Powell Punts and Blunders

As another bank gets ready to bite the dust right after Powell assures "banks are sound."

At the start of this week, I made the following comment about the Yellen mantra in my editorial:

“The banking system remains sound and resilient,” announced the Treasury – a refrain that has also become as predictable as rain in May in Washington State. “Americans should feel confident in the safety of their deposits.”

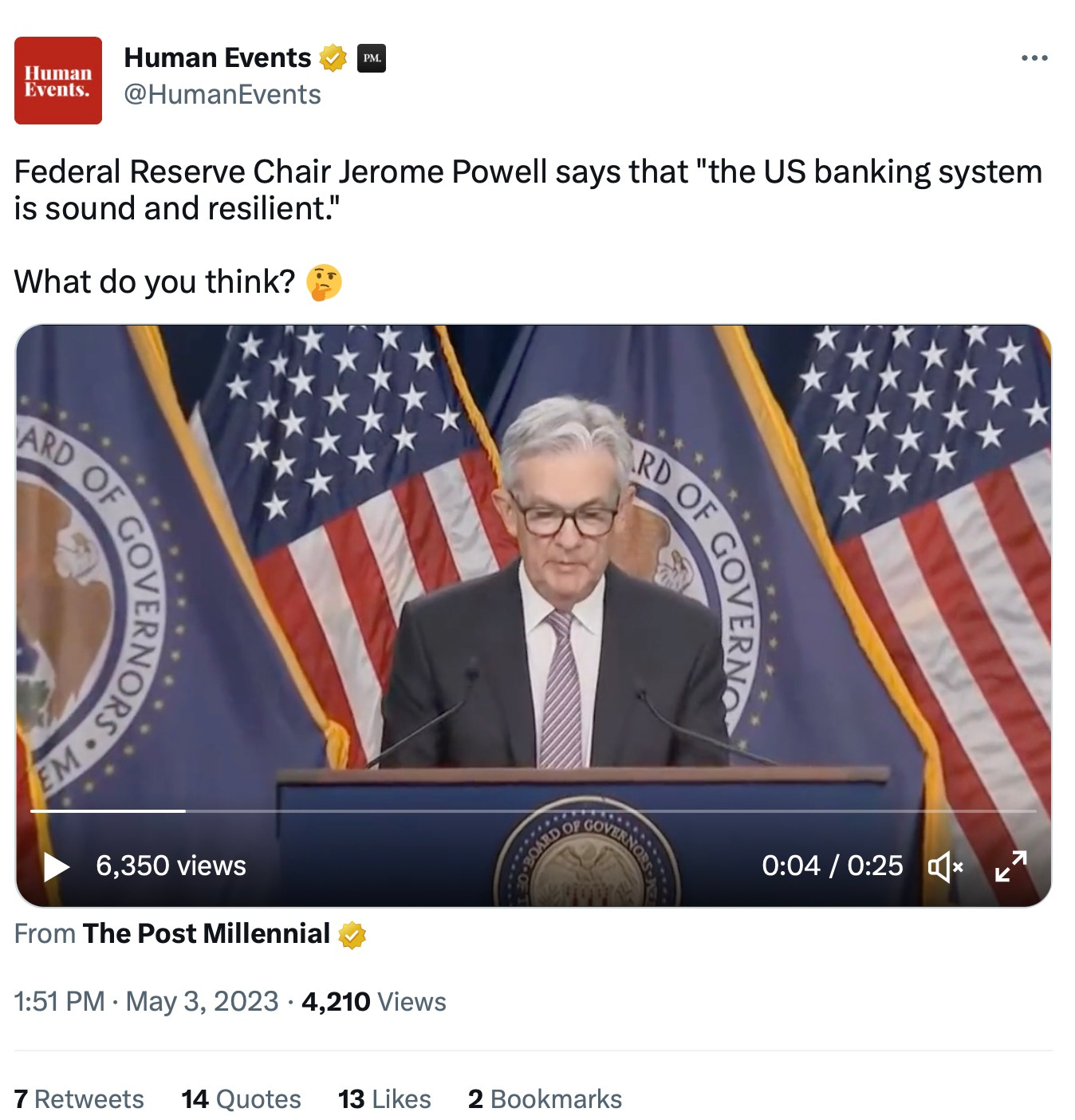

Yesterday, Yellen’s protégé, Jerome Powell, repeated the brainless mantra, as could be easily predicted, in his post-FOMC speech:

I can tell you what half the people in America think about these vapid assurances. According to a poll in The Daily Doom today, about 50% of Americans now fear for their bank deposits — a number slightly greater than during the worst of the Great Recession.

