Something Wicked this Way Creeps

“The [stock] market is very fragile,” warns portfolio manager Lance Roberts. AI mania and the dot-com bubble crash have a lot in common, another article lays out. The economy’s “false calm” is actually its most dangerous sign, says an economist. And “the Fed is in panic mode,” back to printing money again and trying to steer through a stealth repo crisis caused by its tightening of bank reserves, says still another. No wonder, yet another article claims consumers are feeling unsettled and, so, are dialing back their Christmas spending this year.

Stocks stumble

The fragility of the market comes not from graphs, showing how its rise is faltering, but from underlying fundamentals: It’s record highs are built on record margin debt, and that leverage does as much to increase the speed at which the market falls when a fall happens as it does to help push things up higher in the first place. The leverage that is exhilarating on the way up can be quite punishing on the way down. AI stocks are rolling over from record valuations due to significant buildout concerns. Stock earnings expectations seem highly optimistic, rather than based on a solid economic future, and credit-market stresses are becoming quite significant.

What is bad for the stock rollover is the way so much of it looks like the dot-com bust as one MSN article lays out today

Cisco, the dot-com champion that made it through the 2000 crash to become the world’s most valuable company, just finally breached its pre-dot-com-bust valuation high for the first time since March, 2000. It took all that time for its stock price to fully recover from its crash a quarter of a century ago.

Almost all stock shares are at their most expensive relative to earnings since the dot-com bubble broke.

The same new-tech, new-paradigm fever has driven up stock prices based on the brave new world that is coming.

And, once again, that fever is built on dreams about companies that are not earning any profit.

The dot-com crash happened where massive networks of fiberoptic cables were laid all over the country but no one was using most of them. Eventually, they became used, years after the bust was over. The current rush to build vast new AI centers is creating centers that are not used. They probably will be eventually, but even the CEOs have started saying they have no idea how they will make enough in profits to justify stock valuations. ROI may be a long way off, and the investors are already impatient.

Tech has led the market up while just about everything else has gone nowhere … or down. Same thing back in 1999/2000.

Everyone is talking about a bubble while nearly everyone is also saying it can’t break. Same as last time. Right now, the best argument against the market being in a bubble is that “it is only a bubble if it pops.”

Economic creep

Economist Bob Murphy says that debt, interest costs, housing prices, and monetary policy don’t fail loudly — they fail slowly, then suddenly. He explains why so many economists fail to predict recessions when they come, making economists seem useless to many of us.

Murphy points out how prescient the yield curve has been in predicting recessions for decades, and yet its foretelling inversion appears far from happening. That is lulling some economists into believing recession is far off.

Every recession, at least in the postwar era, was preceded by an inversion. So there aren’t false positives or negatives. So that’s why a lot of people look at that as being a pretty good indicator.

Murphy explains the reason the yield curve seems out of synch with the idea of an imminent recession is because there has been such massive Fed interference in bond markets since the Covidcrash. That caused the yield curve to invert for a long time after the crash as the Fed kept running QE on steroids for way too long. Then it went through the process of reverting for a long time when the Fed unwound its QE because it took a lot of time to suck that much money back out of the system. So, it has done its inversion and then the reversion that usually happens just before the economy crashes, but in a very stretched-out way. So, Murphy thinks the timing for the recession that all of that presaged may be stretched, too—meaning we’re now going into or about to go into the recession that the reversion foretold well over a year ago.

Interbank meltdown

And now the Fed is back to doing QE—something that now seems to be its standard answer to every economic crash, even though the Fed never used to do QE prior to the Great Recession. It has now started doing QE again in stealth mode, while it is trying to maintain the pretense that it is not QE.

The Fed is in Panic Mode, No Longer Functioning On Its Mandate

For the past month, Jerome Powell and the rest of the PhD economists inside the Eccles Building have been hustling behind closed doors … firing billion-dollar shots of liquidity at banks to keep them from defaulting on their loans. And that means, many banks aren’t able to meet their obligations. That’s why Wednesday’s split FOMC decision became inevitable….

