Is Japan Crashing the World Today?

One prediction, somewhat supported by strong warnings from Goldman Sachs, said the global financial system would crumble by today.

Last Thursday, Robin Westenra, someone whose site on Substack (Seemorerocks) I recently became aware of and whose articles I have posted here a few times since, published an excerpt with a title I was inclined to categorize in my own mind as “alarmist” because it has that ring of gross exaggeration to it. In which case, I’d still keep an eye on his articles, as being of interest sometimes to readers here (and to myself), given that I’ve published some; but I’d do so with the background mental note that he MIGHT be one of the many who write in this same sphere who are alarmists almost every day like a certain popular Prepper guy, who warns of WWIII “starting now” every time Russia or the US moves a jet capable of carrying a nuclear bomb or every time anything looks moderately concerning like US military jets heading out of NYC toward Europe, as if there is no other reason they could be going that way. It’s always “World War Three Just Started.”

Being careful not to be too quick to categorize someone as “alarmist” because maybe they are just posting truly alarming things, which I post myself, I put Robin’s email on hold to see if anything became of it because I try not to ring any false alarms and because this post came with an easy test. Unlike those false prophets who never specifically date their predicted events, this alarm gave a clear date for the big event:

“Japan will crash markets in the next 48 hours”

You see, it immediately claims some kind of global financial will wipeout (marketS, plural) out of almost nowhere. That made me go, “Well, maybe. It’s not far outside the realm of possibility, but it’s a massive claim with a very short time signature on it. So, I’ll just keep a watch and report it to my own readers on Monday (or by an earlier Extra edition) if it looks like it starts to amount to something. That’s because I’m all for needful alarms, but I want my site to always be credible. So, I filter out a lot of stuff.

So, I did. Robin posted that on Thursday, January 22nd, which would make Saturday the big day, except (to be fair) weekends are slower days for business news since most banks, businesses, and government offices and even many news publications are closed or running on a skeleton crew. So, I figured I’d keep a watch until Monday. After that, if nothing happened, I would throw the story out and not even share it. After all, I had already decided to list Robin’s site on my own recommendations for my own readers as worthy of, at least, keeping an eye on.

But here we are, and I’m sharing it. Nothing much happened on Saturday, but I held on. Then, on Sunday, the news on this subject suddenly expanded.

How big was this story? Mike Wilson, a big Goldman trader and well-known, oft-quoted, market/banking analyst had already written late last week that Japanese government bond volatility is more important than headlines from a small Swiss town. So, in his view, the storm that was brewing already beat out anything happening in Davos, such as that minor announcement by President Trump that he is beginning a peace council that he hopes will soon replace the United Nations and be under his control as permanent chairman. I guess that means this story is, at least, bigger than Davos and the UN combined in Wilson’s mind.

And what was gist of the story?

(Now, this is the point in upcoming days where I may be placing the paywall on my weekly editorials, instead of always giving the whole editorial away, because I’ve decided—as some readers have advised me—that I really do give away more content than anyone else, and that I should expect people to pay me for my work if they want to get all the meat and potatoes. But today I cannot resist giving it all away as usual because it is my habit to inform people as much as possible, and it is a Monday when I usually give everything away, and I might keep doing that much on Mondays. I’ll say more about the change below.)

The gist of the story was this:

The story Westenra carried in Seemorerocks was from another writer who predicted the Bank of Japan’s hiking of interest rates on January 22nd would blow up interest on Japanese Government Bonds (JGB) to the highest level in Japanese history, and those bonds cover $10-trillion in Japanese debt, while Japan also holds $1-trillion in US government debt (US Treasuries). The Japanese Treasury also holds hundreds of billions in other global stocks and bonds.

The original writer made the claim that last Thursday’s event would create a cascade that would blow out in 48 hours across the globe. The debt math, he argued, has turned brutal for Japan, long a massive debtor nation (just like the US). Japan may need to hose its global assets (as in sell them off in a rush) in order to raise funds to support its crashing yen. But, then, the writer said the real accelerant comes:

“The yen carry trade.”

I don’t want to get bogged down into the weeds here on how those trades work. I’ll save that kind of granular detail for my Deeper Dives. The importance is this: as those leveraged trades unwind, the leverage accelerates them rapidly. Force selling begins in Japan and everywhere else because collateral value collapses. So, within as little as 48 hours, everything is selling together all around the world. That’s it in a nutshell.

Because Japanese inflation has finally been elevating faster than the average Japanese fisherman cares for or the average Japanese shop keeper or the small potatoes working in major tech firms, etc., Japan can no longer just print more yen. It’s come to the end of that long game because inflation finally kicked in. It would take a voluntary global rescue to try to shortstop the cascade caused by Japan.

They’re trapped between debt and currency, and the walls are closing in fast.

The guy ringing the alarm bell (which you can follow from Robin Westenra’s article, noted along the lines of Mike Wilson’s concern,

For 30 years, Japanese yields were the invisible anchor holding global rates down.

Every portfolio since the 1990s depended on it - knowingly or not.

That anchor just snapped.

Bonds fall.

Stocks fall harder.

Crypto falls hardest.

We’re entering a market no living trader has navigated before.

As I say, it sounds very alarmist for a market that everyone’s portfolio supposedly depends on for stability, whether “knowingly or not” and whether they are invested in yen or not.

Then on Sunday, Wolf Richter stepped into the argument and pointed out that US Treasuries move to whatever happens with the Yen. That’s because there has been a strong legal tie between valuation of the yen and Japanese ownership of US Treasuries since the rebuilding of Japan that the US engaged in following World War II to successfully turn Japan from an arch enemy into a friend and ally.

Given the strongly forged connection that exists beneath the surface to join the yen to the US dollar, it is not too surprising that Richter noted major emergency action suddenly coming out of the US Treasury on Saturday to arrest the cascade that was spreading to the dollar.

Treasury Secretary Scott Bessent attempted to put a floor under the yen that had plunged against the dollar, and push back down long-term US Treasury yields that had surged, as he saw the turmoil in the Japanese bond market, and the plunge of the yen, bleeding over into the US. “US Government Struggles to Keep a Lid on 10-Year Treasury Yield and Mortgage Rates”)

Note the title focuses on the impact to US Treasuries, which means that suddenly, it was becoming hard for the US to keep a lid on its own massive debt interest rates.

The New York Fed, at the request of the Treasury Department and acting as fiscal agent for the Treasury Department, asked its primary dealers what exchange rate they would get if the NY Fed started buying yen through them. This “rate check” was a signal that the US government is ready to intervene in the currency market to support the yen against the USD.

Now, it is clearly worth watching. The US debt is by far the largest in the world, and I was reporting all of last year how Trump’s Tariff Wars were putting pressure on US debt by seriously driving foreign central banks away from US Treasuries because who needs so many of those major dollar-holding vessels when their nation’s have so much less trade happening with the US? So, a system that was starting to become fragile as Treasury buyers began to flee, as I said would happen right before Trump actually started his tariffs, suddenly got body slammed in the side by the yen last week.

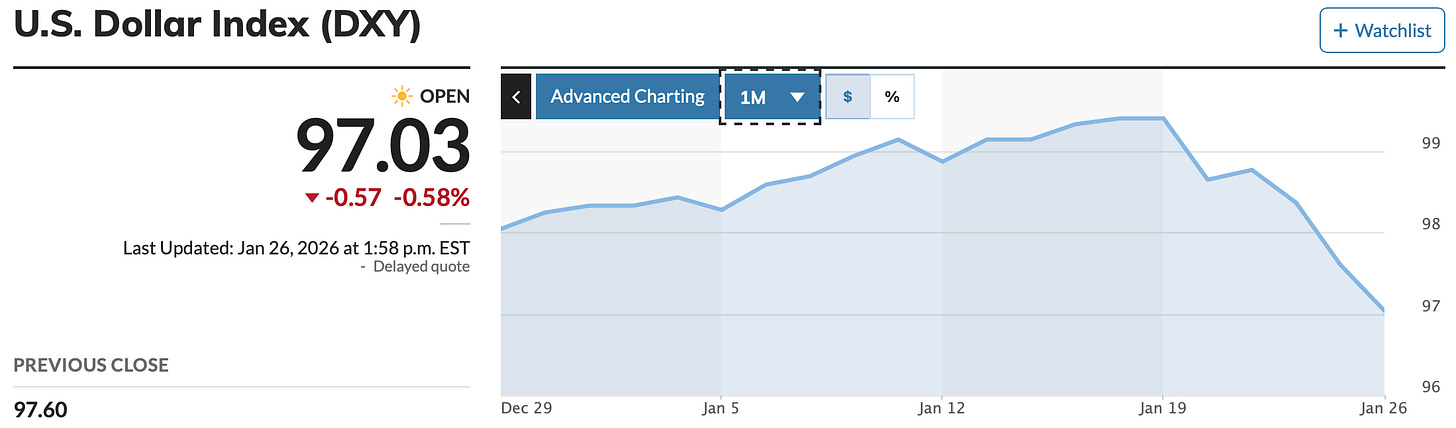

This started to rapidly devalue the dollar, which I’ve said all along would be the victim of nations fading away from purchasing US Treasuries due to the tariff wars.

As soon as this happened around midday Friday, the USD began to plunge against the yen, and the yen jumped from 159.2 yen to the USD to 155.7 by Friday evening

That’s clearly why the US Treasury jumped in to intervene right on schedule for the prediction, as it turns out, on Saturday. This time it just went with making a signal warning that it was ready to take emergency action and then jawboning markets back down under that awareness of a US rescue coming if needed. It’s just as I thought could be the case with this prediction being a couple of days late: the news cycle gets a little slowed down, so the story didn’t start to break through writer/economists like Wolf Richter until Sunday (when I began composing this article as I looked for evidence of what was happening). But the intervention by the Treasury began right on the predicted schedule for major trouble.

Richter gives the following chart to provide some scale for the sudden devaluation of the dollar against the yen:

Now, Bessent has already blamed the initial surging, which you see just ahead of the cliff dive, on the Japanese yen. Fair enough, but don’t forget that it was happening when the yen bumped up against a US dollar (US Treasuries) that was already being turned against by many US trading partners (something the Trump administration is totally unwilling to admit as an outcome of its tariff policy). So, the yen broadsided a dollar that was already being undermined as the global trade currency.

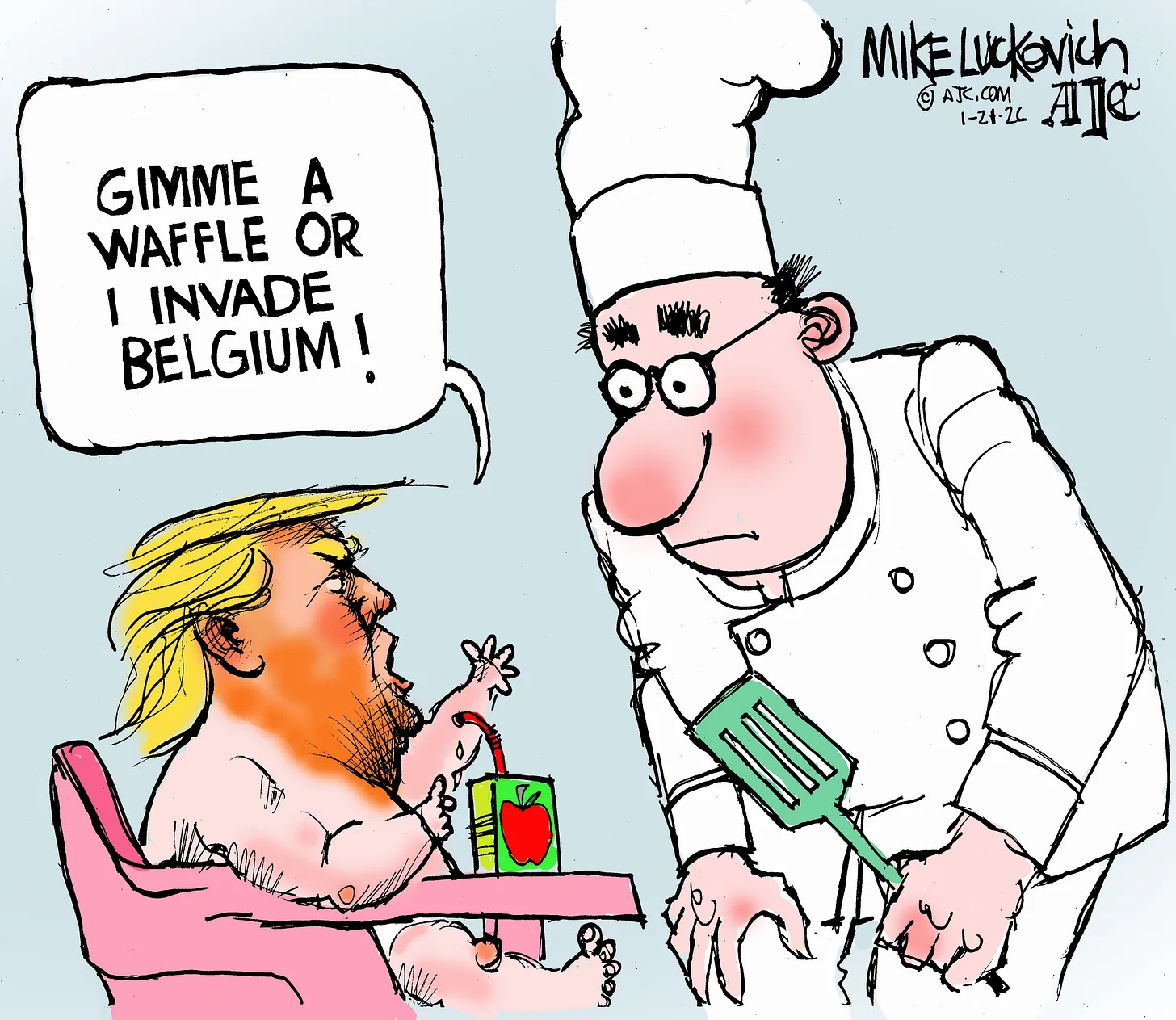

The crucial 10-year JGB yield surged by 15 basis points in two days. And the yen re-plunged against the dollar. The trigger had been Prime Minister Sanae Takaichi’s call for increased government spending with simultaneous tax cuts.

In other words, she began applying the Trump Plan for making America Great Again … only in Japan: Spend a lot more while cutting taxes. That should make us aware of how suddenly things can turn bad here in the US for the wobbly dollar.

Suddenly,

The 10-year US Treasury yield had surged to 4.30% on Wednesday morning, up by 17 basis points in a week.

I just now (Sunday) checked where the US Treasury market closed the week, and apparently Bessent’s move helped cool the market for US Treasuries, as rates on the 10YR dropped back down to around 4.25%, by Sunday (but trading is stopped for the weekend as I am composing this).

The spike in the US10YR caused mortgage rates to spike as well, which Trump has been trying to stuff back down to make it easier for wannabe US home buyers to go back to paying absolutely outrageous prices for homes. (You know, the rinse-and-repeat cycle for bubble crashes that I’ve long been writing about: reinflate the market with cheap and easy credit until it implodes again because that is never a sustainable plan. It’s a greedy plan when the best thing would be to let prices crash and do nothing to bail them out.)

