Tariff Turmoil Freezes International Shipments, Imperils Treasury Market

The latest tariff changes on small purchases, hit shipping like an iceberg, yet the Titanic Treasury market will be at risk if the Supreme Court Reverses Trump's tariffs.

A lot more news streamed in since my Deeper Dive on the labor market, affirming the major recessionary downturn I reported in my analysis. However, since I covered that extensively in the Deeper Dive, I’ll let the headlines below speak for themselves in telling the same story as corroboration. One headline sums it up well: “Big Jobs Miss Suggests Economy Is Sicker than Believed.”

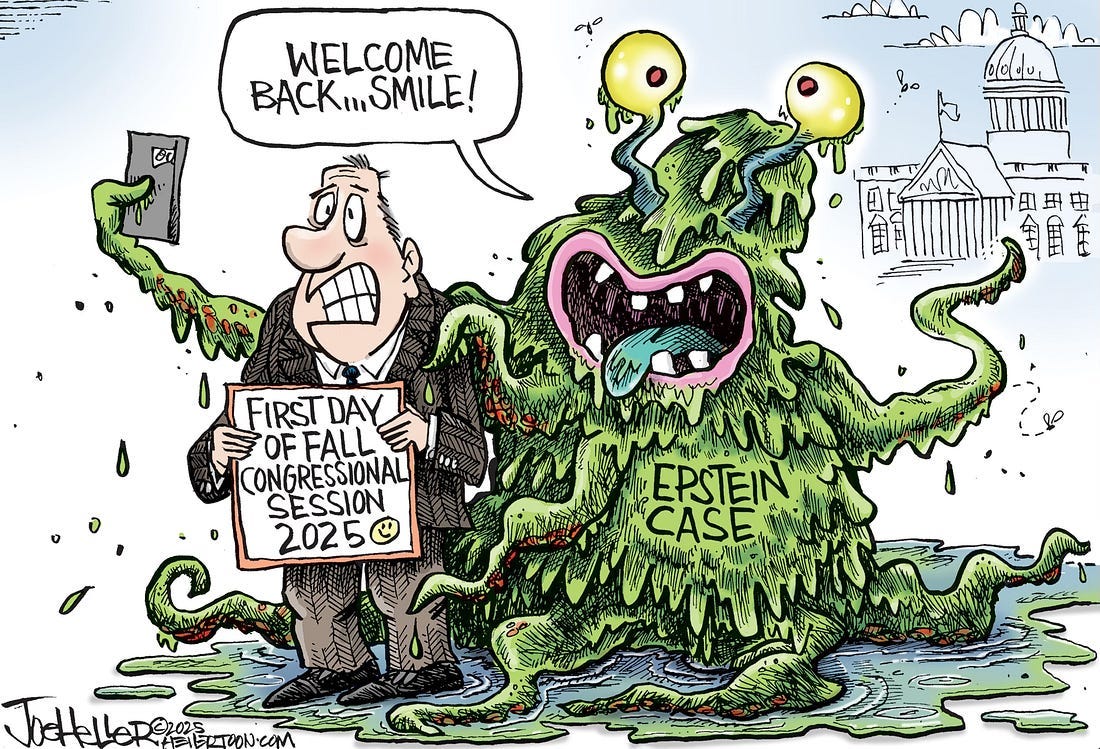

What I want to look to today is the potential calamity the US economy and government could run up on if the Supreme Court rules current tariffs unconstitutional as a reach beyond presidential powers into the jurisdiction of congress. I’ve briefly mentioned this risk in the past, but some articles today really lay out what a disaster this could turn into, depending on how the Supreme Court rules. Team Trump has asked for an expedited ruling before the problem builds up even worse.

(The Supreme Court has been very friendly toward Trump, so maybe his friends on the court will continue to invest him with presidential powers no previous president has exercised to this degree, and a turmoil worse than what has already been seen this week will be averted … though perhaps at the expense of rule of law.)

