We’re running out of places to run. Running out of places to leap to.

The Russell 2000, a measure of smaller companies than the Dow or S&P or Nasdaq has fallen all the way back to a 3-year low. The Nasdaq has retreated clear back to Dec., 2020, and the S&P is back to April 2021. Of course, today gave them a sizable boost back upward, but we’ll have to see if that is a bounce that holds. The move came because the Treasury announced a smaller issuance of new bonds ahead than was highly feared, but we’ll have to see if that holds, too.

“We closed on the lows last week,” said Art Hogan, chief market strategist at B. Riley Financial. “Oftentimes when you get that kind of negativity going into a weekend and nothing new arises that changes the outlook for markets and the economy, you get a bit of a claw back on Monday.”

“Market participants are really hyper-focused on supply now, and we kind of know the Fed is on hold,” Angelo Manolatos, a strategist at Wells Fargo Securities, said in a telephone interview. “So the refunding is a bigger event than the FOMC. It also has a lot to do with the moves we’ve seen in yields since the August refunding.”

Still, we are well on our way back down to the lows during the spring bank crashes:

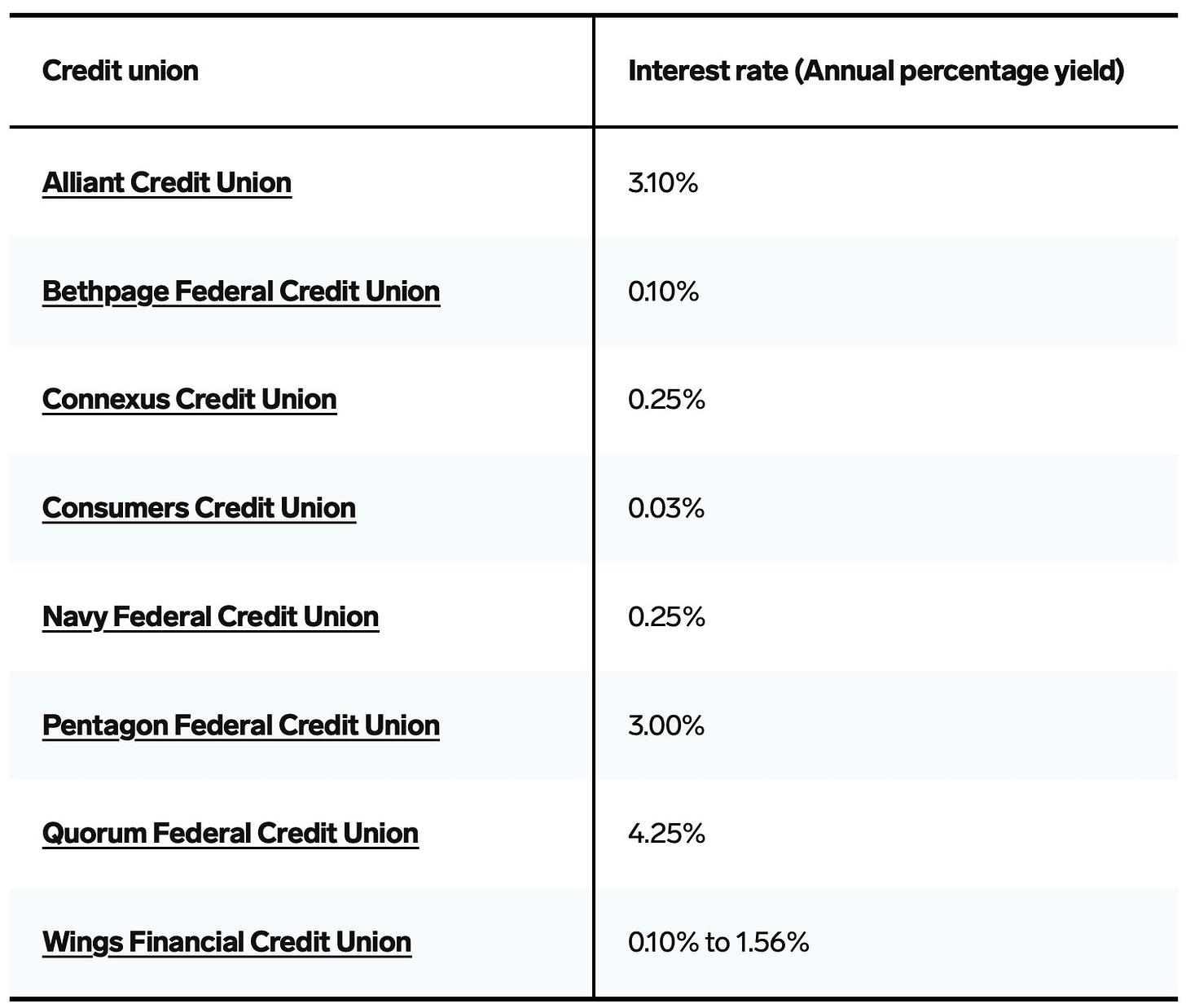

And the Fed just revealed last week some information that shows the next banking crashes may not be far ahead:

Fed Admits Banks Suffered Massive Deposit Outflows Last Week

With usage of The Fed's emergency funding facility rising once again to a new record high last week - and banks stocks clubbed like a baby seal - all eyes are once again on just what The Fed can do to 'seasonally-adjust' the data to avoid the admission of any deposit run fears in domestic banks….

Total bank deposits - on a seasonally-adjusted basis - crashed by a massive $83.7BN last week (the biggest outflows since SVB):

Deposits are almost back down to the level they hit after multiple bank runs drained them down.

Why? Obviously, one major driver is the topic we’ve been following — bond yields. With the 10YR now giving risk-free interest at 5% for anyone who plans to just buy and hold and collect interest, that looks a lot safer place to leap to than banks, and certainly better interest than most banks, but it mobilizes your money unless bond prices fall further so you can sell it for a profit if you need to (not so unlikely with yields looking to rise by market drivers for some time).

There is a lot of range right now between different types of savings accounts at different banks, but here is the average according to Business Insider:

The average savings account in the US has an interest rate of 0.46% APY. But the type of savings account you have has a big impact on your interest rate. Switching your savings from a traditional savings account to a high-yield savings account could help your money grow much quicker.

We use data from the Federal Deposit Insurance Corporation, or FDIC….

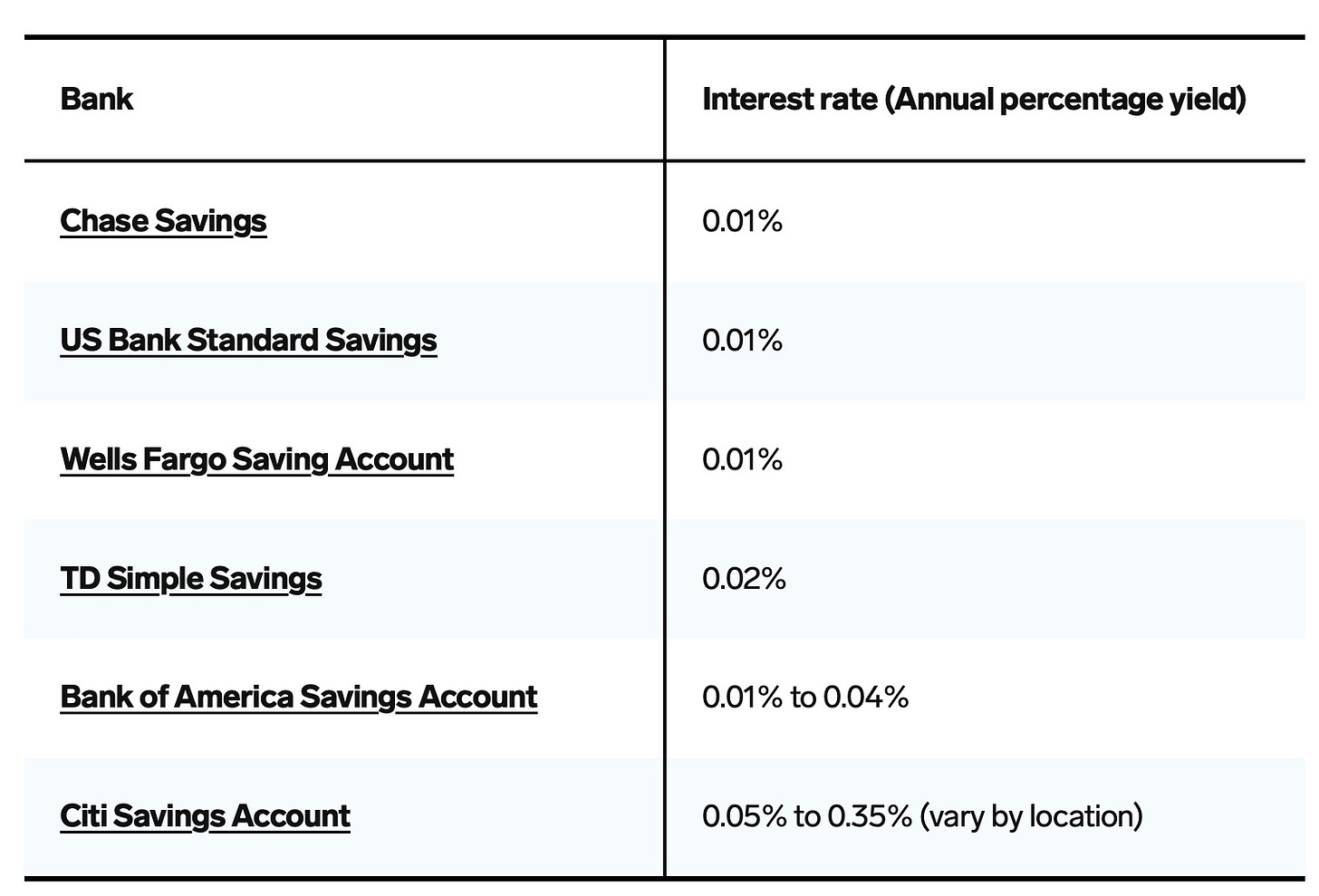

Here are some of the savings account interest rates offered on all balance tiers for the most basic accounts at major banks:

Those are pathetic, but there are some banks with high-yield savings accounts that offer slightly better than the 10YR bond even, forced by competing bond interest and threats of runs to start coughing up better returns for their riskier “vaults.”

Credit Unions also offer much better interest rates:

Comparing the size of monthly outflows from banks looks like this:

With outflows like that, shouldn’t the mainstream financial media be asking, “What’s going on here?” Looks pretty close to the runs the banks got back in March.

I guess we’ll wait for the next crashes to find out who is in trouble and then let J. Powell and J. Yellen — the two blue jays — tell us how strong and resilient our banks are.

There is nothing to worry about, of course, because the Fed’s emergency funds have been shoring up these funds once again, as they were created to do during the SVB crisis in March. So, all is well. Nothing to see here, Folks. Move along.

Except that moving along is exactly what depositors are doing … to other places to try to secure their money now that banks are looking, once again, like falling knives.

They are also moving right along out of stocks (except today) with stocks feeling their worst October in five years due to exiting investors. That’s not bad since five years ago was the October crash that took us minimally into a bear market by Christmas just before the Repo Crisis due to the Fed’s last attempt at quantitative tightening, and the Fed’s new attempt at QT is much bigger for much longer (supposedly), but we’ll see how far they get before everything comes down around them.

Likely today’s boost was a relief rally, offered courtesy of Janet Yellen’s promise that the Treasury issuances wouldn’t grow by too much more (and will be, as she infamously said before the QT that gave us that last bad October, “as boring as watching paint dry”).

Surveys of professional managers show big-money allocators have cut their equities to levels last seen at the depths of the 2022 bear market. Hedge funds just pushed up single-stock shorts for an 11th straight week. Models of investor positioning show everyone from mutual funds to systematic quants reducing equity exposure well below long-term averages.

I don’t see why that should be a problem, do you?

“It’s troubling that a market setback as internally deep as the current one hasn’t resulted in more improvement” in sentiment, said Doug Ramsey, chief investment officer at the Leuthold Group. “The ‘wall of worry’ accompanying much of the 2023 market action has morphed into a ‘slope of hope.”’

Surely, he’s just a worrywart. Probably believes in conspiracy theories and writes himself on the ballot.

