Homicidal Tariffs Rule the Days Ahead as Far as the Eye Can See

(But in this clouded mess, that is not far.)

Before we get into the topic, thank you, all, for your patience as I took ten days of vacation on O’ahu. Just a nice relaxed time with nothing planned, except to sample mai tais from different establishments, as we came across them, and enjoy some excellent food and one of the world’s most magical beaches, which I’ll reveal to paying subscribers if they ask via a reply to this emailed article. Though it is no guarded secret, and I’m sure many have likely already experienced it, I don’t want to do anything to help make that beach more popular than it already is by spreading the word too broadly … or it will someday not be one of the world’s nicest beaches.

(And, NO, we’re not talking Waikiki Beach, though that is nice and fun in its own way, too. I used to live in Waikiki, so it is a special place for me if you enjoy it for what it is. I think of it as the Rodeo Drive or Sunset Strip of Hawaii, which happens to also have a great tropical beach that the others don’t have.)

Today, we’re going to come up to date on the tariff situation, which appears finally to have stabilized some when Trump’s deadline for tariff negotiations passed while I was enjoying a hike to the top of Diamond Head. That, as a segue somewhat meaningful to the present topic, is where my wife once infamously almost texted that she was going to assassinate then-president Obama if she saw him. That happened during the middle of the big Asia-Pacific Economic Conference (APEC), which Obama was attending in order to discuss free trade.

She and I had just seen his entourage drive by about an hour or two before. Significant parts of the city of Honolulu were in lockdown already, with streets boarded off everywhere we turned in order to establish security. Even Diamond Head Crater, itself, was scheduled to be closed in another two hours for the rest of the week, as that is where security for the whole island was going to be headquartered (Diamond Head being the best sniping point in the natural landscape). As hiking the little but spectacularly popular moutain was our regular must-do when visiting the island, we rushed to get there ahead of the military lockdown of the crater.

To capture the full significance of my wife’s little text, bear in mind that meant 27 heads of state were already visiting the island. Now, here is how my wife almost brought Blackhawk helicopters over the Diamond Head crater wall in seconds. (Also, bear in mind that Hawaii is electronic-surveillance central for the entire Pacific Basin, with thousands of people working literally underground who monitor and translate radio messages, including cell-phone texts and conversations, from all around the Pacific.

These intercepted messages all get run through supercomputers that, on the fly, flag any message that merits immediate security attention. This I have been told, while living in Hawaii, by people with minimal security clearances who have been under those volcanic ridges, working in the miles of tunnel networks there, so I trust I am sharing no actual government secrets, as it seems somewhat common knowledge. With nearly all leaders from around the Pacific Basin attending the Asia-Pacific Economic Conference to meet with President Obama and each other, I’m fairly sure the underground spies were working overtime that day on tracking all local messaging.)

In that milieu, as we arrived at the very top of Diamond Head, huffing and puffing, my wife texted her sister an exclamatory, “We’re on top of Diamond Head! If we see Obama, we’ll say hi!” (Her sister is the fan of the man, which I am not.) We had, after all, just seen what looked to be his line of limo trucks drive past us awhile earlier down on the Kalakaua Avenue, the main Waikiki Strip right below Diamond Head, though we could not see through the tinted windows to know for sure it was him.

As she was about to hit “send,” I yelled “STOP! Look at what your auto-speller has changed that to.”

The text she was just going to hit the send button on read:

“We’re on top of Diamond Head! If we see Obama, it will be homicide!”

I kid you not. I don’t know how her phone got that out of “we’ll say hi,” or why it thought that particular revision would be helpful for its owner, but that was the day my wife’s cell phone may have gotten us arrested. Never trust your cell phone. It can create a world of misery in a nanosecond of poor cellular judgment. Fortunately, personal catastrophe was averted, as she carefully corrected the message and double-checked before hitting “send,” which turned out to be her actual most violent of act of the day.

Now, on to the topic du jour:

Homicidal tariffs are here!

(See, I told you my story would relate since free trade was the topic du jour back then, though Diamond Head is a part of our every visit, and Diamond Head will serve well as the motif for the whole piece.)

The tariffs by which we’ll kill our economy and our prosperity are no longer out on the event horizon. They are not the outlook; they are where we now stand right below our feet, and their impact is being felt with some significant tremors that I’ll cover in my weekend Deeper Dive. For this editorial, let’s get to the basic facts about the tariffs, themselves.

Number one above all other facts: we now have the highest tariffs we’ve had since the Great Depression. That is because the only tariffs that were ever this high are the ones that did so much to make the Great Depression the economic crater that it became. Those tariffs may have even been the deciding factor in moving us from what would have been a deep recession to the most miserable recession in US history.

