The Deeper Dive: The US Debt Doom Loop Is a Gordian knot

This mess of loops upon loops will unravel disastrously during the current recession.

I said in a recent editorial that I might include some discussion in a “Deeper Dive” on the way Treasury buyers are drying up, which is highly predictive of a return to rising bond yields. That will have the effect of pushing all interest rates back up higher, regardless of what the Fed does.

I’m covering that today as just one aspect of the complex US sovereign debt doom loop. The fact that we are already going into a recession will add to the debt problem something many will find as an unlikely effect of recessions: It will drive interest rates higher.

That will shock the stock market because everyone expects that the Fed will lower rates in the event of a recession because that is what it does to help us out of recessions. Even though I’ll explain why the Fed will not likely do that this time, it doesn’t matter if they do; and I’ll explain that, too.

(Note: I am sharing some of this “Deeper Dive with everyone as my editorial for the day so everyone gets, at least, the gist of what is coming.)

We’re stuck with the mountain of debt getting worse

On the hopeful side, Moody’s outlook downgrade for US debt along with Fitch’s credit downgrade has caused some members of congress to start, at least and at last, to call for a special bipartisan fiscal commission to study the national debt problem.

On the unhopeful and unhelpful side …

A few people putting out a call doesn’t mean it will happen.

Even if they do form a commission, we all know they can argue about it forever.

The Dems and Repubs still cannot agree on anything. One side will want to resolve the problem solely through tax increases; the other will want do it all via spending cuts. More unfavorable to a solution still: The Republicans will even deadlock with themselves — as they have with the budget funding decisions and debt ceiling decisions.

Even if a commission finally does agree on something, they still have to get congress to approve it without stalemating in more arguments or revisions that gut it. And we have to hope the credit agencies will sit back and wait patiently through all the deadlocked meetings, which is not too likely.

So, congress will most likely just agree to try to kick the can down the road as they’ve done for decades. Only this time, I don’t think the can’s gonna kick or that the credit agencies will allow that without more significant downgrades.

Even if congress does the nearly impossible and gets a solution to the US debt spiral passed, the president might veto it if it cuts funding for his legacy Bidenomics; and there are nowhere near enough votes that could agree to override a veto.

So, from just a purely political perspective alone, it is a Gordian knot that congress will fail to untie.

Clearly we have to blame the massively yawning current deficits on both the Trump tax cuts and the Biden spending binge. There is not, however, much willingness on either side to be honest about its own contribution to the debt problem.

Then, in a real odd twist — unseen in my lifetime until now — this time it is the Democrats who are more prone to spend on war and a fair number of Republicans who are against it. Weird world from the one I lived in all my life. So, the normal divide between spending on welfare v. spending on warfare is also blurred. War, too, has turned out to be an issue that has prevented Republicans from coming to an agreement even with themselves about a solution to the debt problem.

How recession will make the debt doom loop worse

If recession hits, as it is doing, it will greatly compound the nation’s debt problem because the goal the Fed seeks of slightly higher unemployment easily pushes right past “slightly” to become significantly higher unemployment. That is almost always what has happened at this juncture in the tightening cycle when employment turns.

Rising unemployment means even lower personal income tax revenues for the government. A recession means lower business revenue, so lower corporate income taxes revenues, too. That forces the government out to issue even more bonds if it is going to fund the same level of spending. Thus, the supply of Treasuries will explode at an even faster rate. In an environment where we are now seeing lower willingness by investors to buy up auctions of increasing debt supply, more supply will drive the government’s interests even higher. (Jesse Felder talks about that in one of the headline videos below.) That is one of the big loops that is part of the debt doom loop and almost impossible to solve by itself.

The stock market, which thinks the Fed will lower rates, is not thinking about what an explosion of bond issuances due to a recession will do to interest rates, regardless of what the Fed does with its benchmark rate. The Fed will remain out of the picture in terms of bond buying, regardless of what it does with its target rate. Powell has stated unequivocally that the Fed does not intend to stop QT, even if it stops raising rates or even if it starts to lower them. He said the Fed is not even thinking about that. So, regardless of what the Fed does with the Fed Funds Rate, the government’s increased issuance of Treasuries above the increases it has already scheduled to fund Bidenomics will drive Treasury rates up even more.

That in turn, creates another loop — the need for even more bonds to finance the government’s rising interest costs over time, too that increases deficits. That is a partial picture of the debt doom loop we are facing. There is more that I will cover below for paid subscribers.

