Larry Kudlow is Still an Idiot

One Loonie fell today, and another rose. The Canadian "Loonie" tested 2018 lows against the dollar when existing Canadian home sales crashed to their lowest in five years. On the same day Loony Larry Kudlow rose to a new chief position at the White House, more than justifying recirculation of the following article:

Lampooning Larry Kudlow is like shooting fish in a supermarket.

I ought to be embarrassed at going after dead prey and scaring innocent people. Now one of Trump's chief economic advisors, Kudlow is a Washington-Wall-Street insider to the core of his mousy, shriveled soul: A turncoat Democrat -- who, in his early years, worked on campaigns alongside Bill Clinton, John Podesta, and Michael Medved -- Larry Kudlow has flipped as big as you can flop.

Kudlow began his career as a junior economist for the Federal Reserve Bank of New York under a division that handled open-market committee operations. Kudlow also worked as an advisor to Freddie Mac and was employed many years by Bear Stearns until they wouldn't have him any longer because of his cocaine habit, which he maintained at a cost of $10,000 a month. His alcohol addiction was much cheaper, so he should have stayed with that. In the process, he burned his way through two wives and moved on to a third.

Larry, in other words, has lived his entire smelly life inside the beltway of Washington, DC, and at the heart of the establishment's world of finance in New York. You cannot spend your entire life in the fish barrel and not stink of fish. Guilt by association is a fallacy, of course, but Larry Kudlow has a lot of associations worth noting if you can stand the stench long enough to count them all.

After turning from Democrats, this switch-hitter of high principle became one of the founding fathers of supply-side economics. During the Reagan administration, Kudlow worked alongside David Stockman in the Office of Management and Budget to plan and produce Reagan's budget. (Stockman was rapidly able to see the truth about the plan's failed presuppositions and moved on. Larry remained behind as high priest.)

Larry Kudlow is also a TV personality who has regularly matched wits with his cohost, Jim "Crazy" Cramer, another giant talking head from whom I store quotes in my "idiot box" for occasional use in articles about the world's most odious economists and fiasco-ridden financial advisors.

Larry Kudlow's idiotic and dangerous beliefs

In an article titled "Taking Back The Market — by Force" in 2002, Kudlow advocated the overthrow of Iraq:

A lack of decisive follow-through in the global war on terrorism is the single biggest problem facing the stock market and the nation today.... Bush must not allow Saddam Hussein and Osama bin Laden to remain in play....  With weapons of mass destruction at his disposal, and through his financing of terrorism worldwide, Saddam is a dangerous loose end.... Decisive shock therapy to revive the American spirit would surely come with a U.S. invasion of Iraq. Why not begin with a large-scale special-forces commando raid on the Iraqi oil fields? ...A couple of weeks later a final assault on Baghdad can take place. A small war, to use Wall Street Journal editorialist Max Boot’s lexicon, led by fast-moving special forces and leather-toughened Marines, and assisted by high-tech precision bombs and air cover, can get the job done.... The shock therapy of decisive war will elevate the stock market by a couple-thousand points. We will know that our businesses will stay open, that our families will be safe, and that our future will be unlimited. (National Review)

Ahh, shock and awe for the market. Nothing works better than stacking up corpses like cord wood under the smoke of war to heat up the US stock market. Apparently, Lovable Larry loves the smell of napalm in his aftershave in the morning. War is the way to riches.

O.K., so you can't expect an ivy-league economist to have accurate knowledge or insight about weapons of mass destruction; but you should be able to expect him to see an economic time bomb if one is ticking in the middle of his living room, right? As a life-long beltway economist from the New York financial district, Larry's track record for predicting recessions is stunning ... for his ability to miss the biggest and most obvious recession of all. In 2007, Larry wrote insightfully in the National Review,

The recession debate is over. It's not gonna happen. Time to move on.... The Bush boom is alive and well. It's finishing up its sixth splendid year with many more years to come. (National Review)

That's a man I would want to trust for economic counsel on my tax plan, as Trump did in making him Taxonomist in Chief earl in his term.

Unfortunately, Kudlow's hindsight proved even worse than his foresight. Larry had a chance to finally get it right in the middle of 2008 when he denied, as did Ben Burn-the-banky, that the US was already in recession:

So far it's a non-recession recession. Score one for President Bush. President George W. Bush may turn out to be the top economic forecaster in the country.... The president told reporters: “This economy is going to come on. I’m confident it will.

