Inflation Tsunami Sirens Are Screaming!

You can wait for the deluge to hit and then run, or heed the sirens just in time. As I wrote a year ago, the big news for these COVID years would likely be inflation at levels we haven't seen in a long time. The best harbingers for this kind of disaster for the average person are the prices that rise for producers, which lead to consumer price increases, and there has been plenty of that to report on. This week, more than any past week, provided a shipload of new warnings, which I'm going to cover in a staccato basis because there are so many.

Famous last words before the big wave hits consumers

In my last article on inflation, I quoted from a couple of companies regarding their statements about the inflation they now anticipate in their own pricing to consumers. Here are few more. In spite of what the Fed keeps saying, many of the captains of industry don't see the price increases as all that transitory:

General Mills (GIS): "We are taking actions now and in the coming months … to drive net price realization that will benefit our FY2022."

PPG (Manufacturer of paints and powder coatings): "We experienced a significant acceleration of raw material and logistics cost inflation during the quarter.... We ... prioritized selling price increases across all of our businesses. This has helped us achieve solid price increases year-to-date.... We have already secured further selling price increases and are in the process of executing additional ones during the second quarter."

Pentair (PNR, manufacturer of water and fluid controls and equipment): "All inflation remains high. We have instituted a number of selling price increases across the portfolio that we expect to help mitigate inflation in the second half of the year."

Tractor Supply Co. (TSCO): "Compared to our initial outlook for the year, our forecast does reflect higher transportation costs and product inflation. We ... expect them to continue to be a headwind throughout 2021."

Pool Corp (POOL, a wholesale distributor of swimming pool supplies): "We previously said that inflation would be in the 2% to 3% range but now believe it will be in the 4% to 5% with some products into double-digits.... We don't anticipate this inflation having a meaningful effect on demand as it relates to nondiscretionary products such as chemicals, inflation has simply passed through again with no real effects on demand."

Honeywell International (HON): "For us, inflation is taking hold. There's no doubt about it. We knew it. We see it. It's real.... I can tell you that we stood up a pricing team, which has been in place since the beginning of the year. We're quickly taking actions and we are staying ahead of it. And we're going to continue to monitor what happens and stay ahead of it. But it's a watchout item. I don't think things are going to abate."

Kimberly Clark Corp (KMB, paper products): "Our pricing actions and the benefits of that will be coming through the P&L in the second half. In terms of input cost inflation, that is ramping in the first quarter, and the second quarter."

Mondelez International (MDLZ, numerous everyday food products): "In terms of inflation, there is more inflation coming.... The higher inflation will require some additional pricing ... for 2021."

3M Corp.: "We are also raising prices, but it's going to take a little bit of time. The inflation has come in faster."

Avery (office products): "We now expect mid to high single digit inflation for the year with variations by region and product category."

It's all material

Just take a look at material prices going into the input costs for the corporations:

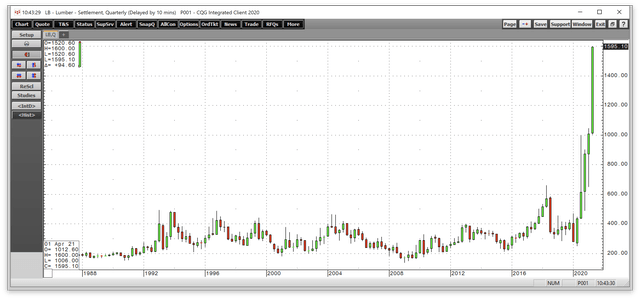

Soaring Lumber Prices Add Nearly $36,000 to Cost of New Home

Skyrocketing lumber prices ... have tripled over the past 12 months....

"The supply chain for residential construction is tight, particularly regarding the cost and availability of lumber, appliances, and other building materials," NAHB Chairman Chuck Fowke said....

At the onset of the health crisis, “the mills stopped producing,†said Dustin Jalbert, senior economist and lumber industry specialist at Fastmarkets in Burlington, Massachusetts. “As soon as they saw 20 million unemployed, they shut down production.â€

These are the kinds of shutdowns I wrote about in the late spring and early summer of 2020, which I said would eventually result in severe material and product shortages down the road. It's taken awhile to play through, but it's here now!

But the pandemic drove demand for housing in low population density areas and for home office space....

Falling supply of materials to work with in the face of skyrocketing demand has made for the most extreme inflation in lumber prices ever seen:

How about that wiring that goes into your house? Price of Dr. Copper:

When I was writing this article, I wrote, "It's not an all-time record, but give it another day." Before I finished the article a couple of days later, it got there.

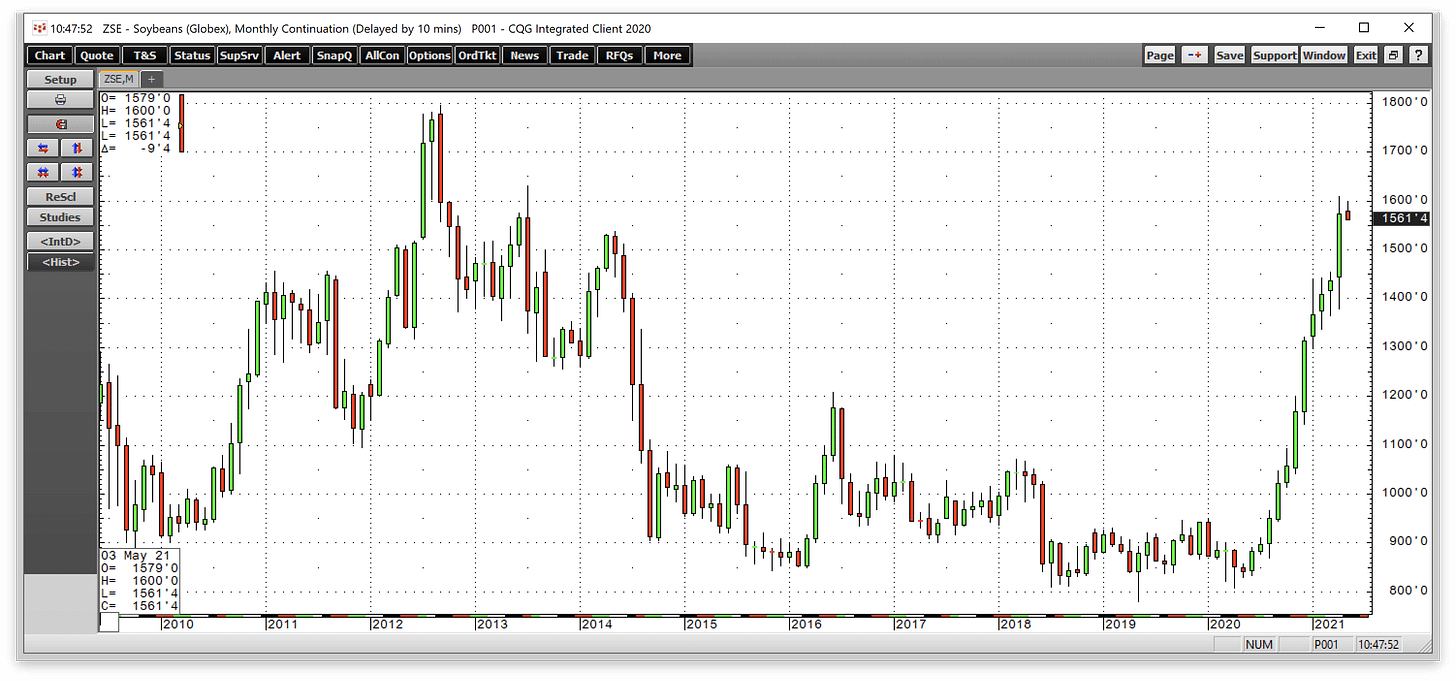

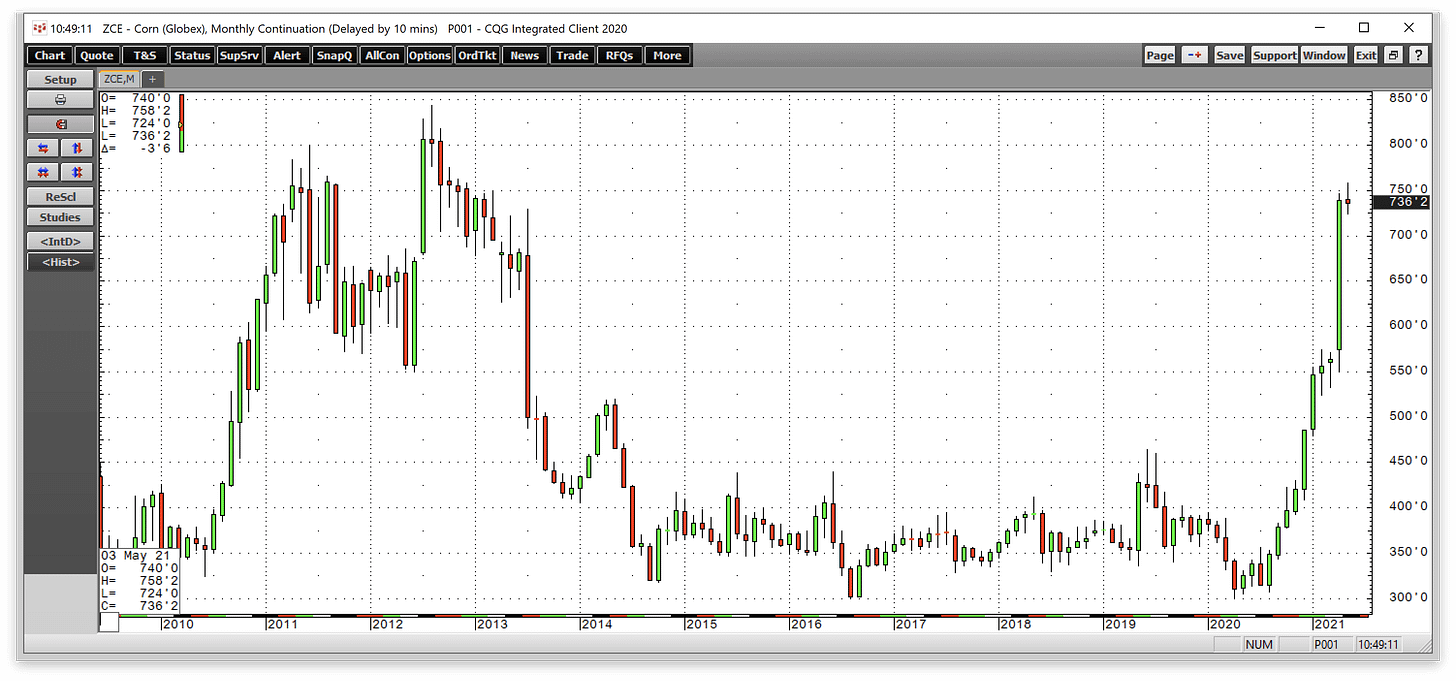

Care any about eating?

Basic ingredients to all the food you eat are almost off the charts, and the rate at which they are rising, for the most part, is steeper and faster than ever before:

This is already translating into higher grocery prices, but here now is one of those areas where I said recently I was going to have to start correcting the misreporting:

Nearly everything at the store, from beef and cereal, to fruit and veggies, costs more than it did a year ago.... [OK, but it always does.] The average prices in March of 2021 for pork chops and chicken breasts are both up more than 10% compared to March of 2020. Eggs and cheddar cheese are both up 6%.... [OK, that's well above normal, but selective.] Looking at all consumer goods as a whole, the latest inflation data in the Consumer Price Index from the U.S. Bureau of Labor Statistics shows the largest month-to-month increase in almost nine years.... [But that is quite something.] V.V. Chari, a University of Minnesota economics professor and adviser to the Federal Reserve Bank of Minneapolis ... says the economy’s making up for the pandemic, when prices didn’t rise like they normally do. Looking at it year-to-year, inflation is only a percent or so higher than what Chari says we would expect.... “There are no indications that we will see the dramatic inflation rates that we saw in the late 70s and the early 80s, when prices went up by 10%, 12% each year,†Chari said.

The notes I inserted in brackets above were not the corrections, but this is the point where I just have to cut in and whack an economist on the head for blatantly false reporting. That comment could only be true if prices declined in March of 2020 due to the COVID shutdown or, at least, inflated significantly less than their normal trend. Your own experience tells you they did not. That was when customers were raiding the shelves and fighting over toilet paper, and the government was actually warning retailers against the urge of price gouging. It was far from an anti-inflationary environment.

In fact, food prices last March rose 1.9% on an annualized basis, which is almost exactly the normal 2% annually that grocery prices usually rise and that the Fed targets for inflation. March of 2020 was completely normal for inflation -- as normal as you get. To put it in context, March of 2019 rose 2.1%, but March of 2018, 2017 and 2016 rose 1.3%, 0.5% and 0.8% respectively. So, the economist is outright lying or just plain dumb. Even common sense tells you she was way off track.

Food prices and many other prices rose like they normally do last March, in spite of the pandemic. In fact, after March, they rose worse than normal with every month in the remainder of 2020 coming in between 3.5% and 4% on an annualized basis. All the remaining months were in excess year-on-year of anything they had seen since 2011. It wasn't a horrible year for inflation, but it was worse than most. So, the economist is speaking utter nonsense or deliberate falsehood, while overall food inflation this year so far is at its worst in nine years.

Yet, we have to endure financial reporting nonsense like this:

So, like groceries, gas is catching up to get back to where we would actually expect it to be, according to Patrick DeHaan, head of petroleum analysis at GasBuddy.

"Catching up" may be true for gas if you look back to where prices were in 2018, but it's total horse manure when you embrace groceries in the comment. Groceries have no catching up to do whatsoever. The average rate of inflation for food for all of 2020 was 3.4%, which compares to rates that 0.3%-2.5% for every year going back until 2011 where the average for the year was. 3.6%.

And while overall inflation was less than normal for April through June last year, what does that have to do with this year? Prices still rose last year; so, it is NOT as if you are comparing to an anomalous year where overall prices fell in those months, meaning some of this year's gain was just making up for last year's unusual loss. Then you could truthfully say there was a base effect.

So, poppycock!

That's why I write this blog -- because the nonsense that gets reported in financial news is so readily accepted as fact.

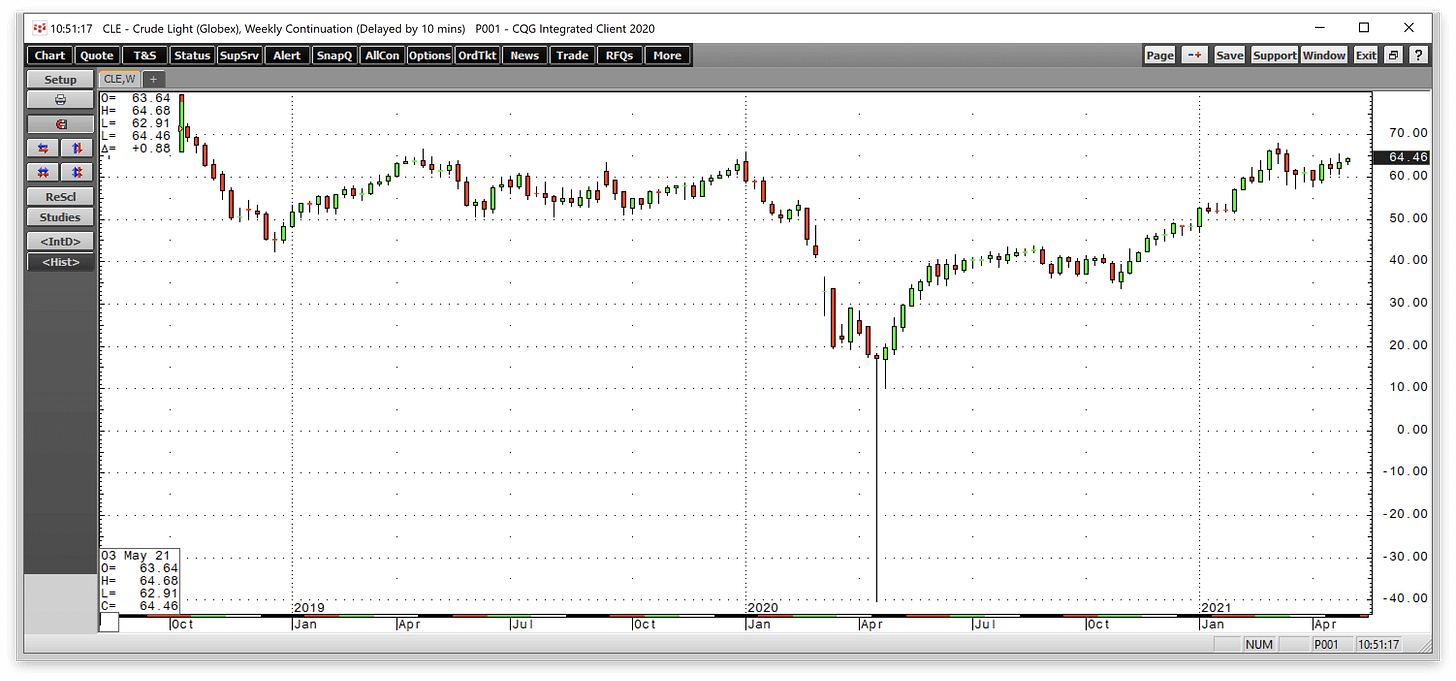

Does your car like to eat?

