Inflation Is Still Burning a Hole Through Your Money

While we are far from the hyperinflation some have predicted errantly for years, we are back to inflation getting hotter, and the market just got a tiny taste of that lingering spicy burn today with the release of the Fed’s minutes. Investors turned the minutes over and inside out several times looking for some small hint that the Fed’s last rate hike was, indeed, its last rate hike. Nothing. They shook the pages to see if anything would fall out from between the lines. Nothing.

So, with that and reports of declining retail sales, the market’s recent big winning streak hit a wall like a cartoon bird that soars into a wall then slows sinks to the ground. In fact, the only thing the minutes seemed to say about inflation was “higher for longer” or, at least, “longer for longer” in fighting it. Amazing! There was nothing to support the market’s Fed fantasy that the central bank will cut rates four times in the coming year. Ha! Not even enough to suggest they’ cut them once unless the whole house is on fire by then, and then what does it even matter?

“It’s possible that we’re in the middle of [an] infrequent but very significant generational regime shift. And it’s possible that we’re not going back to zero rates,” said Jon Burkett-St. Laurent, senior portfolio manager at Exencial Wealth Advisors.

Ya think? Now, there is a penetrating glance into the obvious! At last, it should be obvious, but apparently it isn’t. Because that is how you get to that hyperinflation if that's really where you want to take this. (See the video linked to below about the five worst hyperinflation train wrecks in history.)

As noted below in a DiMartino Booth tweet (or do we call it an “X” now?)

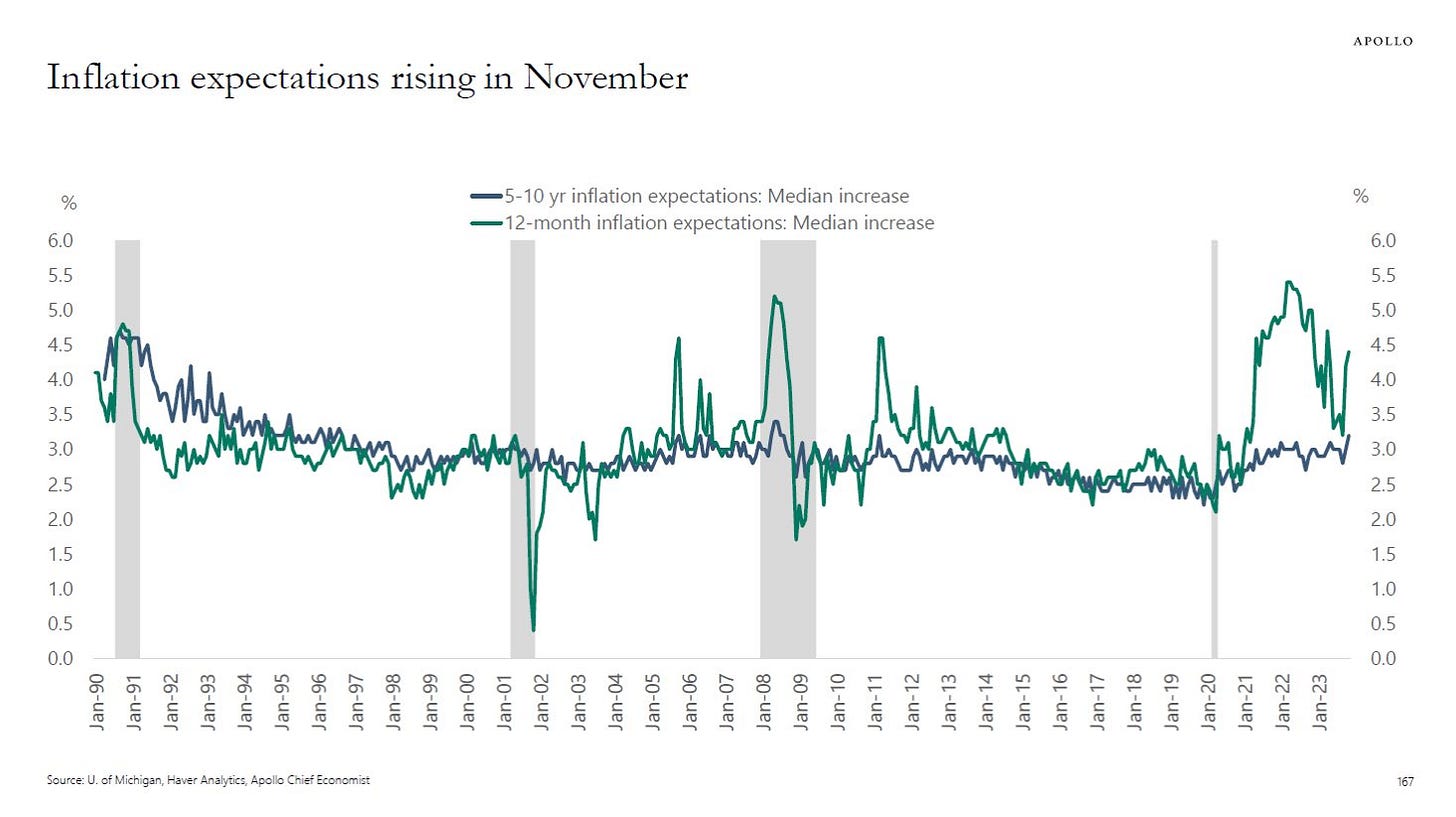

The Fed cannot begin to send dovish signals when inflation expectations jump higher the way they have done recently.

Yet, that is exactly what it did, and we instantly got the proof that it cannot do that. The market immediately snapped at the lure and ran away with the line flying and with the reel screaming. That loosened financial conditions just like the Fed doesn’t want. However, the market found no meat on that lure. Just flash. When the market looked for meat in the minutes, it found nothing to fill its appetite. It was all fantasy feeding. All hook, no meat.

So, DiMartino Booth asks a question similar to the one I’ve been saying is very dangerous: What happens if unemployment goes up quicker than inflation comes down? What do you do if you need to stimulate the economy with looser rates — as the lunatic market wishes for — while inflation is still stuck or even rising? You better be careful what you wish for because that is how you finally start moving toward that potential hyperinflation someday.

Just stimulate the economy in the presence of inflation as unemployment reduces production, thereby reducing the supply of goods. That way people will continue to have money to spend (as the government distributes the new money you print or takes out more loans with lowered interest again) so people can keep spending on fewer goods.

Inflation expectations, she also points out, are now soaring:

Gee, and just a week ago everyone was certain inflation was over. Well, almost everyone. You know who wasn’t, but it looked for a moment like he was wrong.

Turns out oil prices are going back up, too. Who is to say for how long, but OPEC meets this week to try to make sure they go back up and stay up. Since oil was the only thing that truthfully brought inflation down to any significant degree in the last report, we know what happens if oil prices go back up, and that is just in terms of the energy component of CPI, not in terms of how higher energy prices also raise the price of everything that uses energy. Which is … everything.

So, all the stuff that almost everyone was certain had turned a corner last week, now looks uncertain, and may be turning the corner back already.

"For now, with demand still exceeding available supplies heading into the Northern Hemisphere winter, market balances will remain vulnerable to heightened economic and geopolitical risks – and further volatility ahead," the agency said.

Uh huh. That one reversal is all it would take to push official CPI back up, in spite of the “Great CPI Lie.” So, while I admitted I was apparently wrong when the last inflation report coming in even hotter, digging into it revealed the worst baldfaced BS from the BLS I have ever seen; and the only other support they found for getting inflation down was what actually happened in oil, and now that MAY be turning the thermostat on inflation hotter. Money is starting to smoke again.

One thing that might not be burning, however, is the beef on your grill later this year. That will be because it isn’t there. Increasing beef shortages due to summer droughts are expected to double prices by later in the winter. Just today, I heard someone say they paid over a hundred bucks for the seven-pound chunk of prime rib they bought to feed family on Thanksgiving. (Now that is sacrilegious in my book — not serving Turkey on T-day — so I can’t totally sympathize with the fellow, who probably won’t be offering any cranberries or stuffing either, except that those prices and worse will hit all of us good Turkey servers at Christmas when prime rib becomes perfectly acceptable.)

I’m glad we packed our freezer full with some locally raised, grass-fed beef and locally caught coho salmon. We’ll have plenty of meat … even enough to share if you want to stop by for dinner … because that is how it’s done between friends in times of need.

You can read about this stuff piecemeal in publications here and there and get a sense of the trouble that is coming; but reading the aggregated headlines that follow each day, even if you read only the headlines and not the articles and not even these editorials, gives you a much clearer picture of the sweep of things that are coming down. (And prices are no longer one of those things.

Coming up in my next “Deeper Dive” will be the looming debt mountain that is burying the government. I won't be talking so much about the scale of the debt, as we all know how extreme that has become, but more about the ways in which the mountain is cracking like a volcano does before it explodes.

I won’t say more about the debt here, except to note this one little part of one of the articles below about the Fed minutes:

Officials concluded that the rise in [government bond] yields had been fueled by rising “term premiums,” or the extra yield investors demanded to hold longer-term securities. The minutes noted that policymakers viewed the rising term premium as a product of greater supply as the government finances its huge budget deficits.

I read that as the US government is on its own to solve its interest problems on the sovereign debt by dealing with the huge supply issues the government alone is creating. The Fed has no responsibility for the huge increase in supply (outside of enticement with loose credit) and no way to do anything about a bond oversupply issue anyway because raising its balance sheet to absorb the increased supply will take us down that path to hyperinflation. So, it cannot be done. The only workable solution is for the government to balance the budget in order to stop making its debt problem worse.

Speaking of prime rib, FAT lot of chance there is of that under Bidenomics on the expense side or of getting Republicans to do something sane on the tax side like eliminating the special capital-gains tax rate that benefits the well-healed almost exclusively with a lower tax rate than someone putting in lots of hard labor at two jobs to keep up with inflation. None of special tax cut ever tricked down since the Reagan days nor ever resulted in more factories being built in America. That was all a sales job or bad thinking. Why would you build factories when you could just use the savings to buy back your own stocks and get a better tax rate than you get on profits from factories. So, that is what they did — that and pay themselves larger dividends while creating any necessary factories in other countries where labor and construction were cheaper. Even heavy sludge trickled down faster than the special capital-gains tax cut.

Fat lot of chance of getting those Republicans to save social security by eliminating the cap that protects only the income of the relatively wealthy, too — a simple solution that leaves Social Security with a huge surplus for years to come. In fact, all you’d have to do is raise the cap, not eliminate it, in lieu of cutting promised benefits from those who’s money you took in trust with the promise of giving it back with interest upon retirement or disability. (They are entitled to it because it was THEIR money in the first place, supposedly secured by the government as part of their retirement planning.)

No, we’ll just let it all crash into a smoldering heap of rubble or light our money on fire with hyperinflation if the Fed helps the government create more debt to fund it all, which comes to the same thing.