How Dead is the Fed?

You can only be so dead, and that's just "plain dead." But there is also Feddy Krueger dead. The kind of dead that keeps on happening like a demonic death that won't stay dead. It is in that nightmarish Elm St. light that I'm going to review the Federal Reserve's death.

It's happened via face-plant failures over past month that I'm going to lay out to show how savagely the Fed is dying a perpetual-motion death.

Let me pause to assure you, I'm not saying Feddy Krueger is down for the count and will not rise again. He always revives by inventing powers over market death never seen before. Feddy will return with extraordinary and permanent powers beyond those he once used to bring counterfeit salvation from the Great Recession. Feddy gets more empowered by scared government politicians each time the economy crashes. You can't get rid of Feddy. At least, it seems.

What I am saying in calling him "dead" is that all of his old powers are completely dead. Maybe "impotent" would be a better word, but I wish him dead. He is, for the moment, fangless and mangled. He has been able to accomplish nothing for a month, and he has never tried harder! That's right where I said the Fed would be when markets returned to reality. Reality is a hard teacher.

While looking dead on the ground at the moment, Feddy's first resurrection will come from bringing back to life massive bailouts, which he is already working on in his laboratory (and which will be the subject of the next article I'm working on). Feddy will do all of this with full, desperate and almost unquestioning government support.

Of course there will be a few obligatory questions in congress as window dressing just so politicians can look like they're not asleep. Then congress will grant the powers Feddy wants because almost no one in society will speak out against these new powers, for even the masses want anything that will save them.

Screams of bank death already heard around the world

Let us set the scene for Feddy's death with screams in a dark nigh. These are the screams of central banksters and treasurers heard around the world, as they plead for life in a suddenly apocalyptic world.

Nothing chills a banskter's spine and brings a scream like the sight of massive red ink, pouring out of the arteries of banks through their ATMs. We call these "bank runs." They only belong with the worst of crashes -- cash crashes:

Speaking to journalists in Vienna, central bank governor Robert Holzmann said that Austrians have been far more active in pulling money from their banks, and have withdrawn more cash from ATMs last week, double to triple the normal average daily volume of €200MM.

However, hoping to forestall a full blown bank-run, Holzmann said that the central bank has enough cash reserves for ATMs, companies, banks, that "deposits are safe because banks have made homework, built capital reserves", and that he "doesn’t expect a bank run."

That one sounds like just a close call; but, with smart words like that from a central bankster, Austria should have a nice bank run by tomorrow. And if Austria has a run, then Germany's Deutche Bank HAS TO run, and if DB has to run, look for a runs at any bank near you.

The screams from Austria's lead bankster call to mind that surreal moment in December, 2018, when US Treasurer Steven Munchkin let the world know by tweeting from his floatie beside his lovely wife (the kind at greatest risk whenever Feddy is around a swimming pool) somewhere in the Caribbean that he had just called all the largest banks in the US to make sure they had enough capital to survive the storm (when the market dropped FAR less than now), so he could assure us everything was fine!

Storm? What storm?

Oh, Just a minute. The same article about potential Austrian bank runs actually continues (and I truly had not read this far before inserting the above Munchkin reminder, as I can barely keep up with the cascading crash now):

Meanwhile, in the US, eager to avoid any such discussion, US Treasury Secretary Steven Mnuchin told CNBC that "nobody has to pull money out of banks."

Well, that's a grand way to avoid any such discussion. How chillingly reassuring! Just when I thought all was well, the scary music started playing behind the robotic Munchkin. Once again, the Treasury Secretary has alerted the world to a prospect we all possibly should consider with a shudder -- "not pulling our money out of banks." His comment makes me wonder if there was a reason I was supposed to be thinking of doing that.

We've already seen toilet-paper runs all over the United States. And if people will go that crazy to get toilet paper before it runs out, maybe that will extend to other paper. Given the shortage in commercially available paper and the secretary's concern about bank runs, maybe it will soon be more economical to withdraw all our bank funds in dollars bills and use them for toilet paper ... if there are any more bills left in the vaults than there are rolls of TP on the shelves.

Can the US central bank save us from the Munchkin's chirpy tweets?