That can be argued about on all sides, of course, because so many factors go into making an economy that you cannot single out all the variables to figure out which ones were the most impactful; however, the argument has certainly been made with good reason by many that the Smoot-Holley Tariff Act was the major player in the global economic collapse back then.

We may now get to see another cycle replay in proof of how we never learn the lessons from history. Sooner or later, some generation that thinks itself wiser distrusts what the nation long believed it had learned the hard way, and we try it all over again. (Such is the whole basis of my little quick-read, somewhat-humorous book about our second-worst recession: “DOWNTIME: Why We Fail to Recover from Rinse and Repeat Recession Cycles: The same characters who created bailout bonanzas for banksters in the Great Recession are doing it again.”) We can hope it goes better this time, but we’d be wise to be ready for a replay that rhymes with the past, even if it doesn’t exactly match it.

Some argue that it was through signing the Smoot-Holley Act, which Hoover advocated, that President Hoover gained scathing credit for the creation of impoverished Hoovervilles (tent camps) around the nation. We already have plenty of those, so someone may have beat the present president out of that dubious claim to fame. He’ll have to do a lot of damage to make our many homeless camps notably worse than they already became during the Biden days. However, these tariffs may be just the ticket for the expansive future development of future Trumptowns. Ironically, the billionaire developer is likely to go down in history for the shantytowns he created.

Here is a short history of the impact of those past great tariffs and how it all worked out going into the Great Depression:

The Smoot-Hawley Tariff Act raised the United States’s already high tariff rates. In 1922 Congress had enacted the Fordney-McCumber Act, which was among the most punitive protectionist tariffs passed in the country’s history, raising the average import tax to some 40 percent. The Fordney-McCumber tariff prompted retaliation from European governments but did little to dampen U.S. prosperity.

That wasn’t high enough, and so …

In his 1928 campaign for the presidency, Republican candidate Herbert Hoover promised to increase tariffs on agricultural goods, but after he took office lobbyists from other economic sectors encouraged him to support a broader increase….

In response to the stock market crash of 1929 … protectionism gained strength, and, though the tariff legislation subsequently passed only by a narrow margin (44–42) in the Senate, it passed easily in the House of Representatives. Despite a petition from more than 1,000 economists urging him to veto the legislation, Hoover signed the bill into law on June 17, 1930.

Smoot-Hawley contributed to the early loss of confidence on Wall Street and signaled U.S. isolationism. By raising the average tariff by some 20 percent, it also prompted retaliation from foreign governments, and many overseas banks began to fail….

Within two years some two dozen countries adopted similar “beggar-thy-neighbour” duties, making worse an already beleaguered world economy and reducing global trade. U.S. imports from and exports to Europe fell by some two-thirds between 1929 and 1932, while overall global trade declined by similar levels in the four years that the legislation was in effect.

And … KABOOM! … the rest was history—a time that shall live in infamy. Like Hoover, Trump is a man who is obsessed with getting his tariffs higher and higher; so, he, too, will likely cross that level at which they become bigly destructive. He seems prone to do so.

Today’s environment may actually be more explosive. As I’ve repeatedly said in my warnings: you blow up global trade, you blow up the global trade currency; you blow up the dollar. That is the major risk for the US with its huge and clearly now-crumbling mountain of tuff and tephra we know as the national debt that didn’t exist back then. This long-dormant crater could erupt in a way as significant as tariffs erupted through the economy in the 30s.

Back then we had room to take on a lot more debt to try to find a way out of the troubles we made for ourselves. Now ALL major credit agencies have downgraded US credit and are telling the nation that it must reduce its overburden of debt or face even greater (and likely catastrophic) downgrades that could cause an avalanche in bond markets.

The only thing that would keep further downgrades from being catastrophic for the US debt in a time of a diminishing dollar would be if all other economies and their currencies do worse so that, once again, the US comes out on top by simply being the best horse in the Dying-Dollar Horse Races. Good luck with betting on that worn-out and harshly abused nag, named “Ol’ Buck,” even in that lousy race against other losers.

It is in view of that broad scope of history, that I call these tariffs “homicidal.”

We may die by a thousand self-inflicted wounds as well as by the wounds inflicted by our enraged trading partners who become our enemies over the damage we bring to all of them over the next three years as we also try to annex their nations via economic coercion.

