Something Wicked is STILL Prowling Nearby

Now that the Dow finished its best October ever, it is more than clear my anticipation of an October surprise that would deliver a "horrendous" stock plunge couldn't have been more wrong. That was an October surprise on me. It was not, however, a large one, as I didn't have a lot of conviction when I wrote the following quasi-prediction:

I’m anticipating this coming week will be horrendous. That kind of extreme bouncing [seen in August] is nothing but the rapids right before the lip of the waterfall.... There are likely to be more rallies that won’t be much more than huge rapids to go over in the journey, because we’re heading down a chute of waterfalls now.

That was not one of my full-on predictions, often written in red to make them clear and easy to find and stated specifically as a "prediction," but it was something I was "anticipating" as "likely," but it didn't happen. The final statement that "we're heading down a chute of waterfalls now" was, however, made without any equivocation. It was just the precise timing I was not certain of. The worst surprises in stocks seem to love October, so I ran with that as being most likely.

On the other hand my statement that GDP would be negative for a third quarter and that we are in recession has been a definite claim all year. Yet, my apparent miss on a third quarter of negative GDP doesn't bother me because I don't even consider it a miss. As I laid out in my last article, the number reported was the most obviously rigged number I've ever seen in GDP. The positive GDP claim is fully accounted for by the false inflation rate used for GDP, which was completely out of line with any published inflation rate and 50% lower than the rate used in the previous quarters when we all know inflation has not fallen by 50% on ANYTHING in the last quarter, not even gasoline, which experienced the largest decline. So, as I wrote in my last article, "GDP Stands for One “GROSS Domestic Pig†During Election Season."

There is, however, no getting around the fact that I was wrong in anticipating a deeper plunge for stocks in the second half of October. However, if it happens in November, I'll consider it merely premature by a couple of weeks in timing, since I'm never doing analysis for the sake of trading but am solely focused on laying out the problems that are assailing and will assail the overall economy -- stocks being just one of them. If it doesn't happen this fall, however, I'll call my statement that we're now entering a chute of waterfalls a total miss.

I'm still as inclined as I was to believe we're entering that steep canyon chute that is going to be a rough whitewater plunge for the fall season, and I'll lay out why in this article. In the most basic technical terms, I don't think the present rally has much more headroom, as I'd graph out its BEST prospects like something like this:

The ceiling for the peaks and the floor for the troughs have been pretty consistent throughout this full year of a crashing Stockmarket. So, the recent rally doesn't have much more than the middle of November before the bottom falls out again, and there is plenty of news in store for this week that could trip the market earlier and maybe even did already. Barring some really bad news, there isn't much to constrain the S&P from rising to about 4,100 unless events in the upcoming week smack it on the head a few times with a sledge hammer, which they well could do.

Looking at the likelihood of a deeper plunge soon from a historic perspective, if you think this year-long bear market is bad so far, take a look at how it compares to other bear markets for both duration and depth to see how much longer and deeper it can easily go:

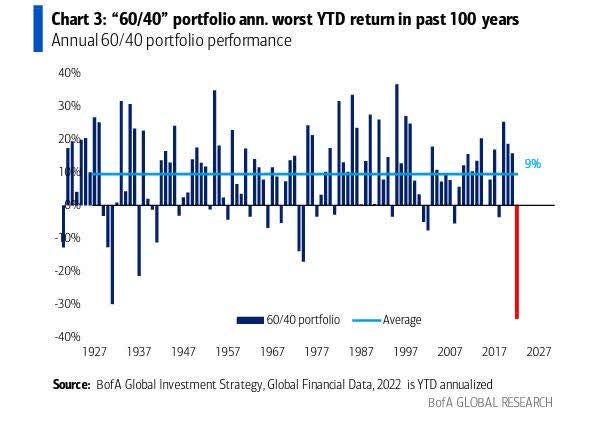

There is one aspect in which this year's crash has already been the most severe ever. That is for the poor person who maintained a classic 60/40 split in his or her portfolio between stocks and bonds because bonds have done terribly when they usually outperform during a bear market for stocks:

Worst ever! Makes even 1929 look a bit relaxed for total wealth destruction on a percentage basis for those in both stocks and bonds.