Yay, George. The Bush Boom proved to be a come-on, indeed. Way to call it, George. Way to call it, Larry. You guys are the best! You're like meteorologists holding lightning rods in an electric storm, telling everyone under the flickering glow of your own burning head that the sun is shining and there is no trouble in sight!

Now, it is not as though no one had warned Larry we might be in a recession already:

We’re in the midst of the most widely predicted and heralded recession in history. Problem is, so far it’s a non-recession recession...

Ah well, turned out so far it was actually the mother of all recessions. Still ongoing, it may prove to be the worst recession's recession in the history of recessions before we find our way out of this economic oblivion. Even with ample warning from all directions, Larry banged his head on that low-hanging pipe. Oops. But, as if he hadn't already said enough to eventually prove himself as stupid as his tie is pink, Larry waffled on:

Interesting — isn’t it? — just how durable and resilient our low-tax, free-market, capitalist economy truly is.

Sure was interesting, Larry. I'm still laughing at that one. The rest of your article is equally filled with laughable optimism about the Bush economy in the summer of 2008.

Two months after Larry wrote that article, his old friend Bear Stearns was the first to fall. Since Larry knew a lot of people inside the Bear, he's all the more without excuse for not seeing the Great Recession was about to eat the bear and everyone inside of it as its first snack.

That last statement more than any Larry has ever made speaks volumes about Larry's understanding of low-tax plans. He can't even see they're failing even after the failure is six months ripe and moments before the biggest calamities in decades start to hit. Larry was a major proponent of the infamous Bush Tax Cuts who couldn't see recession even when he admitted everyone everywhere was telling him that he was in the middle of one. How do you miss that when your specialty is economics?

To put it another way, standing in the middle of the swamps of Foggy Bottom, Larry can't see water. Could it be that Larry is blinded by the fog of his own ideology and his own avarice and his own arrogance about his own opinions, or is he just stupid? (It's a coin toss; you call it.) Apparently, if Trump is going to drain the swamp, he'll have to take the water level down a long way before Larry's dead head starts to appear in the mud at the bottom. The man needs air. Let's hope Trump gives him some by airing him completely out of the Trump administration in a hurry ... before he does as much damage as he's repeatedly done in the past.

Larry Kudlow is still an idiot

Idiots never learn. So, with a little of Laughable Larry's delightful history behind us, I want to move on to one of his most moronic moments  -- this one from both Larry and his cohort in Trumped-up Taxes, Stephen Moore:

Here's a historical fact that Donald Trump, and many voters attracted to him, may not know: The last American president who was a trade protectionist was Republican Herbert Hoover. Obviously that economic strategy didn't turn out so well — either for the nation or the GOP. (Newsmax)

Moronic because these same two, who said in August of 2015 that Trump would be the next Hoover if elected, moved to suck up to Trump to become his two chief tax advisors and media shills. Back then, however, they asked,

Does Trump aspire to be a 21st century Hoover ... that helped send the U.S. and world economy into a decade-long depression and a collapse of the banking system? We can't help wondering whether the panic in world financial markets is in part a result of the Trump assault on free trade.

You can see from the quote above that Krazy Kudlow actually argued in the summer of 2015 that the global crisis from China's crashing stock market was happening because of Donald Trump! Really??? Donald Trump was so all-powerful that fear over his mere words as a candidate who was not even the Republican nominee caused China's stock market to collapse and all the stock markets of the world to follow suit? Wow! And, yet, now Kudlow joins Trump in trumping up Trump's protectionism by filling the position of a man who just walked out over Trump's trade protectionism!

That's where ideotology gets you. Kudlow so hated Trump's arguments against free trade that he couldn't see China was collapsing because its stock market was an enormous bubble, governed by communists, in an economy that has always been rigged and riddled with corruption. When Kudlow cannot even see that the inevitable downfall of China is its corruption and communist foundation or that its stock market was a bubble begging to pop, you know Kudlow can't see anything straight. That's because he filters everything through his ideology which serves only his own self-interest.

Kudlow is a rich man whose only religion is to look out for the rich above all others. Wealth has so convoluted the twists and turns of his brain that he cannot even understand why something as huge as China falters.

The crash of the market in China, which recovered for now in spite of Trump continuing to regale China on trade and in spite of Trump now having the power to actually take a wrecking ball to free trade, proved Kudlow can't understand an economic collapse when the pillars are falling all around him.