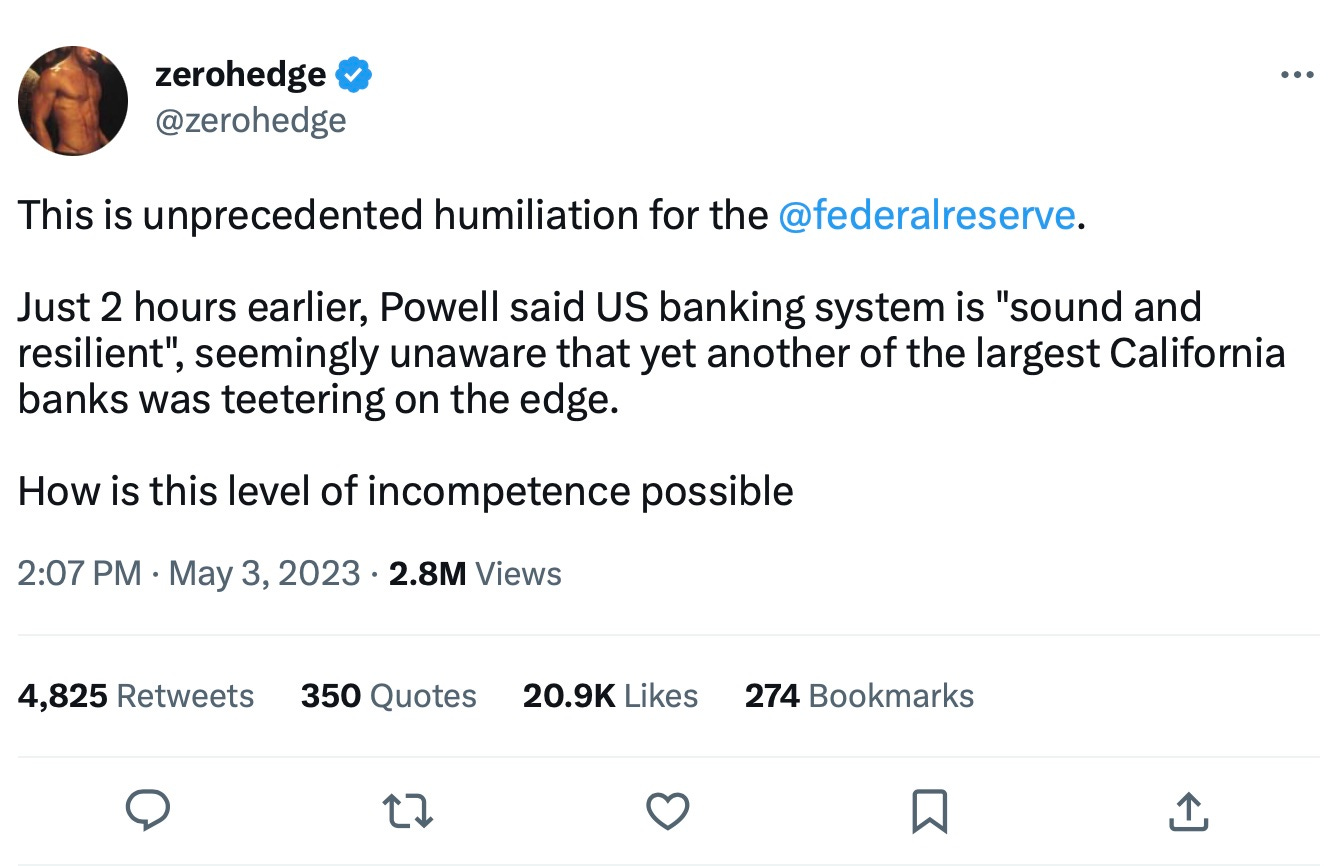

And why should anyone believe liars like Powell and Yellen? They constantly give this assurance, as I wrote on Monday, because they know people are afraid of how rickety the system is. The more they have to reassure us, the more you know there are problems. These same clowns never saw any of this year’s three bank collapses coming, even though it is their responsibility to oversee that they never do come, and even though they created the present situation.

Now, cuing up immediately after Powell’s speech, a fourth bank entered the final nova stage of collapse, announcing it has failed to find an interested buyer. Its stocks crash 60% in after-market trading (to eventually recover to being down about 28%) about as quickly as Powell closed his puckered mouth.

Like me, Zero Hedge balks every time they hear this mantra now and asks in another story today,

How could this former lawyer lie so brazenly to the American people … when in just the past few weeks we had seen over half a trillion in bank failures, making the current bank failure episode even worse than the global financial crisis?

No wonder more people fear for their deposits now than at the heart of the Great Financial Crisis. And that statistic was measured before yesterday’s late cascade in PacWest Bancorp’s stock. So, apparently, “our banks are sound” is code for “get ready for the crash!” Powell’s pucker no sooner slapped shut than PacWest plunged, probably setting itself up nicely in time for another bank buyout/bailout over the coming weekend.

I’m sure JPMorgan is slavering for its next big bite of banker pork butt.

At least, we can rest comfortably, knowing that Powell’s accompanying rate hike yesterday will help suppress the value of bank reserves even further while creating more enticement for people to run their money out of banks to Treasuries that pay much higher interest now than what banks are paying. So, the banking system should be sounder and more resilient than ever!

Bear in mind, Powell is pressed to crush banks and bond values and stock values and home values and jobs, hurting all of us, because he and his pals chose to grossly overstimulate the economy with massive floods of new money two years ago, creating inflation that he also never saw coming, easily predictable in a time of shortages as it was. It was more than obvious to some of us that he was laying in a disaster for the near future.

