THE DEEPER DIVE: More Bubble Trouble Bubbling to the Surface

The cracks in the economy are getting deeper.

What do these important numbers mean to you:

113, 90, 79?

No it’s not the code for hiking the football in another losing Kansas City Chiefs Super-Bowl game. It’s not the code for the padlock that should be used to lock Kash Patel out of his office before he can do any more harm. It’s the rundown of the number of days between each time the US debt added another trillion dollars.

Anyone see a frightening pattern there? Not all that long ago, it took years to accumulate a trillion dollars in the national debt; now it is down to every 2.5 months, and the time has been rapidly shortening all year—first, almost four months, then three, then a little over two. That’s what a doom loop looks like on a national scale, spiraling downward, ever tighter and steeper. It’s no wonder, then, that, toward the end of summer, the US dollar had lost nearly 5% of its international value in less than two months! YTD, it’s down about 12% from where it started the year. Who wants it?

Is it any wonder that Jeffrey Gundlach, in the headlines below, is telling people to buy gold, saying it may hit $4,000 an ounce soon and that holding 25% of your portfolio in gold would not be excessive? It’s only logical that, as the US debt spirals down the drain hole in desirability, especially among nations who don’t need as much of it now that tariffs are curbing their need for dollars (banked in US Treasuries) for foreign exchange, that gold would rise in desirability and value. In these conditions, that’s just logic.

A few others in the article linked below chime in to make a big pitch for hoarding gold right now. Even Morgan Stanley recommended to its wealthiest clients that they change their portfolio investments from the traditional 60/40 balance (60% Stocks and 40% Bonds) to a new formulation: 60/20/20 . . . . 60% stocks, 20% Bonds, and . . . . 20% Gold. Why? Because bonds are looking more and more problematic, and gold is looking more and more SOLID.

So, let’s cover the economic reasons that are becoming so big they are causing bond mongers like Gundlach and major international US banks to recommend gold over bonds—something banks have almost never done. I already started to lay out the apparent beginnings of economic collapse in Friday’s editorial, “Some Big Economic Pieces Starting to Break.” Now, we’ll dig deeper into that and look at other pieces that are shifting as reported in the news over this past weekend.

Rumbling on the roads

It’s the road to automobile perdition in this case … or at least the wrecking yards where dilapidated auto loans go to decay into the landscape.

Following up on what I wrote in that editorial about the collapse of Tricolor Holdings, a major auto dealer that fell into bankruptcy … that was Chapter 7 bankruptcy, complete dissolution, not the usual Chapter 11 for restructuring for survival. The game is over for Tricolor because poorer Americans are running out of money and sliding on their auto loans.

To make matters worse, Tricolor appears to have pledged the same collateral to more than one bank, which is fraud.

At a high level, lenders like Tricolor originate auto loans for its customers, which are grouped into portfolios.

These portfolios can be used as collateral to obtain financing, such as warehouse credit lines (short-term loans banks provide to finance companies to fund operations).

In a double-pledging scheme, the lender pledges the same auto loan portfolio to multiple banks as collateral for different credit lines.

Each bank believes it has exclusive claim to the portfolio’s cash flows or value, unaware that other banks have been promised the same assets.

Since a fair number of Tricolors high-risk loans were, reportedly, to illegal immigrants, it may well be that they fled or got detained and left their cars and loans behind. 69% of Tricolors loans went to people who did not even have a credit score, and over half didn’t even have a driver’s license!

And yet, big banks, snarfed up Tricolor’s likely felonious loan portfolios just like they did those multi-tranched mortgage-backed securities prior to 2008 … because we never learn anything. Greedy people who run the banks and and who use their wealth to run government always want to repeat the greed that worked well for them, especially if they can get other people to backstop their losses with massive bailouts. So, we never, as a nation, end the kinds of activity that ended in collapse once before.

Don’t worry, Pam Blondi and her DoJ are all over this.

Regardless, I raised the question on Friday (one that I don’t have an answer for, just a hunch): Was Tricolor the canary in the coal mine for major defaults at the poorer end of the scale of mismanaged, improperly sold and financed loans? My body-memory instincts from 2008 naturally flinch and cause me to look for more of the same kinds of large failures, soon to come, especially when I just read that most of Tricolor’s loans, which should have been dispatched in a manure spreader, were rated AAA.

