THE DEEPER DIVE: Insidious Inflation Crawls out of the Woodwork More Quickly than the Government Can Hide it

Now, the federal government just told you that inflation rose to 2.8% on the Fed’s favorite gauge. That was but a sneeze, a mere 1% blip up and away from the Fed’s target. So, while it is in the wrong direction, ‘tis but a calming breeze, not a tariff-heated hurricane of price increases. But can you believe it?

Well, of course, you can if want to allow the present administration the illusions it wants you to believe. This week’s PCE reading is the blue pill in the matrix that allows people to believe things are humming along nicely per plan. The red pill—which is the only kind The Daily Doom serves, hence the site’s red thematic colors and the tendency of its cartoons to run red—packs a punch that tears deep into the fibers of reality to expose the electrifying truth behind the rotting framework of the matrix. It exposes the grid where the illusion is projected so that you can see the government’s claims are not real.

If you’re ready for that—if you can handle the truth—read on because I’m about to expose some big lies behind this month’s official inflation reports. If you’re not ready for it, accept that 2.8% as a “fact” that is good enough for you and run with it by swallowing a blue pill. That won’t help your bank account, but it may help maintain faith in your government.

The wiring behind the illusion

The truth behind the now meaningless chatter of the government’s PCE data is that the official numbers are just the detritus of intentional government shutdowns and DOGE department-stripping at the Bureau of Economic Analysis that puts out the PCE report and at the BLS that provides many of the numbers that go into the PCE report.

The other big government inflation report, CPI, which we’re going to look at as primary, is put out the the Bureau of Lying Statistics where the infested data may also be corrupted due to the executive head lopping that was intended to induce fear throughout the department just as the numbers they were putting out were turning bad. That removal came with the overt message that the top dog was being fired for daring to make the king look bad.

Whatever the excuses are for how the nation’s inflation numbers got to be this faulty, they are deeply in error—so far off the mark that one of my favorite economists, Wolf Richter, is still pulling his hair out (and he is typically a tame observer of the government’s numbers—as in not one to be fired up in near rage over the sheer dishonesty). So, you don’t have to take my word for it. I’ll send you to the Wolf, who will also tell you why these faulty number matter so much. Back on January 13, he wrote the following about the CPI numbers that informed this week’s PCE report:

My frustration is boiling over. This is very serious. A lot depends on halfway accurate CPI inflation readings.

Today’s CPI report for December by the Bureau of Labor Statistics still didn’t fix the massive issues with the CPI for Owners Equivalent of Rent (OER), the biggest component of CPI, weighing 26.4% of the all-items…. And due to the unfixed issues in September through November, it continued to substantially push down year-over-year readings in December for the services CPI, core CPI, and all-items CPI. (Wolf Street)

If a number that contributes 26.4% to the headline inflation rate is way off, then clearly the rate everyone is talking about is way off, and Richter notes that the refusal to fix the numbers that went out of whack during the shutdowns will carry through the year as a gross error all the way through August. After that, new September data will supplant the old corrupted data. The September number may have benefited from the head-lopping fear that the United States’ chief executive induced in August because the shutdown that impacted later months didn’t occur until October:

The issue first cropped up for September, when the month-to-month increase of OER did a suspicious outlier-plunge. Then with no data for October due to the government shutdown and apparently no data for November either, the September outlier was carried forward through November, which substantially pushed down overall CPI….

BLS has apparently no intention of fixing the issues with the September through November OER…, and the year-over-year inflation readings will remain downwardly manipulated by this issue through August 2026.

And that matters because …

A lot depends on halfway accurate CPI inflation readings, such as Treasury Inflation Protected Securities (TIPS), long-term commercial lease contracts with CPI riders, Social Security benefit levels for current and future beneficiaries….

If the government is mismanaging, or as the normal sanguine Richter put it, manipulating numbers in CPI to that degree, there is little reason to trust the BEA’s measure (PCE) is any more reliable because …

… the Fed looks at the PCE Price index which uses the data from the CPI plus some data from the PPI, but with different weights and methods.

So, the detritus in CPI is clouding the numbers in this week’s PCE report.

These numbers also matter because, whenever we talk GDP as a measure of economic strength, which the government loves to brag about, we talk REAL GDP—inflation adjusted GDP—because if we don’t take all the actual inflation out, we are not measuring growth in the economy, we are measuring decline in the value of the dollar. In other words, we report GDP as a dollar-based metric. So, we may just be showing that it takes a lot more dollars one month to measure the same amount of domestic production that we had in the month before. We may even have less domestic production, but that production, as measured in dollars will be higher due to inflation.

