Fueling up Inflation

Higher energy costs are raising concerns of a negative impact on the broader economy at a time when the Federal Reserve is aiming to curb inflation….

Energy prices, specifically gasoline, were the biggest culprit of August's hotter-than-expected Consumer Price Index print released last week.

“The oil issue, the higher gas prices — this should be a reminder to all of us that the Fed is not in charge of inflation,” Claudia Sahm, former Federal Reserve Board economist, told Yahoo Finance Live following August's CPI report.

“These are geopolitical events that are driving energy prices," she added.

While the Fed was the culprit in raising inflation, stoking the inflationary furnace as full of fuel as they could get it, the point of the above comment from one of the boldfaced headlines below is that Fed has LOST control of inflation. Market forces in the geopolitics of oil have now taken over in driving up inflation, and there is NOTHING the Fed can do about it.

This situation was a big part of my economic predictions for a return to rising inflation and a return to rising energy prices this year in my prognosis for the economy at the start of this year. It also made it the emphasis of The Daily Doom’s latest “Deeper Dive,” which I will now share in part with everyone.

Consider the following summary statements from that “Deeper Dive” that really lay out the key forces that will be shaping the economy for the remainder of this year and determining the course of the Fed’s inflation fight, and then consider the highlighted headlines at the end of this article (today available even to free subscribers) that put $100-per-barrel oil back in sight just one day after that “Deeper Dive” was written.

Excerpt From “The Deeper Dive: Oil More Sticky than Slippery Plus other Inflation Gushers”:

Saudi Arabia and Russia [are] cutting production for the remainder of the year to intentionally inflate prices. It is just like what we saw OPEC do in the seventies, which gave us one big headache of a recession and mountain of inflation [in what became known as the “Energy Crisis”] because those price increases lasted a few years by intention, heating up the worst inflation we had seen since the end of World War II.

In fact, it became a double spike of inflation because the Fed thought it had inflation beaten down severely enough, so it relaxed the interest-hiking battle, and inflation flared back up to become even harder to beat down in good part with fuel prices pushing it up there. So, unless the Saudis back down on the their pledge to keep production cuts in place through the end of the year and unless the oil sanctions against Russia suddenly go away, these shortages are likely to last through the year’s end and maybe beyond. It would, at least, be foolish to bet otherwise….

Now, you can play the game of pretend that everyone in financial media seems to love to play all the time now, but on what will you base the dream that these gasoline (and other fuel) prices are just a briefly passing phase? A sudden resolution to the war in Ukraine?Russia and Saudi Arabia suddenly deciding they want to be good friends to the US? Iran sanctions all being lifted and Iran deciding it wants to help the West, rather than team with its old ally Russia? New major pipelines going through under Bidenomics? Major oil fields being opened up in the US because that’s what Biden likes to see?

It seems clear to me that the fantasy thinkers are the ones who think the rise in fuel prices is not going to continue to dog us: Fuel will just cut as a break because it does that. It’s volatile. It’s just mad right now and will settle back down once it’s had a good lunch. Sure it will!…

So, the stock market and the vocal analysts were just blowing smoke when they decided to shrug off the upturn in inflation [last] week on the basis that “it’s only fuel, and fuel is like that, you know? It comes and it goes.”

Oh, I know why they think oil prices will soon come down: Maybe Biden will save us from these price increases like he did last time by tapping into the Strategic Petroleum Reserves!

Biden last year released a record amount of emergency oil supply in order to tame gasoline’s record summertime surge. This time, the administration is trying to refill the reserves as the vast caverns sit empty.

Oops. Guess not. Played that card already and pretty much used it up as much as we dare….

These fuel prices haven’t passed through their inflationary effect on other things yet, and the Fed hasn’t even finished fighting the last wave of inflation yet. It has pretty well signaled, at least, one more rate hike this year and then holding high for all of next year and that is with the inflation we’ve already had. If the fuel inflation ignites other prices, then there will come more Fed rate hikes still and longer still, and that means a LOT more time for that recession to keep building.

I’ve warned all along it would be very foolish to think this inflation battle is going to be easy, and there is nothing we can do about the rising oil costs that Biden is willing to do, given all of his anti-oil colleagues….

Maybe Slow-Mo Joe will fist bump the Saudis into loving us and cutting us a break. However, I’m inclined to think the Saudis might favor a little less dependence on their relationship with the US and seize the opportunity to hedge the hegemony by keeping their developing relations with Russia tight. Russia doesn’t tell them to stop killing journalists like we do. Heck, that’s practically a hunting sport in Russia!…

I have been saying all of this is most certainly taking us back into recession before the Fed can end its inflation fight. So, yes, “unless there is a recession” or OPEC decides to do the opposite of what it has already decided to do, prices of oil keep rising … and so do the prices of everything that uses oil for production energy or transport or as an ingredient….

That is the list without the analysis. And, of course, if there is a recession, then that fulfills all I’ve been saying about how all of this Fed tightening ends. It ends when a deep recession finally takes down inflation because inflation took down the economy … or, more specifically, forced the Fed to take down the economy … and take down stocks and the values of existing bonds stuck at historically low interest.

Let's face it: higher oil prices should cause inflation to rise, and resurging inflation is not in the Fed's game plan. Therefore, the Fed must act and could spark a hawkish tone at next week's FOMC meeting. The stock market could react negatively as tighter monetary policy is the last thing risk assets and many market participants want to see.

Yet, stocks are priced as if that is if a renewed battle against inflation is an impossibility, or not reasonably plausible or even perhaps likely … as it may be.

The S&P 500's P/E ratio is around 26 now. This ratio is relatively high, as it's been eclipsed only several times throughout history…. The mean P/E ratio is only 16, 38% lower than here.

Seems a tad top-heavy for stock prices, given high and climbing interest rates, high and climbing corporate defaults, lowering and devaluing bank reserves, Fed money destruction, major labor disputes, gross domestic income (the corollary to gross domestic product) being in recession for two quarters now, a major European-Russian war, global sanctions, an endless trade war with China, a deeply inverted yield curve, sixteen months of Leading Economic Indicators in free fall, with half of that time in the recession zone, savings from Covid stimulus programs nearly exhausted now, economic growth nearly around the world approaching or in recession, particularly in China, which helped save the world from the last recession, the appearance that the US labor market may finally be turning over, and a trio of bank defaults already in the pocket this year that contained two of the three largest bank busts in US history with Jamie Dimon, the nation’s largest banker, saying again and again that more bank busts are almost certainly on the way due to crashing commercial real-estate, then the lag time after the Fed finally stops raising rates and stops destroying money supply with QT taking, at minimum another half year to fully play out, plus all of the above things crashing into each other in chaos … and now inflation appears to be turning upward with high and coming oil prices pushing it, forcing the Fed to hike even higher and longer if that doesn’t oil doesn’t turn back down soon!

In the face of all of that, most of the nation’s leading stock brokers/analystis are saying a soft landing looks almost certain now, even though the Fed has, in the very minimum, another full year of interest at a higher level than present and plans more than a year of monthly quantitative tightening even if inflation stays down. What kind of oil-soaked cigars are they smoking?…

Obviously, at an average of $3.87, gasoline prices are not yet at the souring point. Give them a couple more months. How sour will consumers become if it looks like we have the whole inflation battle to fight again?

Yet, in today’s news, gasoline already hit $6 a gallon in LA, and oil analysts just started saying $100/barrel oil prices are likely in store soon.

From looking at what oil alone has in store for inflation during the remainder of the year (as a near certainty even if it doesn’t get all the way up to $100/barrel), the article goes on to explain the pathways by which the Fed’s quantitative squeezing, never even deployed in the Volcker Energy Crisis inflation-fighting era, is crushing banks right at the time when they are going to have to face these multiple struggles their depositors will be facing and the defaults that come with.

And we are to believe that won’t cause more bank failures?

And that more bank failures won’t cause the stock market to plunge?

And that failing banks and falling stocks won’t drive us into recession?

Sounds like a lot more fantasy to me. Not too realistic.

Then there is one REALLY MASSIVE October surprise that is a certainty to be reported in the November release of CPI data … but, you are going to have to subscribe to see that part of the “DeeperDive” along with all the analysis that supports the size of that hit, as you cannot expect me to give all of my best work away for free. I give as much as I can afford to, thanks to those who do support my work.

It will be a huge hit that is an absolute certainty because it is already baked in, yet it will take many by surprise who have no idea it is coming in November’s report for October CPI. Suffice it to say there is a major resurgence in inflation right around the bend.

