Repocalypse: The Little Crisis that Roared

That didn't take long. I just published an article showing how the Fed had responded with a quarter of a trillion dollars to save the economy from what it claimed was a mere blip. Since then, the recession-causing Repocalypse I've warned of has roared around the world, forcing the Fed to amplify its response again.

The Fed's planners just cannot outrun the little monster they created. It is growing as quickly as they increase their running speed. In the article I just alluded to, I also stated,

As you look at that, bear in mind that the Fed is continuing to add $60 billion more new money on top of that each month all the way to April, and that several times since September they’ve already had to increase what they said they would do, so may have to increase it more still. By the time we are done, based on the Fed’s schedule for its new QE, the Repo crash will have turned out to be so massive that the Fed will have flooded the economy with, at least, HALF A TRILLION dollars just to prevent the crisis from happening again and causing major banking/credit problems

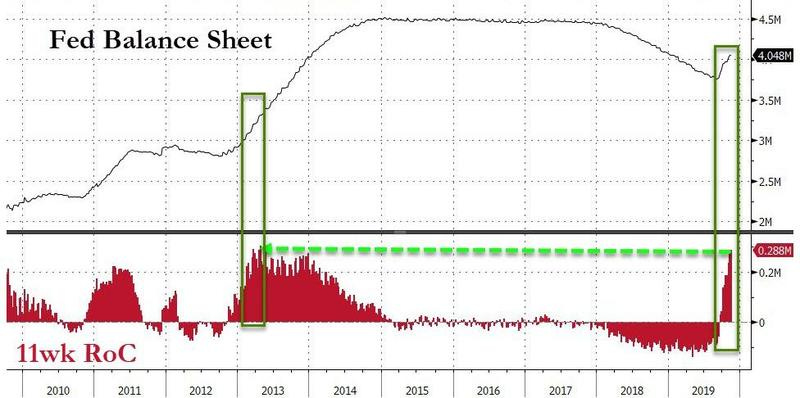

I showed this graph of how far they had already gone in trying to pump the failing system back up:

Then I noted that, in spite of such historically rapid and massive Fed intervention, the economy was still sinking toward -- if not deeper into -- recession.

As for the repo crash being the start of a recession, that remains to be seen. The Fed has leaped in with a quarter-trillion-dollar response to date. We’ll see if that is enough to circumvent the severe banking problems they obviously suddenly fear and the recession I said those banking problems would cause.

Here is another way of presenting the same data:

The red bars show how much was injected into the Fed's balance sheet under QE, then how much was withdrawn from the Fed's balance sheet under QT, and now how much has been re-injected under QE4ever. Tell me that the Fed's current intervention is not every bit as large in scale and faster in timing than any previous round of QE!

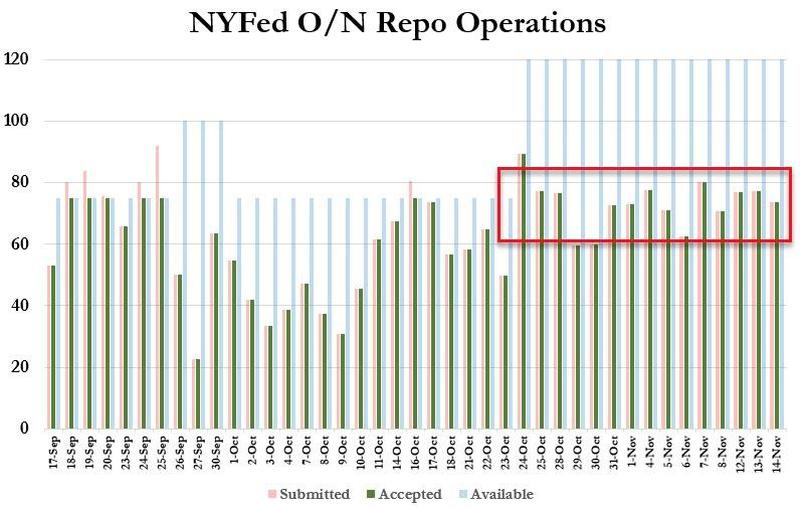

And now they've increased it again! As it turns out, I was so busy putting together that article, that I missed the news that the Fed had just done what I said I thought it might have to do ... yet again. It upped the amperage on its repo operations one more time:

"Fed Braces For Year End Repo Turmoil: Announces $55 Billion In 28, 42-Day Repos To Flood System With Cash"

The Fed confirmed just how reliant both it, and the entire US financial system is on the repo market, when it released its latest term repo schedule, one which for the first time included 28 and 42-day repos which would mature into the new, 2020 year.... Meanwhile, the NY Fed is maintaining its $120BN in overnight repos indefinitely.

These new repos are only supposed to aggregate to an additional $55 billion, but there we go again with the Fed having to add more and more ammo to combat something it continues to say it has under control. It is again stretching the term length of repos to new terms because shorter-term repos to banks are endlessly rolling over but not doing the job. The little monster is growing as quickly as the Fed increases its responses.

This is extraordinary in the truest sense of the word. We've never seen anything like it in the repo market. News of the Fed's constant failure to fully appreciate and address the scale of the funding shortage that began in September keeps pouring in so fast that I am scrambling just to keep up with the news of the Fed's new steps as I research and write my articles about what it has already done!

How the repo crisis has multiplied like a virus through the financial system

Here is how the Fed's overnight repos, generally just an end-of quarter one-day phenomenon (and for almost a decade not even necessary at all), continue to roll over:

And here is how the two-week term repos (a new invention by the Fed in manipulating money markets) have continued relentlessly to roll along:

As I look at that, I have to think the Fed, which originally reported it had solved the problem with a single overnight repo operation -- maybe two or three at the most -- must now be in panic mode as it has gone from inventing fourteen-day term repos to now 48-day term repos to supplement a program that is still not resolving the crisis.

Bank of America sees it as a problem that could be metastasizing into financial collapse:

The repo channel, which is one ingredient within overall financial conditions, is becoming more important as reliance on overnight funding and leverage continues to rise.... The bigger picture is that if repo markets stopped functioning today, the amount of Treasury and MBS securities held outside of banks-dealers requiring liquidation (for lack of funding) would be about twice as large as 2008, and with today's surprisingly low levels of liquidity in the "liquid markets" the impact could be massive. In this context, we view the Fed's purchase program as integral to the promotion of easy financial conditions and supportive of asset prices, which is Chair Powell's second criterion for QE.... In our view, the most worrying part of the Fed's current asset purchase program is the realization that an ongoing bank footprint in repo markets is required to maintain control of policy rates in the new floor system.

It's a good thing this isn't QE4ever or even QE-at-all (according to Fed Chair Jerome Powell). It is just the new norm in overnight bank funding. Just the new norm. The Fed has stated one other reason (than the one mentioned by BofA in the excerpt above) for saying this is not QE: it no longer comes with forward guidance about how much the Fed will buy and when. How the Fed can get away with claiming that when its schedule is published well in advance is beyond me:

How much more obvious does forward guidance need to be? And who cares if the Fed gives forward's guidance at this point? The banks are now so used to how QE works that they could intuitively guess at what the Fed will do. Some writers even say JPMorgan manipulated what the Fed is now doing by helping create this crisis with its own massive balance-sheet rotation just to kick the Fed back into QE mode.

Here, by the way, is a great recent article by Chris Martenson about how QE has been working, explaining how the Fed is, for a fact, illegally monetizing the US debt, even as the Fed claims it is not:

"The Federal Reserve Is Directly Monetizing US Debt"

I've written about that in the past, but there is no need for me to go back and try to recap what I've said when Martenson covers it so well there. The Federal Reserve is breaking the law, and congress couldn't care less. Congress didn't even bother to ask Powell at last week's congressional hearing how it is that the Fed claims it is not monetizing the debt.

The Fed is not only monetizing the debt directly at this point, but as Martenson says, it is even fully engaged in Modern Monetary Theory without admitting it and without any overt choice by government to go that route. Yet, the financial world sleeps as the train goes by -- a congressional circus train for public entertainment about the orange clown named Donald. No, not Ronald MacDONALD. Just Donald. Congress plays with politics while Rome burns.