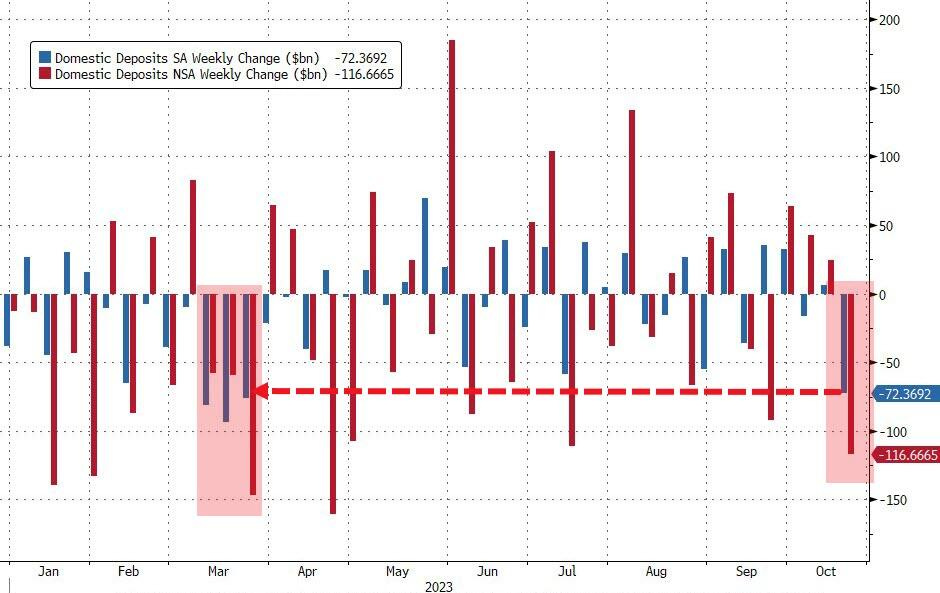

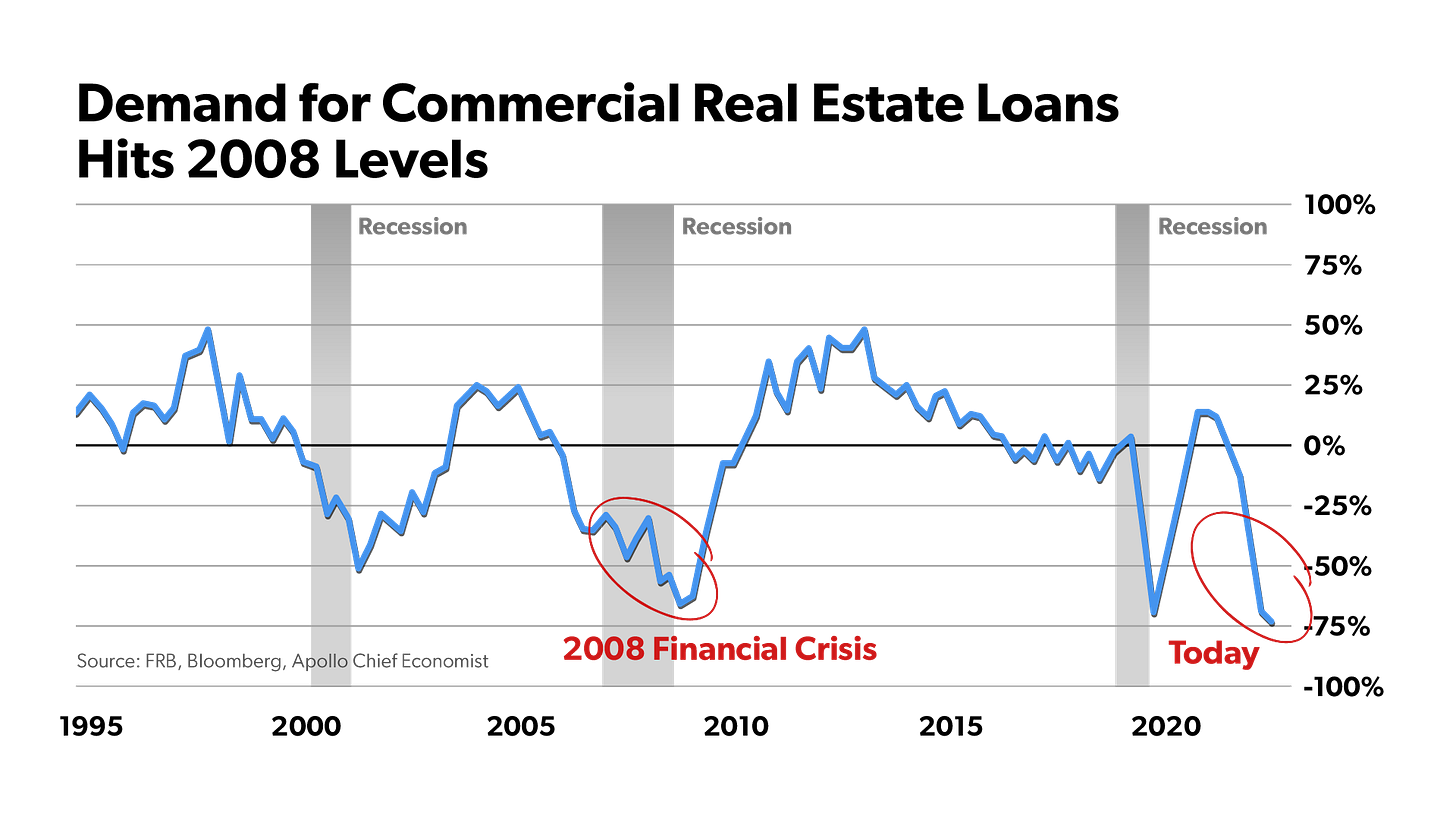

I mean, we’ve got us a couple of nice wars that each could potentially go global in a matter of days, the biggest bond bust in my lifetime, if not everyone’s lifetime, inflation that has returned to rising for three solid months now in spite of the Fed’s best efforts, banks looking about as bad as they did right at the bottom of the last banking bust, the world’s biggest banker having said after the year’s last bust that he’s certain another banking bust is coming due to commercial real estate, and commercial real estate now looking like this:

Can anyone say, “Run!”

Economania (national & global economic collapse + stocks & bonds)

The big bond market event Wednesday is at Treasury, not the Fed

Treasury to borrow $776 billion in the final three months of the year

Stocks are rallying to start the week, with the Dow up over 500 points

Worst October for Stocks in Five Years Has Investors Exiting Market

Russell 2000 Hit 3-Year Low, Nasdaq Back to Dec 2020, S&P 500 Back to Apr 2021

Fed Admits Banks Suffered Massive Deposit Outflows Last Week

5 ways GDP gets it totally wrong as a measure of our success

The Secretive Industry Devouring the U.S. Economy

Biden announces $1.3 billion to build new power lines, upgrade aging electric grid

Google paid $26B to be default search engine, exec testifies in antitrust trial

Real-Estate Rubble (housing, commercial & global real-estate bubble trouble)

The Biggest Housing Crash In History Is Already In Front Of Your Eyes As Mass Price Cuts Begin

Housing Market Poised to Burst with Sudden Flood of Hidden Inventory by Melody Wright

Map: Where Americans are moving

US second home sales slide in pandemic-era vacation hot spots

Overinflated & Underfed (too much money chasing too few goods due to weather, sanctions or other supply issues)