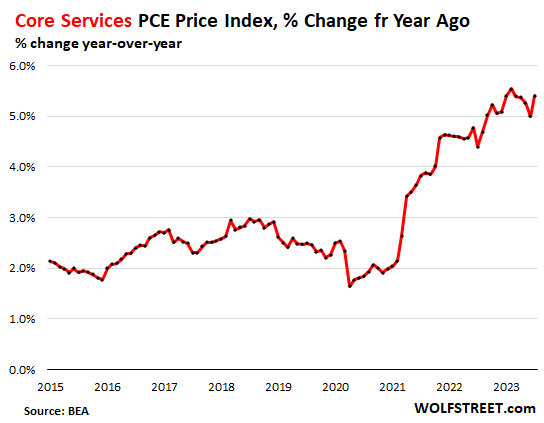

Now, if you still think the Fed has nearly won the inflation battle, look at where the Fed’s FAVORITE inflation gauge now sits:

Almost back where it began! And in just one burst!

Where do you think consumer sentiment will go when everyone realizes we are right back to where we began on the inflation battle? We’re almost there now on the gauge the Fed says counts the most.

And none of that even BEGINS to take into account the effect on inflation down the road that all of today’s headlines about massive labor-union strikes and pay upgrades will bring as CEOs and shareholders refuse to settle for comfortable profits, and pass the full cost of those cost increases, instead, along to consumers to save their robust profit margins because THEY are not about to share the gains with the workers who make the gains. They will continue to think they have a God-given right to expect 20% annual gains on their share values plus huge dividends plus astronomical salaries. Inflation Phase Two is beginning now.

Economania (national & global economic collapse + stocks & bonds)

‘No defensible argument’: Anger boils over at CEO pay among Dems & Repubs

Striking unions are impacting the economy at level not seen in decades

Stellantis could close 18 facilities under UAW deal

Americans plan to keep cutting back on spending through the holidays, new survey says

Big Bank Borrowing Rebound Seen as Sign of Alarm on Reserves

Crisis and Bailout in Ghana: The Tortuous Cycle of Sovereign Debt Defaults and Relief

The Big Employer Still Adding Jobs and Boosting Pay: Governments

Real-Estate Rubble (housing, commercial & global real-estate bubble trouble)

US Homebuilder Sentiment Drops to Five-Month Low on Higher Rates

Money Matters (monetary policy, metals, cryptos, currency wars & cashless)

Japanese Panic Buy Gold As Yen Implodes And Inflation Soars

Gold Is Doing Great -- In Other Currencies

The New Stock Market Mathematics & An Intriguing Setup In Gold

Overinflated & Underfed (too much money chasing too few goods due to weather, sanctions or other supply issues)

Gas prices hit 2023 highs as oil chugs higher

Surging Physical Oil Market Brings $100 Crude Back in Sight

Why Inflation is a Problem, and Why It’s Only Going to Get Worse with John Rubino

Wars & Rumors of War, Revolts, Hacks & Cyberattacks (+ AI threats)

Saudi Arabia suspends talks on peace deal with Israel

Iran blocks nuclear inspectors after U.S. unfreezes billions of dollars for Tehran

Analysis-Upheavals in Xi's world spread concern about China's diplomacy

Russian soldiers blow themselves up after getting drunk on resupply run

Political Pandemonium & Social Senescence (major socio-political issues & events but not campaigns)

McCarthy announces formal Biden impeachment inquiry

California Dems consider unique approach to getting Trump off ballot

Hard-right politics grow across the globe

Trump lawyer Jenna Ellis turns on ‘malignant narcissist’ ex-president

Canada’s brashest Conservative is surging in the polls

Russell Brand accused of rape, sexual assaults and abuse by 4 women including one aged just 16

Dallas’ Cathedral of Hope holds service blessing drag queens amid protests

Damnation by Domination (unelected global government, invasive government, unconstitutional government & censorship)

Will "Climate Stakeholders" Engineer an Economic Depression to Save the Planet From Global Warming?

A Pox Upon Us (the plagues, pandemics & health police of the 2020s)

CDC Admits ~120,000 Children "DIED SUDDENLY" after COVID-19 "Vaccine" Roll-out

Calamity and Catastrophe

Libya Warns More Than 20,000 Dead In Floods

Off-Beat and Off-the-Beat News

Doomer Humor