High Inflation and High Job Losses Flare up together with a Sudden Intense Burn Rate

Just as people are getting burned by losing jobs, their money is also burning up!

One commentator in a video posted below says the jobs report is “so bad that it’s hard to believe.” Zero Hedge called it a “five-sigma miss.” (Of course, they tend to overstate their sigmas in that a five-sigma miss would be something that happens only once in the lifetime of the sun or something like that, but still … strong point made.)

Economists were expecting find another 100k jobs were created based on today’s report, but we got 33k in net job destruction, instead, while the numbers from the last report were revised down in addition to this bad news. So much for “the economy is strong and resilient” or the idea that recession is a 25% risk down the road.

Of course, one mainstream financial writer says wistfully that the ADP report is often off from the government report, so it doesn’t mean that much. I’d note that the ADP report is actual payroll data, while the government report is largely extrapolated and seasonally adjusted; so, of course, the ADP report is often off from the BLS report because the Bureau of Lying Statistics is … well … government. It is not the benchmark of accuracy because it is government; it has a vested interest in skewing everything to the positive because it is government, and all US governments know none gets elected if it precedes over deteriorating jobs in a recession.

Even if government analysts are not outright lying because they intend to be honest (big IF to give them the benefit of the doubt), when you know the big boss will get revenge on you—especially as the current big boss tends to do all the time—you are going to be very careful to make sure that anything that makes the government look bad is vetted and revetted to make certain every argument you an find requires you to publish it; while that which makes the government look good is going to be readily accepted. Your future promotion requires you to be able to justify every report that makes the administration you serve look bad; while no one you work for will dismiss your positive reports. So, you can be sure there is, in the very least, some strong bias built in if not outright goal-searching—especially in all those “seasonal adjustments,” which offer a lot of room for guesswork and ideology.

So, yes, the government report later this week probably will come in better than the ADP report, which has just been described as “the biggest drop in service-provider jobs since the Covid lockdowns.” That makes it even worse because the service sector has been the holdout on changes in unemployment. It is where the gains have been as the manufacturing sector has been struggling under a manufacturing recession for more than two years. And, of course, the rosey-glasses economists—many of whom work for the government and others of whom work for companies with stocks to sell—always like to say, “Well, the manufacturing sector doesn’t really matter that much because we are more of a services-oriented economy now.” Well, they no longer have that argument.

I am going to leave the details of the jobs report news for my Deeper Dive because then both reports will be out, and I can do the deeper digging and compare and contrast the quality of the numbers. My hunch now is that deeper digging will reveal that the huge decline in jobs into actual recessionary deterioration will start to show up now in the parabolic unemployment upturn I’ve said was likely. I think the digging may also reveal that the DOGE cuts and the domino effects from those to other jobs, as well as corporate reluctance to hire in the face of all the tariff chaos and loss of export trade (as already reported), is now streaming into the actual labor statistics as I said we could expect to see.

(I originally said you’d start to see it in late March, but then the courts shortstopped much of the political action that I said would cause that, so the timeframe got pushed back because the cause got pushed back. Since then, the Supreme Court has opened things up for the president and DOGE to continue, and tariffs are starting to take their actual toll by making the US trade deficit WORSE. That, I think, is what a Deeper Dive for my paying subscribers will show.)

High inflation is arriving onshore on shelves already

Now, for the meat of this editorial, I want to follow up on my latest editorial about tariffs destroying the dollar and raising inflation to a few articles today that reveal the start of that happening … right when I said you’d start to see it on the shelves, though not yet in the government stats.

First, to the inflation, we have an article today that is not based on government reports at all, but based on a commercial price survey of what is actually happening on shelves, and it shows how the price action on shelves is happening exactly with the timing I said—a little trickle from a few items since tariffs began, moving upward much more noticeably as we neared the start of summer.

