Housing Market Collapse Hit Hard in 2011, propped by QE2

News of the housing market collapse hit hard at the beginning of spring on March 23rd, 2011 because reporters had spent the winter months with their heads in the tropics so missed the winter chill. All winter the media experts reported the good news that their vaunted industry experts fed to them like peeled grapes in that many of the experts were just talking up their industry while the press readily ate anything they offered. Stan sent me the following article for my entertainment, and these were my responses:

Housing starts collapsed at an astounding 95% annual rate in February (yes, you read that correctly) (Business Insider)

Oh, but, gee, Stan, the head of the American Builders Association (or whatever it was called) predicted in December that housing starts were going to go UP this year! What a surprise for him, hum? Instead they collapsed entirely, as 95% is virtually a total collapse. He must be really scratching his head to figure out what went wrong.

And that ain't all the bad news. It only is getting worse for that poor man's bold predictions:

...The fact that building permits, which lead starts, plunged 8.2% after that dramatic 10.2% falloff in January suggests that a turnaround is not yet in sight

Normally, housing starts are up 34% from the time the recession ends to the 20th month of the expansion (where we are now) - not down 18%, as is the case currently.

What twenty-month expansion? Where do they get these numbers? Unemployment is up over all of these months. What has expanded other than prices? Housing starts are down 18% from what they were twenty months ago because there has been no expansion. [Economists look at any growth in GDP as expansion, but GDP was likely expanding slower than the illegal population of immigrants was expanding, so the only thing growing all winter was the number of dependent people.]

In fact, never before have housing starts been negative at this point into a recovery, let alone being down a huge 18% since the recession ended."

In fact, there has been no recovery at all. What there has been is this thing called "quantitative easing." It means that we have pumped enough baseless money into the economy to provide liquidity that we have eased the decline to where it is an incline; but it is only an incline so long as the easing continues, which the easing cannot do, as it is monstrously expensive.

We are, again, maintaining the ease of the standard of living we are used to by buying it on more credit than ever before and with order ambien online mastercard fake money!. We have actually turned our suffering around in the present fall by making the next generation pay for us to float a little higher. However, the next generation is going to be THE PRESENT generation.

It's not going to work, for only the very old and infirm will die before the time to pay the piper for this folly comes. In short, the numbers that they call "recovery" are only the purchase of Q.E. and will collapse as quickly as Q.E. collapses. That must happen soon as the government is about out of its Q.E. set-asides, I think.

As another writer says...

Yes, stocks are up. And yes, so are junk bonds. You put in $100 billion per month [in Q.E.]; you have to expect something to happen. But what we see is an increase in speculation - and some bouncing around on the hard pan of a Great Correction. And yes, unemployment - as measured by the Labor Department - is down to its lowest level "in almost two years." But 2009 was hardly a good year for jobs. And there are still 7 million fewer jobs today than there were before the Great Correction began in '07. (The Daily Reckoning)

[In other words, WHAT RECOVERY?] It's hard to believe, after all we've seen, that the press and economists are such idiots as to think that Q.E. has worked. It has not worked because it has not accomplished anything that will last beyond the Q.E. program. It only continues to "work" so long as the huge dumps of cash continue to go into the economy, and that was never sustainable and is nearly at the end of its run.

Quantitative Easing was a short-term effort at enormous long-term expense just to float our standard of living a long a couple of years longer -- exactly as we said it would prove to be when it first began. Of course, it has not yet PROVEN to be what we said it would be, but continue to watch, for we are nearly there. Q.E. will most likely have to end this year, and watch how the house of cards starts to fall then.

[It ended by July, and the house of cards fell in August.]

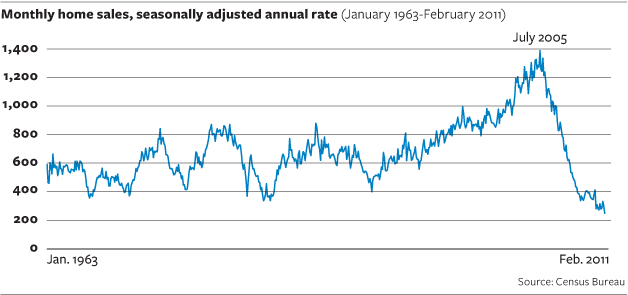

Later I found the following graph of what had been happening to the housing market with the very last blip at the bottom being the winter of 2011 great news of a housing market recovery that everyone had been talking about up to this point (along with the subsequent fall-off):

Was there ever a clearer picture of rosy optimism over nothing?