How I Struck Out and Hit a Grand Slam with the Same Swing

This is my 777th post on this blog, although a couple of those are still in draft form. With this post I get to acknowledge something almost impossible. I struck out with my last post and knocked the ball out of the park. It was tempting to pull the post this morning and revise it, leaving out the error and making it all count, but that's not how I swing.

So, first with admitting the error, then on to the grand slam:

How I struck out and almost passed out

One might say that it was my fourth swing of the bat that knocked a foul and struck out. Inflation, as measure by CPI came in hot today at 7.5% (higher than the expected 7.3%).

U.S. consumer prices rose solidly in January, leading to the biggest annual increase in inflation in 40 years.

Inflation hitting a forty-year record doesn't surprise me in the least and is not the error I'm talking about. My error was in stating that the BLS was a lying bunch of schemers who would doctor their math in order to report a slight decrease in inflation because of the certain damage a hot print would cause at what I have claimed is a highly critical juncture. To put it more exactly, I relayed the following earlier prediction I had made:

I said to expect housing prices to finally start to drive up CPI in January of 2022, just about the time when other supply factors might be maxing out, and that would make sure inflation kept rising for, at least, the first half of 2022.

"Expect the Bureau of Lying Statistics to Tell a Whopper with Thursday’s CPI"

And I noted,

They [the BLS] have zero credibility when their self-confessed margin of error is running +/- more than 100% of their typically reported jobs numbers during half of the months of last year!... So, if CPI ... does NOT come out lower than expectations on Thursday, after these adjustments or actually somehow manages to rise even under the new formulation, just imagine how bad it would have been without the new “adjustments.â€

And I said it most likely would come out lower:

When I say a “whopper of a lie,†I don’t think for a moment they will show inflation falling by 1% annually or something big like that. I assume they are smarter than that, though it’s hard to say by looking at them. They must realize any immediate plunge would raise questions. All they need is to reverse the upward trend to a small fractional decline, and bond yields will relax a little, the stock market will chill.... I suspect they will justify the change by saying it is necessary to remove undue impact from COVID.

I even noted that I had predicted...

housing prices would suddenly start showing up more significantly as part of CPI in January of 2022 because of the lag time for rents to catch up with housing prices,

...and I said...

how much do you want to bet the [promised] change in the calculus for how data is weighted has a great deal to do with wanting to reduce the weight of housing prices in the CPI once again!

Well, I was wrong. It appears they didn't do any of that. In fact, they actually increased the weight for housing prices according to the table they posted to show the changes they just made:

Shelter, fourth from the bottom, actually got a big boost, up 0.6 points.

Here is a more precise list of how all the weighting got changed in core CPI:

Even with that big boost in how much shelter (both rent and ownership) weigh in CPI, I was also wrong in saying housing prices would show up in CPI in a bigger way in January. They didn't, even with the increased weighting!

Surprisingly used cars also got a big boost, even though they have been one of the leading factors in inflation.

And, so, I fouled badly and struck out. The BLS does not appear to have attempted to rig the numbers downward.

Now, to be fair, my statements last year that it would take about about a six-month lag time for the skyrocketing inflation in housing prices of the summer to start to be reflected in rental rates and then to be picked up on by homeowners in that silly survey they fill out to guess the value of their homes if they were rented, was always approximate. With a number that subjective on part of the BLS, there is no way to know exactly when homeowners will start to realize what the rental value of their homes is. So, it was my estimate of the lag time, and I still think housing will start to rise faster in the CPI numbers (even without the change in weighting) in the months ahead.

I even said,

I’ll be more than shocked if the arrival of the new formula on Thursday takes out the lag in housing costs and puts real numbers back in place of the old owners survey of rent guesses … like we had in the seventies. I might fall over dead if that happens or have restored faith in government. I will be more than delighted to find out that I am wrong on all of this. I’ll go have a mai tai if I don’t go unconscious.

Well, they didn't do that, but I'm still surprised. Clearly my view of how dastardly the BLS is a bit jaded, and that's why I usually try to avoid conspiracy theories. Here, of all times, they had a great need to doctor the numbers, and it does not appear they did.

