THE DEEPER DIVE: Shoppers Feel the Pinch of the Grinch, Farmers Feel the Folly

70% of Americans now understand what is really happening in the US economy, and they SERIOUSLY don't like it.

Under a chaotic government where real data just isn’t available, even the Fed no longer trusts what little data is coming out. For example, Fed Chair Jerome Powell doesn’t buy the government’s job numbers at all anymore. In fact, Powell seemed to indicate that the numbers are intentionally “exaggerated,” not merely inaccurate.

Believing that the economy is now falling, the Fed cut another huge check, so to speak, to save the stock market by resorting back to quantitative easing. Once again, they are again pretending it is “not-QE.” They also voted to save the withering economy with another interest cut.

After months of quantitating tightening, member of the Fed’s FOMC have realized yet again, they cannot actually do that without crashing the fake economy they formerly rescued from Trump and Biden’s joint lockdowns of varying kinds with quantitative wheezing that provided money to the masses. So, they are going back to pumping money into rattled bank reserves, which will flow back into easy rounds of stock investments and bond buying to help calm the tornado of government interest rising from TheRump’s Big Bloated Beautiful Bill Budget.

Team Trump’s data takedown

Even when we get numbers, they are far from real.

Fed Chair Warns Trump Admin May Be Seriously Exaggerating Jobs Numbers

Powell said that staffers at the Fed think that the government could be overestimating the number of jobs created by 60,000 each month. With published figures stating that the U.S. has added an average of 40,000 jobs each month since April, the true numbers could be closer to a loss of 20,000 jobs a month.

That article goes on to point out a pattern I’ve pointed out many times of consistent major errors that overstate new jobs to the benefit of the government, which later get revised way back down when fewer people are paying attention:

In recent years, BLS numbers have overstated job creation, sometimes by hundreds of thousands of jobs a year, resulting in revisions showing less jobs later.

But the Trump administration has not responded well to bad jobs reports.

As also pointed out here a few times, Trump fired the head of the BLS for reporting numbers that were unflattering for his government, even though, as the quoted article points out and as Powell indicated, the numbers they were reporting were actually quite exaggerated to the positive all along.

That very public firing, of course, makes all numbers that come out later this month and in the months to follow suspect because Trump clearly stated the firing of the bureau head was due to reporting low numbers that made him look bad. There is no way that message could not have rung loud and clear throughout the bureau, meaning it will take some brave souls if we’re going to see any honest numbers come out of that joint.

When payroll processor ADP reported that the economy lost nearly 32,000 jobs in November, Secretary of Commerce Howard Lutnick scrambled to blame Democrats and deflect blame from President Trump’s tariffs. Trump himself fired the BLS chief over the summer because he was mad about the negative jobs data the agency produced. It’s not outside of the realm of possibility that Trump would put pressure on the agency to fudge better numbers.

You don’t think the firing already did that quite blatantly? As he struggles to hide ugly data, Trump and his team are also playing a blame game that even Fox News doesn’t buy:

‘Good Luck Blaming Biden,’ Says Fox News Host. ‘The Trump Team Knows The Economy Is Going Badly’

Fox News host Jessica Tarlov pulled no punches when talking about President Donald Trump’s handling of the economy.

“The Trump team knows the economy is going badly. Good luck blaming [Joe] Biden for an economy of the GOP’s creation,” she said in a post on X. “Trump is just setting the economy on fire and not in the good way, in the dumpster-fire kind of way.”

Like me, Tarlov suspects more is involved in the lengthy government shutdown than just a budget battle over Obamacare funding:

Tarlov accused the Trump administration of withholding key economic data because the numbers look bad. “We aren’t getting the jobs numbers anymore, the GDP numbers, or the inflation numbers,” she said in a recent episode of “The Five.” “And we know that Donald Trump, if a number is even remotely good or he can lie about it, he tells you what it is.”

The excuses for the lack of numbers or why the numbers that do come in are faulty compared to other sources are also awfully convenient:

Thats why [Trump’s] on the road and why they’ve stopped releasing jobs, GDP, and inflation numbers.

Forget the data. We’re going to hit the roads and personally tell you how good things are … while bringing down the headsman’s axe on anyone who does release real numbers.

It’s all about controlling the narrative.

The inflation fight

In addition to badly flawed and now completely lacking government job numbers, the Fed is also concerned about the underestimated and even largely lacking inflation numbers.

Federal Reserve Admits Job Market Is Collapsing As Inflation Continues To Rise

…the Fed admits that “Inflation has moved up since earlier in the year and remains somewhat elevated.”

For that reason …

Fed Chair Jerome Powell in his press conference signaled there are no open plans to cut interest rates any further, very little at best, for next year.

The end of rate cuts has come in spite of the fact that Powell sees “significant downside risk” for the labor market. That is how inflation is holding the Fed in check on how far it can go, just as I said we’d see when we get to the juncture where the economy is failing. The Fed will be stuck between a rock and a hard place where the only thing it can do to try to save us from economic collapse will cause hyperinflation, which will, in itself, cause economy collapse by a slightly different path. That, I’ve said for years, will be because all of the QE and rate cuts of the past have led down a road of diminishing returns where those methods are not just less effective for quick salvation but more problematic for creating other troubles. We are overdosed on FedMeds. So, now that they have to rescue us from all the damage of Trump Tariffs, good luck!

In spite of the Fed’s reluctance to do any more rate cuts due to rising inflation, I think the Fed has already gone too far. Powell continues to say tariff inflation is a one-time event, in order to try to create wiggle room for his rate cuts, but he is as wrong as he was in the past. As I’ve pointed out, many businesses are doing all they can to hold back on inflation because shoppers are fighting back by cutting their purchases or switching to lower-quality items or buying from other stores.

However, those same businesses have also said they will push through their additional costs whenever they can, and some of the tariffs they have yet to push through are around a 50% increase in their own cost for each item. That back pressure is going to keep pressing through incrementally for a long time. So, Powell’s quaint notion that tariffs will be a one-and-done hit to inflation is looney.

Pretending inflation is akin to transitory will lead to further dollar destruction than we’ve already seen.

There is more that could be said, but we already know what the game is all about: to kill the currency, to further weaken the purchasing power of the dollar and by extension further destroy whatever remains of the middle class.

During the last rate cut in October, Powell announced a new quantitative easing cycle even as inflation was already rising, by their own numbers, thus signaling a new wave of inflation. Their own data admits that the Fed’s money supply was already increasing; and third-party inflation numbers in aggregate are way higher than the fudged federal numbers.

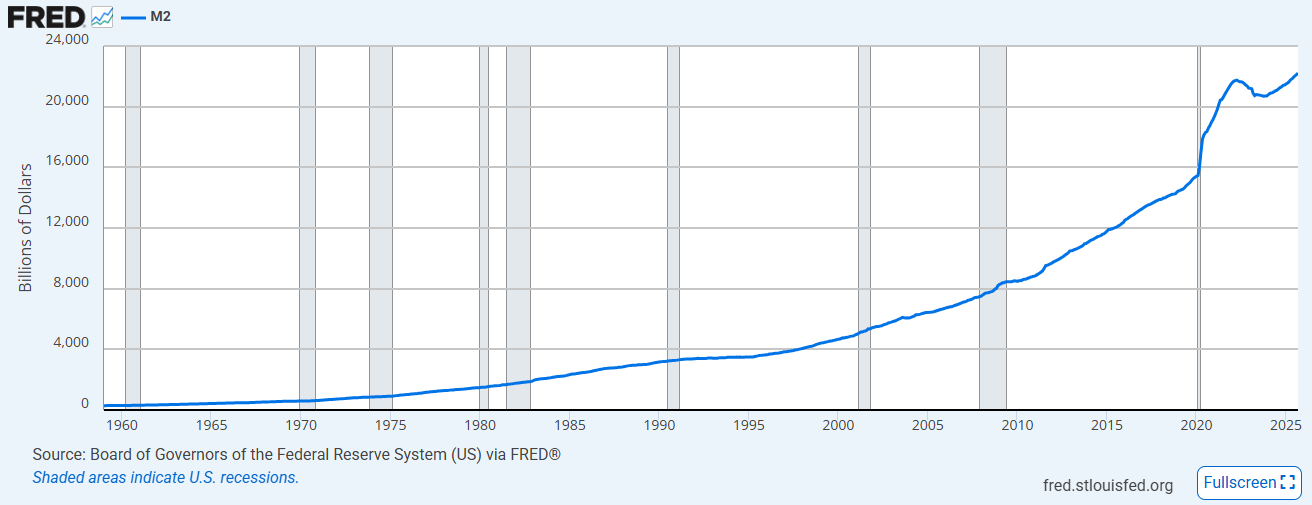

If the Fed keeps creating money, and if that money makes it into the hands of consumers, so they can afford to buy the items they want at the quality they want, then the new money will drive inflation higher. Just look at all the money the Fed and its banks already created:

They did some quantitative tightening and interest-rate hikes to take down the extreme increase in money supply that came from all their largesse during Covid. You can see the dip in money supply that resulted from the tightening, but look at what has happened since they backed off and started cutting rates again and stopped reducing their balance sheet.

