Tariffs, Inch by Inch

Some tariffs creep through one bite at a time.

In my weekend Deeper Dive, I showed where the government’s inflation data on Friday fell far short of the truth; so, you are right in thinking more has been eating away at you than the government reported. Then I provided information to paying subscribers from manufacturers and others about tariff pass-throughs that will soon take much larger bites out of American wallets in the months ahead, which I’ll enhance now with an addendum from one of today’s headlines:

Companies Have Shielded Buyers From Tariffs. But Not for Long….

Companies had passed along about 37 percent of new tariffs to consumers [under-reported by the government], forced 9 percent onto their suppliers and absorbed 51 percent through August, according to Goldman Sachs.

That means, of course, 51% remains to be shoved through. It also verifies that foreign entities are not even paying a tenth of the cost of tariffs.

[The 37%] is a big hit to shoppers’ wallets, enough to reverse inflation’s fall. But it is milder than it would have been if companies were charging consumers as much as they had at the same point in the last burst of tariffs during President Trump’s first term.

Mostly that is because the tariffs are much higher and more widespread than in 2018, making them too difficult for consumers to digest all at once….

Companies want to keep prices low. But they know investors will not accept narrower profit margins for long, so they have to figure out how to make up for tariff costs….

Autoliv, which supplies parts to carmakers, said it had recovered about 75 percent of its tariff costs and expected to make up for all of them by the end of the year….

Companies that have held off on price increases are signaling that they intend to institute them down the road — especially as ever more tariffs are imposed….

Prices have already risen particularly swiftly in categories like home furnishings and recreational goods because so many of those products come from China. New furniture tariffs will force costs even higher….

“We anticipate the tariff change to result in broad price increases for furniture in the U.S., dampen consumer demand and compressed industry margins in the short term for suppliers, manufacturers and retailers,” Derek Schmidt, Flexsteel’s chief executive, told investors….

“The supplier and the intermediaries have also been clear whenever we talk to them that their intent is ultimately to get back to prior margins….”

Tariffs passed through to consumers gradually could keep inflation elevated for a longer period….

In other words, the bulk of the tariffs will be passing through every time companies find a moment when they can add them to the price, even if incrementally.

The creeper

Now here is another even more insidious reason you haven't seen anywhere near all of the pass-through yet:

Richard Rosenfeld, owner of Two Leaves and a Bud, a Colorado-based tea company, was preparing a big expansion as matcha grew in popularity. Then he hit a wall of tariffs — virtually no tea is grown in the United States, so the only options are imported.

He held off on price increases for a while, working through inventory and holding off on hiring more people, waiting to assess the consequences.

“There’s a lot of elasticity in the system,” Mr. Rosenfeld said. But the rubber band has stretched as far as it can go, and he recently imposed the largest price increase in his company’s history.

“We’ll have another price increase absolutely coming soon,” he said. “And I can’t imagine that we won’t have multiple rounds of price increases next year as all these tariffs affect not only us but all the suppliers who supply us and supply our suppliers.”

In other words, it takes time for the price increases to percolate through the layers of production. A retailer’s directly imported products get hit sooner. However, domestically produced products, may contain many components that are produced by several other domestic manufacturers, using foreign ingredients or parts. Each of those component manufacturers may hold off, like the companies described above, for different lengths of time in passing along its tariff costs. So different components in a single US product include tariffs that are priced through to the US manufacturer at different times, causing the price of the final domestically made product to keep rising over time.

Because the tariff pass-through doesn’t happen in one big bang right after the tariffs are implemented, don’t be fooled into thinking there isn’t a lot of inflation coming. Let’s use a US GE-made refrigerator as an example: Each US manufacturer or miner or smelter that provides components or materials to GE that go into the refrigerator (wire, aluminum, steel vinyl, thermal sensors, etc.) will have different abilities to absorb the tariffs it pays on foreign goods that go into making its component. It will also have different incentives for passing those tariff costs along. As GE keeps seeing prices going up on different components or materials it buys from these other US companies, it has to decide when it will pass each of those increases along—by delaying a price increase in order to do it all at once when it finally knows what all the adjustments are, or incrementally each week or month as each part goes up in price … or some of both approaches.

Ultimately, however, many companies are assuring their business customers or consumers that the increases are coming because they are reaching the limit of their ability to absorb the many impacts.

The new corporate tax

While Trump cut corporate taxes during Trump 1.0, he is now massively increasing them because US companies have, so far, absorbed the lion’s share of tariffs, as described in the quote above. Being unable to get foreign suppliers to pay much of the cost by compensating with price reductions on their end, the tariffs have amounted to a massive new corporate tax. Here is an summary example of how much of that tax US some corporations have had to pay out of their own revenue:

Nike — $1.5 billion

Mattel — $100 million

Raytheon — $220 million

3M — $100 million

Halliburton — estimates $60 million

General Motors — anticipates $3.5 billion-$4.5 billion

Paccar (maker of Kenworth and Peterbilt trucks) — $75 million

The Manchurian candidate

Now a new battle zone in the tariff wars opened up. To combat the Chinese with their command economy, the Trump administration has announced it will switch to some of China’s centrally mandated, communist techniques. It will start using price controls. Instead of price limits, for now, they are talking about using presidential commands to establish price floors in order to incentivize more US production of specific resources, such as rare earths, and items, such as certain chips, where the US relies too much on China. That, too, will push prices up by government mandate.