Yet, this self-serving moron, who "misunderestimates" the biggest economic failures in the world, is now one of Trump's chief economic advisors. His failure to understand a crash as obvious as China's means he will never be able to understand the failure of his own tax plan when it happens, just as he touted the successful economic stimulus effect of Bush's tax plan, when people everywhere could see the entire global economy was about to break up.

Larry Kudlow is actually interested in protectionism of the top 10%

While Larry decries trade protectionism, he's nothing more than a protectionist of the establishment at every turn. Let's take another look at how prescient Larry is to see if this protector of the rich can guide us into a better future. Kudlow & Kompany went on to say...

Trump is also now running full throttle on an anti-immigration platform that could hurt growth as well and alienate Republicans from ethnic voters that the GOP needs if it is going to win in 2016.

Yeah, that hurt 'em, Larry. The prescient Kudlow failed completely to see that Trump's immigration policy would rocket the Republicans into a widespread populist victory that swept all branches of government into Republican control. Way to call it, Larry! I'll bet Trump is wishing you were campaign advisor. (Why he's made you his top econ advisor is completely beyond me.)

Larry's ideology blinded him to the fact that Trump's immigration policy would rocket Trump to success. You see, the reason Kudlow disagrees completely with Trump on free-trade agreements is that those agreements have made Kudlow and his Kronies in the top ten percent fabulously rich because those agreements provide cheap labor for the corporations Larry owns stocks in; but they've made everyone else a little more poor.

[Trump's]Â immigration stance would not just deport illegal immigrants, but even lock the golden doors to those who come lawfully for opportunity, freedom and jobs. This could hardly be further from the Reaganite vision of America as a "shining city on a hill."

The middle class has stagnated since the amnesty agreement given to immigrants by Reagan (which promised "never again") and the free-trade agreements that happened under George the First. Larry likes that. Wage suppression that results from US laborers competing against workers overseas and against immigrant workers domestically assures Larry that his stocks will perform better. So, the top 10% of society (the major stock owners) do better while the rest, who depend more on their wages, do worse.

For similar reasons of making sure cheap labor is available to capitalists in the top ten percent, Kudlow & Ko. also lamented that ...

[Trump]Â recently announced that as president he would prohibit American companies like Ford from building plants in Mexico. He moans pessimistically that "China is eating our lunch" and is "sucking the blood out of the U.S.?"

Yeah, we can now see how Trump's ridicule of Ford came back to bite us, as a week after Trump's presidential victory and well before he actually becomes president, Ford announced it will be keeping production in America after all. Then Apple, that it will try, too. Etc. That is what Trump's "pessimism" got us. (Again, why is Larry & Ko, our chief tax advisor? Maybe he said something smart later in his argument. Let's see...)

Quoting Trump, Larry says ...

"Decades of disastrous trade deals and immigration policies have destroyed our middle class," Trump writes in his latest policy manifesto. This "influx of foreign workers," he continues, "holds down salaries, keeps unemployment high and makes it difficult for poor and working class Americans — including immigrants themselves and their children — to earn a middle-class wage."

There's some evidence that competition for jobs in very low-skilled occupations holds down wages, but for the most part immigrants fill niches in the labor market that natives can't or won't fill.

Trump understands it exactly right, Kudlow. You completely fail to grasp that the ONLY reason "natives can't or won't fill" those jobs that immigrants take is that decades of the government turning a blind eye to illegal immigrants in those jobs has suppressed wages, exactly as Trump spelled out for you. (Larry still missed it, even when looking right at Trump's explanation.) If American's took those jobs now with wages that have been suppressed for decades, they could not possibly earn a middle-class income. They would be forced to live in the same tin shacks that their competitors lived in when they were back in their home countries.

Larry pretends to care about the American worker and the poor immigrant. In the first article quoted above, he says,

We want Americans and workers all over the world to have access to the best-quality products at the lowest possible price. This is the centuries-long economic law of comparative advantage first taught to us by David Ricardo.

Yeah, that's what he's concerned about -- getting workers the best prices possible. What Larry leaves out of that argument is that "the lowest price possible" is made possible by the lowest wages possible. So, yeah, I am sure Larry was really worried about American workers. Anyone see the irony in the fact that Larry Kudlow got this policy from someone named "Ricardo." Just sayin'.

But lets check Lunatic Larry's beliefs about free trade a little further:

If it's more profitable for Ford to produce trucks in Mexico, fine. As the supply of Mexican trucks goes up, this creates higher income for all Mexicans who then go out and spend the new money, not just at home, but in purchasing U.S. goods and services available on the market. And the purchase of American goods and services builds up the U.S. economy. It's win-win.

Why would Mexicans spend their lower-than-US-wages on products made in America when all of those products can also be made cheaper in Mexico, providing Mexicans with even more jobs, so that the products are even less expensive for Mexicans? A downward spiral to the lowest common denominator in the labor market does not create a longterm market for US products, and I find it hard to see how that plan will ever sustain the vibrant middle class that we had before free trade took it down.

Greedy people like Kudlow who don't give a rip about American laborers are ultimately shooting themselves in the foot. A robust middle class capable of buying all the stuff the rich manufacture and import made the American economy vibrant. That vibrancy is clearly long gone. As that middle class shrinks in size and stagnates in wealth, that robust consumer base has flattened out.

Still believe Larry cares a rip about American labor? Then let's watch him undermine his own disingenuous argument:

Hundreds of millions have moved into the middle class primarily in China, India and elsewhere in Asia, in parts of Latin America and in sub-Saharan Africa — a phenomenal achievement, underscoring the benefits of free trade and open markets.

You can say anything you want about Larry (and I encourage you to do so frequently and everywhere); but he's absolutely right on that one. And absolutely blind as to how it destroys his own argument. Yes, fair trade has helped the middle class  "PRIMARILY in China, India and elsewhere." All while millions have moved out of the middle class here in Kudlow's Amerika. No one questions that it is helping the third world become the middle world by destroying middle America.

To his credit, Trump accurately recites many of the terrible problems afflicting the American economy:Â "Today, nearly 40% of black teenagers are unemployed. Nearly 30% of Hispanic teenagers are unemployed. For black Americans without high school diplomas, the bottom has fallen out: more than 70% were employed in 1960, compared to less than 40% in 2000. Across the economy, the percentage of adults in the labor force has collapsed to a level not experienced in generations."

Yes, Larry, that's where we are after a third of a century of free-trade agreements. So much for how they've helped us. To Trump's credit he was also smart enough to point out that this was because your free-trade policies are taking away their jobs and suppressing their wages. You admit here that Trump gives a correct assessment of what has happened in AmeriKa.

Kooky Kudlow, the taxicologist

And what a cocktail Larry Kudlow has concocted. Unfortunately, even though Trump won the election by ignoring Larry, he has looked to Larry for his economic plans, first accepting hook and sinker Larry's loopy tax plan:

But the American problems that Trump complains about — stagnant growth and wages and slow job growth — can be found principally in Washington, D.C., not Beijing or Mexico City.

Start with substantially cutting or even eliminating the corporate tax. Then stop the double tax on multinational profits by moving to a territorial system, like everyone else in the world. Also, shift to full cash expensing for new investment in plants, equipment and building structures.

Then reform the personal tax code by lowering the rates, getting rid of corporate cronyist deductions, simplify the whole system and rip out tens of thousands of regulatory pages from the IRS code. We prefer a flat tax structure.

Parts of that, I agree with. I think cutting corporate taxes and repatriating corporate taxes is a good idea because corporate taxes directly suck the fuel out of our economic engines, but reducing personal taxes, too, assures a government steeped deep in destructive debt. We cannot keep creating stimulus out of debt.

Here is a prime example of how far out of whack Larry's thinking is. Kudlow, as a former Democrat, has often referred back to Kennedy to find support for his tax plan:

The last great super-growth Democrat was John F. Kennedy. He targeted 5 percent economic growth rather than 2 percent secular stagnation. He slashed tax rates for the rich, the middle brackets, and the lower brackets, and on corporations, capital gains, and elsewhere. He was a free-trader. And he insisted on a stable and reliable dollar (in those days, linked to gold). (Newsmax)

This was the Kudlow-Kennedy argument -- Kudlow's way of trying to convince a few Democrats they needed to get on board with his plan. The argument sounds good only on the surface, but take a look under the hood of this Edsel: The truth its that Kennedy proposed rate cuts to a level far above where they are today, while Trump (upon Larry Kudlow's advice) cut them far below where they are today.

So, the Kudlow-Kennedy canard is a false comparison made by a deliberately stupid or obtuse man. The Kennedy tax cuts would actually be an enormous tax increase today! Kennedy proposed cutting the top income-tax rate to 65% and the top corporate tax rate to 47%. There is no question that taxes in Kennedy's day -- far above those proposed rates -- were at a confiscatory level. (Kennedy's proposal was never accepted because key Democrats defected, but a reduced set of cuts made it through under Johnson after Kennedy's death.)

If you follow the logic that going lower and lower is always better, why not cut the tax rate to nothing? Clearly, there is a point below which the government goes broke, and making huge tax cuts when we already have an annual government deficit of about half a TRILLION dollars is insane; so, thanks, Larry.

During his career, Laughable Larry provided counsel to A. B. Laffer & Associates where he spent a lot of time working with the Laffer curve. The Laffer Curve postulates that tax revenue follows a bell-shaped curve where, as tax rates rise, government revenue rises until you reach a point where revenue peaks and then starts to fall the more you continue to raise rates until at a 100% tax rate, the government is back down to making no revenue at all because there is no incentive to work.

Makes sense. The problem is in deciding where the optimum point on the curve is when revenue starts to fall as you continue to raise rates. Is it a an even bell with the peak at the middle, or does revenue rise quickly at the beginning of the curve and then fall off slowly (Larry's position), or does it rise slowly well past the 50% tax rate (say to 70%) and then fall off sharply? The simple answer is that there are so many variables and political prejudices that go into theorizing where the peak should be that no one knows.

Kennedy came into office when taxes were at the far end of the curve (extremely high tax rates), so cutting them was a safe bet, as his cuts would have still left tax rates toward the far end of the curve. Trump came in when taxes were already way below a 50% rate.

As for Kudlow's love of a flat tax (to his personal benefit), we'd have to have decades of truly progressive taxes just to recapture the decades during which the top ten-percent have actually paid much less (as a percentage of their total income) in taxes than the middle class. We need to "repatriate" that money back to the middle class from which it has been redistributed for years by staying with a progressive tax structure that treats capital-gains income just like all other income and wipes out all loopholes that benefit the rich. All those loopholes and low capital-gains tax rates have assured that the wealthy have always paid a smaller percentage of their income than the middle class.

We've had decades to learn that lower cap-gains taxes do not result in capital investments in company factories, but only in stock speculation in the Wall St. casino where it is predominantly the rich who benefit as the poor and the middle class can't even afford to ante into the game. Why give the easiest money (investment gains), enjoyed primarily by the wealthiest people, a lower tax rate? But if you keep believing Larry's arguments, you deserve to be taxed more than the wealthy on your income. You deserve every penny of your losses to the rich for being so endlessly duped by them.

Krazy Kudlow

Sometimes, Larry Kudlow is so dumb you cannot even figure out where he's coming from. In June of 2017, he said,

We’ve not experienced high inflation in recent years, but that’s not because the Fed hasn’t tried hard enough. Meanwhile, all the QE, bond buying, and interest-rate fixing did not succeed. (Newsmax)

But in January of this year, he said,

More people working does not cause inflation. And the chief goal of the Fed should be price stability, or near-zero inflation. That’s what we have now.... The unemployment rate has come down to 5 percent and the inflation rate is near zero.... The dollar is up.... There is no global rise of inflation. And there’s a strong worldwide demand for greenbacks. This is good, not bad.... Middle-class workers have suffered enormously in recent years. Why not let them prosper...? The Fed should wise up and stick to price stability rather than slamming workers. And China should let markets determine currency and stock prices instead of the central planners.  (Newsmax)

What a mishmash of conflicting thoughts. If "QE, bond buying, and interest-rate fixing did not succeed," why does Larry think jobs are up, and "that's good;" the value of the dollar is up, and "that's good;" there's a strong demand for dollars, and "that's good;" there's no inflation, and "that's good;" and middle-class workers will prosper if the Fed continues with its interest-rate fixing at a low targeted rate? Sounds like he's saying that is a lot of success and advocating that they stick to determining the price of currency (interest rates on Fed and interbank lending), even as he says China should stop. He goes on to say,

It’s been a Keynesian mishmash. Gigantic federal spending and infrastructure building (remember “shovel ready jobs�).... Overregulated banks, energy, businesses, and health care. None of it worked. Whatever happened to those government-spending multipliers? Never happened.  (Newsmax)

How do you say "none of it worked" with the same mouth that just claimed all kinds of things moved in a good direction? (I would say it worked, but only superficially. It's a bizarre way to make an argument for continuing on that path.) Let's see, "gigantic federal spending and infrastructure building" didn't work, but Trump plans for "gigantic federal spending and infrastructure building with "shovel-ready jobs" at an even greater level of federal spending than Obama wanted and with lower taxes to work with. How do you make that work?

"Overregulated banks?" Were they "overregulated" when they broke the world? "Whatever happened to those government-spending multipliers?" What's going to happen to them under Trump's plan when you cut tax revenue in half so that government-spending becomes a debt multiplier? What about your total nonsense government-tax-cutting multipliers to government revenue, Larry? How are they going to magically multiply government revenue when you take the rates all down to the lowest they've been in your lifetime when lesser reductions had the opposite effect? Even David Stockman, Reagan's tax architect said that the anticipated multipliers of revenue due to economic growth never replaced all the lost revenue -- not even close. So, what happens with much bigger cuts?

Krazy Kudlow also said in June of 2017,

Today, not surprisingly, the business sector is slipping into recession. Profits, production, investment, core capital goods, and business equipment have gone negative. Since supply creates its own demand, the slump in business could spread to the consumer. (Newsmax)

But in September of 2015, when the stock market was sinking sharply, he said

I would say don't sell. There's no catastrophe and I don't see a recession.... In fact, I would argue there is not even a recession in sight at least for a couple more years. (Newsmax)

And in January of 2017, when the market was plunging again, Larry counseled,

Don't get too bearish right now.... We're not going into a recession, we're not going into a stock market crash, we're not going into a banking crash. (Newsmax)

There we go again! Just five months later, Larry did not find it "surprising" that we were "slipping into recession" even though he said wouldn't happen for, at least, two years. I guess he's not surprised by his own mistakes.

And what an odd statement that "supply creates its own demand." That's from an economist? What on earth has gone wrong with the brains of economists? In other words, if I have enough customers to sell 1,000 eggs. I should load up with 10,000 eggs because doing so will give me enough customers to sell 10,000 eggs. Supply creates demand is called "pushing a string." It only works the other way: demand tugs supply along to catch up.

I suppose Larry's loopy logic goes something like this: increasing supply reduces the price that people will pay (by lowering scarcity), and lower prices spawn greater demand. Well, that only works if you a) have enough room to lower price and if b) a lower price will produce higher profits due to higher volume. But there is that old expression, "We're losing a dollar on every unit sold, but we plan to make it up in volume." Increasing supply will not lower prices at all if prices have no room to fall without turning into a loss or because diminishing returns can mean that increased supply actually costs you more to make each unit.

Any economist should be able to see that the theory is rubbish. So, why would you apply rubbish to the entire economy when it doesn't even work in a single small business or industry? Applying it to the entire economy is like saying, "All oranges are fruit; therefore, if we increase the total supply of fruit, we'll have more oranges." Well, you MIGHT, but you probably won't. It's so stupid, it's mind-boggling that you even have to try to argue this basic economic concept into an economist's brain! It's completely absurd that you cannot even get it into there heads using a shoehorn in their ears.

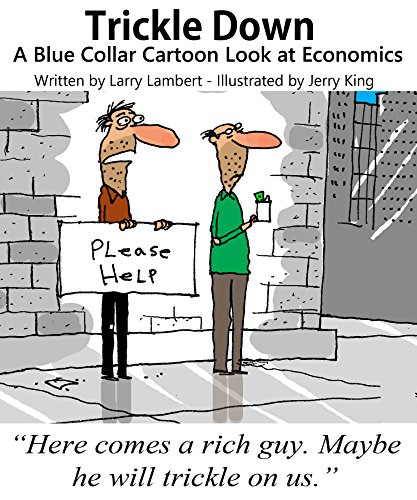

(Click here to see the book.)

On that sad note, I'll conclude with this: Lamentable Larry is trying to save the world for himself by constantly claiming the best way to help the poor is to help the rich -- yet another upside-down idea. For years, he's convinced the poor dolts in the middle class that all of this will benefit them ... someday. Thirty years of history now proves it never has; but that, apparently, isn't going to stop us from going another round ... on steroids. Apparently most of the US believes this time will be different as they are going along with Larry Kudlow's tax plan for the rich and famous. The public belief seems to be that if a little trickle-down economics didn't save the economy under Bush, maybe a whole lot will work a little better. Good luck with that!

If you're one of the few for whom that makes no sense, you might want to share this article in every way you can before it's too late.

(Published originally, November 27, 2016.)