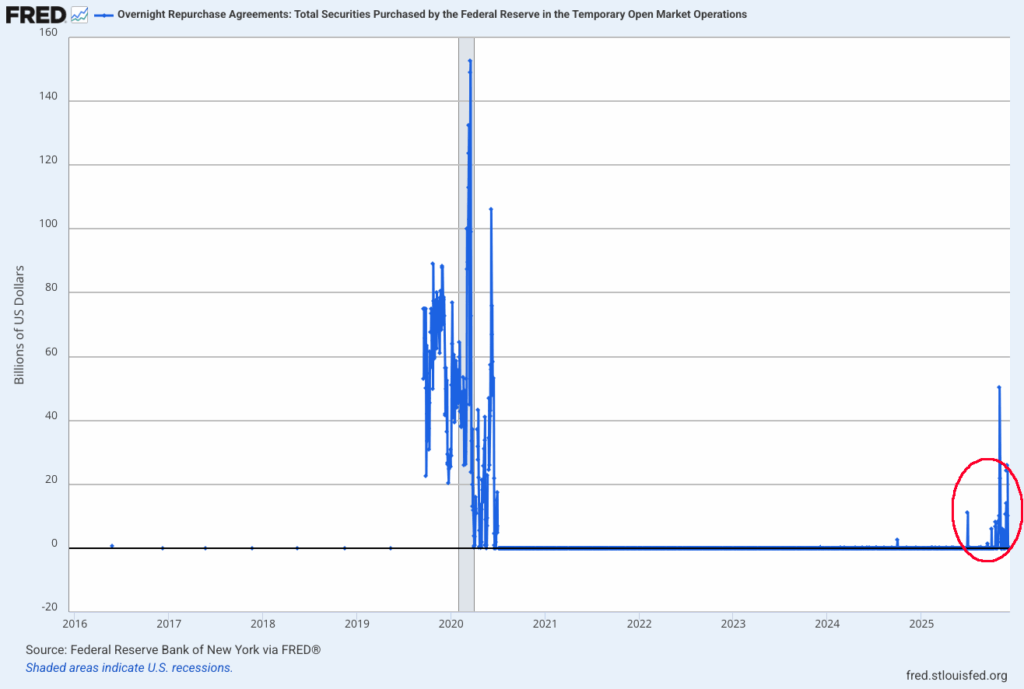

“In the waning days of October 2025, the Federal Reserve executed a series of overnight repurchase agreements that injected a staggering $125 billion into the U.S. banking system over just five days. This move, largely under the radar, culminated in a single-day record of $29.4 billion on October 31, marking the largest such operation since the 2020 pandemic. According to reports from The Economic Times, banks exchanged Treasuries for cash to alleviate funding pressures amid dwindling reserves.

When QE happens on the QT (and I don’t mean “quantitive tightening” with that abbreviation this time), it generally means something insidious is creeping this way through the banking system.

U.S. bank reserves have plummeted to $2.8 trillion, the lowest level in four years, as confirmed by official data from the Federal Reserve Economic Data (FRED). This sharp decline echoes the liquidity strains of 2020, when reserves similarly tightened, prompting emergency interventions. The Fed’s actions, while not outright quantitative easing, have been dubbed ‘stealth easing’ by market observers, as Chair Jerome Powell maintains a hawkish stance on inflation.”

Exactly.

Here is a picture of the original major Repocrisis (the “Repocalypse”), which the Fed tried to relieve with actions it kept claiming were “not-QE” until those endless overnight transactions clearly were not doing the job, and Covid came along and gave the Fed the excuse it needed to stop doing all its interventions as short-term transactions and just leap into mainlining permanent QE into the arteries of the banks. I kept saying it was going to have to be permanent, so it was QE. Their switch t permanent QE brought the freeze-up between banks to an end until recently as the Fed tried reversing the QE via QT, and bank reserves got lower than the banks were willing to bear in the last half of this year, causing their interbank loans to start drying up:

The SRF [Standing Repo Facility] hasn’t been used much in the last few years but it has come back to life and was in fact activated 16 out of 26 days in the weeks before the meeting.

So, the Fed knew it had to do something, and that is why they announced massive bond purchases again; but, just like last time, are trying to claim its “not QE.”

Insidious evil

So, something wicked appears to be creeping this way in credit markets right as money is rolling over dot-com style out of big-tech stocks and into the value stocks that had been going nowhere. The Fed has framed its new QE as “reserve management,” which is much nicer than saying, “We have had to return to quantitative easing because we drained our balance sheet down further than the banks can stand.” Least of all, would they want to call it “monetizing the debt.” (After all, the Fed’s argument, as I explained in a recent Deeper Dive, for QE not being the same thing as “monetizing the debt” was always that the QE would eventually be wound back down. It would not just forever absorb the US debt. However, that is something the Fed has never proven itself able to do. Each time it gets this far, catastrophe sets in.

When the Fed needs to inject liquidity at this scale to prevent market dysfunction, it signals that leverage (bank’s loans, derivative risk, and the inability of the bank to back their own loans) is unwinding. Counterparty risks are rising for banks.

So, don’t worry: stocks are rolling over in a wonky way, consumers are reportedly starting to dial back their Christmas spending, inflation keeps edging back upward, jobs are now falling through the floor, and interbank funding is seizing up to where the Fed has had to return to “not-QE.” It will all work out. Everything will be fine … just fine…. So, go back to sleep.