Powell & Co’s decisions yesterday were also something I predicted on Monday:

The Fed is set to raise interest rates (by which I mean lower the value of existing bonds that banks are holding as unsellable reserves) again this week…. In spite of the obvious, I have already read some greedy marketeers who are predicting the Fed will lower rates at this week’s meeting so that stocks will soar. I boldly predict to the contrary: The Fed will make one last tepid raise this week and simultaneously announce it as their likely holding level.

And that is precisely what the Fed did, contrary to the fantasies of stock-market lunatics who keep betting on the Fed pivot that will never happen in the face of screaming inflation. It raised rates a Tepid 25 basis points, and several articles this morning point out that Powell leaned as heavily into this rate hike being the Fed’s last as a Fed chair can when he must maintain his other mantra that “the Fed is data-dependent” at every meeting and must always leave himself a caveat should inflation take another hike upward, as Powell noted it had done three times already during its path downward for the past year+ of tightening:

Jay Powell hints US central bank has done enough to tame inflation after 14-month campaign

For anyone listening to his nearly hour-long press conference on Wednesday, it was abundantly clear which way he was leaning.

“He couldn’t commit to a pause, but he all but did,” said Mark Zandi, chief economist of Moody’s Analytics.

Said another article this morning,

The Fed raised interest rates by a quarter of a percentage point and signalled it may pause further increases, giving officials time to assess the fallout from recent bank failures….

"The updated language in the policy statement does suggest the bar is going to be quite high for further rate hikes. The statement is pretty clear that today's hike is probably the last," said Tom Garretson, senior portfolio strategist at RBC Wealth Management, US, in Minneapolis.

(The stories covering these quotes can be found in boldface among the morning headlines below. Become a paid subscriber and never miss a drop of the daily doom as this economic crisis unfolds.)