Over the Hill and Not out of the Woods we Go!

Another sleigh ride today for stocks with plenty of tumult for Tesla as Zero Hedge noted:

Shit's getting real in equity-land as this morning's selling pressure has turned into a blood-soaked sea of red with TSLA leading the plunge, down 11% [and] The S&P has erased all of the week's gains...

... and ...

Traders are bracing for worlds end

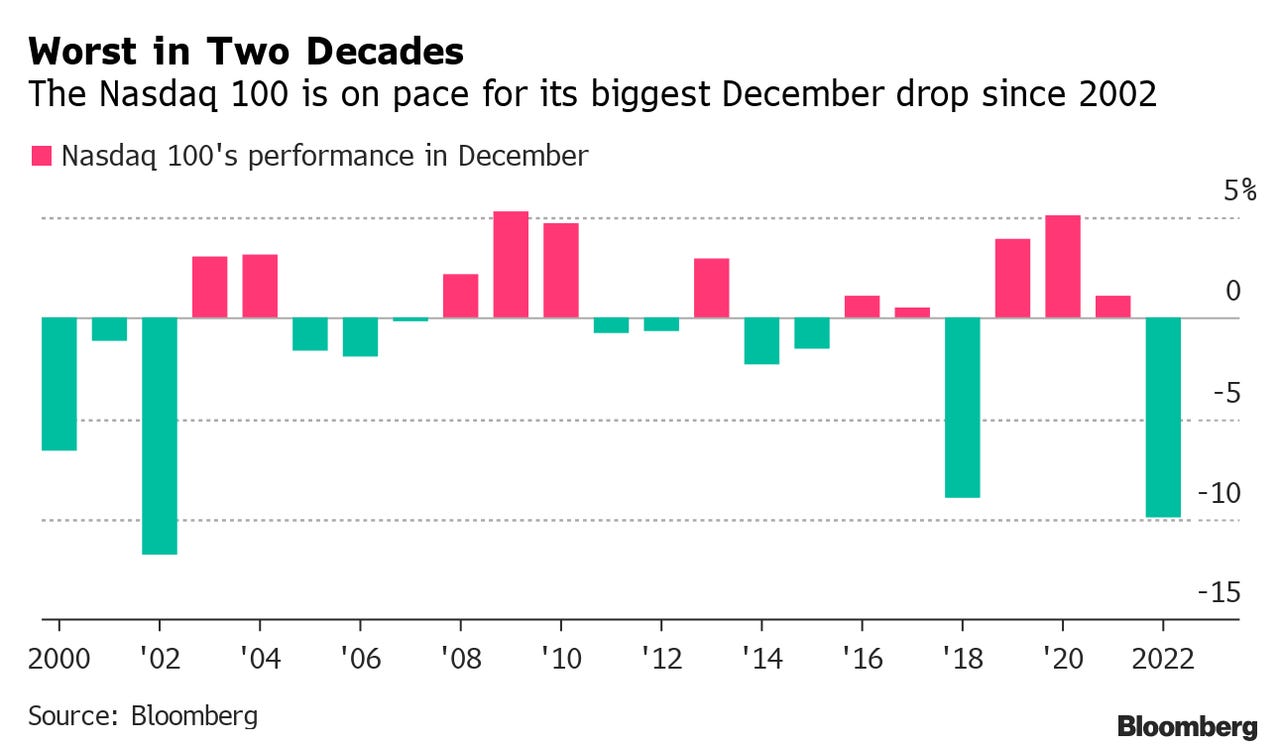

The NASDAQ took it worse, plunging midday the most it has since September 13th and ended the day down 11% from its last rally peak. This all puts the NASDAQ on track for ... (drum roll) ... it's worst December since the big dot-com bust:

(I think Bloomberg got its Christmas colors as upside down in that graph as the market thinks. Shouldn't the December's that were down be the ones that were in-the-red with the money-makers in-the-green? Ah well, what do you expect in this world of slop-happy financial reporting?)

Nevertheless, all stocks did manage to recover about 50% of today's steep fall in the latter half of the day.

What is endlessly bemusing but also frustrating in this is the market's idiocy as it is not hard to figure out where this is going:

Appaloosa's David Tepper told CNBC ... he is "leaning short" because central banks around the world are tightening and traders should "not ignore what the central bankers are saying."

It's so simple for anyone who hasn't been clubbed on the head. If you didn't believe in fighting the Fed all the way up, you have no reason to believe you can fight the Fed on the path down.

I'm leaning short on the equity markets right now because the upside/downside doesn't make sense to me when I have so many Central banks telling me what they are going to do, what they want to do, what they expect to do.

Ya think?

Apparently investors do not.

We all know central banks with infinite money as well as unrestrained ability to remove money from their financial systems are the market riggers, so why would anyone be dumb enough to keep fighting them when they tell you endlessly in tougher and tougher language they are taking this baby down to the bottom of the valley? Still, every bear-market rally is proof that plenty of people are just that dumb.

His message is clear - rates will remain higher for longer as global central banks fight inflation that proves stubborn (wages and labor supply) and the market is not pricing that in at all...

"The market is not buying the Fed’s increasingly hawkish position that they are going to raise rates to a higher-than-expected level and keep them there,†said Lindsey Piegza, chief economist at Stifel Nicolaus & Co...."

Well, the head clubbing will continue until the market finds a deeper bottom that can hold, but this wan't it:

“I believed the Fed before and I believe the Fed now."