With all of that in mind, let's look at what is right ahead and all around us that can soon affect the stock market.

First, a look at where the economy has currently arrived

My thesis for the year is still as solidly on track as it could be with ...

inflation coming in scorching hot all year,

the Fed tightening harder and harder,

bonds experiencing their worst bust in forty years,

and that combo of Fed and bond battles busting the heck out of stocks all all year while,

in my opinion, also being in a recession all year,

We know, of course, the BEA's GDP report for the third quarter of 2022 screams otherwise on recession, but the first two prior consecutive quarters are solidly in my favor, having remained negative through each revision. The BEA's adjustments in the third quarter are the most foul and inexplicable I've ever seen, which is not, in the least, surprising when a major swing in political power rests on those in charge of the governmental department that creates this report obfuscating any message of a recession to any degree they can because America always turns those in power out of power if their watch is dominated by a recession. In fact, I warned in advance to look out for those kinds of shenanigans (to stay with Biden's Irish word preferences) because we are so near to a significant mid-term election in the middle of a recession.

Here is another way of looking at where we are that calls into question the GDP data:

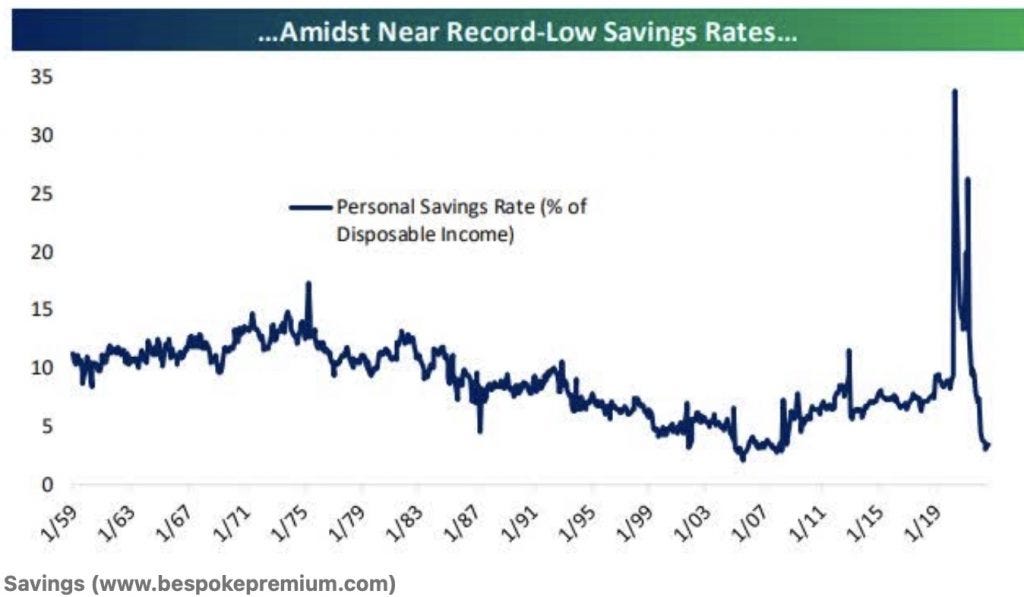

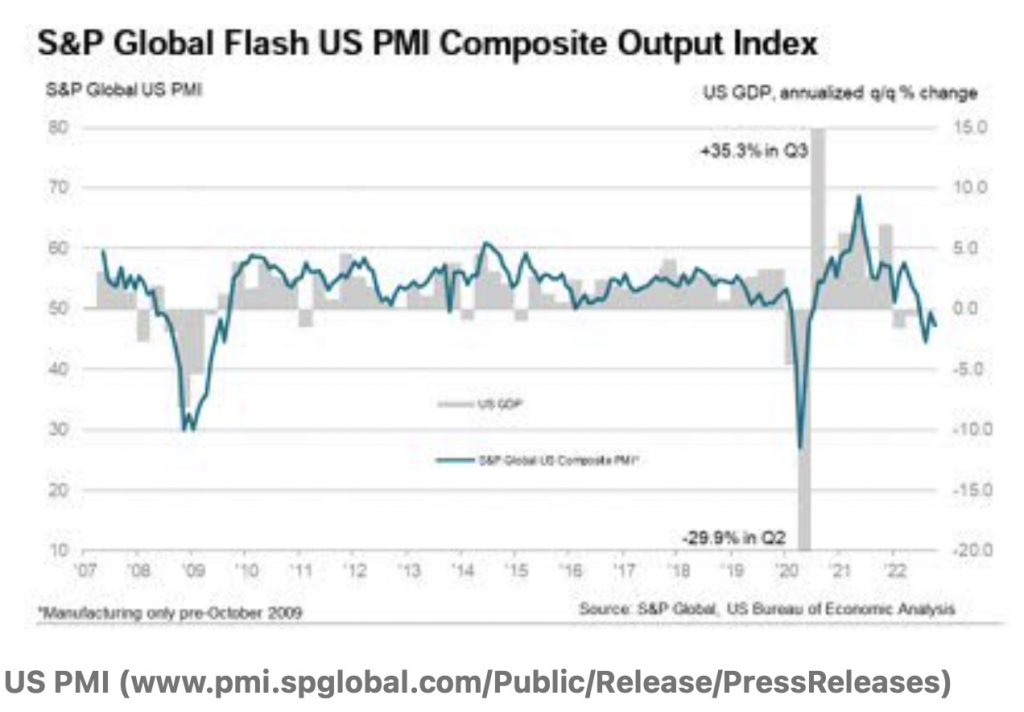

If the economy really put in something like a relatively robust 2.8% GDP growth rate, why is the savings rate lower than it has been since the Great Recession and, otherwise, lower than it has ever been? Also, why has factory demand for new domestic orders and exports fallen off a cliff all year long, and why is it still continuing to fall deeper into already recessionary levels:

None of that squares with the BEA's latest GDP report, and it certainly doesn't look good for stocks to be thinking now is a great time for a full recovery, but there is a lot more to look at. The S&P, for example remains below its 200 day moving average where it has been for 143 trading days, and we all know how the fall of 2018 went when the Fed was tightening at a slower speed than it is today. The yield curve, which presages recessions when it inverts, has only become more inverted as time goes on, and supposedly we're not in the recession yet; which, if that were true, only begs one to ask how much worse the "real recession" is going to be than what we already have.