Companies like Tricolor PAY to have their loan securities packages rated by the nation’s major credit agencies, and they don’t tend to hire the credit agencies that are inclined to give bad ratings to bad credit. So, there is a strong incentive among the major US credit-rating agencies to sound far more positive than they should in order to cultivate repeat business. Still, AAA on likely illegal slop like this? I don’t know that this is a new low for these agencies, because after 2008, nothing surprises me, but it, at least, the same ol’, same ol’ low! It looks like the déjà vu version of 2008.

Now, you may rightly question that and say, “Hold on a moment. Auto loans are small compared to the housing crisis. True enough, but they were a factor back then that was endemic of what was happening in other parts of the credit industry, which is where I came down to asking if they are the same kind of canary in the coal mine today. If the banks were that extremely sloppy and the credit agencies that sloppy—to not realize that no one should be giving AAA ratings to auto loans that went to people with no credit score and NO DRIVER’S license to buy a car, then clearly there are a lot of people in the credit industry who have fallen back to sleep at the switch!

As Hal Turner wrote in the article listed below,

Same playbook as 2008, new bubble.

This is straight out of the 2008 financial collapse playbook: "Give junk debt a fancy rating, package it into securities, pass the risk down the line... hope nobody blinks."

Yup. Same ol’ slop!

And, yet, these loans may be safer than US Treasuries now that His Majesty’s government is going underwater at a rate of nearly $1-trillion every two months! Can anyone join me in saying, “Glub, glub, glub?”

However, as if all of that wasn’t bad enough in the land that never learns anything from previous periods of collapse, Tricolor actually DID package these loans as asset-backed-securities where tranches of animal manure are laid in beneath the good fodder on top, contaminating the whole mess in the end if enough undeserving holders of this credit go under financially or get freely escorted out of the country faster than a naked whore with measles at a policeman’s ball.

Oh, and get the scale of the problem:

PMorgan Chase, Fifth Third Bank, with Origin Bancorp, Renasant Bank, and Triumph Financial, now also reporting exposure, looking at a Total Exposure of $20B Yes, you read that right: TWENTY BILLION DOLLARS.

That’s the magic number that kept flowing around for the size of bailouts during the GFC of 2008-2010.

Cracks in the foundation

OK, so that took us a little deeper into one of the three major pieces of the economy that were breaking apart. One of the other pieces was housing, and look at what this weekend held for updated news on that situation (just in case auto loans were too far off in your view of the 2008 financial crisis, which was far more infamous for its iconic housing collapse):

Another one of our articles today is titled, “Cracks in the Foundation: Why the U.S. Housing Market Is on Shaky Ground”:

The real estate narrative is about to change. Fast.

The headlines are still focused on mortgage rates and supply shortages, but if you dig just one layer deeper, the data is flashing red.

The U.S. housing market isn’t just softening — it’s signaling something far worse: a cascading impact from construction to jobs to the broader economy….

In the early 1990s? Construction jobs rolled over first.

During the GFC? Same story…it led by months.

Even today, we see this pattern. Construction employment has flatlined — after months of growth. That might sound benign, but historically, this is a leading indicator of broader labor market stress.

It’s looking like the beast of 2008 is back on our doorsteps—or, at least, many people’s doorsteps. The peril here is that home construction is the leading economic force in our nation. That’s why we try so hard to create housing bubbles since housing pulls in a lot of work and sales for a lot of industries and moves a whole lot of money in massive purchases. That also means that declines in construction jobs tend to be advance economic indicators because, when construction falls, everything falls around it.

That’s also why, when Trump said the last bad jobs report wasn’t that bad because it was mostly in construction, I had to wonder how a man who has spent his life in construction could possibly not know that that is the worst area where the economy could see decline. Even though he was wrong about the job losses being mostly in construction, the losses there were high, and that’s not good.