As Ronald Reagan once famously quipped, the scariest words in the English language are, “Hello, I’m from the government, and I’m here to help.”

Economania (national & global economic collapse plus market news)

S&P 500 rallies 1%, on pace for first close above 6,800 ever on potential China trade truce

Dow rises 500 points to record as Friday’s rally on mild inflation data accelerates

Bonner: Back with the Breeze (Market way past irrationally euphoric)

Smoke Signals from the Repo Market

Business “Very Slow, No Uptick In Sight”: Dallas Fed Respondents Turn Even More Apocalyptic-er

GM lays off more than 200 salaried workers in latest round of job cuts

Wall Street on alert as another subprime auto lender goes bankrupt as 2008-style crisis grows

Inflation Factors (too much money chasing too few goods due to weather, sanctions, tariffs, quarantines, etc.)

Companies Have Shielded Buyers from Tariffs. But Not for Long.

Cost-of-living worries haunt Americans ahead of midterms, Reuters/Ipsos poll finds

Here are the five key takeaways from Friday’s consumer price index report

Car prices hit an average of $50,000 for the first time

Wars & Rumors of War (including cyberwar, civil unrest and revolts)

Could USA invade Venezuela? Doomsday report warns of 100,000 troops, high cost and social collapse

—

Pentagon Frets Over ‘A House of Dynamite’ Nuclear Doomsday Film

—

Ukraine Attacks Russian Energy Grid - Severe, Widespread Damage

Digital Dominance (AI threats, transhumanism, hacks & cyberattacks, etc.)

Amazon reportedly about to replace half a million human workers with robots

Google Sued for AI-Generated Fake News That Never Existed

Surveillance State: Palantir’s Globalist Ambitions Metastasize into Massive AI Push

Governments Keep Letting AI Make Decisions & It’s Already Going Wrong

Trump Trade Wars & Turf Wars

Trump’s growing beef in the heartland

China’s New Strategy for Trump: Punch Hard, Concede Little

Trump tariff tiff: U.S. terminates all trade talks with Canada over Reagan TV ad

The one-minute Canadian advert that has left Donald Trump fuming and ended trade negotiations

Political Pandemonium & Social Senescence (socio-political issues & events)

The East Wing is gone, and Trump turns to damage control

Trump White House ballroom financed by Big Tech and these other corporate donors

Bonner: Burning Down the House

We are watching the final days of the American Empire, just as it was in the final days of Rome.

Trump’s Argentina bailout enriches one well-connected billionaire

Democrats Reject Bipartisan Bill To Pay Troops, ‘Essential’ Federal Workers During Shutdown

Steve Bannon reveals plan for Trump to subvert Constitution and remain president beyond 2028

As of mid-2025, there were roughly 50 simultaneous national emergencies in force.

The Fox News reporter testing Trump’s patience with his favourite network

Donor Who Gave $130 Million to Pay Troops Is Reclusive Heir to Mellon Fortune

Drone company’s stock soars after it appoints Donald Trump Jr. to advisory board

Milei’s party wins Argentina midterm vote in major comeback

Calamity, Catastrophe & Climate Craziness

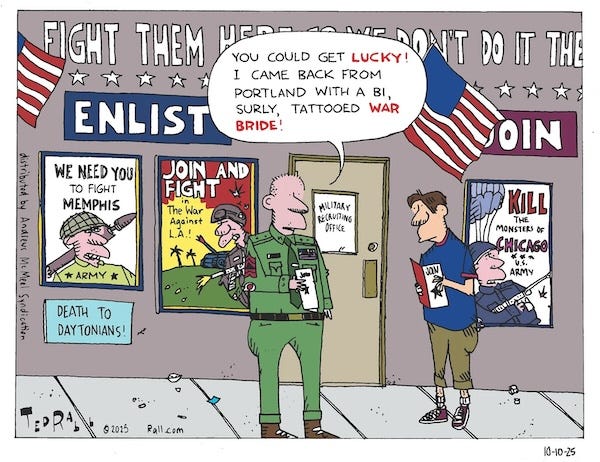

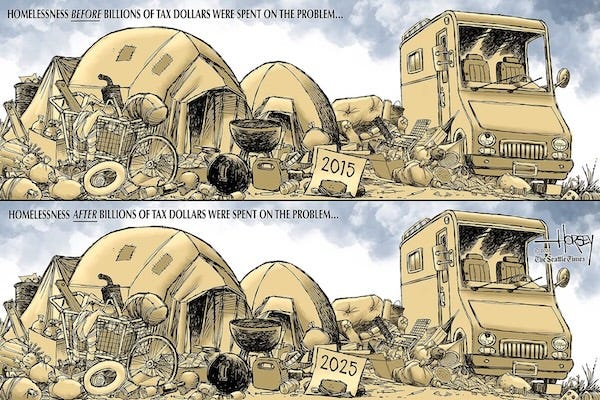

Doomer Humor