And, then, remember that old thing called a housing crisis?

We've barely even begun the journey down in housing, having just seen the first drops in prices two months ago; yet, look at how far we've fallen compared to to other crises already.

Does this look like it squares with Gross Domestic Production turning positive:

I don't think so. That still appears to be in recession territory to me!

So, you can believe the BEA's number for GDP growth if you want, but it is not just that their own numbers look HIGHLY suspect in terms of their inflation assumptions that match up to NOTHING and in terms of the fact that the entire increase can be accounted for just by energy production, even though that should get the biggest inflation adjustment of all ... it is also that all these other macros measurements fully agree with me that we are solidly in a recession, and recessions are not good for bulls but very good for bears.

Now what about the idea that inflation plunged as quickly as the BEA claimed. Here is a look at where we are in the inflation fighting cycle (red line) compared to other inflation-fighting cycles:

What happens once inflation goes above 8%, as is currently the case? Data since 1920 shows that once CPI >8%, it takes around 2 years (!!!) to even fall beneath 6%. Yet, current consensus expects us to be back at or even below 3% in just two years 🧐 pic.twitter.com/rj9nOZYczI

— Patrick Saner (@patrick_saner) October 25, 2022

Does it seem likely we have sliced inflation in half already as the BEA claimed just happened as its basis for showing positive real GDP (inflation is always subtracted directly out of their GDP numbers in order to come up with the "Real GDP Growth" that everyone looks at, so that we're measuring true changes in actual production, rather than just in price? It doesn't look to me like we would be anywhere close to getting it halfway back down. So, I completely disbelieve their claim.

