THE DEEPER DIVE: The US is Being Destroyed by its Debt. What Stops the Fed from Soaking it All up and Destroying the Debt?

David Stockman has written an article that describes in historic perspective how big the national debt has become, how it is going to crush the US economy in the fairly close future and how the Fed is going to feel enormous pressure to solve the problem by “monetizing the debt,” which means buying it all up and turning it into what the Fed calls “money.” Another alternative that people talk about than turning it all into money is to just evaporating all of it, but that is realistically impossible (I think), and I’ll lay out why that is.

I had a reader ask me to write a Deeper Dive about how the Fed could get rid of all the US debt back when I asked for suggestions, so I guess now is the time to tackle it since Stockman is talking about it today. However, Stockman, who was President Reagan’s budget director, surely knows more about the debt problem than just about anyone, and even he just says that, for now, the Fed’s hands are tied and gives one basic reason why. I’m way beneath his capacity on that matter, but I’d like to lay out in a broader way what some of the many other main difficulties are in doing that. I’m sure Stockman knows more about them all than I do, but it wasn’t the point of his article to go into such detail.

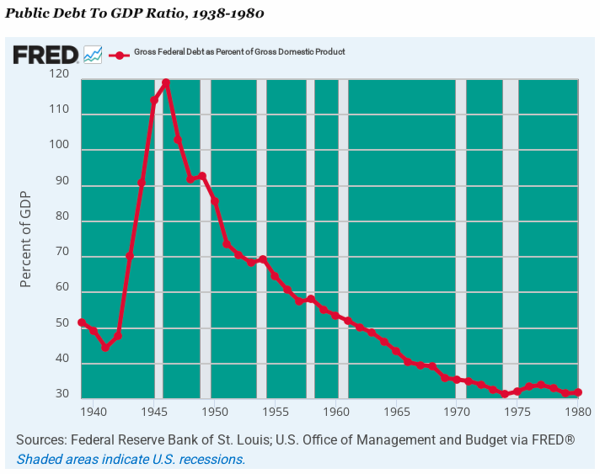

Stockman’s article was more about laying out the scale of the problem and how we got there. To do that, he presents two historic graphs. One shows the national debt as a percent of the gross national product, representing the nation’s ability to pay the debt, going through the huge recovery programs of the Great Depression and World War II. The debt was fully paid down via a largely balanced budget and financial rectitude (which is completely lacking today) over a period of decades:

That is how long the sensible approach of just paying it all off took.

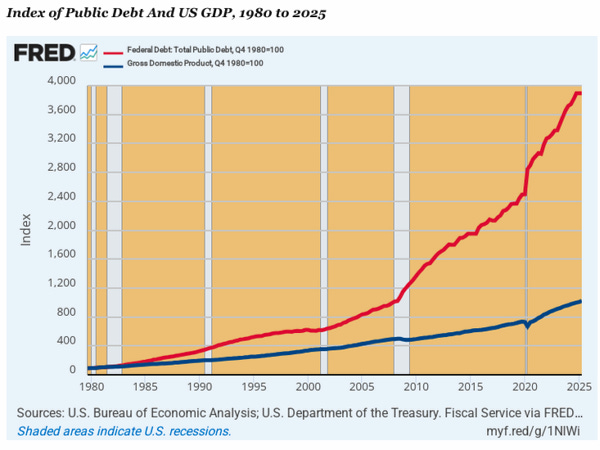

The other is the graph of what happened from Reagan onward when the uniparty system in the US went on endless military and social spending binges and all rectitude gave way to greed:

To mirror images of the world and the kind of people who make it happen.

You can see the problem has only gotten exponentially worse as time has moved forward from those days when the debt was well managed, no matter who was in charge—no matter which party or which president, other than the tiny flat spot on the red line when Clinton was president and Gingrich ran the House and we, again, reached a balanced budget and even minutely paid down the debt around the year 2000 by cutting expenses and raising taxes. That was the only time of temporary budgetary sanity. Since then the debt has evolved into a rocket ride into the stratosphere.