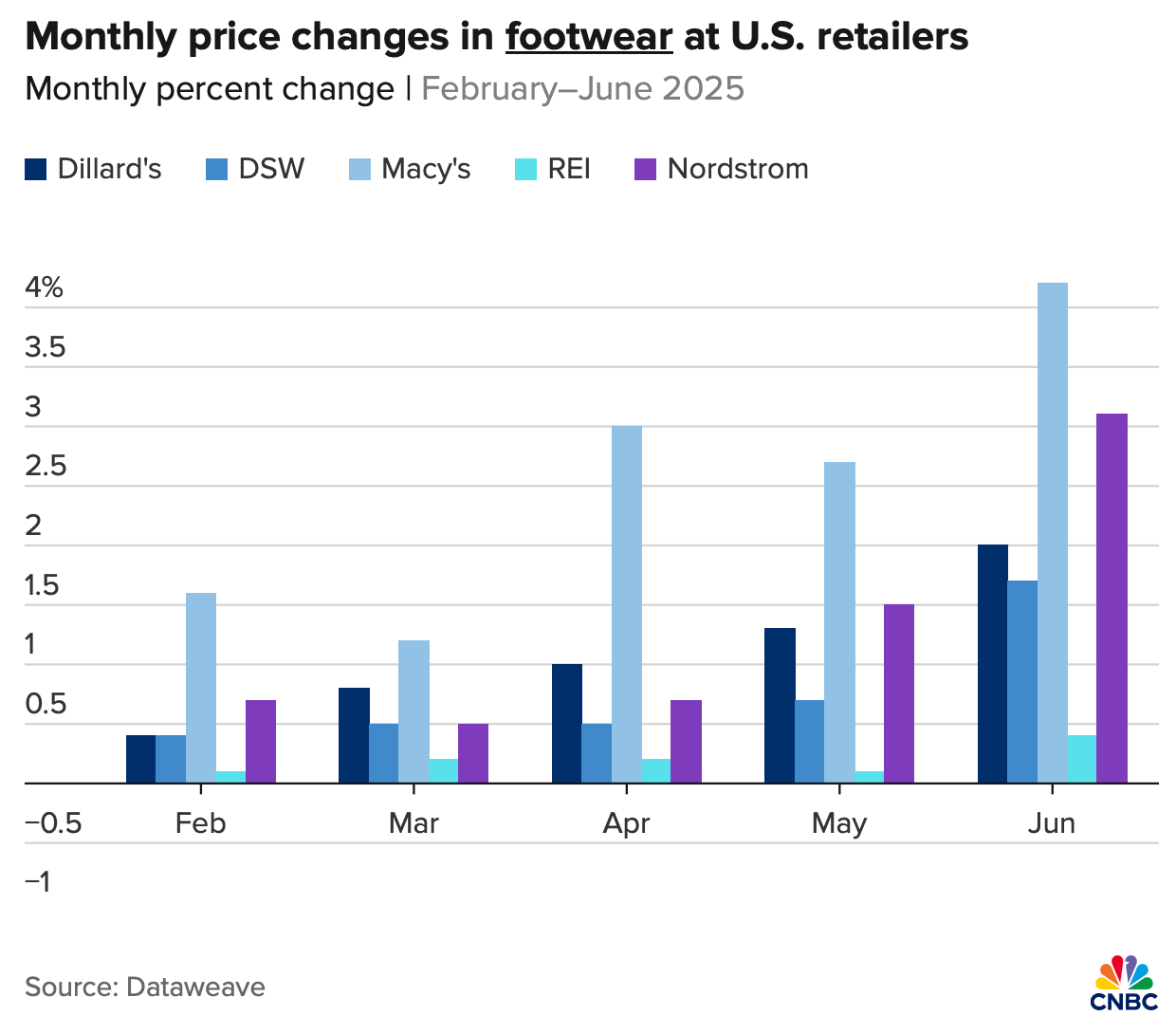

Here is a graph that shows what has happened:

And here is another:

And, yet, another:

What do all these items have in common? They are the kinds of clothing/accesory items that tend to be manufactured in sweatshops in China or Vietnam (where the president just completed a higher-tariff deal today—more on that below). The Chinese tariffs were the first to come in as a closed deal substantially higher than where they had settled, and you can see that the price pressures in March and April, when the tariffs were first placed and pulled and then replaced, remained fairly low; but as we moved into May they started to become a little more substantial, and in June they became notably and broadly spread enough that consumers will be feeling them, even though they will not appear right away in government reports just because of the lag time in getting the reports out.

Now, the Fed, which has said repeatedly that tariffs will be inflationary, as been wrestling with the question of whether said inflation will be a one-time jolt and then done as soon as the tariffs hit or continual; but I think the former is a ridiculous hope. First of all, the above graphs show the tariff impacts are creeping in just as I said, as tariffed products make it to the shelves, and they are hitting different retailers at different times. That is inevitable because some retailers will have a lot more stock in inventory of some items than other retailers, and some will order at different times. So, there will be a spread of months over which retailers in increasing numbers will begin to stock shelves from warehoused inventory that was actually bought under the tariffs.