The BEA's GDP report was a total pig trough of slop, and while stock prices can temporarily excuse themselves to rise based on what the BEA's vacuous numbers mean for the economy and future earnings, ultimately corporations have to deal with the real economy and their earnings and forecasts are going to show that, leaving no room for stock prices to rise at time when the Fed is also sucking money out of the marketplace, and that money has to evaporate from financials somewhere ... or everywhere. Moreover, the rip in GDP assures the Fed will tighten harder and longer, and stocks in recent years have had no appetite for that, so investors are kidding themselves.

Future forces likely to push down hard on stocks

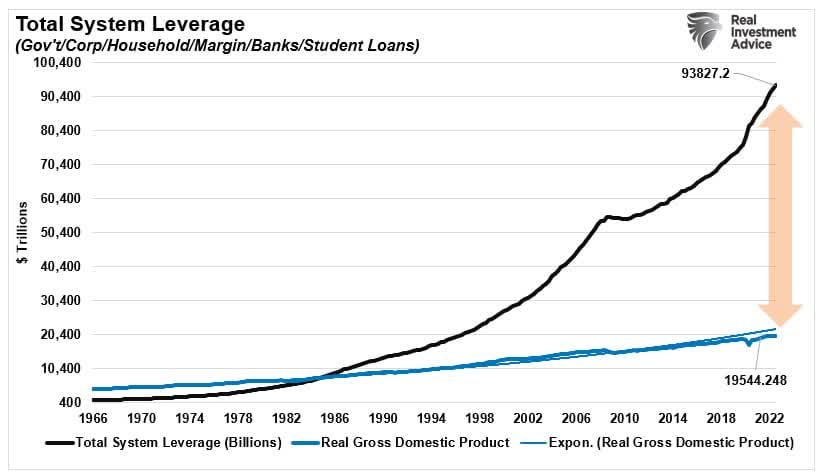

The economy is also a little bit levered up right now, especially compared to the economy's total output (GDP), which makes the situation ... just a little tipsy in terms of being able to keep paying debt as the Fed keeps increasing interest rates and sucking money out of the economy:

There are going to be growing defaults in that kind of environment. There have to be.

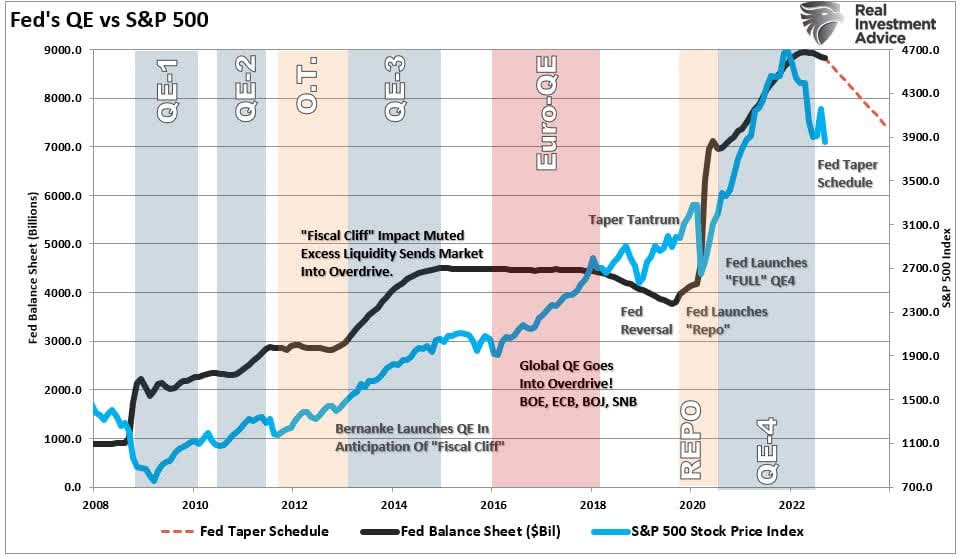

Expressed in terms of what the Fed is doing with all of its money-sucking, the situation looks like this:

You can see how the S&P has generally followed the Fed's inflating of the foundations of money supply, then flattened when the Fed's increases flattened, and has gotten, in the very least, quite erratic when the Fed actually tightened; but it bolted upward when the Fed returned to QE. Right now, the Fed has barely begun tightening, as the graph reflects, and the market, for once, is running ahead of the Fed, rather than with a lag.