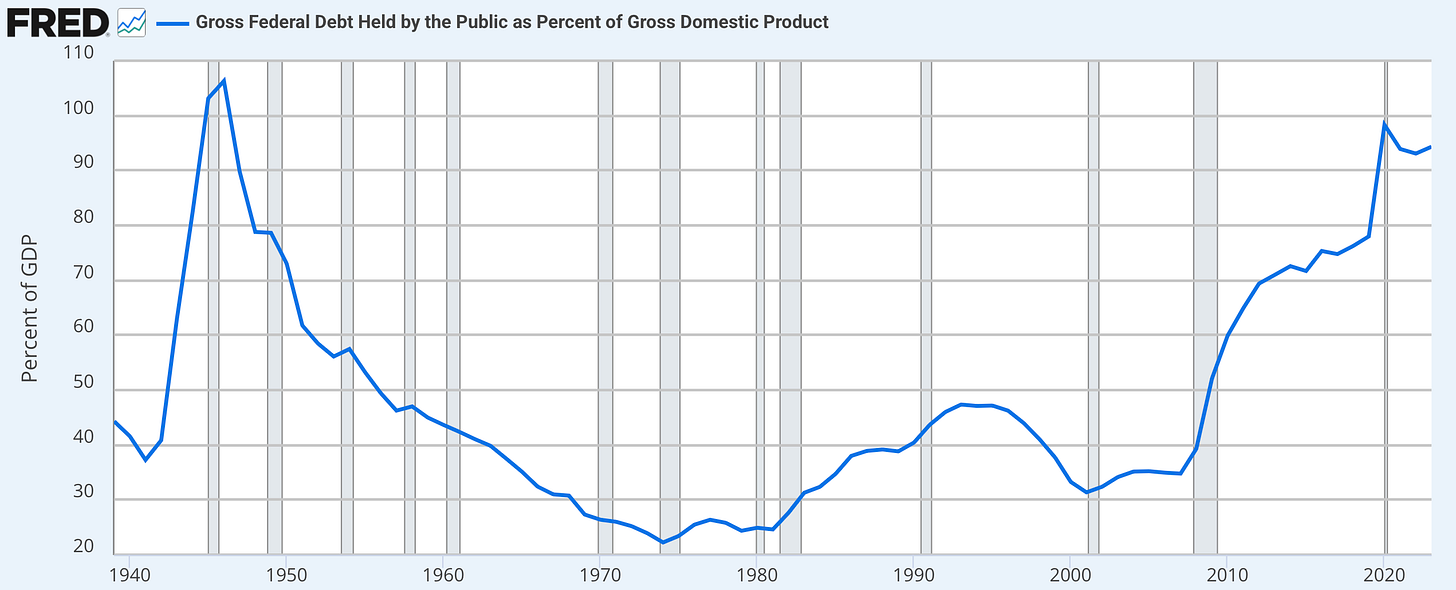

Here is a picture that puts together the peak from the Great Depression and WW2 to the present as a ratio of debt to GDP:

Stockman argues, of course, that is far from sustainable and is a path to financial ruin:

For want of doubt, here is the debt ratio trend since 1980. It embodies a fiscal path that is the absolute inverse of the 1946 to 1980 trend shown above. In fact, during the 45 years since 1980 the debt ratio has tracked all the way back to its WWII peak. Alas, the US economy was drowning in private savings to absorb the debt back then, while today the private savings rate has shrunk to nearly the vanishing point.

Needless to say, this condition puts enormous pressure on the Fed to find an excuse to revert once again to massive debt monetization. Yet with inflation rates trending at +3% and heading higher, the Fed’s printing press has been forced into idleness and may stay there for some time to come.

And that’s notwithstanding the phony “interest rate cuts” being administered from the Eccles Building, which are the result of paying massive levels of interest payments to banks and money market funds to keep their liquid reserves parked at the Fed at the central bank’s pegged interest rate target.

To be sure, if the retaking of the WWII peak debt ratio shown below for 2025 were the end of the story, the future outlook would be bad enough—with either a massive, economy-killing interest rate crunch, if the rising Federal debts were financed the honest way in the bond pits, or another even worse inflationary blow-off, if the Fed’s printing presses are again put into over-drive.

But that’s not the half of it.

The built-in baseline deficits, which would have continued to track the rising path shown below, and would have actually broken into new territory relative to GDP, even had the MOABB been snuffed out on Capitol Hill, as it should have been. Instead, of course, trillions of new debts were layered on top of the inherited baseline, such that the debt ratio will soar to 166% of GDP by 2054.

In round terms, therefore, the built-in public debt barely 30 years down the road will reach $185 trillion!

And that’s not a case of big numbers vertigo, either. The CBO projection of GDP for 2054 now stands at $85 trillion, meaning that the gap between the public debt burden and the national income will continue to widen, and actually accelerate, along the path shown above. That is to say, by mid-century the GDP will be 28X larger than it was in 1980, but the public debt will be up by 185X.

Needless to say, the financial market will buckle and cause the US economy to collapse long before we reach the currently built-in public debt level of $185 trillion by 2054. If for no other reason, there is precious little savings available to honestly finance the UniParty debts, and, as will be evident in the years ahead, the Fed is essentially out of dry powder when it comes to massive monetization. The bond vigilantes have come out of their decades-long slumber.

So how do you finance the built-in 6% to 10% of GDP deficits year after year when net national savings have already vanished?

You can’t. American politics are locked on a path toward fiscal calamity because we now have two pro-government parties. That includes the Warfare State spenders of both parties, and the Welfare State demagogues and cowards, respectively, of what passes for contemporary Democrat and Republican parties.

Editor’s Note: The fiscal trajectory laid out above is not an abstraction, nor is it a matter confined to charts and historical references. It is already reshaping the economic ground beneath every saver, investor, and retiree in the country.

The political class may pretend there is still time to maneuver, but the forces set in motion are now accelerating far faster than Washington can contain them. What comes next will not be a gentle correction—it will be a systemic break, one that arrives with a speed and severity that catches most Americans completely unprepared.