Well ... hold on a minute!

No, I'm not quite convinced of that, so I won't have the mai tai in celebration of the honesty of my government because I have some real concerns about why they seriously stepped down the weight for food and energy -- two areas of especially high price inflation right now that are set to rise a lot more (as I'll show in another post soon). Reducing their weighting reduces their influence on CPI, and I have to wonder how that is justified. With food prices having added 0.9 points to inflation in January, imagine how much they would have added if the weighting had not been reduced! While housing, being adjusted up in weight, added only 0.3. Oh, and electricity jumped 4.2%. Imagine if the weight in energy factored into CPI had not been downgraded!

Are people suddenly less hungry? Eating less? Has food become a much less significant part of their budget? And what about those energy prices? Are we all driving our cars less? Care less about that huge jump in gasoline prices at the pump? Do we not mind the rise in electricity during this cold winter? It certainly all leaves room to wonder if the BLS made the cuts in food and energy because, as we all know, those items are coming in scorching hot. To cut the weight of those items, they would have to increase the percentage weight of something else to remain at 100% total contribution. I wonder if they made room for that by boosting the weight of housing costs because they haven't seen high numbers come filtering through yet in OER, so they think (mistakenly I suspect) that they're in the clear there.

Hmmm.

Well, whatever their reasons, they are stuck with those weights for the next two years. (Reading up more on their methodology, I learned that is why they went back and adjusted from two years ago: they recalibrate their weighting table every two years, so it wasn't about getting around COVID as I had also suggested.)

However, their not doctoring the numbers in any way that actually brought the CPI rate down, letting it, instead, rise even above expectations (though they might have kept it from rising more), is also where I hit a home run with the bases loaded.

Want to see how I pulled that off?

How I hit a grand slam by hitting fowl

It turned out the fowl I hit on that fourth swing was a low-flying goose! Yes, I did actually knock the ball out of bounds, but somehow it hit a light post and flew out of the park striking fowl on the way out. I may have knocked a big goose egg out of it on all of the above, but I also cleared the bases on what really counts.

You see, while I appear to have missed in my jaded view of the BLS as a bunch of liars who would seize the opportunity afforded by their biennial reweighting calculations to save us all miraculously from inflation, what I said would happen to markets if they did not rewrite the equation, couldn't have proven more spectacularly true.

First, I quoted Morgan Stanley as saying,

A Miss In January CPI Is All That Can Save Government Bonds… US 10Y Yields are fast approaching the critical 2.00% level, which will likely be taken out as soon as we see a sustained push above 1.95%.... Thursday’s CPI report will be critical in setting at least the near-term trajectory of yields.

"Expect the Bureau of Lying Statistics to Tell a Whopper with Thursday’s CPI"

Then I used a graph to point out how the 10YR had just hit 1.96% hours after Morgan Stanley's note to point out how that set the 10YR poised above Morgan Stanley's threshold for creating momentum to hit 2.0% in a hurry:

The escalation in government bond yields due to inflation is happening so quickly and sits at such a critical juncture that Morgan Stanley believes the tipping point will be Thursday’s CPI print. If it comes in low, bonds can take a breather. If it comes in hot, look out below!...

So much depends on Thursday’s CPI.

