In Powell We Perish

It Turns out it Is what it Wasn't: The government has been lying all year long about new jobs.

At the start of the summer, I said I expected to see the labor market finally starting to turn down. Then it didn’t happen, so I admitted a few days ago that it appeared I was wrong about that — a little premature perhaps. Well, it turns out I wasn’t quite so wrong, so we’ll start with the labor lies that will be Fed Chair Jerome Powell’s downfall … and ours, too.

Labor luggage

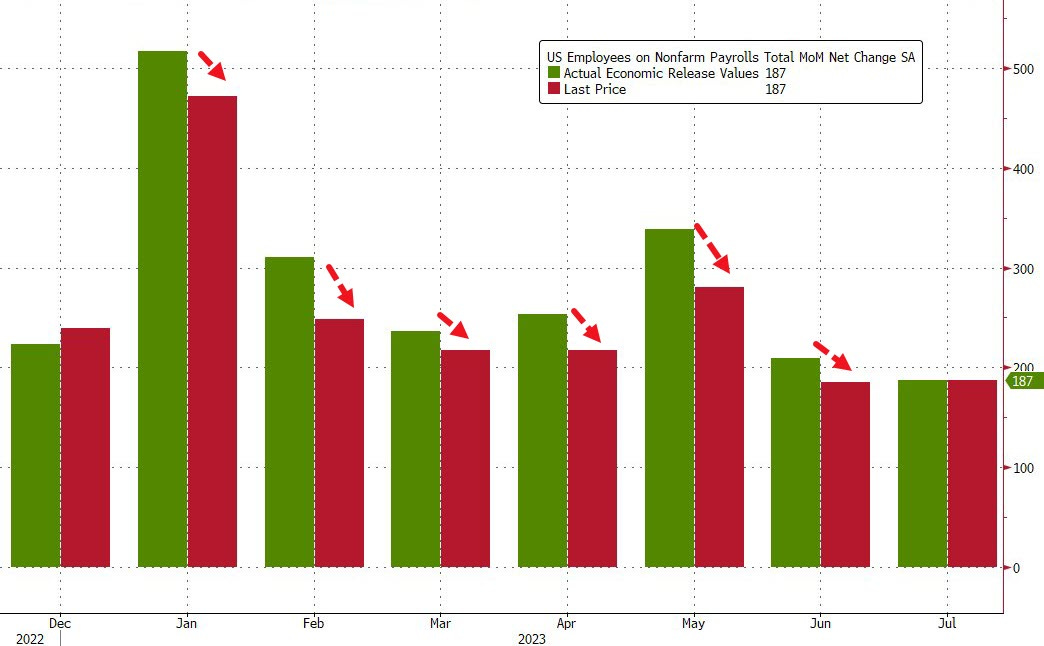

There seems to be a lot of baggage being carried along in the government’s monthly labor reports. The labor market can now be seen to have been turning over throughout the summer — in fact, all year. The government was lying, and it was lying in order to make President NoMoJo look good. I try to avoid jumping to such conclusions, though Biden practically begs for them, but the evidence presented by Zero Hedge today of government revisions in labor reports shows such an absolutely consistent approach of reporting strong labor results on initial reports then revising them down to deteriorating results a month later that the conclusion can hardly be escaped.

You’ll see in the boldfaced articles below that tired old Joe’s government has been reporting high then revising down government job statistics every month this year. I’ve argued in the past that I believe the government reports high then revises low because no one cares a month later how things get revised down. The month being revised already had its big impact when first issued, and now with the downward revision, everyone’s attention is on the latest month, anyway, which is made to look better in the month-on-month comparison everyone watches by the downward revision of the prior month.

When you daisy chain that all year long as ZH’s report shows Biden’s Bureau of False Facts has been doing through several graphs presented, it is pretty hard to escape the conclusion that the government is willfully massaging the data in its interest (presenting a best-case estimate on purpose the first time, then presenting a reality-based report that tightens the data down the next month when no one cares).

At this point, it is abundantly clear that job openings have been dropping most months of the year even though unemployment has not been rising, but you’d hardly perceive that with each month’s initial headline month-on-month report when it comes out.

Each green bar is the initial report for a given month, which gets revised down a month later to the red bar shown for the same month. Then the revised, lower red bar gets used for headlining the MoM gains or losses in the next month’s green bar, making that month “less worse” or even slightly better than the previous month.

