The Great Inflationary Train Wreck is Here

I've bet my blog on my prediction that inflation will crash both the economy and the stock market, saying I believe with enough conviction that I'll stop writing on economics if it fails to happen. Why? Because I wouldn't want to be one of those doom-porn writers who keeps going even after major misses, and because I have track record to keep.

Stocks could be the first car in this great train wreck

While the Fed is the locomotive in this inflationary disaster, stocks may be the first car behind the Fed to jump the rails. I have believed the stock market would be the caboose in the inflation train wreck, but it is already showing signs its wheels are coming off. The market may, of course, pull itself back together and hang on for the end of the ride, winding up the caboose after all. However, since J. Powell spoke to congress, the market is banging around pretty hard.

MarketWatch noted on Monday that all components in the Dow fell, taking the Dow on its biggest plunge (725 points) since last October. And that is after a drop of about 300 points on the previous trading day, leaving the Dow down more than a thousand points in two days. Still, there is nothing to stop it from bouncing back onto the track, and I've certainly never said the market will be the first car in the inflation pileup.

In just the short time since Powell admitted to congress that inflation is hot and more persistent than he thought it would be, the S&P has fallen almost all the way back down to that 4200 level that had held as its firm ceiling for almost two months barely a month ago. So, it looks like its breakout may fail to hold. That level, however, offers strong technical support:

Reasons given for the market's failing are both COVID (hardly a surprise that it would have more punches to throw) and rising inflation expectations (and realizations).

Yes, The Correction Just Started

The S&P 500/SPX (SP500) is in a vulnerable position and is at risk of moving substantially lower in the coming days or weeks.... The bottom line is that the technical image has been overheated for a while and is now worsening. The fundamental landscape suggests that a slowdown in growth is approaching at a time of sky-high valuations and overvalued equities. The result should culminate in a moderate pullback or a correction of 10% or greater.

That's just one more person's opinion like my own, but what I want to bring out is that he goes on to lay out how the technical considerations in market charts are starting to look wobbly. If you want the technicals, there is an article to fill your appetite with plenty of solid material.

Even good news could not keep the markets from falling to inflation:

Stocks fell Friday to push the major market indexes into the red for the week, as rising concerns over inflation outweighed strong retail sales data and better than expected quarterly earnings reports from the big U.S. banks. The major market averages all snapped three-week winning streaks, with the Dow dropping 0.5%, the S&P 500 slipping nearly 1% and the Nasdaq Composite closing 1.8% lower. But the bond market continues to buck inflation fears.

Treasuries tell no tales

Treasury yields (and bonds in general) are plummeting, as MarketWatch noted, and some may ask, based on old-school theories about bonds pricing in inflation, if that doesn't mean inflation is on its way out the back door. Nay. The old-school theories were right for their time, but in their time the Fed was not buying trillions of dollars of treasuries. As the Fed sucks up $120-billion in securities per month, most of them US treasuries, across all maturities, it forces yields to fall by consuming more than half the total treasury market. By deciding how much of each maturity date it buys, the Fed also controls the yield curve. I wrote a Patron Post many months ago to warn you this was likely coming: "The Great Yield Curve Control Conundrum."

The days of price discovery were destroyed by the Fed over the past ten years, but any information prices might have still carried was thoroughly crushed into the ground over the past year as the Fed pushed the throttle forward from its prior massive levels of QE by another 50%, holding it there for the full year. As I wrote in another article recently, he who corners the market sets the price. (And with bonds that means "sets the yield" as well because that is how they work.)

Many have noted recently that the big reason for the bond sell-off is that bond investors believe that the Fed, regardless of inflation, is going to have to go for even more economic stimulus (likely meaning even more inflation), and more bond buying will equal even lower bond yields (higher bond prices) in the future. And bond speculators make good money by selling existing bonds they hold with higher yields (lower original prices) into lower-yield markets (high-priced markets).

That still comes down to everything happening in bonds being based on what speculators believe the Fed is going to do, more than on what inflation is going to do. So, don't trust the bond market to reflect inflation this time around. No true bond market exists anymore. And don't expect the yield curve to reflect a coming recession either. It did last year, but that was before the Fed went back into its greatest QE acceleration in history.

One could even make the argument that investors believe the stock market is going to crash and are running for cover in US treasuries, thinking negative real yields are still better than what they think the next few months in stocks have to offer.

Why? Because the inflation boiler is glowing cherry red and will melt away corporate earnings, causing the stock market a lot deeper troubles and blowing up the economy. It is one thing for stock traders to maintain a bullish narrative when earnings are rapidly rising during a time of high Fed stimulus (an easy tale to tell), but a tougher sell if earnings are plunging even during high Fed stimulus, while the market is already wobbling. It all looks a little like the trestle this train has climbed upon could come down.

Here are some of those details as to how inflation is already damaging the economy and, hence, the stock market's underpinnings:

The sales car is off the rails

If there were a convention of salespeople traveling in a car together on this train, they'd be having a very bumpy ride because their car has already derailed. Inflation is already cutting into sales, which enjoyed a couple of upward bursts earlier in the year causing the convention to party:

US Retail Sales Surprise To The Upside After Big Downward Revision, Auto Sales Slump

Having consistently 'nailed it' over the past few months, BofA's forecast ahead of today's retail sales data was ominous, suggesting a "marked slowdown...." For the first time this year, they were wrong as headline retail sales rose.... However, the big June jump is offset by a big downward revision in May....

After a big boom in March, the last three months data averages flat. Dead in the water, and ...

On a YoY basis, given the base effect is waning, headline and core sales growth is sliding fast…. Under the surface, motor vehicles sales (supply chain bottlenecks?), furniture (as good as it gets as the economy reopened) and building materials (crashing lumber prices? or demand?) were the biggest losers…

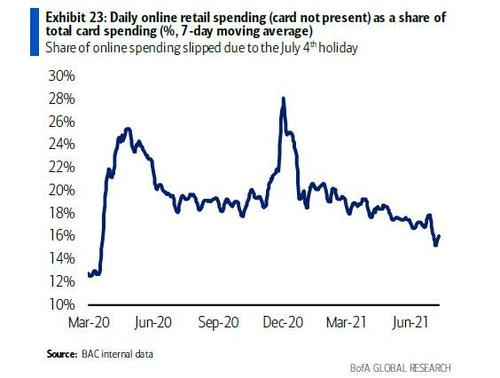

Those sales are measured in dollars, not units sold, so, of course, a drop in a few prices, such as lumber, could cause the sales numbers for those particular items to go down. However, we know most prices have been rising quickly of late, and yet, look at what is happening as a trend in online retail all year long:

That is just a measure of the percentage of credit card sales (in dollars) that have been spent online. It could, of course, be that more people are shopping in retail stores or eating at restaurants. A rise in other areas would cause the same downtrend in the percentage of total sales that are online.

But here is a graph that says the inflation that appears to be eating away at sales, which the Fed says (and I agree in part) is due to supply-chain bottlenecks, is not going away anytime soon (which the Fed doesn't say but I do):

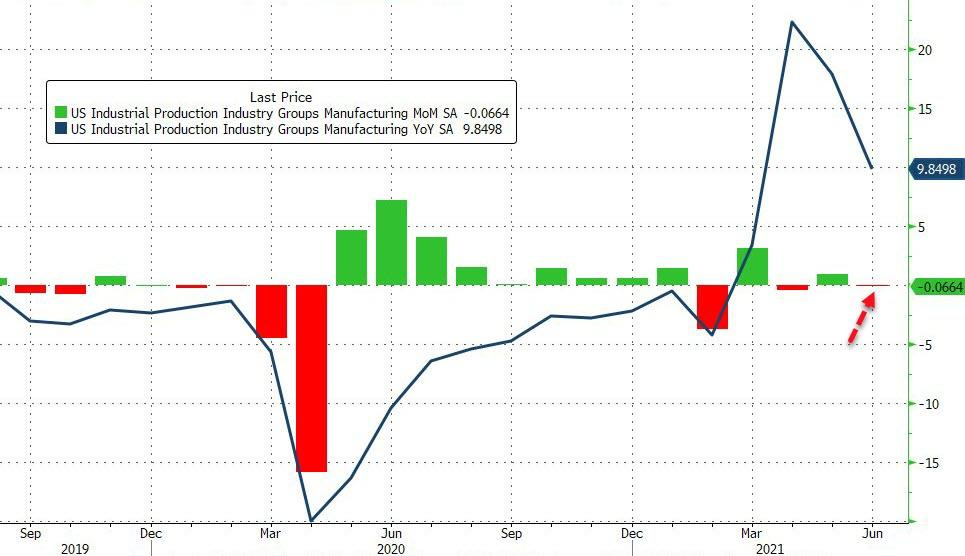

With inventories at extremely longterm lows, as shown above, relative even to very weak sales, the supply shortage isn't about to go away anytime soon! You can kiss the Fed's "transitory" argument good-bye. Neither does US manufacturing look like it is applying more steam to try to jump that inventory gap:

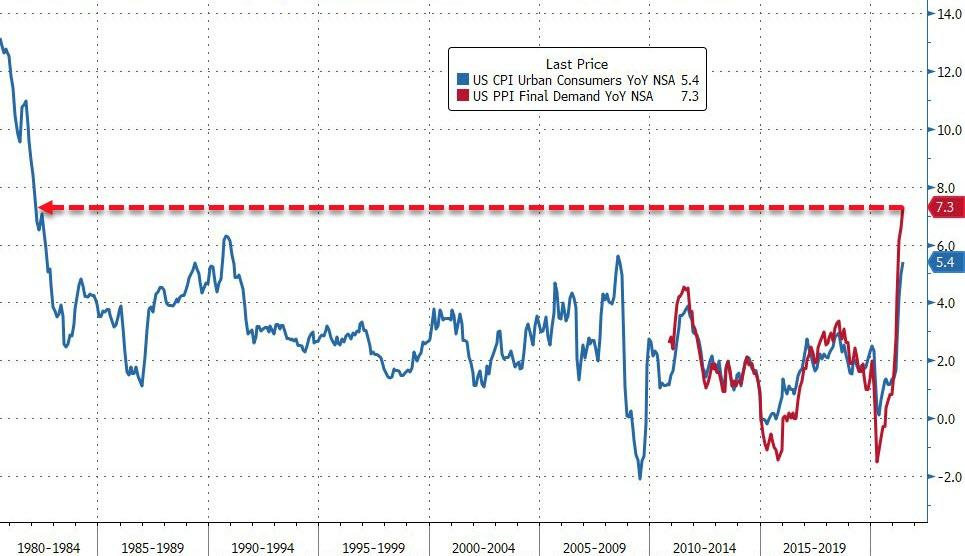

At the same time, on the pressure side of this inflationary steam engine, producer prices continue to soar even faster than consumer prices are catching up: (And it has also been a long time since we've seen anything like this.)

As a result of those higher input prices, corporations face lower profit margins:

How long will stocks be able to hold out against stagnant product demand and falling profit margins?

A sedimental journey

It's not just sales that are down; consumer moods are settling quickly. Consumer sentiment has fallen off a cliff that is only equaled by the great plunge it took last year as we plummeted into the COVIDcrash, going back to the Great Recession:

That is not a pretty picture!