While it's true that oil prices and gasoline prices fell off a cliff in 2020 (and you can see that in the chart below) because nearly all vacation traveling came to a close, office/work traveling and commuting went virtual, and transport of goods was terminated across some borders and slowed way down everywhere due to production lockdowns, oil and gas prices have climbed back to where they were in 2019.

And, in case your car sometimes consumes parts:

Auto-parts stores, seeing a high rise in their costs due to supply-chain and transportations problems that are a one-two punch from COVID and trade wars across many industries, see a clear path to raising prices for consumers. Most of their customers are purchasing for must-have auto repairs, not restoration or customization projects. In the must-haves area, customers who have more government money to spend than what they made working will increasingly spend what it takes to get the parts they need.

Housing is is riding its own wave of inflation

All I'll note here, since I've written about housing recently, is that housing is a major component of CPI (33%), BUT it is priced within CPI solely in terms of rental rates. Because the transition from rising home prices to rising rental rates is just ramping up, you will see significant impact on CPI in the months ahead. As anecdotal evidence, rents where I live have just entered the bidding-up process that has been going on for several months in home purchases. One person applying to rent a small home for $2,000 had to bid the price up to $3,000 a month to get the home. Though I'm sure it has happened in other parts of the nation before, I don't recall ever hearing of bidding wars for rentals. (And the rental rates are already high.)

As you can see in the graph below, rent increases have just begun and are substantial, so they will start to show up very soon in CPI:

American Homes 4 Rent, which owns 54,000 houses, increased rents 11% on vacant properties in April, the company reported....

Invitation Homes, the largest landlord in the industry, also boosted rents by similar amount, an executive said on a recent conference call. Or, as Bloomberg puts it, record occupancy rates are emboldening single-family landlords to hike rents aggressively....

“Companies are trying to figure out how hard they can push before they start losing people,†said Jeffrey Langbaum, an analyst at Bloomberg Intelligence. “And they seem to be of the opinion they can push as far as they want.â€

The laborious facts

One of the major underlying causes of the now rapidly building inflationary pressure is lack of production due to lack of available labor.

Rising vaccination rates, easing lockdowns and enormous amounts of federal stimulus aid are boosting consumer spending on goods and services. Yet employers in sectors like manufacturing, restaurants and construction are struggling to find workers. There are more job openings in the U.S. this spring than before the pandemic hit in March 2020, and fewer people in the labor force, according to the Labor Department and private recruiting sites.

That is the sure-fire path to soaring inflation -- more people with plenty of money demanding more products from a greatly reduced labor force producing fewer products.

The reasons are a little more diverse than you might guess (the easiest being that people are making more by remaining unemployed rather than finding a new job):

Surveys suggest why some can’t or won’t go back to work. Millions of adults say they aren’t working for fear of getting or spreading Covid-19. Businesses are reopening ahead of schools, leaving some parents without child care. Many people are receiving more in unemployment benefits than they would earn in the available jobs. Some who are out of work don’t have the skills needed for jobs that are available or are unwilling to switch to a new career.

So, there is more involved in getting people back to work than just terminating the extra stimulus money; and, as you can see, all the new hiring since last March's big bust doesn't begin to add up to all the jobs that were lost in just one month:

Expressed as a cumulative line graph, rather than a month-by-month bar graph, the jobs "recovery" looks like this:

What that means economically is much lower production capacity at a time of pent-up demand, while in the present singular scenario where most unemployed consumers actually have more spending power, thanks to government aid. Even after those millions of people finally go back to being producers (whenever that may be), instead of JUST consumers, it will take months to get inventory back to where it suppresses inflation.