Consumers are leaning on their savings to spend, and some economists are worried

World Bank: Major Escalation In Israel-Hamas War Could Send Oil Soaring To $157

Oil Prices Plunge 3% as Market Weighs Israeli Attack on Gaza

Wars & Rumors of War, Revolts, Hacks & Cyberattacks (+ AI threats)

Young German-Israeli woman paraded by Hamas was found beheaded

US troops in Iraq and Syria attacked two dozen times in two weeks

‘Like fighting ghosts’: The challenge the IDF faces in destroying Hamas’s tunnels

Erdogan threatens to declare war on Israel, send military to Gaza

Musk offers Starlink internet for ‘recognized’ aid organizations in Gaza

How Toy Drones Are Transforming War in Ukraine and Israel

‘Utterly morally repugnant!’ Lawyer ‘obliterates’ BBC News Israel war coverage live on air

WATCH: Hamas Official Flees Interview When Asked About Massacre of Civilians

The Decolonization Narrative Is Dangerous and False

Political Pandemonium & Social Senescence (major socio-political issues & events but not campaigns)

Justin Trudeau Throws God, Christ Out of Canada

Joe Biden's Impeachment is Looking More Likely

Biden’s Cheat Sheets Attain Comic Book Status, But It's Not Funny

Mike Johnson Already Making MAGA Mad

Haley touts Israel record, rips Trump as ‘chaos, vendettas, and drama’ at GOP Jewish summit

Migrants in New York City hotels and shelters are costing taxpayers $5BILLION

‘The rise is real’: Haley’s breakout is jolting 2024’s undercard race

Former Vice President Mike Pence suspends his 2024 presidential bid

Concern for 'worn out' Donald Trump as he 'loses composure' outside of court

University Students’ Support For Terrorism Isn’t Ideology, It’s Conditioning

New Speaker Mike Johnson’s First Good Idea: A Debt Commission

Damnation by Domination (unelected global government, invasive government, unconstitutional government & censorship)

Matt Taibbi: Note to Readers on "Project Amy" Klobuchar the butcher.

Doomer Humor