Feddy Krueger's dramatic death throes

All of Feddy's old tricks that strung the US stock market up for a decade are so far down the backside of the diminishing returns curve (yeah, economic laws are a bitch, but they still work as I said they would) that the Fed's operations now create the inverse of everything those operations once accomplished. Let's start with just a look at the Fed's thrill ride of failed interventions this past weekend because it was wild:

$1.5 Trillion in longer term repos. The Fed greatly increased the repo deluge and extended the length of those repos (as I explained was necessary in an earlier article: "Big Bond Bubble Begins to Blow!"). Because it knew that would not be enough, it also

Clearly announced that it was spreading its treasury purchases from their short-term restrictions to buying treasuries all across the maturity spectrum, putting to death its former argument that none of its salvation efforts are QE. Knowing that move would also not be grand enough, the Fed even promised to buy

at least, $500 billion in Treasury securities and $200 billion in mortgage-backed securities over the coming months

So, the Fed promised a total of $2.2 trillion worth of intervention in repos and outright purchases of US treasuries and mangy mortgage-backed securities in one weekend! And the stock market's response the next day was what?

It threw up! That's what the victims do in a gory Feddy Krueger film.

The market crashed down the longest set of stairs in terms of total points in its long beleaguered history. It was the third-biggest highest fall even if measured as a percentage of the total market, and that's after the market had set several other records of similar violent upheaval. This past weekend, the Fed's biggest economic stimulus efforts in history -- surpassing any QE ever promised during the Great Recession -- got nothing but a market barf.

So, yes, as I've long said, when the Fed tried to return to QE after tightening, it would find itself so far down the backside of the diminishing returns curve that results will be steeply negative. Not a little negative but screaming--in-the-trenches-because-you-just-got-belly-shot negative! Blow-your-legs-off negative. Feddy-Krueger-hacking-gore negative. Never in its history has the Fed gotten such a violently negative reaction to the promise of giving out free money! Yes, that was to the promise of free money ... boatloads of free money! And the market said, "We don't want your damned money!"

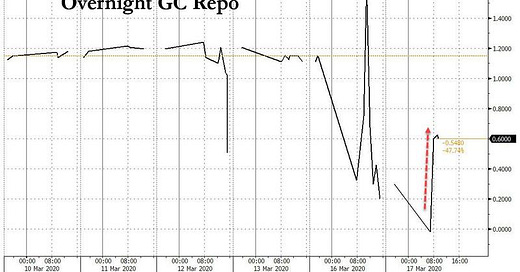

Would you pause to take a bankroll from Feddie Krueger? Even after Feddy slashed interest down to the ground and made all the promises above, overnight repo interest still looked choppy. It did not want to stay down on the ground of the zero bound where the Fed set its own Fed Funds rate (which it uses to persuade overnight repos between banks to crawl that low, too):

Feddy hacked repo down, and it got back up. So, he hacked again, and it got up again. So, the Fed temporarily spared the market -- or tried to -- by quickly throwing in another half a trillion of manic-money green on St. Patty's Day in order to bring stability. As the Fed explained the extra repo offering it laid on the altar, the additional half a trillion step was merely "taken to ensure that the supply of reserves remains ample and to support the smooth functioning of short-term U.S. dollar funding markets." Sounds as good as any other reason. Just taking care of a little half-trillion glitch in operations the day after the last half-trillion offering didn't didn't solve the last glitch; but the market would have none of it, and tumbled again today (Wednesday) -- badly -- down another long flight of steps.

Secretly, the Fed's real reason it needed to whirl up this monetary storm was to start unwinding that twisted, writhing mess of rehypothecated bonds that I described in my last article, "Big Bond Bubble Begins to Blow!" The Fed is fighting to prevent the bursting of the bond bubble, which is now unable to avoid the stresses being pressed upon it by the coronacrisis and is passing those stresses into the repo market. (That's what happens when black swans crash in on a corrupt economy, haunted by its own demons that it has never exorcised.)

What's a villain to do? According to Credit Swiss's Zoltan Pozsar, to whom the Feddy listens, all that's needed now is a multi-faceted solution -- just open lines of free or cheap funds that include all the swaps and repos needed without limits and as much QE as necessary. End all the caps, and we'll be OK.

In other words, say, "You banks and hedge funds and other financial operators just tell us whatever you need, and we'll do it!" That should be confidence building. (And that's why I've been saying since September this is QE4ever -- meaning all limits off if we're going to get any more fix out of the Fed's old dinosaur medicine.)

Are you starting to feel yet like the Repocalypse is "the little crisis that roared," as I said it was way back last fall?

Just sayin'.

And that was all just over the past weekend. Now look back at the Fed's full list of recently spectacular fails:

Fantastic Fed Failures

How bad was the Fed failing before its final death throes this past weekend? Did I mention the $2.2 trillion in Fed follies that have been scheduled? Ah, I did .... but that was just the weekend turnover! The total of everything tbe Fed threatened to do to us comes to about 5-trillion free Fed dollars stitched together from all the old tricks Feddy could think of over the pasts couple of weeks. That amount, if all the offers were taken, would be equal to all the QE done over the entire seven-year course of balance-sheet expansion that started during the Great Recession. Only it's been offered in less than a month!

Didn't I also say something many times over in past years about the next recession being a return back into the belly of the Great Recession? That was certain to happen because the Fed and its pocket politicians hadn't fixed ANYTHING that was corrupt and flawed that took us into the Great Recession in the first place. If all you do is cover cancer with makeup, it spreads and becomes worse. Remember all those times of everyone in congress talking about kicking the can down the road? Well, this is what "down the road" looks like when you get to the end of the road!

The nice thing about all the Fed's new actions is that we are already starting down the road once more toward doing the whole last ten years all over again. Rinse and repeat. It's not going to work, but they'll invent bigger solutions like the ones I've been laying out for my patrons; but I want everyone to, at least, have a clear picture of the trouble that is coming.

We have wound up here as a result of piling up higher mountains of worse debt because we just pushed everything down the road, piling it ahead of us, while providing money for all the corrupt greed to run way out ahead of the rests of the economy. You see, Feddy creates all of his money out of debt. Somebody takes out debt for every penny Feddy makes. Usually that's the US government. Feddy funds the Feds.

Now we're seeing the emergence of the real flaws under the economy that I've been talking about -- the garbage on the sea floor that all gets exposed when the water runs out of the bay just before the tsunami crashes in. It's this stuff -- like those rehypothecated bonds -- that leaves us too weak to weather bad events because the substance that makes our financial world work all starts to unravel when we need to rely on it under pressure.

The Fed has been flopping around in useless spasms for weeks now as one can tell from the following long list of face flops that helped pound the stock market down like a pile driver every time the Fed screwed up with the wrong solution because its old play book doesn't work anymore. Here's the full list of all the major responses I'm aware of that the Fed has undertaken since the coronacrisis hit:

Bolted back to ZIRP, slashing interest rates from from a pathetic 1.25% straight to 0% in an emergency meeting for the first time since the Great Recession!

Pledged over $700 billion in Quantitative Easing (QE) through $500 billion in outright US treasury purchases and $200 billion in Mortgage-Backed Security purchases! (Yeah, all that garbage is upchucking again!)

Spread its treasury purchases from short-term only to full-spectrum, ending the "it's temporary and short-term" argument the Fed used to claim last Fall this is "not QE."

Offered a $1.5 TRILLION repo lending program that has already failed multiple times! (In half-trillion installments with one- and three-month terms every week to the end of March.)

Launched another $1 trillion repo program that also failed.

Allowed primary treasury dealers to start parking non-treasury assets at the Fed, including stocks, as collateral in exchange for short-term credit. (As a back door into essentially buying stocks through others to keep them from dumping them in a falling market, taking losses and pushing the market down harder.)

Opened Euro-Dollar swaps, implying systemically important banks in Europe like Deutsche Bank (?) are in danger of collapse. CBs involved in coordination with the Fed include the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, and the Swiss National Bank.

Is that not thermonuclear Fed already? These moves have been historic -- bigger than anything the Fed tried during the Great Recession! Fed ammo SPENT! Dry powder LONG GONE! And the stock market is still falling and burning like a meteor in the earth's now apocalyptic atmosphere. So, the Fed took another stab at it, which I'm coming to, but first ...

There is now no question that the Fed cannot save this market with more of its old-style pumping. The stock market is dumping as I said it would at this point and chasing the economy down into the basement and the sub-basement ... because reality rules. Reality always rules eventually. And that is why you must always be looking at and dealing with economic reality ... or one day it bites you in the butt.

The economic crisis is now going full economic collapse. Let's hope this, at least, breaks through the economic denial I've been trying futilely to break through for a decade. Otherwise, we will get to rinse and repeat the Great Recession all over again.

The Fed's recovery died along with it. That failure burst into daylight with the Repo Crisis that resulted from the Fed tightening all the way into last summer, which caused an instant turn-around on the Fed's part that did, as I said it would, come too little too late (even as big as their efforts appeared to be last fall, causing even me to think maybe they would do enough in time to forestall the recession anyway ... until they got a shove from a deadly virus).

Have no fear. Good ol' Ben BurnTheBanky and Grandma Yellen are here. They were just quoted in the Financial Times today as recommending EXACTLY what I said in my last Patron Post would most likely be the Fed's first recourse in assuming new powers under the mantle of the Federal Government.

They have urged the Fed to begin buying stocks directly. Yes, the Fed will be enabled at last save its rigged market under any circumstances if the government will grant it this power to use its infinite money machine to buy stocks up to any price it wants. The Fed can print enough money to buy all the stocks in the world, except that it does not ... yet ... have the power to do this because it is not allowed under The Federal Reserve Act. Never let a good crisis go to waste.

Once this practice is allowed, it will probably be a good time to jump back into the most hated and rigged stock market on earth because the Fed will be able to print any price on any stock it wants until money, itself, collapses; and, when that happens, all bets for everything are off, except maybe those good ol' precious metals, but I'll give some warning below on that, too.

Gentle Ben and Grandma Yellen also urged the Fed today to do something I already wrote in the first draft of this article yesterday the Fed was working on. They're using their august prestige to publicly and politically build the case for that which is already fully in motion. I'm referring to Feddy's resurrection of an old commercial paper laundering "facility," which will find little resistance from Trump and congress who want salvation at any price.

The evils beneath the surface

Wasn't I saying something awhile back about the blowing up of the Everything Bubble being an event so broad it would leave the Fed with more wobbling plates than it could keep spinning. Here we are, and who knows what the knock-on effect will be if just one of the plates below hits the ground and shatters?

Zoltan Pozsar who in his latest note published this morning, writes that "all segments of funding markets – secured, unsecured and FX swaps – continue to show growing signs of stress", prompting him to conclude that "the Fed may have to do more still."

Let me cut to the chase on Pozsar's recommended solutions (whose solutions, by the way, the Fed has always grasped at in a hurry because Pozsar is their repo guru): the Fed needs to become the dealer and funder of last resort on anything to anyone, from US CDs to Scandinavian bank credit-default swaps for banks and non-banks. Does that sound like a lot of plate spinning to you? I may be overstating the breadth of his solution a little, but not much! The Fed is pretty much up to now needing to throw in the whole kitchen and pantry and not just the sink.

As Mark Cabana, formerly of the NY Fed, recently said, "the Fed has been on fire." On fire and under fire, and it's firing up even hotter.

The results of the Fed Follies are in and ugly and they give evidence of where the economy is most foul:

The Repo Crisis will not die. First, it was oversubscribed ...

... then finally ignored as being apparently useless in the present catastrophe. Repos are useless now because they are temporary solutions to a longterm problem. That is why I said they would have to be rolled over forever UNTIL the Fed moved to full-on QE, which is why I claimed repos were just a falsified form of QE in the first place. Even with the massive overnight repos the Fed has been offering of $500 billion each operation, the repo rate has looked anything but stable:

Anyone see a stinking dollar shortage anywhere?

Obviously, we've passed that crisis! Don't worry about it. Clearly the Fed has this under control, but you might want to walk a little faster past the graveyard on your way to the ATM because $2.2 trillion doesn't seem to stretch far right now. If it needs to, the Fed can always print 220 trillion. Just add a zero now that we're sliding down the backside of the results curve.

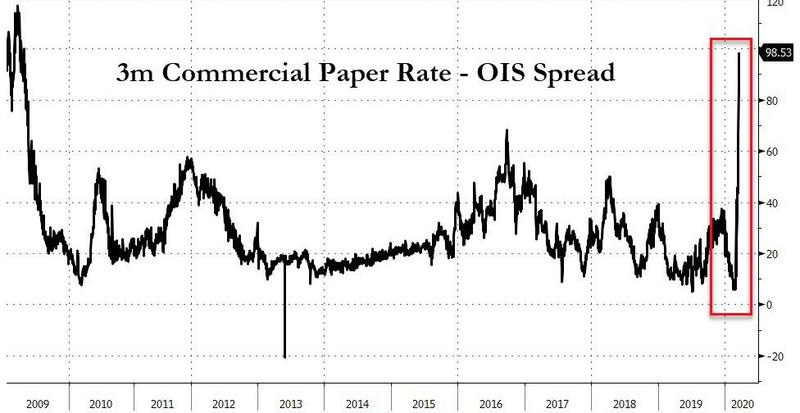

Commercial paper is a newly spotted evil:

The Fed describes commercial paper -- business-to-business loans -- as follows:

Commercial paper markets directly finance a wide range of economic activity, supplying credit and funding for auto loans and mortgages as well as liquidity to meet the operational needs of a range of companies. By ensuring the smooth functioning of this market, particularly in times of strain, the Federal Reserve is providing credit that will support families, businesses, and jobs across the economy.

One line there notes that CP is the loans businesses use to get emergency loans in times of strain from other businesses to carry out their immediate operating needs -- like the loan a stressed bond fund might try to obtain from another financial institution or another business to meet the outflow demands coming from the fund's fleeing investors.

Don't worry. The Fed is getting this one under control, too. This is the part I had written in an earlier draft of this article that I said Ben and Janet were yellin' about today in order to prepare the way. Feddy is resurrecting an old paper shredder in the basement for disposing of some toxic trash. It was last used in the pit of the Great Recession. After all the recent hacks by the Fed that failed, the Fed coughed up an old plan to solve the CP problems ... and so did the Federal government's chief treasurer.

Oh, first let me comfort you by saying there is clearly nothing to worry about here:

TD Economics warns:

Shortly after the collapse in the stock market into bear territory in December 2018, we produced analysis to argue against fearing stock market volatility....

Whoa! Stop! Did I hear right? Someone is finally admitting that the stock market DID crash into a mini bear market in December 2018, an event where I seemed to be the loan voice in calling it a bear ever since? OK, moving right along to the comfort I wanted to give, TD Economics was just saying you needn't fear any of this stock market volatility because ...

Granted the recent rout that dialed the S&P 500 Index back to late 2018 levels in a short period is not common.

Why fear anything that is highly uncommon?

The sharp move corresponds to a 7 standard deviation from historical norms.

Oh, that kind of "not common." Only a standard deviation of 7. Isn't that supposed to represent something like a one-in-seven-quintillion-billion chance? OK. Nothing to be concerned about then. A volatile roll-back of the stock market that had about the same chance of ever actually happening as being aborbed into a black hole tomorrow ... just happened. Pretty standard, really.

However, our eyebrows have been raised at the broadening of financial stress across multiple bond, credit, liquidity and corporate indicators. This is a cause for concern of a possible larger negative credit-event.

Eyebrows raised? Oh, so maybe we should be afraid just as they were telling us not to be? Well, I'm glad something caught their attention! Didn't I just write something about a threatening break-up in the bond market over the weekend? Of course, I should have noted in that article the problem extends to the leveraged-loan sector of the credit world, too. Anyway, it may be nothing more than "a possible larger negative credit-event" that you needn't fear.That credit event also involves a lot of "commercial paper," hence Freddy's need to get the shredder in the basement running again.

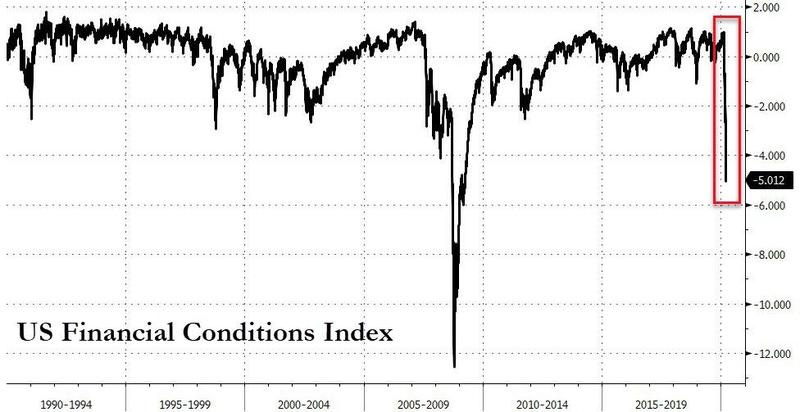

OK, but with all this extra liquidity now starting to flow in, financial conditions surely must be loosening up a little bit, right?