How tariffs are already taxing our individual resources

As all who regularly read here know, I did not expect the tariffs to show much statistical evidence of their damage yet, but I did warn that the nation would be feeling the effects, even if not statistically accounting for them, by this time. On the one hand, we got one headline this week that said the tariffs are already starting to effect a rebalancing of trade. That COULD be good for the US economy down the road; but there are a lot of downsides offsetting that in the present and the immediate future that I believe will overcome any intended good from righting trade imbalances.

The more immediate impacts that are already being felt are the high costs of making that shift as all of us in the US get to pay for those taxes through higher prices.

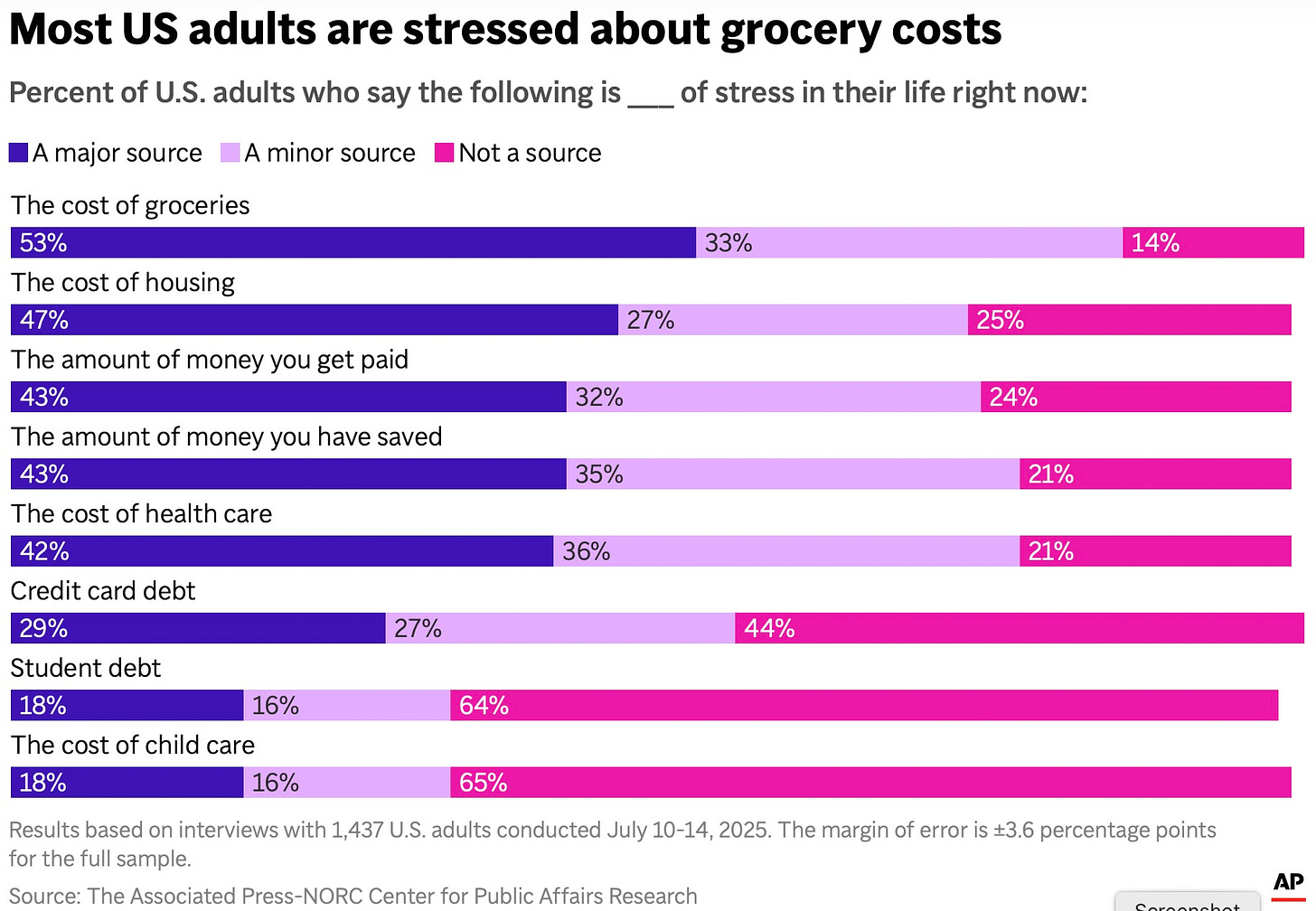

An AP poll this week claims that “the vast majority of adults” in the US are now “stressed out about grocery costs.” This is where I believed we’d feel it the most early on because food is one of our most critical purchases. It is something we purchase a LOT, so we get to feel the impact on a nearly daily basis. Whether tariffs’ addition to prices are showing up in statistics yet or not (never expected they would start to show until next month, then they may arrive slowly at first and quickly later), they are decidedly being felt, which is all I said I was expecting to find at this early juncture:

About half of all Americans say the cost of groceries is a “major” source of stress in their life right now, while 33% say it’s a “minor” source of stress, according to the poll from The Associated Press-NORC Center for Public Affairs Research. Only 14% say it’s not a source of stress, underscoring the pervasive anxiety most Americans continue to feel about the cost of everyday essentials.