“It’s very difficult to disaggregate the market reaction from what’s going on endogenously in Japan,” Bessent told Fox News at the time. And he said that he’d gotten in touch with Japanese officials, and said that he is “sure that they will begin saying the things that will calm the market down.”

Well, of course, since the Japanese yen is married to the US dollar by law, and both are now unstable currencies on their own demerits!

So, the alarm that was sounded in the article I led off with here was right, though it did not result in a global meltdown—so far. Instead, major emergency intervention from the giant force of the US Treasury leaped into the ready onto the scene and calmed markets. So, for now, the situation has stabilized; but will the shoring hold?

The very fact that the event required the US Treasury to flash red, warning signals and required some rapid jawboning by Bessent tells you the concern suddenly became real all the way to the top; and, while the US has intervened to stop the plunge of the now-wobbly dollar, due to the yen, that doesn’t mean other national currencies have managed to do that, so it doesn’t mean troubles from those currencies cannot ricochet around the world to cause more trouble for the dollar on the backside of all of this. That means this one still merits keeping your eyes on.

As Richter concludes,

Obviously, Bessent wouldn’t blame the surging long-term Treasury yields on the ballooning US deficit and the flood of new supply of bonds coming on the market that investors will have to absorb, and he wouldn’t blame it on inflation that accelerated further and that worries the bond market. Jawboning is a lot easier to do than to address those issues.

Heck, they won’t even admit the inflation exits, as I showed in my weekend Deeper Dive, much less that the inflation is now coming from their own policies!

However,

The bond market might not be happy for long with this jawboning.

And that comes with Richter’s warning about that inflation the government has refused to admit.

Inflation is a big issue for bond investors as bonds lose purchasing power due to inflation, and yield is supposed to compensate for the loss of this purchasing power, plus some. But long-term yields are too low to compensate investors for hotter inflation in the future.

What the for-now-narrowly-averted crisis shows is how the dollar and US Treasuries are weakened and susceptible to sudden, unexpected damage from outside. Whether the save will hold for now is also uncertain because we have little idea how the yen carry trade is impacting other nations with less ability to muscle an emergency rescue if needed. If we don’t know where those troubles around the globe might occur, we cannot know how they might cascade into the dollar.

Word at the top of Monday morning, as I get ready to hit “publish,” is that the dollar is back to falling because of the yen:

DXY slides to four-month lows after reports of Fed New York inquiries on Yen exchange rates.

So, maybe the corrective talk was not enough.