Oops. Guess not. Fed actions failed in that market, too. Meanwhile, how has the Fed been doing at getting that non-fearworthy volatility in the stock market back down?

Nice score. Slightly higher than the worst spike in the Great Recession! I guess that's why they said this is standard-deviation 7 move!

Getting back to my original point in this section, all those signs of trouble are why the Fed over the weekend scrubbed up a recycled invention it is codeveloping with the US treasury to gobble up commercial paper. It announced it is creating a commercial paper (CP) bailout facility. There's a favorite word coming back into play! Of course, they didn't call it a bailout, they used more words, (and you'll have to read all abut that in my next article because this one is running long.) That's the shredder.

Before we close this tale, you need to hear the audience scream ... just for fun.

Shrieks of dread were heard everywhere

Albeit not in today's empty movie theaters.

‘Bearmageddon’ for stocks appears to be upon us, strategist says.

The stock market’s worst-case “Bearmageddon†scenario appears to have occurred ... when the economy rolls over at a time of “maximum level†of easy monetary policy, while asset values like stocks are still expensive. “That combination of events becomes toxic because investors begin to express concern that the [Federal Reserve’s] monetary policy has become impotent. All of us have just witnessed a central bank expend all of its conventional and unconventional tools to support an equity market that is less than a month from all time highs.... The central bank continues to intervene without ever giving markets an opportunity to clear,†O’Rourke wrote. “This will only extend the length of time it takes for the market to stabilize.â€

“This is a break-the-glass moment†for the Fed, said Mark Zandi, chief economist at Moody’s Analytics. “They are throwing everything they’ve got at this. My sense is they must be nervous about the credit system not functioning properly. They are trying to shore up confidence.â€

“The Fed has thrown most its weight behind this move, offering almost everything it has to give, which raises the inevitable question — if this doesn’t work, what will?†said Seema Shah, chief strategist at Principal Global Investors....

“When you have folks in power acting in a very panicky way, doing off-scheduled meetings and throwing everything they can at the situation, that doesn’t send a very reassuring signal to the general population.†said Max Gokhman, head of asset allocation at Pacific Life Fund Advisors, in an interview.

After firing the biggest emergency "shock and awe" bazooka in Fed history, one which was meant to restore not just partial but full normalcy to asset and funding markets, Emini futures are not only not higher, but tumbling by the -5% limit down.

“This is all coming to a head very rapidly,†said Brian Barish, chief investment officer in Denver at Cambiar Investors.... “At this point, no sane investor should be concerned with 2020 earnings - they are cooked! - but with getting through to the other side of this.â€

“The toxic fallout from the coronavirus pandemic’s bursting of the Fed’s ‘everything bubble’ has collided with the grotesquely over-leveraged and vulnerable U.S. corporate sector -- this puts equity markets in an even more vulnerable position,†said Albert Edwards, a strategist at Societe Generale SA

“While the market may have been disappointed that Trump did not break out the bazooka last night, the reality is the Fed came close to doing that today -- though the market remained unimpressed,†said RBC Capital Markets LLC economists Tom Porcelli and Jacob Oubina. "We continue to hear that liquidity is terrible in off-the-run Treasuries."

The U.S. economy could contract by a whopping 4% in the second quarter.... That’s the most recent guesswork by Capital Economics.

Goldman Takes Out The Chainsaw: Cuts US Q2 GDP To -5%; Says Recession Has Begun.

We just witnessed a global collapse in asset prices the likes we haven’t seen before. Not even in 2008 or 2000. All these prior beginnings of bear markets happened over time, relatively slowly at first, then accelerating to the downside. This collapse here has come from some of the historically most stretched valuations ever setting the stage for the biggest bull trap ever.

“The level of uncertainty is even beyond what we saw in 2008 immediately after Lehman Brothers collapsed,†Dan Galai, a professor at the Hebrew University of Jerusalem, said. "It’s more violent, and it’s more persistent.â€

"History is riddled with disastrous outcomes born of really good intentions.. and I think we're seeing it now.... It all started in the 80s with Fed Chair Greenspan.... Everybody got lazy ... because they bought back stock, they paid their dividends, and off they went.... It’s freaking people out.... There’s nothing normal about this. The Federal Reserve 's job is not to make the stock market go higher"

(From the video below ... Well worth a listen as someone on CNBC finally gets it.)

Some people apparently can learn and are willing to avoid using the coronavirus as an excuse for the market's crash, but the rest at CNBC still don't get it and are begging for salvation from themselves:

"Just Close The Whole Thing Up": CNBC Anchors Beg For Market Closures

Few are dealing with the economic and market turmoil with more chaos and less class and resolve than the expert "buy and hold" class over at CNBC....

After the Fed bazooka failed to calm markets, it sent the popular talking heads into a typing panic.

"Buy and hold" has morphed into "close and hold" now that the bull is DEAD! How dead? Fed dead! That's how dead the Fed is! (Or how impotent right now.)

Markets, you see, should only be open and free when they are rising and when the Fed is control! And clearly it has totally lost control. So...

"Close Twitter, too", they bellowed from their bullish hideaways. Shut 'er down! lest news of how bad things are brings the markets down more":

"Shut 'er down! Markets are only supposed to make money. We've never seen this before! It's not supposed to happen! It's not how things work! Save us from truth that keeps crashing into our hot-air, Fed fantasy balloon ride."

Ya think! And, yet, I still get accosted on other sites from diehard bulls who are staying with the buy-and-hold mantra. OK. Then enjoy the crash! Maybe the new bull mantra should be "scream and hold on!"

And ABOVE ALL ELSE, BAIL US OUT, they are yelling:

The Federal Reserve’s (Fed) attempt to go for shock and awe seems to have been made with the idea that doing something unusual on Sunday night, after the market closed out strong on Friday, would be good for confidence. Of course, the market didn’t take it that way.... The market seemingly responded as if the Fed knows something we don’t know and it’s actually worse than we think.... It’s going to take some major firepower to resolve the forthcoming problems or the slide will continue....

Our best estimates are that the Chinese economy is contracting in excess of 15 percent at an annualized rate, and I’ve seen numbers as big as negative 40 percent. Europe is probably already in a fairly severe recession at this moment. If the United States is not already in a recession, it will enter one shortly.... The risk is that for the first time since the 1930s we are facing the possibility of a downward spiral into something akin to a global depression ... if policymakers don’t act quickly.

Well, that's comforting.

(I'll get into what Guggenheim is actually baiting policy makers to do as recommended solutions in the upcoming "Bailout Bonanza" article. There is just too much to cover in fully describing the Fed's drawn-out death scenes.)

The market's response today (Wednesday)? Another staircase down, and a lot more blood.

So, I think this pretty well shows that declarations of the Fed's death are just about unanimous ... at least when it it comes to the Fed's expected life-giving power imputation to the stock market or any salvation from recession. It's got nothing that works anymore. That's because the market is now paying attention to one thing only -- the economy. It's rushing to catch down to where the entire global economy is running. Even free Fed funds are meaningless in this recession.

In conclusion

I know, at last! But Feddy Krueger's don't die in one fall. They don't really die at all. They just keep dying. In this case, an unforeseeable little virus (a true "black swan") lit everything on fire, but the forest was filled up with years of dead wood and a nice pile of tinder, gun powder and gasoline was laid by the master planners at the windward side of the forest for the virus to hit like a match. The Fed and other financial wizards of Wonderland and corporate CEOs created so much garbage throughout the economy over the past decade, that one little virus now owns the entire forest, and its taking it quickly! The Fed can be blamed in large part for that. So can anyone else who willingly played along.

That's why I write this blog -- not to advise people on how to invest -- but to say, "Stop doing this!" Kill the Fed. (Not the people in the Fed, just the institution.) Stop bailouts for banksters, laying up moral hazards in the forest for the future. Stop all the share buybacks that were illegal for decades. Stop kicking the can down the road. Stop saving ourselves by piling up debts for our grandchildren to bear. Stop thinking we are generous to the needy because we give them welfare our children and grandchildren will have to pay for. Stop fighting wars all over the world that out children get the bill for. Stop saving the world with aid that we aren't paying for when we cannot even save ourselves. Start revising corporate laws to hold the feet of corporate executives to the fire by putting all of their own personal wealth at stake when their company's downfall is due to their own negligence or illegal activity. Start looking for who is at fault now and do put them in prison this time. Reinstate Glass-Steagall. Stop hiding the financial rubbish up in the attic or down in the basement. Stop saying the economy is strong when it clearly is riddled with cracks everywhere. Start planning for hard times and laying up stores for times like these. Be prudent. Stop hyperventilating the stock market into rarified atmosphere by being a stupid permabull. Start pricing your market bets based on the actual profits of businesses. Stop being a talking television head who says what everyone else says. And NOW keep the Fed from now going into buying stocks directly to pump the market up all over again. Let the market price to reality! Don't let the Fed obtain new powers.