As if that is not perilous enough, governments always want to spend more in a recession to try to pull out of the recession and to help people hurt by the recession, such as supporting those who are unemployed or such as those grants it has suddenly started using to help businesses hurt by recession and, of course, the huge bailout grants it will make to banks if the recession starts taking down too-big-to-fail monstrosities that the Fed and FDIC created with the 2008 bailouts.

So, spending is prone to increase in many ways when a recession hits, even as government revenue decreases. Thus, a new spending loop gets quickly wound into the knot.

Normally, we solve that by just piling on a lot more debt during those times. That will make it very difficult to solve the debt problem now that the government has reached the end of its debt rope with the credit agencies that gave it enough rope to hang itself because those agencies were too reluctant to make this call earlier. So, this has all the potential in many ways to develop into a mammoth debt spiral.

There is another factor with a recession that I have not heard people talking about, but I’ve presented it here a couple of times in The Daily Doom as well as on in past Patron Posts when I was writing The Great Recession Blog. That factor would also be an additional disastrous accelerant to the debt spiral if it happens: A recession means lowered production (which is how we measure recessions); and, in a time of shortages around the world, lowered gross domestic production could exacerbate shortages. That could actually cause inflation to rise faster, the more the Fed tightens to try to curb inflation because rising inflation is what happens when you have a situation of too much money chasing too few goods. That would really be a nasty new spin in the doom loop if it develops. (I’m not saying it as a prediction but as a watch.)

The possibility of that happening based on that formulation for inflation relies on a whether the amount of money supply will go down as quickly as the supply of goods goes down during a recession. While I’m not saying that will happen, it is an unusual risk no one is thinking about. Because no one is even thinking about it, the Fed wouldn’t even know what hit them if it started to happen. They’d be dumbfounded as to why inflation was going back up the more they tightened to get it to go back down. It would be an inverse effect outside of their normal thinking about fighting inflation due to the odd circumstances of driving up shortages in a time that already has serious shortages around the world.

Yes, we’re in a recession now

I won’t fault you if you don’t agree with me about recession being now. Most people don’t. There are however, a few now who are saying the same thing in strong terms — not that recession is coming but that it is likely already here. Last week I quoted Peter Schiff on that as well as David Rosenberg. Today I’ll quote Matthew Piepenburg, partner with Egon von Greyerz at Matterhorn Asset Management:

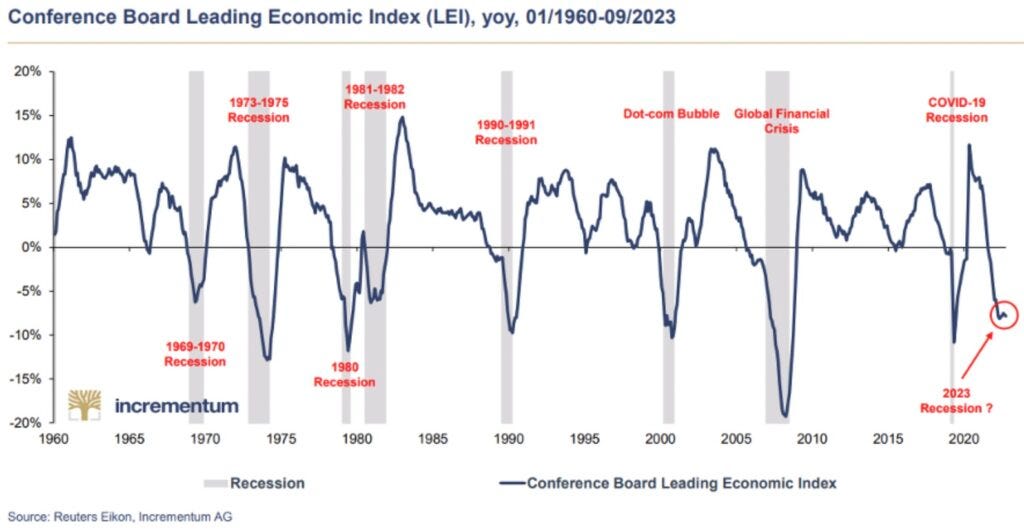

And let us not forget, of course, pundits [are] debating about a recession or “looming” recession when the inverted yield curve … M2 [money supply] declines, the Conference Board of Leading Indicators and … illiquidity in the repo markets make it factually clear that America is already in a recession.