With such slight of hand, the entire monetary regime of the United States has shifted in two months time into a scale of combat never seen in the history of the US repo market -- a central bank directly financing the US federal debt with ever larger rounds of new money, "printed" (an anachronism in that it is done, of course, with the click of computer keys in this age) and deposited in the government's bank account THE VERY SAME DAY that government treasuries are actually issued!

And no one cares. (Well a few readers here (and there), but not many.)

The colossal size of the Repocalypse

As stated in the following video, the Fed has now moved from lender of last resort for banks to the everything of last resort for banks, the government, the stock market, the bond market, money markets, etc. The entire US economy has become utterly Fed dependent. Here is how the Repocalypse moved insidiously from a nothing-of-significance to a semi-covert almost-everything-has-changed-but-almost-no-one-is-talking-about-it:

To clarify one point at the start of the video, yes, the Fed with its endlessly repeated overnight repos and weekly repos has already done $3 trillion in total operations. However, that is misleading in impact in that almost all of that just refinanced the repos that happened earlier. When you keep rolling over an overnight repo every night for two months, it sounds like you pumped in about fifty times more money than you actually did. In fact, all you've done is create one night's worth of new money and then endlessly refinance the original repo every day for fifty business days to keep it in place. The overnight repos don't aggregate at all.

Likewise, when you do that every third day or so with two-week term repos, they aggregate over the course of those two weeks, so you wind up with three of four of them accumulated by the end of two weeks. After that, however, each new term repo is essentially just rolling over one of the term repos that happened in the two weeks prior because those earlier term repos are now rolling off the books as you add each new one.

That's why I used the chart at the top of this article to show what the actual aggregate (to the Fed's balance sheet) of all these reactions along with the latest permanent $60 billion a month has been -- about a quarter of a trillion dollars. Still, a quarter of a trillion dollars is a massive amount of monetary munitions to fire off, which is as great an assault as any QE we ever saw during the Fed's so-called "recovery" period.

Yes, some QE came in bigger single doses, but averaged over the period between one dose and the next, none of them were any greater than what is happening now. QE 1 added about a trillion dollars in almost one burst, but then that was it for almost two years. QE 2 added another 3/4 of a trillion, but that was it for another two years. Then QE3 added $80 billion a month (for almost another two trillion over the course of another two years).

If you average each of those out as a monthly figure over the years that they covered, they are all less than what has just been injected each month over the last two months, which is the best you can do to compare because we have no idea how long the present operations will continue. The Fed states until April, but the Fed has understated by a very large degree how long every operation it has done will continue since it began these emergency operations in September.

The Fed obviously has no idea how long this level of rapid-fire response will be necessary, so why would anyone continue to take the Fed's word on it? The Fed also said QT would be continuing right through the present day on autopilot at this time last year. So, why does anyone take its word on anything anymore? It also said there was no recession in site and no housing crisis on the horizon right in the middle of the Great Recession, and it said there was no recession in sight just before the dot-com bust. Why does anyone continue to accord the Fed any deference or credibility at all?

To reiterate what I said a couple of articles back about the scale of this thing and what the Fed understands about the beast it is battling (this time enumerated for clarity) ...

First, the Fed burst into $75 billion in overnight funding operations due to obvious shortages all over the map in bank reserves.

Then the surge spread beyond that into longer-term temporary funding of $30 billion twice a week because the overnight loans were not up to the needs.

That still not being enough to end the troubles, the Fed’s rapidly expanded the overnight operations to $100 billion and doubled the term operations to $60 billion.

Those operations still did not end the troubles the Fed’s tightening had created, so the Fed decided to flood the murky money pools of this world with $60 billion in frothy treasury purchases.....

Then, all of that pumping of of new fiat money into the monetary system was still not enough, so the overnight and term repos (essentially loans) had to be extended.

Then, because all of those operations together are still not enough, the Fed promised the repos will continue, “at least,†through January, 2020, and the creation of new money [QE] injected into the banks will continue, “at least,†into April.

During those previous rounds, I've stated from time to time each new plan would probably not be enough; and, now, because all of that is still not enough fire power, the Fed has added another $55 billion!