The word “continue” is a meaningful qualifier here, as we never stopped feeling the heat of inflation from Covid times, but we now feel it intensifying again, building up eruptive stress fractures that make us all the more edgy about these price increases because the previous pain is still a little raw. The picture of where people are feeling the pinch of prices and other financial matters looks like this, according to the poll:

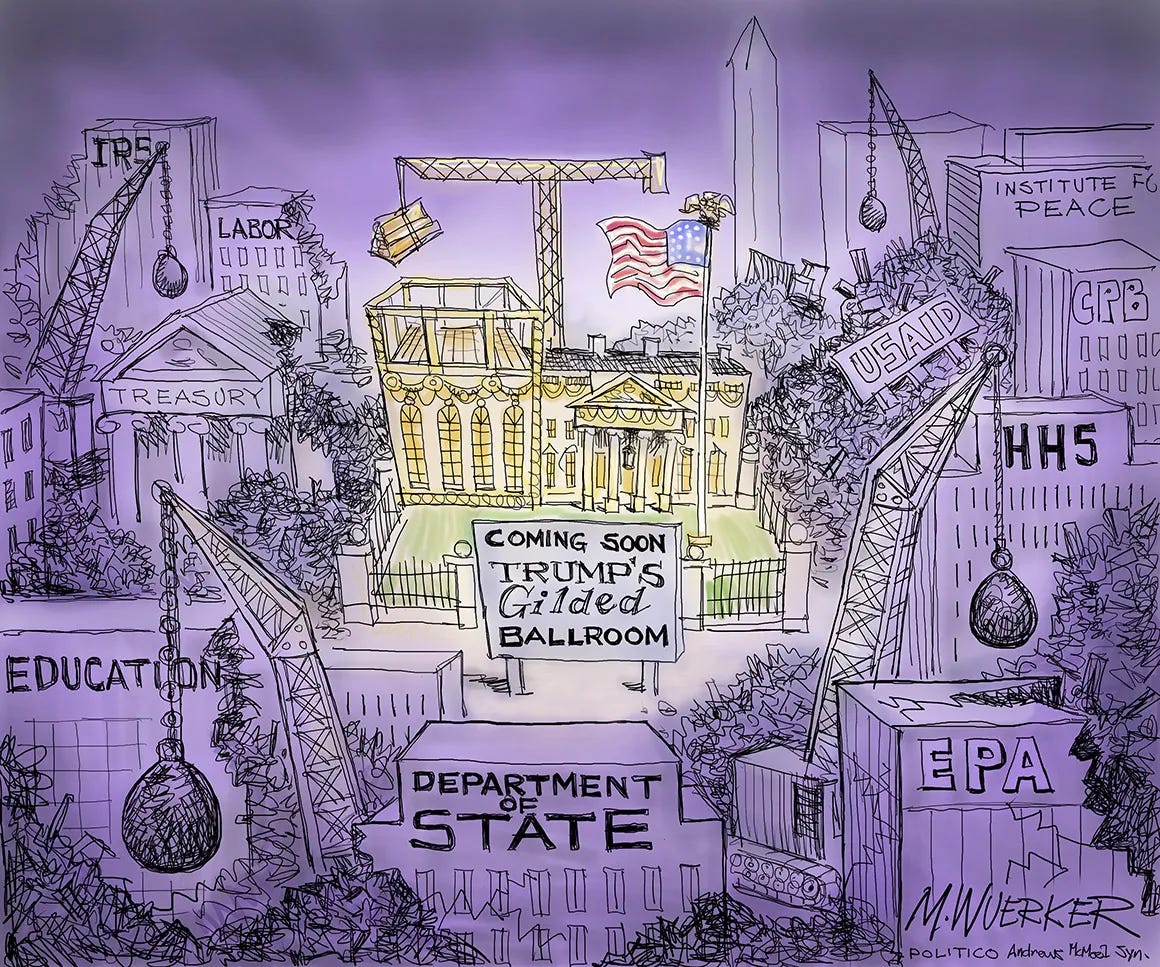

Ooops. Wrong image. They are apparently not feeling the stress at all in government, nor in the high houses of finance. Well, I mean, not in the executive branch where a few departments of the state have been downsized (or DOGEd) in order make room for upsizing the White House, itself. (Trump is apparently planning a garish rooftop addition to the White House, not to be outdone by Fed Chair Powell who has been grandly refurbishing the Eccles Building.)