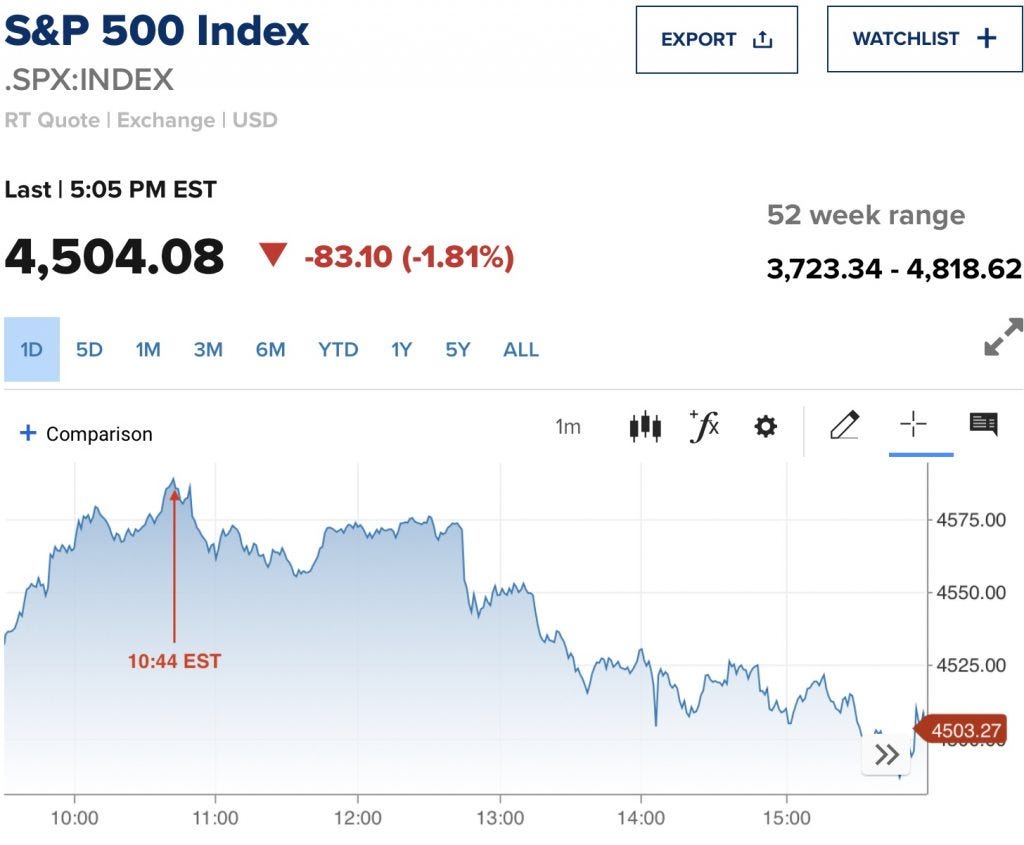

And here we are! Bonds leaped straight up from that 1.96% level at the opening, smacked their head on the 2% glass ceiling over our ballpark and slumped back down, looking dizzy for a bit. Then, about an hour later, the bond vigilantes shook it all off and tried another run at ceiling and smashed through the glass for good (for the day anyway). The big bond breakthrough happened at exactly 10:44 EST, and stocks started to fall at exactly 10:44 EST and went right on down the rest of the day, barely even attempting to regain their ever-so-brief AM poke above null as yields kept climbing:

So, indeed, busting through the 2.0% level in bonds meant look out below in stocks. The move and the response in stocks were both decisive and clear. The S&P fell through the day, busting below its benchmark 4500 level and barely managed to grab a toe-hold there at the end of the day at 4504 (down 1.8%).

I also noted,

I just laid out in a huge Patron Post, how massive and broad in impact a bust of the bond bubble will be (WAY beyond what you might imagine, dwarfing anything that happens in stocks) and how very close we are to it.

So, serious bond action was also imminent as stated, and we're even closer now because, as others, even at the Fed, started pointing out today, this hot inflation print gave a huge boost of adrenaline to the Fed's fear that it needs to tighten even faster and harder. St. Louis Fed President James Bullard, said the Fed now has more reason than ever to jolt markets with an initial 50-basis-point hike in March and maybe even an intra-meeting hike between now and March and to start quantitive tightening (balance sheet reduction) in the second quarter, rather than the third:

St. Louis Federal Reserve President James Bullard said on Thursday that he has become "dramatically" more hawkish in light of the hottest inflation reading in nearly 40 years, and he now wants a full percentage point of interest rate hikes over the next three U.S. central bank policy meetings.