How much will it take for the general public to wake up and realize that the September repo crisis was so enormous that the Fed is still struggling to bring under control? Therefore, I think it merits being called, as some are calling it, "The Repocalypse." In fact, we still don't know how big it is, and to keep us from figuring out whom it was eating, the Fed has said it will refuse to reveal what banks are getting this extreme support for two years! (They don't want to cause a run on banks, you know.) I've said this will mount up to at least, $500 billion in new permanent monetary injection, based on the Fed's stated schedule ... and probably more. We're already halfway there!)

How many times have my own readers heard me warn in years past that, for new rounds of QE to keep working, it is going to take higher and wilder doses of it to achieve the same effect? Isn't that what we are now witnessing?

As noted in the video above, the Fed's asset sheet has just slammed from going in reverse (shrinking) at an annualized rate of about 9% into full forward thrust (growing again) at an annualized rate of 23%! The shift point, of course, was September's repo crisis. That should give you a sound idea of how significant and severe the repo crisis was and is by how much QE it is taking to jar us back out this crisis, hopefully before it becomes a problem across the entire global economy. That is an astounding regime change. And almost no one seems to care.

Everyone is riding along silently in the family car as it flies off a cliff, saying "Dad has this under control."

The speed with which the Fed reversed and the degree to which almost no one cares has been a little surprising to me, though it shouldn't have been, given what I've seen of economic denial in the years I've been writing this blog. The entire US populace, including all the economists and market analysts and politicians have readily and smoothly gone along with the Fed's claim that it is not doing QE, and acquiesced to their stance that this is just a minor technical blip the Fed is correcting purely to maintain monetary policy. Not many are asking why routine monetary policy now requires daily massive interventions by the Fed in increased regular barrages.

A large part of my claim that we'd go into recession this year because the Fed would not react effectively enough to avoid the recession that would be caused by its tightening was rooted in the belief that the Fed's astounding return to QE would finally break through people's denial enough that they'd start raising objections. I thought we'd start to hear arguments like, "Wait a minute here! You told us that QE was temporary. You told us for years you could normalize your balance sheet again and that doing so would be 'as boring as watching paint dry.' You told us that QE was not monetizing the national debt precisely because you would normalize your balance sheet again so that it would all go away and become nothing but a temporary measure that was necessary for economic stimulus, not necessary for funding the US debt. Now, all of that has proven to be total bunk, and you've had to rush back to QE more quickly than you ever thought possible. In fact, you never thought you would have to return to QE at all. Not much more than a year or so ago, Janet Yellen told us we'd never have another financial crisis in her lifetime, and here you are repeating everything you did in the worst part of the Great Financial Crisis. You guys have no credibility left at all!"

I thought some arguments like that might emerge. In that case, the lack of public trust would prove a HUGE problem for the Fed because even the Fed has long openly admitted trust is its only real stock in trade. Without that the fiat dollar has no value at all.

Yet, here we are, with everyone humming "Dixie Land" or something of the kind and the Fed marching along to its own drum without much criticism, and the attitude almost everywhere (so far) is, "Well, we'll just see where this goes. The Fed says it will all be fine. I see no reason not to believe them, do you?"

Maybe history is a reason!

I wrote about how little anyone appears to care about this major Fed regime change in a comment on my last article, and I wrote it before becoming aware of how the Fed just increased its repos/stimulus measures for the seventh time in less than twice as many weeks:

They [bankers, politicians, Wall Street, investors, and citizens in general] have no personal interest in outing the Fed and crashing the party. In fact, I think they have no interest in even seeing that the Fed has failed. Most of them aren't even thinking. Thinking would lead to realizations they don't want to even consider, and denial is best maintained by not thinking about anything you don't want to hear.

We see this all the time in individuals who are in denial about something bad in their lives, such as a cheating spouse. They quickly brush off any warning friends give -- or even raise a barrier of anger against it so they don't have to hear it and don't have to think about it. Thus, ignorant bliss is maintained ... for awhile ... until one day far down the road reality finally crashes through when they catch their spouse in the bedroom with someone else.