Piepenburg presents the following graph of the Leading Economic Index:

As you can see, we’ve never been down this low without already being in a recession. Never! Not even close! So, I think the factors he mentions in the quote above, including this one, mean the burden of proof is on the side of those who think we are not in a recession: Why would this be the ONLY time leading economic indicators were this bad without being already in a recession? They need to explain how that could be. While exceptional claims — such as mine that says were are in a recession even if GDP doesn’t yet agree — require exceptional proof, theirs is an exceptional claim, too — that this is the only time when leading indicators have been this low with no recession.

Recessions, of course, are declared after the fact. So, we never get to see that we are in a recession when the leading economic indicators are this low until one is declared retroactively to where it began. That doesn’t mean we are not in it. It just means we are not aware of it because recessions are NEVER declared until, at least six months, after they have begun. That is why the metrics being aggregated in that graph are called leading economic indicators: they tell us we are in a recession before it actually gets officially declared.

Some will argue that GDP disagrees with me, as I just admitted, and the National Bureau of Economic Research largely determines recessions based on GDP with the next major factor being unemployment. Of course, we’ve talked at length about how Gross Domestic Income is already in recession and how Gross Domestic Product always catches down to GDI when there is significant disagreement between the two, as there is now, never the other way around. So, while we are in a recession by every other measure, it’s still possible the NBER will not ever call the starting date to be the present quarter unless GDP joins all the other metrics by catching down this quarter.

That, in my mind would be just a technicality because all the important lights are blinking recessionary red, except GDP and unemployment; and GDP will turn down to match GDI because it always does. It is just a question of whether it corrects itself this quarter or next

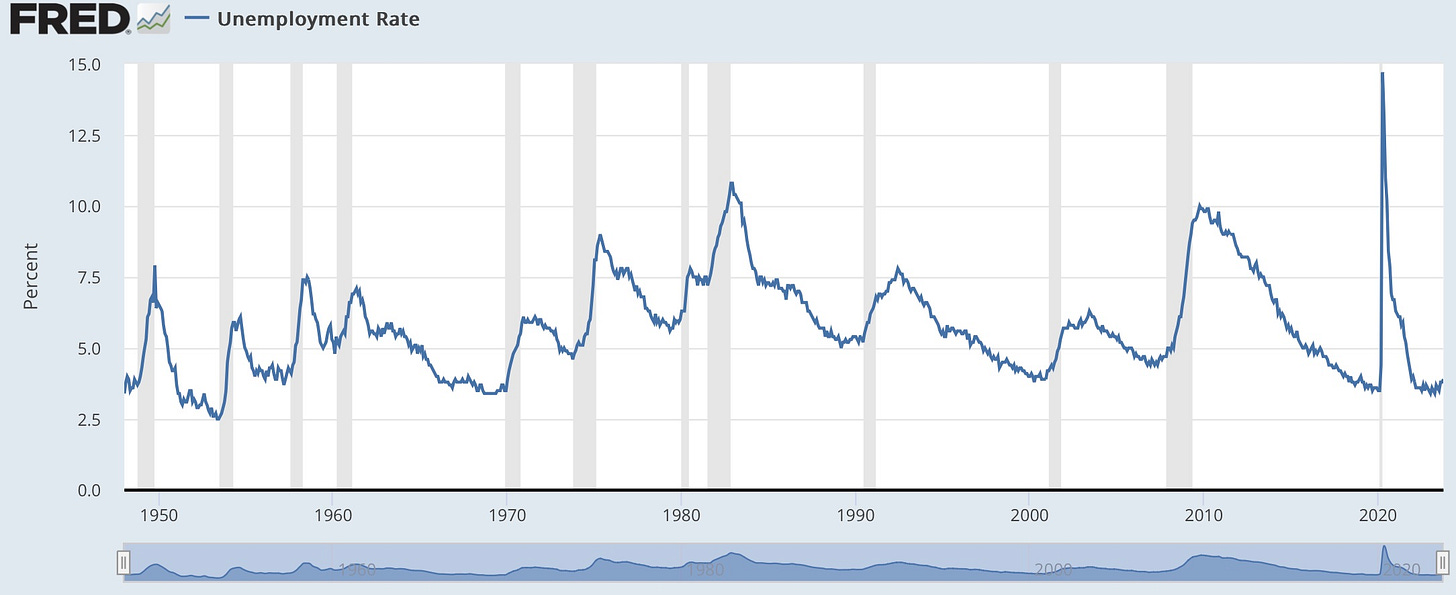

Meanwhile, unemployment is trembling like it is starting to put in a turn. When it does, it turns up very, very quickly. It always goes almost straight up once it puts in a turn of about 0.4-0.5 points above its most recent cycle low; and it has now put in that much of an upturn. So, even unemployment is about where it needs to be to align with the start of a recession.