Thus, the dive between January and February didn’t look like quite as much of a cliff-dive as it would have because February’s initial report (green bar) gets measured off January’s downwardly revised red bar. It was still a big drop, but not as bad as it would have been. Then March’s big step down in new jobs (green bar) from February’s initial report (green bar) didn’t sound bad at all because it got measured in the MoM report off of February’s huge downward revision (red bar), making March actually look almost flat with February. Then in April, when new jobs went up a little in the initial report (green bar), it looked like a decent bump, instead of the mere blip it would have been had it been measured off of March’s green bar and not March’s downward revised red bar. In May, jobs really did get a big bump up, no matter which April measure you compare to, but that required the largest revision of all the next month in order to keep June’s initial report (green bar) from looking like it fell off another cliff. June got revised down just enough to make July’s small drop look flat.

Pope Powell’s apostasy

Nonetheless, ZH also shows in other graphs that unemployment is still unresponsive, flatlining for months, and that is the more important aspect of the turn I was anticipating we’d finally start to see. Now, low unemployment would ordinarily be wonderful news, except that it means Fed Chair Powell does not have what he wants to see before he stops the pain he is laying in for all of us down the road. The labor market hasn’t turned over in respect to the key gauge our economic high priest is using to determine when he has done enough damage to the economy he oversees to make himself happy.

Had Pope Powell never been so apostate in terms of the Fed’s prime mandate of managing everyone’s money for stability by continuing to pump up the economy with high-stimulus FedMeds for months after inflation was already rising, so much economic wreckage would not be necessary now to douse the heat in the inflation the Fed created with its licentious “money printing.” The Fed hopes you’ll see inflation as something it is merely responsive to in our best interest and not something it is responsible for creating because of its own profligacy.

Powell and his banking priesthood used the “transitory” chant to cover themselves when they constantly force-Fed inflation with low interest and continued bond buying, which the Fed ran long past the yellow part of the inflation gauge and well into the orange. Why Father Jerome and his bankster buddies did that when everyone everywhere in the government and financial media was boasting about how strong the economy was is beyond me. Surely a strong economy doesn’t need MASSIVE stimulus.

Some in the heretic alternative press, of course, would say the only explanation for what otherwise must be sheer stupidity (because who couldn’t see the present situation coming?) is that Potentate Powell wanted to create massive inflation so he could have the fun of wrecking everything for everyone — that it is a plot to take over everything. They may be right. Powell has left me without an argument to help him out as an apologist, not that I would ever want to; but I’m just saying no rational argument to advocate the Fed’s actions exists. So, you are left with institutional stupidity (due to bad religion) or evil.

I hope the high priest who roams the Eccles building has to explain his ecclesiastical abomination at some point, but so far he has not been pressed to do so by any of his followers in the mass-media financial press and certainly not by the members of congress who are supposed to oversee him but who want his free money to bless their largesse. Most seem thankful that Pontiff Powell is now on a mission to rescue us from the Frankenstein economic monster he and his cronies created in the Fed’s basement laboratory of financial wizardry. (One might naturally expect, based on the results of their work, they are cooking up some good Covid down there, too.)

The false hopes from the top

All Fed heads have offered hopes of prosperity for the masses that they never actually bestowed to anyone but themselves and their best friends. That’s just a fact of history. True religion is supposed to offer true hope. The Fed offers only fakery. It builds wealth for the crust at the top of society, then destroys the overheated economy its bubbles create at the eventual cost of millions of lost jobs and homes. It has orchestrated those rinse-and-repeat cycles for decades.

Unsurprisingly — in this market where many of the jobs are held by the same people holding all the other jobs — we read today about the critical labor shortage that is holding up production. That should mean a drop in GDP, but as I’ll be showing in the “Deeper Dive” that I am still working on from last week’s news and this week’s, that isn’t showing up. According to the Fed’s latest GDP estimates, times have not been this good in a long time!

I will, of course, show the many reasons that the Fed’s GDP estimate, again, makes no sense at all with underlying facts and is likely as grossly distorted as the government jobs reports. Anything to make Build-Back Biden look better and perhaps to paper over how Powell’s parish is perishing. The disconnect between the Fed’s initial estimates of GDP and reality has never looked so bizarre. The disconnect between the latest government GDP report and reality also looks bizarre. That’ll be the subject, again, but with additional perspective, of the “Deeper Dive” I’m working on in light of the past week’s news.

Also unsurprising was how another one of this morning’s labor articles carried out the apparent corporate and government directive by doing exactly as I said a few weeks back you could expect to see articles doing now that labor is actually making some REAL wage gains and not those kinds of “gains” that keep wages tracking behind or barely up with inflation. The article immediately clamored for increased immigration, as the corporate bosses always want, in order to resolve the labor shortage because, Powell and Biden would beg that God forbid that the corporate protectors of stockholders should have less corporate cash to spend on massive buybacks to manipulate stock prices up. Those buybacks, fully beknownst to all Fed heads, are where all Fed financial blessings have flowed for years.

The tight supply of labor gives labor strength for the kind of uprising the elite overlords hate to see but are now seeing. Powell and Yellen both preached about how they wanted to see more wage growth, but that was always cheap talk. They simply wanted to sound as if their policies actually sought to help the masses when they clearly did not ever help the masses. It was easy talk because wage growth was running even with inflation for years, and inflation was running very low. You won’t here Powells saying he wants to see more wage growth now that REAL growth is actually happening.

The Fed heads NEVER want to see is REAL wage growth; i.e., growth that actually gains on inflation — growth in wages that actually helps the people of the middle class improve their status. Raising wages above inflation creates more inflation because without raising prices to offset the wage increases, how will those who benefit from the massive stock buybacks ever maintain the massive stock buybacks? The untold truth by pontiffs and presidents is that corporate greed drives inflation far more than wage increases.

Labor is saying, “If you don’t want your production to fall due to the labor shortage, give us a bigger piece of the pie to get more workers into the market by natural enticement.” There has long been a lot of extra pie on the top-1% shelf; so there is plenty of room to cut off more pie for the proletariate if you just trim the crust a little from the top 1%. Let them cut into their profits to pay labor more. Let them diminish their dividends.

Most of the buyback action in today’s market was illegal for decades because it manipulates stock prices and enables shareholders to avoid some taxes because stock gains get that special privileged tax rate intended to serve those who work the least but make the most — the shareholders that typically don’t even work at the company they own. So, make those buybacks illegal again. Then the owners can spend their well-known hoarded cash piles on labor.

OK. That isn’t likely to happen, though it could because it once did; but let’s keep an eye on where the greatest greed really is. It is not among the millions who work to make the products; it is in the divine prosperity of the shielded corporate owners who have been blessed with financial indulgences by the Fed and the federal government’s tax laws that help them keep those indulgences to a greater extent than the middle class gets to keep its wages. I’m for capitalist principles and fair taxation, but right now taxation is tipped toward the top because of the special capital-gains tax rate that certainly never helped create jobs in America and even more certainly never trickled down.

Miscellaneous matters

Today, I’ve included a couple of the weather exceptions I said would still be added from time to time, even as I am backing away from weather reportage. As a result of the hottest gulf water temperatures in recorded water-temp history (apparently actual temps., not the heat-index kind of nonsense), the big storm swimming across the gulf toward Florida is likely to strengthen to a major hurricane.

What is unusual is the path the hurricane is taking directly into Florida’s armpit. While that area lacks the big cities that line many other coastal areas, the strong remnants of the storm are likely to cross over the state on a path precisely centered along the Georgia and Carolina coast, which could have a major economic impact due to its long sweep up some of the nation’s most pricy real-estate.

By that time, the winds won’t be as severe, but a lot of storm surge is still expected. More importantly, the amount of rain picked up off all of that exceptionally warm gulf water could cause major flooding. So, the storm path and intensity create the potential for an economically expensive hurricane as it sweeps the southeastern coastline across the better part of three states … if it stays on course.

Finally, a graph in the headlines follows up on my claims about where Treasury yields would be heading this year by showing what a mountain they have climbed, while a report on the London stock exchange follows up on my earlier statements about a likely flight of capital from other nations into the US, helping soften the financial blows here … at least, a little.

(Stories related to the always-free and hopefully helpful weekday editorial appear in boldface below for the paid subscribers that float my boat, who will also be receiving the “Deeper Dive" late today.)