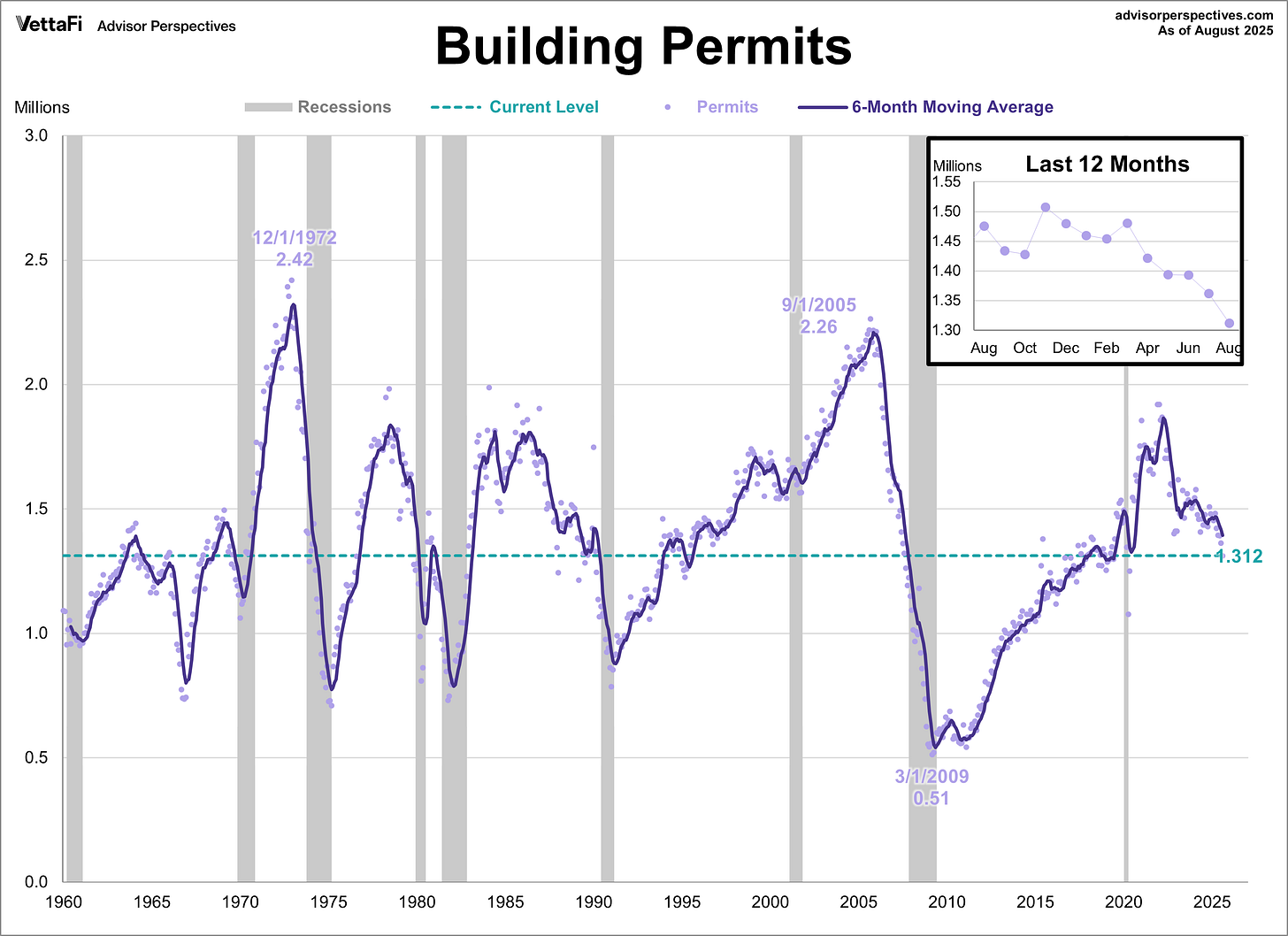

Housing Starts and Permits: Worst print in over a year. This week’s data was a gut punch: Housing starts down 8.5% MoM.

Housing permits are now down to the level that coincided with the start of many past recessions:

And it wasn’t just bad — it crushed expectations:

Starts were forecast at -4.4%; came in at -8.5%

Permits were expected to rise 6%; instead, fell -3.7%

Now that permits and starts have fallen off a cliff, employment will start to fall off a cliff, and what happens when that trouble tumbles into many of the better-quality auto loans? I’m not just talking construction workers, but people who work in the lumber industry, people who work in the appliance industry, and carpet industry and paint manufacturing and sales, etc., etc.