Right now, when even official reported inflation is running hot, it is more important than ever to cut the inflation out of the data. If real inflation is running another point or two higher than the official reported inflation numbers, that would take real GDP down yet another point or two if the true amount of inflation were actually removed.

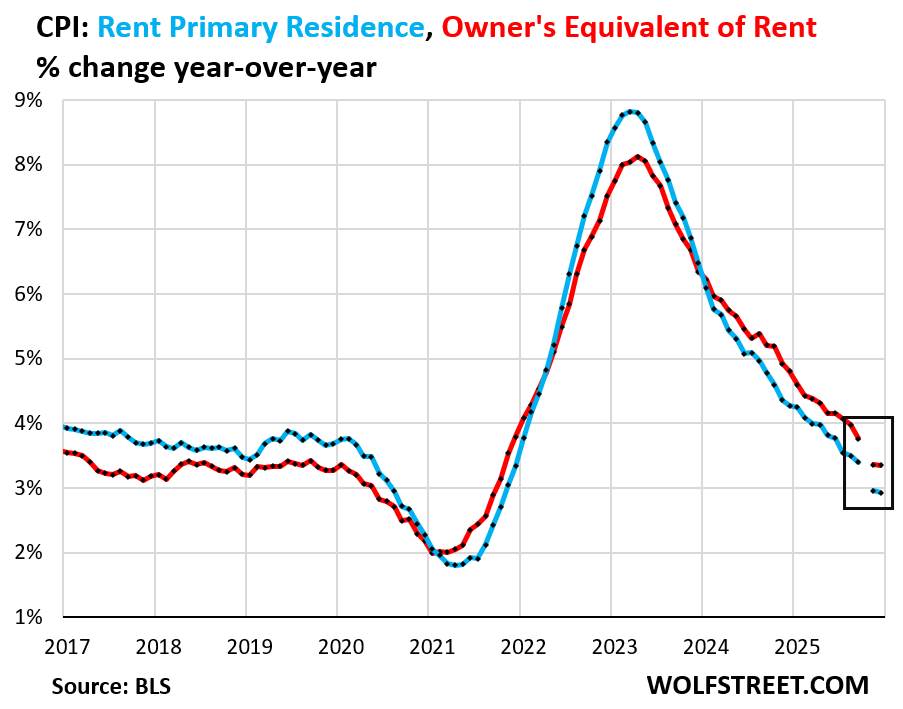

So, the OER talked about here (the measure of the cost of homeownership) has a huge impact on reported inflation, but rent also factors in at 7% of the total, and that number suffered the same kind of anomalies. Just those two components take us up to 33% (a third!) of the reported total for CPI inflation and the somewhat derivative PCE inflation being significantly in error:

CPI for OER and CPI for rent of primary residence account for one-third of overall CPI, and will falsify the year-over-year inflation readings by a substantial amount through August 2026.

You can see in Wolf’s graph below how those two numbers both suddenly plunged (as the government would like to report for inflation) in the September report then gapped downward a lot further over the period of government closure:

We are supposed to believe the inexplicable new gap is a true drop in the components of inflation that make up a total of a third of the reported headline number. The government has decided that we’re going to stay with the gap because it makes everything look better for the government, saving a lot of money on Social Security COLAs, etc..

Of course, as I’ve always reported, the whole method by which the federal government calculates the cost of homeownership is beyond ridiculous anyway. Richter also agrees on that, but I’ve covered that many times, so I won’t go into it again right now.

Bidenomics gets Trumped

However, there is another equally horrendous number that was one of those same kinds of anomalies that started back in the Biden Administration, and the present government has decided not to ever correct that one, too. In fact, the present government has decided to double down on the error. That also became a big bee under Richter’s bonnet.

The chickenshit health insurance CPI.

The health insurance CPI manipulation has been repressing CPI ever since it blew up under the Biden administration. I called it chickenshit back in 2023 for those reasons. And it has gotten worse.

According to today’s manure-laden government numbers, your health insurance has gone down. Yes, you are supposed to believe that, and you will if you are one who prefers the blue pill that keeps one’s delusions about the government alive, though I assume most reader’s here are not, or they wouldn’t be here. So, what follows is a red pill for you: You won’t believe the government numbers if you read The Daily Doom or Richter’s Wolf Street or John Williams Shadowstats where only red pills are served (here on a daily basis.)

Your health insurance has, according to the government dropped 14% on an annualized basis. You should be elated! Here you can see the Biden administration’s enormous “correction” to health insurance, which slashed inflation, aside from you or your employer ever actually experiencing that benefit: