Inflation Rises Faster than the Fed Expected, Giving Fed Less Time Than it Needs

Economists -- including those at the Fed -- were surprised by inflation again. With their consensus view being that inflation for June would print at about a 4.7% increase year-on-year, inflation barreled in at 5%. That took us back to the kind of inflation we saw in 2009 when the economy and stocks were falling apart:

Because of how quickly consumer inflation is rising, Bank of America (in trying to keep with the Fed's view that inflation is transitory) quipped we're moving toward a period of "transitory hyperinflation."

That CPI number, however, was not the worst of it. The Fed prefers a different gauge for determining its economic policy -- their "core" inflation rate, and that number, which strips out the most volatile price categories that are tracked, came in at 3.8%, which is the hottest core inflation has been in more than a quarter-century.

How bad is it?

Inflation is actually much worse than the headline numbers show. If we measure inflation the way inflation was measured in the seventies, we're already there! Those who were around in the 1970's remember inflation as being a big concern in every financial decision for years. If you calculate today's inflation rate the same way it was calculated back then, inflation is already in the double-digits of the seventies.

The only difference in your experience of inflation now compared to back then is that you've only been experiencing it at seventies levels for a couple of months, and inflation does its corrosive damage over time. The high inflation that began in the seventies wore away at people for years.

The difference in how inflation is calculated happened because Fed chair Arthur Burns didn't want to deal with inflation and crash the economy and markets. So, he ordered a revision in how inflation was calculated by removing volatile food and oil prices (two of the three biggest factors in anyone's budget, the biggest being housing) so he could pretend it wasn't as big a problem. As a result, the problem grew worse. (That's not unlike the Fed's denial today with its "transitory" narrative.)

Since then other changes have been made -- the biggest of which was to take care of that nasty housing factor by replacing actual changes in housing prices with guesses by homeowners as to what their house would rent for.

So, that seventies show of inflation has already begun, and the Fed is promising it will do the same thing Arthur Burns did -- ignore it by claiming it is transitory and will go away on its own. The Fed can stop the problem, of course, by raising interest rates drastically as was eventually done by Paul Volcker to end the seventies inflation cycle and by stopping QE (something that didn't even exist back then), but that is exactly what I've said will crash the stock market.

(Note that my argument has not been that inflation will crash the market immediately, but that this inflation cycle will keep rising until it does crash the market, either by forcing the Fed to capitulate or by tearing the financial world apart because what we see right now is the mere beginning, which will grow worse for as long as it is denied. I'll be explaining WHY this inflation will not prove transitory, as the Fed claims it will, in my next Patron Post.)

Going for broke

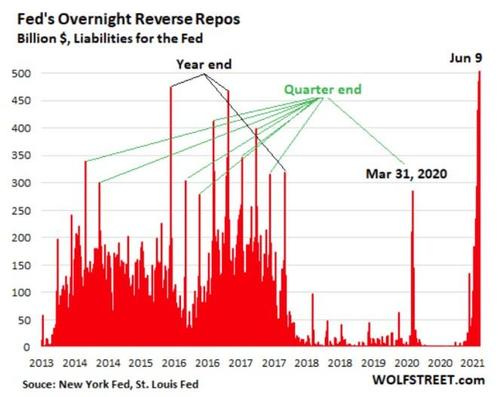

Because the financial system is flooded with more money than it knows what to do with, banks are actually asking businesses not to make deposits and are handing cash back to the Fed through its backdoor at almost the same rate that the Fed is continuing to expand money supply out the front door. The Fed denies this reverse repo crisis is a crisis at all, just as it denied, at first, the 2019 repo crisis was a crisis it couldn't manage without restarting full QE. So, just as back then, the reverse repo crisis keeps breaking past records:

Just as then, the crisis will continue because of the Fed's denial. Only the problem now is too much QE, and the solution now is to end QE. So, the crisis will continue to build. Here is how that works:

U.S. companies are holding on to billions of dollars in cash. Their banks aren’t sure what to do with it.... Because companies are reluctant to borrow from them, they can’t turn it into income-generating loans. That has weighed on banks’ profit margins, and some have started pushing corporate customers to spend the cash on their businesses or move it elsewhere.

Who would have thought we'd ever hear banks saying, "We don't want your money! Take it somewhere else?" What a ludicrous world. "Please don't loan us free money to work with because it costs more for us to store it than its worth to us."

Bankers say they thought the improving economy would reduce companies’ desire for holding cash, but deposit inflows have continued in recent weeks.

Even, the Fed keeps pouring more fuel on the fire at a rate fifty-percent faster than its QE coming out of the Great Recession.

You see, banks don't make money by collecting deposits. That does not become their money. It remains yours and is treated by the bank as a liability (a loan from you). They make their money by investing the money they've borrowed from you and making the return on that investment their money. In return they supposedly give you a tiny share in the form of interest they pay on your deposits, but we all know what a cute anachronism that has become! Now some banks don't even want your money for free. That's not far from where European banks were when depositors had to pay banks to hold their money.

Deposits are your loan or a business's loan to the bank where traditionally the bank loans it back out at higher interest and pockets the money made from that carry. They cannot invest your money directly into stocks, and right now they cannot issue enough loans against your deposits, even at extremely low interest, so the money just keeps piling up on the liability side of their balance sheet.

The industry net-interest margin, a key measure of lending profitability, fell to a record low in the first quarter, according to the Federal Deposit Insurance Corp....

Top of mind for many big banks is a rule requiring them to hold capital equivalent to at least 3% of all assets. Worried about the rule’s impact during the pandemic, the Fed changed the calculation in 2020 to ignore deposits the banks held at the central bank, but ended that break this March. Since then, some banks have warned the growing deposits could force them to raise more capital, or say no to deposits.

“Raising capital against deposits and/or turning away deposits are unnatural actions for banks and cannot be good for the system in the long run,†Jennifer Piepszak, then-CFO of JPMorgan Chase & Co., said on a call with analysts in April.

The the reverse repo crisis broke out because the requirement for raising capital was reinstated in March. The Fed says it is not a crisis, but is going according to plan. Odd plan. Pump in more money than banks can use and then give them a back door to park it out of reserves via reverse repos. This the Fed now has to do in order to avoid that European situation where you have to pay banks (negative interest) to hold your money because the Fed has sworn off of negative interest; but it's money creation is naturally pushing us there.

Either way, the reverse-repo situation reveals there is way more money in reserves than banks can use. If they cannot find people or companies to issue enough loans against their swelling reserves, then they want to remove those excess reserves so that they don't have to raise more investor capital ... or charge people to hold their money or just turn them away. Reverse repos allow them to do that temporarily and get the money back later if they find customers to loan to. Right now, it's almost like money no one wants even at cheap interest.

Bank bulimia

This binge-and-purge bulimic environment is created by the Fed stuffing money down banks' throats at one end and giving them laxatives to pass it through quickly and undigested out the other end. Via its reverse-repo enemas, the Fed has already extracted four months of the money that its quantitative easing stuffed to the financial system.

So, why is the Fed doing something that is damaging its own monetary policy by pressing banks toward negative interest? In spite of the obvious absurdity of this situation, the Fed maintains it must keep the QE up for the economy's sake, but the economy is not utilizing the money. So, it really keeps it up for two very different reasons that have the Fed's back to the wall: Stopping QE would put stock and bond markets into apoplectic death spasms, and stopping it would leave the government unable to finance the massive debts the government must endlessly roll over, much less add to them. Because the Fed has become the major buyer in the world of government treasuries, government interest rates would have to soar to attract enough buyer to replace the Fed.

You would think the Fed would recognize (and care) that they've plunged the banking world down the rabbit hole into another upside-down Wonderland; yet, the Fed continues merrily pumping money down the throats of banks with no hint of flinching on its promise not to taper its money creation or it low interest rates for a couple more years simply because it has to. It's trapped.

Whether or not stock investors fully believe the Fed's narrative that this inflation is "transitional," investors do appear to believe that the Fed believes it, and that is all that matters because it means the Fed will not relent on its massive monetary agenda.

The Fed has clearly already stood the banking system on its head this year now that it has banks for the first time I can remember throwing cash deposits off to other banks as quickly as they can, saying to their own customers, "Please don't make us store more of your money."

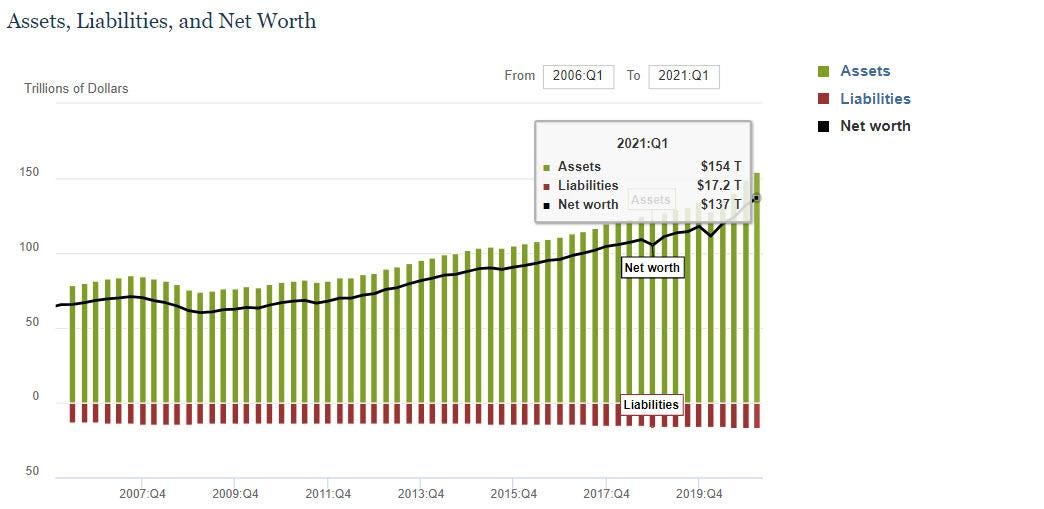

Households don't need loans. They have more money than ever, even though I'm sure most don't feel that way:

You may not be feeling the wealth, and that's because most of the average household's rise in net worth is due to rise in real-estate values that don't do most people any good because they don't intend to cash out their house, and if they sell, it will cost them more to buy something of equal quality a week later because real estate is inflating so quickly. Meanwhile, higher home values mean higher property taxes. Some of the rise in household wealth is due to a rise in the value of retirement funds, but most people don't feel the value of that right now either.

You also may not be feeling the rise in net worth because an inordinate amount of the new wealth went, as always, to the top 1% due to the inflation in stock values as usual. So, very few households are getting much of a share. (Yet, the Fed does not believe it creates wealth disparity, or, at least, it denies it.)

Household savings are up, too, and many are using their government checks to pay down credit cards (though student loans and auto loans have risen some). Net savings rose by half a trillion in the first quarter and by 3/4 of a trillion in the last quarter of 2020, but that, too, went mostly to the 1%. That leaves the banks with fewer loans to make and means many people have more cash that they can use to bid up the price of goods and services that are in shortage due to people not going back to work.

You may remember that a year ago when employment started to recover quickly, I said it would stall out about halfway back to normal, and that is where we are, and I said that would all end in product shortages that would push inflation up for the first time in years.

There is also not a lot of room for banks to reinvest deposits by issuing home mortgages because the government has completely seized the real-estate market via its mortgage forbearance and rent forbearance programs. Because of the real-estate market being held in suspended animation until later this month (and that can may get kicked down the road again as it has twice already), there isn't much inventory turning over on which to make new loans. Houses are selling for a lot in many places and selling at a record pace, but that is mostly because very few homes are selling at all because inventory is locked up.

Inflation's catch-22 for markets

I believe inflation will become catastrophic for the economy and the stock and bond markets. We have seen how the market is already edgy about the Fed staying on plan, but it is willing to accept all the Fedspeak that is telling investors what they want to hear. For example, even though inflation came in a little hotter than economists expected last Thursday, the market did fine because the numbers were not radical enough to cause the Fed to change course.

So long as investors are convinced that inflation is temporary or simply convinced that the Fed is convinced inflation is temporary in order to keep the easy money flowing, the markets will be OK because the Fed will stay with its plan not to taper. The transitory belief, however, is a blinder that will cause the Fed to run too hot for too long (which it has already done) until inflation rates are much higher than present (I've said probably double-digit). The stock market may keep rising so long as the Fed remains on plan and the Fed doesn't start changing its tune. But when the rates get higher, it will become harder for the Fed to convince everyone it still has this all under control, and markets will get edgier.

Tapering talk among Fed officials has already begun, which is even sooner than I thought it would begin. Those officials will increasingly waver as we reach higher inflation numbers. We are certain to reach them because the Fed won't back off full QE and zero interest until we do, and most product and service shortages are not going away soon enough to avoid causing higher inflation either. These nervous Fed officials will not outlast either the long rise of inflation or the long period of shortages to come, and markets will grow more nervous as Fed chatter grows more jittery until things fly apart or the Fed caves in to inflation's demands and crashes markets by tapering. The gist of my belief is simple: inflation and shortages have more longevity in them than the Fed has guts or room to run because the Fed will need a lot of both, and they are worsening faster than the Fed or other economists thought they would.

(As I mentioned, my next Patron Post will lay out my reasons for believing inflation and shortages are not going to be anywhere near as transitory as the Fed needs them to be.)