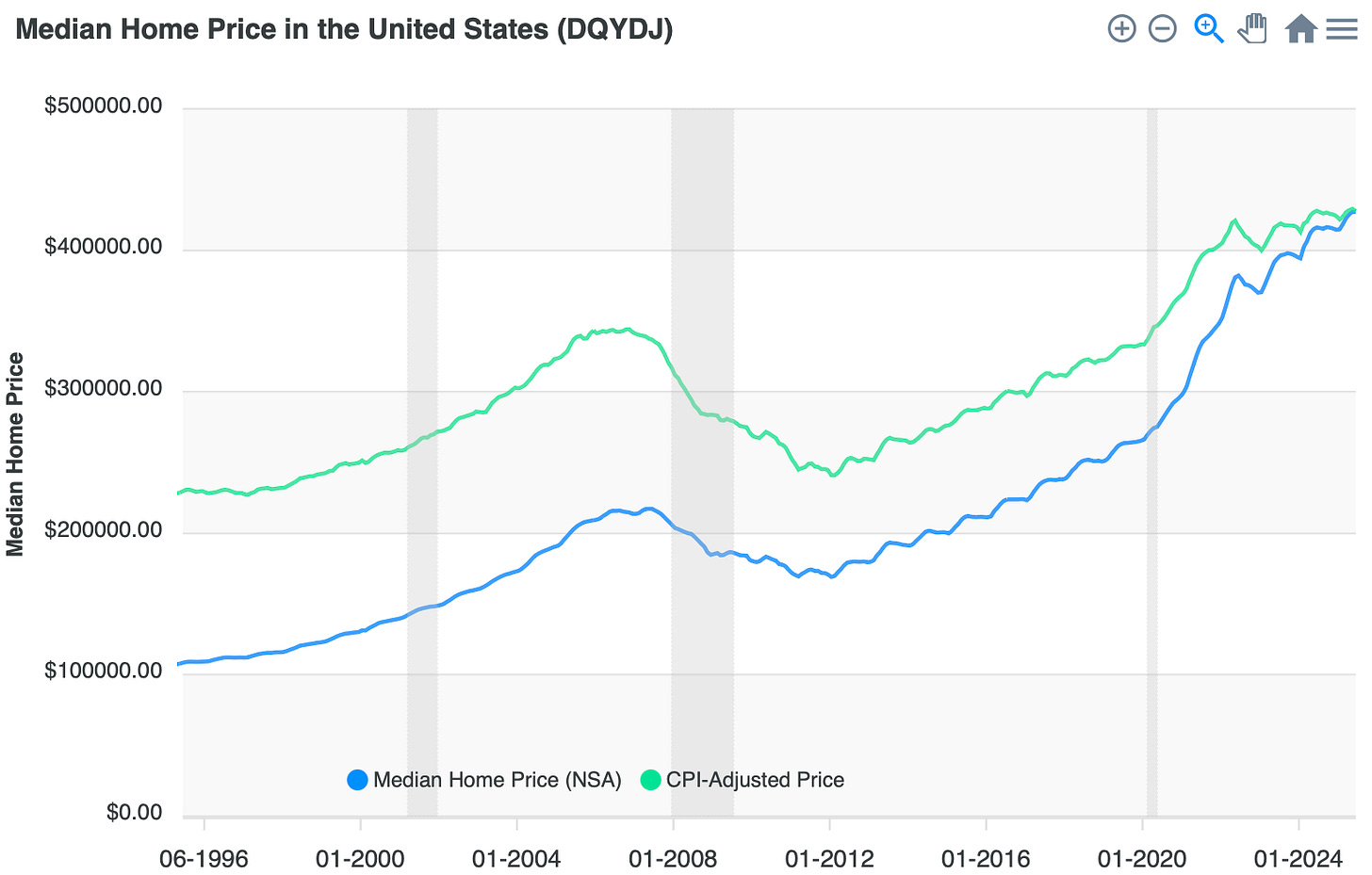

Now, you might be tempted to think Jerome Powell leaped in last week just in time to try to start saving things. However it’s nearly certain that his quarter-point rate cut won’t make a dime’s worth of difference. In fact, it’s unlikely several rate cuts will make a big enough difference with housing prices now being the highest they’ve ever been by far and just starting to tumble.

As I pointed out in my Deeper Dive, I said five years ago that the next collapse would not be led by housing because there were very few adjustable-rate mortgages this time around, which were the time bombs last time. However, Covid rapidly changed all that when prices soared under Fed helicopter money to the masses, reaching the highest levels ever seen by far. So, now we have everything in place for a similar collapse—the ARMs that will be repricing very soon (on a typical five-year escalation clause) to interest rates that are more than twice what they were (even after the Fed’s latest cut) back when the homes were bought during the Covid housing rush.

