Market Euphoria over Elusive Debt Ceiling Drives Stocks Skyward as Rising Inflation Forces Fed to Tighten Harder

The stock market is dumber than a crypt full of dead idiots.

Stocks are soaring again today because opiated euphoria has investors believing a long-elusive, debt-ceiling agreement is about to end the crisis fabricated over a possible US debt default. Of course, as I’ve pointed out, such a default could only happen if President Biden chose to deliberately break US statutory law and constitutional law by not prioritizing payment of the national debt over operating expenses that constitute a huge part of the US budget and are not obligatory if congress does not approve the debt to fund them. The real legal option, if the debt ceiling is not raised, is shutting down parts of government, but that would also restrict available wages, damaging economic activity from the spending of those wages and from all the projects the government pays to build. There is no win to be had from the mess the Fed and feds have created.

Investors, who are rendered ignorant by relying on their money dreams, are oblivious to the reality that the end of the debt-ceiling debate is ominous for stocks, no matter how it is settled. Besides which, it is asinine to be floating heavenward on euphoria over a debt deal being settled when the negotiators have expressed positive hopes throughout the debate for months, yet have never come to a solution, and when a sharply divided and entrenched congress still has to approve any deal that is developed. The way stocks are rising this morning, you would think the deal had just been finalized by congress.

As some articles are pointing out today, an agreement on a debt deal will likely — as I painstakingly explained in that earlier article this week — swamp stocks and bonds because it will open up a flood of new Treasury issuances during a time when the Fed is not buying Treasuries. This will be unprecedented because such a large flood has never happened during a time of intense Fed tightening. So, we will see how the bond market responds to having to supply a multitude of buyers of US debt when the Fed is no longer the buyer of first resort any longer and when other nations like the BRICS nations are fleeing the Fed’s weaponized money. In the past, when nation’s divested from US Treasuries, the Fed was always there to soak them up. We’ll also see what spillover rising Treasury interest has to stocks. Investors are literally dumb by choice on this one.

No deal, of course, will be catastrophic, even without an actual default, because all credit agencies would, then, jump in with a downgrade of US credit worse than we saw in 2011 because none of them are willing to trust the present government morons to operate within the law and prioritize the payment of US debt (unless prioritizing payment of the debt over other expenses is immediately turned into a mandate by congress).

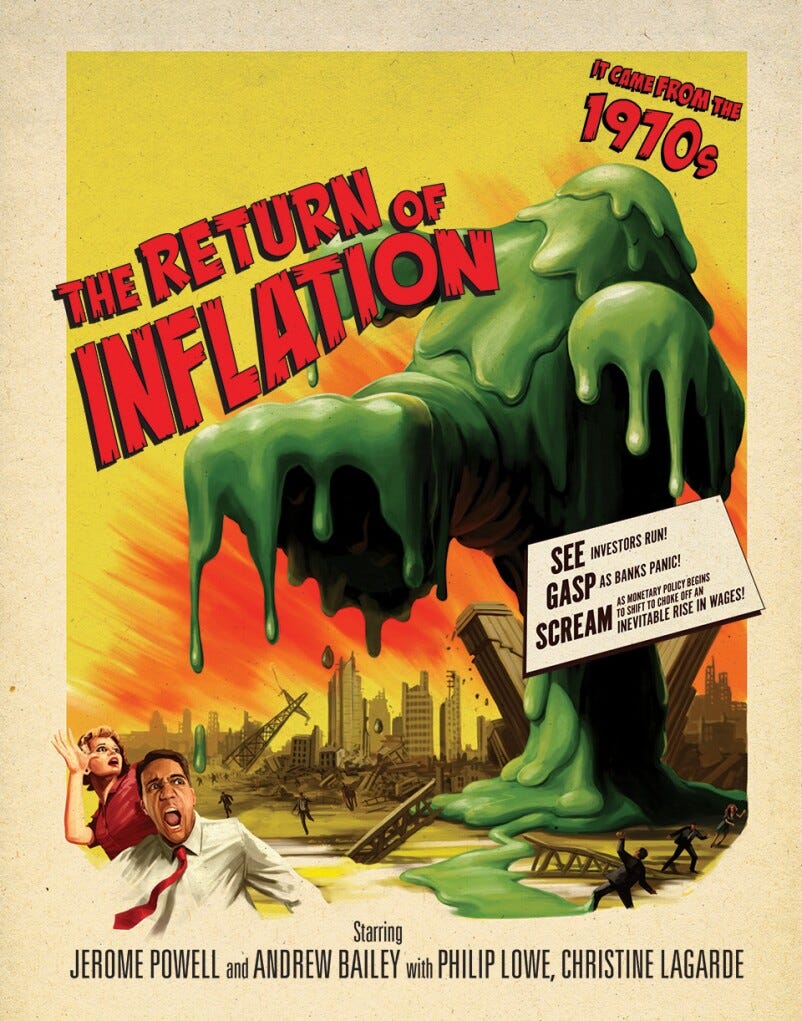

And, as if all of that doesn’t put the market’s rise this morning beyond moonstruck stupid, the market is blasting off on a day when inflation data says inflation has become VERY sticky to the point that it has returned to rising, so the Fed’s fight is far from over. Even Fed speaker Neel Kashkari says it is likely the Fed will need to raise rates again at its June FOMC meeting unless the banking crisis does the job for the Fed. (Not likely that soon.) The return of rising inflation, as I predicted for this year, means the Fed will be pressed to keep tightening, leaving it restrained from jumping in to help the Treasury with its own purchases of US debt if the situation does get rough. If the Fed were to jump back in, it would fuel this return of inflation to climb even faster and break public trust in the Fed’s ability to fight the inflation monster that Dr. Jekyll created.

G. Edward Griffin, author of the very highly rated (on Amazon) The Creature from Jekyll Island: A Second Look at the Federal Reserve, says this is all intentional as the Fed is now entering its end game for turning the US into a cashless society. Another Fed critic, The Maverick of Wall Street, shows how little the Fed appears to recognize that it is the source of all the nation’s Treasury troubles, banking collapses, and undying inflation by rebutting Minneapolis Reserve Bank President Neel Kashkari, who attempts to sound like the Fed is doing its noble job on behalf of America when it crashes banks and Treasuries. Kashkari says, with no apparent concern or remorse whatsoever, that the Fed may have to pressurize more bank crashes. He completely skirts admitting he and his coterie from Jekyll Island caused the mess that is now forcing it to do these things because it painted itself into this corner. Griffin’s view is that it is a corner the Fed wanted to be in, so it could create the final excuse for launching its own digital currency in order to seize more central-bank control.

(All these headlines and more are in the news that is covered for paid subscribers of The Daily Doom, each weekday, except on holidays, such as this coming Monday.)