Secondly, this inflation has huge resistance. Consumers are fed up with inflation, and are likely to strike against price hikes by moving to cheaper products or other retailers or other service providers or even completely different products as substitutes, such as chicken, instead of beef. So, companies, which have experienced huge profits in recent years to a point where they can afford (and have returned to) massive stock buybacks, have a lot of cash cushion. Still, that is some companies more than others.

All are reluctant to lose market share, so they will soften the tariffs with their cash cushion to the extent they have to, carefully feeling their way into price adjustments. Still, some, such as even price-champion Walmart, have warned the nation they WILL be raising prices. They cannot absorb it all, or they are not willing to absorb any more than they must because they love those stock buybacks that enrich the executives massively.

So, here is how that will play out: They will raise prices at every price point where they see an opportunity to do so. They will test the market with a few price increases here or there to see how much price elasticity there is right now for different products. BUT the price back-pressure from the tariffs is massive, so it will be pressurizing prices for as many YEARS as those tariffs keep import costs way up. Retailers will keep looking for a way to recapture their profits.

What you may also see is corporate buyouts by companies with cash to burn, done to take away competition in order to make it easier to raise prices—buyouts of companies that burn themselves out first, trying to hold out against price rises as long as they can without the strength to hold out long enough until they have to start raising prices and wind up losing customers … or they see the writing on the wall and choose to sell before they lose customers so they still have something to sell.

That all means there is a LOT of price pain coming to businesses from these tariffs, but over time companies will be increasingly become strained to pass the pain along, and they will wherever they find moments of opportunity to lift a price. So, NO, this will not be “one-and-done.” Trump plans for the tariffs to last throughout his four years; so, until his tariff wars completely blow up in his face so that he has to retreat (play ultimate TACO and blame it all on Biden), you are going to keep seeing intense price pressure on businesses. That will, in the very least, slowly keep seeping through to consumers. And it may come through a lot quicker than that, depending on how quickly the competition caves in and many other factors I’ve talked about pile onto the tariffs.

From that article with these early headline results (listed in the headlines that follow for paying subscribers), we read …

Tracking of recent price hikes in apparel, footwear, and bags across major U.S. department store chain websites shows the accelerating impact of tariffs. May was the turning point, according to a Dataweave analysis of prices from Macy’s, Nordstrom, Dillard’s and other chains.

Because those are the kinds of items frequently manufactured in cheap sweatshops in places like China and Vietnam, those are the things where you might expect to see price increases first on shelves, and they are, in fact, coming in right on the cusp of my early summer prediction—even a little sooner for those frontrunners in cheap manufacturing, which tend to be high-demand, label-dominated brands. There is clearly not much resistance shown there in passing the price increases on to the customer.

“Companies are mitigating what they can and are passing on the rest,” Bill Simon, former CEO of Walmart, tells CNBC.

That is EXACTLY what he told the entire world he would do, as reported here a month or more ago. The Trumpette mouthpieces of the president, of course, have continued to say tariffs will not cause that kind of inflation—that Walmart doesn’t know what it is talking about or wouldn’t actually have the guts or ability to do that—and Trump said he’d be watching them closely. Zero Hedge has even maintained that line. Well, they are doing it, and they are telling you about it. So, that was all naysayer nonsense. Simon assured customers back then that Walmart was doing all it could to negotiate its suppliers down and to absorb what it could, but there would be price increases for certain, even with all of that effort.

First evidence of Team Trump’s lies or errors

Now, we come to that great trade deal announced by the president today: You know, the one that investors were betting would keep tariffs down because surely the president would be negotiating lower-tariff deals. I’ve pointed out relentlessly how COMPLETELY STUPID that fantasy is because Trump has told them all along the way that the best deals are ones where the US gets to place very high tariffs on its imports from other nations, which he says those nations will have to pay, while gets very low tariffs placed on its products. (Also brain-rot nonsense.)

Well, here we have it:

The Vietnam trade deal announced by President Trump on Wednesday would result in a minimum 30% in total tariffs on Vietnamese goods, and potentially more than double that rate for goods that are finished in Vietnam but originate from China.

Thirty percent! That’s massive. Imagine how much price pressure that will create in the US. And, yes, the president is bragging about it as a great deal because apparently he and his team are such clowns they believe their own drivel about how other nations will pay for the US tariffs.