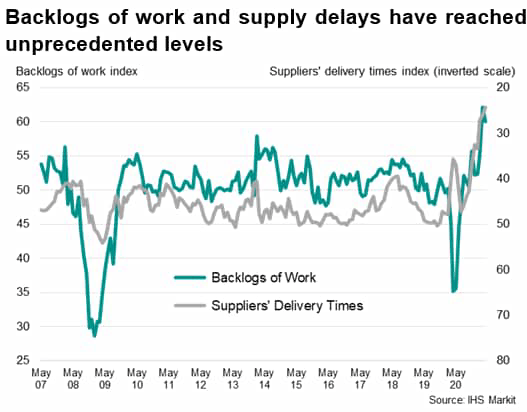

As a result of these supply shortages and labor shortages, here is the difference between orders (demand) and production (supply):

That actual supply shortfall in an environment largely flush with cash translates to inflation, particularly as inventory whittles down. You can see the backlog that cannot be made up from inventory as well as the backlog in work that needs to be done to eliminate the inventory backlog is already the highest it's been by far in, at least, more than a decade:

This becomes even more notable when broken down to consumer goods:

Everything from computer chips and lumber to chlorine and tanker truck drivers are in short supply. Manufacturers, restaurants and other businesses are also desperate for workers.

Meanwhile, many food makers and distributors say labor shortages, supply constraints and high freight costs are making it difficult to deliver complete, timely orders for goods from cake mix to ramen noodles. Similar tensions are mounting throughout the U.S. economy, as industries contend with shortages of supplies and complications of reopening businesses in the wake of the coronavirus pandemic. Prices for many foods, consumer products and other goods are rising as a result.

As I stated, the shortfall is not going to be made up soon, as can particularly be seen in the severely short-stocked steel market, which illustrates all of what I've been saying about each commodity:

The pandemic brought the American steel industry to its knees last spring, forcing manufacturers to shut down production as they struggled to survive the imploding economy. But as the recovery got underway, mills were slow to resume production, and that created a massive steel shortage.

Now, the reopening of the economy is driving a steel boom so strong that some are convinced it will end in tears....

"It's very appropriate to call this a bubble," Bank of America analyst Timna Tanners told CNN Business, using the "b-word" that equity analysts from major banks typically avoid.

After bottoming out around $460 last year, US benchmark hot-rolled coil steel prices are now sitting at around $1,500 a ton, a record high that is nearly triple the 20-year average.

How easily is this ultra-high materials cost problem being passed along to the consumer to balance the supply-demand equation by raising prices? With surprising ease according to Warren Buffet:

“We’re seeing very substantial inflation.... It’s very interesting. We’re raising prices. People are raising prices to us and it’s being accepted..... The costs are just up, up, up. Steel costs, you know, just every day, they're going up.â€

Why does this matter? Because the ability to pass on price increases and have them stick, means the surge in prices will not be transitory....

"They [the Fed] can't stop people from buying things. And we can't deliver them. They say, well, that's OK because nobody else can deliver them either, and we'll wait for three months or something of the sort.

"The backlog grows, and then we thought it would end when the $600-- the payments ended, and I think around August of last year, it just kept going. And it keeps going and it keeps going and it keeps going.... And it just won't stop. People have money in their pocket, and they pay the higher prices...."

There's more inflation going on than-- quite a bit more inflation going on than people would have anticipated just six months ago or thereabouts.

Exactly the scenario I warned of right after the pandemic shutdown. There's not a bit more inflation going on than I anticipated back then. And why is it so easy to raise prices, as Warren says?

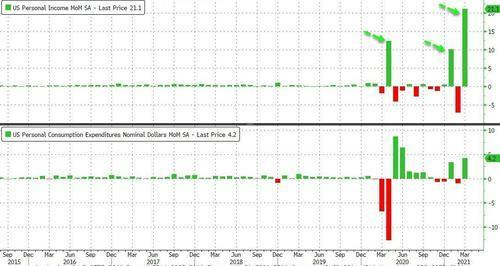

Because US household income is rising faster than it has in a long time:

And, how is that possible with record unemployment?

As expressed earlier, and will now be verified, because of this:

Throughout the past year since March, 2020, every single ingredient for high inflation has been firmly embedded by Fed and feds and the government's COVID shutdowns. And now we're here and everyone is seeing it and reporting it, except the Fed, which believes it is transitory. For more on that, see my latest post made generally available to everyone: "Over-Fed but Malnourished."