We see it working out the same way in economics today with Joe Citizen who is not asking any questions of the Fed. I had hoped (not a lot, but to some degree) that people would finally smarten up and start asking some real questions about the Fed's failure now that it is laid out in the open for all to see, but I guess that is beyond hope. I find that the majority of people cannot even be convinced when you dissect the failure in a post-mortem of the Fed's recovery right in front of them. I still hear back on various forums or from friends that "The Fed says this isn't QE, so it isn't" or "The economy is doing the best it ever has because Trump says so, and he's my president."

People are believing exactly what they want to believe and not letting anything else in. I thought it might become hard for people to disbelieve in the underlying economic realities and maintain trust in the Fed's alternate narrative once the Fed was forced to do the opposite of what it had reassured the world it would do and had to leap in an extraordinary way back to QE (as I always said they would do). I hoped people would start to ask questions when they saw the Fed's total about-face. I thought their doubting the Fed would render the new QE a lot less effective. Even the Fed expressed in a number of speeches that it was now concerned about losing the public's trust. However, apparently that is not to be case. I'm not hearing many questions even from the average citizen. In fact, almost none.

I think all of this is just human nature living in denial in all segments of economic/business life. I guess the only thing that will crash through denial is total economic collapse.

Even then, I suspect everyone will simply be asking "Why did this happen" and probably fastening on the most ready scapegoat they can find and agreeing that "no one could really see something like this coming." I'm not sure, in that case, what collapse will look like -- just a long run of stagnation into greater and greater confusion and despair about what is wrong with the world (with no clarity) or sudden realization as we all fall off a cliff.

There are a few bigger names by far than I, such as Santelli in the video linked in a comment above, who are saying, "Hold on a minute! What is going on here?" But even they don't seem to be breaking through the public mindset. Maybe that realization is something that is dawning slowly, but right now it appears the Fed is going to get another free pass by 95% of the citizenry with little effort.

None of the people who should be questioning it, such as the financial media, are going to; but apparently the public isn't going to either. Investors certainly are not going to, as they only want the market to go up, so don't bother us with facts about how spectacularly the Fed failed or about how it is now monetizing the US debt on an infinite trajectory. We don't want to hear it; and, if we do hear it, we'll simply respond that it doesn't matter anyway and end the conversation.

For example, I just read a writer who, after noting that the Fed had just IN ONE WEEK pumped an additional $100 billion into the economy (more than it ever did in one month of QE3), summed that up as follows:

"The Federal Reserve is doing what it needs to do to keep its policy rate of interest steady.... I think the Federal Reserve has been doing a good job in some pretty tough times."

That's all. The whole massive burst of new money was just normal policy-rate control, and hats off to the Fed. NO question as to why it now takes such ABSOLUTELY MASSIVE actions (by any historical standard) just to maintain its policy rate of interest. All that matters is dad has control of the car as it flies over the cliff. "Back to sleep children. Don't worry about the trees below that will soon be coming through the floor of the car. Rock a bye baby in the tree tops."

Congress, which has oversight of the Fed, preferred to sit tight during Powell's recent meeting with them because none of them want to deal with the massive problem that sits in front of them. So, they enter the meeting, hoping Powell will give them what they need to maintain belief that there is nothing they need to do. Hearing no basis for alarm from the Financier-in-Chief, they leave content that there is no problem they must resolve, no reason to have to reform the Fed because it failed, etc.

Continued belief in the Fed may mean things take longer to crash than I predicted because consumer sentiment holds out longer. We'll see what happens; but, at the moment, it seems everyone is content to keep whistling Dixie.

That said, economic pressures do continue to mount toward a recession, and consumer sentiment is finally showing minor cracks as denial becomes harder to maintain. It is too early yet for the Fed's intervention to have provided any stimulus to the overall economy, so stats are still coming in worse than the months before. Whether this breaks through before the Fed's absolutely massive new stimulus starts to turn things back up a little, remains to be seen over the next couple of months.

As I concluded in my last article,

The question that remains to be seen, therefore, is whether its panicked leap back into QE with both feet came soon enough and is large enough. They stopped QT quicker than they thought they would (but right when I predicted they would) and leaped back in quickly [a couple of months sooner than even I thought they would] with an extremely large response, so maybe they will narrowly avert the recession that otherwise would have started roaring like a blast furnace after September’s huge repo crash.

[See also the followup article to this one: "Repocalypse: The Second Coming."