Going back to expanding their balance sheet with a return to QE is only going to make the steepest rise in money supply in national history even steeper than the curve you would already have to plot to connect 2020 with where the line is today. The inflationary money supply just gets steeper and steeper as the Fed continually finds it cannot really do the quantitative tightening that it claims it will do in order to avoid the charge of “money printing” or “monetizing the government debt.”

In spite of tariff inflation that is hurting everyone and a accelerating growth in money supply, Trump has promised he is going to install a new leader at the Fed who will be much more amenable to pumping even more money into the system, which would indicate he must be aware that his moribund economy needs to be shocked back to life, or he wouldn’t be constantly pressuring Powell to take out the paddles and goose it with the Fed’s defibrillator.

Trump showed back in 2016 that he understands how this all works:

“They’re keeping the rates artificially low so the economy doesn’t go down,” Trump said in response to a question about a potential rate hike by the Federal Reserve this month. “So that Obama can say he did a good job. That’s the only reason that the rates are so low. They’re keeping the rates artificially low so that Obama can go out and play golf after January and say that he did a good job. But it is a very, a very false economy.”

Uh huh, and what does Trump plan to do now, then. The same thing … obviously.

“We have a very false economy,” he repeated.

Yes, we do!

“At some point the rates are going to have to change,” Trump added. “The only thing that is strong is the artificial stock market.”

True enough again. The Uniparty speaks.

“That’s only strong because it’s free money because the rates are so low. It’s an artificial market. It’s a bubble. So the only thing that’s strong is the artificial market that they’re created until January. It’s so artificial because they have free money... It’s all free money. When rates are low like this it’s hard not to have a good stock market,” he also said.

Again, so true, Candidate Trump. Too bad you cannot be so true when you are president. During Trump 1.0 and 2.0, the president started pushing for massive Fed rate cuts as soon as he got into office. If the market is doing badly or the economy performing sluggishly, it’s always someone else’s fault. The only buck that has ever stopped with this president, is yours when the president takes each buck away from you with his tariffs. Of course, he promises to stop some of that steal with a Trump dividend that will give you some of your own money back. (That tariff take, of course, comes out of your pocket through higher prices.)

I can justify calling all of this “a steal” because they have been telling you all along that they are not taking anything from you in order to create this bad economy and that inflation is going down. That makes this a con job because that is a baldfaced lie; hence, they need to cripple the bureau that provides the economic numbers and to go on the circuit telling people the economy is really fine. If it’s a lie, then it’s a steal because the lie is ripping money from your pockets and trying to keep you from knowing you’re being fleeced.

Powell blames the inflation on the high tariffs:

Fed’s Powell says inflation overshoot caused by Trump tariffs

Federal Reserve Chair Jerome Powell said Wednesday that the current overshooting of the central bank’s 2% inflation target is mostly the result of President Donald Trump’s import tax hikes.

“It’s really tariffs that are causing the most of the inflation overshoot,” Powell said after the latest Fed meeting, reiterating his expectation the tariff impact on inflation is likely to be a “one-time price increase.”

He’s as badly wrong about the one-time price increase as he was dead wrong about inflation being “transitory” last time the Fed went nuts with QE. But, back to nuts we go, and the president says the Fed isn’t even nutty enough.

There are, at least, glimmers of hope that people will not fall for Trump’s con job so easily this time as he takes to the circuit to sell his story. In the meantime, however, the stock market predictably loved the Fed’s economic rescue move back to QE. It leaped to a new record on the Dow this past week; although, it eventually gave some of that back on Friday with the S&P even ending negative for the week. Why the rapid give back? Because the bubble market is weak, as well it should be:

It is, as Trump said when he was candidate, an “artificial stock market,” riding on a “fake economy.”