With the problem squarely framed, I want to address, at least, partially, the question my reader asked me to deal with when I asked people for subjects for a Deeper Dive:

I think it will take a very bright person to write about this.

We all understand that only hope to avoid a US default on the $38T is to deflate the cost of that debt away, yet we all somehow ignore this. So article:

“FED BUYS All $38Trillion of US GOVERNMENT outstanding debt tomorrow “

Then you discuss all the repercussions you believe would happen. So, you accelerate the damage. I think it will be the hottest , most read article for a week

I wish I could be that bright person, and I thank him for thinking I might be able to, but it exceeds my capacity right now for reasons I’ll give. Still, I will try to give some sense of the breadth of the difficulty for the Fed in doing that and some sense of the many possible serious repercussions.

It might be the hot article he describes if I could write that article and actually predict how the Fed will do that; but right now there is no pathway for that. Stockman alludes to that solution, too, which is called “monetizing the debt” and states one basic obstacle stopping the Fed from doing that when he says,

Needless to say, this condition puts enormous pressure on the Fed to find an excuse to revert once again to massive debt monetization. Yet with inflation rates trending at +3% and heading higher, the Fed’s printing press has been forced into idleness and may stay there for some time to come.

The Fed’s inflation mandate is key to understanding why it cannot do that legally at present, especially when inflation is already running hot; but there are also other significant legal and practical matters that prevent this final solution. So, I don’t foresee it doing that currently, but I can lay out the obstacles it would have to contend with in order to do that down the road. Certainly, the time is coming, as David Stockman says when it will face enormous pressure to do that, and that force time may not be far off.

Before I lay out a sort of primer as to why the Fed is both practically and legally prevented from doing that with the entirety of the debt, here are the Monday headlines for everyone, including Stockman’s article. Then follows the rest of the Deeper Dive for paying subscribers, explaining what makes that impossible to do as well as what it would take to make that route possible.

Many talk about the Fed doing this someday, especially now that the US debt mountain looks insurmountable; but there are many solid reasons why the Fed has not monetized the debt other than temporarily; I’'ll dive into that below….

Economania (national & global economic collapse plus market news)

Middlemen are swallowing the economy

Angst Turns to Anger and “Trust” Issues in Hollywood as Netflix Merges with Warner Bros.

Paramount Skydance launches hostile bid for WBD ‘to finish what we started,’ CEO Ellison tells CNBC

Finger-pointing in Washington as Paramount goes hostile

Inflation Factors (too much money chasing too few goods due to weather, sanctions, tariffs, quarantines, etc.)

Trump struggles to persuade Americans to ignore affordability issues

Trump Melts Down as Peter Schiff Focuses on Affordability on Fox News

The narrative of cheap green electricity is shattering in the face of international data

Wars & Rumors of War (including cyberwar, civil unrest and revolts)

Report: 20% of all US aid to Afghanistan for “nation building” was “wasted”

—

Russia unleashes massive drone and missile attack on Ukraine as diplomatic talks continue

Zelensky rules out ceding land to Russia, refusing to bow to Putin or Trump

—

Digital Dominance (AI threats, transhumanism, hacks & cyberattacks, etc.)

Substack Capitulates To UK’s Online Safety Act, Forces Users To Provide Digital ID To Access Content

Alaska Plots AI-Driven Digital Identity, Payments, and Biometric Data System

Trump Trade Wars & Turf Wars

Political Pandemonium & Social Senescence (socio-political issues & events)

David Stockman: The Triumph of the UniParty: Debt, Decay, and Imminent Fiscal Breakdown

Many say they still don’t trust electronic voting machines

The US citizens getting caught in Trump’s immigration crackdown

An anti-woke counter-revolution is sweeping through the media

Former MAGA loyalist Marjorie Taylor Greene says Trump policies are not America First (Says His policies are for Billionaires, Arab Royalty and NYC Socialists First)

Trump Goes Totally Ballistic against “Marjorie Traitor Brown” over her Interview on 60 Minutes

FBI Making List of American “Extremists,” Leaked Memo Reveals

ICE cruelty is off the charts against law-abiding people previously granted asylum or work visas

Karoline Leavitt’s family member is freed after ICE arrest

Supreme Court poised to expand Trump’s power over independent agencies

Is Hollywood Getting God? Movies and pop stars wrestled with faith in 2025.

Trigger warning slapped on Harry Potter for ‘outdated attitudes’

A Pox Upon Us (the plagues, pandemics & health police of the 2020s)

The Married Scientists Torn Apart by a Covid Bioweapon Theory

Did the Draconian Lockdowns Kill More People than Covid-19?

Amazon Data Center Linked to Cluster of Rare Cancers

WHO Director-General Tedros Says ‘It’s Time To Be More Aggressive In Pushing Back On Anti-Vaxxers’

More than 100 people infected with ‘rib-cracking’ virus after outbreak on cruise ship

Calamity, Catastrophe & Climate Craziness

Off-the-Beat News & Just Plain Offbeat News

He has 400 movies to his name. And he says now is ‘the most difficult’ time to make one

The quest to slow aging leads scientists into the powerhouse of cells