It's All Coming Together by All Falling Apart

Even the mainstream press is now noting that things are all falling apart in the many ways predicted here for the past year, meaning the predictions are all coming together now.

Even though Biden continues to pour on the coal of fascist economics, which is when governments fund private/corporate ventures to make them happen, as Hitler did in Germany to build Germany back better after its deep depression, January sent some brief chills into markets, particularly bonds. Stocks shrugged the news off after a day.

Having just reported on those bad turns in the data in last week’s editorials as the news happened, I’ll now give a recap from the mainstream press today as they finally start to see glimpses of the dark realities at a level where they cannot avoid reporting on them any longer:

Recent data over the past week has challenged [the soft-landing] narrative. January inflation reports from the Consumer Price Index (CPI) and Producer Price Index (PPI) showed prices increased more than economists projected in the last month. And the January retail sales report showed sales dropped by more than economists had expected. In other words, neither inflation nor consumer strength improved.

While one person in the article just quoted says to pay no attention to the man behind the curtain, another notes these are real concerns. We’ll stay with a quote from the more intelligent one as the unintelligent ones get WAY more time in the mainstream press than they ever deserve anyway:

The growing economic consensus has hit a bump in the road.

…The recent string of January data is notable because it's largely the first chunk of data to challenge the soft landing narrative since Federal Reserve Chair Jerome Powell hinted the US economy may be headed to the ideal outcome during the December Fed meeting.

"The data is stacking up against investors in a way that's making people more nervous," SoFi head of investment strategy Liz Young told Yahoo Finance Live.

After this week though, economists are cutting their projections for first quarter gross domestic product (GDP), a popular economic growth measure. Goldman Sachs has shifted its forecast from 2.9% annualized growth in the first quarter entering the week down to 2.3%. The Atlanta Fed's GDP tracker moved down to 2.9% from a 3.4% projection on Feb. 8. Not auspicious for the economic growth component of a soft landing.

In other worse, where I have repeatedly said that, whenever Gross Domestic Income (GDI) runs the opposite of GDP (as GDI has been in recession for months now), it is always GDP that corrects to come in line with GDI. So, now we see GDP inching downward in the direction of GDI.

Likewise, with inflation, which I’ve predicted you would see crowding back upward. Now the mainstream economists that everyone listens to have turned their tales and are finally writing in my direction. Inflation is going back up:

The data is also moving projections for Personal Consumption Expenditures (PCE), the Fed's preferred inflation gauge, ahead of its release later this month. Goldman now projects core PCE, which excludes the volatile food and energy categories, increased 0.43% in January, an increase from its prior forecast of 0.35%. Bank of America's economics team also sees a reading near 0.4%…. Not auspicious for the second component of a soft landing.

This is why I say The Daily Doom gives you the news before it happens. I predicted those moves at the start of last year for later in the year and started reporting last summer on the areas where you could see them incrementally creeping back into the data, saying eventually they would break the surface. Now they have done so noticeably enough that the mainstream media is capable of seeing those moves, too. That, or they always were capable, but just didn’t have to report it until it started becoming this obvious. For the most part, I think the writers are chickens or not too thoughtful who just parrot what they are being told. These are now the big people who are joining my marginal (at best) voice:

"While January data are often noisy, the inflation data do suggest that disinflation took two steps back in January," Bank of America US economists Stephen Juneau and Michael Gapen wrote in a note to clients on Friday.

I agree that January data are often noisy, and I don’t expect the big changes from January to continue in such a pronounced way. Jobs will probably revert back to the kinds of government-fogged readings we’ve had, while inflation will continue to rise. GDP, supremely pumped up by fascist economics as it is, will have a hard time going actually negative to match down to the far more truthful GDI (where I found others in agreement in my last Deeper Dive).

Almost no one believes in March or May rate cuts anymore, and June may be ambitious, unless the economy blows up in March, which is far from unlikely; but that is a whole different kind of pivot than the one that markets have fantasized for. That means grave economic disruption of the kind that is never good for markets—not the soft-landing stuff that dreams are made of.

In fact, the change in narrative has swept so strongly in the direction I’ve said things would go that even Zero Hedge, proponent of the “Fed pivot” for well over a year and half, has joined me on the surprising claim I made in my last Goldseek Radio interview and repeated in the one that will be published next: The Fed is far more likely to raise rates in March than cut them. ZH is the only other publication I know now venturing that possibility. You probably won’t be able to read the article because it is available only to their premium subscribers (and I am not one), but I think we can get the gist of it from the title:

“Is The Fed's Next Move A Rate Hike?”

My surprising (I think stand-alone) claim in those radio interviews was that a March rate hike was FAR more likely than a March rate cut, though I also said I doubted the Fed had the nerve to do that; but that is what its data and the market mania will be telling it it should do. Nice to see ZH finally on board with me, though they still couldn’t resist saying in the lead-in to that article that Powell had made a “stunning dovish pivot” in his November speech.

Sorry, pivots only happen in policy not in whispers about remote hypothetical possibilities months into the future, so NO PIVOT. Nada one. Not even a slow curve in the general direction. It’s just important to ZH to sound like they nailed it and it actually happened. Nope. Rates are right where they were back then, which is where they were left in September (right where I said long ago they would most likely reach as their high point), and even ZH now acknowledges the Fed’s March move could be more likely a rate hike. (I’ll post a link to my own interview on that with Goldseek when they publish it.)

Just trying to give you the news before it happens and help you track how that goes (which also includes admitting whenever it doesn’t go that way).

As for the lunatic stock market, Adam Taggart’s interviews in this weekend’s Deeper Dive pointed out how the extreme moves in major indices are made only by the concentrated stocks in the “Magnificent 7,” which puts the market in some peril of the kind of rip that happened back in 2000. When the top seven, now just the top six, as Tesla takes the off-ramp—are the sole reason indices are climbing, a change in their direction would hugely amplify downward moves that are already happening in most stocks beneath them.

One article in the news today says, “Magnificent 7 profits now exceed almost every country in the world. Should we be worried?” It’s the mainstream press, though, so their answer to this worry that is actually building among investors is, “Sure, this could be cataclysmic, but don’t worry about it because everything is going to turn out fine.”

Alrighty then.

In that Deeper Dive, Sven Henrich showed two charts that he called “mind blowing” and the “most bizarre” thing he’s ever seen in charting, but then said even he has no idea of what to make of the second of those charts because he’d never seen anything like it before.

Henrich says all hell will break loose if this market breaks downward from these trends, which will require massive bailouts that will certainly be tried because the alternative will be unbearable….

“What lurks beneath the present charts is pretty dark.” There is a lot of selling underneath this market that is being masked by just a few stocks that are driving up the major indices. The most bizarre thing he’s ever seen is that, with the market rising to new all-time highs, the market is also now “max oversold.”

The only time the market has gone this oversold by the measures used in these graphs when it was making all-time highs was just before the sudden Covidcrash.

There are some really odd things going on in the charts that have me baffled…. In past, this has produced sizable corrections.

The signals are bizarre, and Henrich sees this as a big roller-coaster year.

Or, as I labelled it, “The Year of Chaos.”

One of the other things I’ve said will make this a year of chaos is also being realized in the mainstream news today;

Investors and firms are flagging that the war in the Middle East poses a major risk for earnings as boycotts dampen sales and Red Sea shipping chaos threatens their supply chains.

Those headwinds pose a danger to the record rally in US stocks, according to a Bloomberg analysis of hundreds of earnings calls….

Any major threat to earnings, or signs that inflation is returning, could impact the months-long rally which has sent the US benchmark to record highs….

“If the pressure continues for longer, this could weigh on corporate margins and be inflationary as costs are passed on through price increases. This kind of scenario is not in estimates….”

From consumer goods companies, to social media, to freight firms, Bank of America Corp.’s latest fund manager survey also showed that investors see geopolitics as the second biggest risk to share prices after inflation, although the two dangers are connected — participants expect a further escalation in the Red Sea or Middle East to add new price pressures higher oil and freight rates.