You’ve seen the graphs I’ve presented for that before, but here for good measure it is again: (Note that the parabolic rise in unemployment after the tiniest upturn happens entirely inside of the recession, not before, and you can see our wiggle upward right now is about the same as all prior wiggly upturns immediately before the geyser of rising unemployment hit during recession.)

There is no rounding upward with unemployment in these situations. Every single time, it just rockets almost straight up once it has wiggled up as much as it now finally has.

Piepenburg continues,

At the same time, the U.S. is approaching year-end with over 400 bankruptcies and rising lay-offs as its debt-driven S&P 7 pretends “resilience” while ignoring the over $750B in corporate bonds beneath those stocks about to roll-over at higher (Powell-made) debt costs in 2024, and another $1.2T more roll-overs coming in 2025.

Crescat Capital notes that its macro model, encompassing 17 macro, fundamental, and technical indicators, “is now at one of its most alarming levels in the data record”:

It’s worth noting that this model has proven highly effective in identifying pivotal shifts in the US business cycle, which inherently oscillates between expansion and contraction in tandem with fluctuations in asset valuations and credit availability. Presently, nearly all indicators have reached historic extremes, corroborating our perspective on the high risk of an impending hard landing.

We currently stand at a crucial juncture in financial markets and the global economy, supported by an extensive list of compelling macro reasons:

The only time they show their recession indicator being this extreme was just before the Covidcrash:

Their article goes on to list and explain a plethora of additional factors screaming about a severe recession beyond those shown above in their chart. Another graph linked below also gives more indicators of a recession that will begin this quarter.

(I have made this much of this week’s “Deeper Dive” available for free for all because I believe the turn back into recession after the first dip into a “technical recession that we experienced last year, is critical due to how much it will complicate the huge debt problem we now face; so I want everyone to have the gist of it. What follows for paying subscribers, after today’s free headlines, is a much deeper layout of how severe the national debt crisis is … and is going to become as this recession takes the national deficit up higher this fiscal year than the one-trillion dollars that was already projected without a recession in the government’s own forecast.)

Economania (national & global economic collapse plus market news)

Recession To Send Interest Rates Even Higher In 2024?

A Profusion of Recession Indicators

Treasuries Extend Blockbuster Rally on Fed Wagers

Dave Hunter: New Great Depression is on the Horizon, Time to Prepare is Now

Banks set 2024 S&P 500 targets to 5,000 and above

UPS and FedEx are no longer the largest delivery companies in the US

Real-Estate Rubble (housing, commercial & global real-estate bubble trouble)

Money Matters (monetary policy, metals, cryptos, currency wars & cashless)

Aztec Minerals Times the Winter Rally Perfectly

Gold hits 6-month high on Fed pause expectation, softer dollar

Overinflated from too much money & Underfed from too few goods (due to weather, sanctions or other supply issues)

Oil Declines as Traders Wrestle With Chance of OPEC+ Output Cuts

Wars & Rumors of War, Revolts, Hacks & Cyberattacks (+ AI threats)

Elon Musk commenting on the big changes at OpenAI: “Uh oh.”

Putin Staked Resources on Victory in Ukraine. Can West Match Him?

Putin will win unless the West finally commits to Ukrainian victory

Political Pandemonium & Social Senescence (major socio-political issues & events but not campaigns)

Members of Congress Head for the Exits, Many Citing Dysfunction

Trump hints at expanded role for the military within the US

Case That Could Destroy the Government's Regulatory Systems

This lawsuit could disrupt the U.S. tax system. Key facts are in dispute.

Dutch politician Wilders slammed for ‘Jordan is Palestine’ claim

Trump’s vote share is higher than any time in the past year. Biden’s, worse.

Voters are saying the economy is what Democrats need to be alarmed about

Calamity and Catastrophe

Here’s Your Global Warming: Lake-effect snows could dump 30 inches in Upstate New York

Going Green and Mean

Power Grid Operator Warns of Total Blackout Due to Imminent Shut Down of Coal Plant

Off-the-Beat News and Just Plain Offbeat News

Expats are flocking to this European country for happier lives abroad—here’s why