Along the way forward, if I can see any way you can save yourself from the crashing of the Everything Bubble where there are no safe havens anymore, I'll let you know in my Patron Posts, but I haven't figured that out yet. At least, I will scout the lay of the land as it is appearing before us if I have your continued support; but I'll warn you, it is not a rosy picture.

While I know what transformative cures the economy needs, I don't necessarily know how you can save your personal economy from what the general economy all around you is now going to do to you if you haven't already taken the precautions I've given over the years of just being ready for hard times. If reading my blog got you to stop being a permabull a couple of months ago when I ripped into how dangerous the runaway bull market was (if you ever were a permabull), then I've already helped you a lot.

It's time to act to stop the stupidity before it's all repeated because the Fed is working on its resurrection now. We need to become a country of PRUDENT business people again. We need to stop the bailouts that are forming so as not to rerun the entire Great Recession! Stop the rinse-and-repeat massive recession cycles that result from Fed bubbles. Stop the greed!

Those behind the bailouts were all capitalists when the cash was rolling in and the credit was cheap. Now, they're all socialists as soon as everything turns to loss. They are already pleading with the government to socialize their losses onto the back of the government, the Fed, and ultimately the tax payer. It's time to Beat the Establishment before it beats all of us into the ground because the replay of the Great Recession has already begun.

A step you can take for your own protection

There are no safe havens any longer, though gold is looking safer than anything, but just remember central banks own a lot of it to protect their currencies because they know people like it as a safe haven when they want to run from CB currencies. So, they own it as ballast to throw off if their own currency starts sinking -- as a way to suppress the price and appeal of gold.

They own their governments too, and governments have put price controls and even possession controls on gold in the past. A case in point came from one of my regular readers this morning (Chris P):

The price of silver got hammered down this past week and none of the dealers have any in stock and the people you contact that are supposed to be reputable are asking $18-$19 and oz. So there is a $7 premium on silver since in my opinion the Fed didn't want any competition with their $ or market.

The banks essentially own the COMEX where precious metals are traded. As Chris further noted, the COMEX looks broken because it appears recently to be pricing metals the opposite way from where they should be going when the economy is crashing; but that's why central banks own hoards of PMs; so they can crash the metals market when they need to save their own proprietary product -- money.

Still, precious metals look safer than other options at the moment, even at today's heady prices, and prices of precious metals usually eventually return to their high. They will never go bankrupt or insolvent on you if you physically hold them (so long as they don't get stolen, which is another risk). So, if you want to convert your 401Ks into gold, knowing full well that even precious metals are not guaranteed safety, you might investigate Perpetual Assets to see what is involved.

It's not easy to convert your 401Ks into gold, though Perpetual Assets can guide you if you are thinking about doing that.

Full disclosure: I do get a commission from any business that comes their way due to that ad in my site's left sidebar, and I haven't used them yet myself. That means I cannot recommend them from personal experience. The reason I haven't used them is that they are expensive, but the process of doing things legally is a bit involved, which is why I probably would use them if I were going to convert our 401Ks to precious metals.

However, losing half the value of your 401K is expensive, too. So, my failure to use them is inertia on my part, I guess. That said, see the ad at the bottom of the left sidebar if you want some help with converting 401Ks to precious metals. Even at today's precious prices, their approach is becoming more tempting to me, and that's why I've kept their ad around, even though I've never made a dime off of it so far.

Do let all of us know how it goes if you use their services, as no one has gone to them from this blog so far and actually used them. If it's not worthwhile based on your actual experience, I'll take down the ad. But it may be worth an inquiry because there is a lot more market pain coming from many directions ... in my opinion. I don't think anything is safe with the Everything Bubble breaking all over the place.

![By Neuroxic (Own work) [CC BY 4.0 (http://creativecommons.org/licenses/by/4.0)], via Wikimedia Commons By Neuroxic (Own work) [CC BY 4.0 (http://creativecommons.org/licenses/by/4.0)], via Wikimedia Commons](https://substackcdn.com/image/fetch/$s_!bnnv!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F86154e11-88c0-4447-8709-3b546e5d8b5f_300x286.jpeg)