It is not anti-Trumpism that causes me to say that a Supreme Court overturning of Trump’s tariffs-by-decree (already overturned by two lower federal courts) would be a huge blow to the economy and the national debt. His own Treasury Secretary warned today that the refunds required if the Supreme Court rules against what Trump has done by disagreeing with his interpretation of his emergency powers (or what constitutes a true emergency), would be “massive.”

Treasury Secretary Scott Bessent said Sunday that he is “confident” that President Donald Trump’s tariff plan “will win” at the Supreme Court, but warned his agency would be forced to issue massive refunds if the high court rules against it.

If the tariffs are struck down, he said, “we would have to give a refund on about half the tariffs, which would be terrible for the Treasury,” according to an interview on NBC’s “Meet the Press.”

He added, however, that “if the court says it, we’d have to do it.”

At least, it sounds like they will play by rule of law. So, that much is good because, without that, the whole nation falls apart along the legal seams that hold it together.

The Trump administration last week asked the Supreme Court for an “expedited ruling” to overturn an appeals court decision that found most of his tariffs on imports from other countries are illegal.

Generally, the Supreme Court could take as long as early next summer to issue a decision on the legality of Trump’s tariffs.

Bessent has said that “delaying a ruling until June 2026 could result in a scenario in which $750 billion-$1 trillion in tariffs have already been collected, and unwinding them could cause significant disruption….”

Before court action, Trump’s tariffs were set to affect nearly 70% of U.S. goods imports, according to the Tax Foundation. If struck down, the duties would impact just roughly 16%.

The impact of tariffs on the economy is already looking quite significant according to one tell-tale sign reported today:

On Saturday, the Universal Postal Union, an agency of the United Nations, said postal traffic into the U.S. plummeted by more than 80% after the Trump administration ended the tariff exemption on cheap imports as postal operators looked for guidance on compliance with the new rules.

A sudden bill to the Treasury that could top $1-Trillion dollars if Trump was playing outside his lane and gets called on it could be quite an upset to a Treasury bond market that has already shown off-and-on signs of struggling under credit downgrades from all major rating agencies. We’re talking struggles that, early in the trade wars, sent a chill through the Treasury secretary’s spine and caused the government to immediately recoil on its initial tariffs. This would be greater than that if it happened because of the sudden burden to the Treasury market to pay that all back on top of the major loss in future revenue.

You see, it wouldn’t just be the massive payback with interest that would be a huge hit to Treasuries plus the interest on the bonds issued to pay it all back, but the sudden removal of Trump’s major funding for Big Beautiful Bill would create enormous future deficits that would require either major spending cuts, eviscerating Beautiful Bill, or major tax increases, gutting the rest of us, because Treasury could never issue a surge of debt that size without capsizing its own bond market.

Team Trump has said, if they lose at the Supreme Court, they will move to establish other means of trying to implement tariffs, but that means more chaos for the whole economy as businesses struggle all over again to figure out what replacement tariffs they will be under and how that affects their capital and their operating funds and, as everyone wonders, whether the Trump Admin even has the right to deploy the new methods toward tariffs they come up with, any more than they did with the last ones.

On top of that, it would be a huge upset with our trading partners—the other governments who would almost certainly throw their hands up in the air and say, “When can we, in dealing with the US, ever trust any deal to actually be a deal?” It would be huge loss of credibility for Trump’s team in future negotiations.

Trump is already starting the process of renovating the major trade pact he established in his first term between the US, Canada and Mexico, which comes up for renewal and renegotiation next year. So, everything done with Mexico and Canada this year can all be undone by what happens in that process, making for ground that feels constantly unstable to everyone.

This week, markets froze over

The latest new tariff rules provided a clear example in today’s headlines of what a significant upset the constantly shifting ground can bring because no one can keep up with how fast the rules and rates are coming or how big the final tariffs will they will actually be:

New tariff rules bring ‘maximum chaos’ as surprise charges hit consumers

The bills are sudden and jarring: $1,400 for a computer part from Germany, $620 for an aluminum case from Sweden and $1,041 for handbags from Spain….

Some U.S. shoppers say they are being hit with surprise charges from international shipping carriers as the exemption on import duties for items under $800 expires as a part of President Donald Trump’s tariff push.

And that is where almost overnight 80% of international mail has seized up. Shocked consumers are not risking anymore purchases because they have no idea how much they’ll be on the hook for.

That’s leading to some frustration and confusion as shoppers and shippers both try to navigate a new reality for anybody ordering goods from abroad.

“It’s maximum chaos,” said Nick Baker, co-lead of the trade and customs practice at Kroll, a firm that advises freight carriers.

If you believed the promises that US consumers won’t pay for these tariffs, guess again:

Thomas Andrews, who runs a business in upstate New York restoring vintage computers from the 1980s and 1990s, said he was shocked to receive a tariff bill from DHL for approximately $1,400 on a part worth $750. He said he assumed there must have been a mistake.

“That’s extortion,” Andrews said.

The actual tariff should have been only $110, but that is what the chaos of rapid change is causing—many major mistakes. Even a hundred bucks, though, still amounts to paying a large lump of change, which many people who believed the promises didn’t expect to get hit with as a newly imposed sales tax.

Though some reported cases were mistakes, many consumers are still reporting tariffs that substantially exceeded the purchase price. I takes time, effort, frustration, and, for some, a touch of fear to appeal these charges.

Beware:

Since the new de minimis rule began taking effect, social media platforms have been filled with accounts of U.S. customers receiving shock bills from major shippers like DHL, FedEx and UPS, having received no notice about the charges from the foreign merchant they’d ordered from . and remember that tariffs are payable to the U.S. government….

Due to the chaos, the high volume of returns, people refusing to pay, etc. …

Many merchants abroad have posted to social media to alert U.S. customers that they are suspending shipments there.

The resultant 80% grind-down in international postal traffic is certainly going to have significant economic impact since we do a major part of our shopping online and since many small retailers are the ones placing many of these small orders. When they turn them back, they disappoint their customers and lose business, present and future.

“This last quarter is probably going to tank us,” Narciso said. “The margins on this type of business are slim to begin with.”

He added: “It just doesn’t feel like the American way to me.”

Economania (national & global economic collapse plus market news)

Potential Trump tariff refund bill could top $1 trillion as Supreme Court fight looms

Treasury Secretary Bessent warns of massive refunds if the Supreme Court voids Trump tariffs

Big Jobs Miss Suggests Economy Is Sicker than Believed

Trump’s job market promises fall flat as hiring collapses and inflation ticks up

Unemployed Americans Surpass Available Jobs, First Since 2021 As Economy Melts Down

More Than 40% Of Americans Expect To Work Until They Die

Top 1% Now Have More Wealth than Entire Middle Class and Our Kids Are the Biggest Losers

Preference for Capitalism over Socialism Slips to 54% in U.S.

Your Wallet vs. the Fed: "A picture of an Economy Drifting into Dysfunction"

Real-Estate Rubble (housing, commercial & global real-estate bubble trouble)

Money Matters (monetary policy, metals, cryptos, currency wars & going cashless)

Trump Family Adds $1.3 Billion of Crypto Wealth in Span of Weeks

Gold Hits All-Time High Above $3,600 After Weak U.S. Jobs Report

Inflation Factors (from too much money chasing too few goods due to weather, sanctions, tariffs, quarantines, etc.)