It’s a lunatic market, long on greed, short on common sense, that has seen all of this and chosen to absolutely skyrocket anyway. In fact, the head of the US Navy says the navy hasn’t seen this much fighting at sea since WWII, and the battle turned worse today. (See headlines below.) The Houthis today are scoring bigger successes, possibly even sinking a large cargo ship.

So, chaos in the Middle East as Israel attacks Lebanon, chaos in Ukraine as Ukraine retreats and US support stalls, chaos in shipping, chaos in American politics (to get worse after the election no matter who wins), chaos in totally contradictory economic data, and a stock market that may fall chaotically based on the normally accurate Henrich’s once-in-a-lifetime bottomless charts. And we’re less than two months into the year. Hang onto the handrails!

Economania (national & global economic collapse plus market news)

Record stock rally under threat from world in turmoil

January economic data challenges soft landing narrative

Magnificent 7 profits now exceed almost every country in the world. Should we be worried?

Taxes Will Bite the Stock Market

Foreign Direct Investment to China Slumps to 30 Year Low

Money Matters (monetary policy, metals, cryptos, currency wars & cashless)

Zero Hedge: Is The Fed's Next Move A Rate Hike?

Overinflated from too much money & Underfed from too few goods (due to weather, sanctions or other supply issues)

The Kremlin has never been richer – thanks to a US strategic partner

Wars & Rumors of War, Revolts, Hacks & Cyberattacks (+ AI threats)

Yemen Shoots Down U.S. Mq-9 "Reaper" Drone; Hits Uk Ship "Rubymar" - Now Sinking?

Red Sea attack: Houthi missile strikes India-bound oil tanker

Pentagon Confirms $32M Drone Downed Off Yemen, Same Day UK Tanker Destroyed

—

Ukraine makes major troop withdrawal in key win for Putin and Russia

Ukraine’s Allies Are Gaming Out a World in Which the US Retreats

Biden, after Navalny’s death, says ‘no doubt’ that ‘Putin and his thugs’ were behind it

Putin’s Pals Link Navalny Murder to Tucker Carlson Interview

Vladimir Putin, riding high on Carlson Interview before Navalny’s death, seems unstoppable now

Russian experts on why Putin likely chose now to kill Navalny now

Russian courts hand jail terms to dozens of Navalny mourners

Cheney warns of a ‘Putin wing of the Republican party’

—

Israel to continue full-scale operations in Gaza for at least a month before scaling back war

War Expands With Massive Israeli Airstrikes 60km Deep Into Lebanon

—

New AI-video tool by maker of ChatGPT worries media creators

It’s the End of the Web as We Know It

Political Pandemonium & Social Senescence (major socio-political issues & events but not campaigns)

High-profile Republicans head for the exits amid House GOP dysfunction

Now We May Find out What Trump Properties Are Actually Worth

Damnation by Domination (unelected global government, invasive government, unconstitutional government & censorship)

A tree fell in Washington, but no one heard it: Gov’t plot lot to take down the Donald

Tractors roll into downtown Prague as Czech farmers join protests

A Pox Upon Us (the plagues, pandemics & health police of the 2020s)

Largest Covid Vaccine Study Yet Finds Links to Health Conditions - Bloomberg

Brownstone Institute: Trump’s Covid Response Casts a Long Shadow

COVID Vaccine Shedding Is 'Real', FDA & Pfizer Documents Are Proof: Clinicians

US Officials Concede No Active Surveillance On Long-Term Effects Of COVID-19 Vaccines

Calamity and Catastrophe

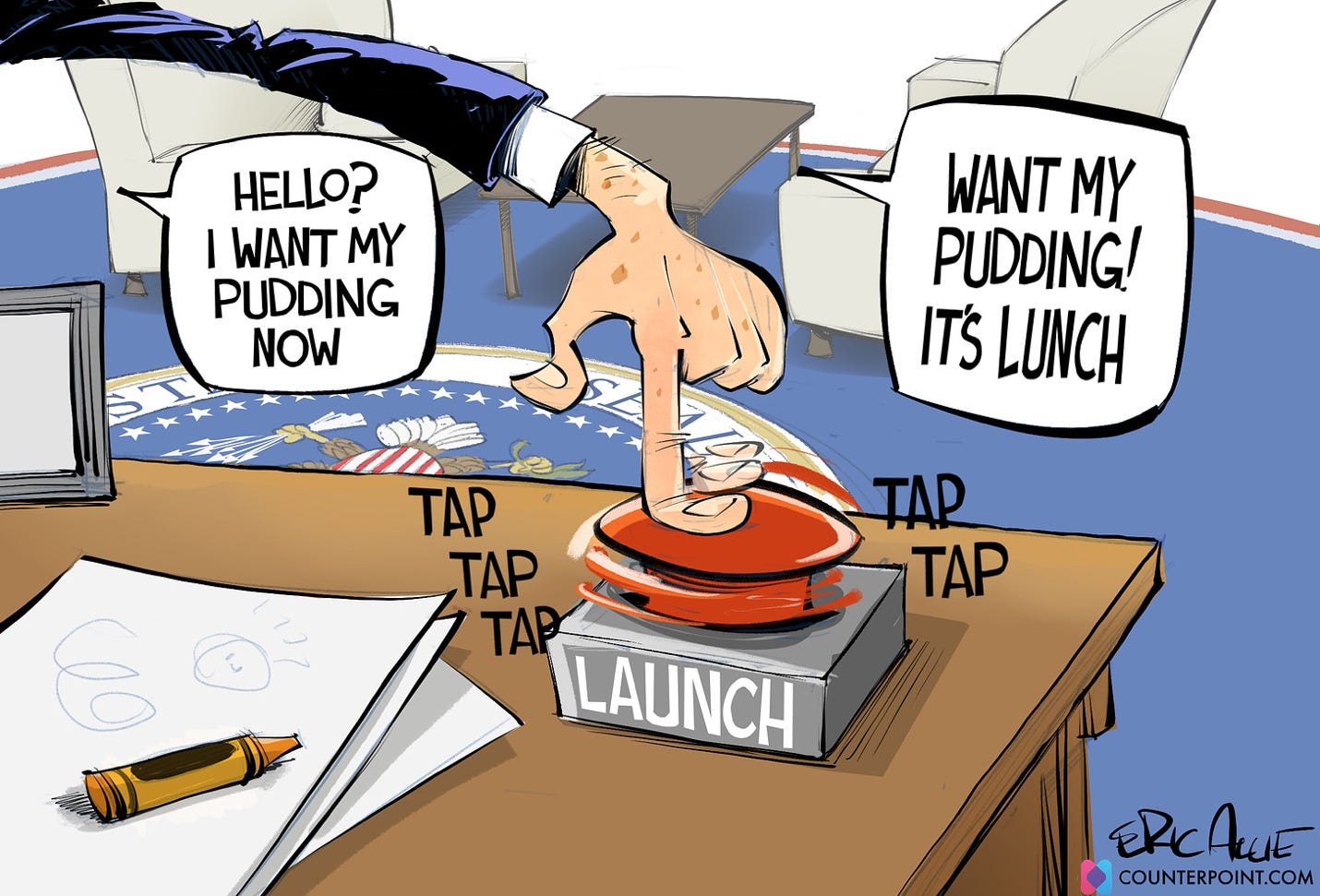

Doomer Humor

The MSM and others that mimic that message operate under the assumption that people do not remember from one day to the next what they said. Judging by some of the people I interact with, they might be correct regarding the short attention span. Just last week, a mortgage broker I follow on social media was shouting from the rooftops that rates were headed down, and buyers were flooding the market. "Buy now, before home prices increase again!" This crew of lenders is only regurgitating the mainstream message, just like they copy the latest TikTok videos to try and stay "relevant." Today, their social media post said that mortgage rates in 1971 were 7.33%, and if you waited then for rates to go down, you waited until 1993. What!? I thought last week rates were going down? Are you telling me now that rates will stay high for 20 years? The messaging is so bi-polar I don't know how anyone could take them seriously. Yet, day after day, they crank out conflicting messages and even more ridiculous TikTok videos trying to whip people into a frenzy to BUY NOW. What a hopelessly unserious world we live in.