Even Wolf Richter keeps sounding like tariffs will not result in significant inflation. While I respect him quite a bit, I have no idea where he gets that idea. Maybe he voted for Trump or realizes most of readers voted for Trump. Regardless, the timing of the inflation arrival is happening right on the schedule I’ve been giving:

The impact of President Donald Trump’s tariffs on prices throughout the economy is expected to increase over the summer. At U.S. department store chains including Macy’s, Nordstrom, and Dillard’s, the evidence of sticker price inflation is starting to show up across more items.

… and right on the schedule that Walmart’s CEO promised. So, are you going to believe Team Trump when they keep LYING to you (or, in the very least, vomiting out their ignorant beliefs as “alternative facts”)? There is the evidence. What more do you need?

Recent price increases in apparel, footwear, and bags across major U.S. department-store websites tracked by DataWeave indicate a turning point in May, when prices started their ascent.

That sure didn’t take long for those particular products. I have said, since Trump got elected, there would be a few product leaders that would show up for inflation ahead of the pack, and that is what this is—the initial pre-summer trickle. There is plenty more in store!

DataWeave analyzes nearly 15,000 SKUs (stock keeping units), a scannable code retailers use to identify and track a product, and has been collecting that data from January to June for signs of price hikes in footwear, apparel, and bags.

You can see examples of the results in those graphs. Some prices have seen a 4% increase. Now consider this: Those are monthly price increases, and the amount of each monthly increase has continued to grow higher than the previous month’s increase. Annualized as those increases aggregate over the course of a year—if the numbers keep coming in like this—that is going to be some very intense inflation (as I warned it might be), and we’re barely getting started!

So, as I indicated weeks back,

Type of product and its sourcing can influence how fast the price hikes arrive.

Private-label lines, many of which are made in China, refresh every few months, so retailers like Macy’s and Nordstrom feel higher landed costs sooner

That means this inflation will spread across time, as it takes on more products and more sources and as Trump finalizes more of his tariffs above his current baseline, and as those things slowly make their way across the ocean, through the ports, into warehouses and finally onto shelves. And, yet, it is all happening right on the schedule I’ve alerted you to expect.

Footwear reacts fastest because it carries some of the steepest baseline duties and relies heavily on China for finished pairs. “Even a modest levy can ripple through quickly once fresh stock lands in distribution centers,” Bettadapura said. Apparel, with longer design cycles and a more diversified supply base, “is moving more gradually,” she added.

And, yet, obviously not THAT gradually!

The retailers have been warning you, as I diligently reported in contradiction to the Team Trump lies (or grossly negligent errors), and those retailers they are still warning you:

55% of respondents said they expect their average retail price to rise between 6%-10% in 2025 as a result of tariffs.

Believe them! This is happening! It won’t show up right away in the government inflation reports, but this private report clearly shows it is happening exactly as products hit the shelves.

“With all back-to-school styles now facing tariffs of between 10-30 percent, higher prices should not be a surprise this summer,” said Stephen Lamar, CEO of the American Apparel and Footwear Association. “While each company makes their own decisions, these tariff costs are now being felt across the board,” he said.

It’s happening.

And this is just the early start.

(So, I hope a few people who cancelled their paid subscriptions because they got sick and tired of me spouting against Trump will reconsider their decisions and say, “Do I REALLY want to punish the person who, against his own financial interests, gave me the hard truth?” Whether they do or not, however, I will continue my, perhaps suicidal, mission.)

Higher for longer … much longer

Where that goes from here, we haven’t even begun to see because the tariff deals have barely started to happen, and the are coming in hot when they do.

“If these tariffs persist or increase after July 9, we can expect more of the same in the seasons to come,” Lamar said.

And, of course, they will continue and will increase because Trump keeps telling market analysts—unwilling as they have been to recognize the truth—that he intends to get as high a tariff as he can negotiate on our imports while helping other nations keep their tariffs (paid by their consumers) as low as possible (though that is not quite the way he phrases it, but that IS how it works out).

Trump has been non-committal recently on sticking to the July 9 deadline his White House set for tariff deals with many trading partners or implement additional tariffs. The White House announced on Wednesday morning it has a trade deal with one key retail manufacturing partner, Vietnam.

While you can expect a little more TACO sauce on his deadline, he is still leaning in hard on the highest tariffs he can extract.

Trump said in a social post the tariff rate on Vietnamese goods will be 20%, and go to 40% for any goods that are finished in Vietnam but originate in other countries, such as China, in what is called “transshipment,” a supply chain strategy also known as “China Plus One” that has been used by companies to avoid tariffs.