I'd say that is because those in the market have some idea of that leverage position shown above and know the market is more fragile, so they are more reactive to the Fed's tightening. Clearly, the Fed has a long way to go even to just get back to its pre-2020 balance-sheet high, so stocks have a long way they can keep falling just to wind up where the Fed winds up.

The generals are all dying

Remember how the FAANG stocks created momentum that often was the sole force pushing the stock averages up. Well, since we are talking the stock averages in this article, we should look at how those are doing. In the battle between the bulls and the bears the worst breakage has been in the FAANGs.

The current stock market crash started last fall in the tech-heavy NASDAQ, and the NASDAQ's leaders are plunging.

What’s this? After less than stellar third quarter earnings results at Facebook, Amazon, Google, and Apple (which reported lower than expected iPhone sales and declined to give any financial forecasts), the markets have ripped to the upside this morning. The Generals are in retreat. But the rank and file in the indexes are advancing!

It’s a mutiny! A real insurrection! A retail rebellion!

...But it’s not like inflation has suddenly been extinguished. Core personal consumption expenditures (PCE)—the Fed’s preferred measure of inflation—were up 6.2% in September year-over-year....

The personal savings rate fell to 3.1% in the third quarter, according to Fed data released this morning. That’s the lowest it’s been since 2005. Not coincidentally, credit card balances hit $916 billion in September, according to data released by Equifax today. That’s back to a pre-pandemic high.

Savings down. Credit card balances up. Earnings down. And the recession hasn’t even begun yet!

And, yet, that is what the market celebrated through the second half of October, even as GDP (fake as it was) and inflation both screamed the Fed will have to keep tightening, a scenario stocks have usually fled, and even as the Big Tech stocks, which typically lead the way, ran. Why are the rest not running from the very thing that frightens them most -- assured longer Fed tightening?

While it will never get this far, the Fed has another ...

$15 trillion to go

[and]

Since 1929, the average bear market lasts fourteen months and has a peak-to-trough drawdown of 36%....

Since we’re in a recession (or since we had one in the first eight months of this year with two consecutive quarters of declining GDP), that means we could be looking at a sixteen month bear market with a fall to around 2,782 on the S&P 500....

[The GDP increase] might also mean the case for the Federal Reserve hiking interest to around 5% is still strong, with labor markets and inflation powering higher....

(And just today, the jobs market came in tighter looking than ever.)

The key question will be inflation and interest rates. The Fed is hiking rates into a recession. Mainstream media pundits have already said the Fed’s gone too far and that inflation has peaked. Thus it can, and should, pivot to a more neutral stance. And soon...!

[However] The data don’t support that conclusion.... Check out the chart below.

However, the data do not support that conclusion, as the article shows in a graph:

Clearly, it has always taken a much higher level of target interest (red line) than we have yet reached to stomp down high inflation -- always exceeding the level of PCE inflation in the past by almost double. Maybe this time is different because the economy is so saturated in debt and, so, is much more fragile. However, it is extremely unlikely that, being this far beneath inflation, the Fed is going to feel it is anywhere close to where it needs to be. So, the pressure is on. We'll see what they say on Wednesday when they come out of their FOMC meeting; but another stern hawkish message might be hard for stocks to keep ignoring.

Remember:

The moral of the story is that every time the Fed thought it had a handle on inflation in the 1970s, it cut rates too soon and inflation came roaring back. It took a target rate nearly twice core PCE to finally slay the inflation dragon. Today, that would imply a nominal target rate of 9.8%.

The Fed doesn't want to climb that mountain that it had to scale three times from 1970 to 1984 because it thought the inflation battle was over prematurely so it saw inflation start to soar again as quickly as it backed down from the fight with each fight getting harder and drawing the process out much longer.

With as much debt as we have now piled up, neither the economy nor government is going to survive the rates required in the past -- double the inflation rate -- to get ahead of inflation. Everything will break before that. Breaking will get inflation down well before then so the Fed doesn't have to go that high, but breaking is still breaking. In a fragile economy that cannot withstand the level of rates usually needed to break inflation, the breakage is likely to be worse, not less.

