The Deeper Dive: Federal Reserve Posts Its First Operating Loss EVER. It’s HUGE! YOU pay.

And, of course, you don’t hear the mainstream media saying a word about this.

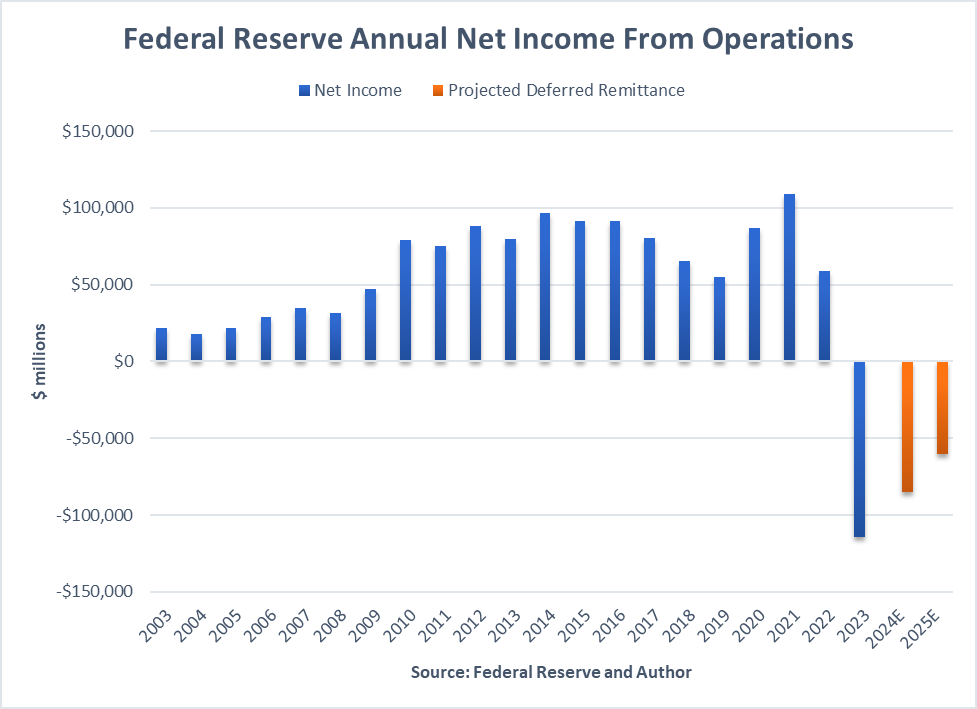

The Fed’s tightening regime just bit deeper into the national deficit. For the very first time in 108 years, the Fed just ran at a net loss, and it was huge. To be specific, the Fed reported a loss of $114.3-billion in 2023. Now, for the Fed, losses are no big deal because they own the money printers (at least the ones that just require entering digits in data fields on banking computer systems). However, for the US government, the loss is all theirs to shoulder.

The way this works is the Fed normally transfers all of its net profits to the US Treasury’s general account, and it has profits every year … until 2023. The Fed’s charter was set up so that IF the Fed EVER did experienced a loss, AS IT FINALLY HAS, that loss would be handled as a debit against future profits the Fed hands over to the government. So, no profits from 2023 go to the US Treasury this year, and future profits will have to add up to $114.3-billion before the Fed again starts handing any profits to the government. In the meantime, that means the government has to add that shortfall to its debt.

While the Fed cannot realize any losses, itself, you might think the first loss in its entire existence would have a somewhat bone-chilling effect, as many people would wonder what was so exceptional about 2023 that it is the only year to have seen a loss in the Federal Reserve System. No matter what the US went through—the Great Depression, World War II, the Great Recession, the Covid lockdowns with their massive deficits—there was never a loss until the year just accounted for.

Moreover, the Fed is predicted to have losses for 2024and for next year as well:

What gives here? 108 years with no loss and with some of the biggest net profits ever from the Great Recession all the way to the present, and now, BAM! right to the bottom? Moreover, this plunge follows the biggest year of profits the Fed ever realized in its history just two years ago.

Yet, apparently, the mainstream financial media either failed to notice or didn’t think you’d even care to know what just went down here. That, or their owners are friends of the Fed.

The answers to “what gives here?” lie in the rest of this Deeper Dive below the today’s news headlines. So does the source of the Fed’s losses, which tax payers will find to be real ringer when they see how much they are paying to enrich banks, but I thought everyone should, at least, know the Fed just scored its first loss, and it is all yours to bear.

Today’s headlines:

Economania (national & global economic collapse plus market news)

Manufacturing PMIs Mixed on Growth but Both See Prices Soaring

Gross Domestic Income Shows America Is In Stagnation

United asks pilots to take unpaid time off, citing Boeing’s delayed aircraft

‘Guilt tipping’ is getting out of control, but signs show consumers are pushing back

Baltimore bridge collapse a ‘national economic catastrophe,’ says Maryland governor

Baltimore Bridge Collapse Has East Coast Ports On Alert For Cargo Diversions

Real-Estate Rubble (housing, commercial & global real-estate bubble trouble)

They came for Florida's sun and sand. They got soaring costs and a culture war.

Money Matters (monetary policy, metals, cryptos, currency wars & CBDCs)

GoldSeek Radio Nugget - David Haggith: Inflation Data and Gold

Gold Soars To Record High, But Take A Look At This…

Gold prices hit another record high on Fed cut expectations

Proof that Gold Should Get to $10 000!! And Silver to $500! (By 2028?)

HSBC issuing Tokenized Gold. Very Interesting Timing. Very Risky Product.

Massive gold buying in China driving prices up

Spending, Income, And Inflation Data Do Not Support Fed Interest Rate Cuts

Inflation Factors (due to too much money chasing too few goods)

FTC calls out profits as driver of grocery costs

Wars & Rumors of War, Revolts, Hacks & Cyberattacks (+ AI threats)

Haiti declared 'open-air prison' as gang violence reaches 'apocalyptic' levels

Rising global threats force 'epoch-making' shift in world order

Moscow nexus revealed during '60 MINS' Havana Syndrome investigation

Political Pandemonium & Social Senescence (socio-political issues & events)

Trump and Republicans Ramp up Religious Rhetoric as they Blast Biden for "Blasphemy"

Republican blame game heats up as their majority thins

Trump attacks resigning GOP Reps as ‘cowards and weaklings’ as majority thins

Embittered Republicans plot to knock off House GOP’s hard-right leader in Virginia primary feud

The Church of Trump: How He’s Infusing Christianity Into His Movement

Globalism & Deep Domination (undemocratic government & censorship)

Elon Musk Has Entered the ‘Please Clap’ Stage of His Megalomania

A Pox Upon Us (the plagues, pandemics & health police of the 2020s)

Large review finds CBD products don’t relieve chronic pain after all. They just stink

Calamity, Catastrophe & Climate Craziness

Nobody Told EV Owners How Quickly They Burn Through Tires

Off-the-Beat News & Just Plain Offbeat News

Poll Finds Almost 70 Percent Believe Jesus Christ Physically Rose from the Dead

Liquid nitrogen fertilizer spill kills nearly 750,000 fish in Iowa river, officials say

Doomer Humor

JP Sears: This is Definitely Not a Psyop

The real ringer on the Fed’s massive, first-in-its-history loss and how you get fleeced for it comes in finding out who actually gets all your money. The rest of the Deeper Dive below lays out the whole ugly truth: