boomers -- who have the means to put in all-cash offers on homes are keeping home prices elevated, Hepp said.

So who would be able to buy and sell? Cash buyers. "They tend to be older people like baby boomers who own their homes free and clear," she added. "If they live in more expensive areas, like anywhere in California, they can sell their home and walk away with in excess of $500,000. And that in some markets buys them two homes.”

That is what frozen looks like. The river may not be frozen solid, but it is an ice flow that has become badly choked.

The ice breaks when …

"if the labor market should weaken and unemployment rise, home foreclosures would rise," deRitis added, "placing downward pressure on home prices.

"So the housing market is definitely suffering from high rates," Hepp said. "But I think even higher rates would be pretty devastating for the housing market."

Then there is China, which is the “Deeper Dive” I am working on today, which fills the news again today. Here is what is important to realize that many are not seeing: It is not what is happening in the US economy today that is the fundamental concern for recession, which Powell reiterated he and now most of the Fed see as unlikely. (That, of course, is when you should be most concerned because, if there is anything dependable about the Fed, it is that its experts truly fail to see recessions the most when they are already standing in the middle of them.)

The real recession concern for the US economy is what these big forces in bond interest, housing and China will be bringing for the next entire year. These will cause the US economy to start hemorrhaging in the months to come, and these deeper forces are not going away. In fact, they are just getting started.

As Fed Chair Powell tells you he is almost certain the Fed can avoid creating a recession while it continues to engage in QT, shrinking money supply, keep this chart in mind and think about it:

Powell is smoking pot.

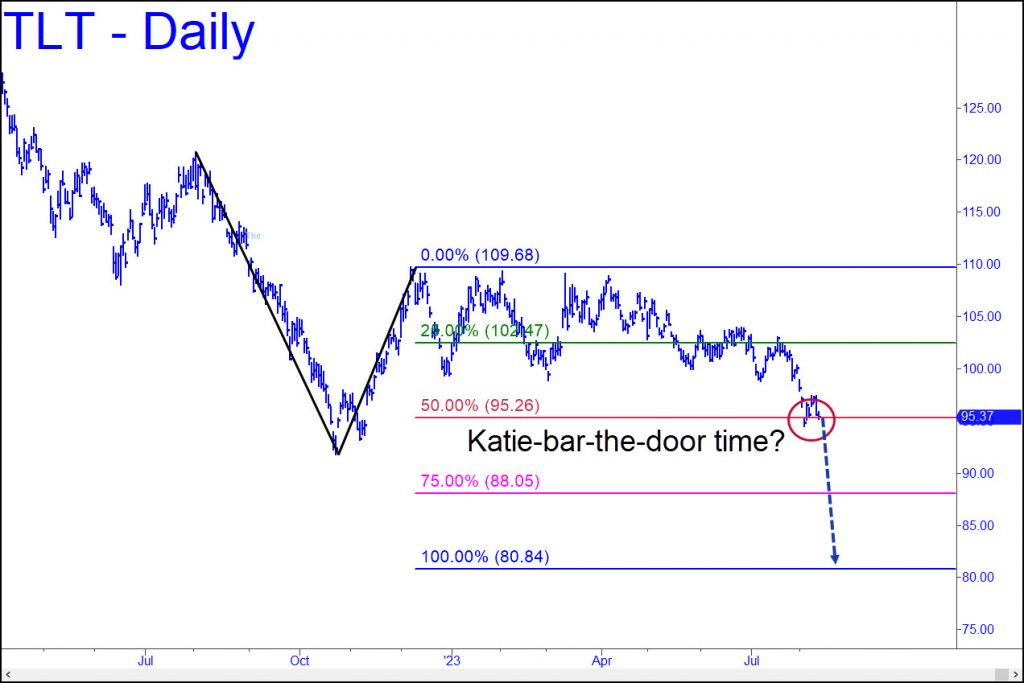

As for bond prices, the inverse of bond yields, maybe it’s …