THE DEEPER DIVE: The Bond Market is Now Flying Inverted to the Fed's Controls

It looks like the Fed's soft landing really will end like this after all:

As things are playing out this week in the bond market, it may well be that the Fed’s soft landing winds up looking exactly like the photo that I have sometimes used to represent the Fed’s soft landing abilities based on their historic record. The Fed’s control mechanisms have reversed to where major interest rates are now doing the opposite of what the Fed decrees. Pushing on the stick makes the plane go up. If the Fed lands at all, it looks for sure like it will be with its landing gear pointing up to the sky.

Bonds have been acting in a highly unusual way since the Fed’s big rate cut—completely disobedient to the Fed’s will. This unexpected result is something I’ve talked about as a possibility—the bond vigilantes seizing the reins—but not something I predicted with any certainty would happen. It is also something I thought would happen by bond investors acting ahead of the Fed and its promises, not by them doing the exact opposite of the Fed.

Well, now it has certainly happened and worse than imagined. It’s such a complete anomaly that the financial world is starting to talk about it and scratch their heads, and it shows in a highly significant way that the Fed, for now at least, has lost control of interest rates.

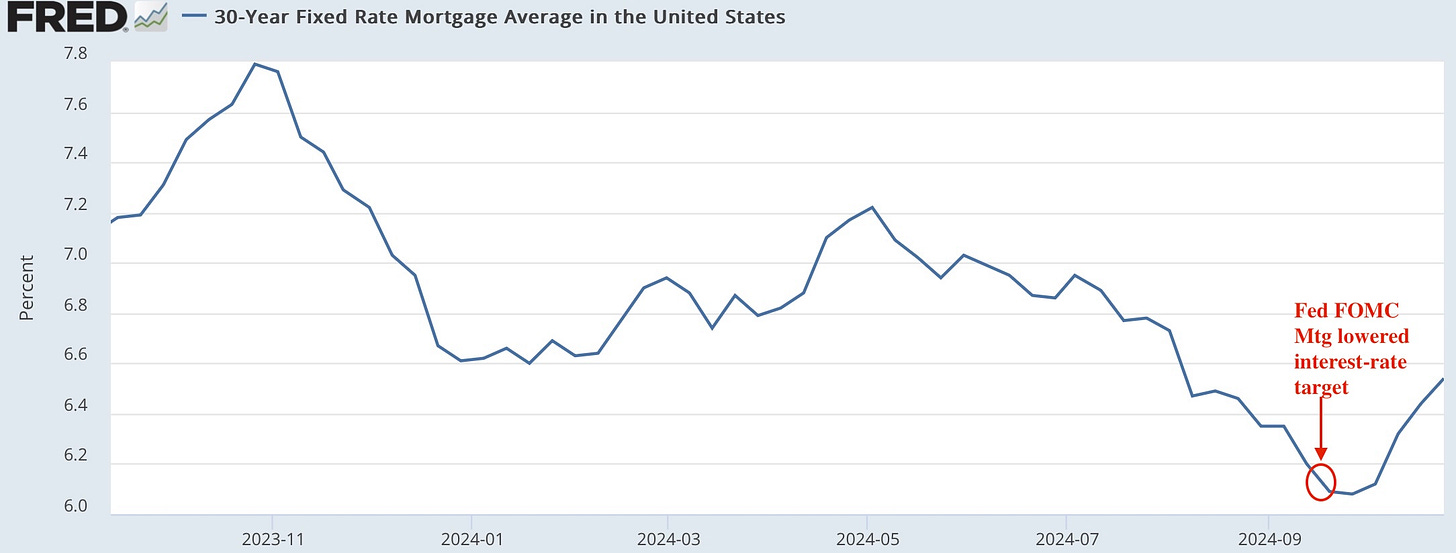

Just take a look at how the rampage by bond investors to take interest the opposite direction from the Fed’s goals has impacted home mortgages. When the Fed starts lowering interest rates, even if it focuses on the short-term end of the credit spectrum, you certainly don’t expect mortgage rates to rise. In fact, nearly everyone was saying they would start to come down more quickly now that the Fed had lowered its fundamental interest target, but just not as quickly as short-term rates. Instead, look at what actually happened:

They have absolutely soared!

On the short end, where the Fed’s rate change focused, credit-card interest has fallen slightly, but not much. The Fed dropped its benchmark rate by half a percent, and credit cards—both new and existing—came down an average of less than a quarter percent.

It looks like longer-term credit is running for cover—demanding protection from inflation that investors believe is about to start rising again and demanding risk premium for the huge issuance of additional US government debt that must find buyers for the big deficits that will be coming out of either presidential candidate, given their tax and spend plans. (Anyone who thinks either candidate will not bury us in more debt is living in total denial of either candidate’s history in government and of their promises.)

This kind of clear loss of control by the Fed rarely happens, so it’s important that we take a deeper look at what is happening here. This can be as much of a game changer as the Repo Crisis that forced the Fed to switch from running money off its balance sheet to piling it back on in a hurry. (Incidentally, we’re not out of the woods on another repo crisis either according to Goldman Sachs, which, if it happens, would likely emerge at the end of the year as everyone reconciles everything, especially portfolios, and which could force the Fed to reverse from its continued QT once again back to QE. More on that below.)

Of course, if the Fed were to switch from its current balance-sheet reduction (QT), which attempts to take money out of the system, back to rapidly pumping money back in (QE) so as to avert another repo crisis (where banks astronomically raise interest on interbank lending of their reserves to each other to clear debits of the past day), that would light inflation on fire. There is nothing like rapidly expanding money supply to breathe oxygen into already smoldering inflation and set it back on fire.

This is the risk of losing control of interest rates. To the extent the market is now doing the opposite of the Fed’s goal and raising interest, the market forces us into recession; no soft landing. It’s as if the Fed said, “We’re about to score our soft landing,” and bond investors said, “Oh no, you’re not!”

To the extent, the Fed changes policy and starts increasing money supply, it likely reignites already hot inflation, especially since that inflation, as I’ve pointed out, already looks like it wants to rise now. The Fed can, of course lower interest to stave off the recession; but, if the market is no longer listening to the Fed’s cues, what the Fed does with its targets is irrelevant because market interest goes up anyway, tightening down on the economic screws.

That’s bond vigilanteism, and today’s Deeper Dive is going to dig down into this mess to see what is happening there and just how badly it indicates the Fed is losing control of interest rates and of its economic influence. It doesn’t do much good to have a skilled pilot attempting a soft landing if the stick and all other controls go completely dead 500 feet above runway elevation. Powell’s stick is dead, and the other controls are, according to Goldman, working kind of wonky right now. The remainder of this Deeper Dive will delve into just how weird it all is.