The Pound Sterling (GBP) rises some 0.55% on Monday as the US Dollar (USD) remains on the defensive amid rumors of possible interventions in the FX markets by Japanese authorities and the Federal Reserve (Fed). Solid US data was ignored by traders. (FXStreet)’

CHANGES COMING TO THE DAILY DOOM:

For paying subscribers …

nothing will change, except formatting, though I will by trying (against my thorough nature) to make daily editorials a little shorter than some have been. Deeper Dives will stay the same. The only format change is because of the change I’m going to try out for free subscribers, which will cause paying readers to have to skip past the headlines to get to the remainder of the editorial. (Think of it as being like the front page of a newspaper where lead stories continue somewhere toward the back of the paper.)

For free subscribers …

I’ll keep the whole issue free on Mondays for now, but I am thinking about making the headlines free for everyone every weekday; however, the rest of the weekday editorials will only give a bite with substance but not the full meal above the paywall. (Unfortunately, that means moving the headlines up into the middle of the article so they are above the paywall for everyone to be able to see). Paying subscribers will have to skip past the headlines to read the rest of the editorial. Deeper Dives will remain generally only available for paying subscribers, though they will give everyone the sense of the content. (I’m still thinking the value of the headlines part over, but I don’t think they are the main value subscribers are paying for.)

And please comment if you have other changes to suggest or comments to make about these possible changes:

Economania (national & global economic collapse plus market news)

Hard Times in the Delta as Farmers Consider Letting Crops Rot

Money Matters (monetary policy, metals, cryptos, currency wars & going cashless)

“Japan will crash markets in the next 48 hours”

Curious and Worrisome: Fed Intervenes to Support Japan Yen Currency

The price of silver has passed $US 100

Yen surges as intervention risks lurk, gold surpasses $5,000/oz

What the Japanese bond crisis could mean for the US

GBP/USD climbs to 1.3690 as Dollar slumps amid rumors of Yen intervention

Dollar slips across the board; yen higher on intervention risk

Meet The Man Who Bought $1 Billion In Physical Silver Before The Rally

Crypto takeaways from Davos: Politics and money collide

Wars & Rumors of War (including cyberwar, civil unrest and revolts)

Here Are the Details of President Trump’s Greenland Deal

UK’s Starmer Lambasts Trump Remarks On NATO Troops: “Insulting & Frankly Appalling”

—

Israel’s Ex-Minister ADMITS ‘DEFEAT’? ‘Iran DESTROYED Israel’s Defenses’

Ayatollah ‘goes into hiding’ over US strike fears

Over 36,500 killed in Iran’s deadliest massacre

—

—

US Pledges To ‘Starve’ Iraq Of its Own Oil Revenue If Pro-Iran Parties Join New Government

Digital Dominance (AI threats, transhumanism, hacks & cyberattacks, etc.)

The government police dog that will do you in:

Try fighting that one off when the government wants you.

AI-induced cultural stagnation is no longer speculation − it’s already happening

New Gig Economy Job: Train AI That Replaces You

Trump Trade Wars & Turf Wars

Trump Says Canada Will Face 100% Tariffs if It “Makes a Deal with China”

Political Pandemonium & Social Senescence (socio-political issues & events)

‘Sometimes You Need A Dictator,’ Trump Says Of Himself At The World Economic Forum, As He And BlackRock’s Larry Fink Sing Each Other’s Praises

Canadian woman was euthanized ‘against her will’ after husband was fed-up with caring for her

Obama’s Fingerprints All Over Investigations of Trump And Clinton

Ice Storm: Agents Kill Another American

Agent shot him in the back. However…

Community Members’ with Rifles Stand Guard in Minneapolis Where Armed Man Was Shot

Agents Disarmed Man In Minneapolis -- Then Killed Him

Videos Show Moments in Which Agents Killed a Man in Minneapolis

NRA Makes Rare Statement Against Trump Admin Over Alex Pretti Shooting

Noem Claims Contradict Video Evidence

Democrats Vow Not to Fund ICE After Shooting, Imperiling Spending Deal

Deep Domination (globalism, unelected government, unconstitutional government & censorship)

Larry Fink Says Public Has Lost Trust In Davos Elites And He Blames “Capitalism”

A Pox Upon Us (the plagues, pandemics & health police of the 2020s)

American Academy of Pediatrics Hit With Federal RICO Lawsuit for Vaccine Safety Fraud

Calamity, Catastrophe & Climate Craziness

Last Look At Snowfall Models As ‘Snowpocalypse’ Begins

Massive Winter Storm Puts 230 Million Americans At Risk As Panic Buying Begins

Doomer Humor