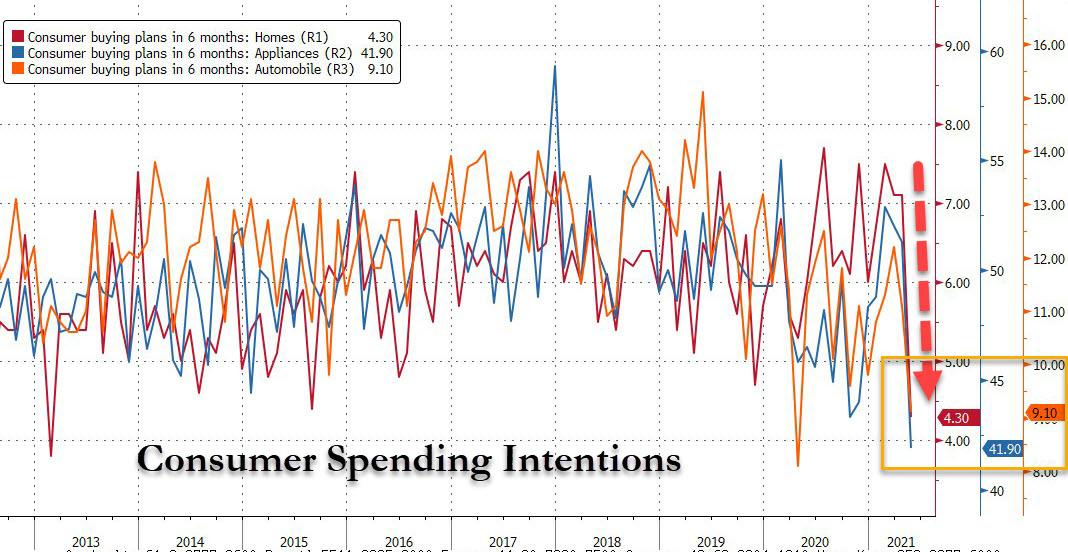

Homes, where consumer inflation has been the worst for just about anything except lumber, have seen the biggest retreat in interested buyers, even though low inventory is still pushing prices higher in spite of the fall-off in demand:

With that all-out crash in home-buyer sentiment, home-builder sentiment is finally capitulating and turning the same direction. With prices staying high and cost of construction still quit high, you can guess which trend will prevail for homebuilders -- the recent up trend or the even more recent downtrend that is following buyers:

While the Fed says inflation is transitory, you can see in the following long-reputable survey that consumers are not buying that at all. What they believe is coming a year from now looks like the bridge is out up ahead:

Richard Curtin, Director of Consumer Sentiment Surveys at University of Michigan, opines that it is time for the Fed to switch to another track:

"Rather than job creation, halting and reversing an accelerating inflation rate has now become a top concern." As Curtin adds, "Inflation has put added pressure on living standards, especially on lower and middle income households, and caused postponement of large discretionary purchases, especially among upper income households."

Inflation is, in other words, a runaway train heading toward a bridge that is out, so the Fed better change tracks.

It gets worse because as the UMich director notes next, "consumers’ complaints about rising prices on homes, vehicles, and household durables has reached an all-time record."

The passengers on the train are already screaming, and I've already talked about what happens when consumer expectations of longterm inflation set in. It sounds like we are there. Inflation becomes its own vortex as workers demand higher wages to meet the inflation they expect. While sales have stagnated to where they have averaged no net rise across the last three months, they have not yet started to fall. Curtin has a warning about that, too:

The mask will quickly fall away however, giving way to a full blown stagflation in early 2022, if inflation is not transitory, and here is Curtin admitting just that: "the precautionary impulse will quickly fade if the “transitory†spike in inflation extended into 2022." Meanwhile, "resurgent consumer spending propelled by fiscal stimulus is likely to increase inflation" while "small policy steps could now have a large impact on ending inflationary psychology."

Powell made abundantly clear in his testimony to congress last week that those policy steps are NOT now coming.

It could get worse:

"The factors that now underlie the recent surge in inflation are quite unique. A rising inflation in the months ahead may convince consumers that they underestimated its eventual rise, causing them to revise how high it will climb and how long the inflation runup will last."

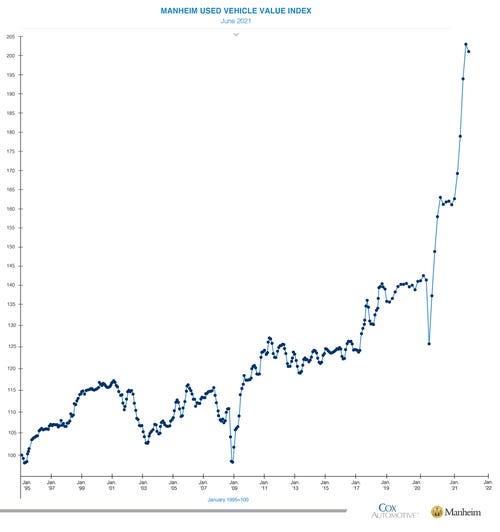

Just for fun, have you tried buying a used car lately? Oh look, prices are coming down just like Powell said they would (but you have to squint to see it):

Waaay up there on the oxygen deprived summit of Mount Everest.

Conclusion

The Fed with its one-track mind is barreling down the rails at a rate of 336 mph (Millions Per Hour in dollars of bond purchases) while government spending is traveling at 875 mph (Millions Per Hour in dollar spending). A train wreck at those velocities is bad enough, but a train wreck off a washed out bridge suffers a particularly nasty landing: (You don't even need words to anticipate how bad it will be. You can feel it coming.)

Well that was fun, but don't expect the Fed's Loan Arranger to save you.