"We are going to have a lot more tightenings.â€

"Don't ignore what these guys (Central bankers) are saying...."

"It's going to be just difficult for things to go up right now because of these banks and because what they are saying,"

Even ZH has pounded the pivot fantasy for months, as if they were the Vampire Squid, otherwise known as Goldman Sucks. However, even ZH stopped and took a breath today:

It appears the market had its ever-optimistic-pivot-blinkers really removed by Appaloosa's David Tepper

Let's hope ZH has its pivot blinkers removed, too.

It wasn't just Tepper who tapped the market on the head with a sledge hammer. We also saw some of the old familiar good news (albeit fake) is bad news knee-jerk reflex. The fake Gross Domestic Pig report for the third quarter received a hefty boost to even loftier fantasies today. Mr. Market didn't like that because, while it doesn't ever want to believe the Fed will keep tightening, news that the economy was running even hotter was apparently too much to handle. So, we got an "Oh, maybe the Fed will keep tightening" response. (I won't even go into how fake that GDP report was, having already covered it; so, you can read it at the link just provided. Let it suffice here to say they just managed to fake it up higher!)

As a result of the Tepper Tantrum and the vainglorious fake news about our fully recovered economy that is somehow soaring -- even though there were NO jobs added for the past six months (see end of article) and efficiency has been declining all year -- the market gained some serious downward velocity during the day:

"Most Shorted" stocks were clubbed like a baby seal on the day, now trading the velocity of decline during the COVID lockdowns...

The fall was arrested by internal technicals of the market:

The S&P broke below its 50DMA but 3800 (the Put Wall) was the big support for the S&P 500:

Based on put options, odds favored the market finding some support at that level, and that support might hold until those options expire on December 30th say the market analysts.

Yeah, but that depends on how good the bad good news is or how bad the too-bad-to-pretend-its-good bad news is. What a dumb market the Fed has created with its years of interventions. Markets are chasing the Fed all over, rather than the economy, but the economy is now driving the Fed to get tough as I promised it would, and the market just doesn't know what to think because most players have never seen a truly tough central bank fight truly hot inflation that it truly lost control of because it believed in nothing true.

All this action also put the bond market, which I just pointed out had not been the smart money in my opinion, back in the direction my opinion thinks it should have been going. Yields went back to rising this week, as if they now agree "Oh, maybe the Fed will raise interest rates higher," and today sent them higher still.

Thus, we saw terminal-rate expectations regarding the Fed's tightening agenda finally smarten up straight today:

And, while history is not always prologue for the stock market, there is clearly plenty of reason to think things could get worse:

Enjoy that little Christmas sled run if Santa's sleigh gets pushed off the crest of the hill!

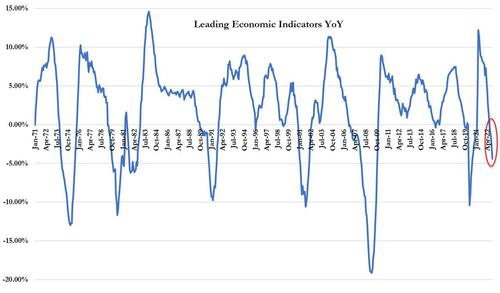

And ... judging from all past times when leading economic indicators put in a turn like they recently have ... it's about to:

Expressed another way, the Leading Economic Indicators Index never goes down this far without falling further:

EVERY big turn in this index has seen leading economic indicators fall further than this turn has so far. I see NO reason for an exception this time since the Fed is on an all-out tightening rampage at the same time all major central banks are on the same rampage, and even the Bank of Japan finally joined them, as I reported in The Daily Doom earlier this week.

And they are doing this, claiming they need to hurt the jobs market more, when we now know that the biggest job reporting error in history has been covered to such a seemingly corrupt degree that one senator said today,

"We need answers now!"

Senator Shreds Biden Admin For 'Lying' After Fabricating One Million Jobs

I think all the Fed's additional tightening after a period of having effectively ZERO jobs created for six months now, is certainly going to take those leading indicators down a lot further. (See: "Snow Job: Fed Admits Gov’t Job Estimates too High by Over 1-Million, which Means Serious Peril!") The truth is out of the bag ... like Creepy Santa dropped a surprise package of ammo down the chimney and into the wood fire ahead of Christmas. Apparently, even the senate is waking up from its chair beside the fireplace to run after the man responsible for this truth bomb that sent bullets flying around the lazy living room. This Santa may have a different kind of slaying in mind this Christmas.

So, ladies, with all due respect, clasp your cleavage because this roller coaster looks about ready to plunge when we hit the usual January market lull. And, if those put options don't have enough mojo to hold the brakes on Creepy Santa's sleigh until the end of the month now that we've crested the hill, this sled of a market might plunge into a steep run this Christmas. Things may pop out in public that weren't meant to.

(If you want to keep up with all the insanity that is happening all over the world right now -- particularly the economic collapse, sign up to receive The Daily Doom in your email box for free every weekday morning. It's a news headline publication of this website focused on the collapse.)

![By Moxie837 (Own work) [Public domain], via Wikimedia Commons By Moxie837 (Own work) [Public domain], via Wikimedia Commons](https://substackcdn.com/image/fetch/$s_!i9Ds!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F6e290621-30f1-426a-b1b4-f63c9ed40b4a_314x331.jpeg)