You can see that on this historic chart:

Mortgage rates were between 2.5% and 3% back when some houses that are now repricing interest were purchased in 2020. That’s going to be an impossible jump. And the problem will get worse as the prices of homes soared after 2020:

So, the Fed lowering rates won’t help enough to stop the fatal blood-like flow of red ink because home prices almost doubled from where they were in 2020 over the ensuing years. Contraction in employment, now being joined by falling construction employment will only make the abilities of many buyers to maintain payments worse. Prices will have to fall to get back down to affordable levels where people can start qualifying for loans again. I seriously doubt the Fed can lower rates back to the zero target they were at in order to arrive at mortgages around 2.5% again with inflation still hot from their last period of extravagance and with tariffs now forcing inflation higher, regardless of what the Fed does. The math to avoid collapse without causing something like hyperinflation just isn’t there.

Here’s what the doom loop in housing looks like:

Housing starts fall.

Construction jobs stall, then decline.

Broader labor market weakens.

Consumer income drops.

Forced sales rise.

Prices decline further.

Right now, we’re ready to start step three due to the knock-on effects of falling construction and should be seeing that this fall.

The housing market needs that kind of adjustment because the Fed knowingly created another massive housing bubble even bigger than the one they created and destroyed in the last bust. This is all on them. It’s the kind of cycle I said in my little humorous book about the Great Financial Crisis we never learn from: DOWNTIME: Why We Fail to Recover from Rinse and Repeat Recession Cycles. We’re about to do it all again from an even greater height, and last time the Fed didn’t have any inflation to fight, so it was free to stimulate the economy to the max.

(The rest of this Deeper Dive that is for paying subscribers will continue after the headlines section, made available today, as on most Monday’s, for all subscribers. It includes more on the housing market collapse, then a section on consumer collapse and then more details about how an automobile collapse does historically tie in with major housing collapses.)

Economania (national & global economic collapse plus market news)

79 Days . . . The Fastest Debt Spiral in History; Sub-Prime Auto Loans Wiping Bonds Out

Americans have never had this much car debt… experts warn it could start a 2008-like recession

Low-income Americans slash spending, a worrying sign for the economy

Many Americans can’t buy homes, get jobs or move in this stuck economy

Real-Estate Rubble (housing, commercial & global real-estate bubble trouble)

Cracks in the Foundation: Why the U.S. Housing Market Is on Shaky Ground

Money Matters (monetary policy, metals, cryptos, currency wars & going cashless)

The Merger That Could Break the Dollar

The Genius Act Will Soon Bring Radical Change to the US Economy Using Digital Currency

Cryptocurrencies sink as $1.5 billion in bullish bets wiped out

Wars & Rumors of War, Revolts, Hacks & Cyberattacks + AI threats

Trump Laments “Putin Let Me Down” and Warns “Netanyahu Is F--king Me”

Putin Decides He Can Step Up Attacks on Kyiv and Trump Won’t Act

—

—

Poland scrambles jets as Russia launches massive aerial assault on Ukraine

Poland's Donald Tusk warns country will shoot any Russian planes in its airspace

Russia's 'greyzone' invasion plan to start WW3 before Christmas revealed by defector

—

Australia joins UK and Canada in formally recognizing Palestinian state

—

DFW Airport, Love Field disruption caused by 'multiple failures' of telecommunications equipment

‘Cyber attack’ that crippled major airports ‘could be test for something bigger’

Trump Trade Wars & Turf Wars

Microsoft asks all its foreign staff to return to US by Sunday after Trump's H1-B bombshell

Political Pandemonium & Social Senescence (socio-political issues & events)

Kash Patel's astonishing response to detailed questions about Trump shooter Thomas Matthew Crooks

‘It’s unacceptable’: Inside growing concerns about Patel’s FBI leadership

Would-Be Kavanaugh Assassin Identifies as Transgender

“Hate Speech” Isn’t Real and Pam Bondi Is an Enemy of Freedom

Ghislaine Maxwell pictured for first time since sex trafficker was moved to cushy prison, "Club Fed"

The Continuing Resolution Didn’t Pass, Government Shutdown Looms October 1 (The press says this every time in the game of endless last-minute brinksmanship.)

Violence erupts at right-wing demonstration in the Netherlands ahead of election

Deep Domination (globalism, unelected government, unconstitutional government & censorship)

Off-the-Beat News & Just Plain Offbeat News

Voyager 1 Just Imaged Something in Deep Space We've Never Seen

World’s Smartest Kid Claims CERN’s Quantum AI Opened a Portal… Joe Rogan Reacts

European airports snarled by cyberattack