Ah, here we go:

Even in the high-income group, only 2-in-10 say that rising grocery costs are not a concern at all. They may have no need to fear rising food costs, but food is something we feel. It’s instinctive to worry about any perceived threat to our food, even at higher income levels.

As a result, people are already dialing down their purchases in order to shift their own behavior as a way of shielding themselves from price increases:

Some people are making changes to their lifestyle as a result of high costs. Shandal LeSure, 43, who works as a receptionist for a rehabilitation hospital in Chattanooga, Tennessee, and makes between $85,000 and $100,000 a year, said she’s started shopping for groceries at less expensive stores.

“It’s an adjustment,” she said. “Sometimes the quality isn’t as good.”

That kind of resistance that becomes willing to accept less in quality in order to remain able to afford to buy (even with those who have good-paying professions) may help force some of the cost of tariffs onto the owners of grocery stores. That kind of pressure against price increases, to the extent consumers manage to push back, will reduce the cash that shareholders have been accustomed to piling up and then paying out through stock buybacks and dividends. So, pricing will be a rough tug-o-war or push-o-war as consumers push back against price increases; but retailers will shove through as much as they can without losing market share.

A growing number of companies in recent weeks, including Procter & Gamble, Nike and Hasbro, have said they plan to raise retail prices to compensate for their rising tariff bill.

Shareholders will have to absorb some, however, and will likely be experiencing lower share values as dividends and buybacks get scaled down during the push-back war.

Because “many US adults have used ‘buy now, pay later’ services” as a way of trying to manage rising prices, particularly for groceries, their worries over credit are likely to rise, too.

As they stretch limited budgets, about 3 in 10 U.S. adults overall say they’ve used “buy now, pay later” services such as Afterpay or Klarna to purchase groceries, entertainment, restaurant meals or meal delivery, or medical or dental care, according to the poll.

This is just a way of bringing one’s future buying power forward in hopes of making it through the price increases long enough to see wage adjustments that help out. Doing that is obviously likely to diminish your economic strength down the road as you are borrowing just to survive, so the debt does not increase your income potential.

Most likely, that is a source of stress piling into the worries in the “amount of money you get paid” category of the chart above. If that bet doesn’t play out as people are hoping for and prices continue to rise even higher after people’s debt balances have also risen and then interest rises on top of all that, something made likely by tariffs due to their impact on bonds, which peg interest rates, that is when we are really going to see some major stress cracks in the swelling national debt volcano (public and private). The stresses over not making enough and paying out too much are likely to become highly disruptive in those days ahead.

Already …

An increasing share of “buy now, pay later” customers are having trouble repaying their loans, according to recent disclosures from the lenders. The loans are marketed as a safer alternative to traditional credit cards, but there are risks, including a lack of federal oversight. Some consumer watchdogs also say the plans lead consumers to overextend themselves financially.

The state of tariffs at present

While the overall hit to Americans is promised to rise further, likely most of the tariff increases are now in place. Hard to say, though, under the wavering TACO king and given the fact that most of these tariffs have not been agreed to in writing by both parties. However, we still have to wait to see what the retaliatory tariffs from other nations will be. Those won’t hit the pocketbooks of Americans as consumer costs, but they will diminish foreign purchases of US goods, making those longed-for wage increases, especially unlikely as production and services to foreign countries slow.

Trump is still singing to the tune—hoping he can imbed it in our brains like an ear worm—that says other nations are paying for all the tariffs:

“BILLIONS OF DOLLARS, LARGELY FROM COUNTRIES THAT HAVE TAKEN ADVANTAGE OF THE UNITED STATES FOR MANY YEARS, LAUGHING ALL THE WAY, WILL START FLOWING INTO THE USA,” Trump posted on Truth Social Wednesday night.

Mark my words: You’ll come to know what a lie this is as the impacts described above start to play through. Yes, the tariff taxes will be flowing rapidly into government coffers, but it is you and American companies that will be paying the lion’s share.

Stock investors are still being irrational about how all of this will play out for them, but I believe they are about to quickly relearn the lesson they almost learned when the market nearly crashed in March and April as predicted here at the start of the year. It didn’t quite make it down to a full-blown crash because most of the tariffs and government DOGE firings got immediately put on hold for months; but now that courts have allowed many DOGE cuts to move forward and now that tariffs are being settled into place (it seems), the impacts will get quite real. (Keep in mind that forced government firings were also not in play as leading factors in the Great Depression. So, that is a second way in which these times could be worse … at least, in their setup.)

“Getting real”, of course, is exactly where everything remains willy nilly as the president spins on a dime. India, for example, thought a week ago, it knew where tariffs would be, then Trump upped them by 25 percentage points to a total around 50% because he didn’t like how India was supporting Putin’s War in Ukraine with oil purchases. So, things completely unrelated to the balance of trade can cause an entire national trade agreement to spin out of control on a one-day notice. Trump has seized tariffs as his tool by which he can cudgel other nations to do his bidding—to “make him happy.”

The sudden doubling of tariffs on goods made in India may have also been intended to give an unexpected revenge blow to the heads of all those companies that shifted manufacturing form China to India, rather than the US, because of tariffs, to give pause to everyone who thinks of taking that route:

The company beefed up its U.S. inventory before the tariffs on Chinese goods spiked in April. It also squeezed cost reductions from its suppliers in China and shifted some production to Cambodia, Vietnam and India.

The fast-changing nature of the president’s trade offensive has made it hard to keep pace. As CEO Thomas Florsheim explained the strategy to investors on a quarterly earnings call, news arrived that the president had just raised tariffs on Indian products to 50 percent.

“We’re going to have to wait and see what happens with India,” Florsheim said. “If the Indian tariffs get unmanageable, we’re going to have to shift more product back to China.”

Not even “back to the US.” And, so, the landscape changes as rapidly as any war plan because that is what this is—a tariff war—actually a whole lot of tariff wars fought all over world at the same time—world war. Expect the chaos of war, which is intentionally surprising by nature, to come with its own heavy price, as in any war, compounding the actual cost of the tariffs, themselves.

In Switzerland, business groups called upon the government to continue negotiating with the U.S., concerned over the impact a 39 percent tariff would have on an economy highly dependent on foreign trade. “If this horrendous tariff burden remains in place, it will mean the de facto death of the export business of the Swiss tech industry” to the U.S., Swissmem, a trade group representing the Swiss engineering and tech industries, said in a statement.

“Legal certainty and predictability are hardly likely to return in the next few years even with agreements,” Swissmem President Martin Hirzel said.

This why retaliatory tariffs are being held off by some nations, as they still hope to negotiate with President Trump, but here is where we’ll also see the cost of chaos, which may be less quantifiable than price increases, but will still be intensely felt. Resentment from the nations that take all this heavy pounding on their own industries—driving up unemployment, poverty, and social unrest in those nations—will become intense toward the US. That could impact many other kinds of international relations.

In the very least, more of the same kinds of retaliatory tariffs that we experienced during the Smoot-Holley days are likely to hit the US, even though they will be as ill-advised as our own tariffs are, shutting down global commerce even further. It devolves into a lose-lose—or, as described in a quote above, a “beggar thy neighbor”—scenario.

The ensuing chaos will cause civil unrest globally, including in the US where even some of the people who now support Trump may become far less supportive as they feel the multitude and magnitude of impacts from the Trump Tariffs dent their lives again and again for years.

Trump has long held that imposing taxes on trade will improve the nation’s grim finances and rebalance relationships with foreign nations that he says are taking advantage of the U.S. He has also used tariffs in recent weeks to try to accomplish foreign policy objectives, dangling threats of new trade barriers to stop skirmishes between Thailand and Cambodia.

But consumers often ultimately pay for tariffs through higher prices, even if some of the costs are spread throughout the supply chain. And there are many nations with which the U.S. must trade to secure goods that can’t be made or grown at home. Some economists worry that Trump’s new trade policy could cause the economy to shrink and rupture certain alliances that domestic producers have relied upon to manufacture cheap goods.

A test case could be Apple’s iPhones and other consumer electronics, which are assembled at factories predominantly in China and India. The company announced a $100 billion investment Wednesday to produce components, including glass and semiconductors, for those items in the U.S. — in part to avoid tariff rates.

Even Trump-supporting Zero Hedge is calling out the Apple deal, saying it is likely a promise never to be realized, as making promises to buy time while Apple hopes a new administration in 3.5 years will throw off these tariffs, is easy. They may just keep saying they are working on it, and show some mollifying indications that they are. What they are trying to avoid is this…

Trump said he planned to impose a 100 percent tariff on chips and semiconductors, but those wouldn’t apply to firms that are setting up new domestic production facilities.

“If you’re building in the United States of America, there’s no charge even though you’re building, and you’re not producing yet,” Trump said in the Oval Office Wednesday afternoon, flanked by Apple CEO Tim Cook.

They may be genuine, but Apple’s follow-through remains to be seen.

The policy is designed to give firms “breathing room” to move manufacturing facilities and supply chains to the U.S., similar to the White House’s treatment of tariffs on automakers, a Trump administration official said.

That may also be breathing room used by Apple to attempt to hold off the tariffs as long as possible, hoping the ill-advised nature of tariff policy gets Trump’s edicts overthrown by a new congress in a year and half and perhaps in hopes that courts say Trump has overstepped in many instances because in most respects congress holds the power of trade treaties/tariffs in its hands if it chooses to use those powers.

Inconclusion again

The fact that tariffs were delayed by Trump for months as his team worked out the details and recoiled from immediate economic impacts, and then came on in a one-nation-here, ten-nations-there, another-nation-revised-over-yonder, and add-a-blanket-tariff-for-every-nation-for-that-natural-resource, daily changing manner … means that the tariffs’ impacts will CERTAINLY NOT be the one-time effect that some have said they will be.

So much has already come on over a spread of time in widely different amounts, and so much continues to be worked out, and so many of the tariffs supposedly establish contain a clause that says they will rise by enough to offset any retaliatory tariffs, that this is going to play out as one very long and worsening mess, even though August 1st took us past a line that supposedly settled a lot of the tariffs. The most that can be said, and the best, is that most of the tariffs are tentatively settled in a temporary way that is far more likely to get worse than better for all the reasons above.

You can knock economies all over the world around again and again with this kind of chaos, but you cannot do it without wrecking things sometimes slowly at first and then sometimes quickly and unexpectedly. And what will the knock-on effects be from all the unexpected damage? While there is, by definition, no way to know, one has to assume that, too, will become real and apparent enough over time.

About all that can be said in summary now is …

Last week, hours before the tariffs were set to kick in, the administration said the deadline would be delayed another week to give U.S. Customs and Border Protection more time to prepare to charge the new levies.

After 126 days, the administration came up far short of Trump’s goal on deals, though the agreements it did achieve — and its additional extensions with Mexico and China — cover the vast majority of the U.S. international goods trade.

Those frameworks are far from formal trade deals, which can take decades of negotiations and emerge in binders the size of phone books. Trump has heralded many of the new arrangements via sparse social media posts.

“For sure, this means higher prices,” said Dean Baker, senior economist at the Center for Economic and Policy Research, a left-leaning think tank. “The question we’re all asking is how it’s going to be divided between the various middlemen, the direct importer, retailers and the consumers. The history has been most of it is paid by the consumers, and my guess is that will end up being the case this time, as well. But that is up for grabs. We just haven’t seen tariffs like this.”

Of course, courts could also throw all this rule-by-edict out as an unconstitutional overreach in light of the separation of powers with congress’s express powers over tariffs. Then the present congress will try to implement as much as it can, and the chaos gets a whole new churning.

Either way, due to the chaos and the impacts while the tariffs last, we may soon all be singing, “The Bailout Banker Blues” from Yours Truly:

In this weekend’s Deeper Dive for paying subscribers, I will be digging thoroughly into the overall US economic picture, including what the latest GDP report really reveals about how weak the economy is when you look under the hood. We’ll look at why the headline number popped strongly upward, which was not a surprise here. I said a few times in the last couple of months, I expected GDP would likely go back to positive for the second quarter but also said why that would be deceptive, so we’ll get into that confirmation of my expectations and what that conformity to logic means for what is coming. We’ll also look at how markets have misread the strength of the economy. Coming from many directions, the truth about the US economy is much more problematic than is indicated by the sanguine headline GDP number that came out while I was on vacation.

(More can be found from the articles quoted via the headlines highlighted in boldface below:)

Economania (national & global economic collapse plus market news)

The Mystery of the Strong Economy Has Finally Been Solved

Biggest part of U.S. economy barely grew in July, ISM finds, due to tariff knock-on effects

It's NOT A Recession That's Coming, It’s Something Much Worse.

Big rebound in GDP masks hidden weakness in the US economy

The economy is cracking. This trend is most alarming.

The Bubble Is Bursting: Delinquency Rates Have Doubled And Credit Card Defaults Are Soaring

Forecasts predict a dismal decade for stocks. Here's what to do.