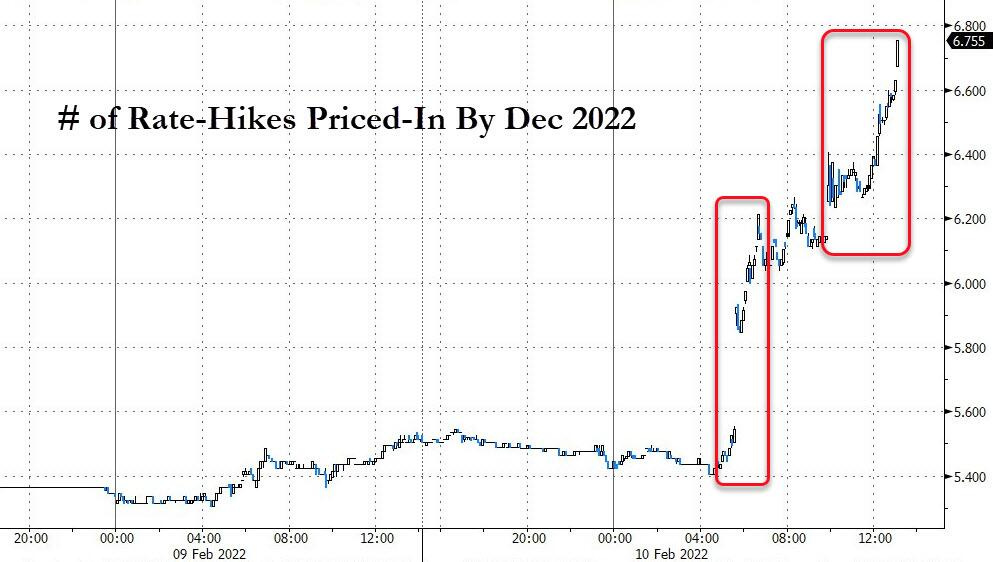

Within minutes, Bullard's view became the market's view, with rate futures contracts now fully pricing an increase in the Fed's target range for its policy rate to 1%-1.25% by the end of its policy meeting in June, with some bets on an even steeper rate hike path.

"I'd like to see 100 basis points in the bag by July 1...."

Before Thursday, most economists and analysts had expected the Fed to move only in regular quarter-percentage-point increments.

Getting so hawkish out there. @TimDuy says Fed is deeply behind curve on inflation, adds "I would not be surprised by an intermeeting move either tomorrow Friday or by Monday. I know, this is crazy aggressive."

— Michael S. Derby (@michaelsderby) February 10, 2022

Everything exploded so quickly with today's CPI uptick -- diminished from what it could have been as it was by the down-weighting of food and energy -- that the market has already price in a 75% chance of seven rate hikes this year:

Zero Hedge also noted that betting on the Fed Funds Rate hit its highest level ever today:

And mortgage rates finally tapped a hair shy of 4% today:

And all because of inflation, which is why I started telling my patrons many months ago to keep their eyes on inflation as the number-one thing and to know that when it started to force the Fed to move faster, as it certainly would, that is when to expect a crash in stocks ... and why that would be so. I set the timing, not by date, but by the alignment of those events with the certainty of betting my blog as the seal on my belief that this alignment would become perfect not that far away. You don't get more perfect correlation between inflation, bonds and stocks than today brought ... right to the minute, shockingly fast and breathtakingly steep!

You may want to learn about that bond bubble to see where all this goes. The connection with stocks was the part I said would happen first once the bond vigilantes got going.

They're going!

The stock bubble, the bond bubble (along with its sub-bubble, the zombie corporation bubble), and the housing bubble are all major parts of the economy that central banks directly inflated with their profligate monetary whoring that will all deflate catastrophically when the hot air blown into their love dolls is taken away. These bubbles constitute the “Everything Bubble....†I want to focus on what a bursting bond bubble would look like and the evidence that we are in one that is already blowing up.... The bond bubble collapse described here is just the core implosion in the Everything Bubble supernova that will be blowing up around the same time because the other bubbles have strong, interacting "bonds" with the core.... The interaction of other markets with bond rates is why we have already seen stocks starting down into a bear market of their own.... [but] stock market crashes ... are mere solar flares compared to the core implosion of a global bond bubble.... Expect the repricing of bonds to happen quickly (in a realm of normally glacial moves in interest) and yield curves to flatten quickly and all of that to roil a lot of markets.... The battle is engaged!

"Patron Post: The Everything Bubble Bust Pt. 3: The Big Bond Blowup"