What do "the generals," the Big Tech leaders have to do with this?

The leadership change in the stock market is still underway, from tech stocks to energy stocks. The first aspect of it is destroying value for companies that relied on the liquidity provided by low interest rates and the premium investors attached to growth and tech stocks. Who’s next? Try Apple, or Tesla.

The tech sector still has a total market capitalization over $10.5 trillion. Financials are next at over $8 trillion. The Energy sector, by contrast, is just the 8th largest at $3.4 trillion. That’s up from last at 11th when we first recommended energy as our Trade of the Decade.

The rollover from growth to value is likely to bring a lot more carnage to the stock averages (indexes) because the leaders are so high, while the rise in the much lower growth stocks is not likely to be anywhere near as high in this fragile environment to compensate. The continued fall of these leaders is likely to create a downdraft in the market that pulls many other stocks lower with them, even as energy, perhaps, climbs.

Meta/Facebook may have finished the ride down or come close, but it has the help of dumb management. Apple, Tesla and others have a long way they can still fall:

Single Greatest Wealth Loss In History: $100 Billion Zuck-Bucks Vaporized As Meta-Bet Bombs

Mark Zuckerberg's social media empire is collapsing after Meta shares crashed 24.5% from Wednesday's close.... Today's crash is the second-largest drop in Meta's history, and the stock is now trading back below $100 for the first time since early 2016.

Meta has fallen so hard all year, due to Zuckerberg's dumb ideas, which nobody appears to want (thankfully), that it may be nearing the end of its self-destruction:

Jim Cramer begins to cry and apologizes on being wrong on $META pic.twitter.com/c8qoB8iv3m

— unusual_whales (@unusual_whales) October 27, 2022

Amazon has also taken a major toboggan ride, too. However, there is plenty of room still to fall in terms of Big-Tech overvaluation:

Put the market caps together of Microsoft, Apple, Nvidia, Tesla and Amazon and compare that figure with their aggregate free cash flow and you get a multiple of over 50 times, down from nearly 70 at the start of the year. This historic level of overvaluation was only made possible by massive money printing on the part of the Fed that supported both cash flows and the multiple applied to them. Now that inflation is raging, however, the money printer has been shifted into reverse and that’s already having a visible impact....

And the Fed just got up to full rewind speed!

Furthermore, if the Fed follows through on its commitment to normalize the balance sheet over the next few years then this reversion in valuations has only just begun. In fact, price-to-free cash flow ratios could still halve from their current levels....

As I wrote in the prior piece, “Considering the nature of the pandemic and the stimulus enacted as a result, it’s not unreasonable to think there was a significant pulling forward of demand for Big Tech products and services that will now leave a vacuum of demand for a prolonged period of time.†We’re just now beginning to find out how much of a vacuum of demand now lies in front of us. And a Fed-induced recession resulting from the rapid rise in interest rates and draining of liquidity isn’t likely to improve things in that regard.

Of course, the Fed will never get as far as it has indicated it would like to reduce its balance sheet (anymore than it succeeded at that in the past) before something breaks, and by "something" I mean something really big ... or a lot of somethings ... and stocks don't like really big breakdowns. They tend to cause market-screaming panics.

Like Felder, Zero Hedge writes, but for a different reason,

The Big Stock Capitulation Is Yet To Come

The real decline in stocks has yet to come, as inflation and recession threaten the historic overweight in equities versus bonds....

The stock-bond ratio has declined precipitously, but we are likely just getting started.

As stocks capitulate to the greater wisdom of bonds, the rollover from Big Tech to value will be a big part of the action.

We are in the process of an overshoot that could take it much lower still, driven by the twin specters of inflation and recession.

It’s a common misconception that equities are an inflation hedge. Some stocks and sectors, particularly those related to real assets, do make good inflation hedges, but equities overall are terrible at protecting against persistent price rises.

In fact, equities were the worst-performing main asset class in both real and nominal terms during the Great Inflation of the 1970s. This is because they became a shunned asset....

As it becomes apparent inflation is entrenched and not returning to a low-and-stable regime any time soon, the penny will drop that equities are more of a leaky ship than a water-tight revenue generator, prompting an exodus to comparatively inflation-resilient bonds.