Whacked Down by Plunging Inventories and Whacked Up by Plunging Imports, GDP Grows by 3.0%

US Factory Orders Tumbled In June By The Most Since COVID

Bill Bonner: The Sound and the Fury: Numbers Don’t Mean Much Anymore

"Illusion Economics" Is about to Take on a Higher Dose of #FAKE

Very Ugly, Tailing 10Y Auction Sees Slide In Foreign Demand, Plunge In Bid To Cover

Money Matters (monetary policy, metals, cryptos, currency wars & going cashless)

The "Big Money" Still Lies Ahead [for Mining Stocks]

Silver's Bull Market Has Officially Begun

Rubino: Marin Katusa on the Coming Silver Shortage

Big Events & Reports: Bullish For Gold?

Trump order will allow alternative assets like cryptocurrencies, private equity in 401(k)s

Inflation Factors (from too much money chasing too few goods due to weather, sanctions, tariffs, quarantines, etc.)

The vast majority of US adults are stressed about grocery costs, an AP-NORC poll finds

Wars & Rumors of War, Revolts, Hacks & Cyberattacks + AI threats

Russia Issues Nuclear Weapons Warning: 'No Limits'

For Putin, Trump Summit Is Key to Securing Ukraine Goals

Kremlin, sensing advantage, confirms Putin-Trump meeting in coming days

—

Video shows current Department of Justice official urging Jan. 6 rioters to 'kill' cops

—

Crescendo: World War III enters a dangerous new phase.

—

Hamas releases chilling video of ‘living skeleton’ Jewish hostage Evyatar David

In First, Ben Gvir Leads Settler Raid On Al-Aqsa Mosque Under Heavy Guard

—

China's 'biggest threat' to US is a 'tech kill-switch'

Trump Trade Wars & Turf Wars

Trump’s tariffs take effect, potentially upending global trade and prices

US import taxes hit levels not seen in nearly 100 years

Trump Slaps India With Additional 25% In Tariffs Over Russian Energy Trade

In Latest Empty Promise, Apple To Announce Another $100 Billion Investment In US Manufacturing

Political Pandemonium & Social Senescence (socio-political issues & events)

Trump Fired America’s Economic Data Collector. History Shows the Perils.

Donor List Suggests Scale of Trump’s Pay-for-Access Operation

Laura Loomer blasts Tucker Carlson as a 'fraud' and 'terrible person'

Marjorie Taylor Greene says GOP women 'sick and tired' of treatment by male colleagues

Republican Party Has “Turned Its Back On America First” – MTG Says

ICE arrests decline amid backlash to June immigration raids

US citizens jailed in LA Ice raids speak out: ‘They came ready to attack’

Leaked FBI Document Reveals Jeffrey Epstein's Secret History as an FBI Informant

Ex-Obama officials face federal grand jury probe into whether they promoted false Trump-Russia ties

Top Trump officials discuss Epstein strategy at Wednesday dinner hosted by Vance

JD Vance denies convening Trump’s top team to discuss Epstein

Never-Before-Seen Photos Inside Jeffrey Epstein's Creepy Mansion

Sen. Adam Schiff Under Criminal Investigation for Mortgage Fraud

Trump wants Census to ignore some people, despite the 14th Amendment

A Pox Upon Us (the plagues, pandemics & health police of the 2020s)

She Listened to Doctors About Which Vaccines to Get. Her School Kicked Her Out.

Calamity, Catastrophe & Climate Craziness

The Dark Side Of Big Solar Exposed As The Fight To Save Farmland Heats Up

Off-the-Beat News & Just Plain Offbeat News

Doomer Humor

Please help The Daily Doom succeed in delivering its warnings, given in hope of making the collapse that is now unfolding understandable to as many as possible. It is easier to believe in the causes, when the effects have been laid out in advance and then you see them happen. Afterward, there will be endless arguments about the causes of collapse, but the most likely ones in most minds will be the ones that could be seen in advance. Help others believe:

“the Apple deal is likely a promise never to be realized” Exactly! Apple has promised approximately 1.38 trillion dollars in US investment since 2018. Wanna guess how much they've spent? Apple will slow play the promise until Trump is out of office and then stop. Anyone who promises to do any manufacturing in America will do the same thing, because American unions push for outrageous wages and benefits that no other country pays.

In Detroit: “Active worker compensation including wages, bonuses, and benefits was estimated at about $55 per hour, with an additional $15 attributed to retiree costs, bringing the total labor cost to roughly $70 per hour [2008 survey].” “China's car industry ranges from 4,914 CNY [$684/month = $3.89/hour] to 12,901 CNY [$1796/month = $10.20/hour], with 80% of employees earning within this range.” — Brave AI