Wars & Rumors of War, Revolts, Hacks & Cyberattacks + AI threats

Caribbean war fears grow as Venezuelan fighter jets fly over US warship in 'show of force'

US deploying 10 fighter jets to Puerto Rico for drug cartel fight

—

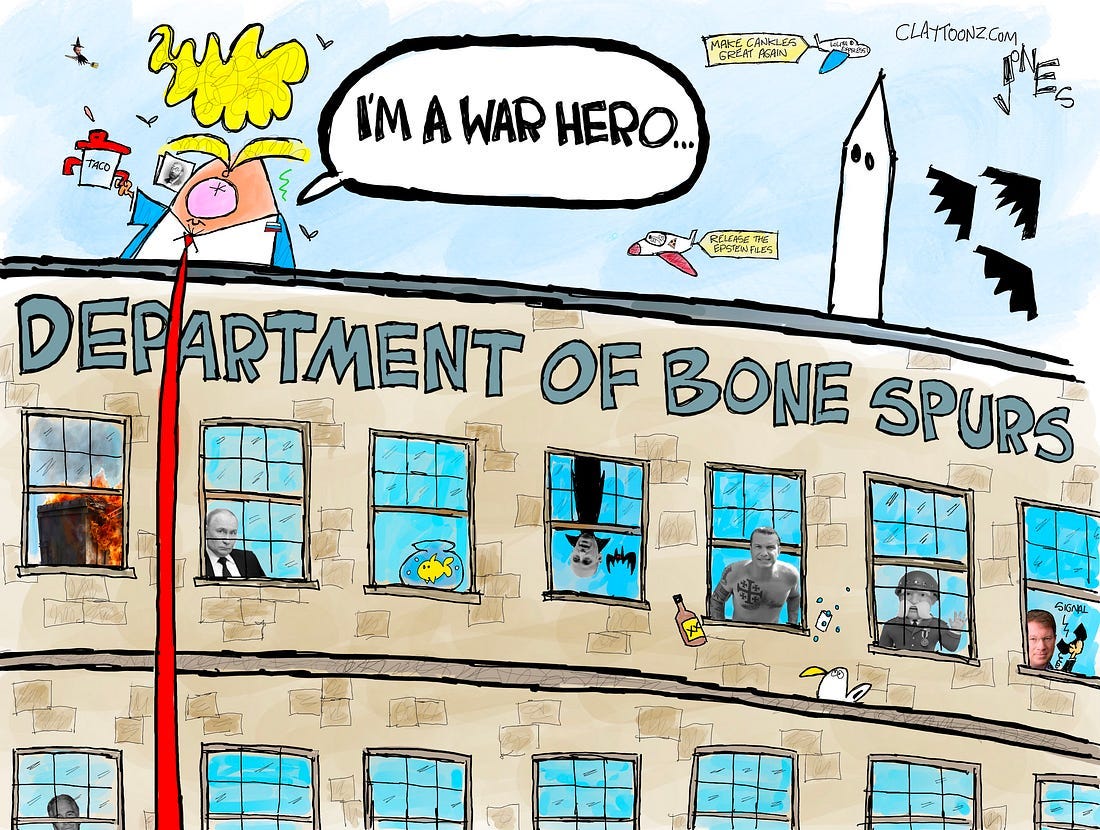

Trump Revives ‘Department of War’

—

Poland Issues "URGENT" Instruction: Citizens MUST Leave Belarus Immediately

—

Israel Expands Gaza City Offensive, Strikes High-Rises and Destroys Hamas Command Tunnel

Trump Trade Wars & Turf Wars

Trump Prepares to Start North American Trade Deal Renegotiation

New tariff rules bring ‘maximum chaos’ as surprise charges hit consumers

Lutnick says big trade deals to stay despite ongoing legal battle

Political Pandemonium & Social Senescence (socio-political issues & events)

How Stephen Miller is running Trump’s effort to take over D.C.

Big Tech elite lavish praise on Trump at White House dinner. Musk Not Invited.

Epstein Birthday Letter with Trump’s Signature Revealed

Paul Ryan Rips Party's Failure to Budget, Spend Responsibly

Trump loses bid to overturn $83.3 million judgment in E. Jean Carroll defamation case

The next time Trump blows up a speedboat in international waters, it’ll be full of $750 computer parts being smuggled in to avoid $1400 tariffs.

At least it's not Kamala