That’s what he said, but according to this article, the final deal actually came in at 30%. Why? Because he’s adding the tariffs he negotiates to the baseline 10% tariff. That is because he wants the highest tariffs he can wring out of them. At least, he says he is wringing out of them because THEY WILL PAY, but the data just collected and the quotes just quoted from major retailers shows YOU WILL PAY.

The 20% tariff would be less than Trump’s initial threat of a 46% tariff on goods from Vietnam, but would be stacked on top of existing 10% most-favored nation tariffs paid by Vietnam, bringing the combined tariff to as high as 30% at a minimum, which could cause significant economic challenges for retailers.

So, the stock market sounded like it was stupidly thinking tariffs would remain at 10% or, worst-case scenario in investors’ opiated brains (who don’t read here because they hate to hear what they hate to hear), 20%. However, the real deal turns out, according to this article anyway, to be that Trump stacked the the baseline that impacts everyone everywhere and the negotiated nation-specific tariff in order to raise prices by 30% to our business people.

While I don’t know if that is the accurate take because I see articles both ways today, I think it is. If so, you better hope retailers forego their usual path of applying their normal markup to all cost increases, or the tariff impact will be even worse on the shelves. (I imagine they will avoid that for quite awhile for the reasons I gave above, but eventually, they work things through so that their entire cost for each product gets the same high markup as always.)

“Disrupting that pipeline with additional tariffs would hit American consumers and our industry hard,” FDRA CEO Matt Priest said in a statement on Wednesday calling the Vietnam tariff agreement as “unnecessary” and “bad economics.”

Well, that’s true, but it’s also irrelevant because tariff-caused price increases are coming … and they are starting to arrive already. Everyone needs to stop believing the fantasy that tariffs do not cause inflation because a fantasy is all it ever was. This is real! People need to wake up—especially investors who have been categorically in a coma about this.

Retailers have tried to mitigate price increases, but the merchandise subject to the tariffs is working its way through the supply chain and is now being placed on store shelves.

Exactly … as I’ve been trying to warn my readers.

Of course, consumers will fight back as a mitigating factor, meaning those huge monthly price increases seen in the graphs above may not continue that large each month through the year:

Bill Simon, former CEO of Walmart, said the data correlates with what he is seeing, and the next move in either stoking or stifling the inflation trend across products may be up to the consumer.

“Companies are mitigating what they can and are passing on the rest,” Simon told CNBC. “Consumers, who are the final arbiter of tariffs, then come into play. Will they buy the item that has gone up in price, or will they switch to another item in the same category that has less (or no) tariff? The customer gets to decide if they want to leave the category all together,” he said.

Still, we have no idea who will win this tug-o-war … or who will win the most as retailer and consumer struggle over finding price equilibrium. It won’t be that one side takes all the loss quite for awhile, but retailers will, over the years ahead, find ways to keep getting those prices up in order to pass along as much of the pressure as they are able to.

Peter Boockvar, chief investment officer at Bleakley Financial Group, says inflation is underway, “and has been for the last few months,” citing a recent rise in core import prices, ex food and energy, in April and May. “The only question is how this will now flow through the supply chain and who gets to eat it,” Boockvar said. ”[Fed Chair Jerome] Powell has made it clear that he is going to wait as long as possible until the tariffs fully work their way through the supply chain so he can see where they end up in terms of absorption.”

In another article, we read today,

A pricing model created for CNBC this month by retail consulting group AlixPartners found that a 10% U.S. tariff on Vietnamese goods would cause the price of an imported men’s sweater to rise by about 8%….

Some analysts believe the lack of a widespread impact on U.S. prices so far is the result of pre-tariff stockpiling by companies, as well as the time it takes for those tariffs to show up in the economy.

Uh huh.

Dollar destruction comes with the bargain

Below, you will also find a video with Ron Paul on how de-dollarization is happening, as well as an article telling how emerging markets are causing that to happen now. The article misses how that is due to the mechanism that I said would move investors (but especially central banks) away from US debt as a safe haven. That was the key point of insight now provided to all of my readers from my predictions for this year—the foreign-exchange/tariff connection. While it still misses seeing that key factor, it does certainly see the loss of safe-haven status for US Treasuries now becoming a “clear trend.”

"There's definitely a theme among global issuers currently exploring more non-USD financing alternatives as borrowers are seeking to achieve less reliance on USD-denominated funding," Weiler said, adding it was an early sign of de-dollarisation. "I think it's the start of a clear trend."