The Fed’s meeting today resulted in the following:

No change for rates, barely any change in the statement, upgraded economic growth, but big 'signals' from the Dot-Plot with 2024 remaining the same (3 rate-cuts) but 2025, 2026, and beyond all seeing higher rates (less cuts).

As the Fed has moved toward fewer rate cuts, further out, US economic data has plunged while inflation expectations have soared:

This is exactly the kind of stagflationary recession scenario I’ve warned since Covid we’d see as the actual kind of landing the Fed is going to deliver. So, we’re coming in on approach as could be expected, but not as the Fed and markets have expected. Of course, the idea that there would be no rate cuts in March was a lonely point to pound when nearly everyone, even Zero Hedge, was betting firmly on a Fed pivot in March. Now we know it didn’t happen, proving what a nonsense fantasy that was all along. (At this point, however, just about everyone had finally come on board with that view over the past month or two, so the market is not surprised at all by that.)

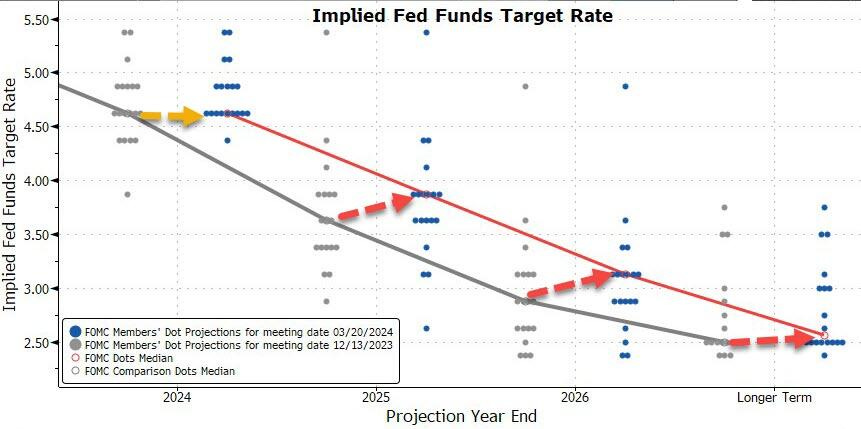

The Fed’s dot-plots by which each voting member puts forward their best guess of where future rates will be has shifted from its December meeting to the present as follows:

The move is slightly toward staying at higher rates for longer across the board.

While The Fed kept its median dot at 3 cuts for 2024, beyond that the dots signal considerably less aggressive Fed rate-cutting. We also note that while the median 2024 dot remained the same, 8 Fed voters were for 50bps or less in Dec, now it's 9. The Fed now expects one less rate-cut in 2025 and 2026... and the so-called 'neutral' rate has also been increased [i.e., the rate at which it anticipates it will eventually hold].

The median rates for each quarter in the dot-plot have all shifted higher as seen from the gray line to the red line:

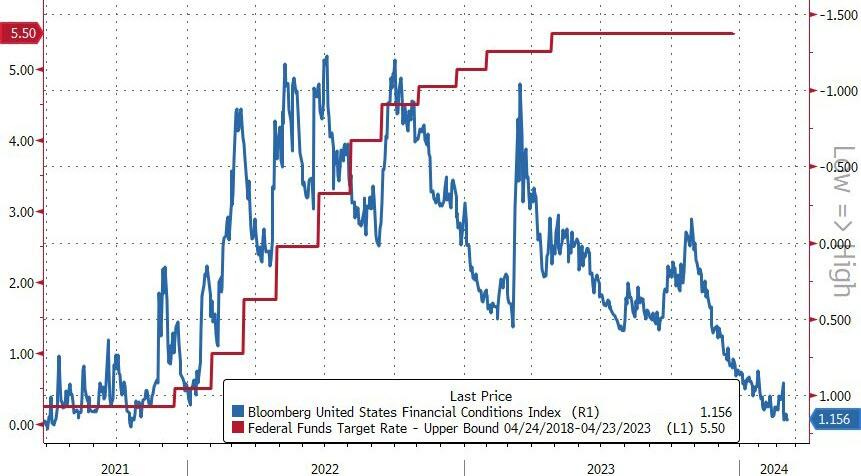

While Powell & Co. have held hard to tight policy in the face of resurgent inflation, his soft-sounding tone has certainly caused financial conditions to loosen considerably since November where he first said the Fed could ease off some if markets kept doing the Fed’s fighting for it. As you can see, the market immediately did the opposite, cementing the Fed into a position where it will actually have to tighten for longer and may have to raise rates to undo this counterproductive turn:

Four months of financial conditions throughout the economy that were actually getting tighter under Fed rates and tough talk in mid to late ‘23 was more than wiped out in two months at the end of 2023 after Powell spoke. Conditions have actually loosened now to being the easiest they have been since QE was roaring back in 2021 because Powell has continued to bring up future rate cuts sometime this year.

I find it amazing that Powell would continue to speak of future Fed rate cuts getting close even as financial conditions kept loosening back to the extremely easy conditions of 2021 that created this inflation in the first place. The looser financial conditions that have already occurred as a result almost assure inflation will rise more than it would have if Powell had not mentioned rate cuts later in the year at all. His plan has come undone because of his loose mouth to such extent that we could even find we go back to red-hot inflation since conditions are now as loose as they are. By the time Powell realizes the recent increases in inflation are not “transitory,” we could all be back in a world of hurt because inflation will keep rising for awhile even after the Fed realizes it needs to tighten again.

You may think I’m premature in saying Powell’s plan has come undone, even as he told congress today that all was going beautifully according to plan, but I was premature in saying inflation would rise when Powell and everyone who listens to him said it wouldn’t three years ago. I was premature in saying it would rise a second time last year and this when almost everyone believed the battle was winding down. I was premature in saying rate cuts would get pushed back from where 90% of investors believed they were going to happen in March. So, I’ll go ahead and be premature in stating now that his plan has come undone as a fait accompli because I’m as certain of that as of all that came before. It’s the kind of prediction I call publishing “the news before it happens.” So, mark this word for down the road.

Here’s the full Powell press conference after the Fed’s FOMC meeting today. If there was anything in the Q&A session after his summary comments that needs commentary, I’ll cover that in my weekend Deeper Dive for paid subscribers along with anything more on that prediction if there’s more to say, but it does not appear there were any surprises here:

The Fed’s overall plan is to make certain the rich get richer

In a video I posted earlier this week, Wolf Richter explained how liberals love the term “wealth effect,” while conservatives prefer “trickle down,” but both mean exactly the same thing, and both Dems and Repubs work to make sure it happens. Here is how that works:

Janet Yellen, when she was president of the San Francisco Fed, wrote a paper discussing the wealth effect, the doctrine says that the central bank can make the wealthy - the asset holders - wealthier. They can create wealth through money printing and interest rate repression, and so the wealthy people that have these assets become wealthier, and then they spend some of this money, and as they spend this money, it props up the overall economy, because it's part of consumer spending. So maybe they're they're buying a new house, or they're building a castle, or buying a yacht, and a new vehicle, and they're splurging on other stuff, and hopefully the yacht is made in the United States somewhere, and so there'll be jobs, and people make money - so this is the whole theory of the wealth effect.

Ben Bernanke explained to the stunned American public that the Federal Reserve is purposefully making their wealthy even wealthier, so that they feel wealthy, and feel rich, and spend a little bit more of their money, and you know hopefully prop up the economy. So this is an official doctrine, and there's all kinds of economists that have written about it, so you can Google that, and it has a very spotty record in in terms of helping the actual economy. It has a very solid record in terms of making the wealthy wealthier, but the trickle down effect of that wealth effect is pretty small, and you end up with this huge division in wealth, and so that's the principle that the FED did this on…

I think the wealth effect has been discredited, I think it's bogus, it's a fake doctrine, but that governed the Fed's action at the time, and it was well established in economic literature, and Bernanke explained it to the American people, so it's not something that Fed did secretly. It discussed it. It said this is what we're doing, and this is why we're doing it, we're going to make the wealthy wealthy, and hopefully they spend a little bit of that, it's going to help the economy, and that was the theory.

The philosophy, n other words, if you take care of the rich, they’ll take care of the rest. The little guy, of course, can’t risk money in that casino, and the little guy is also hit hardest by inflation since he has no disposable wealth but typically spends almost all that he makes. So, under this plan—especially once it starts causing inflation—the rich keep getting richer (even with the inflation) because most of their money stays in assets that are rising, while the poor get poorer.

As Yellen constantly promoted and carried out that doctrine, she often wondered with seeming innocent bewilderment why it was that Fed policy was increasing the wealth gap … as if she cared. It was so hard, apparetly, for her to figure out why on earth giving all the big money directly to the rich bankers would rocket them into much higher orbit while doing very little for the rest. In fact, the rest barely got enough boost for their wages to keep up with inflation during the decades of trickle-down economics that began in the Reagan era.

Showing it another way, here is a picture of how it works with the top one-percent, the next nine percent, and then the rest of us:

(Sources for the quotations above appear in boldface among the headings that follow:)