This exodus could be sizable....

A recession only makes the risk of further stock underperformance more immediate. Leading indicators point to a US recession in the next 3-6 months as being all but inevitable. Stocks face more downside in a downturn, while bonds are likely to catch their usual haven bid....

High inflation means yields could rise much higher, and at this point equities would be sacrificed....

The long-term outlook for bonds is less than rosy in the current inflation paradigm, but the prospect for stocks is dimmer still.

To which, today's jobs news, as I briefly mentioned above, was was exactly the kind of thing to drive the Fed even harder down its path with greater resolve:

Bonds & Stocks Battered As 'Good' JOLTS Print Sends Rate-Hike Odds Soaring....

While tomorrow's 75bps hike is a lock, the odds of a 75bps hike in Dec jumped today and the odds of a 50bps hike in Feb also jumped notably today…

US equity market had been grinding higher overnight but puked on the JOLTS data and Nasdaq extended losses

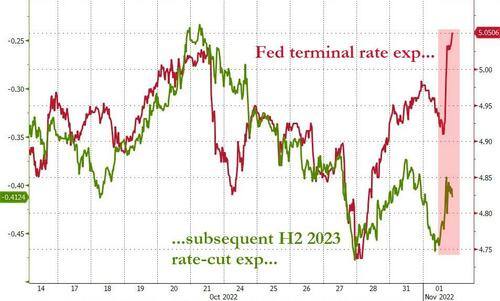

The JOLTS data saw a notable rise above expectations which resulted in fresh hawkish market pricing to see market pricing imply a terminal rate north of 5%, with Treasuries seeing pronounced flattening.... As a hawkish offset to expectations around an approaching Fed pause, Powell could use the meeting to signal a higher terminal rate ... whilst continuing to lean on the "higher for longer" messaging.

Amid all the market Generals, Amazon's downturn today was particularly hideous, taking the stock all the way back in a single shock to April of 2020:

And the yield curve inverted even more with the 3mo-30yr spread inverting for the first time since the 2019 top where it is now the worst it's been since since the lead-up to the Great Recession in 2007. So, maybe just maybe, depending on what the Fed comes out with tomorrow (Wednesday), the market's recent rally will be short-lived and never even reach its familiar down-sloped ceiling laid out at the start of this article.

Today, it looks like Zero Hedge may be capitulating to reality (which means to my view, whether it knows it or not). Having hyped its "Two-Michaels Rally," as I have been calling it, for all of October and having pressed its "Fed pivot" talk all summer, it finally ran an article today that said,

Peak Fed Hawkishness Means Sustainable Rally Is Still A Way Off

Stocks will be stuck in a bear market for several more months even with a peak in Fed hawkishness....

Peak global inflation is likely here, allowing global central banks, including the Fed, to begin a gradual tempering of their hawkishness.... This might be taken as an all-clear for stocks and a swift end to the bear market, but current formidable headwinds and history suggest otherwise.

First, a distinction needs to be made between peak Fed hawkishness and the Fed pivot. A peak in hawkishness does not mean an immediate flip-flop to dovishness. Instead, it means the peak [predicted] Fed Funds rate should stop rising - which we have seen - and be maintained. As the market starts to price this in, the front of the very steep Fed Funds curve should flatten, and the back of the curve – where the pivot is – should disinvert, taking the pivot out....

The pricing out of the Fed pivot has implications for volatility as the relative price of crash insurance has a strong relationship with expected Fed cuts. No pivot likely means more expensive out-of-the-money S&P puts, and hence a higher VIX....

In median terms, the S&P moves sideways for about six months after the last Fed hike before putting in a pronounced rally....

Given we likely have three (perhaps more) rate moves to go before the Fed pauses – along with an increasingly likely earnings recession – any sustainable rally in equities and an end to the bear market is a way off.

So, maybe the Two-Michaels Rally will be definitively over already if the Fed stomps its head on Wednesday. Even if the Papa Powell emerges a little less fierce than expected, this stock market faces far to much trouble to punch up beyond the ceiling outlined above. So, it hasn't got far to go before its next leg deeper.